Market Overview

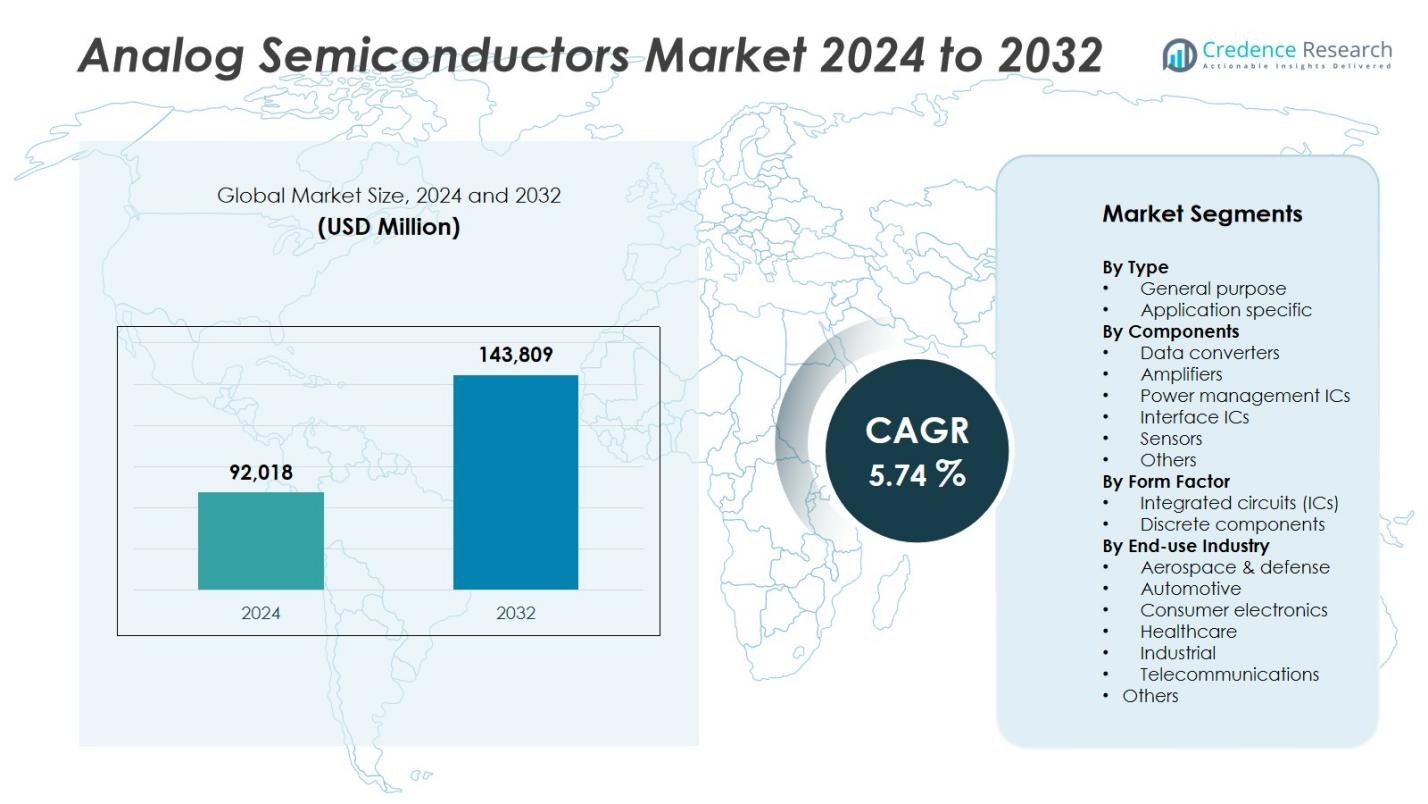

The analog semiconductors market size was valued at USD 92,018 million in 2024 and is anticipated to reach USD 143,809 million by 2032, growing at a CAGR of 5.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Analog Semiconductors Market Size 2024 |

USD 92,018 Million |

| Analog Semiconductors Market, CAGR |

5.74% |

| Analog Semiconductors Market Size 2032 |

USD 143,809 Million |

The analog semiconductors market is highly competitive, led by prominent players such as Texas Instruments, Analog Devices, Infineon Technologies, STMicroelectronics, NXP Semiconductors, ON Semiconductor, Renesas Electronics, Microchip Technology, Maxim Integrated, and Skyworks Solutions. These companies dominate through extensive product portfolios, technological innovation, and strategic collaborations targeting automotive, industrial, and consumer electronics sectors. Asia-Pacific emerged as the leading region with a 42% market share in 2024, supported by strong manufacturing infrastructure and high demand for consumer and communication devices. North America and Europe follow, driven by advancements in automotive electronics, 5G connectivity, and industrial automation applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The analog semiconductors market was valued at USD 92,018 million in 2024 and is projected to reach USD 143,809 million by 2032, growing at a CAGR of 5.74% during the forecast period.

- Rising demand for energy-efficient electronics, electric vehicles, and IoT devices is driving market growth, as analog ICs enable efficient power management, signal conversion, and connectivity across diverse applications.

- Key trends include the adoption of SiC and GaN materials, AI-based circuit design, and the integration of analog functions in compact ICs, enhancing performance and reducing power loss.

- The market is moderately consolidated, with leading players such as Texas Instruments, Analog Devices, and Infineon Technologies dominating the segment; application-specific analog ICs accounted for 58% of the market share in 2024.

- Asia-Pacific led with 42% share, followed by North America (27%) and Europe (21%), driven by strong manufacturing capabilities and high consumer electronics demand.

Market Segmentation Analysis:

By Type:

The analog semiconductors market by type is categorized into general-purpose and application-specific segments. The application-specific segment dominated the market with over 58% share in 2024, driven by the growing integration of customized analog solutions in automotive, industrial, and communication systems. These semiconductors deliver optimized performance for targeted applications such as powertrain control, sensor interfaces, and telecommunication modules. Meanwhile, the general-purpose segment continues to grow steadily due to its use in consumer electronics and computing devices, supported by increasing demand for versatile and cost-efficient analog components.

- For instance, Analog Devices advanced automotive Ethernet connectivity solutions optimize in-vehicle networking for software-defined vehicles, enabling personalized, autonomous, and safer systems.

By Components:

Based on components, the market includes data converters, amplifiers, power management ICs, interface ICs, sensors, and others. The power management ICs segment held the leading position with around 32% market share in 2024, owing to their crucial role in enhancing energy efficiency and battery management across portable and IoT devices. The rising adoption of electric vehicles and renewable energy systems further boosts demand for high-performance power management solutions, while amplifiers and sensors are experiencing steady growth in industrial automation and medical applications.

- For instance, Texas Instruments’ TPS62840 step-down converter, with an ultra-low quiescent current of 60 nA, is widely used in IoT devices and wearable electronics to extend battery life, supporting applications such as smart meters and medical sensor patches.

By Form Factor:

By form factor, the analog semiconductors market is divided into integrated circuits (ICs) and discrete components. The integrated circuits (ICs) segment accounted for nearly 71% of the market share in 2024, attributed to the miniaturization trend and the need for compact, high-efficiency analog solutions. ICs enable improved signal processing, power control, and interface management in consumer electronics and automotive systems. In contrast, discrete components maintain relevance in high-power and specialized applications, particularly in industrial and defense sectors, where design flexibility and high voltage tolerance are essential.

Key Growth Drivers

Rising Demand for Power-Efficient Electronics

The increasing adoption of energy-efficient consumer and industrial electronics drives the growth of the analog semiconductors market. Devices such as smartphones, wearables, and IoT sensors rely heavily on analog ICs for efficient power management and signal conversion. Manufacturers are investing in low-power designs to extend battery life and reduce heat generation. The shift toward green energy systems and electric mobility further accelerates demand for advanced analog components that enhance system reliability and energy efficiency.

- For instance, IBM Research’s development of an energy-efficient analog chip for AI inference, achieving 400 GOPS/mm² throughput with significantly higher compute efficiency and comparable energy savings compared to previous chips.

Expansion of Automotive and Industrial Automation

The growing penetration of automotive electronics and industrial automation is a major catalyst for analog semiconductor adoption. Modern vehicles integrate analog ICs for safety, infotainment, and powertrain management, while industrial systems depend on sensors and amplifiers for precision control and monitoring. The transition toward electric vehicles (EVs) and Industry 4.0 has amplified the need for analog chips capable of handling high-voltage operations, real-time data processing, and enhanced connectivity within complex automation frameworks.

- For instance, Infineon Technologies has a strong portfolio in power management analog ICs tailored for automotive and industrial applications, supporting advanced sensor integration and precision control essential for Industry 4.0 automation systems.

Rapid Growth of 5G and IoT Infrastructure

The global rollout of 5G networks and the expansion of IoT ecosystems are fueling demand for analog semiconductors in communication and connected devices. Analog components such as RF amplifiers, data converters, and interface ICs play a crucial role in enabling signal accuracy, low latency, and seamless connectivity. With billions of IoT nodes coming online, the need for efficient analog interfaces in smart homes, industrial sensors, and wearable electronics continues to grow, strengthening the long-term growth trajectory of the market.

Key Trends & Opportunities

Integration of AI and Advanced Analog Design

Analog semiconductor manufacturers are integrating artificial intelligence and machine learning to enhance design precision and performance optimization. AI-driven simulation tools and adaptive circuit design help in reducing power loss and improving system reliability. This convergence is enabling new opportunities for smart sensors and predictive maintenance systems across healthcare, automotive, and industrial applications. The trend toward intelligent analog devices is expected to reshape design strategies, offering greater customization and adaptive control in next-generation electronic systems.

- For instance, Synopsys has developed ASO.ai, an AI-powered analog design optimizer that enables rapid migration of analog IP across technology nodes and optimizes designs across hundreds of processes, voltage, and temperature corners, significantly reducing manual effort and simulation time for complex analog blocks.

Emergence of SiC and GaN-Based Analog Devices

The adoption of wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) is revolutionizing analog semiconductor performance. These materials offer superior power density, thermal efficiency, and faster switching capabilities compared to traditional silicon. Their use is expanding in electric vehicles, renewable energy systems, and 5G infrastructure, where high efficiency and compact designs are critical. This transition presents significant growth opportunities for manufacturers investing in next-generation analog power solutions and high-frequency communication components.

- For instance, Cree (Wolfspeed) supplied GaN power transistors for telecom base stations and 5G networks, allowing operators to boost their power output and shrink hardware size in recent commercial deployments.

Key Challenges

High Design Complexity and Manufacturing Costs

Analog semiconductors involve intricate design processes that require precise optimization for noise reduction, power efficiency, and signal integrity. Unlike digital chips, analog designs are less scalable and more dependent on expertise and manual calibration. The complexity increases manufacturing costs and limits rapid prototyping. Moreover, the ongoing miniaturization trend intensifies challenges in maintaining analog performance at smaller geometries, making it difficult for smaller manufacturers to compete with established players.

Supply Chain Disruptions and Material Shortages

Frequent supply chain disruptions and raw material shortages pose significant challenges to the analog semiconductor market. Dependence on a few global suppliers for critical components and wafers has exposed manufacturers to geopolitical risks and logistical constraints. The COVID-19 pandemic and subsequent semiconductor shortages highlighted the market’s vulnerability to such disruptions. As demand for analog chips rises across automotive, telecom, and industrial sectors, supply constraints could hinder production scalability and delay product launches.

Regional Analysis

North America

North America held a 27% market share in 2024, driven by strong demand from the automotive, telecommunications, and industrial sectors. The region’s advanced manufacturing infrastructure and presence of key players such as Texas Instruments and Analog Devices foster innovation in power management and signal processing solutions. The rising adoption of electric vehicles and 5G connectivity continues to accelerate analog semiconductor deployment. Additionally, government initiatives supporting semiconductor manufacturing under the CHIPS Act are strengthening the regional supply chain, ensuring steady growth in both integrated circuits and discrete components across various industries.

Europe

Europe accounted for a 21% market share in 2024, primarily supported by advancements in automotive electronics, renewable energy, and industrial automation. Countries such as Germany, France, and the Netherlands are major contributors due to their robust automotive and manufacturing bases. The demand for analog ICs in EV powertrains, energy-efficient systems, and smart factories continues to expand. Moreover, the European Green Deal and investments in semiconductor R&D have bolstered regional innovation. Increasing collaborations among semiconductor manufacturers and automotive OEMs further strengthen Europe’s position in energy management and sensor integration technologies.

Asia-Pacific

Asia-Pacific dominated the analog semiconductors market with a 42% market share in 2024, driven by high production and consumption across China, Japan, South Korea, and Taiwan. The region’s strong electronics manufacturing ecosystem, along with rising investments in 5G infrastructure and consumer electronics, fuels market growth. China leads in large-scale semiconductor fabrication, while Japan and South Korea focus on high-performance and automotive-grade analog devices. Rapid industrialization and government support for domestic chip production also enhance the region’s competitiveness, making it the central hub for analog semiconductor development and export.

Latin America

Latin America captured a 6% market share in 2024, supported by growing industrial automation and telecommunications development across Brazil, Mexico, and Argentina. The demand for analog semiconductors is rising due to increasing digital transformation in manufacturing and expanding automotive assembly operations. Governments are emphasizing smart infrastructure and renewable energy initiatives, boosting the use of power management ICs and sensors. While the region’s manufacturing capabilities remain limited compared to Asia-Pacific, growing foreign investments and regional trade partnerships are expected to accelerate technology adoption and market expansion in the coming years.

Middle East & Africa

The Middle East and Africa held a 4% market share in 2024, with emerging opportunities in energy, telecommunications, and smart city projects. Nations such as the UAE, Saudi Arabia, and South Africa are investing heavily in digital infrastructure, renewable power, and automation technologies. The rising adoption of IoT-enabled systems in utilities and construction is fueling demand for analog ICs and power management components. Although the market remains in its early growth stage, ongoing diversification efforts and infrastructure modernization initiatives are expected to create favorable conditions for long-term semiconductor market expansion.

Market Segmentations:

By Type

- General purpose

- Application specific

By Components

- Data converters

- Amplifiers

- Power management ICs

- Interface ICs

- Sensors

- Others

By Form Factor

- Integrated circuits (ICs)

- Discrete components

By End-use Industry

- Aerospace & defense

- Automotive

- Consumer electronics

- Healthcare

- Industrial

- Telecommunications

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the analog semiconductors market is characterized by the presence of major players such as Texas Instruments, Analog Devices, Infineon Technologies, STMicroelectronics, NXP Semiconductors, ON Semiconductor, Renesas Electronics, Microchip Technology, Maxim Integrated, and Skyworks Solutions. These companies focus on innovation, strategic acquisitions, and portfolio diversification to strengthen their market presence. Continuous advancements in power management ICs, sensors, and interface solutions are driving intense competition across consumer electronics, automotive, and industrial sectors. Leading manufacturers are investing in advanced fabrication technologies and AI-enabled design tools to enhance performance efficiency and reduce power consumption. Collaborations with OEMs and ecosystem partners are further enabling customized analog solutions tailored to emerging technologies such as 5G, EVs, and IoT applications. Moreover, regional production expansion and supply chain optimization remain key priorities as companies aim to balance cost efficiency with growing global demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Renesas Electronics

- ON Semiconductor

- Skyworks Solutions

- Texas Instruments

- STMicroelectronics

- Infineon Technologies

- Maxim Integrated

- NXP Semiconductors

- Analog Devices

- Microchip Technology

Recent Developments

- In January 2025, Onsemi acquired the Silicon Carbide (SiC) JFET technology portfolio of Qorvo, including the United Silicon Carbide brand, together with certain associated patents, for 115 million.

- In September 2024, Toshiba introduced the TB9033FTG, an automotive use innovative CXPI responder interface IC with integrated hardware logic for efficient communication. Its utility is further enhanced by the low consumption and fault detection features.

- In September 2024, Analog Devices (ADI) and India-based Tata Group formed a partnership that aimed at discussing opportunities in semiconductor manufacturing in India. Tata Electronics is spending a billion dollars to set up a semiconductor manufacturing and assembly plant in Gujarat and Assam.

- In January 2024, Renesas Electronics agreed to acquire Transphorm, a specialized producer of gallium nitride (GaN) power semiconductors, in a deal expected to cost about $339 million.

Report Coverage

The research report offers an in-depth analysis based on Type, Components, Form Factor, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The analog semiconductors market will continue to grow steadily, driven by increasing demand across automotive, industrial, and consumer electronics sectors.

- Power management ICs and sensors will remain the most in-demand components due to the rising need for energy-efficient solutions.

- The expansion of electric vehicles and charging infrastructure will significantly boost analog chip adoption in automotive systems.

- Rapid deployment of 5G networks will enhance the need for high-performance analog and RF components.

- Integration of AI and machine learning in analog design will improve efficiency and accelerate innovation.

- Asia-Pacific will retain its leadership position due to strong manufacturing capabilities and high electronics consumption.

- The shift toward silicon carbide (SiC) and gallium nitride (GaN) materials will open new growth opportunities for power applications.

- Companies will focus on developing ultra-low-power analog ICs to support IoT and wearable devices.

- Strategic mergers and collaborations will increase as firms seek technological synergies and market expansion.

- Government investments in semiconductor manufacturing will strengthen supply chains and regional competitiveness globally.