Market Overview

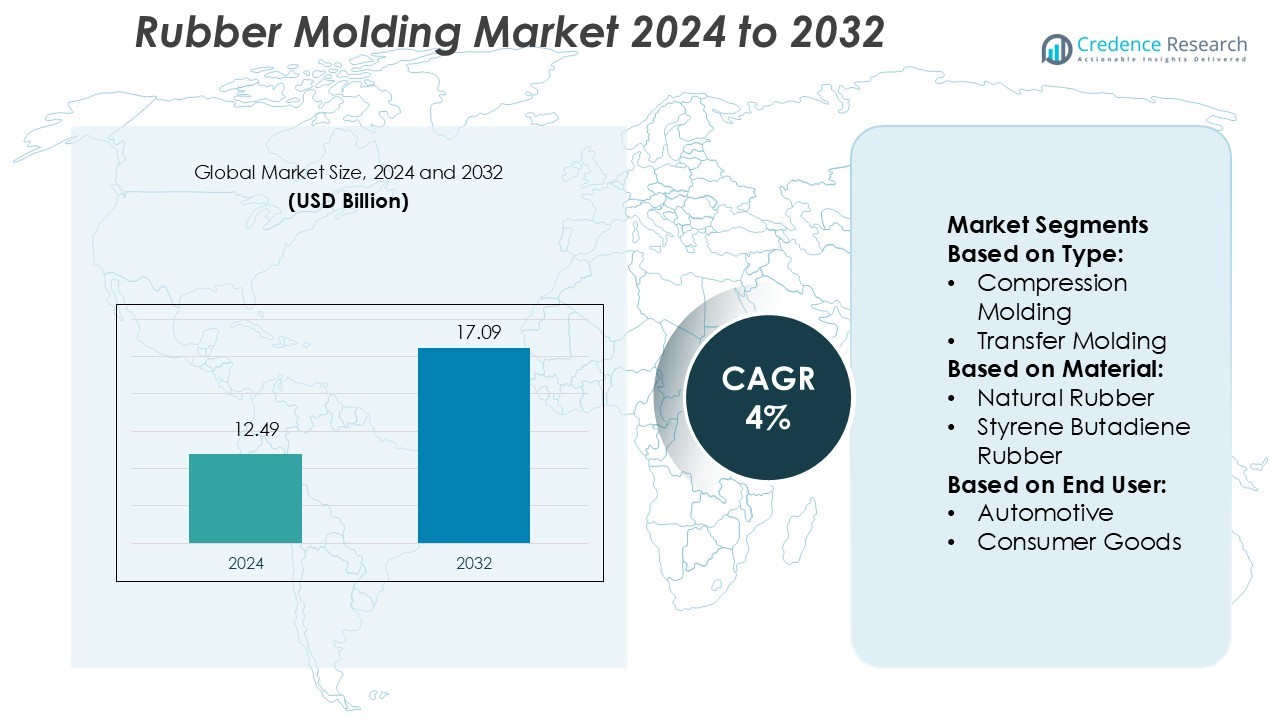

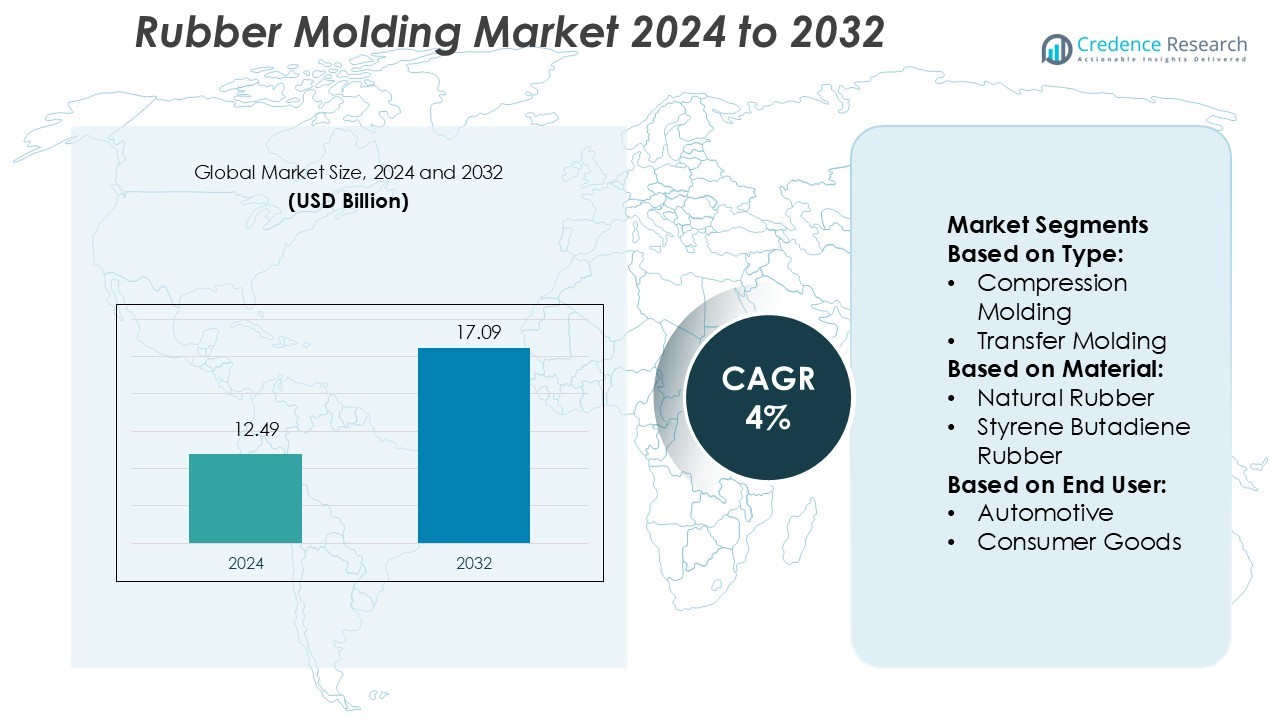

Rubber Molding Market size was valued USD 12.49 billion in 2024 and is anticipated to reach USD 17.09 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Molding Market Size 2024 |

USD 12.49 Billion |

| Rubber Molding Market, CAGR |

4% |

| Rubber Molding Market Size 2032 |

USD 17.09 Billion |

The Rubber Molding Market Mason Rubber Company, Freudenberg and Co, Sumitomo Riko Ltd, Britech Industries, Toyota Gosei Co Ltd, Intertech Taiwan, Cooper Standards, Dana Incorporated, NOK Corporation, and Continental AG are leading players in the Rubber Molding Market. These companies focus on advanced molding technologies, high-performance materials, and customized solutions to serve automotive, consumer goods, healthcare, and electronics sectors. They invest in R&D, automation, and sustainable material adoption to enhance product quality and efficiency. Asia-Pacific emerges as the leading region, capturing approximately 35% of the global market share, driven by rapid industrialization, automotive production, and electronics manufacturing in China, Japan, and India. Growth in emerging markets, coupled with demand for lightweight and durable components, positions the region as a key growth hub. The combined focus on innovation, regional expansion, and sustainable practices strengthens the competitive positioning of these top market players globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rubber Molding Market size was valued at USD 12.49 billion in 2024 and is projected to reach USD 17.09 billion by 2032, growing at a CAGR of 4% during the forecast period.

- Asia-Pacific leads the market with approximately 35% share, driven by automotive, electronics, and industrial demand in China, Japan, and India.

- Compression molding dominates the type segment due to cost-effectiveness and high-volume production, while EPDM leads the material segment for durability and weather resistance.

- Key players such as Mason Rubber Company, Freudenberg and Co, Sumitomo Riko Ltd, and Continental AG focus on R&D, automation, and sustainable materials to strengthen competitiveness.

- Market growth is challenged by high raw material costs and stringent environmental regulations, while trends toward lightweight, eco-friendly materials and customization create opportunities across automotive, consumer goods, healthcare, and electronics sectors.

Market Segmentation Analysis:

By Type

In the Rubber Molding Market, compression molding leads the type segment, accounting for around 45% of the market. Its dominance is driven by cost-effectiveness, suitability for high-volume production, and ability to handle complex shapes with consistent quality. Transfer molding holds a significant share due to precision in manufacturing intricate parts, while injection molding is growing rapidly, supported by automation and faster cycle times. Other molding techniques contribute minimally but remain essential for specialized applications. Rising demand for durable and lightweight components across automotive and industrial sectors continues to propel the growth of compression molding.

- For instance, Freudenberg Sealing Technologies employs advanced hydraulic presses with platen sizes up to 36″ x 36″, enabling efficient production of parts with varying complexities. These presses are equipped with precision controls to ensure consistent molding quality.

By Material

Ethylene Propylene Diene Terpolymer (EPDM) dominates the material segment, representing nearly 40% of the market. Its widespread use is fueled by excellent weather resistance, flexibility, and long-term durability in automotive seals and construction applications. Natural rubber maintains a strong presence due to high elasticity and shock absorption, while styrene-butadiene rubber sees demand in tire and industrial products. The choice of material is heavily influenced by end-use requirements such as temperature tolerance, chemical resistance, and mechanical performance. Growth in automotive, electrical, and consumer goods sectors drives EPDM adoption globally.

- For instance, Sumitomo Chemical Co., Ltd., a key partner, manufactures ESPRENE EPDM 7456, a peroxide-cured grade with a molecular weight of 980,000 and an ethylidene norbornene (ENB) content of 6.5%.

By End-user

The automotive sector leads the end-user segment, capturing approximately 50% market share. Strong growth is supported by increasing production of lightweight and high-performance components such as seals, gaskets, and vibration-damping parts. Consumer goods and healthcare segments also show steady demand, driven by flexible and durable molded rubber products for appliances and medical devices. Electrical & electronics and construction applications are growing due to insulation and sealing needs. Innovations in material formulations and rising regulatory emphasis on safety and sustainability further fuel automotive and consumer adoption of molded rubber components.

Key Growth Drivers

Rising Automotive Production

Increasing automotive production globally drives demand for rubber molded components. Components like seals, gaskets, and vibration-damping parts rely on advanced rubber molding techniques. Growth in electric vehicle production further fuels demand due to requirements for lightweight, durable, and heat-resistant materials. Additionally, stringent safety and emission regulations push manufacturers to adopt high-performance rubber materials. Expansion of automotive manufacturing hubs in Asia-Pacific and North America continues to boost demand for compression, transfer, and injection molding, establishing the automotive sector as a primary driver of market growth.

- For instance, Toyota Central R&D Labs, Toyoda Gosei developed a technology that reduces steam usage during rubber hose production. This innovation cuts steam consumption by 50%, leading to a reduction of 110 tonnes of CO₂ emissions annually at their Morimachi plant.

Expansion in Consumer Goods & Healthcare

The growing consumer goods and healthcare sectors significantly drive rubber molding adoption. Durable rubber components are essential in appliances, personal care devices, medical instruments, and protective equipment. Rising demand for hygiene-focused products, wearable devices, and home automation appliances encourages manufacturers to use molded rubber for durability and design flexibility. Moreover, innovations in materials like EPDM and silicone enhance product performance and longevity. Expansion of healthcare infrastructure and increasing consumer spending on premium appliances further support rubber molding market growth in these segments.

- For instance, Puyang Linshi produces IR-550 polyisoprene latex with no branching or microgels, achieving particle sizes of 0.15 µm and molecular weights around 1.2 million g/mol, making it functionally similar to natural rubber latex in sensitive film applications.

Technological Advancements in Molding Techniques

Advancements in molding technologies, including precision injection, transfer, and compression molding, accelerate market growth. Automation and digital control systems improve production efficiency, reduce cycle times, and minimize waste. Development of eco-friendly and high-performance rubber compounds also attracts industries requiring durability, heat resistance, and chemical stability. Manufacturers can produce complex shapes with high dimensional accuracy, supporting diverse applications in automotive, electronics, and healthcare. Continuous R&D in molding processes strengthens market competitiveness and encourages adoption of advanced molded rubber components across multiple end-user industries.

Key Trends & Opportunities

Integration of Lightweight & Sustainable Materials

The market is witnessing a trend toward lightweight and eco-friendly rubber materials. Companies focus on reducing component weight while maintaining durability for automotive and industrial applications. Recycled rubber and bio-based polymers are increasingly integrated into molding processes to meet sustainability targets. Additionally, demand for energy-efficient, lightweight products in automotive and consumer goods sectors creates new growth opportunities. Adoption of green manufacturing practices and regulatory incentives for sustainable products encourage manufacturers to innovate in materials, driving long-term expansion of the rubber molding market globally.

- For instance, Yokohama Bay Bridge in Japan underwent a seismic retrofit in 2005 using steel link-bearing connections (LBCs) to enhance its ability to withstand seismic events.

Rising Demand in Electronics & Electrical Applications

Growing electronics and electrical industries present opportunities for rubber molding due to insulation and sealing requirements. Molded rubber components are increasingly used in connectors, switches, protective casings, and vibration-damping systems. Miniaturization of electronic devices drives demand for precision molding with high dimensional accuracy. Innovations in heat-resistant and flame-retardant materials further support adoption. Expansion in consumer electronics, renewable energy infrastructure, and smart devices continues to fuel market growth, offering opportunities for advanced molding techniques to meet industry-specific performance and regulatory standards.

- For instance, Zeon’s planned SSBR output expansion will bring combined installed capacity to 125,000 tonnes per annum across its Japan and Singapore plants. The material’s balance of durability and affordability keeps it a preferred choice for tire manufacturers.

Customization & Design Flexibility

Increasing demand for customized rubber components drives market innovation. End-users require tailored shapes, hardness levels, and surface finishes for specific applications. Advanced molding technologies allow manufacturers to meet these specifications efficiently. Automotive, healthcare, and consumer electronics sectors especially benefit from design flexibility to enhance performance and aesthetic appeal. Opportunities exist in developing multi-material and multi-color molded products, which improve functionality and user experience. Companies investing in R&D for customization gain a competitive edge and expand their market presence in diverse industrial applications.

Key Challenges

High Raw Material Costs

Volatile raw material prices, particularly natural rubber and synthetic polymers, challenge market profitability. Price fluctuations affect production costs and pricing strategies, limiting adoption in cost-sensitive industries. Dependency on petroleum-based feedstocks for synthetic rubber exposes manufacturers to global supply chain disruptions. Additionally, maintaining consistent quality while controlling costs is a persistent challenge. Companies must adopt efficient procurement, recycling, and alternative materials to mitigate impact. High raw material costs may slow market expansion, especially in emerging economies where price sensitivity is significant.

Stringent Environmental & Regulatory Compliance

Rubber molding manufacturers face strict environmental and safety regulations. Compliance with chemical handling, emissions, and waste disposal norms increases operational complexity and cost. Regulations on volatile organic compounds (VOCs) and sustainability standards further require adoption of eco-friendly materials and processes. Non-compliance can result in penalties, recalls, or restricted market access. Companies must invest in cleaner production techniques, waste management, and employee training. Navigating varying regulations across regions presents a challenge, particularly for global manufacturers seeking consistent quality and environmentally responsible operations.

Regional Analysis

North America

North America holds a significant share of the Rubber Molding Market, accounting for approximately 28%. The region benefits from strong automotive and aerospace industries, demanding high-performance molded rubber components. Growth in consumer goods and healthcare sectors further supports adoption. Technological advancements in compression and injection molding, coupled with stringent quality standards, enhance market competitiveness. The U.S. dominates regional demand, driven by electric vehicle production and advanced manufacturing capabilities. Expansion of R&D facilities and investments in sustainable and lightweight materials continue to strengthen North America’s position as a key market, offering opportunities for both domestic and international manufacturers.

Europe

Europe contributes roughly 25% to the global Rubber Molding Market. Automotive, construction, and electrical industries drive strong demand for molded rubber components. Germany, France, and Italy lead adoption due to advanced manufacturing infrastructure and regulatory emphasis on sustainability. High-quality standards, coupled with innovations in EPDM and silicone molding, support precision applications. The rise of electric vehicles and renewable energy projects boosts requirements for durable and lightweight components. Increasing focus on environmentally friendly materials and efficient molding processes enhances regional growth prospects. Europe remains a mature and technologically advanced market, balancing innovation with compliance and sustainability initiatives.

Asia-Pacific

Asia-Pacific dominates the Rubber Molding Market with nearly 35% share, driven by robust automotive, electronics, and construction sectors. China, Japan, and India are key contributors, leveraging large-scale manufacturing and cost-efficient production. Rising urbanization, infrastructure development, and consumer goods demand fuel regional expansion. Adoption of advanced molding technologies, including automated injection and transfer molding, supports high-volume and precision applications. Government initiatives promoting electric vehicles and industrial modernization further boost market growth. The region presents significant opportunities for domestic and international players due to favorable labor costs, growing industrial base, and increasing demand for high-performance molded rubber components.

Latin America

Latin America accounts for around 7% of the global Rubber Molding Market. Brazil and Mexico lead regional demand, driven by automotive, construction, and consumer goods sectors. Expansion of industrial infrastructure and growing vehicle production support adoption of molded rubber components. The market faces challenges due to fluctuating raw material prices and limited technological adoption compared to developed regions. However, rising investments in manufacturing facilities and government initiatives to support industrial growth create growth opportunities. Demand for durable, lightweight, and cost-effective molded components in automotive and electronics applications continues to drive regional market expansion.

Middle East & Africa

Middle East & Africa contribute roughly 5% to the global Rubber Molding Market. Automotive, construction, and electrical industries drive regional adoption, with the UAE, Saudi Arabia, and South Africa leading demand. Infrastructure projects and rising energy sector activity increase the need for molded rubber components. Market growth is challenged by limited local manufacturing capabilities and reliance on imports. However, ongoing industrialization, investment in advanced molding technologies, and expanding automotive production create growth opportunities. Focus on durability, chemical resistance, and heat tolerance in rubber components further supports adoption, strengthening the region’s market presence despite moderate overall share.

Market Segmentations:

By Type:

- Compression Molding

- Transfer Molding

By Material:

- Natural Rubber

- Styrene Butadiene Rubber

By End User:

- Automotive

- Consumer Goods

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Rubber Molding Market players such as Mason Rubber Company, Freudenberg and Co, Sumitomo Riko Ltd, Britech Industries, Toyota Gosei Co Ltd, Intertech Taiwan, Cooper Standards, Dana Incorporated, NOK Corporation, and Continental AG. The Rubber Molding Market is highly competitive, driven by technological innovation, material advancements, and growing demand across end-use industries. Companies focus on enhancing precision, durability, and design flexibility through injection, compression, and transfer molding techniques. Rising adoption of lightweight and sustainable materials supports applications in automotive, healthcare, consumer goods, and electronics. Strategic initiatives such as regional expansion, automation, and R&D investment strengthen market positioning. Increasing demand for customized and high-performance rubber components, coupled with regulatory compliance and sustainability requirements, continues to fuel growth. Collaboration with end-users and innovation in production processes remain critical to maintaining competitiveness and capturing emerging opportunities in the global rubber molding market.

Key Player Analysis

- Mason Rubber Company

- Freudenberg and Co

- Sumitomo Riko Ltd

- Britech Industries

- Toyota Gosei Co Ltd

- Intertech Taiwan

- Cooper Standards

- Dana Incorporated

- NOK Corporation

- Continental AG

Recent Developments

- In April 2025, Tariff turbulence cast a shadow over the rubber plantations of Kerala. With the U.S. tariff suspension on the Indian rubber industry, prices are affected with a certain drop in the rate.

- In November 2024, Ecore International received a significant investment from General Atlantic’s BeyondNetZero fund to enhance its rubber recycling operations. This funding aims to support Ecore’s efforts in developing sustainable solutions for recycling rubber materials. The investment aims to expand the company’s capabilities and contribute to a circular economy by reducing waste and promoting the reuse of rubber products.

- In April 2024, Continental has acquired the mold manufacturing specialist EMT Púchov s.r.o. based in Slovakia. Continental Acquires Mold Specialist for Commercial Vehicle and Specialty Tires. This acquisition completes Continental’s portfolio for mold making technology.

- In March 2024, Firestone Natural Rubber Company reported a 12% increase in rubber production from its Liberian plantations, reaching 180,000 tons in 2024, driven by sustainable farming and high-yielding rubber tree varieties.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to rising automotive and industrial demand.

- Increasing adoption of electric vehicles will drive high-performance rubber component usage.

- Lightweight and eco-friendly materials will see broader application across industries.

- Advanced molding technologies will improve production efficiency and product precision.

- Growth in healthcare and consumer goods sectors will boost molded rubber adoption.

- Emerging markets in Asia-Pacific and Latin America will offer significant expansion opportunities.

- Customization and design flexibility will become critical to meet end-user requirements.

- Integration of sustainable and recycled materials will gain regulatory support.

- Industry consolidation and strategic partnerships will enhance global competitiveness.

- Continuous R&D and innovation will support high-performance, durable, and versatile products.