Market Overview

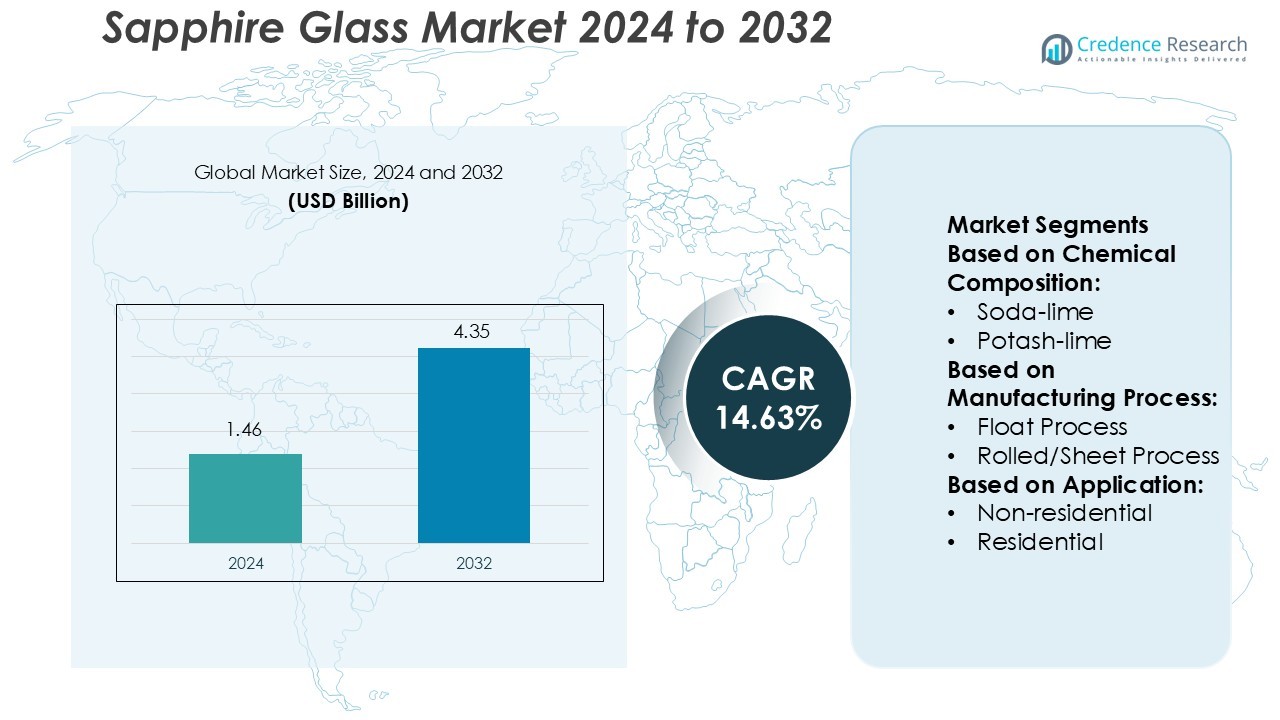

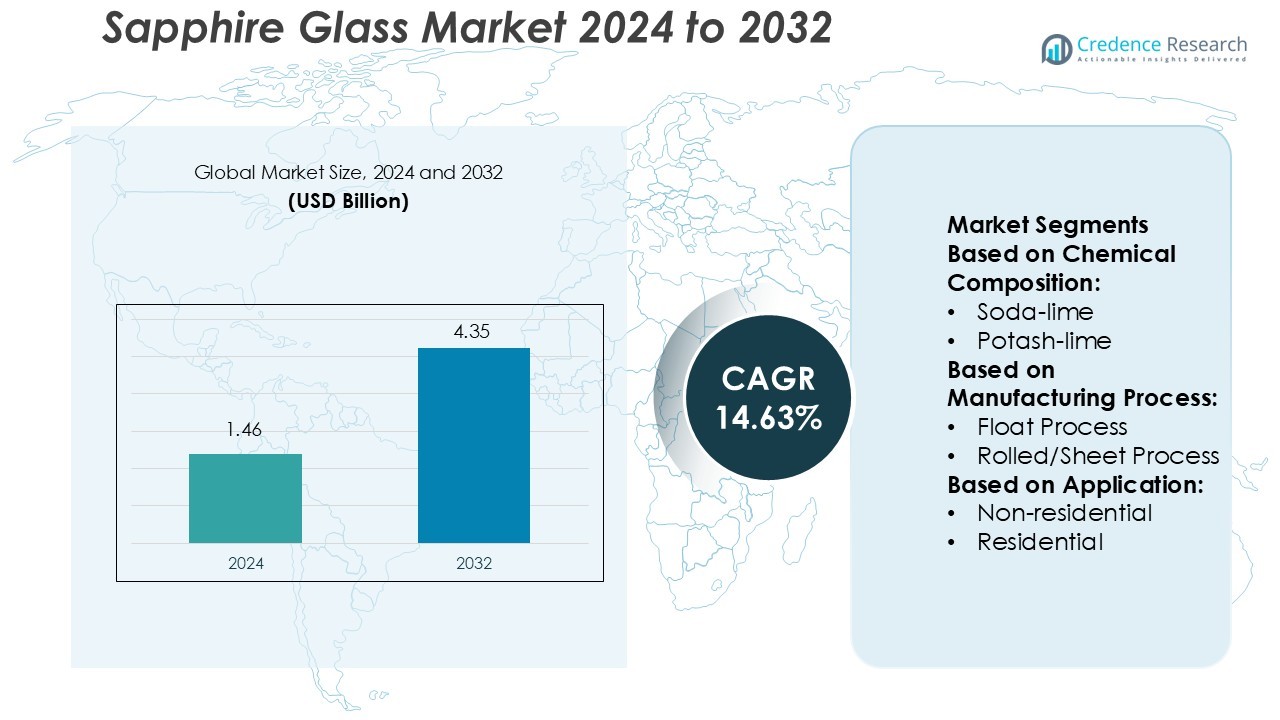

Sapphire Glass Market size was valued USD 1.46 billion in 2024 and is anticipated to reach USD 4.35 billion by 2032, at a CAGR of 14.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sapphire Glass Market Size 2024 |

USD 1.46 Billion |

| Sapphire Glass Market, CAGR |

14.63% |

| Sapphire Glass Market Size 2032 |

USD 4.35 Billion |

The sapphire glass market is driven by prominent companies including Corning Inc., Schott AG, Saint-Gobain, AGC Glass, Asahi Glass, Guardian Glass, Ardagh Group, Vetropack Holding SA, Stoelzle Glass Group, and Virdala. These players focus on advanced crystal growth, high-precision optical processing, and sustainable production technologies to meet the growing demand from electronics, aerospace, and defense industries. Continuous innovation in ultra-thin substrates, scratch-resistant coatings, and heat-resistant materials supports product diversification. Asia-Pacific leads the global sapphire glass market with a 37% share, driven by large-scale electronics manufacturing, robust semiconductor production, and expanding LED applications across China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sapphire Glass Market size was valued at USD 1.46 billion in 2024 and is projected to reach USD 4.35 billion by 2032, growing at a CAGR of 14.63% during the forecast period.

- Rising demand for durable, scratch-resistant materials in electronics, optics, and aerospace drives market expansion, supported by growing LED and semiconductor applications.

- Technological advancements in ultra-thin substrates, heat-resistant coatings, and precision manufacturing create strong competitive differentiation among key producers.

- High production costs and complex crystal growth processes remain major restraints, limiting large-scale adoption in mid-range consumer devices.

- Asia-Pacific dominates the market with a 37% share, followed by North America at 32% and Europe at 26%, while the electronics segment holds the largest share due to widespread use of sapphire glass in displays, sensors, and optical lenses across industrial and consumer applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Chemical Composition

The soda-lime segment dominates the sapphire glass market with the largest market share. Its widespread use is driven by high clarity, scratch resistance, and low production cost. Soda-lime glass serves applications in smartphone displays, watch crystals, and optical components. Manufacturers enhance its strength through ion exchange and thermal tempering. For instance, Corning Incorporated’s strengthened soda-lime formulations are used in precision optical systems and display covers, improving durability under extreme stress conditions and enabling large-scale production for consumer electronics and industrial optics.

- For instance, Guardian Glass has developed its “UltraClear®” low-iron soda-lime float glass with an average iron content of just 0.01 % and visible light transmittance exceeding 91 %.

By Manufacturing Process

The float process segment holds the dominant share in the sapphire glass market. This process offers high surface uniformity and cost efficiency, making it suitable for large-scale production. It ensures optical-grade transparency and minimal distortion, which are critical for electronic displays and sensor windows. For instance, SCHOTT AG employs advanced float lines with precision-controlled atmospheres to achieve consistent thickness and high purity across sapphire substrates used in defense optics, semiconductor wafers, and aerospace windows, ensuring tight dimensional tolerances and defect-free surfaces.

- For instance, Schott uses its proprietary micro-float process to produce specialty glass with exceptional flatness and mirror-like surfaces. The process involves precise temperature control, with the glass floating on a tin bath at temperatures around 600°C.

By Application

The non-residential segment leads the sapphire glass market with the highest share. Demand is driven by its use in aerospace, defense, and industrial sectors where thermal stability and hardness are essential. Non-residential uses also include instrumentation panels and protective covers for harsh environments. For instance, Saint-Gobain produces high-transparency sapphire glass for avionics and infrared sensor housings, offering hardness exceeding 2000 HV and transmission rates above 85%, which ensures performance reliability in defense-grade applications and precision optical instrumentation.

Key Growth Drivers

Rising Demand for Durable Optical Materials

The increasing use of sapphire glass in smartphones, wearables, and optical instruments drives market growth. Its superior hardness, scratch resistance, and high optical clarity make it ideal for high-end consumer electronics. Manufacturers prefer sapphire glass over traditional materials due to its longer lifecycle and resilience to environmental stress. For instance, Apple integrates sapphire crystal covers in device cameras and watch displays, enhancing durability and aesthetic appeal, while Samsung uses sapphire-coated lenses for high-precision imaging performance and enhanced optical transmission.

- For instance, Ardagh Group’s glass division invested in a “NextGen” furnace at its Obernkirchen, Germany facility that transitions the energy input from ~90% natural gas to ~80% renewable electricity and ~20% gas, a change which is calculated to reduce Scope 1/2/3 CO₂ emissions at that site by 65-70%.

Expanding Adoption in Aerospace and Defense Applications

Sapphire glass is gaining traction in aerospace and defense for sensor windows, armor systems, and optical domes. Its exceptional thermal stability and resistance to ballistic impact enable use in harsh operational environments. Growing defense budgets and investments in advanced surveillance systems further boost demand. For instance, Raytheon Technologies utilizes sapphire windows in infrared and laser systems that withstand temperatures exceeding 2,000°C, ensuring mission reliability and optical accuracy during high-velocity and high-temperature operations.

- For instance, Corning’s Gorilla® Glass Victus® 2 survived drops up to 1 metre onto concrete-simulating surfaces, while competitive aluminosilicate glasses failed from ~0.5 metre.

Technological Advancements in Manufacturing Processes

Continuous improvements in sapphire glass production, such as the Kyropoulos and Czochralski methods, enhance yield and quality. These techniques enable the production of larger and defect-free crystals at reduced costs. Automation and digital control technologies are streamlining growth rates and refining optical properties. For instance, Rubicon Technology’s precision-controlled growth systems allow the fabrication of 8-inch sapphire wafers, improving uniformity and minimizing material loss, which supports large-scale adoption in semiconductor and optical applications globally.

Key Trends & Opportunities

Integration in Next-Generation Electronics

Sapphire glass is increasingly integrated into next-generation devices such as foldable smartphones, AR/VR headsets, and advanced sensors. Its transparency and thermal endurance suit emerging display technologies. The trend supports higher performance and longevity in premium electronics. For instance, Huawei uses sapphire lenses for its flagship smartphone cameras, improving optical precision and reducing distortion in high-resolution imaging, creating opportunities for sapphire suppliers to expand into smart device ecosystems.

- For instance, Stoelzle reports that in autumn 2020 they began producing white glass using at least 20 % post-consumer recycled (PCR) cullet, which resulted in about 20 % natural raw material savings, 4 % energy savings and approx. 16 % CO₂ reduction.

Growth in Semiconductor and LED Applications

The rising production of LEDs and optical semiconductors presents major growth opportunities. Sapphire substrates are crucial for epitaxial growth of GaN-based LEDs due to their lattice stability and heat resistance. Global transition toward energy-efficient lighting drives sapphire substrate demand. For instance, Kyocera Corporation supplies precision sapphire wafers for blue and white LED production, ensuring superior thermal conductivity and defect control to meet global lighting efficiency targets and high-luminance display applications.

- For instance, Saint-Gobain’s Crystals business offers sapphire windows with a surface flatness of up to 1/20 λ and a surface quality down to scratch-dig “10-5”.

Key Challenges

High Production and Processing Costs

Sapphire glass manufacturing involves high energy consumption and complex crystal growth processes. These factors elevate overall production costs compared to alternatives like Gorilla Glass. The need for precise machining and polishing also adds expenses. For instance, companies like Monocrystal invest heavily in automated grinding and polishing technologies to reduce unit costs, yet sapphire remains less cost-competitive, posing a barrier to adoption in mid-range consumer electronics and large-scale display applications.

Technical Limitations in Large-Scale Fabrication

Producing large, defect-free sapphire glass sheets remains challenging due to brittleness and thermal expansion constraints. Scaling up without compromising optical clarity or mechanical strength demands advanced crystal control systems. For instance, GT Advanced Technologies continues R&D in high-temperature furnace systems to improve large boule yields, but maintaining uniformity across wider panels still limits use in large displays and architectural applications, hindering full commercialization potential in broader markets.

Regional Analysis

North America

North America holds a 32% share of the sapphire glass market, driven by strong demand from the aerospace, defense, and electronics sectors. The United States leads the region due to its established semiconductor and optical component manufacturing base. Growing investments in defense optics and smartphone displays strengthen market growth. For instance, Raytheon and Corning supply sapphire optics for infrared sensors and smartphone components, respectively, ensuring high durability and thermal resistance. Continuous R&D in high-purity sapphire crystal production supports regional competitiveness and fosters technological innovation across defense and advanced electronics applications.

Europe

Europe accounts for a 26% share of the global sapphire glass market, supported by strong industrial and automotive applications. Countries such as Germany, France, and the U.K. drive adoption in optics, defense, and luxury consumer goods. The region benefits from technological expertise in precision optics and sustainable manufacturing. For instance, SCHOTT AG and Saint-Gobain produce high-grade sapphire components for avionics and sensor systems, ensuring superior clarity and strength. Increased adoption of sapphire glass in automotive sensors and laser optics contributes to Europe’s expanding share in the global market.

Asia-Pacific

Asia-Pacific dominates the global sapphire glass market with a 37% share, led by China, Japan, and South Korea. Rapid growth in electronics manufacturing and LED production fuels demand across the region. The presence of major smartphone and semiconductor manufacturers accelerates consumption. For instance, Kyocera and Monocrystal produce sapphire substrates for LED and display applications, meeting high-volume production standards. China’s expanding optical manufacturing infrastructure and government initiatives to boost high-tech material development further strengthen the regional market. Asia-Pacific remains the hub for innovation, low-cost production, and export-oriented sapphire glass manufacturing.

Latin America

Latin America holds a 3% share of the sapphire glass market, primarily driven by growing industrial and electronics applications in Brazil and Mexico. Increasing demand for high-durability glass in instrumentation and communication equipment supports market development. Local adoption in renewable energy sensors and automotive components is also emerging. For instance, regional electronics assemblers source sapphire-coated optical parts for advanced devices and measurement tools. Although manufacturing capabilities remain limited, rising imports of sapphire substrates and growing collaboration with global material suppliers enhance market prospects across Latin America.

Middle East & Africa

The Middle East & Africa region captures a 2% share of the global sapphire glass market, supported by defense modernization and infrastructure advancements. The UAE and Saudi Arabia are leading adopters of sapphire-based optics for military and aerospace applications. Industrial and architectural glass demand is also rising with growing urban infrastructure. For instance, regional defense firms integrate sapphire windows for thermal imaging and targeting systems to ensure optical performance in desert climates. Increasing partnerships with global optics manufacturers are helping the region strengthen its sapphire glass supply chain capabilities.

Market Segmentations:

By Chemical Composition:

By Manufacturing Process:

- Float Process

- Rolled/Sheet Process

By Application:

- Non-residential

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sapphire Glass Market features leading players such as Vetropack Holding SA, Guardian Glass, Schott AG, Ardagh Group, Virdala, Corning Inc, Stoelzle Glass Group, Saint Gobain, Asahi Glass, and AGC Glass. The sapphire glass market is highly competitive, driven by advancements in material engineering and precision manufacturing. Companies are investing heavily in R&D to enhance transparency, durability, and cost efficiency of sapphire substrates. Innovations in crystal growth methods such as the Kyropoulos and Czochralski processes are improving yield and scalability. Manufacturers are also focusing on developing eco-efficient and energy-optimized production systems to reduce carbon emissions. Strategic collaborations with semiconductor and consumer electronics firms support technology transfer and application expansion. Continuous product differentiation, automation, and quality control remain central to maintaining competitiveness in the global sapphire glass market.

Key Player Analysis

- Vetropack Holding SA

- Guardian Glass

- Schott AG

- Ardagh Group

- Virdala

- Corning Inc

- Stoelzle Glass Group

- Saint Gobain

- Asahi Glass

- AGC Glass

Recent Developments

- In January 2025, AGC Glass Europe is set to invest a significant amount in a new production line at its Lodelinsart facility in Belgium for FINEO ultra-thin insulating vacuum glass. This initiative aims to enhance glass manufacturing capabilities, responding to increasing customer demand for innovative solutions. Set to begin operations in mid-2026, the line is expected to boost production of FINEO.

- In October 2024, Vetropack was awarded the prestigious Austrian State Prize Smart Packaging in the “Packaging of the Future”. The company received the award for its innovative 0.33-litre reusable bottle made of thermally tempered lightweight glass, which is available to the entire Austrian brewing industry as a standard solution.

- In July 2023, HeatCure, a transparent nanotechnology coating, launched its operations in India. The primary function of this nanotechnology-based coating is to block heat gain from glass doors, windows, and facades.

- In June 2023, Saint-Gobain India has launched the production of India’s first low-carbon glass, aiming to meet the growing demand for sustainable building materials in the construction industry. This innovative glass manufacturing process is expected to reduce carbon emissions by approximately 40% compared to existing products, utilizing two-thirds recycled content and renewable energy sources.

Report Coverage

The research report offers an in-depth analysis based on Chemical Composition, Manufacturing Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sapphire glass will increase across smartphones, wearables, and optical sensors.

- Manufacturers will adopt advanced crystal growth technologies to improve production efficiency.

- The use of sapphire substrates in LEDs and semiconductors will continue to expand.

- Defense and aerospace sectors will boost adoption for high-durability optical components.

- Integration of sapphire glass in automotive sensors and display panels will grow steadily.

- R&D investments will focus on reducing manufacturing costs and defect rates.

- Partnerships between glass producers and electronics companies will strengthen global supply chains.

- Asia-Pacific will remain the leading manufacturing and export hub for sapphire products.

- Sustainable production and energy-efficient furnace systems will gain industry focus.

- Emerging applications in renewable energy and medical devices will create new growth opportunities.

Market Segmentation Analysis:

Market Segmentation Analysis: