Market Overview

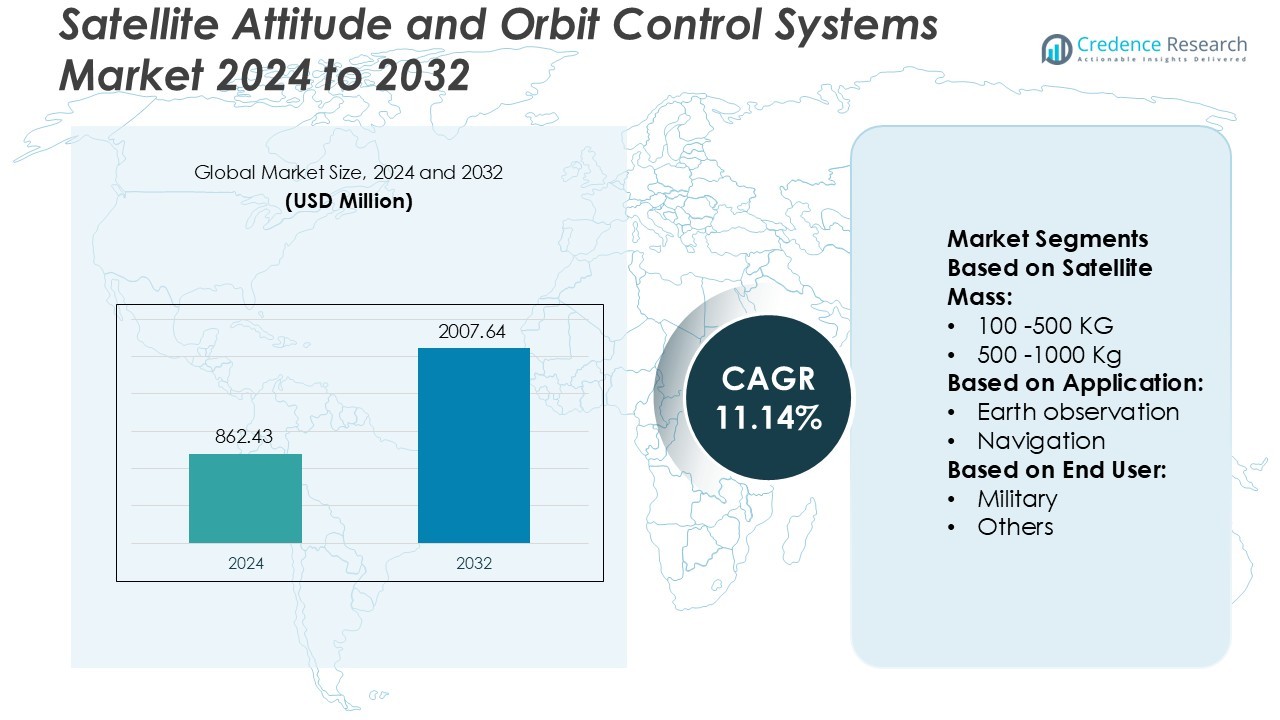

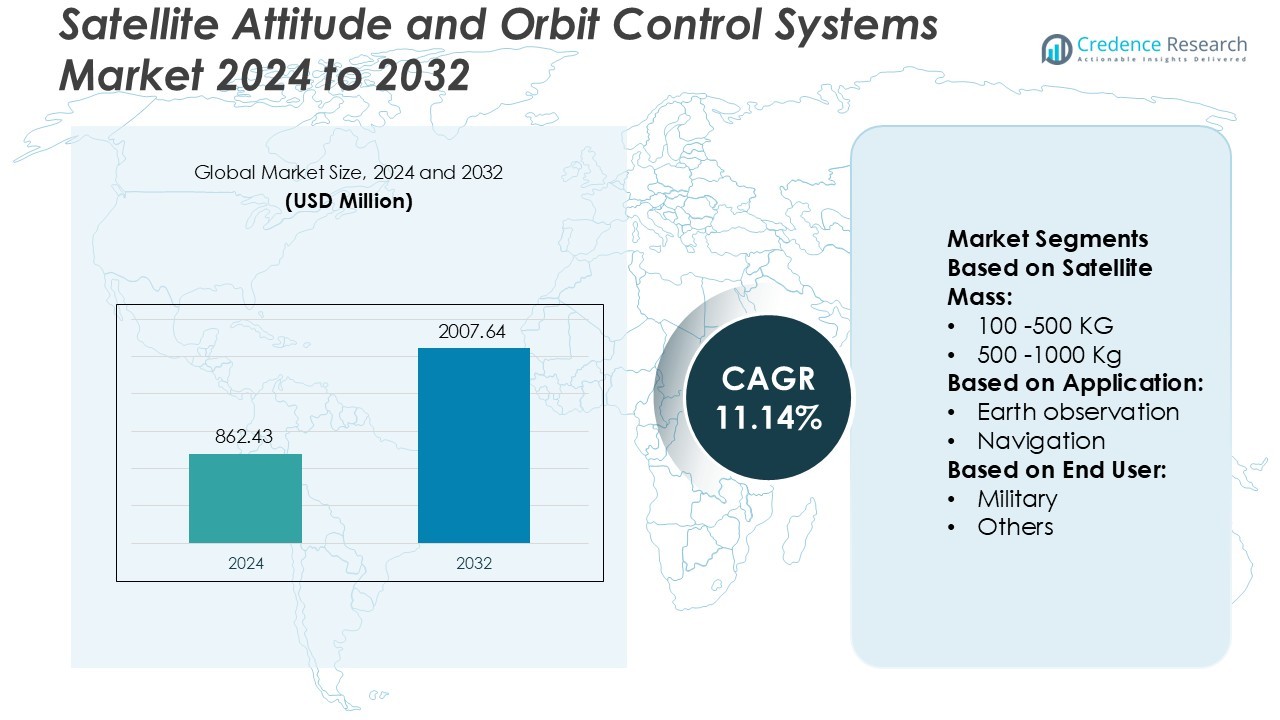

Satellite Attitude and Orbit Control Systems Market size was valued USD 862.43 million in 2024 and is anticipated to reach USD 2007.64 million by 2032, at a CAGR of 11.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Attitude and Orbit Control Systems Market Size 2024 |

USD 862.43 Million |

| Satellite Attitude and Orbit Control Systems Market, CAGR |

11.14% |

| Satellite Attitude and Orbit Control Systems Market Size 2032 |

USD 2007.64 Million |

The Satellite Attitude and Orbit Control Systems (AOCS) Market is shaped by leading players including Rockwell Automation, Inc., Siemens AG, OMRON Corporation, Emerson Electric Co., Honeywell International, Inc., ABB Ltd., Schneider Electric, Mitsubishi Electric Corporation, Yokogawa Electric Corporation, and Kawasaki Heavy Industries, Ltd. These companies focus on enhancing satellite precision, stability, and energy efficiency through advanced control algorithms and sensor integration. They invest in AI-driven automation, lightweight actuators, and modular AOCS platforms to support rising small satellite deployments. North America leads the global market with a 36% share, driven by strong investments in space exploration, defense satellites, and commercial communication constellations. Strategic collaborations between private space firms and government agencies further strengthen the region’s dominance in AOCS innovation and deployment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Satellite Attitude and Orbit Control Systems Market was valued at USD 862.43 million in 2024 and is projected to reach USD 2007.64 million by 2032, growing at a CAGR of 11.14% during the forecast period.

- Growing satellite launches for communication, Earth observation, and navigation are major drivers boosting the adoption of precise orbit control systems.

- Technological advancements in AI-based control algorithms, miniaturized sensors, and micro-propulsion units are transforming satellite efficiency and reliability.

- The market faces restraints from high development costs and strict testing requirements, which limit accessibility for small operators.

- North America dominates the market with a 36% share, driven by government and private space initiatives, followed by Europe at 28% and Asia-Pacific at 25%, where increasing LEO satellite deployments strengthen regional demand across commercial and defense sectors.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Satellite Mass

Satellites weighing above 1,000 kg dominate the Satellite Attitude and Orbit Control Systems (AOCS) Market with a 42% share. These large satellites demand precise attitude control for stable imaging, communication, and navigation functions. Their complex payloads and longer operational lifespans drive the need for advanced propulsion and stabilization systems. Manufacturers are integrating electric propulsion and gyroscopic stabilization for higher accuracy and reduced fuel usage. The demand from geostationary communication and defense satellites continues to strengthen this segment’s leadership, supported by increasing government and commercial launches of heavy satellites.

- For instance, ISRO satellite such as GSAT-2 or those in the INSAT-4 series (e.g., INSAT-4B) weighed approximately 1,825 kg (or slightly more) at launch and employed a 440 N liquid apogee motor along with sixteen 22-N reaction control thrusters for both orbit-raising and attitude control tasks.

By Application

The communication segment holds the dominant position with a 38% market share in the Satellite AOCS Market. Growth in global broadband networks, 5G connectivity, and direct-to-home services drives demand for communication satellites with precise orbit control. Companies are focusing on real-time telemetry and active attitude correction systems to maintain uninterrupted signal transmission. Increasing investments in high-throughput satellites (HTS) and Low Earth Orbit (LEO) communication constellations further boost system adoption. The segment’s dominance stems from its critical role in ensuring continuous coverage, especially across remote and maritime regions.

- For instance, Siemens’ digital twin and model‐based systems engineering (MBSE) solution for aerospace reports a 96% on-time delivery rate and a 90% reduction in labor hours during conceptual design.

By End-user

The government and military segment leads the Satellite AOCS Market with a 47% share. National space agencies and defense organizations rely heavily on accurate orbit control for surveillance, reconnaissance, and navigation missions. Rising investments in defense satellite programs and earth monitoring initiatives support steady growth in this segment. AOCS solutions are crucial for ensuring positional accuracy, mission longevity, and resilience in high-threat environments. Increasing partnerships between defense agencies and private aerospace firms also accelerate the integration of advanced attitude control technologies for strategic and tactical space operations.

Key Growth Drivers

- Rising Demand for High-Precision Earth Observation Missions

The increasing number of Earth observation satellites requires advanced attitude and orbit control systems for accurate imaging and data collection. Governments and private firms deploy satellites with high-resolution cameras for agriculture, climate monitoring, and disaster management. These missions demand fine pointing accuracy and rapid stabilization after maneuvers. As imaging resolutions improve below one meter, AOCS technologies integrating reaction wheels and star trackers become essential, driving strong market growth across environmental and defense applications.

- For instance, OMRON announced its NX 502 automation controller features data-collection jitter of 1 µs or less and a data-transfer capacity roughly 4× that of its prior equivalent class.

- Expansion of LEO Constellations for Communication Networks

The surge in Low Earth Orbit (LEO) satellite constellations for broadband and communication services fuels AOCS adoption. Companies like SpaceX and OneWeb deploy thousands of small satellites requiring compact yet efficient orbit control systems. These systems maintain precise formation and minimize collision risk through continuous orbit correction. The rise of commercial satellite internet networks strengthens demand for lightweight and power-efficient AOCS units optimized for multi-satellite coordination and real-time control, ensuring uninterrupted connectivity and reduced latency.

- For instance, Emerson’s Paine™ 212 miniature-satellite pressure transmitter weighs just 75 grams and operates up to 5,000 psia (344 bar) while being radiation-hardened to 100 kRad (Si) for satellite thruster and propellant pressure monitoring.

- Government Investments in Space Exploration Programs

National space agencies are significantly increasing investments in advanced satellite control technologies for exploration and defense. Programs by NASA, ESA, ISRO, and CNSA include interplanetary and lunar missions that require long-duration orbit control. These initiatives accelerate the development of robust propulsion and attitude systems capable of maintaining trajectory accuracy in deep-space conditions. Additionally, defense-related space programs demand secure and autonomous control systems, further supporting AOCS innovation and technology standardization.

Key Trends & Opportunities

- Integration of AI and Autonomous Control Systems

Artificial intelligence integration in AOCS enhances autonomy, enabling real-time fault detection and self-correction. AI algorithms optimize attitude control efficiency and minimize human intervention in satellite operations. This trend supports the shift toward autonomous satellite constellations that can reorient and adjust orbits independently. Companies developing intelligent AOCS platforms gain opportunities to reduce operational costs and extend satellite lifespan. The advancement of onboard processing and machine learning further enhances precision, safety, and responsiveness in dynamic space environments.

- For instance, Honeywell’s next-generation Reaction Wheel Assembly (HC-RWA) supports spacecraft from 150 kg to 700 kg and builds on more than 2,500 small-satellite units already in flight.

- Miniaturization and Development of Compact AOCS for Small Satellites

The growing popularity of CubeSats and nanosatellites drives demand for miniaturized control systems. Manufacturers focus on developing lightweight sensors, magnetorquers, and reaction wheels tailored for small satellites. These compact AOCS solutions reduce launch costs while maintaining high reliability and precision. Startups and research institutes are investing in scalable designs that can support multi-satellite missions in LEO. This miniaturization trend expands market reach among commercial players entering Earth observation, IoT, and academic space research.

- For instance, Schneider Electric has supported over 15 years of launch-vehicle and satellite operations at Indian Space Research Organisation’s Satish Dhawan Space Centre (SDSC SHAR).

Key Challenges

- High Cost of Development and Integration

Developing and testing advanced AOCS technologies requires substantial investment in hardware, calibration facilities, and simulation environments. High-precision components like gyroscopes, actuators, and star sensors significantly raise production costs. Smaller satellite manufacturers face financial barriers in adopting advanced systems, especially for LEO missions. Additionally, the integration of AOCS with propulsion and communication modules adds complexity, increasing overall mission expenses and limiting market access for emerging space companies.

- Reliability Issues and Environmental Constraints

Satellite AOCS components operate under extreme temperature fluctuations, radiation exposure, and mechanical stress. These conditions can cause sensor drift, actuator degradation, or control instability during long missions. Ensuring reliability and redundancy in such environments remains a challenge for system designers. Failures in attitude or orbit control can lead to mission loss or orbital debris generation, prompting stricter quality standards. Manufacturers must invest in radiation-hardened materials and fail-safe architectures to ensure long-term operational stability.

Regional Analysis

North America

North America dominates the Satellite Attitude and Orbit Control Systems (AOCS) Market with a 36% share, driven by strong investments in satellite communication and defense programs. The United States leads due to NASA, SpaceX, and Northrop Grumman’s continuous advancements in spacecraft precision systems. The rising number of LEO satellite launches for broadband connectivity and Earth observation supports market expansion. Canada contributes through its space robotics and small satellite initiatives. Continuous collaboration between public and private players enhances innovation in control algorithms and propulsion integration, solidifying North America’s leadership in global satellite operations.

Europe

Europe holds a 28% market share in the Satellite Attitude and Orbit Control Systems Market, supported by the European Space Agency (ESA) and leading aerospace firms like Airbus Defence and Space and Thales Alenia Space. The region focuses on enhancing spacecraft autonomy and control precision through advanced micro-propulsion systems. The demand for high-accuracy AOCS in Earth observation and interplanetary missions further accelerates market growth. Countries such as France, Germany, and the U.K. lead R&D investments to strengthen navigation and stabilization systems, ensuring Europe remains a competitive hub for next-generation satellite technologies.

Asia-Pacific

Asia-Pacific captures a 25% share of the Satellite Attitude and Orbit Control Systems Market, propelled by increasing satellite launches from China, India, and Japan. Organizations like ISRO, JAXA, and CASC drive advancements in cost-effective AOCS modules for LEO and GEO satellites. The region’s growing participation in global space exploration and communication satellite programs boosts adoption. Expanding private space ventures in India and China also contribute to the market’s development. The surge in government funding for domestic space technology enhances the region’s manufacturing and export capabilities, strengthening Asia-Pacific’s global position.

Latin America

Latin America accounts for a 6% share of the global Satellite Attitude and Orbit Control Systems Market. The region’s growth is fueled by Brazil’s expanding satellite programs under INPE and increasing participation in international space collaborations. Emerging nations like Argentina and Mexico are also investing in small-satellite missions for environmental and agricultural monitoring. Partnerships with U.S. and European agencies help strengthen regional satellite control capabilities. Although infrastructure limitations persist, government support for space education and R&D is steadily improving, indicating gradual market expansion and stronger regional presence in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the Satellite Attitude and Orbit Control Systems Market, supported by rising interest in national space programs and satellite-based communication. The UAE and Saudi Arabia lead with growing investments in Earth observation and defense satellites. The UAE Space Agency’s strategic initiatives, including Mars missions, drive demand for advanced AOCS technologies. Africa’s focus remains on communication and navigation satellites for connectivity and resource management. Despite smaller budgets, regional governments are increasingly partnering with global aerospace firms to develop indigenous satellite control capabilities.

Market Segmentations:

By Satellite Mass:

By Application:

- Earth observation

- Navigation

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Satellite Attitude and Orbit Control Systems (AOCS) Market features prominent players such as Rockwell Automation, Inc., Siemens AG, OMRON Corporation, Emerson Electric Co., Honeywell International, Inc., ABB Ltd., Schneider Electric, Mitsubishi Electric Corporation, Yokogawa Electric Corporation, and Kawasaki Heavy Industries, Ltd. The Satellite Attitude and Orbit Control Systems (AOCS) Market is moderately consolidated, characterized by continuous innovation and technological advancement. Leading manufacturers prioritize high-precision sensors, miniaturized actuators, and advanced control algorithms to enhance spacecraft maneuverability and stability. The industry focuses on developing scalable AOCS platforms suitable for both large and small satellite constellations. Strategic partnerships between aerospace firms and government space agencies drive new product development and strengthen global supply chains. Companies are investing heavily in AI-enabled control systems, low-power propulsion, and fault-tolerant designs to improve reliability and mission efficiency. With increasing demand for Earth observation, navigation, and communication satellites, competition intensifies around energy-efficient and autonomous AOCS technologies. Continuous R&D investments and collaborations across commercial and defense sectors are expected to shape future market dynamics, fostering innovation and operational excellence across satellite missions.

Key Player Analysis

Recent Developments

- In July 2025, Honeywell International Inc. was selected by the US Department of Defense’s (DoD’s) Innovation Unit under the TQS program to develop quantum-sensing inertial units (CRUISE and QUEST) for navigation and inertial sensing, a capability with relevance to attitude/orbit control subsystems.

- In October 2024, Italian space logistics company D-Orbit signed a contract with the European Space Agency for the maintenance of spacecraft. Under the contract, D-Orbit would develop, launch, and demonstrate a vehicle capable of performing rendezvous, docking, and orientation and orbit control functions for satellites in geostationary orbit.

- In July 2024, CNES and Bpifrance selected a Thales Alenia Space-led consortium, including the Magellium Artal Group, to showcase an in-orbit capture and inspection service. This project, DIANE (Démonstration d’Inspection et Amarrage Novatrice Embarquée), is part of France’s 2030 national investment plan.

- In February 2023, Jena-Optronik announced its selection by satellite constellation manufacturer Airbus OneWeb Satellites to supply the ASTRO CL star tracker for the ARROW family of small satellites. Airbus OneWeb Satellites, a joint venture between Airbus and OneWeb, has chosen Jena-Optronik, a leading provider of advanced optical sensors for the global space industry, to contribute its expertise to this project.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Satellite Mass, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for small and nanosatellites will continue driving innovation in compact AOCS designs.

- Integration of AI and machine learning will enhance satellite autonomy and fault detection capabilities.

- Growth in commercial space missions will increase the adoption of cost-efficient control systems.

- Advancements in micro-propulsion technologies will improve orbit correction accuracy and efficiency.

- Rising LEO satellite constellations will create consistent demand for scalable control architectures.

- Collaboration between private space firms and national agencies will accelerate AOCS research and deployment.

- Modular and reconfigurable AOCS units will gain traction for multi-mission adaptability.

- Increased focus on satellite longevity will drive development of durable and energy-optimized components.

- Adoption of hybrid propulsion and attitude control systems will enhance maneuvering precision.

- Expansion of global satellite broadband networks will strengthen investment in high-reliability AOCS technologies.

Market Segmentation Analysis:

Market Segmentation Analysis: