Market Overview

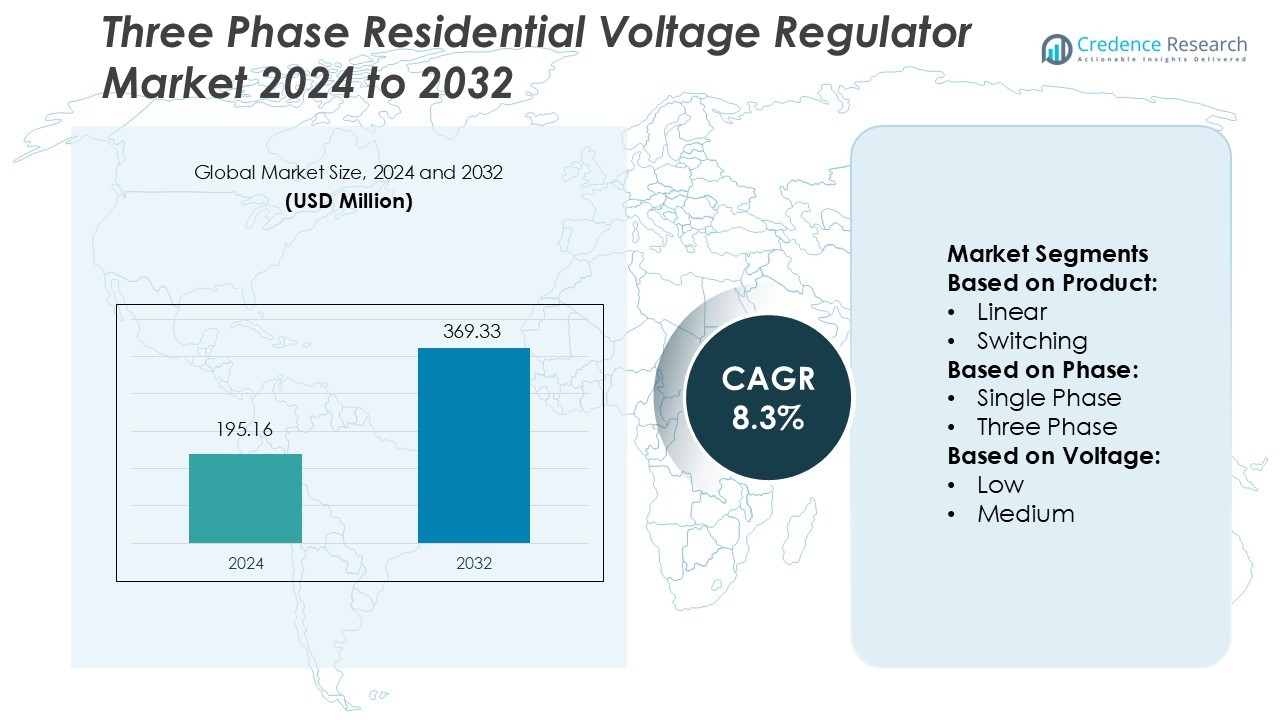

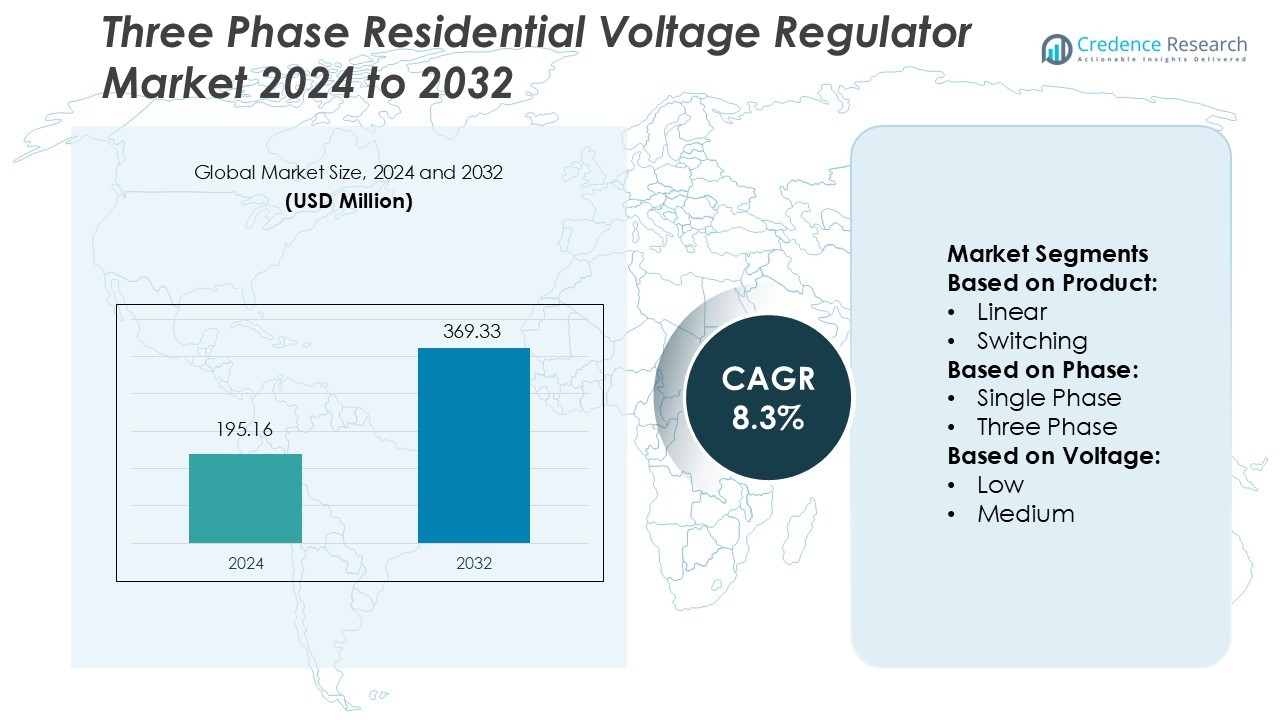

Three Phase Residential Voltage Regulator Market size was valued USD 195.16 million in 2024 and is anticipated to reach USD 369.33 million by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase Residential Voltage Regulator Market Size 2024 |

USD 195.16 Million |

| Three Phase Residential Voltage Regulator Market, CAGR |

8.3% |

| Three Phase Residential Voltage Regulator Market Size 2032 |

USD 369.33 Million |

The three‑phase residential voltage regulator market include Analog Devices, Inc., Eaton Corporation, General Electric Company, Infineon Technologies AG, Legrand S.A. and Siemens AG. These firms lead through strong brand recognition, global channel networks and broad technical portfolios in residential power‑quality solutions. The Asia‑Pacific region commands the largest share of the global market with an exact figure of 36 %. The region’s dominance stems from rapid urbanisation, increasing residential electricity demand and aging grid infrastructure, all of which drive adoption of three‑phase regulators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The three phase residential voltage regulator market was valued at USD 195.16 million in 2024 and is projected to reach USD 369.33 million by 2032, growing at a CAGR of 8.3% during the forecast period.

- Asia Pacific leads the market with a 36 % share, driven by urbanisation, rising residential electricity demand, and aging grid infrastructure, followed by North America and Europe with significant adoption rates.

- Analog Devices, Inc., Eaton Corporation, General Electric Company, Infineon Technologies AG, Legrand S.A., and Siemens AG dominate the competitive landscape, leveraging strong brand presence, extensive distribution networks, and advanced technical portfolios.

- Linear regulators hold a dominant segment share due to their efficiency in maintaining stable voltage levels for residential applications, while three‑phase systems are preferred for high-load residential setups.

- Market trends include smart voltage monitoring, integration with renewable energy, and IoT-enabled solutions, whereas restraints involve high installation costs and regulatory compliance challenges in emerging regions.

Market Segmentation Analysis:

By Product

The linear voltage regulator segment dominates the Three Phase Residential Voltage Regulator Market, holding a 61% share in 2024. Its popularity stems from simple circuit design, low noise output, and cost efficiency for household appliances. Linear regulators provide stable voltage with minimal electromagnetic interference, ideal for sensitive residential electronics. Their high reliability in low-voltage environments further drives adoption in smart homes and modular power distribution systems. The switching regulator segment, while smaller, is expanding due to energy-efficient designs and higher power conversion capabilities for modern household devices.

- For instance, Purevolt offers three‑phase air‑cooled servo voltage stabilizers rated from 1 kVA to 2,000 kVA. These units maintain output voltage at 380/400/415 V ±1% for three‑phase configurations.

By Phase

The three-phase segment accounts for a 58% share, emerging as the dominant phase configuration in the market. Its high efficiency and superior load-balancing capacity make it suitable for large residential complexes, high-rise buildings, and smart grid integrations. Three-phase systems enable stable voltage regulation during peak loads, reducing power loss and extending appliance lifespan. Demand is further driven by the growing shift toward energy-efficient electrical infrastructure and integration of solar-based residential power systems, where three-phase regulators enhance distributed power control and stability.

- For instance, Microchip’s MCP1702 series delivers up to 250 mA output current while consuming only 2.0 µA quiescent current, and its input operating voltage range is 2.7 V to 13.2 V.

By Voltage

The low-voltage segment leads the market with a 64% share, driven by widespread use in household electrical circuits and appliances. These regulators are ideal for operating below 1 kV, ensuring consistent power quality and safety in residential setups. Their compact design and easy installation make them preferred for low-load home applications such as lighting, air conditioning, and refrigeration. Increasing demand for home automation systems and smart metering further supports this segment, as low-voltage regulators ensure reliable operation of connected devices and sensitive electronic components.

Key Growth Drivers

- Rising Residential Power Demand and Electrification

Increasing household electricity consumption is a major driver for the Three Phase Residential Voltage Regulator Market. Rapid urbanization and the expansion of smart housing projects boost demand for efficient voltage management systems. Households depend on regulators to protect modern electronic appliances from voltage fluctuations. The push toward electrification of residential infrastructure, combined with increasing use of HVAC systems, lifts the adoption of advanced three-phase regulators designed for consistent voltage delivery and energy stability in densely populated areas.

- For instance, MaxLinear’s G.hn baseband processors and analog front‑end chipsets deliver physical data rates up to 2 Gbps over power‑lines and support up to 250 network nodes across distances of up to 700 m, thus enabling high‑speed communication in smart residential electrical systems.

- Integration of Smart Grid and IoT-Based Systems

The growing integration of smart grid infrastructure and IoT-enabled systems supports market expansion. Three-phase voltage regulators equipped with digital monitoring and automated control help utilities manage distributed loads more efficiently. These regulators ensure voltage optimization through real-time communication with grid systems, improving power reliability. The adoption of smart homes and connected devices increases the need for regulators that can adapt to dynamic load variations while minimizing energy waste and enhancing overall grid efficiency.

- For instance, Ricoh’s regulator model R1560 accepts an input voltage range up to 60 V (absolute max rating up to 80 V) and consumes only 3.0 µA supply current in its operating mode, making it suitable for integration into electrified residential infrastructure.

- Expansion of Renewable Energy in Residential Power Supply

The rising penetration of solar and wind energy in residential power networks drives demand for reliable voltage regulation. Three-phase voltage regulators stabilize fluctuations caused by variable renewable inputs, ensuring steady power delivery. They are essential in hybrid energy systems combining grid and solar sources. The global focus on sustainability and government incentives for renewable integration encourage households to adopt efficient regulators capable of managing distributed power generation while reducing power loss and improving energy quality.

Key Trends & Opportunities

- Adoption of Energy-Efficient and Eco-Friendly Regulators

Manufacturers are increasingly developing energy-efficient voltage regulators that reduce power losses and carbon emissions. Modern three-phase systems use advanced semiconductor materials and digital control circuits to optimize energy flow. The shift toward green technologies aligns with global energy efficiency standards and consumer preferences for sustainable solutions. This trend creates opportunities for companies to innovate eco-friendly designs that meet regulatory norms while supporting renewable integration and energy conservation in smart residential environments.

- For instance, GE’s pole‑mounted voltage regulator model VR‑PM supports over 2 million mechanical load‑tap changer operations, demonstrating extreme durability in variable power networks.

- Growing Demand for Smart Monitoring and Automation

The trend of remote monitoring and automation in residential power systems enhances the appeal of intelligent voltage regulators. These systems enable homeowners to track energy performance and detect voltage anomalies in real time through connected interfaces. Cloud-based analytics and AI-driven control further improve operational efficiency and maintenance scheduling. As smart home ecosystems expand, integrating automated voltage regulation technologies becomes an opportunity for manufacturers to differentiate through digital performance and predictive reliability features.

- For instance, Cooper Power Series step‑voltage regulators operate in 32 discrete tap positions (~5/8% per step) to achieve ±10% voltage regulation in wye‑connected banks.

Key Challenges

- High Installation and Maintenance Costs

The adoption of three-phase residential voltage regulators faces hurdles due to higher installation and maintenance costs compared to single-phase systems. These regulators require complex wiring and periodic calibration, increasing total ownership expenses for homeowners. In regions with limited technical expertise, installation inefficiencies can delay adoption. Addressing cost constraints through modular design and low-maintenance components remains a key challenge for market expansion in price-sensitive economies.

- Compatibility Issues with Legacy Residential Infrastructure

Integrating advanced three-phase regulators into existing residential electrical networks presents compatibility challenges. Older housing systems often lack the wiring capacity or safety provisions needed for multi-phase regulation. Retrofitting such structures can be costly and time-consuming, discouraging end-user adoption. Manufacturers must design adaptable solutions that offer backward compatibility while meeting safety and performance standards, enabling broader implementation in both modern and legacy residential environments.

Regional Analysis

North America

The North American market commands roughly 24 % of global revenue, driven by extensive residential electrification and strengthening grid infrastructure. The U.S. housing sector’s new builds and upgrades support demand for three‑phase regulators in suburban and multi‑unit homes. Advanced energy‑efficiency mandates and increasing smart home adoption boost regulator usage. Aging distribution systems and frequent voltage disturbances further reinforce investing in stabilisation devices. Manufacturers and utilities collaborate to bundle voltage regulation with automation offerings. The combination of regulatory incentives and consumer awareness positions North America as a mature but steadily expanding region for three‑phase residential voltage regulation.

Europe

Europe holds approximately 22 % share of the market, with growth propelled by retrofitting legacy grids and integrating renewable micro‑generation at the residential level. Mature housing stock in Germany, France and the UK often uses three‑phase supply in multi dwelling units, supporting regulator adoption. Stringent power‑quality standards and increasing electric‑vehicle loads contribute to demand for three‑phase voltage stabilisers. Manufacturers are targeting smart‑grid enabled solutions that tie voltage regulation into home energy management systems. While growth rates are lower than in emerging regions, Europe remains a key region for high‑performance residential voltage regulation solutions.

Asia‑Pacific

Asia‑Pacific leads the market with about 34 % share, driven by rapid urbanisation, electrification of new residential developments, and rising appliance loads in India, China and Southeast Asia. Many new residential complexes are wired with three‑phase supply, enabling the roll‑out of three‑phase regulators to improve power quality and protect electronics. The region’s ageing grids, frequent outages and surge in rooftop solar setups create high demand for voltage stabilisation devices. Affordable manufacturing and increasing local infrastructure investment support regional solution providers. Asia‑Pacific presents the largest growth opportunity for three‑phase residential regulator vendors.

Latin America

Latin America accounts for roughly 9 % of the global market, supported by expanding residential segments in Brazil, Argentina and Mexico that adopt three‑phase systems in higher‑end homes and small‑scale apartment blocks. Grid instability, voltage fluctuations and growing solar‑PV installations fuel demand for residential‑grade three‑phase voltage regulators. Some regulatory environments are evolving to promote power‑quality devices in new housing. However, budget constraints and slower infrastructure refresh cycles dampen penetration compared to developed regions. Suppliers focusing on cost‑efficient models find favourable traction in Latin America’s emerging residential regulator market.

Middle East & Africa

The Middle East & Africa region holds about 11 % share, driven by new residential developments, smart‑city projects and large‑scale electrification in the Gulf and Africa. Many properties in the Middle East deploy three‑phase connections to serve high loads in villas and residential towers, making three‑phase voltage regulation a relevant value proposition. Regions with extreme ambient conditions and grid volatility particularly benefit from high‑reliability regulators. Market growth is supported by government initiatives targeting energy‑efficient homes and grid resilience. Nonetheless, fragmented supply chains and varying regulatory frameworks across countries moderate growth pace.

Market Segmentations:

By Product:

By Phase:

By Voltage:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Three Phase Residential Voltage Regulator Market include Maschinenfabrik Reinhausen GmbH, Infineon Technologies AG, Purevolt, Microchip Technology Inc., MaxLinear, Ricoh USA, Inc., General Electric, Legrand, Eaton, and NXP Semiconductors. The Three Phase Residential Voltage Regulator Market is highly competitive, driven by continuous technological innovation and increasing demand for reliable power quality solutions. Companies focus on enhancing regulator efficiency, integrating smart monitoring, and improving surge protection to meet growing residential and multi-unit housing needs. Product differentiation through modular designs, compact form factors, and energy-efficient operation is critical. Strategic collaborations, mergers, and regional expansions help strengthen market presence and reach emerging markets. Additionally, investments in R&D accelerate development of advanced solutions that support smart grids, renewable energy integration, and remote diagnostics. The competitive environment encourages continuous improvement in product performance, reliability, and cost-effectiveness, driving overall market growth while addressing residential energy stability and sustainability requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Maschinenfabrik Reinhausen GmbH

- Infineon Technologies AG

- Purevolt

- Microchip Technology Inc.

- MaxLinear

- Ricoh USA, Inc.

- General Electric

- Legrand

- Eaton

- NXP Semiconductors

Recent Developments

- In May 2024, Eaton has inaugurated its new manufacturing plant in Santiago de los Caballeros. This expansion is in line with the company’s commitment to enhancing supply capabilities essential for data centers, energy storage systems, renewable energy projects, and electric vehicles. Moreover, the company is enhancing manufacturing capabilities for voltage regulators, transformers, and EV charging technologies.

- In April 2024, STMicroelectronics introduced the LDQ40 and LDH40 voltage regulators, designed to operate efficiently from a low 3.3V input and up to 40V. The LDH40 offers adjustable output ranging from 1.2V to 22V, providing up to 200mA, while the LDQ40 delivers 250mA with adjustable outputs from 1.2V to 12V, along with fixed options of 1.8V, 2.5V, 3.3V, and 5.0V.

- In March 2024, Maschinenfabrik Reinhausen has completed the acquisition of Easun-MR Tap Changers. This acquisition solidified EMR as a fully owned subsidiary of MR while preserving its autonomous market role. This acquisition not only strengthens MR’s commitment to the Indian market but also positions the company to capitalize on emerging opportunities in the dynamic global energy landscape.

- In May 2023, Toshiba International Corporation launched the TCR1HF series of regulators offering high voltage and a wide input voltage range and industry-leading low standby current consumption. These regulators support input voltages from 4V to 36V, making them ideal for a variety of applications, including USB PD. The company intends to expand the series to meet the diverse needs of different applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Phase, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart home technologies will drive demand for advanced three-phase regulators.

- Integration with renewable energy systems will enhance regulator relevance in residential settings.

- Increasing urbanization and high-rise housing developments will expand market opportunities.

- Aging electrical infrastructure will prompt upgrades to improve power quality and stability.

- Manufacturers will focus on energy-efficient and compact designs for modern homes.

- Growth in electric vehicle charging at residences will require stable three-phase supply.

- Regulatory standards for voltage quality will encourage wider deployment of regulators.

- Digital monitoring and IoT-enabled devices will support predictive maintenance and performance optimization.

- Expansion into emerging markets will sustain regional growth and competitive advantage.

- Continuous R&D will lead to more reliable, durable, and cost-effective voltage regulation solutions.