Market Overview

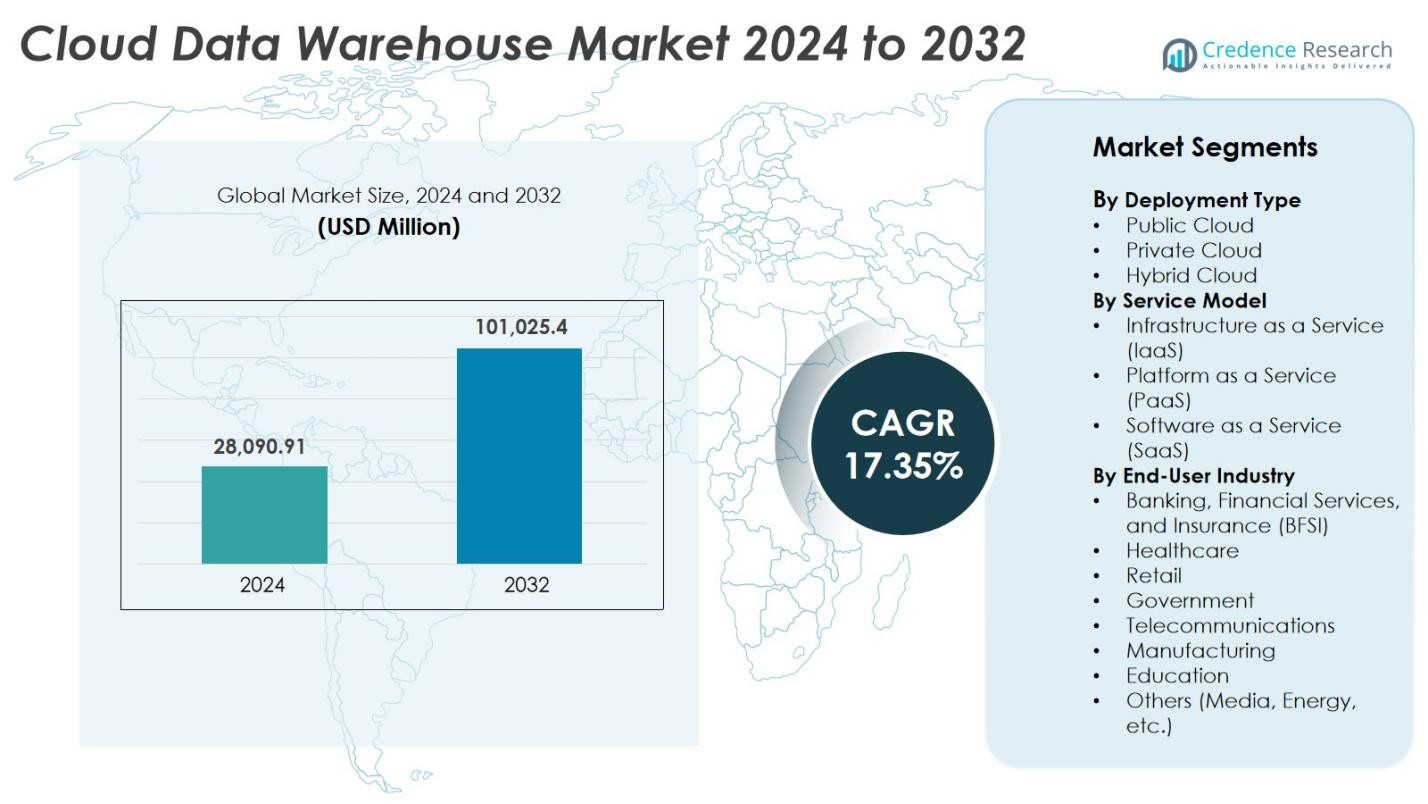

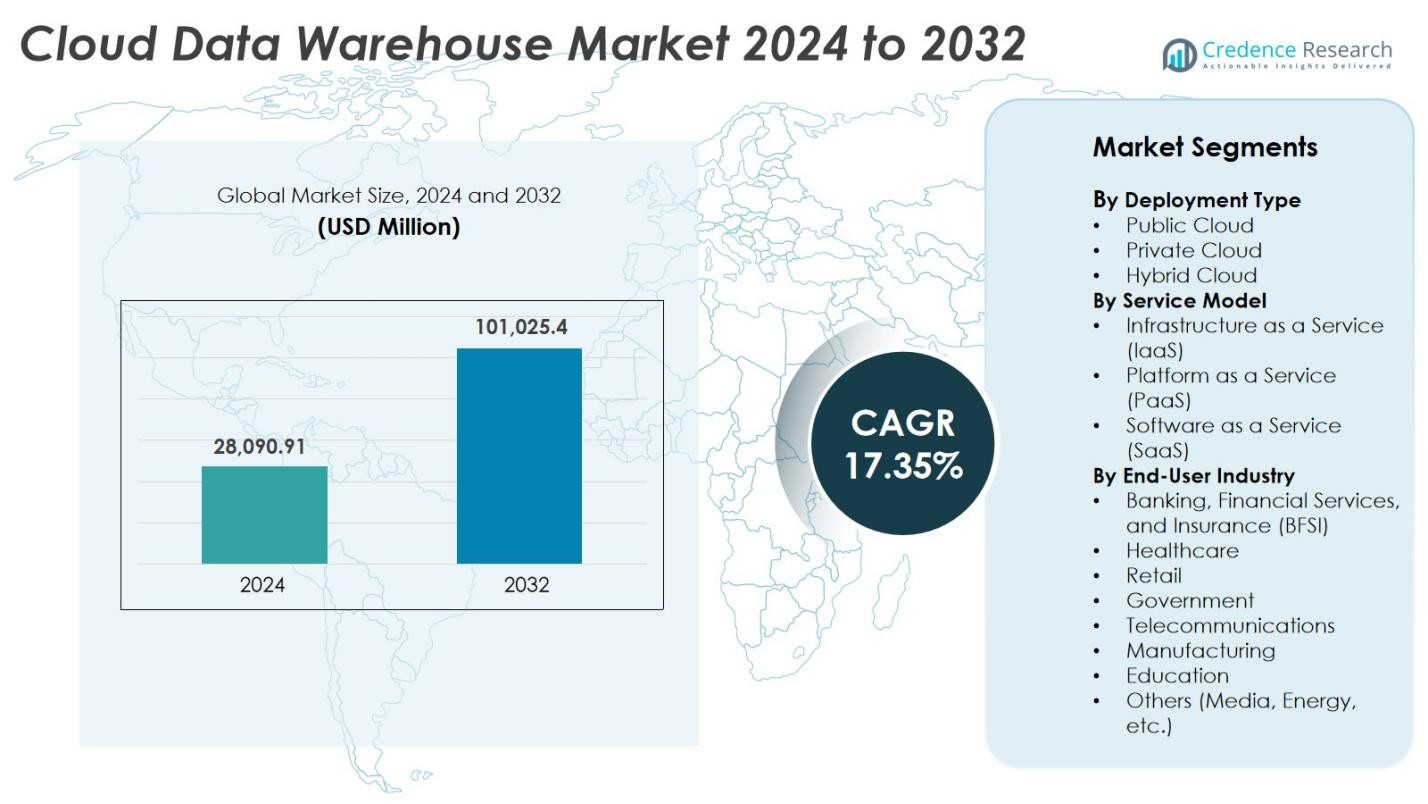

Cloud Data Warehouse Market size was valued USD 28,090.91 million in 2024 and is anticipated to reach USD 101,025.4 million by 2032, at a CAGR of 17.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Data Warehouse Market Size 2024 |

USD 28,090.91 Million |

| Cloud Data Warehouse Market, CAGR |

17.35% |

| Cloud Data Warehouse Market Size 2032 |

USD 101,025.4 Million |

The Cloud Data Warehouse market is led by major providers such as Amazon Web Services, Microsoft Azure, Google Cloud, Snowflake, Oracle Cloud, SAP, IBM Cloud, Cloudera, Teradata, and Alteryx. These companies dominate due to high-performance architectures, scalable storage, AI-driven analytics, and strong partner ecosystems. AWS and Snowflake maintain leading presence in enterprise deployments, while Microsoft Azure and Google Cloud expand through integrated data, security, and machine learning services. North America holds the highest share at 41%, supported by early cloud adoption, large-scale digital transformation, and strong investment from BFSI, telecom, and retail industries.

Market Insights

Market Insights

- The Cloud Data Warehouse market reached USD 28,090.91 million in 2024 and will hit USD 101,025.4 million by 2032 at a 17.35% CAGR.

- Demand rises due to real-time analytics, AI-ready workloads, and cost-efficient storage, with public cloud holding the largest deployment share because of scalability and pay-as-you-go pricing.

- Trends include growing multi-cloud and hybrid adoption, strong shift toward SaaS-based platforms, and machine-learning automation improving data processing and predictive insights.

- Competition is led by AWS, Microsoft Azure, Google Cloud, Snowflake, Oracle Cloud, and IBM, focusing on faster queries, integrated analytics, and multi-cloud support for regulated industries.

- North America leads with a 41% regional share, driven by early cloud adoption and strong enterprise spending, while BFSI is the largest end-user segment due to fraud detection, regulatory reporting, and real-time decision-making needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Type

Public cloud deployment dominates the Cloud Data Warehouse market with the largest share due to its scalability, pay-as-you-go pricing, and minimal infrastructure burden on enterprises. Small and medium businesses rapidly adopt public cloud platforms to reduce capital expenses and accelerate data analytics. Hybrid cloud adoption is increasing in data-sensitive sectors that require both on-premise control and cloud flexibility. Private cloud remains relevant for organizations with strict compliance needs, but its growth pace is slower compared to public cloud models.

- For instance, Amazon Web Services (AWS) powers many cloud data warehouse solutions, enabling small and medium businesses to adopt scalable data analytics without heavy upfront investments.

By Service Model

Software-as-a-Service (SaaS) holds the dominant share in the service model segment, driven by ease of deployment, automatic updates, and reduced IT overhead. Businesses prefer SaaS-based data warehouses because they offer optimized storage and analytics without requiring hardware or database management expertise. PaaS continues to gain traction as enterprises seek customized data workflows and integration flexibility. IaaS remains popular among large organizations with in-house IT teams looking for full control over computing, storage, and networking infrastructure.

- For instance, Snowflake, a leading SaaS data warehouse, offers cloud-agnostic services on AWS, Azure, and Google Cloud, enabling separate scaling of compute and storage resources while processing millions of rows in seconds.

By End-User Industry

Banking, Financial Services, and Insurance (BFSI) lead the market with the highest share, supported by increased adoption of cloud-based analytics for fraud detection, regulatory reporting, and real-time customer insights. Telecommunications and retail industries follow due to rising data volumes from digital platforms, customer tracking, and predictive analytics. Healthcare and government agencies adopt cloud data warehouses for secure record management and data standardization, while manufacturing and education sectors continue to grow with gradual digital transformation.

Key Growth Drivers

Rising Adoption of Analytics and Real-Time Insights

Organizations generate massive data from applications, IoT devices, transactions, and customer platforms. They now require real-time analytics to make fast and informed decisions, which drives rapid adoption of cloud data warehouses. These platforms support large-scale data integration and fast query performance, helping enterprises convert raw data into actionable insights. Industries such as BFSI, retail, and telecom use cloud-based analytics for customer behavior tracking, fraud detection, and operational forecasting. As data models become more complex, traditional databases struggle to scale, while cloud warehouses offer high compute power and elastic storage without downtime. The demand for predictive analytics and AI-ready datasets further pushes companies toward cloud-native warehouse solutions.

- For instance, JPMorgan Chase accelerated its cloud-first strategy by migrating critical workloads to hybrid cloud platforms, enabling real-time analytics for customer insights and fraud detection.

Cost-Efficient Storage and Flexible Scalability

Cloud data warehouses reduce capital expenses by eliminating hardware purchases, maintenance, and on-premise data centers. Businesses shift to subscription-based models and pay only for consumed storage and compute resources, which supports better cost management. Their ability to scale automatically during heavy workloads attracts enterprises with fluctuating data needs. This flexibility is beneficial for industries dealing with seasonal spikes, such as e-commerce, media, and travel. Cloud providers also introduce tiered storage options and automation to reduce operational costs. The financial advantages, combined with reduced administrative efforts, encourage fast adoption among small and midsized enterprises seeking enterprise-grade analytics without large upfront investment.

- For instance, Snowflake’s multi-cloud architecture allows customers to scale compute and storage independently, paying solely for the resources they use, which enhances cost efficiency.

Increasing Cloud Migration and Digital Transformation

Global digital transformation initiatives push companies to modernize legacy warehouse systems that are slow, costly, and inflexible. Enterprises migrating to the cloud benefit from improved reliability, disaster recovery, and centralized data access across departments and regions. The rise of remote work, online services, and digital customer engagement increases the volume of structured and unstructured data. Cloud data warehouses support seamless integration with CRM systems, IoT platforms, ERP software, and AI tools, enabling end-to-end digital ecosystems. Governments and large enterprises also adopt cloud-first strategies to improve efficiency, transparency, and automation. This transition continues to act as a major growth catalyst for the market.

Key Trends and Opportunities

Expansion of AI-Optimized and Machine Learning Workloads

Cloud data warehouses increasingly integrate AI and machine learning capabilities to deliver faster predictive modeling, pattern identification, and automated data preparation. Businesses use AI-driven analytics for customer segmentation, demand forecasting, recommendation engines, and cybersecurity analysis. Providers now offer built-in machine learning modules, reducing the need for separate platforms or data pipelines. The interoperability of cloud warehouses with popular ML frameworks creates opportunities for advanced analytics in BFSI, healthcare, retail, and manufacturing. As more companies focus on automation and intelligent data processing, demand for AI-ready data warehouse architectures continues to rise.

- For instance, Oracle Autonomous Data Warehouse leverages an autonomous machine learning layer that optimizes query performance, workload balancing, and schema design automatically.

Growth of Multi-Cloud and Hybrid Deployments

Enterprises adopt multi-cloud and hybrid models to avoid vendor lock-in, enhance data security, and optimize workload placement. Sensitive data can remain on-premise, while analytics operate in the public cloud, offering both control and performance. Multi-cloud environments also improve resilience by distributing data and compute tasks across providers. Cloud vendors respond with interoperability tools, unified dashboards, and cross-platform data management. This trend opens new opportunities for service providers offering migration support, governance, and integration services. As regulatory compliance grows stricter, hybrid cloud becomes a preferred model for highly regulated sectors.

- For instance, IBM Cloud and Microsoft Azure collaborated to enable enterprises to seamlessly bridge on-premises IBM Power workloads with Azure’s cloud-native services, allowing businesses to deploy applications on the most suitable infrastructure while maintaining interoperability across environments.

Key Challenges

Data Security and Compliance Concerns

Despite strong growth, many enterprises remain cautious due to concerns about data privacy, cyberattacks, and regulatory compliance. Sectors such as BFSI, healthcare, and government handle sensitive information that must meet strict standards. Misconfigurations, weak access control, and third-party vulnerabilities create risks in shared infrastructure environments. Cloud providers offer encryption, identity management, and monitoring tools, but businesses must implement proper governance to prevent data loss. Complying with global standards such as GDPR, HIPAA, or financial regulations adds complexity, especially for multi-cloud deployments.

Integration Complexity with Legacy Systems

Many organizations still depend on outdated databases and on-premise applications. Migrating historical data, ensuring compatibility, and redesigning workflows can be resource-intensive. Data mapping, ETL processes, and application modernization require skilled professionals and time. Some enterprises face performance issues when legacy tools are not built to handle cloud-native processes. Resistance from internal IT teams and high transition costs can slow deployment. These challenges push companies to adopt phased migration strategies, but slow integration may limit the full benefits of cloud data warehousing.

Regional Analysis

North America

North America holds the largest share of the Cloud Data Warehouse market, accounting for about 38% of global revenue. The region’s dominance is driven by early cloud adoption, robust IT infrastructure, and growing demand for real-time analytics. The United States leads the market, supported by major providers such as Amazon Web Services, Google Cloud, and Microsoft Azure, which have their headquarters or large operations in the region. High adoption across BFSI, retail, healthcare, and telecom continues to boost growth. Enterprises are increasingly migrating from legacy systems to cloud-native data warehouses to enhance scalability, performance, and data-driven decision-making.

Europe

Europe ranks second in the Cloud Data Warehouse market, contributing 27% of global revenue. Strong digitalization across manufacturing, banking, and government sectors supports market expansion. Enterprises continue transitioning toward centralized and compliant data platforms aligned with GDPR requirements. Key countries such as Germany, the United Kingdom, and France drive enterprise cloud adoption with hybrid and multi-cloud models ensuring flexibility and data sovereignty. Investments in AI-driven analytics, cybersecurity, and automation strengthen operational efficiency. Ongoing modernization of analytics infrastructure and cloud-native innovation helps Europe maintain a vital role in shaping the global data warehouse ecosystem.

Asia Pacific

Asia Pacific emerges as the fastest-growing region in the Cloud Data Warehouse market, holding 24% of the total share. Rapid digital transformation across China, India, Japan, and Southeast Asia accelerates adoption in e-commerce, telecommunications, and BFSI sectors. Small and medium enterprises increasingly opt for cost-effective cloud solutions to improve data accessibility and scalability. Regional and global providers like Alibaba Cloud, Tencent Cloud, and AWS are expanding data centers to meet growing local demand. Rising smartphone penetration, online transactions, and government-led digital initiatives further boost demand for cloud-based analytics, making Asia Pacific a major future growth hub.

Latin America

Latin America holds a smaller yet steadily expanding portion of the Cloud Data Warehouse market at about 6%. Brazil and Mexico lead regional adoption, fueled by the growth of e-commerce, fintech, and government cloud programs. Enterprises increasingly adopt SaaS-based warehouse solutions to reduce infrastructure costs and improve analytics efficiency. Despite challenges such as economic fluctuations and limited IT budgets, sectors like retail, telecommunications, and banking continue embracing digital transformation. Ongoing partnerships with global cloud providers and local investment in analytics modernization are driving gradual yet sustainable growth across Latin America’s enterprise cloud ecosystem.

Middle East & Africa (MEA)

The Middle East & Africa region maintains a developing share in the Cloud Data Warehouse market, estimated at 5%. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are leading adoption through ambitious national digital transformation strategies. Demand continues to rise for secure, scalable, and centralized analytics systems across banking, energy, retail, and government sectors. Global providers like Microsoft Azure, Oracle Cloud, and Huawei Cloud are expanding data center operations to strengthen regional infrastructure. While limited access and uneven adoption persist in some areas, increased connectivity and modernization efforts are creating strong long-term growth prospects.

Market Segmentations:

By Deployment Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Service Model

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail

- Government

- Telecommunications

- Manufacturing

- Education

- Others (Media, Energy, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Data Warehouse market features strong competition among global cloud providers, database vendors, and analytics specialists offering scalable, high-performance platforms. Leading companies focus on faster query processing, real-time analytics, AI integration, and automated data management to gain market advantage. Major players expand services through partnerships, acquisitions, and industry-specific cloud solutions to meet diverse enterprise needs. Many providers integrate machine learning, cybersecurity tools, and multi-cloud support to improve usability and reduce migration barriers. Competition also grows from specialized vendors offering cost-efficient, columnar storage, and workload optimization features to attract small and midsized enterprises. As demand rises for hybrid cloud, cross-platform data sharing, and governance automation, vendors continue to enhance interoperability and compliance capabilities. The market remains dynamic, with innovation centered on performance, lower storage costs, and seamless scaling.

Key Player Analysis

- Cloudera

- Snowflake

- SAP

- Oracle Cloud

- IBM Cloud

- Alteryx

- Teradata

- Microsoft Azure

- Amazon Web Services

- Google Cloud

Recent Developments

- In June 2025, Snowflake acquired Crunchy Data, introducing native PostgreSQL support and broadening its AI-ready transactional footprint.

- In May 2025, Salesforce signed a definitive agreement to acquire Informatica for USD 8 billion to enrich its customer 360 data foundation.

- In May 2025, Fivetran agreed to buy Census, creating an end-to-end data-movement suite with more than 900 connectors.

- In September 2024, Firebolt launched its next-generation cloud data warehouse, delivering sub-second analytics with efficiency gains over previous releases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Deployment, Service, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud data warehouses will support deeper AI and machine learning automation for faster insights.

- Real-time analytics adoption will increase as enterprises move toward predictive decision-making.

- Multi-cloud and hybrid environments will expand to reduce vendor lock-in and enhance security.

- More industries will replace legacy on-premise systems with cloud-native warehouse platforms.

- Built-in governance, encryption, and compliance tools will grow to support regulated sectors.

- Columnar storage, query acceleration, and workload optimization will improve performance.

- Small and midsized enterprises will adopt SaaS-based warehouses due to lower upfront cost.

- Edge computing integration will rise to process data closer to devices and remote sites.

- Partnerships between cloud providers and data integration firms will simplify migration.

- Industry-specific analytics solutions will gain traction in BFSI, healthcare, retail, and telecom sectors.

Market Insights

Market Insights