Market Overview

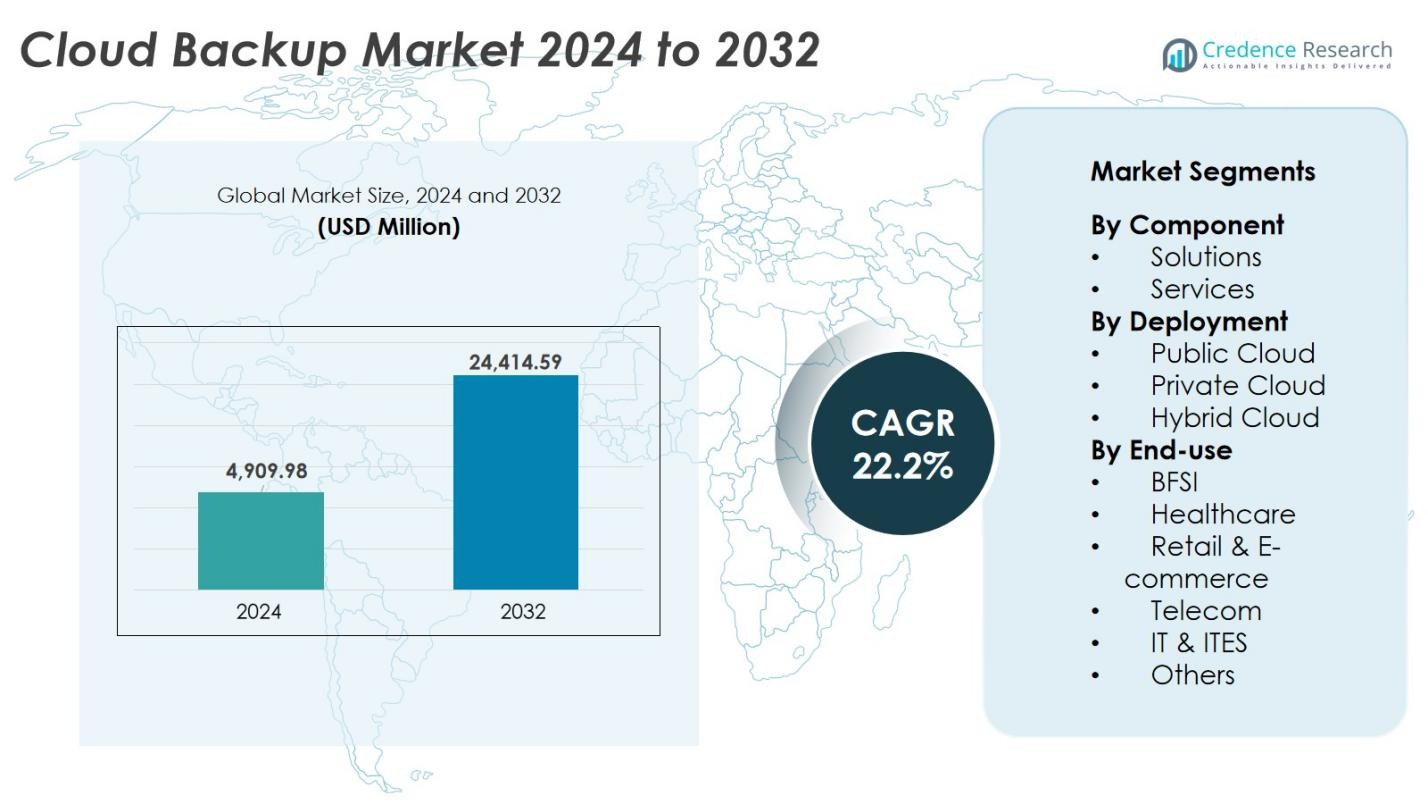

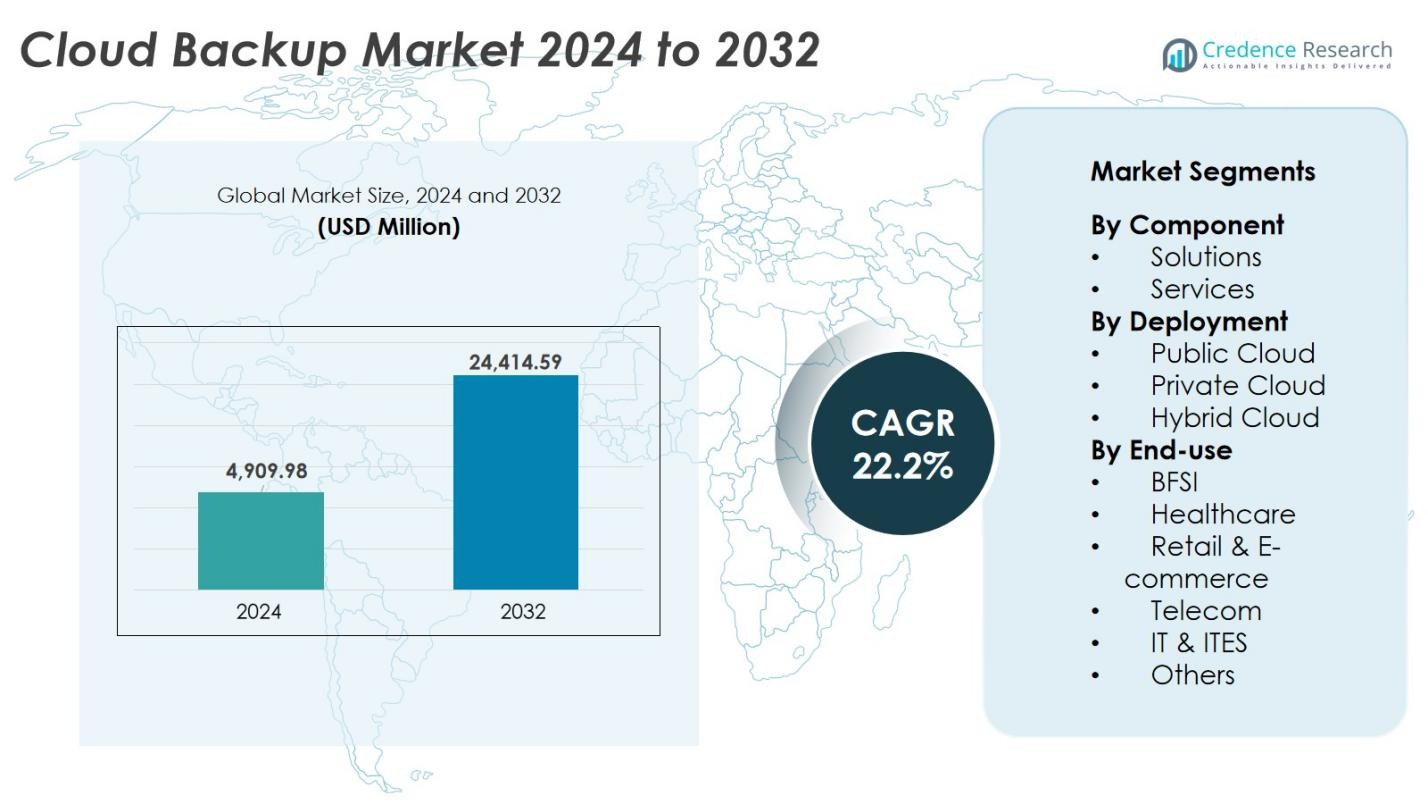

Cloud Backup Market size was valued at USD 4,909.98 million in 2024 and is anticipated to reach USD 24,414.59 million by 2032, growing at a CAGR of 22.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Backup Market Size 2024 |

USD 4,909.98 Million |

| Cloud Backup Market, CAGR |

22.2% |

| Cloud Backup Market Size 2032 |

USD 24,414.59 Million |

The Cloud Backup Market is led by major players such as Dropbox Inc., IBM Corporation, Acronis International GmbH, Datto Inc., Open Text Corporation, IDrive Inc., Microsoft Corporation, Asigra Inc., Backblaze, and Amazon Web Services Inc. These companies emphasize innovation in automated data recovery, AI-powered analytics, and secure multi-cloud architectures. Their focus on cybersecurity integration and compliance-driven solutions strengthens global adoption across industries. North America emerged as the leading region, holding a 38% market share in 2024, supported by strong enterprise digitization, advanced IT infrastructure, and the presence of major technology providers driving continuous market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cloud Backup Market was valued at USD 4,909.98 million in 2024 and is projected to reach USD 24,414.59 million by 2032, growing at a CAGR of 22.2%.

- Rising data generation, cybersecurity threats, and growing digital transformation across industries are key drivers fueling the adoption of automated and scalable cloud backup solutions.

- Major trends include the integration of AI for predictive data recovery, growing hybrid cloud adoption, and increasing demand for industry-specific backup solutions in BFSI and healthcare.

- Leading players such as Microsoft, IBM, AWS, and Acronis dominate the market through innovation in AI-based automation, compliance-focused tools, and hybrid storage models. North America leads with a 38% share, driven by advanced IT infrastructure, while the solutions segment holds 63%, reflecting enterprises’ focus on data recovery efficiency and security across large and small organizations.

Market Segmentation Analysis:

By Component

The solutions segment dominated the Cloud Backup Market with a 63% share in 2024, driven by increasing demand for secure data storage and rapid disaster recovery. Businesses prioritize automated and scalable backup software to ensure business continuity amid rising cyber threats and data breaches. Leading providers such as IBM, Acronis, and Microsoft enhance data recovery speed through AI-integrated backup solutions. The services segment also grows steadily as organizations seek managed backup and support services to handle complex cloud infrastructures efficiently.

- For instance, IBM’s Cloud Backup system leverages AI to optimize data recovery through adaptive backup policies and centralized management, supporting multi-location data restoration with encryption to prevent unauthorized access.

By Deployment

The public cloud segment held the largest market share of 52% in 2024, owing to its cost-effectiveness, scalability, and accessibility. Enterprises prefer public cloud platforms such as AWS, Microsoft Azure, and Google Cloud for flexible data storage and pay-as-you-go pricing models. Increasing adoption by SMEs and startups further supports this growth. Meanwhile, hybrid cloud solutions gain traction due to their ability to balance data security and control, combining the flexibility of public cloud with the privacy of private infrastructures.

- For example, Azure Arc enables businesses to manage resources across hybrid setups, providing a unified platform for on-premises and cloud workloads.

By End-use

The IT & ITES sector led the market with a 29% share in 2024, fueled by the surge in data generation and the need for remote data management. Companies in this sector rely on cloud backup for real-time data synchronization, ransomware protection, and regulatory compliance. The BFSI and healthcare sectors also show strong adoption due to the growing need for secure and compliant data storage systems. E-commerce firms increasingly integrate automated backup systems to safeguard transactional and customer data from cyberattacks.

Key Growth Drivers

Rising Data Generation and Digital Transformation

The exponential growth of enterprise data and increasing digitalization across industries are major factors driving the Cloud Backup Market. Organizations generate vast amounts of data daily from IoT devices, connected applications, and digital transactions. This surge creates a critical need for scalable and secure cloud storage solutions. Enterprises are adopting automated cloud backup systems to ensure seamless data recovery and business continuity. The growing shift toward digital operations and remote workforces further amplifies the demand for centralized data protection and real-time synchronization, particularly in IT, BFSI, and healthcare sectors.

- For instance, Tsukaeru.net’s Cloud Backup solution, widely used in digital transformation efforts, secures data with double encryption and simple, quick restoration processes, appealing to businesses needing cost-effective, reliable backup for digital operations.

Increasing Cybersecurity Threats and Ransomware Attacks

Rising incidences of ransomware and cyberattacks are compelling enterprises to adopt cloud backup solutions as a safeguard against data loss. Cloud-based backups enable quick data restoration and minimize downtime during security breaches. Companies such as Acronis and IBM integrate AI-driven anomaly detection and zero-trust architectures to improve backup integrity and prevent unauthorized access. The growing focus on compliance with data protection laws, such as GDPR and HIPAA, also supports market expansion. As threats become more sophisticated, organizations view cloud backup as an essential layer of their cybersecurity strategy.

- For instance, Acronis integrates AI-driven anomaly detection in its Cyber Protect Cloud platform, analyzing over 150 behavioral parameters to detect and stop zero-day ransomware attacks with a false positive rate under 0.1%.

Growing Adoption of Hybrid and Multi-Cloud Architectures

The increasing preference for hybrid and multi-cloud environments significantly fuels market growth. Enterprises leverage hybrid architectures to balance cost efficiency, scalability, and data privacy. By combining on-premises infrastructure with public and private clouds, businesses can optimize workloads while maintaining sensitive data under strict control. Major providers like Microsoft Azure and AWS offer flexible hybrid backup solutions to support enterprise digital ecosystems. This architectural shift allows organizations to achieve enhanced data redundancy, regulatory compliance, and disaster recovery resilience, driving widespread adoption across medium and large enterprises.

Key Trends & Opportunities

Integration of Artificial Intelligence and Automation

AI and automation technologies are transforming cloud backup operations by improving speed, accuracy, and threat response. AI-powered solutions predict potential failures, optimize storage allocation, and automate recovery processes. Vendors such as IBM and Veritas have launched intelligent backup tools that use predictive analytics to identify anomalies and minimize downtime. Automated workflows also reduce human errors and enhance operational efficiency for enterprises handling large data volumes. The integration of AI not only strengthens system reliability but also opens opportunities for self-healing and self-managing cloud environments.

- For instance, IBM’s Backup and Restore Manager for z/VM automates backup processes with incremental backups and encrypted storage, minimizing downtime for critical enterprise systems.

Expansion of Cloud Backup Adoption Among SMEs

Small and medium-sized enterprises (SMEs) are rapidly adopting cloud backup services due to their affordability and ease of deployment. Cloud-based models eliminate the need for physical infrastructure, enabling SMEs to secure data with minimal IT investment. Platforms like IDrive and Backblaze provide cost-effective backup plans with scalable storage options and user-friendly interfaces. The growing awareness of cyber risks and the increasing regulatory focus on data protection are further encouraging adoption. This trend presents a strong opportunity for service providers to expand in emerging markets and offer customized SME-focused solutions.

- For instance, IDrive offers unlimited device support and comprehensive server backup, making it ideal for small businesses with multiple endpoints and compliance needs, such as HIPAA or GDPR.

Rising Demand for Industry-Specific Cloud Backup Solutions

There is an emerging opportunity for industry-tailored backup solutions that address unique data needs in sectors such as healthcare, BFSI, and government. These solutions incorporate compliance-driven frameworks and specialized data encryption techniques. For example, healthcare cloud backup platforms integrate HIPAA-compliant protocols to protect patient information, while BFSI systems prioritize encryption and audit trail tracking. Vendors like OpenText and Acronis are launching industry-specific products that enhance compliance and data management efficiency. This specialization trend fosters customer trust and drives adoption across regulated industries.

Key Challenges

Data Privacy and Compliance Concerns

Stringent data protection regulations and privacy concerns remain key challenges in the Cloud Backup Market. Enterprises must comply with laws such as GDPR, CCPA, and HIPAA, which impose strict requirements on data handling, storage, and transfer. Non-compliance can lead to severe penalties and reputational damage. Moreover, cross-border data transfer complexities create barriers for multinational organizations using global cloud platforms. Service providers are investing in regional data centers and encryption technologies to mitigate these issues. However, ensuring consistent regulatory compliance across diverse jurisdictions continues to be a major hurdle.

High Costs and Bandwidth Limitations

While cloud backup reduces hardware costs, ongoing subscription fees and data transfer costs can strain budgets, especially for large enterprises managing petabytes of data. Bandwidth limitations and latency issues also affect backup speed and recovery time, particularly in regions with weak internet infrastructure. Businesses in developing economies face challenges in adopting cloud solutions due to these performance and cost constraints. Vendors are addressing this through compression technologies, incremental backup systems, and tiered pricing models, yet affordability and network reliability remain critical obstacles for market expansion.

Regional Analysis

North America

North America dominated the Cloud Backup Market with a 38% share in 2024, driven by strong adoption across IT, BFSI, and healthcare sectors. The region benefits from the presence of major cloud providers such as Amazon Web Services, Microsoft, and IBM offering advanced, AI-integrated data protection solutions. High awareness of cybersecurity threats and strict data compliance regulations like HIPAA and CCPA accelerate market demand. The widespread implementation of hybrid and multi-cloud infrastructures further strengthens market growth across enterprises and government agencies in the U.S. and Canada.

Europe

Europe accounted for a 27% market share in 2024, supported by the region’s strict data protection policies and growing digital transformation initiatives. The enforcement of GDPR has driven widespread adoption of secure and compliant cloud backup solutions across industries such as BFSI, healthcare, and manufacturing. Companies like Acronis, OpenText, and IBM expand their regional presence by offering localized storage services and encryption technologies. Increasing investments in data sovereignty and private cloud deployments further reinforce the region’s focus on data security and regulatory compliance.

Asia-Pacific

The Asia-Pacific region held a 22% share in 2024 and is the fastest-growing regional market due to rapid cloud adoption among SMEs and large enterprises. Expanding digital ecosystems in China, India, Japan, and South Korea fuel demand for affordable, scalable backup services. Governments’ initiatives toward cloud infrastructure and data localization also support this growth. Key players such as Microsoft, AWS, and Alibaba Cloud are expanding regional data centers to enhance accessibility and latency performance. The increasing prevalence of e-commerce and fintech further accelerates cloud backup adoption.

Latin America

Latin America captured a 7% share in 2024, primarily driven by expanding IT infrastructure and growing awareness of data protection. Countries such as Brazil, Mexico, and Chile are witnessing rising adoption of public cloud solutions among financial institutions and government bodies. Local service providers collaborate with global firms to introduce cost-effective backup services tailored to regional compliance needs. Although internet infrastructure remains uneven, ongoing digital transformation initiatives and data security regulations are expected to strengthen market expansion in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for a 6% share in 2024, supported by increasing cloud investments and digitalization in sectors like telecom, government, and BFSI. The United Arab Emirates and Saudi Arabia lead regional growth, focusing on national data strategies and smart city initiatives. Global players such as IBM, Microsoft, and AWS are investing in local data centers to meet rising demand for secure and compliant backup solutions. Although adoption is still in early stages, improving IT infrastructure and cybersecurity frameworks are fostering steady market growth.

Market Segmentations:

By Component

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By End-use

- BFSI

- Healthcare

- Retail & E-commerce

- Telecom

- IT & ITES

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Backup Market is highly competitive, characterized by the presence of global and regional players offering advanced data protection and recovery solutions. Key companies such as Dropbox Inc., IBM Corporation, Acronis International GmbH, Datto Inc., Open Text Corporation, IDrive Inc., Microsoft Corporation, Asigra Inc., Backblaze, and Amazon Web Services Inc. dominate the landscape through continuous innovation and product diversification. These players focus on developing AI-driven, automated, and scalable backup systems that enhance data security and recovery efficiency. Strategic partnerships, mergers, and acquisitions are common, enabling companies to strengthen cloud infrastructure and expand global reach. For instance, Microsoft and AWS invest heavily in hybrid cloud capabilities, while Acronis and IBM integrate cybersecurity tools into their backup platforms. The competition also intensifies as service providers introduce region-specific offerings and flexible pricing models to cater to SMEs and enterprises seeking cost-effective, compliant, and high-performance cloud backup solutions.

Key Player Analysis

- Dropbox Inc.

- IBM Corporation

- Acronis International GmbH.

- Datto Inc.

- Open Text Corporation

- IDrive Inc.

- Microsoft Corporation

- Asigra Inc.

- Backblaze

- Amazon Web Services Inc.

Recent Developments

- In June 2024, OpenText Cybersecurity has announced the launch of its new Carbonite Cloud-to-Cloud Backup service in India, aimed at helping organizations safeguard their business-critical data stored on third-party SaaS applications. This service supports a wide range of platforms including Microsoft 365, Salesforce, Google Workspace, Dropbox, and Box.

- In June 2024, Backblaze partnered with Coalition to offer enhanced cyber risk management through the Coalition Control platform. This collaboration provides businesses with direct access to Backblaze’s enterprise-grade, unlimited, automatic cloud backup solution, addressing critical gaps in cybersecurity and supporting cyber insurance eligibility amid rising ransomware threats.

- In June 2023, Impossible Cloud launched its Partner Program, enabling seamless integration of its decentralized cloud platform with innovative backup solutions from Comet Backup and Acronis. This program supports VARs, SIs, MSPs, and ISVs in offering innovative, secure, and cost-effective cloud backup services. Leveraging web3 benefits, the program ensures business continuity with scalable, consumption-based storage infrastructure, enhancing efficiency and security over traditional cloud providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for cloud backup will rise as businesses expand digital operations.

- Hybrid and multi-cloud deployments will become the preferred data protection model.

- AI and machine learning will enhance automated recovery and threat detection.

- SMEs will increasingly adopt affordable and scalable cloud backup solutions.

- Data sovereignty and compliance-focused services will gain greater importance.

- Integration of cybersecurity tools with backup platforms will strengthen market growth.

- Edge computing and IoT data expansion will drive new storage requirements.

- Partnerships between cloud providers and telecom firms will improve service

- Energy-efficient and sustainable data centers will support green cloud initiatives.

- The Asia-Pacific region will record the fastest growth due to rapid digital transformation.