Market Overview

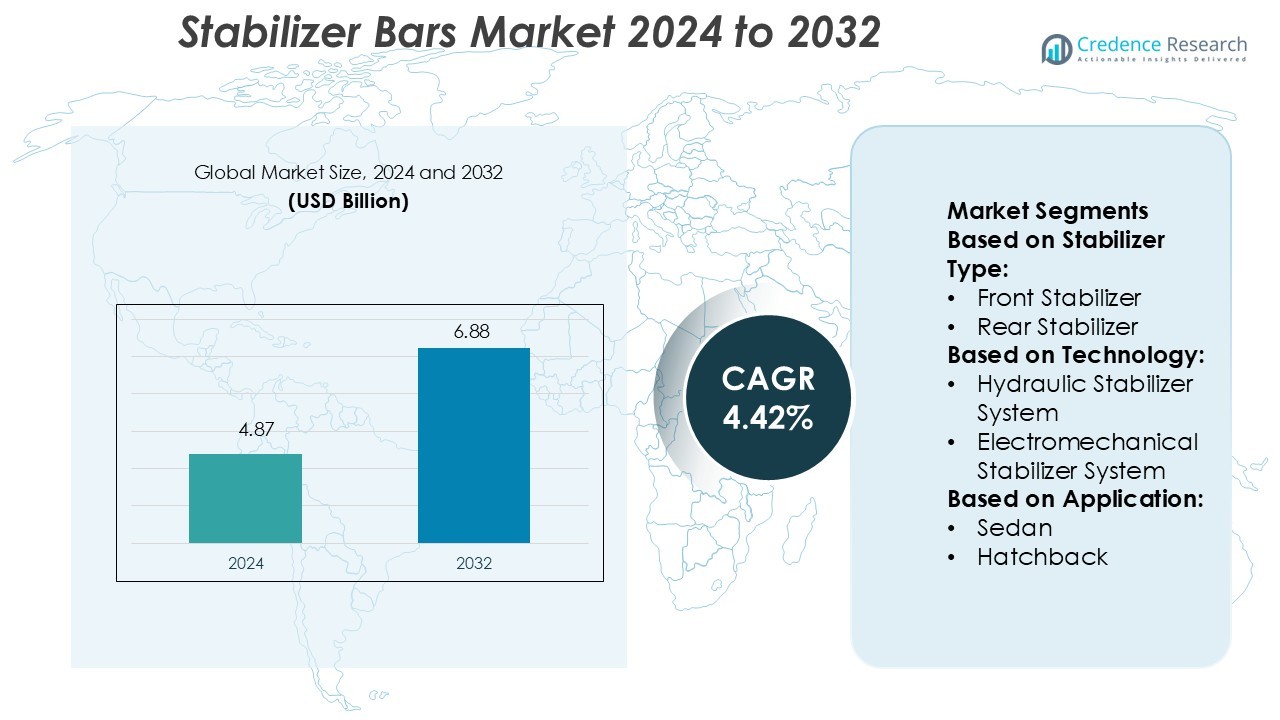

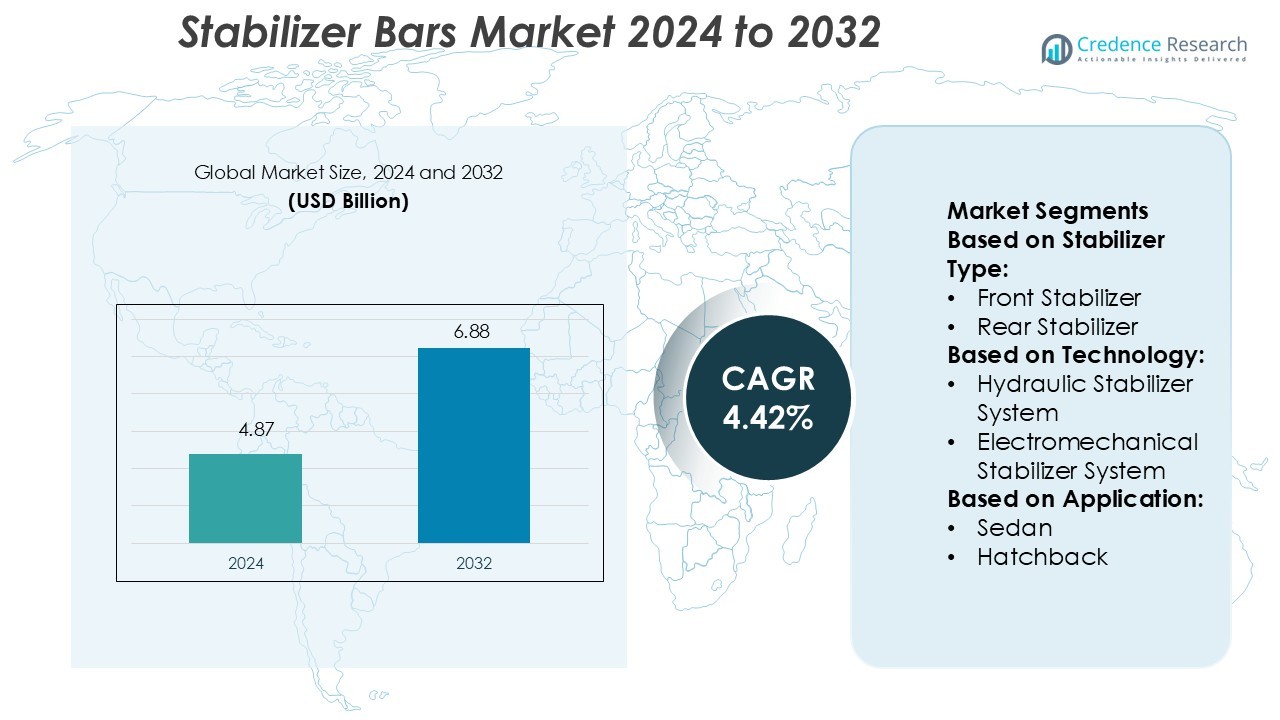

Stabilizer Bars Market size was valued USD 4.87 billion in 2024 and is anticipated to reach USD 6.88 billion by 2032, at a CAGR of 4.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stabilizer Bars Market Size 2024 |

USD 4.87 Billion |

| Stabilizer Bars Market, CAGR |

4.42% |

| Stabilizer Bars Market Size 2032 |

USD 6.88 Billion |

The stabilizer bars market is driven by major players such as ZF, Thyssenkrupp, Hendrickson, Mubea, NHK International, Sogefi Group, Kongsberg Automotive, DAEWON, Dongfeng, and SwayTec. These companies focus on technological innovation, lightweight materials, and active suspension systems to enhance vehicle handling and comfort. ZF and Thyssenkrupp lead in developing electronically controlled stabilizer technologies, while Mubea and NHK International specialize in high-strength steel solutions for improved performance. Asia-Pacific dominates the global market with a 34.2% share in 2024, supported by rapid automotive production, rising SUV demand, and expanding electric vehicle manufacturing across China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Stabilizer Bars Market was valued at USD 4.87 billion in 2024 and is projected to reach USD 6.88 billion by 2032, growing at a CAGR of 4.42% during the forecast period.

- Growing demand for vehicle safety and stability is a key driver, supported by advanced suspension technologies and the rising production of SUVs and electric vehicles.

- Market trends highlight increasing adoption of lightweight materials and electronically controlled stabilizer systems to improve energy efficiency and handling precision.

- Competitive dynamics remain strong, with leading companies like ZF, Thyssenkrupp, and Mubea investing in R&D for active stabilizer innovations, while others focus on cost-effective mechanical systems.

- Asia-Pacific leads the global market with a 34.2% share, driven by strong automotive output in China, Japan, and South Korea, while the front stabilizer segment dominates with a 57.8% share due to its critical role in vehicle balance and performance.

Market Segmentation Analysis:

By Stabilizer Type

The front stabilizer segment dominated the market with a 57.8% share in 2024. This dominance stems from its essential role in reducing body roll and enhancing vehicle handling during cornering. Front stabilizers are standard in most passenger cars and SUVs, ensuring better stability and steering response. Growing demand for improved ride comfort and safety in modern vehicles supports this segment. The rise in high-performance and luxury vehicle production further drives the adoption of advanced front stabilizer systems across global automotive manufacturing lines.

- For instance, ZF Friedrichshafen AG’s electromechanical roll-control (ERC) system achieves a stabilization torque of up to 1,400 Nm in the front axle during cornering, enabling the vehicle to actively counteract body roll and maintain chassis stability.

By Technology

The electronically controlled stabilizer bar segment led the market with a 41.2% share in 2024. This segment benefits from growing adoption in premium and electric vehicles for dynamic ride control. These systems use sensors and actuators to adjust stiffness in real time, improving comfort and cornering precision. Increasing integration of electronic control units (ECUs) and vehicle dynamics management systems enhances performance efficiency. Automakers’ shift toward adaptive suspension technologies strengthens demand for electronically controlled stabilizer bars in both passenger and utility vehicle categories.

- For instance, Mubea developed a transversal blade spring that replaces multi‑link axles, removing 20 kg of weight and freeing battery installation space in BEVs It enhances passenger safety while ensuring better stability at higher speeds.

By Application

The SUV segment held the largest market share of 45.6% in 2024, driven by rising consumer preference for off-road and multi-terrain vehicles. SUVs require high-strength stabilizer bars to maintain balance and minimize body roll during high-speed turns or uneven road conditions. Automakers are equipping SUVs with active and semi-active stabilizer systems for superior ride control and safety. Growing sales of electric and hybrid SUVs further contribute to segment expansion. This trend reflects consumer demand for comfort, stability, and durability in larger vehicle formats.

Key Growth Drivers

Rising Demand for Vehicle Stability and Safety

The increasing emphasis on vehicle stability and passenger safety is a major driver for stabilizer bars. Automakers are integrating advanced suspension systems to minimize body roll and enhance cornering stability. Regulatory mandates on safety performance also encourage wider adoption in passenger and commercial vehicles. As road safety awareness increases globally, manufacturers are developing stabilizer systems with lightweight materials and improved torsional strength. This growing focus on safety standards continues to elevate demand for stabilizer bars across multiple vehicle categories.

- For instance, Dongfeng’s Aeolus Haohan PHEV uses the world’s first 4‑speed power‑split plus series‑parallel hybrid system, delivering a combined output of 265 kW and 615 Nm of torque, and achieves a claimed range of 1,300 km.

Expansion of SUV and Off-Road Vehicle Production

The rapid rise in SUV and off-road vehicle sales significantly drives stabilizer bar demand. SUVs require strong stabilizers to manage higher centers of gravity and provide balanced handling on rough terrains. Manufacturers are adopting active stabilizer systems that adapt to dynamic driving conditions, improving comfort and performance. Growing consumer preference for adventure and family vehicles strengthens this trend. The increasing number of electric SUVs also contributes to market expansion, as stability enhancement remains a priority in heavier vehicle models.

- For instance, Kongsberg Automotive developed a rear axle stabilizer that uses high‑strength forged link arms and advanced tube forming. This design achieves a weight reduction of over 30% compared to traditional solid‑rod stabilizers.

Technological Advancements in Suspension Systems

Technological innovation in suspension and chassis systems boosts stabilizer bar integration. Developments in electronically controlled and electromechanical stabilizer systems enable real-time performance adjustments based on driving conditions. These systems enhance comfort and energy efficiency, supporting adoption in electric and premium vehicles. The rise of smart sensors and control modules further improves system precision and reliability. Automotive manufacturers are investing in active stabilizer systems to meet evolving consumer expectations for performance and driving comfort.

Key Trends & Opportunities

Adoption of Lightweight and Composite Materials

The shift toward lightweight vehicle construction has encouraged the use of composite stabilizer bars. Manufacturers are developing stabilizers using materials like carbon fiber and high-strength steel to reduce weight while maintaining rigidity. Lightweight stabilizers enhance fuel efficiency and reduce carbon emissions, aligning with sustainability goals. This trend presents opportunities for material suppliers and component manufacturers focusing on advanced composites and hybrid material technologies for next-generation vehicle suspension systems.

- For instance, Thyssenkrupp’s VarioShape® tubular stabilizer bar achieves a weight reduction of up to 50 % compared to conventional solid stabilizers while maintaining mechanical strength. It enhances passenger safety while ensuring better stability at higher speeds.

Integration of Advanced Electronic Control Systems

Automotive manufacturers are increasingly integrating electronic control units with stabilizer systems for enhanced performance. Electronically controlled stabilizer bars offer adaptive handling and comfort by adjusting stiffness dynamically. This integration is gaining traction in electric, hybrid, and luxury vehicles where ride quality and efficiency are critical. The ongoing trend toward vehicle electrification creates new opportunities for suppliers specializing in intelligent, electronically managed suspension systems that complement autonomous and connected vehicle designs.

- For instance, Hendrickson’s STEERTEK NXT steer axle introduced in mid-2025 offers 25 pounds of additional weight savings in school buses compared to its prior axle generation.

Growth in Aftermarket Customization

The aftermarket segment is witnessing rising interest in performance upgrades and customization. Vehicle enthusiasts and fleet operators are opting for adjustable stabilizer bars to improve handling characteristics. The growing popularity of motorsports and off-road modifications fuels demand for performance-oriented stabilizers. Companies offering tailored solutions and durable materials are capturing strong aftermarket growth opportunities, especially in emerging markets with expanding car modification cultures.

Key Challenges

High Manufacturing and Integration Costs

The development and integration of advanced stabilizer systems involve high production costs, limiting adoption in budget vehicle categories. Electronically controlled systems require precision engineering, costly sensors, and advanced control units, raising vehicle prices. These cost pressures challenge manufacturers to balance affordability with innovation. Smaller automakers face difficulty competing with established brands investing heavily in active suspension technologies. Managing these expenses remains a key barrier to market penetration, particularly in price-sensitive regions.

Complex Maintenance and Durability Concerns

Active and electronic stabilizer systems, while offering superior performance, often face challenges related to long-term durability and maintenance complexity. Components exposed to varying environmental conditions may experience wear and calibration issues over time. Repair and replacement require skilled technicians, increasing maintenance costs for end users. These challenges can limit adoption in developing markets with limited technical infrastructure. Enhancing durability and reducing maintenance frequency remain priorities for manufacturers to sustain consumer trust and market growth.

Regional Analysis

North America

North America accounted for a 31.6% share of the stabilizer bars market in 2024, driven by high vehicle production and advanced automotive technologies. The U.S. leads regional demand due to widespread adoption of SUVs and premium vehicles equipped with active suspension systems. Automakers such as Ford, General Motors, and Tesla emphasize ride comfort and safety through electronically controlled stabilizer systems. The region also benefits from strong aftermarket activity and consumer interest in performance upgrades. Increasing R&D investments in lightweight materials further strengthen North America’s competitive position in the global market.

Europe

Europe held a 28.4% share of the stabilizer bars market in 2024, supported by strong manufacturing bases in Germany, France, and the UK. The region focuses on vehicle safety and handling efficiency, aligning with stringent EU performance standards. Major automakers such as BMW, Volkswagen, and Mercedes-Benz integrate adaptive and electromechanical stabilizer systems in luxury and electric models. Growing emphasis on sustainability and emission reduction drives adoption of lightweight and recyclable materials. Technological innovation and collaboration between OEMs and component suppliers sustain Europe’s leadership in advanced stabilizer solutions.

Asia-Pacific

Asia-Pacific dominated the global stabilizer bars market with a 34.2% share in 2024, fueled by rapid automotive expansion in China, Japan, India, and South Korea. The region’s growing middle-class population and rising SUV demand contribute significantly to market growth. Leading manufacturers, including Toyota, Hyundai, and Honda, are investing in lightweight and electronically controlled stabilizer systems to enhance performance. Increasing vehicle exports and local manufacturing initiatives strengthen regional competitiveness. Asia-Pacific also serves as a major production hub for raw materials and components, ensuring cost efficiency and supply chain resilience.

Latin America

Latin America captured a 3.7% share of the stabilizer bars market in 2024, supported by increasing vehicle production in Brazil, Mexico, and Argentina. Rising disposable incomes and expanding automotive assembly facilities contribute to steady growth. The market benefits from demand for mid-range passenger cars and light commercial vehicles requiring efficient stabilizer systems. However, limited access to high-end electronic technologies constrains wider adoption. Ongoing infrastructure projects and foreign investments by global automakers are expected to enhance stabilizer bar production capabilities and drive gradual technological advancement in the region.

Middle East & Africa

The Middle East & Africa region accounted for a 2.1% share of the stabilizer bars market in 2024. Growth is driven by rising vehicle imports, expanding urban mobility, and infrastructure development. Countries such as the UAE, Saudi Arabia, and South Africa show increasing demand for SUVs and commercial vehicles suited to rough terrains. The preference for durable, corrosion-resistant stabilizer bars is strengthening due to extreme climatic conditions. While adoption of advanced technologies remains limited, government incentives for industrial diversification are expected to attract component manufacturers and boost regional production capacity.

Market Segmentations:

By Stabilizer Type:

- Front Stabilizer

- Rear Stabilizer

By Technology:

- Hydraulic Stabilizer System

- Electromechanical Stabilizer System

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The stabilizer bars market is highly competitive, with key players including ZF, Hendrickson, NHK International, Sogefi Group, DAEWON, Mubea, Kongsberg Automotive, Thyssenkrupp, Dongfeng, and SwayTec. The stabilizer bars market features intense competition, driven by continuous innovation and evolving automotive technologies. Companies are focusing on lightweight materials, active suspension systems, and electronic control technologies to enhance driving comfort and fuel efficiency. Increasing demand for adaptive stabilizers in electric and hybrid vehicles is accelerating R&D investments across the industry. Manufacturers are also emphasizing sustainability by adopting recyclable materials and energy-efficient production methods. Strategic collaborations between automakers and component suppliers are helping optimize cost and performance. This dynamic environment encourages technological advancement, ensuring competitive differentiation and long-term growth in global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZF

- Hendrickson

- NHK International

- Sogefi Group

- DAEWON

- Mubea

- Kongsberg Automotive

- Thyssenkrupp

- Dongfeng

- SwayTec

Recent Developments

- In April 2025, General Motors supplemented their safety recall of 17 Cadillac Lyriq electric SUVs in North America for front stabilizer bar bracket bolts that were inaccurately torqued in assembly. The error was due to an issue in the production software logic utilized for bolt fastening.

- In January 2025, CES in Las Vegas, American Axle & Manufacturing (AAM) introduced their SmartBar which is a disconnecting stabilizer bar designed for use on off-road vehicles. The SmartBar system uses an electronically controlled module to disengage the stabilizer bar, enabling maximum wheel articulation over tough terrain to improve traction and ride comfort.

- In January 2025, SONGWON Industrial partnered with Altek International FZE to distribute PVC stabilizers across the Middle East and North Africa, expanding regional reach in construction and packaging segments.

- In September of 2024, Stumpp Schuele & Somappa Springs (SSS), which is part of the MG Brothers Group announced a joint venture with Chuhatsu of Japan to form SSS Chuhatsu Precision Springs Pvt. Ltd. The joint venture is the first domestic manufacturer of powerbackdoor springs in India. PBD springs are an important component of automated tailgate systems that have previously been imported entirely.

Report Coverage

The research report offers an in-depth analysis based on Stabilizer Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electronically controlled stabilizer bars will continue to rise in premium and electric vehicles.

- Lightweight composite materials will gain wider adoption to improve fuel efficiency and reduce emissions.

- Integration of active suspension systems will become standard across mid and high-end vehicle segments.

- Growing SUV and off-road vehicle production will sustain long-term demand for heavy-duty stabilizer systems.

- Automakers will increase R&D investments in adaptive and intelligent chassis technologies.

- Expansion of EV manufacturing will drive innovation in compact and energy-efficient stabilizer designs.

- Asia-Pacific will remain the leading production hub due to strong automotive output and cost efficiency.

- Strategic partnerships between OEMs and component suppliers will accelerate product innovation and regional expansion.

- Advanced sensor technologies will enhance real-time control and system reliability.

- Aftermarket demand for customizable stabilizer systems will increase with growing vehicle personalization trends.