Market Overview

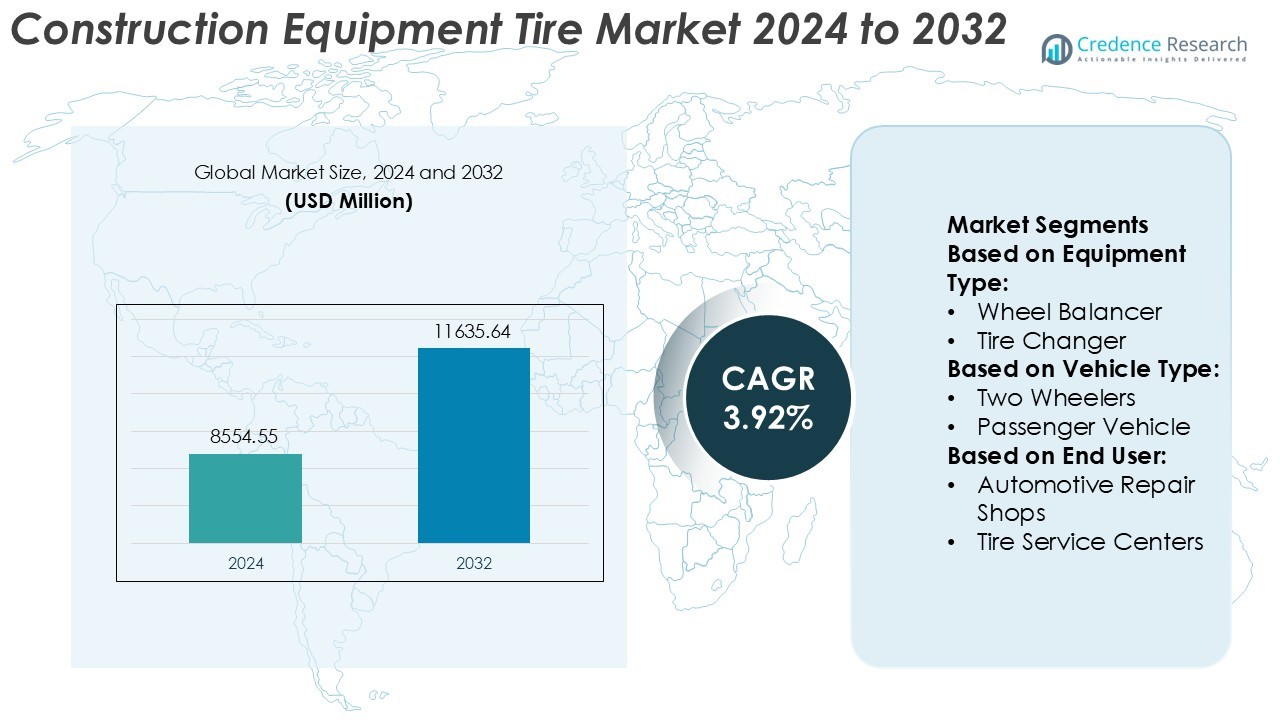

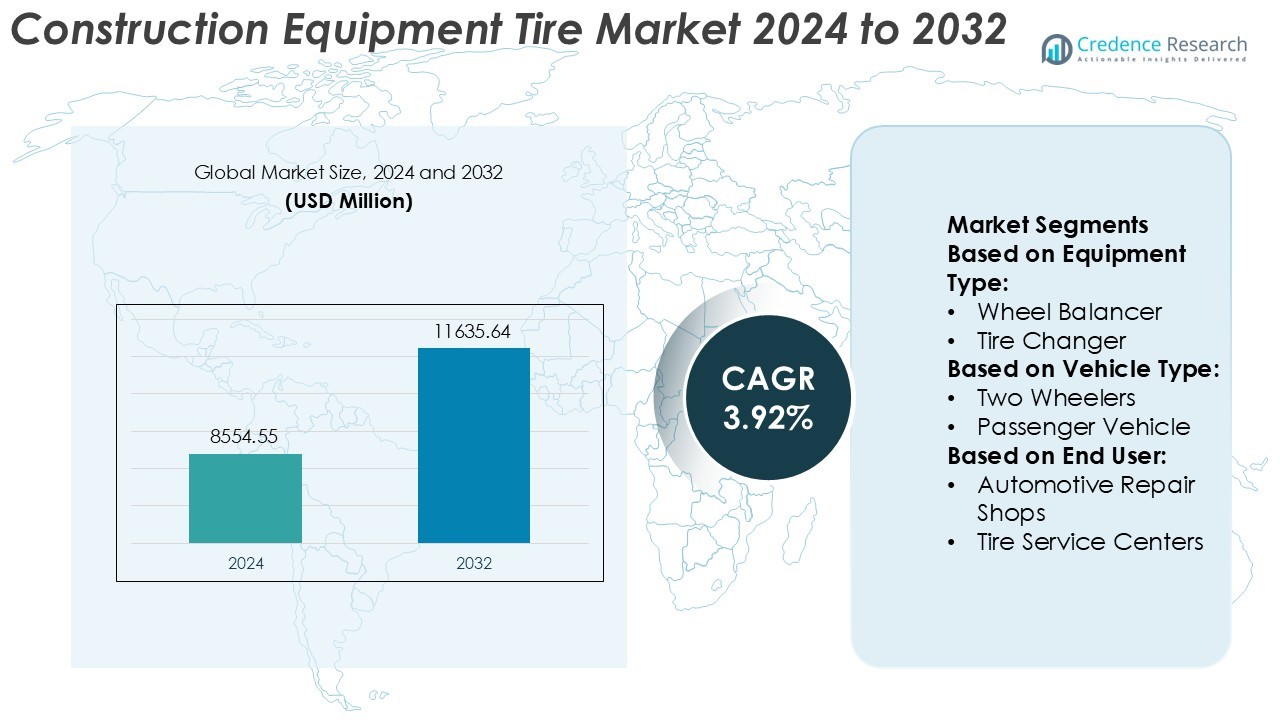

Construction Equipment Tire Market size was valued USD 8554.55 million in 2024 and is anticipated to reach USD 11635.64 million by 2032, at a CAGR of 3.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Tire Market Size 2024 |

USD 8554.55 Million |

| Construction Equipment Tire Market, CAGR |

3.92% |

| Construction Equipment Tire Market Size 2032 |

USD 11635.64 Million |

The Construction Equipment Tire Market is shaped by strong competition from global and regional manufacturers offering tires for loaders, excavators, dump trucks, and graders. The market includes premium brands focusing on advanced tread compounds, puncture resistance, and longer operating life, while cost-focused suppliers compete through affordable bias and radial options for developing countries. Asia Pacific remains the leading region, holding 35% market share, driven by large infrastructure programs, rapid urbanization, and expanding mining and quarrying activities. High construction equipment utilization in China, India, and Southeast Asia sustains steady replacement demand. Growing adoption of radial tires, increasing rental equipment fleets, and investments in tire pressure monitoring technology further strengthen the region’s leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Equipment Tire Market was valued USD 8,554.55 million in 2024 and is set to reach USD 11,635.64 million by 2032 at a 3.92% CAGR, supported by steady demand from construction and mining fleets.

- Infrastructure development, mechanized construction, and higher equipment utilization drive demand, while the shift toward radial tires increases market revenue due to longer life, better stability, and lower rolling resistance.

- Smart technologies such as tire pressure monitoring and predictive maintenance gain traction, and replacement sales remain strong as rental fleets account for a large share of equipment usage.

- Competition stays intense as premium brands focus on durability and advanced tread compounds, while low-cost manufacturers gain share with budget-friendly bias and radial tires.

- Asia Pacific leads the market with 35% share due to rapid construction activity in China, India, and Southeast Asia, and radial tires hold the largest segment share as contractors prefer longer service life and reduced downtime.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Equipment Type

Wheel balancers hold the leading share in the construction equipment tire market with 31% share. Fleet operators and service centers prefer wheel balancers because they reduce vibration, improve tire life, and protect suspension components. Heavy construction vehicles need precise balancing due to uneven terrain and long operating hours. Tire changers and inflators follow, supported by rising maintenance needs in infrastructure projects. Wheel alignment systems and lifting equipment grow at a steady pace due to safety regulations and the need to minimize downtime.

- For instance, JK Tyre’s global research and technology centre at Mysore utilised its testing rigs to validate tyre-changer compatibility across 10 size-categories in 2023, ensuring service-tool readiness for commercial and OTR tyres.

By Vehicle Type

Commercial vehicles dominate this segment with 46% share. Construction fleets rely on heavy-duty trucks, LCVs, and HCVs for material transport, which increases tire wear and service frequency. Rising logistics activity and large construction investments also push tire maintenance demand. SUVs, luxury cars, and mid-size vehicles contribute steady growth due to increased urban construction activity, but their service requirement remains lower compared to large commercial fleets. Coaches and buses add a smaller share, driven by infrastructure-linked public transport growth.

- For instance, Cheng Shin Rubber Ind. Co., Ltd. (CST) introduced the “CST Cortex” radial tyre featuring a 60 TPI sidewall carcass design, achieving a weight reduction of 0.72 kg per unit and a rolling-resistance drop of “more than 10 %”.

By End User

Automotive repair shops lead the market with 38% share, driven by high daily service volume and wide availability in urban and rural areas. These workshops handle routine tire changes, balancing, and inflating for both personal and commercial vehicles. Tire service centers follow, supported by dedicated equipment and specialized technicians. Motorcycle repair shops add steady demand due to two-wheeler dominated regions. Automotive OEM dealerships capture a smaller share, mostly serving premium and new-vehicle owners who prefer brand-certified service facilities.

Key Growth Drivers

Rising Construction and Infrastructure Spending

Global infrastructure programs, housing development, and public transportation projects boost demand for construction equipment tires. Heavy machinery like loaders, excavators, and graders require durable tires that can withstand harsh operating environments. Government investments in roads, bridges, smart cities, and industrial facilities continue to expand fleet sizes. Manufacturers are also supplying tires optimized for fuel efficiency and traction to support productivity at construction sites. Growth in commercial real estate and mining activity further supports tire replacement needs, creating sustained market demand across developing and developed nations.

- For instance, Continental AG’s EM-Master range for wheel loaders and articulated dump trucks uses a steel-cord reinforced carcass capable of handling loads up to 15,000 kg per tire, as documented in Continental’s OTR product specifications.

Rapid Urbanization and Industrial Expansion

Urban population growth drives real estate development, public utilities expansion, and road construction. Industrial growth increases the use of earthmoving and material-handling machinery, directly influencing tire consumption. Manufacturers are developing high-load capacity tires for rough terrains, tunnels, and high-dust environments. Urban redevelopment projects, warehouse automation, and logistics infrastructure also contribute to equipment utilization rates. Rising demand from rental fleets accelerates frequent tire replacement cycles. As cities expand and industries adopt mechanized construction, the need for efficient equipment tires continues to strengthen market revenues.

- For instance, Guizhou Tyre Co., Ltd. produces its “Advance” OTR series at the Zhazuo plant in Guiyang, which is undergoing expansion through an “intelligent manufacturing” project designed to eventually reach an annual output capacity of 380,000 OTR tires and includes specialized steel-cord radial lines for mining equipment.

Technological Advancements in Tire Engineering

Enhanced tread designs, puncture-resistant compounds, and self-sealing technologies improve durability and reduce downtime. Tire companies are investing in real-time pressure monitoring and smart tire sensors to prevent equipment failures. Low-heat-generation rubber compounds help extend tire life during long operating hours. Manufacturers are designing tires that support higher ground stability and lower fuel consumption for heavy-duty vehicles. These innovations reduce operating costs for contractors and fleet operators. The growing adoption of radial tires over bias-ply designs further increases market potential by offering better load distribution and longer service life.

Key Trends & Opportunities

Growing Demand for Sustainable and Retreadable Tires

Construction companies are switching to eco-friendly tire materials and retreadable designs to cut waste and reduce costs. Retreading extends tire life and lowers expenses for rental fleets and contractors working on large infrastructure projects. Tire makers are introducing recyclable rubber compounds and bio-based materials to reduce carbon footprints. Green construction certifications and sustainability initiatives encourage contractors to adopt products with lower environmental impact. These trends create opportunities for suppliers offering fuel-efficient, low-rolling-resistance tires built for long-term use in heavy-duty environments.

- For instance, Camso’s retread program for construction tires supports tread reuse up to 3 times on its solid skid-steer lines, and the company documents that retreading can reduce raw-material consumption by up to 63 kg per tire compared to a full replacement.

Rapid Adoption of Smart and Connected Tire Solutions

Digital tire management systems help track wear, pressure, and temperature in real time. Connected sensors alert operators before failures occur, reducing accidents and machine downtime. Contractors with large fleets gain cost savings through automated alerts, predictive maintenance, and optimized tire usage. Smart tires also support fleet analytics, improving performance and safety on job sites. As construction becomes more digitized, demand for smart tire technologies continues to rise among OEMs, rental companies, and heavy-duty machinery owners.

- For instance, Kenda reports that its automated inspection line performs uniformity and X-ray checks on every single OTR tire, which is a key feature of Industry 4.0 automation designed to ensure 100% quality control and the line scans carcass thickness to a precision of 0.01 millimeters.

Expansion of Rental Construction Machinery Fleets

Short-term construction projects and cost-optimization practices increase reliance on rental machines. Rental fleets replace tires more frequently due to heavy utilization across varied terrains. Tire makers are developing rugged models that meet rental fleet durability and low-maintenance requirements. This trend unlocks growth for mid-priced and premium tire segments used in loaders, cranes, backhoes, and excavators. Regional equipment rental penetration in developing markets presents new opportunities for tire suppliers to expand distribution networks and service partnerships.

Key Challenges

Volatility in Raw Material Prices

Rubber, carbon black, and specialty polymers face fluctuating prices due to supply constraints, energy costs, and geopolitical instability. Rising input costs pressure manufacturers and distributors, pushing them to adjust product pricing. Smaller suppliers face margin challenges when large contractors demand cost-competitive tires. Currency fluctuations further raise import expenses in developing markets. These conditions complicate long-term production planning and impact profitability across the supply chain, especially for companies without integrated raw-material sourcing.

Intense Competition from Low-Cost Tire Manufacturers

Low-cost producers offer budget-friendly tires that attract small construction contractors and rental companies. This competition pressures premium brands to reduce pricing or expand mid-range offerings. Cheaper tires often have shorter service life, increasing replacement cycles, but some buyers prioritize upfront cost over durability. Global manufacturers must differentiate through performance, safety certifications, and advanced technologies. As price competition increases across Asia and Latin America, brand loyalty becomes harder to maintain without strong service and distribution support.

Regional Analysis

North America

North America holds a significant share of the Construction Equipment Tire Market due to strong demand for machinery used in road building, commercial infrastructure, and mining operations. The United States accounts for the highest spending on heavy equipment fleets, driven by federal and state infrastructure programs. High mechanization levels and strict safety standards encourage the use of premium, puncture-resistant tires. The region captures around 28% market share, supported by a large rental equipment ecosystem and advanced tire management technologies. Replacement tire sales remain steady as fleets operate in high-wear conditions across construction and quarry sites.

Europe

Europe secures approximately 25% market share, supported by public investment in transportation, energy networks, and industrial facilities. Germany, France, and the U.K. lead demand for high-durability tires used in compact construction machinery and material-handling equipment. The region emphasizes low-emission and sustainable tire materials due to strict environmental regulations. Manufacturers focus on retreaded products and radial tire adoption to reduce operating costs. Ongoing housing upgrades, tunnel development, and refurbishment of aging infrastructure sustain replacement cycles. The presence of major tire producers and high safety certification standards supports continued product innovation across European construction fleets.

Asia Pacific

Asia Pacific commands the largest share of the Construction Equipment Tire Market, holding close to 35%. China, India, Japan, and Southeast Asia show strong demand due to rapid urbanization, industrialization, and large government-funded infrastructure programs. Growth in mining, real estate, and transport corridors increases the need for heavy-duty and earthmoving tires. Local manufacturing capacity enables competitive pricing and wider product range availability. Rising adoption of mechanized construction techniques and expanding rental equipment fleets further strengthen consumption. Frequent replacement of tires in rough terrain and hot climates sustains long-term demand across the region.

Latin America

Latin America accounts for around 7% market share, driven by construction activities in Brazil, Mexico, Chile, and Colombia. Mining operations in Chile and Peru further boost the need for off-road and loader tires. Infrastructure expansion, including highways, airports, and commercial facilities, supports steady equipment usage. However, market growth fluctuates with economic cycles and public spending. Local distributors and global tire brands compete through price-focused offerings. Demand for durable and cost-efficient radial tires is rising as contractors seek to reduce downtime in rugged conditions. Replacement sales contribute a significant portion of revenue.

Middle East & Africa

The Middle East & Africa region captures approximately 5% market share, supported by construction of smart cities, energy infrastructure, and mega commercial projects. The Gulf countries deploy large fleets of cranes, loaders, and haul trucks for road building and real-estate expansion. Mining activities in South Africa, Botswana, and Ghana also drive off-the-road tire demand. Hot climates and abrasive terrains cause faster tire wear, pushing frequent replacement cycles. Increasing investments in logistics, seaports, and industrial zones support tire consumption. However, reliance on imported products and price sensitivity influence buyer preferences across several emerging markets.

Market Segmentations:

By Equipment Type:

- Wheel Balancer

- Tire Changer

By Vehicle Type:

- Two Wheelers

- Passenger Vehicle

By End User:

- Automotive Repair Shops

- Tire Service Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Equipment Tire Market features strong competition among JK Tyre & Industries Ltd., CST (Cheng Shin Tire), Continental AG, Guizhou Tyre Co., Ltd., Camso, Kenda Rubber Industrial Co., Ltd., Alliance Tire Group (ATG), Bridgestone Corporation, Carlstar, Hankook Tire, and Balkrishna Industries Limited (BKT). The Construction Equipment Tire Market is characterized by strong rivalry among global and regional manufacturers offering tires for heavy-duty machinery such as loaders, excavators, and dump trucks. Leading companies focus on advanced tread patterns, heat-resistant compounds, and high-load radial tires to enhance durability and reduce operating costs in harsh environments. Many players expand their aftermarket reach with dealer partnerships and service networks to support faster replacement cycles. Innovation in tire pressure monitoring, self-sealing technology, and retreadable designs helps differentiate premium brands from low-cost competitors. Sustainability initiatives, including recyclable rubber compounds and reduced rolling resistance, further influence purchasing decisions across major construction and mining fleets.

Key Player Analysis

- JK Tyre & Industries Ltd.

- CST (Cheng Shin Tire)

- Continental AG

- Guizhou Tyre Co., Ltd.

- Camso

- Kenda Rubber Industrial Co., Ltd.

- Alliance Tire Group (ATG)

- Bridgestone Corporation

- Carlstar

- Hankook Tire

- Balkrishna Industries Limited (BKT)

Recent Developments

- In March 2025, Continental widened its TeleMaster lineup with new pneumatic and solid non-marking tire solutions. Engineered together with JLG, the new TeleMaster V.ply provides a pneumatic option specifically designed for use in telehandlers in the United States with improved stability and comfort through V.ply technology and optimized tread design.

- In February 2024, MAXAM Tire, a global leader in specialty tire manufacturing, improved farmers’ and growers’ productivity by introducing the VF sizes to the AGILXTRA I-3 implement product series.

- In January 2024, The Goodyear Tire & Rubber Company introduced the GP-3E tire line to its Goodyear Off-the-Road (OTR) portfolio. The GP-3E line offers a range of sizing options and features and specially formulated tread compounds designed for extended wear and advanced abrasion resistance in various underfoot conditions.

- In October 2023, Trident launched a skid steer tire, showcasing a patented non-directional traction tread pattern. This groundbreaking design ensures outstanding performance while providing added benefits including reduced wear and lowered inventory expenses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Vehicle Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as countries continue to invest in road, rail, and smart city projects.

- Adoption of radial tires will increase due to better load stability and longer service life.

- Sustainable and retreadable tires will gain preference to reduce operating costs and carbon impact.

- Smart tires with pressure and temperature monitoring will see wider use in rental and large fleets.

- Growth in mining and quarrying activities will boost heavy-duty and off-the-road tire consumption.

- Expanding rental equipment fleets will drive frequent replacement demand across developing regions.

- Manufacturers will introduce advanced tread designs for better traction on uneven and abrasive terrains.

- Digital fleet management and predictive maintenance systems will support tire performance monitoring.

- Price competition will intensify as low-cost Asian suppliers expand global distribution.

- OEM partnerships and product customization will increase to meet regional construction requirements.

Market Segmentation Analysis:

Market Segmentation Analysis: