Market Overview:

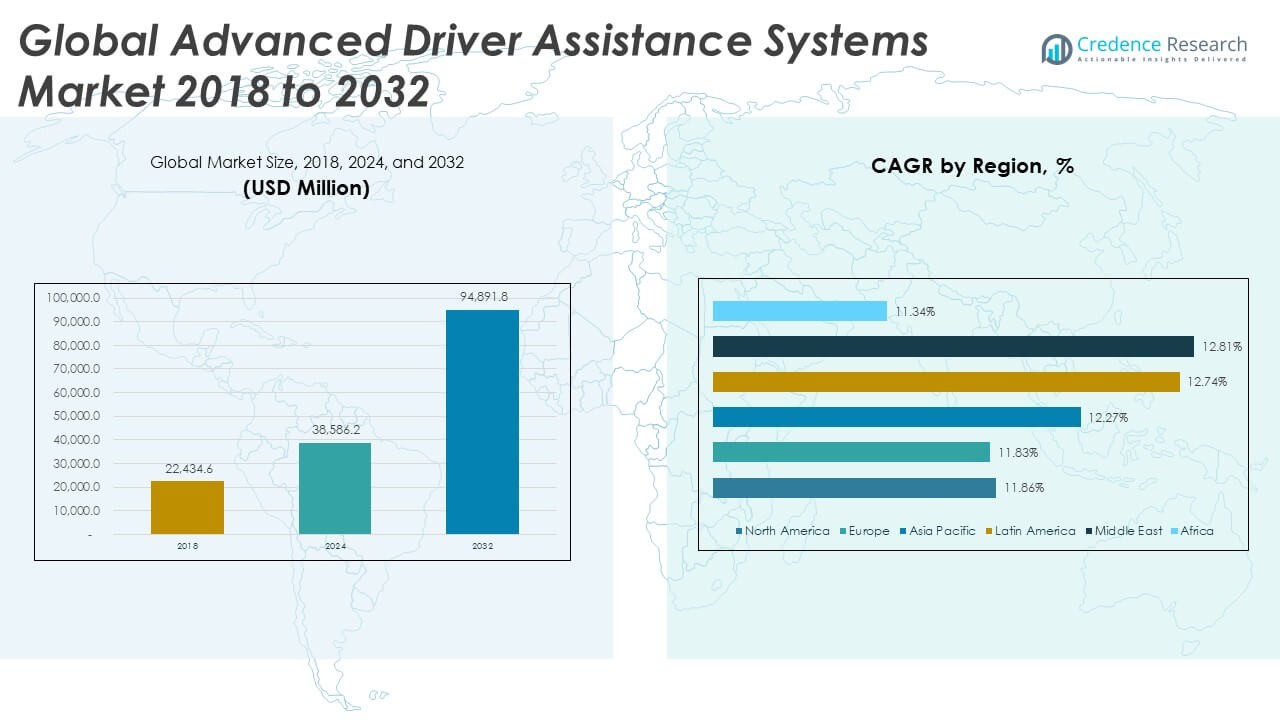

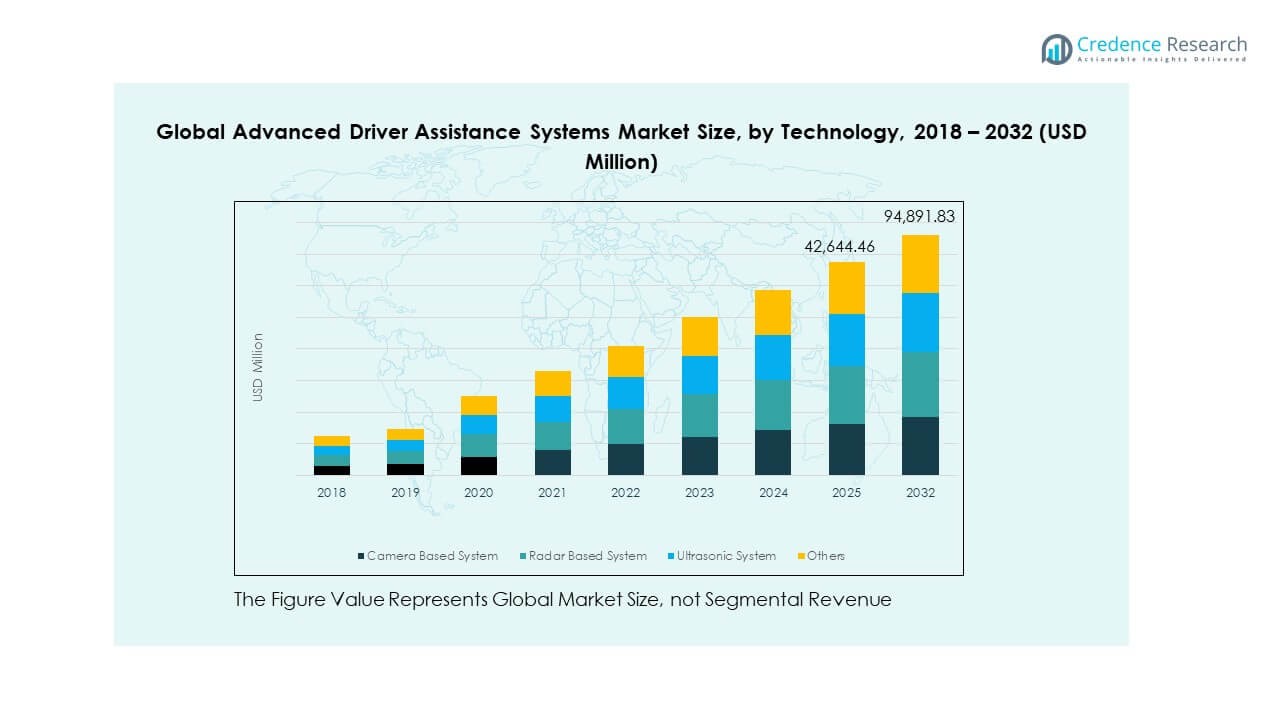

The Global Advanced Driver Assistance Systems Market size was valued at USD 22,434.6 million in 2018 to USD 38,586.2 million in 2024 and is anticipated to reach USD 94,891.8 million by 2032, at a CAGR of 12.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Driver Assistance Systems Mark Size 2024 |

USD 38,586.2 Million |

| Advanced Driver Assistance Systems Mark, CAGR |

12.10% |

| Advanced Driver Assistance Systems Mark Size 2032 |

USD 94,891.8 Million |

Growth in the market is fueled by increasing demand for safety, automation, and comfort features across vehicle segments. Automakers integrate technologies such as adaptive cruise control, automatic emergency braking, and lane departure warning to reduce human error and enhance driving convenience. Regulatory mandates in North America, Europe, and Asia-Pacific accelerate the installation of ADAS components. The expansion of electric and autonomous vehicles further strengthens adoption, supported by AI and sensor fusion innovations that improve precision and reliability in real-time driving environments.

Asia-Pacific dominates the market, driven by high automotive production in China, Japan, and South Korea. North America follows due to rapid technology adoption and strong investments in autonomous mobility research. Europe maintains steady growth through stringent safety regulations and the presence of key automotive OEMs. Emerging economies in Latin America and the Middle East are gaining traction through rising vehicle demand and safety awareness. Africa shows gradual growth, supported by premium imports and government initiatives promoting road safety modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Advanced Driver Assistance Systems Market was valued at USD 22,434.6 million in 2018, reaching USD 38,586.2 million in 2024, and is expected to attain USD 94,891.8 million by 2032, expanding at a CAGR of 12.10%.

- Asia Pacific leads with a 33% share, driven by strong automotive manufacturing in China, Japan, and South Korea and government-backed safety initiatives.

- Europe holds 27% share, supported by stringent safety regulations, while North America follows with 24%, backed by advanced technology integration and R&D investments.

- Latin America is the fastest-growing region with a 9% share, propelled by expanding vehicle production, regulatory adoption, and increasing awareness of safety features.

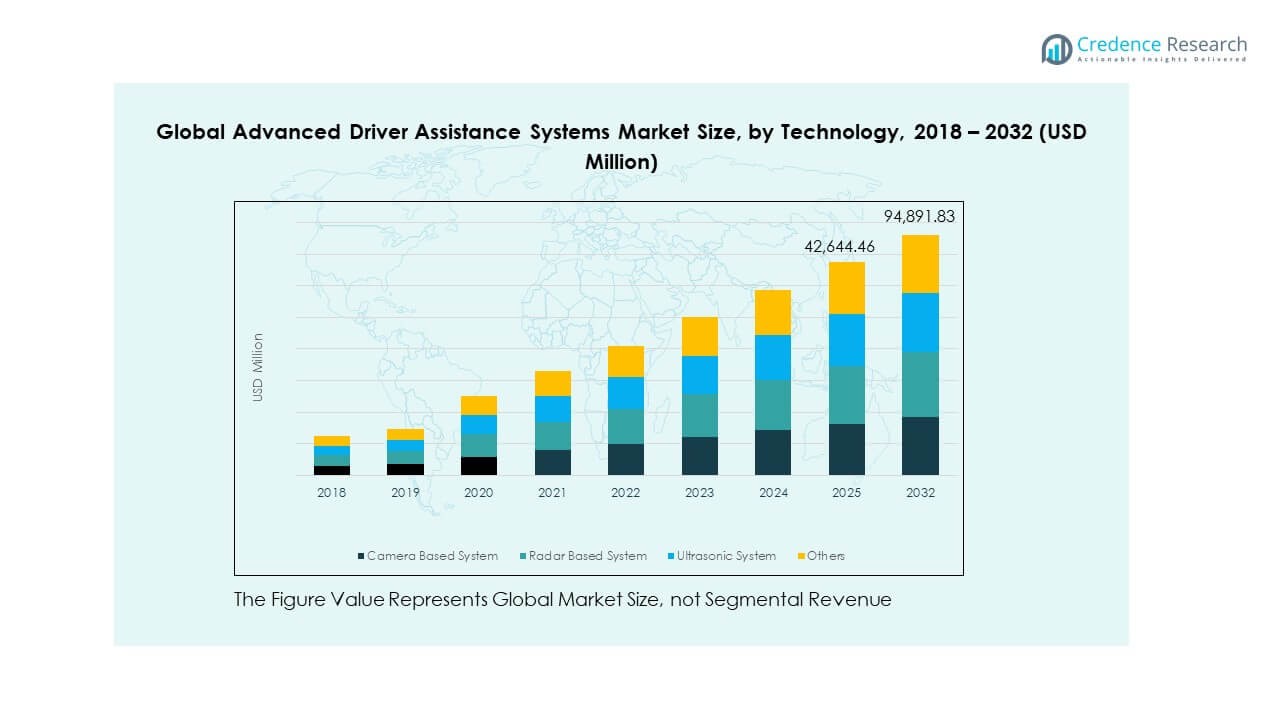

- By technology share, camera-based systems account for nearly 40% of total adoption, radar-based systems contribute around 35%, while ultrasonic and other technologies collectively represent 25%, reflecting balanced growth across sensor innovations.

Market Drivers

Rising Demand for Vehicle Safety and Collision Avoidance Technologies

The Global Advanced Driver Assistance Systems Market is expanding due to the growing need for vehicle safety and collision avoidance features. Governments worldwide enforce safety mandates such as automatic emergency braking and lane-keeping assist to reduce accidents. Consumers prioritize safety while purchasing vehicles, creating demand for systems that enhance driver awareness. Automakers integrate radar, camera, and ultrasonic sensors to improve real-time detection and response. Increasing road congestion and accident rates accelerate adoption of these solutions. Automakers invest in research to advance warning systems and adaptive technologies. Strong focus on passenger safety drives innovation across automotive design. These advancements ensure safer mobility and greater consumer trust in smart vehicle systems.

- For example, the U.S. National Highway Traffic Safety Administration (NHTSA) conducted studies on Brake Assist Systems showing that vehicles equipped with BAS help drivers achieve faster, more consistent braking during emergencies. The agency confirmed that such systems improve stopping performance and reduce collision risk.

Integration of Artificial Intelligence and Sensor Fusion in Automotive Systems

Artificial Intelligence supports precise decision-making in driver assistance functions. The integration of AI-based perception and deep learning enhances real-time detection accuracy in vehicles. The market benefits from the fusion of radar, camera, and LiDAR technologies, which deliver 360-degree environmental awareness. It enables automated lane changes, pedestrian recognition, and traffic sign identification with improved reliability. OEMs deploy machine learning algorithms to interpret road conditions quickly. Tier-1 suppliers like Bosch and Continental develop sensor networks that support high-speed data processing. Enhanced AI-driven analytics improve navigation and vehicle control stability. Continuous technological progress strengthens market competitiveness and user experience.

Government Regulations and Road Safety Initiatives Across Major Economies

Strict safety regulations in North America, Europe, and Asia-Pacific stimulate ADAS adoption. Authorities mandate safety systems such as adaptive cruise control and driver monitoring in new vehicles. The Euro NCAP and NHTSA programs reward automakers with safety ratings based on advanced features. Governments emphasize reduced fatalities through automated braking and collision warnings. Subsidies and tax benefits for ADAS-equipped cars encourage faster consumer adoption. The market witnesses policy alignment with global safety frameworks. It strengthens partnerships between technology firms and automakers. The regulatory environment ensures consistent innovation and compliance in safety technologies.

Rising Adoption of Semi-Autonomous and Electric Vehicles

Growing demand for semi-autonomous vehicles accelerates ADAS integration worldwide. Electric and hybrid vehicles require advanced sensors to optimize driver control and safety. Automakers focus on Level 2 and Level 3 automation capabilities to enhance comfort and reduce fatigue. The market experiences strong synergy between EV development and intelligent driving systems. Consumers appreciate convenience and precision offered by smart parking and adaptive cruise features. The system’s compatibility with electric powertrains ensures operational efficiency. It supports eco-friendly driving while minimizing human errors. The shift toward autonomous mobility amplifies technological advancement in safety-driven innovations.

- For example, in early 2024, Tesla released Full Self-Driving (FSD) Beta version 12, which introduced an end-to-end neural network architecture for improved urban driving behavior. Early user feedback and independent testers reported smoother turns and more natural lane changes, reflecting noticeable progress in Tesla’s autonomous navigation capabilities.

Market Trends

Increasing Penetration of Connected and Smart Vehicle Technologies

The Global Advanced Driver Assistance Systems Market evolves with the rise of connected vehicle ecosystems. Integration of telematics and 5G networks enhances real-time communication between vehicles and infrastructure. Cloud-based data processing supports instant updates for route optimization and hazard alerts. Automakers leverage over-the-air software upgrades to improve ADAS performance post-purchase. It ensures consistent functionality and reduced maintenance dependency. Smart connectivity allows vehicles to share sensor data for traffic efficiency. The collaboration between telecom providers and OEMs drives innovation in connected mobility. This trend positions intelligent connectivity as a backbone of future automotive safety.

- For instance, in October 2024, Hyundai Motor integrated Qualcomm’s Snapdragon X35 5G Modem-RF System into its Diagnostic Scan system at the Ulsan plant in Korea, using Samsung’s Private 5G (P-5G) RedCap technology to enable efficient data transmission and centralized control for dozens of automated guided vehicles.

Growing Role of High-Resolution Mapping and LiDAR Advancements

High-definition mapping and LiDAR sensor innovations improve vehicle perception accuracy. Real-time mapping systems deliver centimeter-level precision in navigation and object detection. Automakers adopt LiDAR sensors to complement cameras and radar in complex environments. The market benefits from cost reductions and miniaturization of LiDAR components. It allows wider implementation in mid-range vehicles beyond luxury segments. Advanced mapping supports smoother lane management and route prediction capabilities. Tech companies partner with automakers to integrate spatial analytics and AI models. This transformation strengthens the foundation for higher levels of vehicle autonomy.

Shift Toward Human-Machine Interface (HMI) Enhancements

User experience becomes central to driver assistance system development. Automakers refine interfaces for better alert presentation, gesture control, and voice feedback. The market focuses on minimizing driver distraction through ergonomic dashboard design. Eye-tracking sensors and haptic feedback improve situational awareness and comfort. It enhances driver engagement without overwhelming cognitive load. Personalized display options adapt to user preferences and driving habits. Integration of AR-based visualization strengthens decision support in real-time navigation. The trend signifies growing attention toward intuitive interaction between humans and advanced systems.

Collaborative Partnerships Driving Innovation in ADAS Ecosystem

Strategic partnerships between automotive manufacturers, semiconductor firms, and AI developers accelerate innovation. The Global Advanced Driver Assistance Systems Market benefits from cross-industry collaboration for hardware-software integration. Tier-1 suppliers align with tech firms to create adaptable architectures supporting autonomous functionalities. It ensures interoperability and faster system validation cycles. Joint R&D centers explore solutions for energy efficiency and sensor calibration. Automakers gain access to AI-driven analytics platforms for predictive performance optimization. Collaborative models reduce development costs and shorten time to market. Such alliances foster technological evolution and sustained competitive advantage.

- For instance, Mercedes-Benz’s partnership with NVIDIA enabled the introduction of the MB.OS architecture powered by the NVIDIA DRIVE Orin platform, delivering high-performance AI compute to support Level 3 conditionally automated driving.

Market Challenges Analysis

High Implementation Costs and Complex Sensor Integration Issues

The Global Advanced Driver Assistance Systems Market faces high costs associated with sensor fusion and system calibration. Manufacturers invest heavily in multi-sensor configurations, driving up production expenses. Complex integration of radar, camera, and LiDAR requires advanced software compatibility. It demands significant testing for accuracy and environmental adaptability. Limited affordability in entry-level vehicles restricts penetration in developing economies. Suppliers struggle with standardization, leading to interoperability issues. Maintenance and recalibration of sensors add further operational costs. These challenges limit rapid scaling across the broader automotive landscape.

Cybersecurity Threats and Reliability Concerns in Automated Systems

Increasing digital connectivity exposes ADAS platforms to potential cyberattacks and data manipulation. Unauthorized access to vehicle control systems threatens driver and passenger safety. The Global Advanced Driver Assistance Systems Market must address these security risks through stronger encryption and network protection. It requires consistent updates to secure software integrity. Dependence on GPS and cloud services increases vulnerability during network disruptions. Malfunction risks in extreme weather conditions undermine user confidence. Automakers invest in redundancy protocols to ensure operational safety. Building consumer trust remains essential for long-term adoption and compliance.

Market Opportunities

Expansion of Autonomous Mobility and Smart Infrastructure Integration

The Global Advanced Driver Assistance Systems Market holds significant potential through autonomous mobility advancements. Integration with smart city infrastructure allows vehicles to interact seamlessly with traffic systems. Governments invest in intelligent transportation to improve road efficiency. It strengthens demand for ADAS-equipped fleets and shared mobility platforms. Automakers explore Level 4 and Level 5 automation readiness. The expansion of urban infrastructure accelerates adoption across logistics and passenger vehicles. The alignment between urban planning and vehicle automation promotes sustainable transport solutions. This synergy creates strong long-term growth opportunities for the ADAS ecosystem.

Growing Aftermarket Demand and Software Upgrade Potential

The rising aftermarket demand for ADAS components presents new revenue streams. Vehicle owners upgrade systems for enhanced safety and comfort features. Software-based updates enable periodic performance improvements without full hardware replacement. It creates recurring income opportunities for automakers and technology providers. Consumers prefer cost-efficient retrofitting options compatible with older models. Increasing awareness of road safety encourages broader adoption across mid-range vehicles. The focus on software-driven adaptability strengthens lifetime value for manufacturers. This growing ecosystem supports steady expansion and continuous innovation momentum.

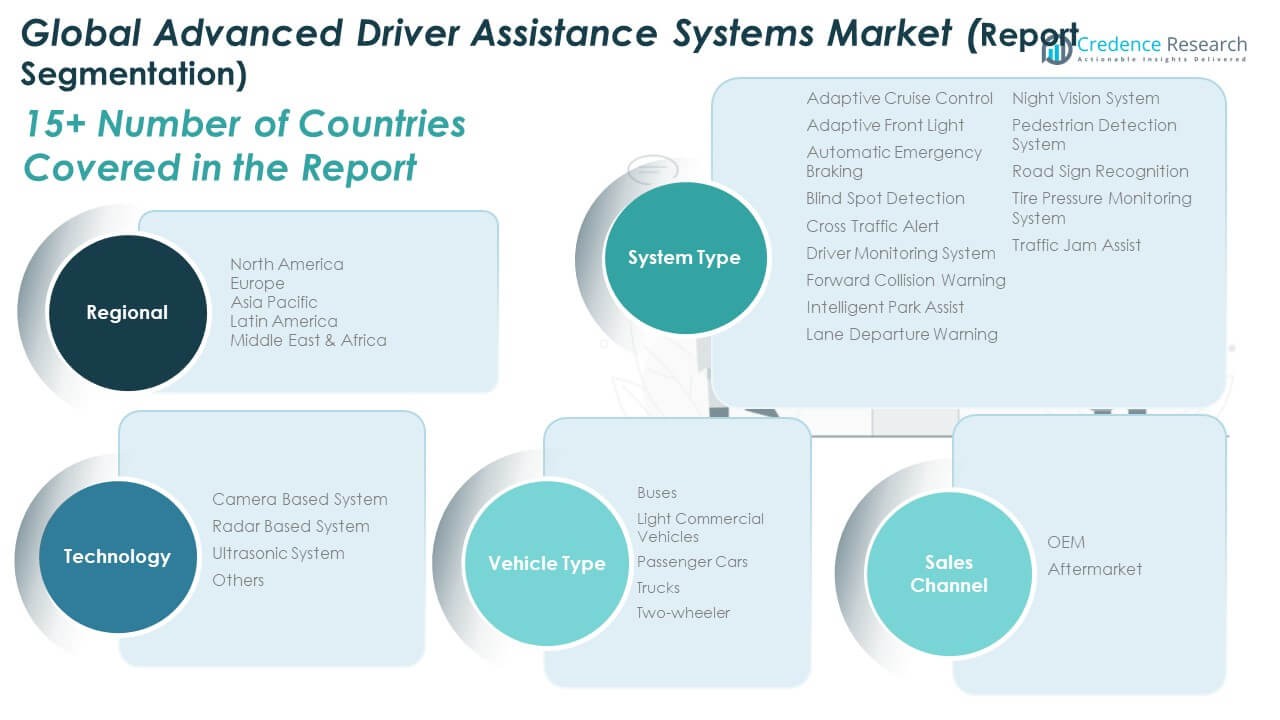

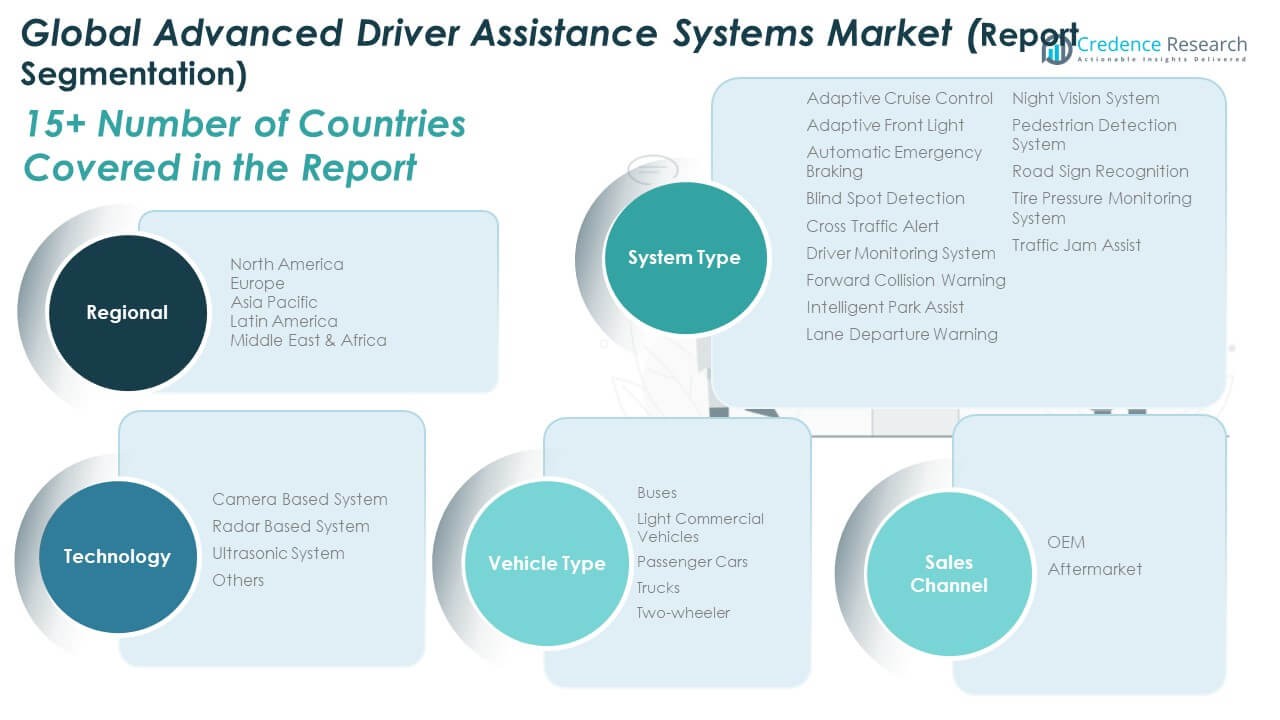

Market Segmentation Analysis:

By System Type

The Global Advanced Driver Assistance Systems Market includes several critical system categories that enhance driver safety, comfort, and situational awareness. Adaptive Cruise Control, Automatic Emergency Braking, and Lane Departure Warning remain key features in modern vehicles, supporting accident prevention and smoother driving control. Blind Spot Detection, Cross Traffic Alert, and Intelligent Park Assist improve spatial awareness in dense traffic. Driver Monitoring Systems and Forward Collision Warning ensure proactive responses to distractions or fatigue. Night Vision Systems, Pedestrian Detection, and Road Sign Recognition enhance visibility and awareness during low-light conditions. Tire Pressure Monitoring and Traffic Jam Assist systems continue to expand across mass-market and luxury vehicle platforms, strengthening vehicle reliability and user confidence.

- For example, the U.S. National Highway Traffic Safety Administration (NHTSA) has conducted evaluations of driver monitoring technologies used in Level 2 vehicles. These studies confirm that such systems issue visual, haptic, or auditory alerts when drivers fail to maintain proper attention or hand contact, reinforcing safety compliance and situational awareness.

By Technology

Technological segmentation highlights the importance of sensor-based innovation across the industry. Radar-Based and Camera-Based Systems dominate due to high precision and adaptability under varying conditions. It benefits from AI integration and sensor fusion that deliver enhanced decision-making and detection accuracy. Ultrasonic Systems provide low-speed maneuvering support for parking and obstacle avoidance. The “Others” segment includes hybrid and emerging technologies integrating multiple sensor types for comprehensive environmental perception. Continuous advancements in software algorithms and miniaturized hardware components improve cost-efficiency and broaden adoption across multiple vehicle classes.

- For example, Valeo produces roughly 20 million ultrasonic sensors annually, including its advanced USV10 unit. The USV10 supports precise parking assistance and obstacle detection, designed for seamless integration in premium vehicle platforms. Valeo confirms these sensors as core components of its ADAS portfolio, enhancing short-range perception and supporting higher levels of driving automation.

By Vehicle Type

Passenger Cars represent the largest share in the Global Advanced Driver Assistance Systems Market due to mandatory safety regulations and consumer preference for convenience features. Light Commercial Vehicles increasingly adopt driver assistance tools to enhance fleet safety and reduce operational risks. Trucks and Buses integrate ADAS solutions such as adaptive braking and lane assistance to improve long-haul stability and driver comfort. It continues to expand across Two-Wheelers with the introduction of compact radar systems and blind spot alerts, supporting the growing focus on rider safety in urban environments.

By Sales Channel

OEMs lead the market share through factory-installed ADAS features that meet international safety standards. Automakers integrate multi-sensor systems during production to enhance reliability and ensure compliance with regulatory norms. It reinforces brand value and safety perception among buyers. The Aftermarket segment grows as consumers retrofit older vehicles with advanced technologies like dash cameras, parking aids, and blind spot detection kits. Software updates and modular integration solutions further drive aftermarket accessibility. Expanding consumer awareness and the availability of cost-efficient upgrade options continue to strengthen aftermarket adoption across both passenger and commercial vehicle categories.

Segmentation:

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Region

- North America: U.S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Global Advanced Driver Assistance Systems Market size was valued at USD 5,408.97 million in 2018 to USD 9,184.06 million in 2024 and is anticipated to reach USD 22,195.20 million by 2032, at a CAGR of 11.86% during the forecast period. North America accounts for nearly 24% of the global market share. Strong regulatory support for vehicle safety and the rapid adoption of autonomous technologies drive regional growth. The U.S. leads due to high consumer awareness and government programs promoting advanced safety standards. Automakers integrate adaptive cruise control, collision avoidance, and driver monitoring systems across premium and mass-market models. It benefits from robust R&D investments and collaborations between OEMs and tech firms. Canada focuses on integrating ADAS features in electric vehicles, while Mexico supports regional assembly networks for system manufacturing. The region’s mature infrastructure and regulatory alignment encourage continuous technological advancement.

Europe

The Europe Global Advanced Driver Assistance Systems Market size was valued at USD 6,057.33 million in 2018 to USD 10,269.43 million in 2024 and is anticipated to reach USD 24,766.77 million by 2032, at a CAGR of 11.83% during the forecast period. Europe holds roughly 27% of the global market share. The region leads in regulatory enforcement and safety testing standards under Euro NCAP frameworks. Germany and the UK serve as key hubs for autonomous technology integration. Automakers prioritize radar-based and camera-based systems to comply with emission and safety goals. It experiences strong demand from luxury car manufacturers embedding ADAS features in connected vehicles. France and Italy expand adoption through government incentives and consumer demand for intelligent parking and lane-keeping assistance. Regional innovation clusters foster collaboration between semiconductor and automotive suppliers. Consistent policy alignment sustains Europe’s competitive edge in safety technologies.

Asia Pacific

The Asia Pacific Global Advanced Driver Assistance Systems Market size was valued at USD 7,329.37 million in 2018 to USD 12,716.90 million in 2024 and is anticipated to reach USD 31,636.94 million by 2032, at a CAGR of 12.27% during the forecast period. Asia Pacific represents approximately 33% of the global market share, making it the dominant region. China, Japan, and South Korea lead ADAS production with large-scale automotive manufacturing bases. Increasing urbanization and vehicle sales drive demand for intelligent driver systems. It benefits from government-backed road safety initiatives and expanding EV production. India shows rising adoption through mid-range vehicles integrating adaptive and collision warning systems. Japan continues to advance LiDAR and sensor fusion applications, while China accelerates autonomous vehicle testing and component exports. The region’s innovation-driven environment ensures sustained market leadership through technology deployment.

Latin America

The Latin America Global Advanced Driver Assistance Systems Market size was valued at USD 1,965.27 million in 2018 to USD 3,502.52 million in 2024 and is anticipated to reach USD 9,014.72 million by 2032, at a CAGR of 12.74% during the forecast period. Latin America contributes around 9% of the global market share. Brazil leads with early implementation of lane departure and collision alert technologies. Expanding vehicle production and rising consumer focus on safety stimulate adoption across the region. It benefits from partnerships between OEMs and local distributors to enhance product reach. Mexico supports component manufacturing and cross-border exports to North America. Argentina shows gradual adoption within premium and commercial vehicle categories. Limited affordability in low-cost segments slows penetration, but government awareness campaigns help improve acceptance. The region’s growing middle-class population supports long-term expansion of driver assistance technologies.

Middle East

The Middle East Global Advanced Driver Assistance Systems Market size was valued at USD 1,072.37 million in 2018 to USD 1,918.83 million in 2024 and is anticipated to reach USD 4,962.84 million by 2032, at a CAGR of 12.81% during the forecast period. The region represents nearly 4.5% of the global market share. Rising luxury vehicle imports and smart city investments stimulate demand for ADAS-equipped vehicles. The UAE and Saudi Arabia lead in early adoption, focusing on connected vehicle infrastructure. It experiences increasing collaboration between international automakers and local dealers for technology integration. Government transport modernization projects strengthen adoption in public and private fleets. Israel supports innovations in sensor development and autonomous driving software. Regional climatic diversity influences the demand for adaptive lighting and night vision systems. Continuous digital transformation initiatives promote greater acceptance of intelligent vehicle technologies.

Africa

The Africa Global Advanced Driver Assistance Systems Market size was valued at USD 601.25 million in 2018 to USD 994.42 million in 2024 and is anticipated to reach USD 2,315.36 million by 2032, at a CAGR of 11.34% during the forecast period. Africa holds close to 2.5% of the global market share. The region is in an early stage of ADAS adoption, driven by urban safety initiatives and premium vehicle imports. South Africa leads regional progress through dealership-driven installations of adaptive braking and lane monitoring systems. Egypt shows rising demand in commercial fleets for collision avoidance and driver monitoring features. It faces challenges such as limited infrastructure and affordability concerns. International OEMs collaborate with local distributors to improve market accessibility. Government programs promoting road safety awareness encourage future adoption. The region’s gradual shift toward vehicle digitization is expected to strengthen its position in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis:

- Altera Corporation

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Magna International Inc.

- ZF Friedrichshafen AG

- Aptiv PLC

- Valeo SA

- Mobileye

- NXP Semiconductors N.V.

- Autoliv Inc.

- Other Key Players

Competitive Analysis:

The Global Advanced Driver Assistance Systems Market features strong competition among technology leaders and automotive suppliers focused on safety innovation. Major players such as Robert Bosch GmbH, Continental AG, DENSO Corporation, ZF Friedrichshafen AG, and Magna International Inc. dominate through extensive product portfolios and global manufacturing networks. It emphasizes continuous innovation in radar, camera, and sensor fusion technologies to enhance precision and reliability. Companies invest in AI-based perception systems and software upgrades to support autonomous driving functions. Strategic collaborations between OEMs and semiconductor manufacturers accelerate feature integration across vehicle segments. Emerging players focus on cost-efficient solutions for mid-range vehicles to expand accessibility. Continuous advancements in hardware efficiency, system calibration, and cybersecurity define the competitive intensity within this rapidly evolving market.

Recent Developments:

- In October 2025, VVDN Technologies and Mobileye formalized an agreement to localize and offer Mobileye’s advanced driver assistance solutions for Indian automakers. This partnership is designed to strengthen local manufacturing and align with India’s safety and regulatory needs, highlighting the region’s expanding focus on ADAS deployment and domestic market growth.

- In October 2025, Aptiv introduced its Gen 8 radar technology and the Aptiv PULSE Sensor, designed to advance next-generation ADAS with improved detection and cost-efficient solutions. These products expand Aptiv’s reach in automotive safety, targeting broader industrial applications and supporting complex hands-free driving scenarios.

- In October 2025, Autoliv announced a planned safety electronics joint venture in China with Hangsheng Electric. Expected to be formalized in early 2026, this partnership aims to localize advanced ADAS safety products for the fast-growing Chinese electric vehicle market, underpinning Autoliv’s strategic expansion into Asia.

- In September 2025, Valeo entered a strategic partnership with Momenta, to jointly develop advanced mid- to high-level ADAS and autonomous driving technologies for global markets. This collaboration bolsters Valeo’s leadership in AI-powered sensor fusion and ADAS software, accelerating innovation and competitive positioning outside China.

Report Coverage:

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing emphasis on autonomous mobility will accelerate the integration of advanced driver assistance technologies across all vehicle segments.

- Increasing regulatory support for mandatory safety systems will enhance ADAS installation rates in both developed and emerging markets.

- Expansion of electric and hybrid vehicle production will drive demand for adaptive and energy-efficient assistance systems.

- AI-driven sensor fusion and machine learning algorithms will strengthen object recognition and decision accuracy.

- Cloud-based analytics and 5G connectivity will enhance real-time vehicle-to-infrastructure communication and predictive safety capabilities.

- Continuous software updates and over-the-air upgrades will create recurring revenue streams for manufacturers.

- Expansion of the aftermarket segment will provide cost-effective ADAS retrofitting opportunities in existing vehicle fleets.

- Collaboration between OEMs and semiconductor firms will accelerate hardware optimization and platform scalability.

- Smart city development and intelligent transport infrastructure will increase adoption of connected ADAS features.

- Sustainability goals and emission reduction initiatives will promote the adoption of advanced safety technologies in electric mobility ecosystems.