Market Overview

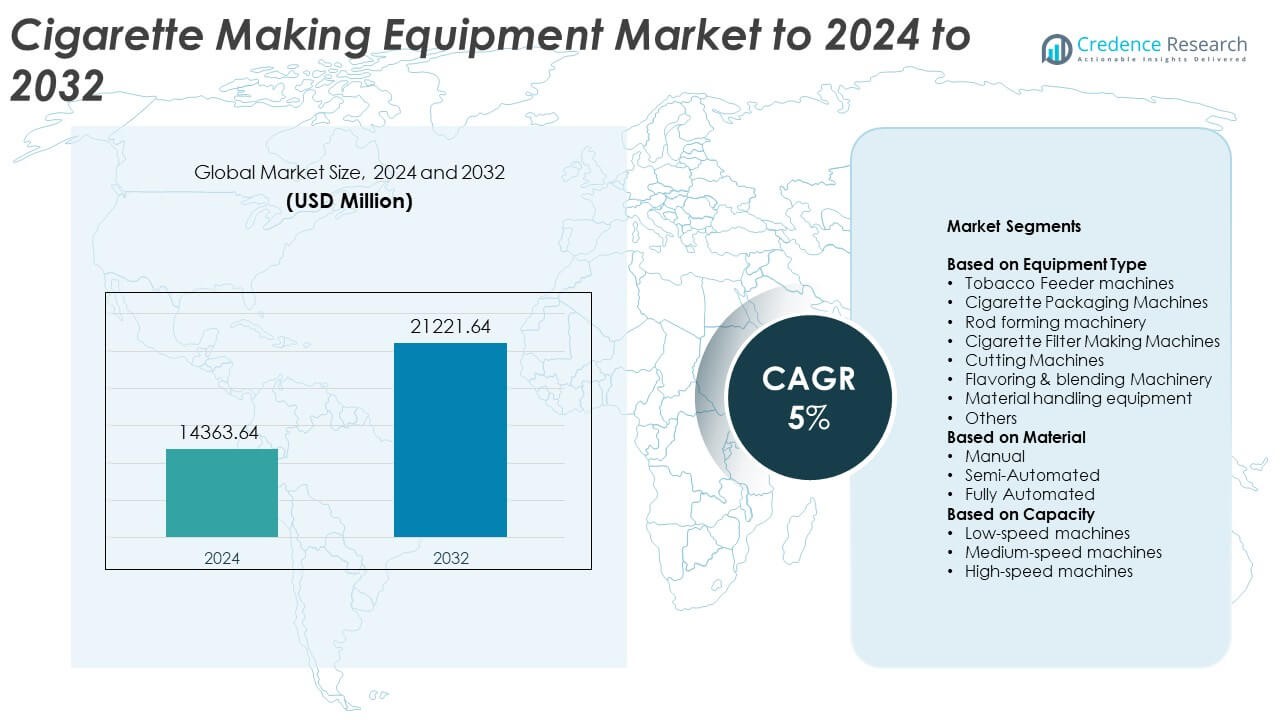

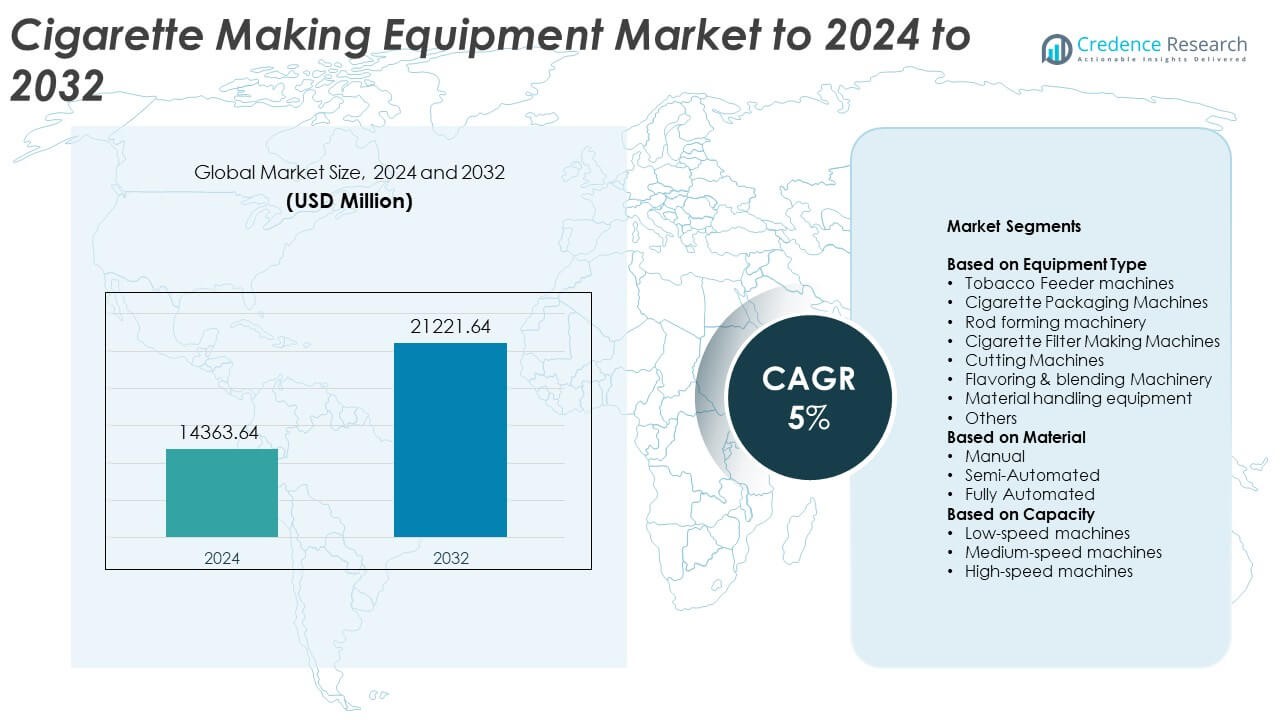

Cigarette Making Equipment Market size was valued at USD 14363.64 Million in 2024 and is anticipated to reach USD 21221.64 Million by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cigarette Making Equipment Market Size 2024 |

USD 14363.64 Million |

| Cigarette Making Equipment Market, CAGR |

5% |

| Cigarette Making Equipment Market Size 2032 |

USD 21221.64 Million |

The cigarette making equipment market is dominated by major companies such as Hauni Maschinenbau GmbH, G.D S.p.A., Körber Technologies, ITM Group, Focke & Co., and Molins, known for their advanced manufacturing systems and global reach. These players emphasize automation, digital monitoring, and energy-efficient designs to enhance production speed and precision. Regional competitors including HK UPPERBOND INDUSTRIAL LIMITED, Cipta Bena Kencana, Orchid Tobacco Machinery, and Makepak International are strengthening their presence with cost-effective and region-specific solutions. Asia-Pacific leads the market with a 39% share in 2024, followed by North America at 26% and Europe at 23%, supported by strong industrial infrastructure and modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cigarette making equipment market was valued at USD 14363.64 million in 2024 and is projected to reach USD 21221.64 million by 2032, growing at a CAGR of 5%.

- Growth is driven by increasing adoption of automated and high-speed machinery that enhances production efficiency and precision across global manufacturing facilities.

- Rising integration of smart monitoring, IoT, and energy-efficient designs is shaping new trends, helping manufacturers achieve sustainability and compliance with global standards.

- The market is competitive, with companies focusing on technological innovation, modular designs, and regional expansion to strengthen their positions amid evolving tobacco regulations.

- Asia-Pacific dominates with around 39% share in 2024, followed by North America at 26% and Europe at 23%, while the cigarette packaging machines segment leads the market with nearly 33% share due to high demand for precision wrapping and labeling systems.

Market Segmentation Analysis:

By Equipment Type

The cigarette packaging machines segment dominates the cigarette making equipment market, accounting for around 33% share in 2024. Their leadership is driven by growing demand for high-speed, precision packaging systems that enhance efficiency and ensure product consistency. Automation in wrapping, labeling, and sealing has improved production throughput and reduced operational costs. Increasing investments by tobacco manufacturers to adopt advanced packaging technology for regulatory compliance and brand differentiation further boost this segment’s growth. Meanwhile, rod forming and filter-making machinery are gaining traction with the rise in filtered cigarette production.

- For instance, FOCKE’s latest hinge-lid packer produces 1,000 packs per minute.

By Material

The fully automated segment leads the market with approximately 58% share in 2024, driven by the growing shift toward smart manufacturing and productivity optimization. Fully automated systems streamline cigarette production, minimize human error, and ensure consistent quality standards across batches. Manufacturers increasingly favor automation to meet stringent safety regulations and achieve higher output rates. Integration of intelligent control systems, predictive maintenance, and robotics in cigarette manufacturing has strengthened the dominance of this segment, reducing downtime and enhancing operational efficiency across large-scale production facilities.

- For instance, Hauni PROTOS 80 ER outputs 8,000 cpm (regular) and 7,000 cpm (slim).

By Capacity

High-speed machines dominate the cigarette making equipment market, capturing nearly 61% share in 2024. Their dominance stems from the strong demand among large tobacco producers for machinery capable of exceeding 8,000 cigarettes per minute. These systems enable mass production while maintaining precision in rod formation, cutting, and wrapping. Continuous advancements in servo-driven technology and synchronized control systems have enhanced speed without compromising product quality. The high-speed segment continues to benefit from modernization initiatives in established cigarette factories aimed at improving efficiency and reducing manufacturing costs.

Key Growth Drivers

Rising Demand for Automated Manufacturing Systems

Automation remains the primary growth driver in the cigarette making equipment market. Tobacco manufacturers are rapidly adopting fully automated machinery to improve precision, reduce waste, and ensure high-speed production. These systems enhance quality consistency and minimize operational errors. The integration of robotics, sensors, and digital monitoring tools helps producers meet strict global standards. This transition toward smart manufacturing supports higher productivity and cost efficiency, driving strong investment in modern cigarette-making technologies across both established and emerging markets.

- For instance, Körber’s LASERPORT supports makers operating up to 20,000 cpm.

Expansion of Tobacco Production in Emerging Economies

Expanding cigarette production capacities across Asia-Pacific, Africa, and parts of Latin America fuels equipment demand. Countries like China, Indonesia, and India continue to host large-scale tobacco manufacturing hubs due to strong domestic consumption and export activities. Local producers increasingly invest in advanced forming, packaging, and filtration machinery to meet growing output requirements. Supportive government policies and lower labor costs encourage manufacturers to establish production plants, strengthening regional demand for efficient and high-capacity cigarette-making systems.

- For instance, Dynamic Tools’ M5000 delivers 4,500 cpm, and the company serves customers in 41+ countries with its various machinery lines.

Technological Advancements in Machinery Design

Continuous innovation in cigarette-making technology enhances operational performance and energy efficiency. Modern equipment integrates digital controls, servo-driven components, and IoT-based monitoring systems that optimize performance in real time. These advancements reduce downtime, improve yield, and ensure consistent product quality. Manufacturers increasingly focus on developing modular and flexible systems that accommodate diverse cigarette sizes and flavors. Such innovations enable producers to adapt to changing consumer preferences and comply with international quality and safety regulations.

Key Trends & Opportunities

Shift Toward Sustainable Manufacturing Solutions

Sustainability is emerging as a key trend shaping the cigarette making equipment industry. Manufacturers are designing machines that consume less energy, use recyclable materials, and generate minimal waste. The move toward eco-friendly packaging materials also drives innovation in related machinery. Equipment capable of supporting biodegradable filters and low-impact production processes is gaining preference. As global regulations tighten around environmental impact, companies adopting sustainable production technologies are positioned to achieve long-term competitiveness and regulatory compliance.

- For instance, Filtrona’s ECO Tube achieved 90% biodegradation in 90 days.

Integration of Digital and Smart Monitoring Systems

The growing adoption of Industry 4.0 solutions presents major opportunities for cigarette equipment manufacturers. Smart monitoring systems equipped with AI and IoT technologies provide real-time data on machine performance and maintenance needs. This digitalization improves operational transparency and predictive maintenance capabilities, reducing unplanned downtime. It also enhances traceability and compliance with regulatory standards. The integration of connected technologies in cigarette-making systems is expected to boost efficiency, precision, and production flexibility across global manufacturing plants.

- For instance, Körber Digital’s Uptime solution and other AI-driven predictive maintenance technologies can reduce equipment downtime by up to 50%, lower maintenance costs by 10% to 40%, and increase operational availability by 12%, which helps improve overall productivity.

Key Challenges

Stringent Regulatory Restrictions on Tobacco Production

Global tobacco control initiatives continue to challenge market growth. Strict government regulations related to cigarette advertising, packaging, and health warnings directly affect production volumes. Many countries are implementing higher taxes and plain packaging mandates, limiting market expansion opportunities. These regulatory pressures force manufacturers to adapt their production strategies and reconfigure machinery to meet compliance requirements. This ongoing regulatory uncertainty remains a significant hurdle for cigarette-making equipment suppliers worldwide.

High Capital Costs and Maintenance Requirements

The high cost of advanced cigarette-making equipment poses a major barrier for small and mid-sized manufacturers. Modern automated and high-speed machinery requires substantial investment, which increases initial setup and operational expenses. Regular maintenance and skilled technical support add further costs. Additionally, integrating advanced technologies such as robotics and IoT systems demands specialized expertise and infrastructure upgrades. These financial and technical constraints often delay adoption in developing markets, restraining overall market penetration.

Regional Analysis

North America

North America accounts for around 26% share of the cigarette making equipment market in 2024. The region’s growth is driven by ongoing modernization of existing production facilities and the adoption of automated packaging and filter-making systems. Major tobacco companies in the United States and Canada are investing in high-speed machinery to maintain efficiency amid tightening regulatory standards. The shift toward sustainable production and reduced labor dependency further supports equipment upgrades. Despite declining smoking rates, consistent demand for premium cigarettes sustains machinery replacement and innovation across established manufacturers.

Europe

Europe holds approximately 23% share of the cigarette making equipment market in 2024. The region benefits from advanced manufacturing infrastructure and the presence of leading machinery suppliers in Germany, Italy, and the United Kingdom. Strict quality standards and automation adoption continue to drive technological development. Manufacturers focus on energy-efficient systems to meet environmental regulations under the EU’s sustainability directives. Additionally, modernization of Eastern European facilities and the rising export of high-quality machinery enhance market expansion across both domestic and international markets.

Asia-Pacific

Asia-Pacific dominates the cigarette making equipment market, capturing around 39% share in 2024. Strong tobacco production hubs in China, India, Indonesia, and the Philippines contribute significantly to regional growth. The region’s high consumption rates and export-oriented manufacturing drive substantial investment in automated and high-speed production lines. Local producers are increasingly embracing digital control systems and robotics to improve output quality and operational efficiency. Supportive government policies, cost-effective labor, and expanding cigarette exports strengthen Asia-Pacific’s position as the leading market for cigarette-making equipment.

Latin America

Latin America represents nearly 7% share of the cigarette making equipment market in 2024. Growth is supported by modernization efforts in Brazil, Mexico, and Argentina, where tobacco processing and cigarette manufacturing remain key industries. Increasing adoption of semi-automated and fully automated equipment improves productivity and compliance with global standards. Local manufacturers seek cost-effective machinery to meet growing export demands across neighboring markets. However, economic volatility and fluctuating tobacco regulations limit the pace of technological adoption across smaller producers in the region.

Middle East & Africa

The Middle East & Africa region accounts for about 5% share of the cigarette making equipment market in 2024. Rising consumption in countries like Egypt, Nigeria, and Saudi Arabia drives moderate growth. Investments in small to medium-scale production facilities are increasing as regional manufacturers expand output to meet domestic demand. Equipment suppliers are focusing on introducing affordable, energy-efficient systems suitable for developing markets. However, inconsistent regulatory enforcement and limited industrial infrastructure continue to challenge widespread adoption of advanced cigarette-making technologies in the region.

Market Segmentations:

By Equipment Type

- Tobacco Feeder machines

- Cigarette Packaging Machines

- Rod forming machinery

- Cigarette Filter Making Machines

- Cutting Machines

- Flavoring & blending Machinery

- Material handling equipment

- Others

By Material

- Manual

- Semi-Automated

- Fully Automated

By Capacity

- Low-speed machines

- Medium-speed machines

- High-speed machines

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Hauni Maschinenbau GmbH, G.D S.p.A., Körber Technologies, ITM Group, Focke & Co., Molins, HK UPPERBOND INDUSTRIAL LIMITED, Cipta Bena Kencana, Orchid Tobacco Machinery, Makepak International, Dynamic Tools Pvt Ltd., Decouflé, and CBK are the key players in the cigarette making equipment market. The competitive landscape is marked by strong technological advancement, automation, and continuous innovation to enhance production efficiency. Global manufacturers emphasize digital monitoring, modular machine design, and energy optimization to meet diverse production demands. Strategic mergers, partnerships, and expansion into emerging markets help companies strengthen their regional foothold. Growing regulatory pressures and the push for sustainable operations are also driving investment in eco-efficient and precision-engineered equipment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Dynamic Tools has continued to emphasize and market its range of advanced cigarette packing machines, particularly the HLP2 Cigarette Packing Machine and the Shell and Slide Packer.

- In 2025, Körber Technologies announced a sustainability tie-up with H.B. Fuller. Tests targeted adhesive performance in tobacco production.

- In 2024, Focke & Co. participated at PACK EXPO International 2024. Tobacco packaging capabilities were profiled for attendees.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Material, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with increasing automation across cigarette manufacturing lines.

- Manufacturers will focus on developing energy-efficient and low-emission machinery to meet green standards.

- Demand for high-speed and precision packaging equipment will rise among global tobacco producers.

- Digital monitoring and predictive maintenance technologies will enhance productivity and equipment life.

- Emerging economies in Asia-Pacific and Africa will drive new machinery investments for capacity expansion.

- Equipment suppliers will introduce modular systems allowing flexible production across cigarette types.

- Global regulations will push innovation in sustainable materials and recyclable packaging equipment.

- Integration of AI and IoT will support real-time process optimization in manufacturing facilities.

- Consolidation among key manufacturers will strengthen global distribution networks and aftersales services.

- Long-term growth will depend on balancing automation efficiency with evolving health and regulatory norms.