Market Overview

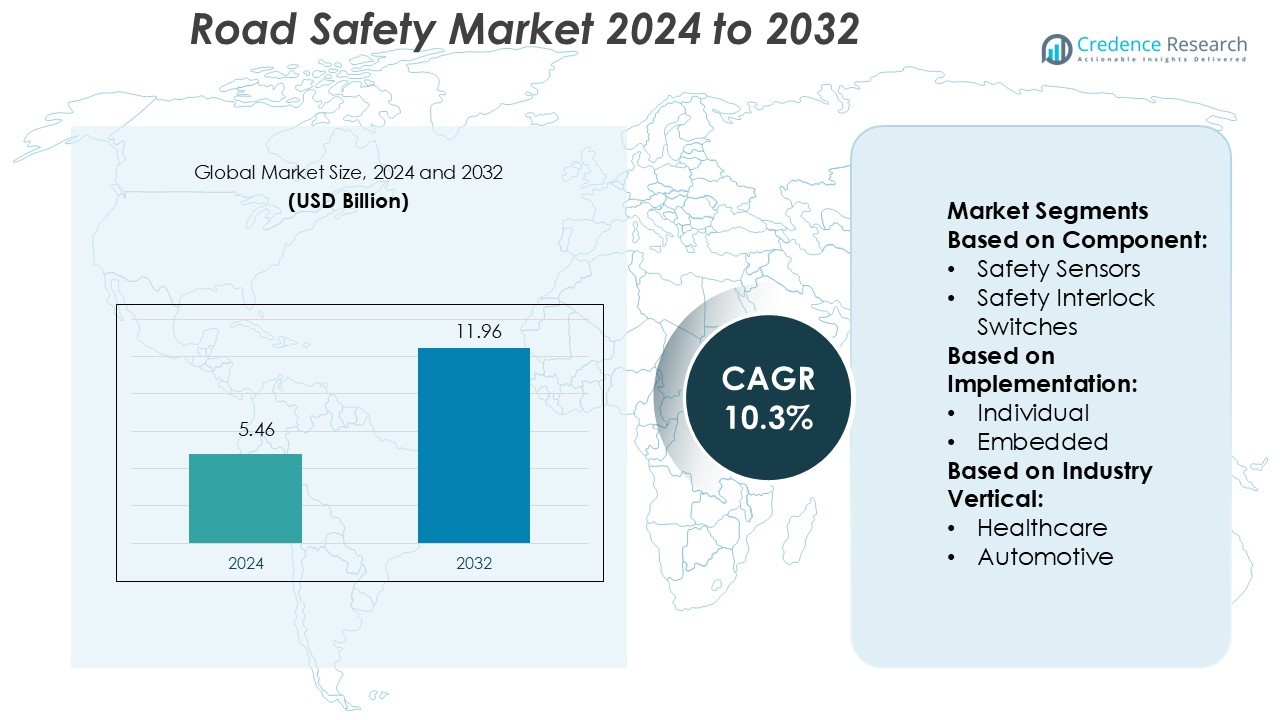

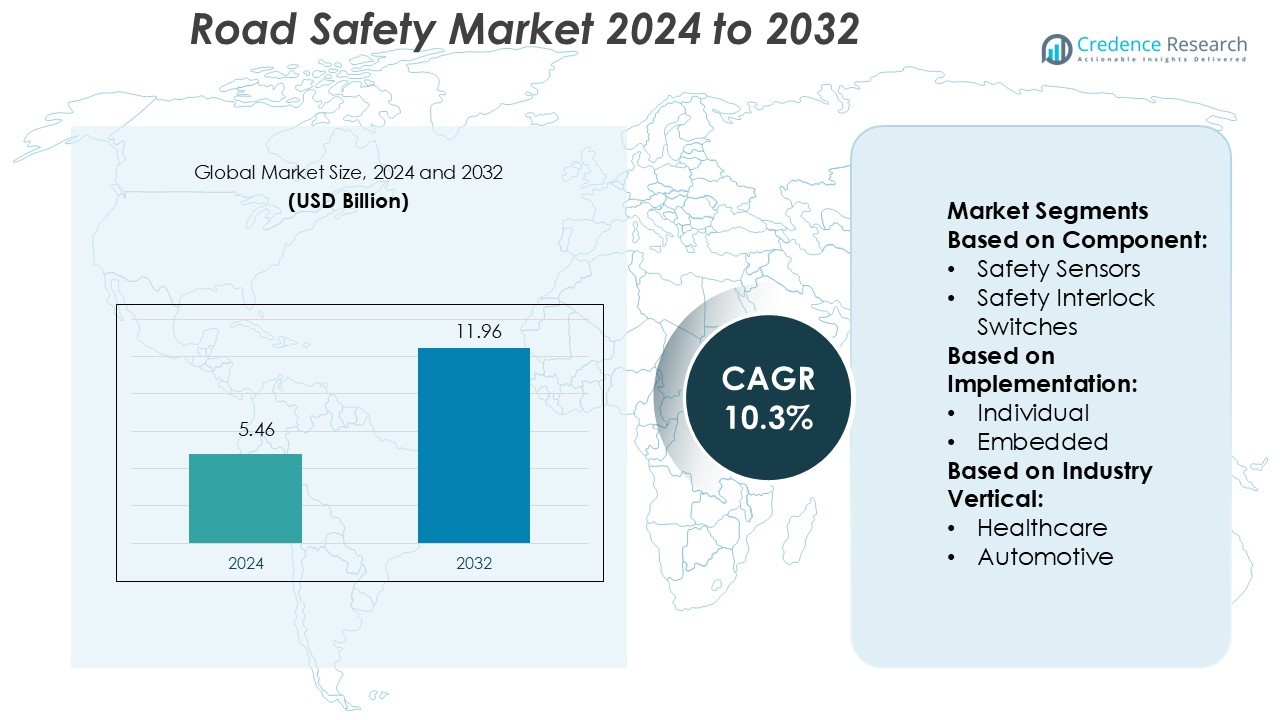

Road Safety Market size was valued USD 5.46 billion in 2024 and is anticipated to reach USD 11.96 billion by 2032, at a CAGR of 10.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Road Safety Market Size 2024 |

USD 5.46 Billion |

| Road Safety Market, CAGR |

10.3% |

| Road Safety Market Size 2032 |

USD 11.96 Billion |

The road safety market features intense competition among global players focusing on innovation, automation, and integrated safety systems. Companies are expanding their portfolios with intelligent traffic management, advanced surveillance, and AI-driven enforcement technologies to enhance roadway efficiency and safety outcomes. Leading participants continue to form strategic partnerships with governments and infrastructure providers to deliver large-scale safety modernization projects. North America leads the global market with a 34% share, driven by strong regulatory support, high adoption of smart infrastructure, and growing investments in connected transportation networks that prioritize accident prevention and mobility optimization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Road Safety Market was valued at USD 5.46 billion in 2024 and is projected to reach USD 11.96 billion by 2032, registering a CAGR of 10.3% during the forecast period.

- Increasing government regulations and investments in intelligent transportation systems are driving adoption of advanced road monitoring and automation technologies.

- The market is witnessing strong trends in AI-powered traffic management, smart surveillance, and integration of IoT-based safety systems across highways and urban infrastructure.

- Competitive dynamics are shaped by innovation-led strategies, with companies expanding global reach through partnerships, AI analytics, and adaptive traffic control solutions.

- North America dominates with a 34% share, followed by Europe at 28% and Asia-Pacific at 26%, while the safety sensors segment leads the component category with the highest share due to its critical role in accident prevention and real-time monitoring efficiency.

Market Segmentation Analysis:

By Component

Safety sensors hold the dominant share in the road safety market, driven by their critical role in detecting speed, lane departure, and collision risks. These sensors enable real-time monitoring, improving vehicle and infrastructure safety. Their adoption in intelligent transportation systems and connected vehicles enhances driver assistance and accident prevention. Safety interlock switches and controllers also contribute by improving response systems and machine control. Increasing investments in sensor-based automation and advanced driver-assistance systems (ADAS) are key factors driving demand for this segment across both developed and emerging economies.

- For instance, SWARCO AG is a leading supplier of road marking materials and Intelligent Transport Systems (ITS) worldwide. Its high-performance glass beads can achieve retroreflectivity values of over 1,000 mcd/m²/lx, significantly enhancing visibility compared to standard products.

By Implementation

The embedded implementation segment dominates the road safety market, supported by its integration within vehicle systems and infrastructure. Embedded safety technologies enable seamless communication between road sensors, cameras, and control units, ensuring faster response and higher accuracy. Automotive manufacturers are increasingly embedding safety modules to comply with regulatory mandates and enhance vehicle intelligence. Individual implementations, while growing, remain secondary due to lower scalability. Rising demand for connected and autonomous vehicles further accelerates the adoption of embedded safety architectures in transportation networks.

- For instance, AutoMark Technologies (India) Pvt. Ltd. expanded thermoplastic road marking material production capacity to approximately 72,000 metric tons per year, handling over 5,000 metric tons monthly, and offers thermoplastic screed machines that process up to 300 kg of material per load at temperatures up to 400 °C.

By Industry Vertical

The automotive industry leads the road safety market, holding the largest share due to its extensive use of advanced safety technologies. Vehicle manufacturers are integrating radar, LiDAR, and camera-based systems to prevent collisions and improve passenger protection. Governments worldwide are enforcing strict road safety regulations, boosting adoption across commercial and passenger vehicles. Oil and gas, mining, and healthcare sectors also implement road safety systems to manage fleet operations and ensure worker safety in high-risk zones. Continuous innovation in automotive electronics and smart mobility is strengthening segment dominance.

Key Growth Drivers

Rising Road Accident Rates and Safety Regulations

The growing number of traffic accidents worldwide is driving investments in road safety solutions. Governments are implementing strict safety mandates and intelligent transport systems to reduce fatalities. Advanced technologies like automated speed enforcement, traffic signal control, and collision avoidance systems enhance monitoring and compliance. Automotive OEMs are integrating smart safety components to meet global standards. Increasing public awareness and regulatory efforts toward zero-fatality transport goals continue to accelerate adoption across highways, urban roads, and logistics networks.

- For instance, Sherwin-Williams’ Pro-Park™ Waterborne Traffic Marking Paint confirms a coverage rate of approximately 330 linear feet of a standard 4-inch stripe per gallon.

Technological Advancements in Vehicle and Infrastructure Safety

Rapid progress in vehicle-to-everything (V2X) communication, IoT sensors, and AI analytics is reshaping the road safety landscape. These technologies enable real-time monitoring, predictive analytics, and data-driven traffic management. Smart intersections with AI-based cameras help reduce congestion and enhance pedestrian safety. Automotive companies are deploying radar and LiDAR for improved situational awareness. Infrastructure upgrades combining 5G and cloud platforms further improve data exchange between vehicles and control systems, resulting in faster response times and reduced accident risks.

- For instance, Nippon Paint’s Aquatec 6900 water-based acrylic road-marking paint achieves a dry film thickness of 55–60 µm, covers approximately 6 m² per liter per coat, and delivers VOC content below 50 g/L, all while reaching touch-dry in 10–20 minutes and full hardness in 30–45 minutes.

Increasing Adoption of Smart Mobility and Connected Systems

The rise of smart cities and connected vehicles is fueling the integration of advanced safety technologies. Governments and urban planners are investing in intelligent transport infrastructure for efficient traffic management. Cloud-based platforms enable dynamic traffic control, vehicle tracking, and emergency response optimization. Integration of telematics and advanced analytics allows authorities to detect unsafe driving patterns and take preventive measures. The growing use of connected vehicle solutions in fleet and logistics management enhances operational safety and supports long-term sustainability goals.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

AI and ML are revolutionizing road safety systems by enabling predictive analysis and adaptive decision-making. AI-powered analytics detect risky driving behavior and optimize traffic signals based on real-time data. Advanced image recognition assists in identifying vehicle violations, pedestrian movement, and accident-prone areas. The growing use of AI-driven control systems in smart traffic management presents significant opportunities for reducing human errors and improving urban safety efficiency across large metropolitan areas.

- For instance, Aximum S.A. offers its TYPHON VILLE-ROUTE water-based acrylic paint with a density of 1.68 kg/L, packaged in 25 kg buckets or 300 kg drums, and certified with S3 anti-slip performance for urban environments.

Expansion of Smart Infrastructure Projects

Ongoing investments in smart infrastructure are creating new opportunities for road safety solution providers. Governments in Asia-Pacific and Europe are prioritizing intelligent highways equipped with surveillance, lane detection, and adaptive lighting systems. The integration of IoT-enabled devices enhances communication between vehicles and infrastructure, improving overall mobility. Public-private partnerships are also driving deployment of automated monitoring systems, offering vendors significant prospects to supply hardware, software, and analytics platforms for modern transportation networks.

- For instance, Ennis-Flint offers its HPS-6 MMA markings, which are applicable in film thicknesses from 10 to 500 mils, can be applied at temperatures as low as 35 °F (2 °C), are resistant to snowplow damage, and maintain durable retroreflectivity with proper glass beads.

Growth in Electric and Autonomous Vehicle Ecosystem

The rise of electric and autonomous vehicles is generating demand for advanced road safety systems. These vehicles depend on sensor networks, radar-based detection, and high-precision mapping for safe operation. Manufacturers are investing in real-time perception systems and adaptive cruise control for enhanced accident prevention. The growing ecosystem of EV charging networks and autonomous mobility solutions provides fresh avenues for integrating intelligent safety frameworks, particularly in high-density urban regions.

Key Challenges

High Implementation and Maintenance Costs

Deploying advanced road safety systems requires significant investment in infrastructure, software integration, and maintenance. Developing regions face financial constraints that limit large-scale adoption of intelligent safety technologies. Upgrading legacy road systems with AI and IoT tools demands specialized equipment and skilled personnel. Additionally, recurring costs for calibration, data storage, and communication networks add to operational expenses, creating barriers for municipalities and small fleet operators aiming to modernize road safety initiatives.

Data Privacy and Integration Issues

The increasing use of connected devices and surveillance systems raises serious concerns over data privacy and system interoperability. Integrating data from multiple sources—such as cameras, sensors, and GPS modules—often leads to compatibility challenges. Inconsistent data formats can hinder real-time decision-making and reduce accuracy in safety predictions. Cybersecurity vulnerabilities expose road safety infrastructure to potential breaches, necessitating strong encryption and regulatory compliance measures to ensure public trust and long-term operational reliability.

Regional Analysis

North America

North America holds the largest share of 34% in the road safety market, driven by strict traffic safety regulations and early technology adoption. The United States leads with widespread deployment of intelligent transportation systems, speed enforcement cameras, and vehicle-to-infrastructure (V2I) solutions. Canada is investing in smart city projects emphasizing AI-based monitoring and accident prevention systems. Government initiatives promoting Vision Zero and strong collaborations between public and private entities further enhance safety infrastructure. The region’s mature automotive ecosystem and consistent funding in road modernization continue to strengthen its leadership in global market adoption.

Europe

Europe accounts for 28% of the road safety market, supported by advanced vehicle safety standards and sustainable mobility initiatives. Countries such as Germany, the United Kingdom, and France emphasize automation, adaptive traffic management, and driver assistance technologies. The European Union’s focus on achieving zero road fatalities under its “Road Safety Policy Framework 2021–2030” drives innovation. Investments in connected road infrastructure and autonomous vehicle testing create strong demand for intelligent systems. Partnerships between automakers, telecom operators, and safety solution providers ensure continuous improvement in traffic monitoring and accident response mechanisms.

Asia-Pacific

Asia-Pacific captures a 26% share of the road safety market, driven by rapid urbanization, infrastructure development, and high road traffic density. China, Japan, and India are key contributors, investing heavily in intelligent traffic systems, CCTV monitoring, and smart intersections. Governments across the region are implementing stricter road safety laws and investing in digital infrastructure. The rise of connected vehicles and public-private partnerships accelerates technology deployment. Expanding smart city initiatives and growing awareness of road hazards continue to support market growth, positioning Asia-Pacific as the fastest-evolving regional segment globally.

Latin America

Latin America holds an 8% share of the road safety market, supported by growing awareness of traffic safety and government-led modernization programs. Brazil, Mexico, and Chile are adopting AI-enabled traffic monitoring and automated enforcement systems. Despite infrastructure limitations, regional governments are investing in digital road mapping and traffic management solutions. International collaborations with safety technology providers improve accident response efficiency. Increasing demand for safer urban transport and the integration of data-driven analytics for traffic control are strengthening market penetration across major metropolitan regions in the continent.

Middle East & Africa

The Middle East & Africa account for a 4% share of the road safety market, with increasing government focus on reducing high road fatality rates. The United Arab Emirates and Saudi Arabia lead investments in intelligent transportation systems and automated speed enforcement. South Africa shows progress in traffic management modernization and smart city initiatives. Challenges such as limited connectivity and low technology adoption persist but are improving with public infrastructure reforms. Growing partnerships with international vendors and national road safety campaigns are expected to enhance market growth in the coming years.

Market Segmentations:

By Component:

- Safety Sensors

- Safety Interlock Switches

By Implementation:

By Industry Vertical:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The road safety market is characterized by strong competition among leading players such as Motorola Solutions, Dahua Technology, Redflex Holdings, Cubic Corporation, Jenoptik, IDEMIA, Kapsch TrafficCom, Conduent, FLIR Services, Inc., and American Traffic Solutions (Verra Mobility). The road safety market presents a highly competitive environment marked by continuous technological innovation and strategic partnerships. Companies are increasingly investing in intelligent transportation systems, AI-driven traffic management, and data analytics to enhance road monitoring and safety compliance. The market is witnessing rapid adoption of integrated hardware-software solutions, combining sensors, cameras, and automated enforcement systems. Growing collaborations between public authorities and private firms support large-scale infrastructure modernization and smart mobility initiatives. Continuous R&D in connected vehicles, smart intersections, and predictive analytics strengthens the industry’s evolution toward safer, data-driven road ecosystems, fostering sustainable growth worldwide.

Key Player Analysis

- Motorola Solutions

- Dahua Technology

- Redflex Holdings

- Cubic Corporation

- Jenoptik

- IDEMIA

- Kapsch TrafficCom

- Conduent

- FLIR Services, Inc.

- American Traffic Solutions (Verra Mobility)

Recent Developments

- In November 2024, Honeywell International Inc. entered into an agreement to sell its Personal Protective Equipment (PPE) business to Protective Industrial Products, Inc, a U.S.-based worker safety provider. The sale aligns with the company’s strategy to streamline its portfolio and focus on key growth areas, including automation, the future of aviation, and energy transition.

- In May 2024, Survitec launched a cutting-edge energy containment safety device designed to mitigate risks linked to catastrophic valve actuator malfunctions. This innovation bolsters safety protocols in sectors where such failures can result in serious injuries or considerable equipment damage.

- In April 2024, HexagonAB announced the acquisition of Xwatch Safety Solutions, a UK-based company specializing in construction machinery equipment. This strategic move aims to bolster Hexagon AB’s construction safety portfolio by integrating Xwatch’s advanced machine control hardware and software technologies.

- In October 2023, Norfolk Southern, in partnership with the Georgia Tech Research Institution, introduced a digital train inspection technology aimed at improving rail safety throughout its network.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Implementation Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of AI-powered traffic management systems will improve real-time decision-making.

- Governments will increase investments in smart infrastructure and intelligent transportation networks.

- Connected and autonomous vehicles will drive demand for advanced safety sensors and analytics.

- Integration of 5G technology will enhance communication between vehicles and traffic systems.

- Cloud-based platforms will support data sharing for predictive road safety management.

- Public-private collaborations will expand large-scale implementation of digital safety solutions.

- Advanced camera and radar systems will strengthen automated enforcement and monitoring.

- Smart city projects will continue to boost investments in road surveillance and mobility control.

- Rising awareness of zero-fatality initiatives will encourage stricter global safety regulations.

- Ongoing technological innovations will transform traditional traffic systems into connected safety ecosystems.