Market Overview:

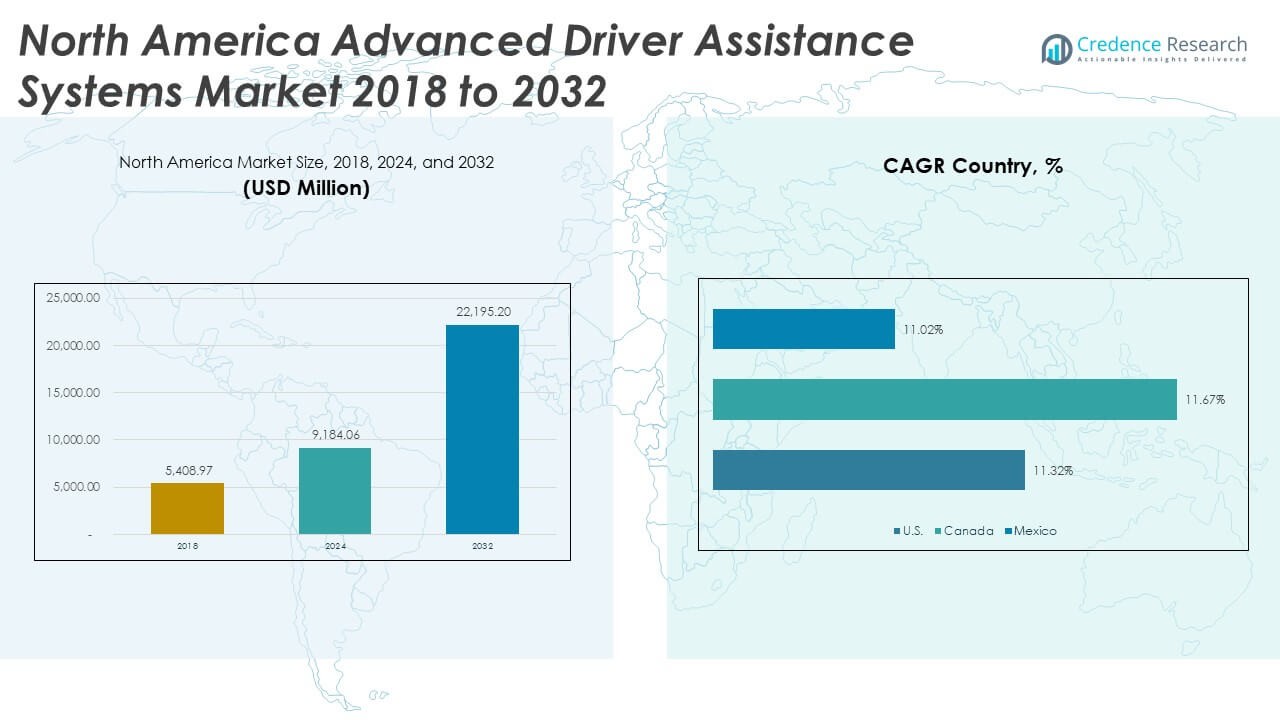

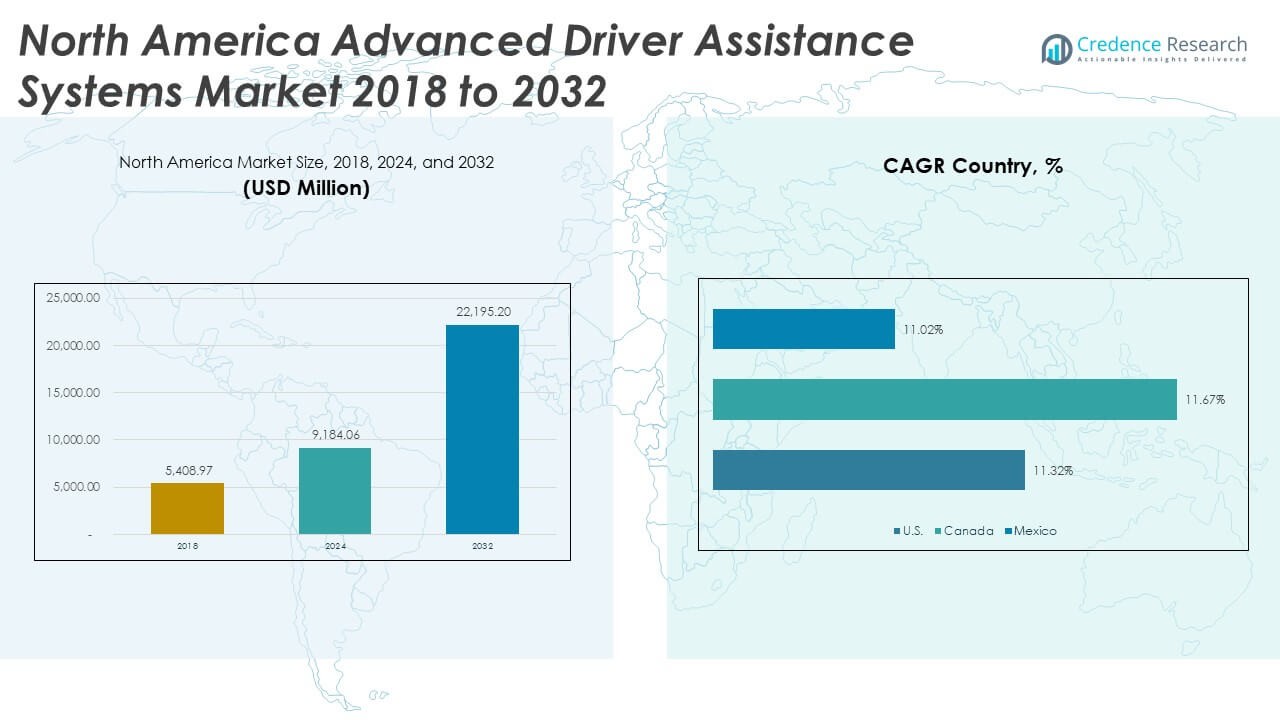

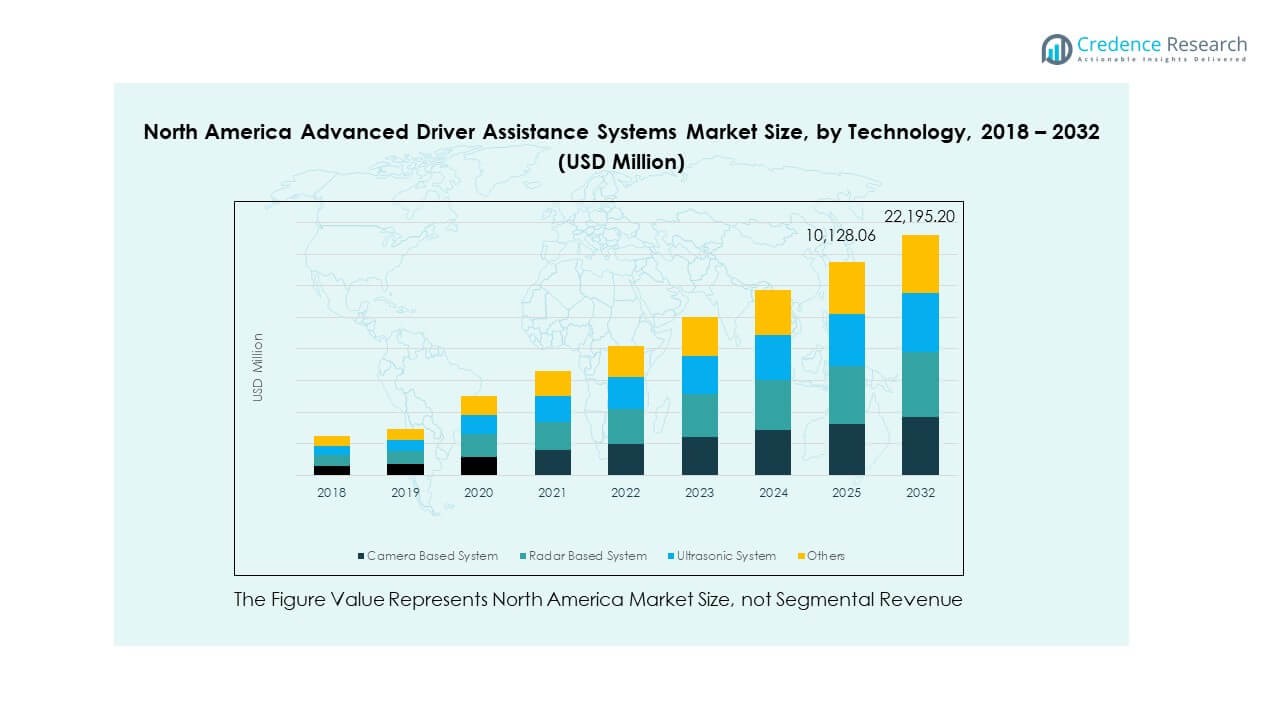

The North America Advanced Driver Assistance Systems Market size was valued at USD 5,408.97 million in 2018 to USD 9,184.06 million in 2024 and is anticipated to reach USD 22,195.20 million by 2032, at a CAGR of 11.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Advanced Driver Assistance Systems Market Size 2024 |

USD 9,184.06 Million |

| North America Advanced Driver Assistance Systems Market, CAGR |

11.66% |

| North America Advanced Driver Assistance Systems Market Size 2032 |

USD 22,195.20 Million |

Growth in this market is driven by the increasing integration of safety and automation technologies across passenger and commercial vehicles. Automakers are adopting adaptive cruise control, lane departure warning, and blind spot detection to meet stricter safety regulations. Rising consumer awareness of collision prevention and road safety strengthens adoption rates. The presence of major OEMs and advancements in radar, lidar, and camera systems further enhance vehicle reliability, performance, and comfort.

The United States dominates the regional landscape due to strong automotive manufacturing capabilities and rapid technological adoption. Canada shows stable growth supported by smart mobility initiatives and national safety policies. Mexico is emerging as a competitive hub for ADAS component manufacturing and exports, aided by expanding production capacity and cost efficiency. Together, these countries form a robust ecosystem that drives regional innovation and positions North America as a leader in global ADAS development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Advanced Driver Assistance Systems Market was valued at USD 5,408.97 million in 2018, reached USD 9,184.06 million in 2024, and is projected to attain USD 22,195.20 million by 2032, growing at a CAGR of 11.66% during the forecast period.

- The United States leads with 68% share, driven by robust OEM production and regulatory safety mandates; Canada follows with 19%, supported by connected mobility projects; while Mexico holds 13%, benefitting from cost-efficient manufacturing and growing exports.

- Mexico is the fastest-growing region, supported by expanding ADAS component manufacturing capacity, global OEM investments, and industrial modernization programs promoting automation and safety integration.

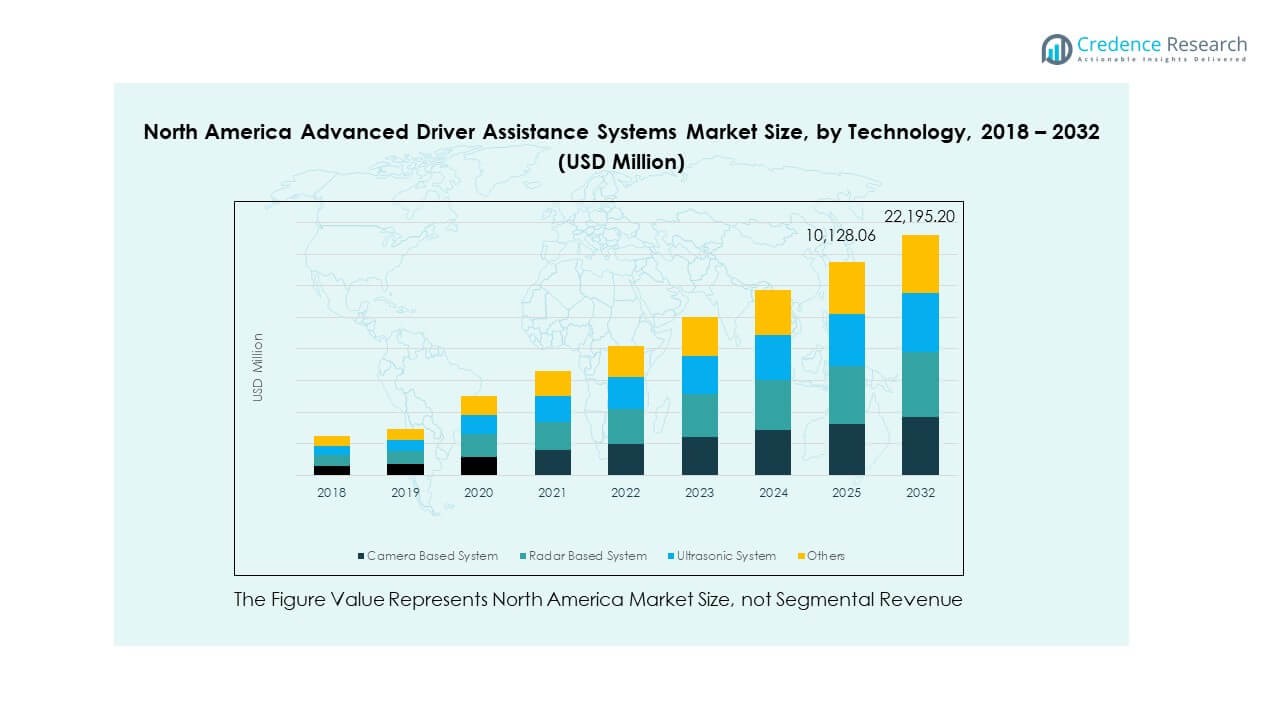

- Camera-based systems account for 42% of total market share, owing to strong adoption across passenger and commercial vehicles for enhanced visual detection and driver monitoring functions.

- Radar-based systems hold 33% share, favored for reliable long-range sensing and adaptability to diverse driving and weather conditions across North American terrains.

Market Drivers

Rising Adoption of Autonomous and Semi-Autonomous Vehicle Technologies

The North America Advanced Driver Assistance Systems Market benefits from the rapid shift toward autonomous and semi-autonomous driving features in vehicles. Automakers prioritize safety and convenience by integrating adaptive cruise control, automatic braking, and lane-keeping functions. Consumers prefer vehicles equipped with real-time sensing and control technologies that minimize accidents. Government safety mandates accelerate integration across mass-market models. Major automotive OEMs deploy scalable ADAS platforms compatible with electric and hybrid vehicles. Increasing collaboration between software developers and sensor manufacturers improves data accuracy. It supports the development of connected vehicle ecosystems that rely on advanced algorithms for real-time response and safety enhancements.

- For instance, Tesla’s Autopilot system (Hardware 2–3 generation) used eight cameras providing 360° visibility, complemented by 12 ultrasonic sensors and a forward radar with a detection range up to 170 meters. Recent models now employ a vision-only configuration under Tesla Vision.

Growing Emphasis on Passenger and Pedestrian Safety Standards

Rising concerns over road accidents and fatalities have driven manufacturers to integrate advanced safety solutions. The U.S. National Highway Traffic Safety Administration’s (NHTSA) regulatory push promotes the inclusion of automatic emergency braking and lane departure systems. Automakers actively implement safety technologies to comply with insurance incentives and regulatory frameworks. The growing urban population intensifies the need for intelligent traffic management systems. It encourages vehicle makers to adopt systems that detect pedestrians and vulnerable road users with higher precision. Enhanced data fusion between radar, camera, and lidar strengthens performance reliability in varied weather. These safety-driven innovations ensure consistent demand for ADAS integration across premium and mid-range vehicles.

- For instance, Volvo’s City Safety system, standard on Volvo vehicles, uses an integrated camera and radar setup for collision avoidance and automatic emergency braking. According to the Insurance Institute for Highway Safety (IIHS), 2011–2012 S60 models and 2010–2012 XC60 models saw a 41% reduction in rear-end crashes and a 47% reduction in occupant injuries after City Safety was implemented.

Integration of Artificial Intelligence and Machine Learning in Vehicle Safety Systems

Artificial intelligence plays a key role in improving ADAS precision and predictive analytics. Machine learning models process real-time environmental data to improve system responsiveness. Automakers rely on AI algorithms for pattern recognition, object detection, and adaptive decision-making. This trend enhances the overall intelligence of systems like adaptive cruise control and collision avoidance. It reduces the rate of false alerts and improves reaction time in complex traffic conditions. Integration of cloud-based analytics enables continuous software updates and real-time communication between vehicles. AI-led innovation in sensor fusion, perception, and vehicle control makes safety systems more scalable. Manufacturers invest heavily in data validation to meet evolving safety certification standards.

Expansion of Connected Vehicle Infrastructure and Smart Mobility Ecosystem

The expansion of connected infrastructure supports the rapid adoption of ADAS across North America. Integration of vehicle-to-everything (V2X) communication allows cars to interact with other vehicles and traffic systems. It increases driver awareness and optimizes route management under urban congestion. Telecom operators collaborate with automakers to deploy 5G-enabled vehicle communication networks. The integration of ADAS with cloud computing improves predictive analytics for road hazards. Smart city initiatives across the U.S. and Canada enhance system interoperability. Rising investments in real-time data sharing improve vehicle performance, especially in metropolitan areas. These advancements establish a strong foundation for the evolution of autonomous mobility services.

Market Trends

Increased Penetration of Radar and Camera Fusion Systems Across New Models

The North America Advanced Driver Assistance Systems Market experiences a strong shift toward radar and camera fusion technologies. Automakers enhance system precision by merging visual recognition with radar-based object tracking. The approach reduces the limitations of single-sensor dependency and improves reliability under poor visibility. Integration across mid-range vehicles boosts affordability and mainstream adoption. It allows automakers to maintain consistent safety standards without increasing production costs significantly. Suppliers focus on compact, energy-efficient modules that deliver accurate data. These hybrid sensing solutions help vehicles identify multiple objects in dense urban traffic. Advancements in chip miniaturization and algorithm optimization reinforce their performance efficiency.

- For instance, Continental announced in May 2025 that it had produced 200 million radar sensors, reinforcing its global leadership in ADAS technologies. The company secured major series orders from automakers, with production of next-generation radar systems scheduled to begin in 2026 and 2027, supporting functions such as adaptive cruise control and automated emergency braking.

Rising Demand for Electrified and Software-Defined Vehicles with ADAS Features

Automakers increasingly adopt a software-first approach, integrating ADAS into electric and hybrid vehicles. Software-defined vehicle architectures allow seamless over-the-air updates for performance enhancement. It supports predictive maintenance and real-time safety improvements without hardware replacement. Demand for electric vehicles accelerates the installation of intelligent assistance systems to ensure driver confidence. Fleet electrification in logistics and ride-hailing services amplifies demand for advanced monitoring. OEMs collaborate with cloud providers to improve telematics and predictive navigation. Regulatory agencies encourage electric vehicle adoption through safety-oriented incentives. This convergence of digital architecture and electrification strengthens the market’s technological maturity.

Growth in Human-Machine Interface (HMI) and Augmented Reality-Based Assistance

Human-machine interface technologies enhance driver awareness through real-time visual overlays and alerts. Augmented reality head-up displays offer contextual information such as road signs and hazards. It ensures safer navigation and reduces driver distraction. Automakers integrate gesture and voice-controlled systems for intuitive interaction with ADAS functions. HMI evolution supports adaptive systems that learn user behavior and adjust sensitivity. The inclusion of haptic feedback improves confidence in semi-autonomous modes. Suppliers focus on ergonomic design that aligns with comfort and safety. Integration of AR technology enhances situational awareness across urban and highway environments.

- For instance, BMW announced its Panoramic Vision head-up display as part of the upcoming Neue Klasse vehicle platform, projecting information such as speed and navigation across the entire width of the windshield. The system will enter series production in 2025, marking a major step in BMW’s next-generation in-car display technology.

Adoption of Cloud-Based Simulation and Validation Platforms for ADAS Testing

Cloud-driven simulation platforms accelerate the validation of driver assistance systems in diverse conditions. Automakers and suppliers test algorithms using virtual environments before real-world deployment. It reduces development time and improves safety certification compliance. Integration of big data analytics enables continuous system refinement using millions of driving scenarios. Manufacturers collaborate with tech firms to leverage scalable cloud processing power. Virtual testing ensures product reliability and reduces the need for costly field trials. The trend aligns with regulatory requirements for transparency and traceability in system testing. It promotes faster innovation cycles and minimizes production delays for OEMs.

Market Challenges Analysis

High Integration Costs and Complexity of Sensor Calibration in Vehicle Platforms

The North America Advanced Driver Assistance Systems Market faces high production costs due to complex sensor and software integration. Advanced radar, lidar, and camera systems demand precise calibration for effective performance. Each vehicle model requires customized configurations, increasing design time and cost. It challenges small manufacturers aiming to achieve large-scale adoption. Maintenance complexity further raises aftersales costs for consumers. Fluctuations in semiconductor availability delay production schedules and impact system consistency. Hardware and software interoperability remain technical challenges among multi-brand suppliers. The need for robust calibration tools slows mass deployment of cost-effective ADAS systems across the region.

Cybersecurity Vulnerabilities and Data Privacy Concerns in Connected Vehicles

Increased connectivity introduces risks associated with data breaches and unauthorized system access. Continuous data exchange between vehicles, cloud, and infrastructure exposes vulnerabilities. The North America Advanced Driver Assistance Systems Market must address compliance with regional cybersecurity regulations. Hackers targeting control systems or communication networks can disrupt vehicle functions. It pressures automakers to enhance encryption and intrusion detection mechanisms. Implementing secure over-the-air updates requires robust network protocols and monitoring frameworks. Rising consumer awareness of data privacy intensifies scrutiny of vehicle data management. These cybersecurity challenges demand higher investment in resilient software and hardware architecture.

Market Opportunities

Expansion of Autonomous Vehicle Testing Zones and Infrastructure Readiness

The North America Advanced Driver Assistance Systems Market benefits from expanding test environments for autonomous driving technologies. Federal and state authorities promote pilot projects across highways and urban centers. It supports large-scale validation of driver assistance features under real-world conditions. Collaborations between automakers, tech firms, and regulatory agencies strengthen ecosystem reliability. Cities integrate intelligent traffic systems that complement ADAS functions. Continuous investments in 5G and sensor infrastructure enhance communication between vehicles and road networks. These developments create opportunities for early commercialization of high-level automation features.

Rising Aftermarket Demand for Retrofitted Safety Assistance Systems

Consumer demand for enhanced driving safety drives the aftermarket segment’s growth. The North America Advanced Driver Assistance Systems Market sees increased adoption of retrofit kits for older vehicles. It enables drivers to access blind spot detection, collision alerts, and lane departure systems. Growing awareness of accident prevention motivates investment in affordable add-ons. Distribution networks expand through online platforms and service centers. It provides suppliers new revenue channels beyond OEM contracts. This shift broadens ADAS accessibility and strengthens consumer confidence in smart mobility.

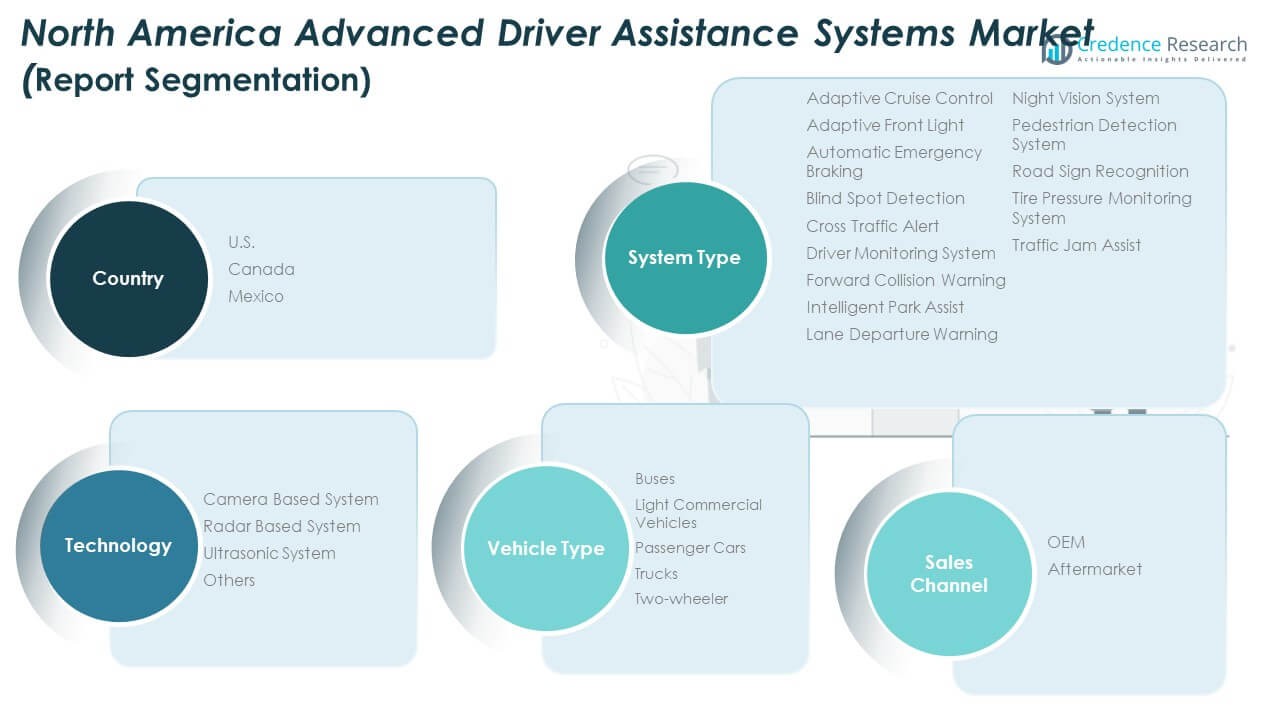

Market Segmentation Analysis

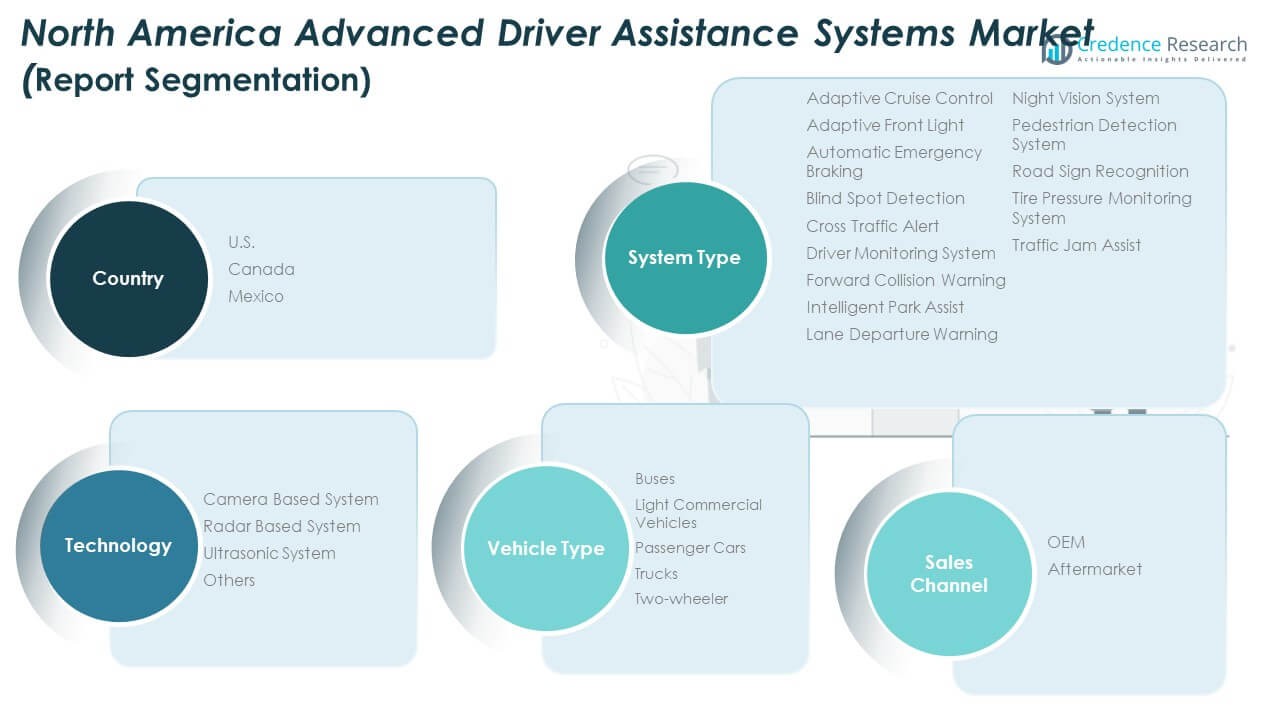

By System Type

The North America Advanced Driver Assistance Systems Market includes systems such as adaptive cruise control, automatic emergency braking, blind spot detection, lane departure warning, and night vision systems. Each category supports different safety functions across passenger and commercial vehicles. Integration of intelligent park assist and traffic jam assist enhances driver comfort. Increasing use of road sign recognition and tire pressure monitoring aligns with evolving safety norms. Pedestrian detection and forward collision warning remain core technologies in premium models.

- For instance, the Ford Co-Pilot360 suite delivers advanced safety features including Lane-Keeping, Pre-Collision Assist with Automatic Emergency Braking, Blind Spot Information System (BLIS), Evasive Steering Assist, and a Rear View Camera—all available on nearly all new Ford models from 2024, as documented by Ford. These features are confirmed to operate together, providing comprehensive driver-assist capability throughout Ford’s passenger and commercial vehicle lineup.

By Technology

Camera-based systems dominate due to their visual accuracy and cost efficiency. Radar-based systems gain momentum for long-range detection and reliable operation in harsh conditions. Ultrasonic systems are widely used for parking and low-speed navigation support. The North America Advanced Driver Assistance Systems Market also incorporates hybrid technologies for improved environmental sensing. Emerging technologies use AI-enabled data fusion for precise object recognition and control.

By Vehicle Type

Passenger cars lead due to strong consumer demand for safety and comfort. Light commercial vehicles adopt ADAS for fleet safety and logistics optimization. Trucks integrate collision prevention and monitoring to meet regulatory compliance. The North America Advanced Driver Assistance Systems Market also covers buses and two-wheelers adopting adaptive alerts and visual systems for urban navigation. Expansion across diverse vehicle classes ensures steady long-term adoption.

- For instance, Daimler’s Detroit Assurance 4.0 suite, available on Freightliner Cascadia trucks, leverages a radar system that tracks up to 40 objects at distances as far as 660 feet (200 meters), recalculating threat assessments 200 times per second, and provides Adaptive Cruise Control and Active Brake Assist. The system is radar-based, always on, and can automatically apply braking to avoid collisions, per Daimler’s official documentation and commercial vehicle safety publications.

By Sales Channel

OEMs dominate the distribution due to integration during manufacturing, ensuring reliability and warranty coverage. The aftermarket grows due to increasing demand for retrofitted ADAS kits. It allows cost-effective upgrades for vehicles lacking advanced safety features. Independent service providers collaborate with software firms to improve calibration accuracy. The North America Advanced Driver Assistance Systems Market gains traction through multi-channel availability and consumer customization options.

By Region

The U.S. remains the largest contributor driven by high automotive innovation and stringent safety regulations. Canada supports adoption through national road safety initiatives and emerging smart city projects. Mexico shows strong potential due to expanding vehicle production capacity. The North America Advanced Driver Assistance Systems Market benefits from cross-border collaborations and technology partnerships enhancing overall competitiveness in the global ADAS sector.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Region

- North America: U.S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis

United States: Dominant Market Driven by Technological Leadership and OEM Integration

The United States holds the largest share of the North America Advanced Driver Assistance Systems Market, accounting for 68% of the regional revenue. Strong automotive manufacturing capabilities and rapid adoption of autonomous technologies drive the country’s leadership. Major OEMs like Ford, General Motors, and Tesla invest heavily in ADAS research and large-scale deployment. Federal safety mandates, including NHTSA’s AEB requirements, encourage mass integration of systems across all vehicle segments. It benefits from advanced R&D infrastructure and the presence of leading semiconductor and sensor manufacturers. Increasing consumer awareness of road safety and the expansion of electric vehicle production further strengthen market penetration across both passenger and commercial vehicle categories.

Canada: Expanding Market Supported by Government Safety Policies and Smart Mobility Projects

Canada contributes 19% of the North America Advanced Driver Assistance Systems Market, supported by federal safety initiatives and growing demand for connected vehicles. The Canadian government’s road safety vision promotes adoption of features such as lane departure warning, blind spot detection, and adaptive lighting. It gains traction through smart city initiatives and connected mobility pilots in major provinces. Leading automakers partner with tech firms to enhance ADAS integration in hybrid and electric vehicles. The strong digital infrastructure supports cloud-based analytics and telematics for predictive safety functions. Continuous advancements in AI-based sensor technology and growing partnerships between OEMs and tier suppliers elevate Canada’s position in the regional landscape.

Mexico: Emerging Hub for Production and Export of ADAS Components

Mexico represents 13% of the North America Advanced Driver Assistance Systems Market and is rapidly evolving into a manufacturing hub for automotive electronics. Rising investments from global OEMs and component suppliers expand the country’s production capabilities. Its cost-efficient labor base and favorable trade policies attract large-scale ADAS assembly and export operations. The government supports industrial modernization programs that encourage automation in vehicle safety technologies. It experiences increasing demand from domestic and export-oriented passenger car production. Collaboration with the U.S. and Canada in the North American automotive supply chain ensures technology transfer and accelerates local innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the North America Advanced Driver Assistance Systems Market is dominated by global technology leaders and regional automotive suppliers. Robert Bosch GmbH, Continental AG, and DENSO Corporation hold strong positions through extensive OEM partnerships and broad sensor portfolios. Aptiv PLC, Magna International Inc., and ZF Friedrichshafen AG focus on integrated hardware and software platforms supporting automated driving. It benefits from collaboration between semiconductor firms such as NXP Semiconductors, Texas Instruments, and Infineon Technologies that supply critical radar and camera components. Valeo SA and Autoliv Inc. maintain competitive strength in vision and active safety modules, expanding through regional production facilities. Continuous innovation in AI, sensor fusion, and high-performance computing drives market competitiveness, while mergers, R&D investments, and supply chain localization shape future strategic growth.

Recent Developments

- In September 2025, Qualcomm and BMW publicly announced a partnership for launching an automated driving system targeted at the North American market, offering new functionalities such as hands-free driving assistance intended to boost customer attraction as ADAS features continue to expand and evolve.

- In September 2025, Valeo entered a global strategic partnership with Momenta to co-develop advanced ADAS and intelligent driving products. This long-term collaboration aims to bolster Valeo’s hardware and software expertise, tailoring next-generation ADAS solutions that meet North American automaker needs.

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Integration of AI-driven perception and decision-making systems will enhance precision in real-time vehicle control.

- OEMs will expand partnerships with semiconductor and software providers to improve ADAS scalability and cost efficiency.

- Increasing adoption of Level 2+ and Level 3 automation will redefine driver engagement and safety expectations.

- Demand for 5G-enabled communication networks will strengthen connected vehicle infrastructure and data sharing reliability.

- Sensor fusion combining radar, camera, and lidar will become a key differentiator among automakers.

- The aftermarket segment will grow with rising installations of retrofit ADAS kits in older vehicles.

- Stringent safety regulations across the U.S. and Canada will mandate advanced safety features in new vehicles.

- Cross-border collaborations within North America will support regional standardization of automated mobility solutions.

- Expansion of electric and hybrid vehicle fleets will increase the need for intelligent driver assistance integration.

- Continuous innovation in human-machine interface and AR-assisted displays will elevate driver awareness and comfort.