Market Overview:

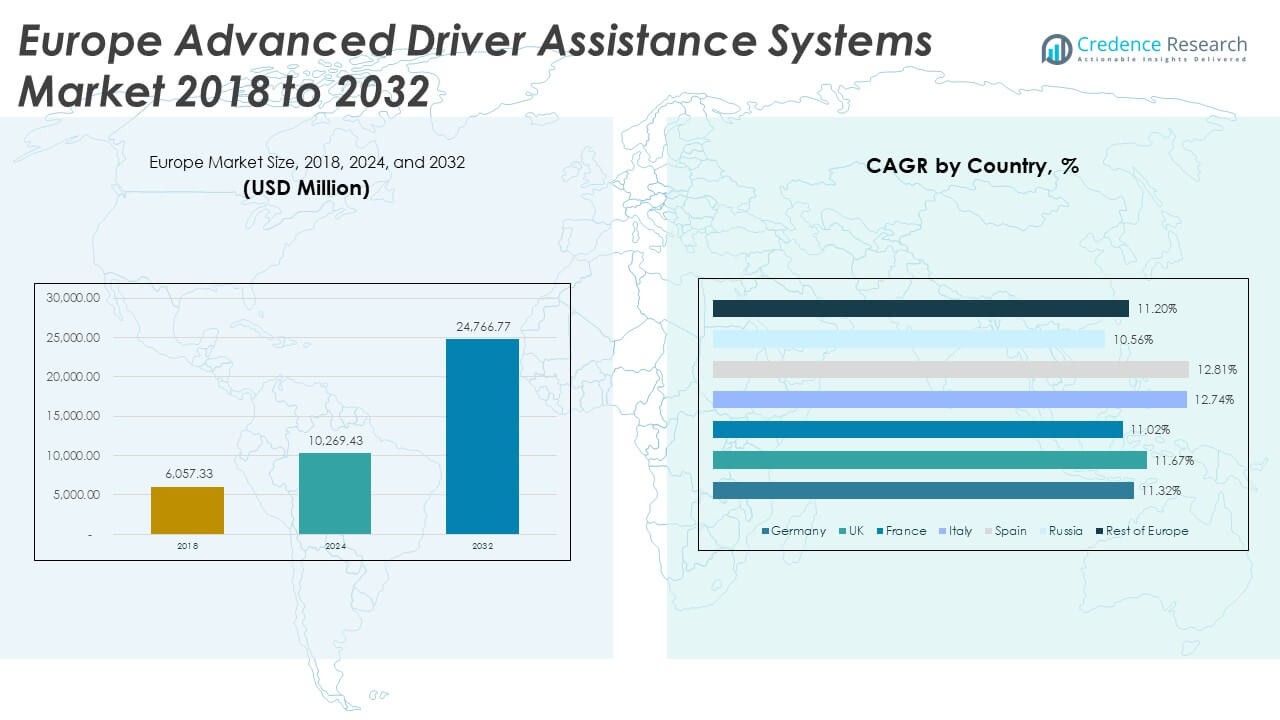

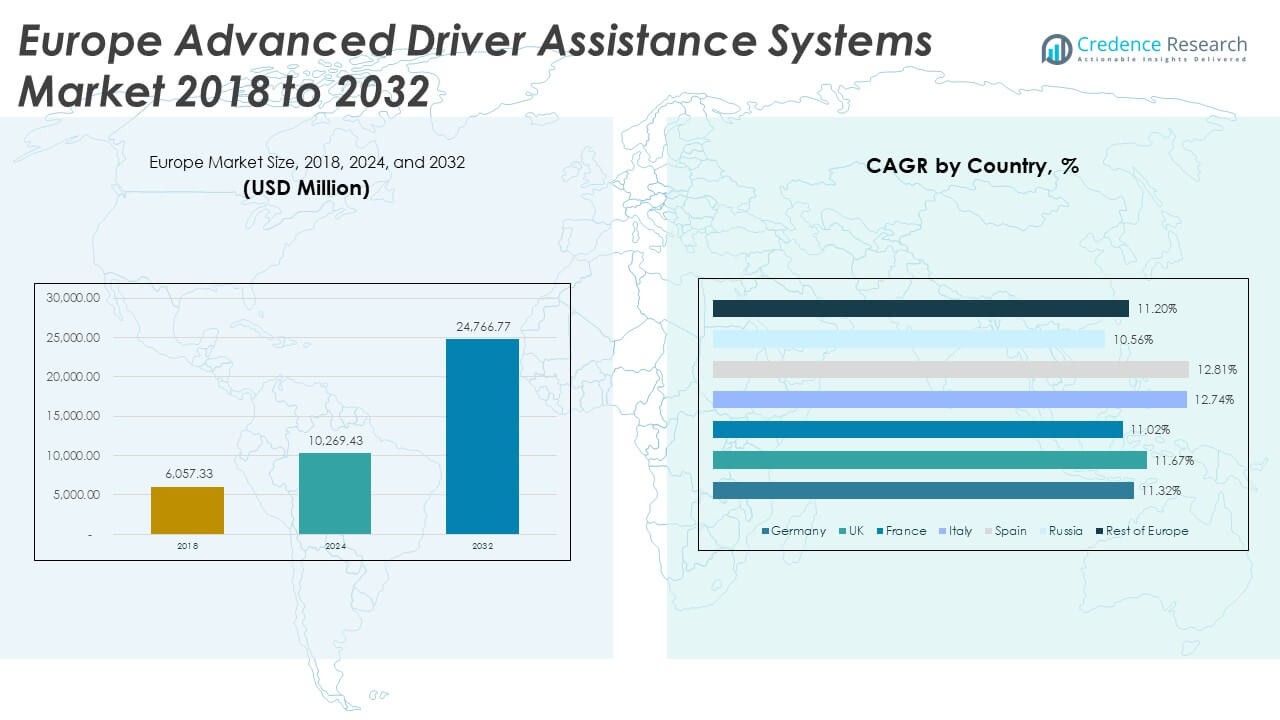

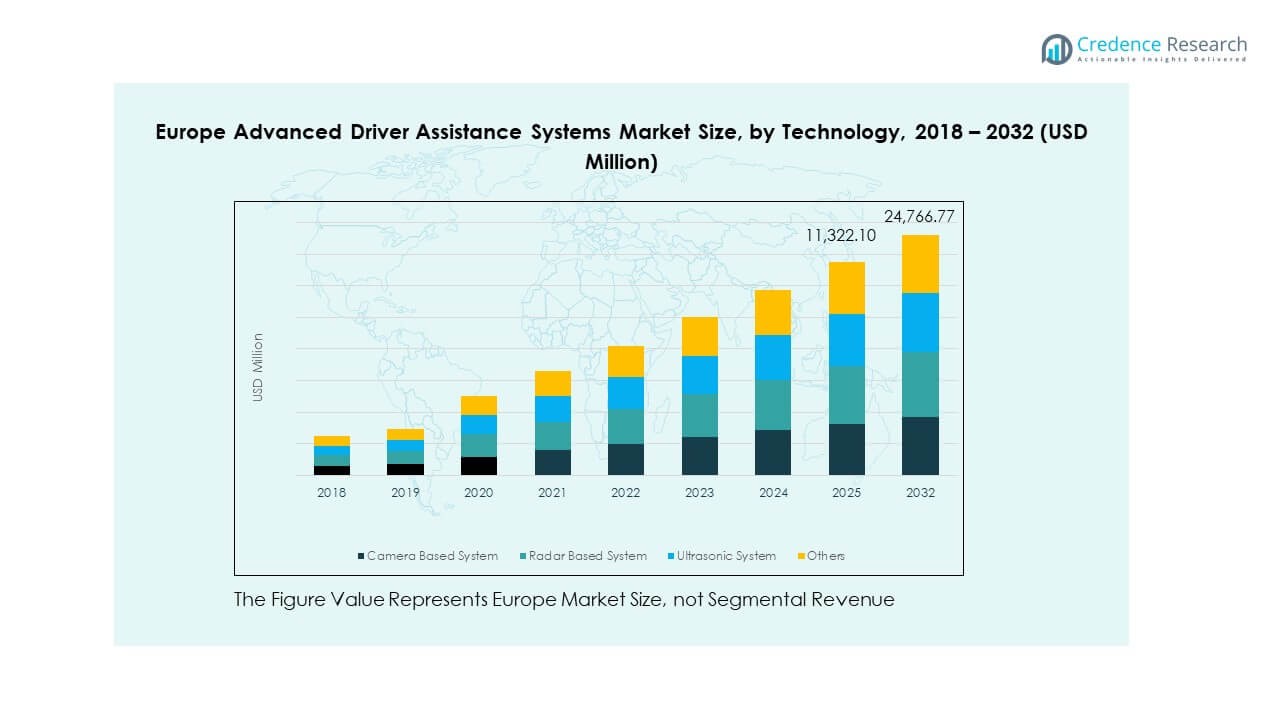

The Europe Advanced Driver Assistance Systems Market size was valued at USD 6,057.33 million in 2018 to USD 10,269.43 million in 2024 and is anticipated to reach USD 24,766.77 million by 2032, at a CAGR of 11.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Advanced Driver Assistance Systems Market Size 2024 |

USD 10,269.43 Million |

| Europe Advanced Driver Assistance Systems Market, CAGR |

11.63% |

| Europe Advanced Driver Assistance Systems Market Size 2032 |

USD 24,766.77 Million |

The market expansion is driven by strict vehicle safety norms, rising adoption of autonomous features, and continuous advancements in radar, camera, and LiDAR technologies. Automakers integrate adaptive cruise control, lane-keeping assist, and automatic emergency braking to enhance safety and comfort. Supportive EU regulations such as General Safety Regulation (GSR) and the growing penetration of electric vehicles further accelerate demand. Increasing consumer awareness of advanced safety systems strengthens the integration of ADAS across passenger and commercial vehicle categories.

Germany leads the regional landscape due to its advanced automotive manufacturing ecosystem and early technology deployment by OEMs like BMW, Mercedes-Benz, and Volkswagen. The UK and France show steady growth with strong regulatory enforcement and adoption of mid-range ADAS systems. Italy and Spain strengthen the market through expansion in affordable safety features. Nordic nations invest heavily in connected mobility, supporting smart infrastructure and sensor calibration for extreme weather conditions. Eastern Europe emerges as a promising region as global automakers establish production bases and enhance ADAS penetration across entry-level vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Advanced Driver Assistance Systems Market was valued at USD 6,057.33 million in 2018, reached USD 10,269.43 million in 2024, and is projected to attain USD 24,766.77 million by 2032, expanding at a CAGR of 11.63% during the forecast period.

- Western Europe holds 42% share, driven by Germany’s strong automotive production, premium OEM presence, and early adoption of connected safety systems. Southern Europe follows with 26%, supported by demand for cost-effective ADAS and compliance with EU vehicle safety norms.

- Northern and Eastern Europe together capture 32%, emerging as the fastest-growing subregion with expansion in smart mobility infrastructure, ADAS calibration centers, and rising local manufacturing capabilities.

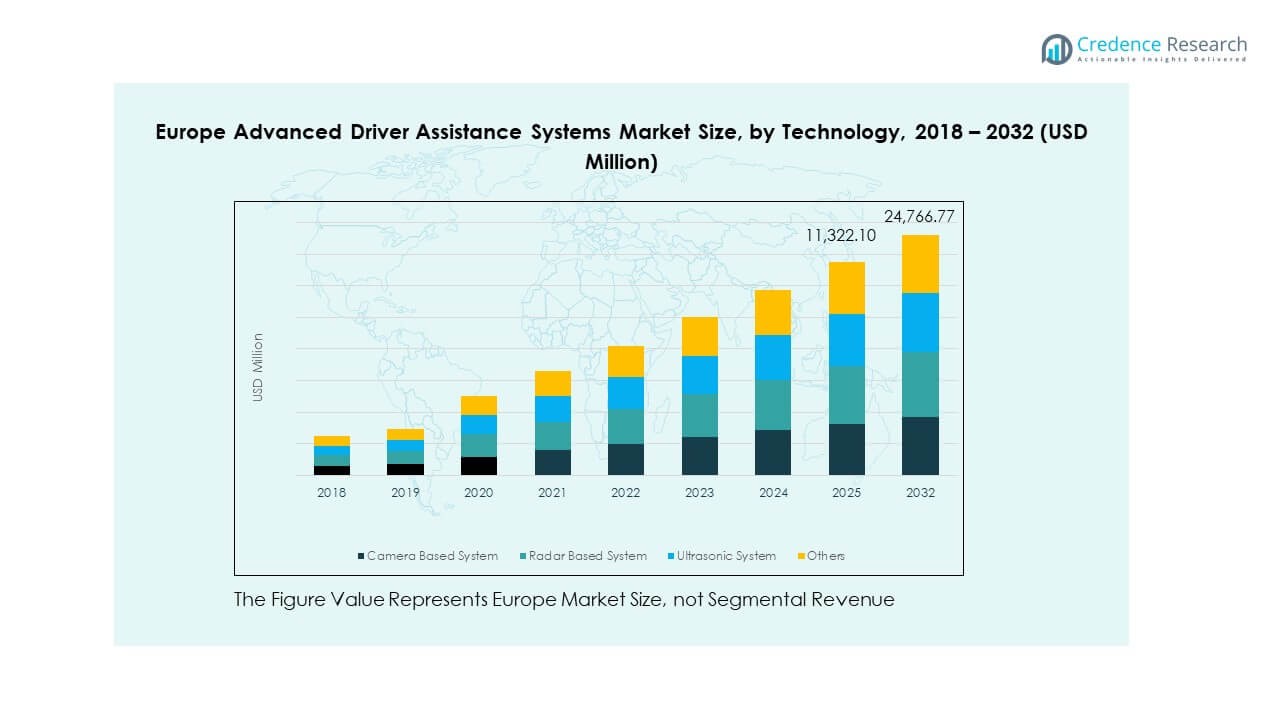

- Camera-based systems account for nearly 38% of segmental share, favored for visual precision and cost efficiency in mass-produced vehicles across passenger and commercial fleets.

- Radar-based systems hold about 33% share, leading advancements in long-range detection and adaptive functionality for collision avoidance and automated emergency braking applications.

Market Drivers

Stringent Road Safety Regulations and Policy Mandates Accelerating ADAS Integration

The Europe Advanced Driver Assistance Systems Market grows steadily due to strict safety mandates across the region. The European Union’s General Safety Regulation requires advanced systems like emergency braking and lane-keeping in all new vehicles. Automakers invest in intelligent technologies to meet these rules and reduce accident rates. Governments promote Vision Zero initiatives to eliminate road fatalities, supporting wide ADAS deployment. Consumer awareness about safety standards reinforces the demand for reliable systems. Insurers also encourage ADAS adoption through premium discounts. This regulatory framework drives the transition toward safer, semi-autonomous mobility. It strengthens Europe’s position as a global leader in automotive safety innovation.

Rising Demand for Luxury and High-Performance Vehicles with Integrated Assistance Features

Luxury carmakers integrate sophisticated assistance systems to enhance comfort and brand value. The market benefits from consumers seeking superior safety and convenience technologies. Premium OEMs equip vehicles with adaptive cruise control, parking assist, and driver monitoring features. These systems improve control, reduce fatigue, and appeal to safety-conscious buyers. Increasing purchasing power and strong automotive exports expand demand across Western Europe. Integration of LiDAR and radar sensors improves detection precision in urban traffic. High-end segments lead innovation, pushing suppliers to develop advanced components. It fosters rapid technological adoption among mainstream car manufacturers.

- For instance, Mercedes-Benz received type approval from the German Federal Motor Transport Authority (KBA) in December 2024 to operate its Level 3 Drive Pilot system at speeds up to 95 km/h on the S-Class and EQS, making it the world’s fastest approved Level 3 system in a production vehicle and the first of its kind in Europe.

Technological Innovation and Sensor Fusion Driving Functional Advancements in ADAS

The market witnesses strong progress through improved radar, LiDAR, and camera integration. Sensor fusion enhances system reliability under varied environmental conditions. Real-time data processing helps prevent collisions and optimize vehicle response times. OEMs collaborate with technology firms to refine perception algorithms and hardware efficiency. The rollout of 5G networks supports faster data communication for connected vehicles. Innovations in AI-powered vision systems improve object recognition accuracy. These developments support advanced automation capabilities in both passenger and commercial fleets. It reinforces Europe’s commitment to developing intelligent transport ecosystems.

Growing Consumer Awareness and Preference for Safety-Oriented Mobility Solutions

Consumers prioritize vehicle safety more than ever before. The rising awareness of accident prevention technologies fuels adoption of ADAS-equipped vehicles. Campaigns highlighting safety ratings by Euro NCAP influence buying behavior. Automakers respond by offering ADAS features even in compact and mid-range models. Growing demand for electric and hybrid vehicles with integrated safety tools boosts system penetration. Fleet operators also adopt these technologies to lower liability costs. Public awareness initiatives strengthen trust in semi-autonomous driving functions. It enables continuous expansion of safety technologies across diverse vehicle categories.

- For instance, the Volkswagen ID.4 was reassessed by Euro NCAP in 2025 and received a 5-star rating, in part for its expanded standard-fitment of safety features such as Lane Assist and Travel Assist, meeting advanced criteria for driver support technology in real traffic environments.

Market Trends

Shift Toward Autonomous Driving and Integration of Level 2+ and Level 3 Capabilities

The Europe Advanced Driver Assistance Systems Market moves toward semi-autonomous driving functionality. Automakers accelerate deployment of Level 2+ and Level 3 features in premium models. Enhanced lane-centering, adaptive cruise, and automated braking redefine driving experience. Collaboration between OEMs and software providers refines decision-making systems. Manufacturers introduce over-the-air updates to enhance ADAS performance remotely. The growing emphasis on software-defined vehicles strengthens innovation cycles. These features support Europe’s long-term transition toward fully autonomous transport. It sets the foundation for advanced human-machine interaction and driving precision.

- For instance, Mercedes-Benz became the first automaker to commercially offer an internationally certified Level 3 system (“Drive Pilot”) for consumers in Germany in 2022 and extended its approval in 2024, allowing hands-free driving at speeds up to 60 km/h on nearly 8,200 miles (over 13,000 km) of German highways, initially in the S-Class and EQS models.

Integration of Artificial Intelligence and Machine Learning in Vehicle Safety Platforms

Artificial intelligence enhances predictive analysis and situational awareness across vehicles. AI models process multiple sensor inputs to predict collision risks accurately. Machine learning refines object classification, improving pedestrian and cyclist detection. Automakers deploy embedded intelligence for proactive braking and steering control. Continuous data collection strengthens self-learning algorithms for adaptive driving conditions. AI-powered perception systems support next-generation driver monitoring and fatigue detection. This evolution makes safety systems smarter and more context-aware. It ensures consistent accuracy in complex road environments.

- For instance, Mobileye’s EyeQ™ chips have been integrated into over 200 million vehicles worldwide as of 2024, supporting advanced driver-assistance and autonomous functions for numerous global automakers. The company leverages large-scale road data collected from its deployed fleet to enhance real-time mapping, perception, and collision avoidance capabilities.

Expansion of Connected Vehicle Infrastructure and Smart Mobility Ecosystems

Connected infrastructure enables ADAS to communicate with external systems efficiently. Vehicle-to-everything (V2X) technology improves coordination at intersections and crowded roads. Smart cities in Germany, France, and the Netherlands develop pilot programs for connected transport. These networks enhance decision-making accuracy and system responsiveness. Integration with cloud computing platforms supports real-time updates and diagnostics. Connected systems also reduce latency and improve data-driven performance. It enhances road safety through synchronized mobility operations. This shift promotes sustainable and cooperative driving environments.

Rise of Cost-Effective and Scalable ADAS for Mass Market Adoption

Manufacturers focus on scalable systems suitable for mid-range and compact cars. Reduced sensor costs make ADAS integration affordable across vehicle categories. Tier-1 suppliers optimize software and hardware to support flexible configurations. Mass production of radar and vision modules lowers component expenses. Government incentives encourage deployment in public and fleet vehicles. Standardization of design protocols accelerates product compatibility. This shift ensures broader consumer accessibility and safety coverage. It propels Europe’s vision of achieving safer, technology-driven mobility.

Market Challenges Analysis

High Production Costs and Complex Integration Across Diverse Vehicle Platforms

The Europe Advanced Driver Assistance Systems Market faces high system and calibration costs. Integrating multiple sensors, cameras, and software modules demands strong precision. Variations in vehicle design complicate standardization and mass deployment. Tier-1 suppliers balance affordability with system reliability and safety compliance. Complex sensor alignment and maintenance increase manufacturing timelines. Smaller OEMs struggle to achieve economies of scale in ADAS implementation. Rising semiconductor costs add supply chain pressure for automakers. It slows widespread adoption in budget-friendly segments and emerging markets.

Regulatory, Ethical, and Cybersecurity Concerns Limiting Full ADAS Deployment

Governments enforce strict compliance on data handling and system accountability. Ethical issues around automated decision-making raise public concerns. Cybersecurity threats to connected vehicle networks intensify safety vulnerabilities. Manufacturers must invest in encryption and continuous monitoring systems. Variations in national testing standards delay cross-border deployment approvals. Regulatory fragmentation across Europe limits uniform adoption timelines. Insurance frameworks also lag in adapting to semi-autonomous driving risks. It necessitates greater collaboration among regulators, OEMs, and technology firms to build consumer trust.

Market Opportunities

Rising Penetration of Electric and Connected Vehicles Creating Growth Scope for ADAS Suppliers

The Europe Advanced Driver Assistance Systems Market benefits from electric mobility expansion. EV platforms integrate ADAS for improved energy efficiency and safety management. Government support for e-mobility boosts infrastructure and adoption rates. EV makers collaborate with software firms for sensor calibration and system control. Integration of V2X and AI enhances the driving experience in electric fleets. Consumers favor EVs with high safety ratings, strengthening ADAS relevance. The push toward zero-emission transport aligns with autonomous feature development. It opens strong opportunities for innovation-led partnerships and investments.

Collaborative Ecosystem Among Automakers, Tech Firms, and Startups Driving Innovation

Partnerships between automakers and startups foster advanced technology transfer. Collaborative ecosystems enable real-time simulation testing and faster product validation. Industry leaders invest in AI labs to accelerate prototype development. Public-private programs promote safer mobility and infrastructure modernization. Local suppliers gain from joint ventures with global ADAS providers. Investments in regional R&D hubs enhance Europe’s competitive advantage. It supports scalable, sustainable, and export-ready ADAS solutions. Growing cooperation ensures a stronger innovation pipeline for future mobility systems.

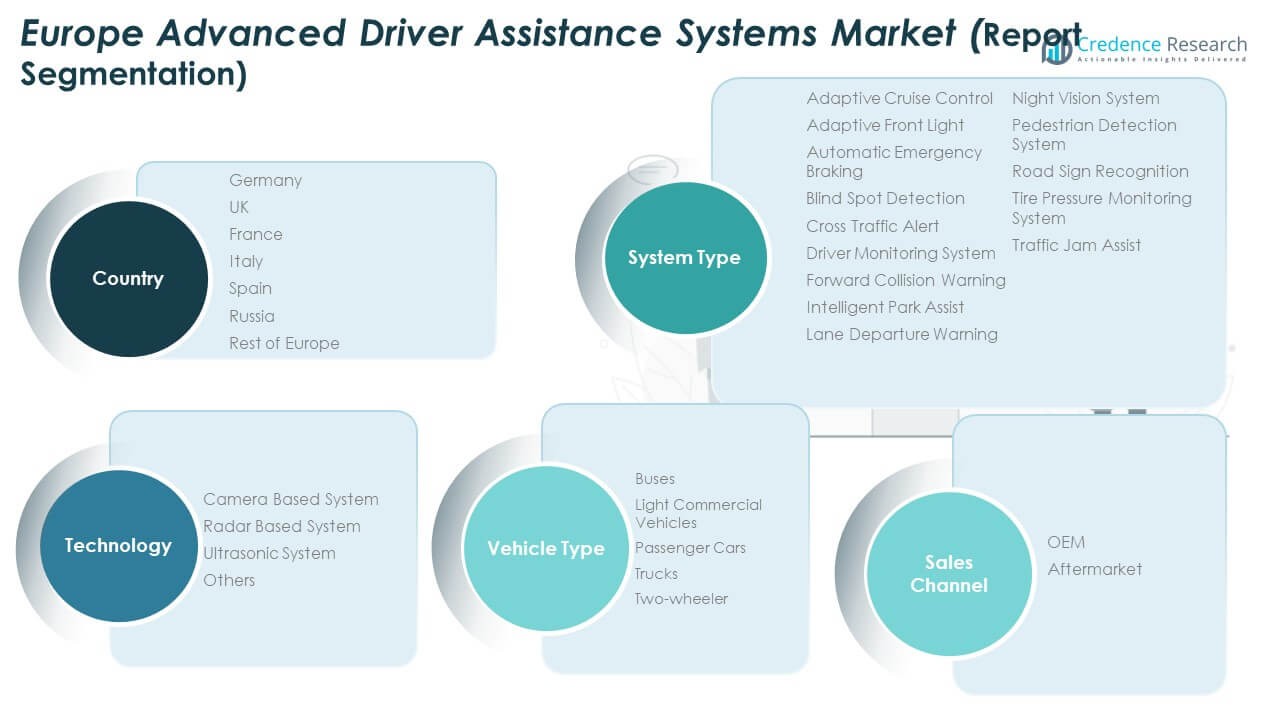

Market Segmentation Analysis

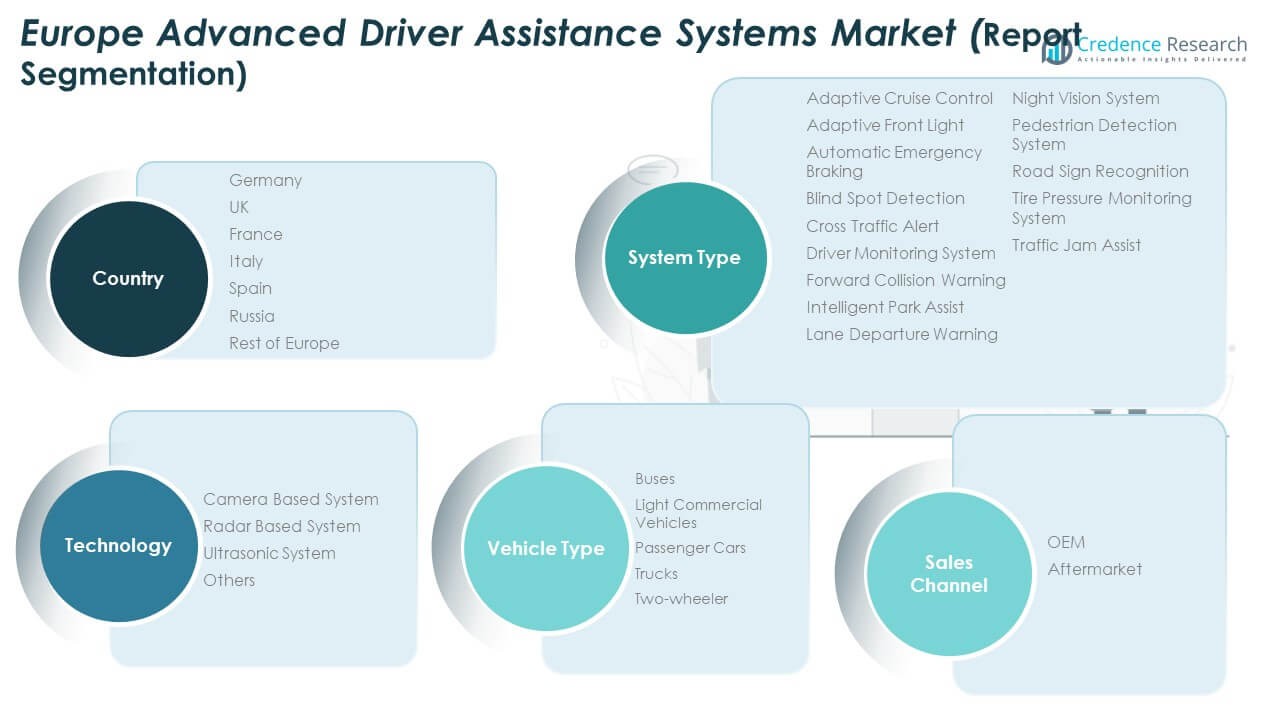

By System Type

The Europe Advanced Driver Assistance Systems Market covers diverse technologies improving vehicle safety and comfort. Adaptive cruise control, automatic emergency braking, and blind spot detection dominate adoption due to strong regulatory focus. Lane departure warning, intelligent park assist, and pedestrian detection gain traction in passenger vehicles. Premium cars adopt night vision systems and road sign recognition for enhanced awareness. Commercial vehicles integrate driver monitoring and tire pressure systems for operational safety. Cross-traffic alerts and traffic jam assist enhance urban driving. The combined system deployment enhances driver convenience and safety consistency.

- For example, Bosch’s automatic emergency braking system is shown to prevent up to 72% of rear-end collisions resulting in injury in Germany, according to Bosch Corporate Research and national accident research data. This system is active at all speeds and uses predictive collision warning alongside hydraulic brake assist modules for enhanced safety performance.

By Technology

Camera-based systems lead adoption due to affordability and visual clarity. Radar-based systems gain attention for high-speed detection accuracy under low visibility. Ultrasonic sensors assist in short-range maneuvers such as parking. Advanced sensor fusion systems merge inputs for real-time situational awareness. AI-powered analytics refine decision-making accuracy in diverse traffic conditions. Integration of 5G networks enhances data exchange for connected systems. The market’s technological diversification supports tailored safety solutions. It sustains strong innovation momentum across Europe’s automotive ecosystem.

- For example, Continental’s ProViu 360 2nd Generation Surround View System utilizes four high-resolution automotive cameras providing a 360° virtual bird’s eye view in real time, displayed on a 10-inch HD touchscreen monitor. The cameras offer enhanced safety by eliminating blind spots and include advanced worker detection features optimized for both commercial vehicles and construction site applications.

By Vehicle Type

Passenger cars dominate ADAS integration driven by consumer demand for safety features. Light commercial vehicles and trucks integrate ADAS for fleet safety and cost efficiency. Bus operators adopt advanced braking and monitoring systems to ensure passenger protection. Two-wheelers begin integrating simplified collision alert technologies in premium models. Regulatory focus on heavy vehicles accelerates deployment of monitoring systems. OEMs emphasize multi-vehicle compatibility for seamless adoption. It enables a broader reach across transportation categories. The expanding use cases highlight ADAS as a universal mobility enhancer.

By Sales Channel

OEMs lead sales through factory-fitted ADAS technologies in new vehicles. Aftermarket channels grow steadily with retrofit solutions for older models. Independent workshops and dealerships offer customized upgrades to meet safety standards. OEM collaborations with software developers ensure optimized integration and calibration. The aftermarket benefits from declining hardware costs and easy installation kits. Consumers prefer certified products aligned with vehicle-specific requirements. This dual-channel growth model broadens accessibility across user segments. It strengthens Europe’s movement toward safer and smarter vehicle ecosystems.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Region

- North America: U.S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis

Western Europe Leading the Market with Advanced Automotive Innovation

Western Europe dominates the Europe Advanced Driver Assistance Systems Market, holding a 42% market share in 2024. The region benefits from a mature automotive ecosystem, advanced R&D capabilities, and early adoption of connected technologies. Germany leads due to its strong manufacturing base and continuous investments by key automakers such as BMW, Audi, and Mercedes-Benz. The UK and France contribute significantly through regulatory enforcement of safety standards and expansion of electric vehicle adoption. Strong infrastructure for testing and deployment of autonomous technologies reinforces the region’s leadership. It continues to act as a key innovation hub for premium and mid-segment vehicles integrating ADAS functionalities.

Southern Europe Expanding Adoption Through Mid-Segment Vehicle Integration

Southern Europe accounts for 26% market share, led by Italy and Spain, where growing vehicle production supports market penetration. Manufacturers integrate cost-efficient driver assistance systems to appeal to a broader consumer base. Governments implement vehicle safety mandates that accelerate adoption in both private and commercial fleets. Increasing tourism and logistics activities further raise demand for vehicles equipped with intelligent braking, adaptive lighting, and collision warning systems. OEM partnerships with local suppliers enhance accessibility of radar and camera modules. It creates a balanced ecosystem for technology diffusion across vehicle classes. Continuous consumer education campaigns also strengthen awareness and usage rates.

Northern and Eastern Europe Showing Rapid Growth with Infrastructure Modernization

Northern and Eastern Europe collectively hold 32% market share, driven by emerging adoption and infrastructure development. Nordic countries invest heavily in connected mobility ecosystems and ADAS calibration suited for extreme climates. Poland, Hungary, and the Czech Republic experience rising production from global OEMs establishing regional assembly plants. Government-led smart mobility programs promote the inclusion of lane departure warning and blind spot detection in public transport fleets. Strong supply chain networks encourage local sourcing of advanced sensors and electronic components. It supports cost reduction and scalability across growing vehicle categories. The subregion remains an important growth engine for future ADAS expansion in Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Europe Advanced Driver Assistance Systems Market is highly competitive, with global Tier-1 suppliers and regional OEMs driving innovation and technological integration. Key companies such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, and DENSO Corporation maintain leadership through extensive product portfolios and strong OEM partnerships. These players emphasize AI-based perception systems, real-time data processing, and cost-effective sensor solutions to enhance performance reliability. Strategic collaborations between software developers and component manufacturers expand functional capabilities and strengthen safety compliance. Emerging participants, including Valeo SA, Aptiv PLC, and Mobileye, focus on adaptive algorithms and hardware optimization for next-generation vehicles. Competition intensifies through investments in LiDAR, radar calibration, and over-the-air update technologies. It fosters continuous advancement in safety innovation, automation levels, and scalable deployment across passenger and commercial vehicle platforms.

Recent Developments

- In October 2025, Magna ramped up deployment of its driver and occupant monitoring systems (DMS) in China and Europe, partnering with new OEMs and expanding volume deployment in the European market.

- In October 2025, Aptiv PLC launched its latest advanced radar technology aimed at significantly boosting vehicle safety, detection, and automation within driver-assistance systems; this innovation supports next-gen ADAS requirements for European manufacturers.

- In September 2025, Bosch announced the integration of NVIDIA DRIVE AGX Thor into its ADAS compute platform, enhancing OEM implementation flexibility and performance. Bosch also expanded its collaboration with Horizon Robotics, unveiling new multipurpose cameras based on Horizon’s Journey 6B and securing design wins from multiple OEMs for its ADAS product family.

- In March 2025, Magna and NVIDIA announced a new collaboration to deliver AI-powered solutions for next-gen vehicle intelligence and autonomy, solidifying Magna’s market leadership in advanced ADAS technologies.

- In December 2024, DENSO and onsemi reinforced their decade-long partnership by announcing plans for further collaboration and procurement of advanced ADAS and autonomous driving technologies. DENSO also declared its intent to acquire onsemi shares, deepening their supply chain integration for continuous innovation in safety and vehicle intelligence.

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe Advanced Driver Assistance Systems Market will advance with strong regulatory alignment toward road safety and automation.

- Demand for Level 2+ and Level 3 autonomy features will rise, supported by OEM integration in premium and mass-market models.

- AI-driven perception technologies will redefine vehicle safety, enabling real-time environmental awareness and improved decision-making.

- Connected vehicle ecosystems will strengthen through expanding V2X infrastructure, improving system accuracy and traffic coordination.

- Affordable ADAS kits in compact and mid-size vehicles will boost penetration across Western and Southern Europe.

- Radar, LiDAR, and camera-based fusion systems will dominate innovation, enabling precision and all-weather functionality.

- Collaborations between automakers and software firms will accelerate system calibration, testing, and autonomous readiness.

- Fleet modernization and electrification initiatives will stimulate adoption of ADAS in commercial vehicles and logistics fleets.

- Growth of smart city networks will promote synchronized data exchange between vehicles and road infrastructure.

- Rising consumer confidence in semi-autonomous functions will drive continuous investments in safety and human-machine interface technology.