Market Overview

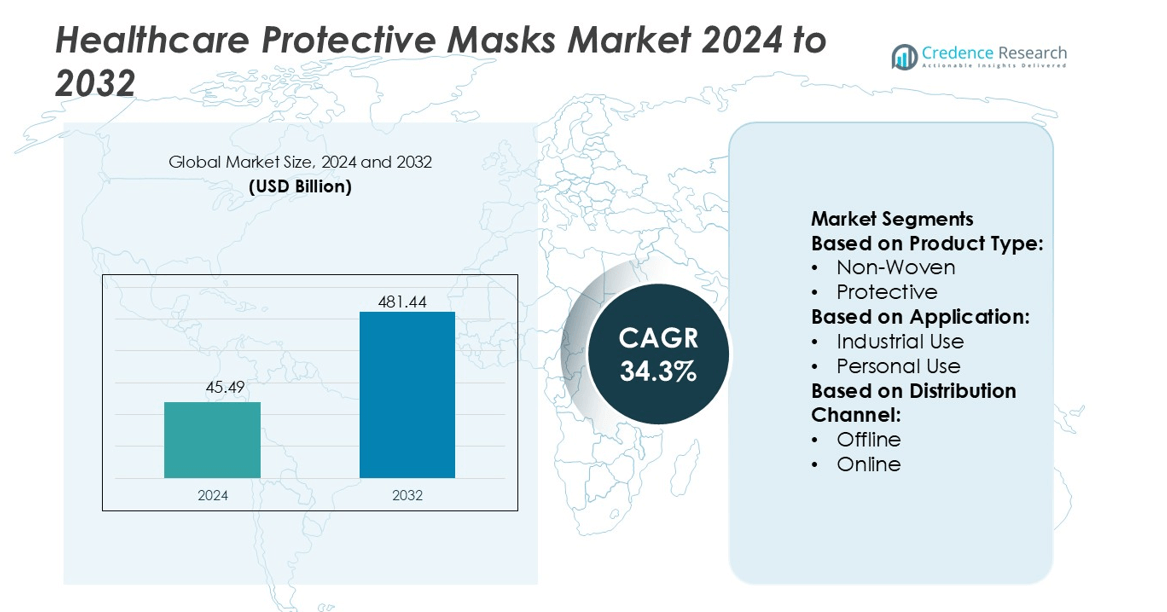

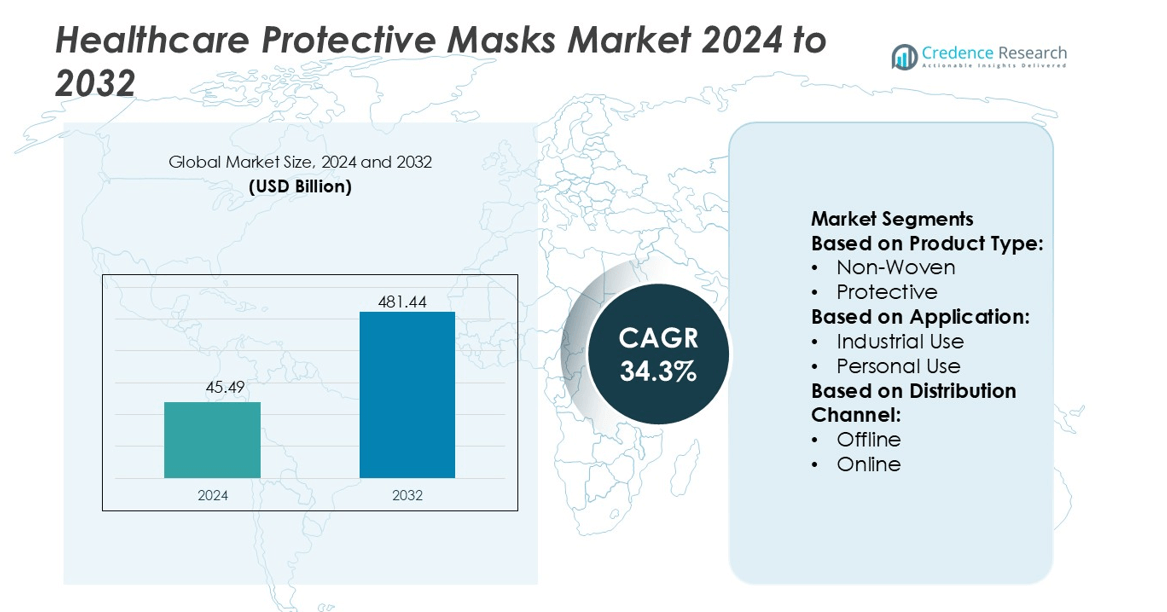

Healthcare Protective Masks Market size was valued USD 45.49 billion in 2024 and is anticipated to reach USD 481.44 billion by 2032, at a CAGR of 34.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Protective Masks Market Size 2024 |

USD 45.49 billion |

| Healthcare Protective Masks Market, CAGR |

34.3% |

| Healthcare Protective Masks Market Size 2032 |

USD 481.44 billion |

The healthcare protective masks market include 3M Healthcare, Baxter International Inc., Cardinal Health Inc., Medtronic PLC, B. Braun Melsungen AG, Abbott, Sunrise Medical, Air Liquide, F. Hoffmann-La Roche AG, and Amedisys, Inc. These companies compete through certified medical-grade masks, strong hospital supply chains, and wide product portfolios covering surgical, disposable, and respirator categories. Many players invest in advanced filtration materials, ergonomic fit, and reusable options to meet clinical and industrial needs. North America remains the leading region with a 35% market share, driven by high healthcare spending, strict infection-control rules, and strong domestic manufacturing capabilities.

Market Insights

- The Healthcare Protective Masks Market size reached USD 45.49 billion in 2024 and will rise to USD 481.44 billion by 2032, registering a CAGR of 34.3%.

- Rising demand for infection prevention and strict hospital hygiene rules drive higher adoption of surgical, disposable, and respirator masks across clinical and industrial users.

- Leading companies such as 3M Healthcare, Cardinal Health Inc., Medtronic PLC, Baxter International Inc., and Abbott compete through certified medical-grade products, reusable models, ergonomic designs, and strong supply chains.

- Raw material price fluctuations and supply disruptions remain key restraints, especially in regions dependent on imports and low-cost suppliers.

- North America leads with a 35% share due to high spending and domestic manufacturing, while Asia-Pacific grows rapidly with large consumption and low-cost production; surgical masks hold the dominant segment share as hospitals and clinics prioritize certified protection for routine and critical procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Non-woven masks hold the leading share at 52%. Healthcare workers prefer non-woven designs because the material filters small particles and offers good breathability. High production capacity and low unit cost also support their demand. Surgical masks remain popular in hospitals, clinics, and emergency rooms because they provide splash resistance and easy disposal. Dust masks serve industrial workers in high-pollution zones. Protective respirators serve infection-control teams during outbreaks. Growing infection risks, safer raw materials, and hygiene standards continue to push non-woven masks as the dominant product type in global sales.

- For instance, 3M Healthcare documented that its AURA 1870+ respirator uses a three-panel, non-woven filtration media that achieves a particle capture efficiency of 0.1 microns and passed a fit-test requirement of ≥ 100 on OSHA protocols.

By Application

Industrial use accounts for 56% of total demand. Hospitals, pharmaceuticals, chemical plants, and food processing units follow strict safety standards, which drives bulk purchases. Workers use protective respirators during cleaning, packaging, and waste handling. Mask usage also increases in laboratories due to hazardous particles and biological exposure. Personal use grows fast, driven by rising health awareness, seasonal flu, and pollution in large cities. The need for worker safety, strict rules, and medical inspections maintain industrial usage as the leading application segment.

- For instance, Baxter’s official 2024 Corporate Responsibility Report, the company achieved a TRIR of 0.38 in 2024. This rate enabled them to meet their goal of top quartile workplace safety performance among industry peers.

By Distribution Channel

Offline channels lead with 60% share because hospitals, pharmacies, and distributors buy in bulk. Medical institutions rely on verified suppliers who meet safety and sterilization standards. Retail pharmacies supply certified masks for households and small clinics. Online platforms grow steadily due to lower prices, doorstep delivery, and wider design choices. E-commerce brands offer multi-layer masks, subscription packs, and instant restocking options. However, healthcare buyers still trust offline procurement for quality checks and compliance, keeping offline channels as the dominant segment.

Key Growth Drivers

Rising Focus on Infection Prevention and Public Health Safety

Demand for healthcare protective masks grows due to stricter infection-control standards in hospitals, clinics, and diagnostic centers. Governments enforce hygiene rules, while medical staff use protective masks during surgeries, examinations, and emergency care. Rising infectious diseases, hospital-acquired infections, and seasonal flu cases support uptake. Strong awareness campaigns encourage mask usage in high-risk areas. Large healthcare chains also maintain bulk procurement to ensure uninterrupted supply. This shift toward preventive healthcare drives steady volume demand across industrial and medical environments.

- For instance, Cardinal Health documents that its SecureShield™ surgical masks deliver ≥ 98% bacterial filtration efficiency (BFE) and particle filtration efficiency (PFE) at 0.1 micron, and meet ASTM F2100 Level 3 standards with a fluid resistance rating of 160 mmHg.

Growing Use of Masks in Industrial and Personal Safety Applications

Protective masks now serve more sectors beyond clinical settings. Workers in pharmaceuticals, chemicals, food processing, and manufacturing use masks to block fumes, dust, and harmful particles. Companies adopt strict workplace safety rules to reduce respiratory risks and avoid compliance penalties. Household consumers also buy masks for pollution, allergies, and respiratory protection during travel or crowded events. Retail and e-commerce platforms expand product reach and offer quick delivery. This wider application base supports sustained commercial growth.

- For instance, Air Liquide’s “Respireo™ Hospital F” full-face mask specification sheet lists a dead-space volume of 215 ml for size L, and allows up to 20 sterilisation cycles for the reusable cushion before replacement.

Technological Advancements and Product Innovation

Manufacturers develop lightweight, breathable, and skin-safe masks with multilayer filtration. Many brands use melt-blown fabric, nanofibers, and active carbon layers to improve protection. Fog-free and hypoallergenic designs enhance comfort for doctors, nurses, and long-hour users. Smart production automation and quality testing ensure consistent standards. Some companies introduce reusable and washable models for cost savings and reduced waste. Improved filtration efficiency and better fit encourage repeat demand from both professional and personal users.

Key Trends & Opportunities

Shift Toward Reusable and Eco-Friendly Masks

Growing environmental awareness drives demand for washable and biodegradable masks. Healthcare providers and consumers look for solutions that reduce disposable waste. Manufacturers use fabric blends, natural fibers, and advanced coatings to enhance durability. Reusable models deliver long service life at lower replacement frequency. Brands highlight sustainable packaging and green processes to attract eco-conscious buyers. Hospitals also adopt structured recycling plans for disposable masks. This shift creates scope for innovation in material science and waste reduction.

- For instance, 3M’s Aura™ 1870+ N95 flat-fold surgical respirator is certified to NIOSH approval TC-84A-5726, delivers bacterial filtration efficiency (BFE) > 99% and fluid resistance to 160 mm Hg according to ASTM F1862.

Rising Demand from Online Distribution Channels

E-commerce platforms boost accessibility through fast delivery and wide product variety. Consumers compare features, certifications, and reviews before purchase. Vendors offer bulk discounts, subscription models, and doorstep delivery for medical facilities and businesses. Online channels reduce dependence on traditional retail networks and allow faster regional expansion. Global brands also enter new markets through digital sales. This trend opens space for new market entrants, private labels, and specialized medical supply portals.

- For instance, DuPont’s Tyvek® 400 protective fabric declares particle barrier capability “down to 1.0 micron in size”, as cited in DuPont’s product literature.

Integration of Advanced Filtration and Comfort Features

Masks now feature enhanced comfort, better airflow, and ergonomic fit. Multi-layer filtration blocks aerosols, dust, and microorganisms while reducing breathing resistance. Sweat-absorbent liners and non-irritating fabrics support long working hours for medical teams. Anti-fog panels benefit users wearing glasses or face shields. Innovation in coatings and antimicrobial layers further improves hygiene. These features help upgrade traditional mask designs and increase customer preference for premium products.

Key Challenges

Raw Material Cost Fluctuations and Supply Disruptions

Non-woven fabrics, melt-blown materials, and filter media often face price volatility. High demand periods strain global supply chains, increasing production costs for manufacturers. Logistics delays or export restrictions disrupt inventory planning for hospitals and distributors. Import-dependent countries experience higher procurement difficulties. These issues force companies to maintain large stock reserves and explore local sourcing. Sudden cost pressure affects pricing and profit margins across the supply chain.

Growing Market Saturation and Quality Variations

Many new players enter the market with low-cost products, leading to quality inconsistencies. Some masks lack certification, proper filtration standards, or medical-grade approval. Hospitals and buyers must scrutinize supplier credibility, increasing procurement time. Regulatory bodies tighten inspections and require standard compliance. Counterfeit or substandard products also threaten consumer safety and brand trust. Established companies invest more in testing and certification to differentiate their products from low-quality alternatives.

Regional Analysis

North America

North America holds the leading position in the healthcare protective masks market with a 35% share. High healthcare spending, advanced hospital infrastructure, and strict infection-control standards sustain strong demand. Major manufacturers and distributors ensure stable supply to hospitals, laboratories, and emergency care units. Widespread awareness campaigns encourage mask adoption among healthcare professionals and the general population. Industrial users in pharmaceuticals and biotechnology further add volume. The region also sees high adoption of premium and certified masks such as N95 respirators. Continuous investments in R&D, regulatory compliance, and domestic manufacturing support long-term market stability.

Europe

Europe accounts for a 28% market share, supported by strong healthcare regulations and extensive public health programs. Hospitals, clinics, and elderly care homes maintain bulk procurement to prevent hospital-acquired infections and seasonal disease spread. Government initiatives encourage domestic mask production and stockpiling for emergency readiness. Manufacturers focus on eco-friendly materials, reusable models, and certified products that meet EN standards. Industrial workplaces in chemicals, food processing, and pharmaceuticals also adopt protective masks for occupational safety. Online and pharmacy channels support easy availability. Growing focus on sustainable medical supplies enhances opportunities across Western and Central Europe.

Asia-Pacific

Asia-Pacific holds a 30% market share and serves as one of the fastest-growing regional markets. Large population size, rising respiratory disease cases, and rapid urbanization drive consistent demand. Hospitals and diagnostic centers expand procurement due to infection-control rules and national health programs. Local manufacturers produce low-cost surgical and disposable masks, boosting affordability and distribution. Strong industrial growth in chemicals, manufacturing, and food processing increases consumption of protective masks for workplace safety. E-commerce platforms widen product access in urban and rural areas. Ongoing investments in healthcare capacity and domestic production strengthen regional supply chains.

Latin America

Latin America holds a 4% market share, driven by growing awareness of infection control and occupational safety. Hospitals and clinics adopt protective masks to reduce cross-contamination during surgeries and examinations. Pharmaceutical and food industries follow stricter health standards, encouraging workforce mask usage. Import-dependent markets face supply fluctuations, leading governments to promote local sourcing. Public health campaigns and retail expansion improve product reach across urban areas. Although pricing pressures exist, demand rises for certified masks that meet medical standards. Improvements in healthcare infrastructure and industrial safety rules are expected to support steady market growth.

Middle East & Africa

The Middle East & Africa represent a 3% market share, influenced by improving healthcare infrastructure and rising infection-prevention programs. Hospitals, diagnostics centers, and emergency care providers use protective masks to enhance patient and worker safety. Large industrial sectors, including oil, gas, and chemicals, increase purchases for occupational protection. Countries rely heavily on imports, leading to higher costs and supply challenges during global disruptions. Public health initiatives and procurement by private hospitals increase adoption in major cities. Growth remains steady as governments expand health spending and enforce hygiene standards across medical and industrial environments.

Market Segmentations:

By Product Type:

By Application:

- Industrial Use

- Personal Use

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the healthcare protective masks market includes Amedisys, Inc., Baxter International Inc., Cardinal Health Inc., Air Liquide, Medtronic PLC, Sunrise Medical, Abbott, B. Braun Melsungen AG, F. Hoffmann-La Roche AG, and 3M Healthcare. The healthcare protective masks market features strong participation from global medical manufacturers, specialist PPE suppliers, and regional producers. Companies focus on certified filtration materials, multi-layer designs, skin-safe fabrics, and improved breathability to meet strict hospital standards. Many brands expand reusable and biodegradable mask portfolios to reduce waste and align with sustainable healthcare goals. Manufacturers invest in automation, melt-blown production lines, and quality testing to maintain consistent supply and filtration efficiency. Distribution strategies include direct hospital supply contracts, pharmacy partnerships, and online channels for faster regional coverage. Competition also centers on regulatory compliance, with producers seeking approvals from agencies such as FDA, CE, and ISO. Pricing remains competitive due to the presence of low-cost regional suppliers, while premium models target surgical, emergency, and long-hour clinical use. As demand continues across medical and industrial environments, companies adopt R&D programs and product differentiation to secure long-term market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Honeywell announced that it has agreed to sell its protective equipment (PPE) business to Protective Industrial Products, Inc., a subsidiary of Odyssey Investment Partners.

- In July 2024, Star Health and Allied Insurance Company expanded its offerings to include home healthcare services, which are now available in over 50 cities across India. This initiative is part of a broader strategy to enhance accessibility and affordability of healthcare for customers, particularly in the context of rising healthcare costs and the challenges posed by limited infrastructure.

- In May 2024, KARAM Safety announced the successful acquisition of Midas Safety India, a well-known company in the safety sector. This initiative is a significant step for KARAM Group to expand its footprint and enhance its product range.

- In February 2024, Ansell Ltd. introduced a new highly textured glove called MICROFLEX Mega Texture 93-256 to the market. This orange-colored disposable nitrile glove provides a reliable grip and long-lasting protection for industrial workers

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as hospitals strengthen infection-control protocols and patient safety rules.

- Manufacturers will scale automated production to prevent supply shortages during peak demand.

- Reusable and biodegradable masks will gain adoption due to sustainability goals in healthcare.

- Advanced filtration materials will improve comfort, breathability, and long-hour usability.

- Smart distribution systems and e-commerce channels will expand product access in remote areas.

- Industrial sectors will increase procurement to meet stricter occupational safety standards.

- Governments will build strategic stockpiles to support emergency preparedness and disease outbreaks.

- Premium surgical and respirator masks will see higher adoption in specialized medical procedures.

- Local manufacturing will grow to reduce import dependence and supply disruptions.

- Continuous regulatory compliance and quality certifications will guide product development and global trade.