Market Overview

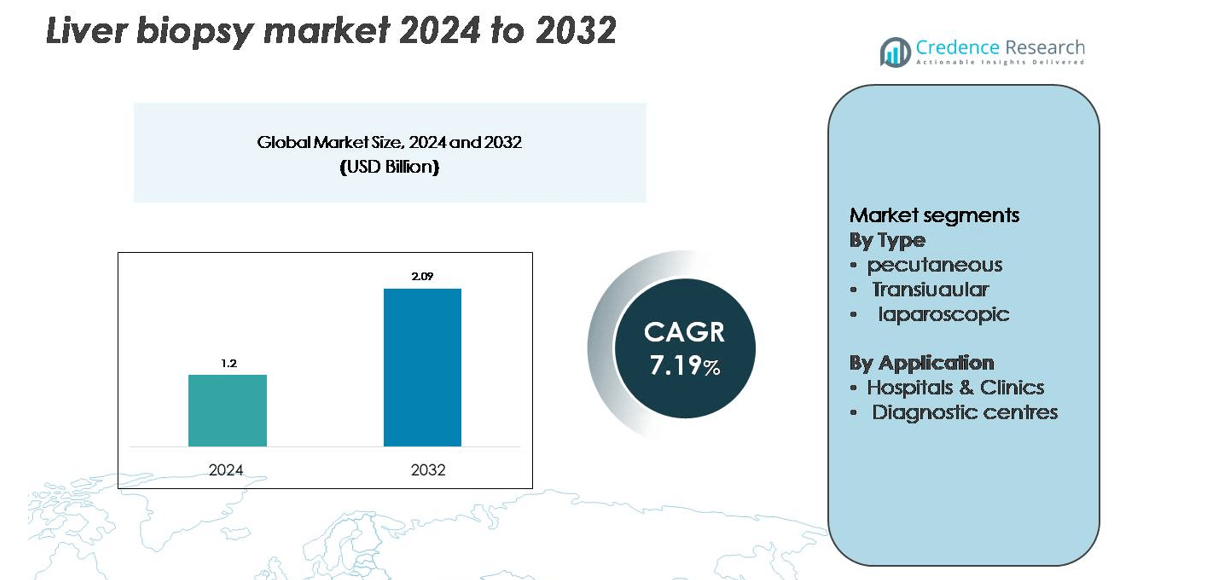

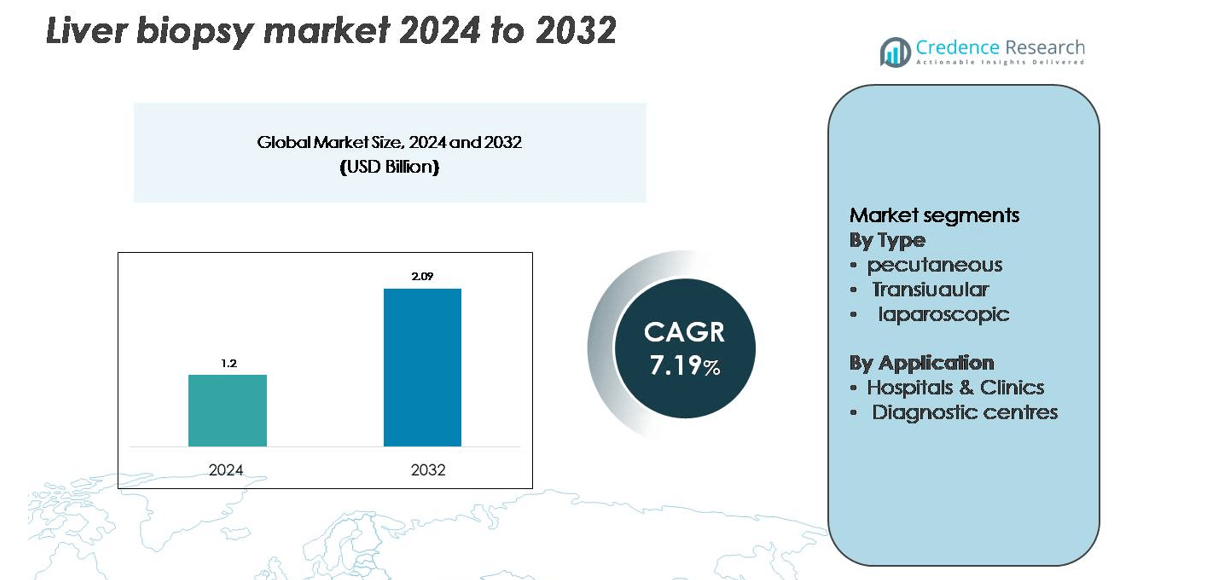

The Liver Biopsy Market was valued at USD 1.2 billion in 2024 and is anticipated to reach USD 2.09 billion by 2032, growing at a CAGR of 7.19% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liver Biopsy Market Size 2024 |

USD 1.2 billion |

| Liver Biopsy Market, CAGR |

7.19% |

| Liver Biopsy Market Size 2032 |

USD 2.09 billion |

The liver biopsy market is led by key players such as Becton, Dickinson and Company (BD), Boston Scientific Corporation, Medtronic plc, Argon Medical Devices, Cook Medical, Hologic, Inc., Fujifilm Holdings Corporation, and Cardinal Health. These companies dominate through innovations in minimally invasive and image-guided biopsy systems, enhancing diagnostic accuracy and patient comfort. North America remains the leading region, holding a 38% market share in 2024, driven by advanced healthcare infrastructure and high disease prevalence. Europe follows with a 27% share, supported by early adoption of digital imaging and strong public healthcare networks, while Asia-Pacific shows rapid growth driven by expanding diagnostic access.

Market Insights

- The liver biopsy market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.09 billion by 2032, growing at a CAGR of 7.19% during the forecast period.

- Growing prevalence of liver disorders such as hepatitis, cirrhosis, and fatty liver disease is driving market demand, with percutaneous biopsy holding a 54% share due to its precision and minimally invasive nature.

- Technological advancements in imaging-guided and AI-assisted biopsy systems are enhancing diagnostic accuracy, promoting adoption across hospitals and diagnostic centres.

- Market competition remains strong, with major players like BD, Boston Scientific, Medtronic, and Cook Medical focusing on innovation and global expansion; however, high procedural risks and growing preference for non-invasive alternatives restrain growth.

- North America leads with a 38% market share, followed by Europe (27%) and Asia-Pacific (22%), while hospitals and clinics dominate applications with a 63% segment share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The percutaneous segment holds the dominant share of 54% in the liver biopsy market in 2024. This method is preferred for its minimally invasive nature, lower procedural cost, and wide clinical applicability. Enhanced precision through ultrasound and CT guidance has improved sample quality and safety, driving higher adoption across healthcare facilities. Growing cases of chronic liver disorders and cirrhosis have also boosted the need for accurate histopathological evaluations. Continuous innovation in fine-needle and vacuum-assisted systems further supports its leadership by reducing complications and improving diagnostic efficiency.

- For instance, GE Healthcare ultrasound systems improved targeting precision operators using the LOGIQ E system achieved needle-tip visualization within 2.3 mm of the lesion in 130 consecutive percutaneous liver biopsies conducted under ultrasound-guidance.

By Application

Hospitals and clinics account for the leading market share of 63% in 2024, driven by their advanced diagnostic infrastructure and access to skilled professionals. These facilities perform a majority of biopsy procedures for managing conditions such as hepatitis, liver fibrosis, and carcinoma. The integration of image-guided biopsy systems and real-time monitoring technologies enhances accuracy and patient safety. Additionally, growing investments in hospital-based diagnostic units and government support for early liver disease detection continue to strengthen this segment’s dominance over diagnostic centres.

- For instance, Cleveland Clinic uses a hollow-needle liver biopsy that takes about 15 to 30 minutes in the percutaneous form.

Key Growth Drivers

Rising Prevalence of Chronic Liver Diseases

The growing incidence of chronic liver disorders such as hepatitis B, hepatitis C, fatty liver disease, and cirrhosis is a major driver of the liver biopsy market. With lifestyle changes, alcohol consumption, and obesity-related metabolic issues increasing worldwide, the demand for precise liver diagnostic tools has surged. Liver biopsy remains the gold standard for histological examination and disease staging. Healthcare systems are also investing in biopsy-based diagnostic programs to manage the increasing burden of non-alcoholic fatty liver disease (NAFLD). Government initiatives promoting early diagnosis further encourage biopsy adoption, ensuring timely medical intervention and improved patient outcomes.

- For instance, according to the World Health Organization, approximately 254 million people were living with chronic hepatitis B infection in 2022.

Advancements in Image-Guided Biopsy Techniques

Technological innovations in imaging modalities such as ultrasound, CT, and MRI have transformed liver biopsy procedures by improving precision and safety. Real-time imaging guidance minimizes procedural risks and enhances tissue sample accuracy, which is crucial for effective diagnosis. The introduction of robotic and automated biopsy systems has further enhanced reproducibility and efficiency. Integration of advanced imaging platforms allows interventional radiologists to identify targeted lesions, reducing repeat biopsies. As healthcare providers adopt hybrid imaging and minimally invasive devices, patient comfort and diagnostic reliability improve, making image-guided liver biopsies the preferred clinical choice across developed markets.

- For instance, a study of the AcuBot system demonstrated an average needle-placement error of 2 mm (range 0.39–2.82 mm) during phantom trials of percutaneous procedures.

Increasing Focus on Personalized Medicine and Research Applications

Growing interest in personalized treatment strategies has significantly increased the use of liver biopsy in molecular and genetic research. Biopsy-derived tissue samples enable genomic profiling and biomarker discovery, which guide targeted therapies for conditions like liver cancer and autoimmune hepatitis. Pharmaceutical and biotechnology companies are increasingly employing liver biopsy data in clinical trials to evaluate drug safety and efficacy. The expanding scope of translational research and precision diagnostics has positioned biopsy-based tissue analysis as a critical element of modern hepatology. This trend continues to drive collaborations between research institutions and diagnostic laboratories globally.

Key Trends & Opportunities

Shift Toward Minimally Invasive and Needleless Biopsy Alternatives

The market is witnessing a clear shift toward minimally invasive and less painful biopsy techniques. Innovations in fine-needle aspiration and vacuum-assisted systems are reducing complications and recovery times. At the same time, the growing use of liquid biopsy and elastography presents complementary opportunities, offering non-invasive alternatives for liver health assessment. Manufacturers are developing hybrid systems that combine imaging and diagnostic capabilities to improve patient comfort while maintaining accuracy. These advancements are likely to expand accessibility and adoption rates, especially in outpatient and diagnostic center settings across emerging economies.

- For instance, Hologic’s Brevera system combines tissue acquisition with real-time imaging in one workflow. The platform verifies samples at the point of care to streamline procedures. This reduces handling steps compared with separate imaging systems.

Integration of Artificial Intelligence in Diagnostic Imaging

Artificial intelligence (AI) and machine learning are increasingly integrated into biopsy imaging workflows to improve lesion targeting and diagnostic accuracy. AI-powered imaging platforms assist clinicians in detecting small hepatic lesions, optimizing needle placement, and predicting fibrosis stages. Automated image segmentation and predictive analytics enhance efficiency and reduce human error. AI-based pathology solutions are also accelerating biopsy sample analysis, providing faster and more accurate reports. As digital health ecosystems expand, the fusion of AI with imaging and histopathology represents a major opportunity for diagnostic precision and clinical efficiency in liver care.

- For instance, the company Infervision developed an AI-assisted platform for liver lesion detection on CT images that achieved an average Dice coefficient of 0.8819 in segmentation tasks across 140 patients, and exceeded 0.9 for lesions over 20 mm in diameter.

Key Challenges

Risk of Complications and Procedural Discomfort

Despite technological progress, liver biopsy remains an invasive procedure with potential risks such as bleeding, infection, and pain. Patient reluctance due to procedural anxiety limits acceptance, particularly in low- and middle-income regions. Additionally, contraindications in patients with coagulopathy or ascites restrict the applicability of certain biopsy types. Inconsistent operator expertise and inadequate training can also impact accuracy and safety. These challenges underline the need for improved patient education, specialized training, and wider access to advanced guidance systems that can reduce procedural risks and increase patient confidence.

Rising Adoption of Non-Invasive Diagnostic Alternatives

Non-invasive diagnostic tools such as transient elastography (FibroScan), magnetic resonance elastography (MRE), and serum biomarkers are increasingly challenging the need for traditional biopsies. These methods provide reliable assessments of liver fibrosis and inflammation without procedural risks. As their accuracy improves, clinicians may prefer them for initial disease evaluation. This growing competition from non-invasive solutions could restrain biopsy volumes, particularly in developed regions. To remain competitive, manufacturers and healthcare providers must emphasize biopsy’s superior diagnostic specificity and integrate it with non-invasive technologies to deliver comprehensive, hybrid liver assessments.

Regional Analysis

North America

North America dominates the liver biopsy market with a 38% share in 2024. The region’s leadership is driven by advanced healthcare infrastructure, high prevalence of liver disorders, and early adoption of image-guided biopsy technologies. The United States leads the market due to strong reimbursement frameworks and growing liver cancer screening programs. Increased R&D investments and collaborations between hospitals and diagnostic companies further support innovation in biopsy devices. The presence of key medical device manufacturers and growing awareness of non-alcoholic fatty liver disease (NAFLD) contribute to the region’s sustained market growth.

Europe

Europe accounts for a 27% market share in the liver biopsy industry in 2024, supported by rising liver disease incidence and a well-developed healthcare network. Countries such as Germany, the U.K., and France dominate due to widespread availability of advanced imaging-guided biopsy systems and skilled professionals. The region’s focus on early diagnosis and government-funded healthcare programs drives consistent procedure volumes. Additionally, the growing elderly population and prevalence of alcoholic liver disease create strong diagnostic demand. European hospitals are also integrating AI-driven imaging technologies to enhance biopsy precision and improve patient outcomes.

Asia-Pacific

The Asia-Pacific region captures a 22% share of the liver biopsy market in 2024 and is expected to register the fastest growth rate. Increasing liver cancer prevalence, especially in China, India, and Japan, drives biopsy demand. Expanding healthcare access, government initiatives for liver disease screening, and the establishment of specialized diagnostic centres are key factors fueling regional expansion. Growing investments by local and international medical device manufacturers are improving biopsy affordability and accessibility. Rapid urbanization, changing dietary habits, and a rising geriatric population continue to strengthen the region’s market potential.

Latin America

Latin America holds an 8% share of the liver biopsy market in 2024, with Brazil and Mexico leading regional adoption. Growing healthcare expenditure, improving diagnostic infrastructure, and rising awareness of hepatitis infections contribute to market growth. Public health programs aimed at early liver disease detection are supporting biopsy procedure expansion in hospitals and specialized clinics. However, limited access to advanced imaging and high procedure costs remain key challenges. Ongoing private-sector investments and medical training initiatives are expected to improve biopsy precision and accessibility in the coming years.

Middle East & Africa

The Middle East & Africa region represents a 5% share of the liver biopsy market in 2024. Increasing cases of liver fibrosis, hepatitis B, and fatty liver disease are driving diagnostic demand across Gulf nations and South Africa. The UAE and Saudi Arabia lead regional growth with expanding hospital networks and adoption of minimally invasive biopsy systems. However, limited healthcare access in parts of Africa constrains market potential. Government-backed healthcare modernization projects and partnerships with global diagnostic firms are expected to improve service availability and support long-term market expansion.

Market Segmentations:

By Type

- Percutaneous

- Transjugular

- Laparoscopic

By Application

- Hospitals & Clinics

- Diagnostic centres

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The liver biopsy market is moderately consolidated, with leading players focusing on product innovation, imaging integration, and global expansion to strengthen their presence. Key companies include Becton, Dickinson and Company (BD), Boston Scientific Corporation, Medtronic plc, Argon Medical Devices, Cook Medical, Hologic, Inc., Fujifilm Holdings Corporation, and Cardinal Health. These firms emphasize the development of advanced biopsy needles, image-guided systems, and minimally invasive devices that enhance diagnostic precision and patient safety. For instance, BD and Medtronic have expanded their portfolio with ultrasound-guided and vacuum-assisted biopsy solutions to reduce complications and improve tissue yield. Strategic collaborations between medical device manufacturers and healthcare institutions are accelerating R&D and clinical adoption. Additionally, mergers, acquisitions, and regional partnerships are helping players expand into emerging markets. Continuous innovation in disposable biopsy instruments and AI-enabled imaging support further differentiates market leaders, fostering competition and driving technological advancement in liver disease diagnostics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FUJIFILM

- Cook Group

- INRAD

- Hologic

- Cardinal Health

- Devicor Medical Products

- Boston Scientific

- Argon Medical Devices

- Braun Melsungen

- Becton, Dickinson, and Company

Recent Developments

- In September 2024, Argon Medical, simultaneously announced their expansion of the liver management portfolio with the launch of Intara Introducer Sheath and TLAB Transvenous Liver Biopsy System products in the U.S. and Canada. With the introduction of the products, the company hopes to improve procedural efficiency and increase their scope under interventional oncology, further strengthening its position in market.

- In 2024, Argon Medical’s TLAB Transvenous Liver Biopsy System received FDA clearance for transfemoral access, representing a significant advancement in the field. This system incorporates a unique feature that allows physicians to adjust the shape of the device to best suit the patient’s individual anatomy. This flexibility enhances navigability and improves sample acquisition in challenging anatomical scenarios, ultimately contributing to the success and safety of the procedure.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The liver biopsy market will continue to expand with the rising burden of chronic liver diseases worldwide.

- Advancements in image-guided and robotic biopsy technologies will enhance procedural precision and safety.

- Integration of AI and digital pathology will accelerate biopsy sample analysis and improve diagnostic outcomes.

- Demand for minimally invasive and ultrasound-guided procedures will increase across hospitals and clinics.

- Emerging economies will see higher adoption driven by improved healthcare infrastructure and awareness programs.

- Biopsy use in molecular research and clinical trials will grow as personalized medicine advances.

- Collaboration between medical device manufacturers and diagnostic laboratories will strengthen product innovation.

- Development of single-use and disposable biopsy instruments will support infection control and procedural efficiency.

- Government initiatives for liver disease screening and early detection will boost biopsy procedure volumes.

- The Asia-Pacific region will witness the fastest growth due to expanding diagnostic access and healthcare investments.