Market Overview:

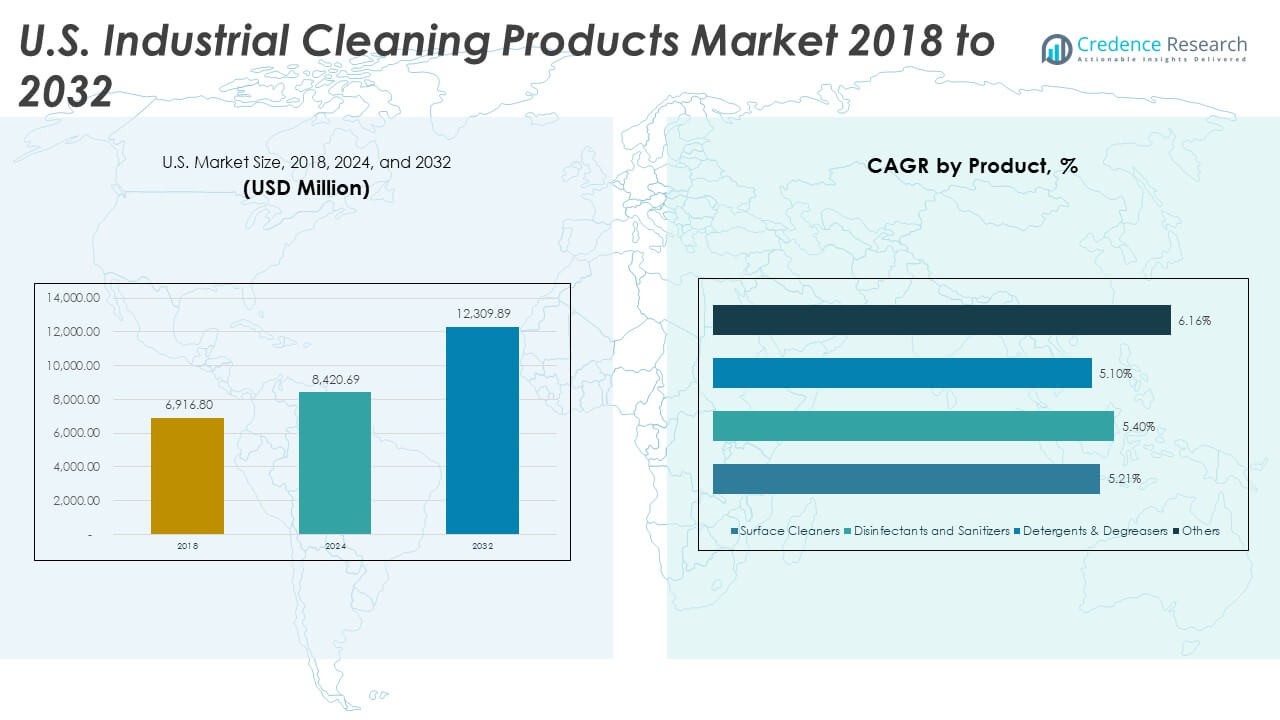

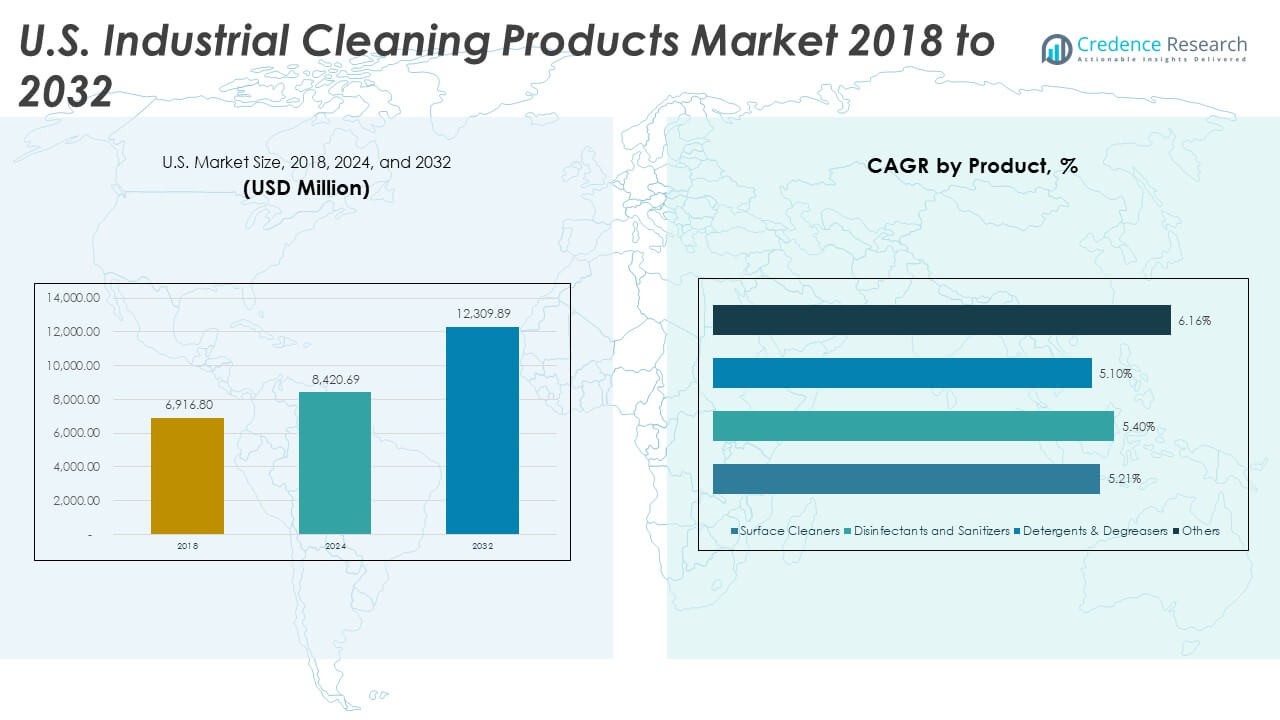

The U.S. Industrial Cleaning Products Market size was valued at USD 6,916.80 million in 2018, reached USD 8,420.69 million in 2024, and is anticipated to reach USD 12,309.89 million by 2032, growing at a CAGR of 4.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Industrial Cleaning Products Market Size 2024 |

USD 8,420.69 Million |

| U.S. Industrial Cleaning Products Market, CAGR |

4.86% |

| U.S. Industrial Cleaning Products Market Size 2032 |

USD 12,309.89 Million |

Market growth is driven by strict hygiene regulations, increasing industrialization, and the adoption of eco-friendly cleaning solutions. The expansion of manufacturing, food processing, and healthcare sectors fuels steady demand for disinfectants, degreasers, and surface cleaners. Industrial operators focus on efficiency and safety by integrating advanced cleaning agents and automated systems. Rising emphasis on sustainability and regulatory compliance continues to influence product innovation and material use. Companies invest in R&D to develop biodegradable and concentrated formulations that lower environmental impact while improving cleaning performance.

Regionally, the North and Midwest regions dominate due to strong manufacturing activity and industrial infrastructure. The Southern states show rapid expansion with growing demand from food, petrochemical, and energy sectors. The Western region benefits from institutional and commercial growth, especially in healthcare and technology hubs. Emerging demand from the Northeast supports market diversity, driven by stringent sanitation standards and environmental initiatives. Together, these regions create a balanced and competitive landscape, reinforcing steady nationwide growth in industrial and institutional cleaning applications.

Market Insights

Market Insights

- The U.S. Industrial Cleaning Products Market was valued at USD 6,916.80 million in 2018, reached USD 8,420.69 million in 2024, and is expected to hit USD 12,309.89 million by 2032, growing at a CAGR of 4.86%.

- The North and Midwest regions together hold 38% of the market, driven by strong manufacturing bases and industrial infrastructure. The South follows with 33%, supported by expanding energy and food processing industries, while the West holds 18% with its growing healthcare and technology sectors.

- The fastest-growing region is the South, accounting for 33% of the share, driven by infrastructure growth, expanding chemical manufacturing, and rising investments in energy and utilities.

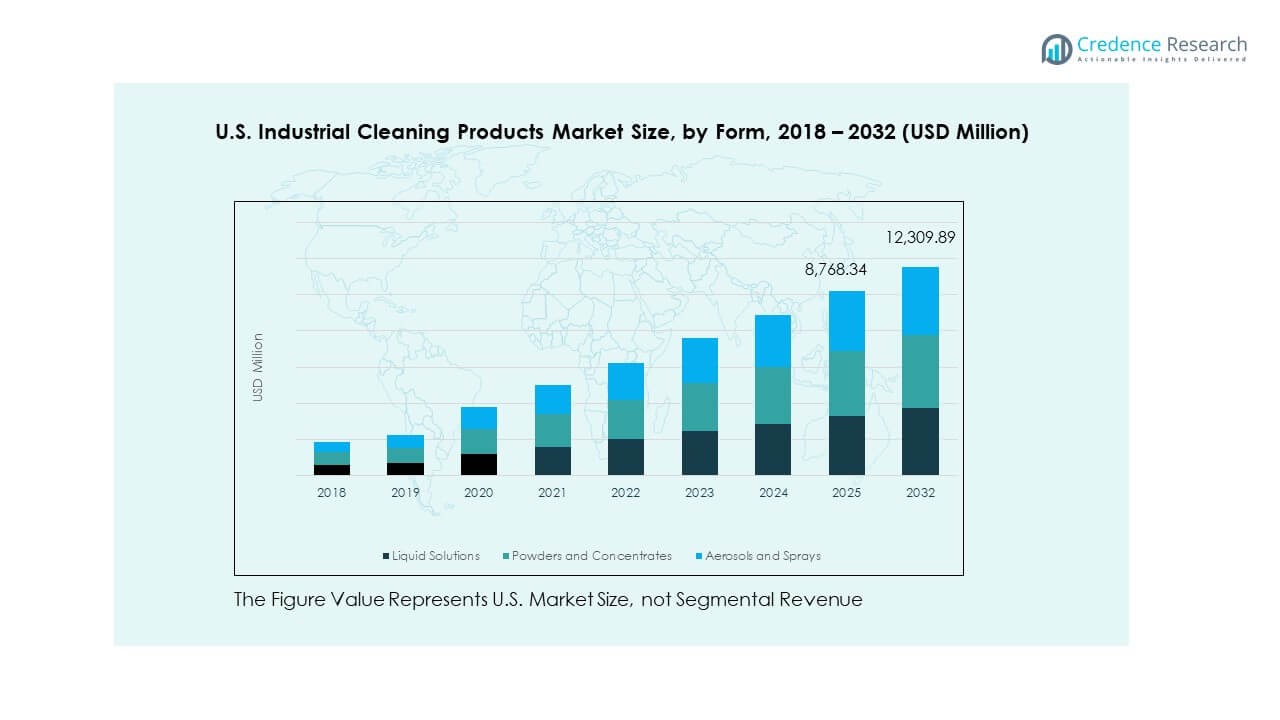

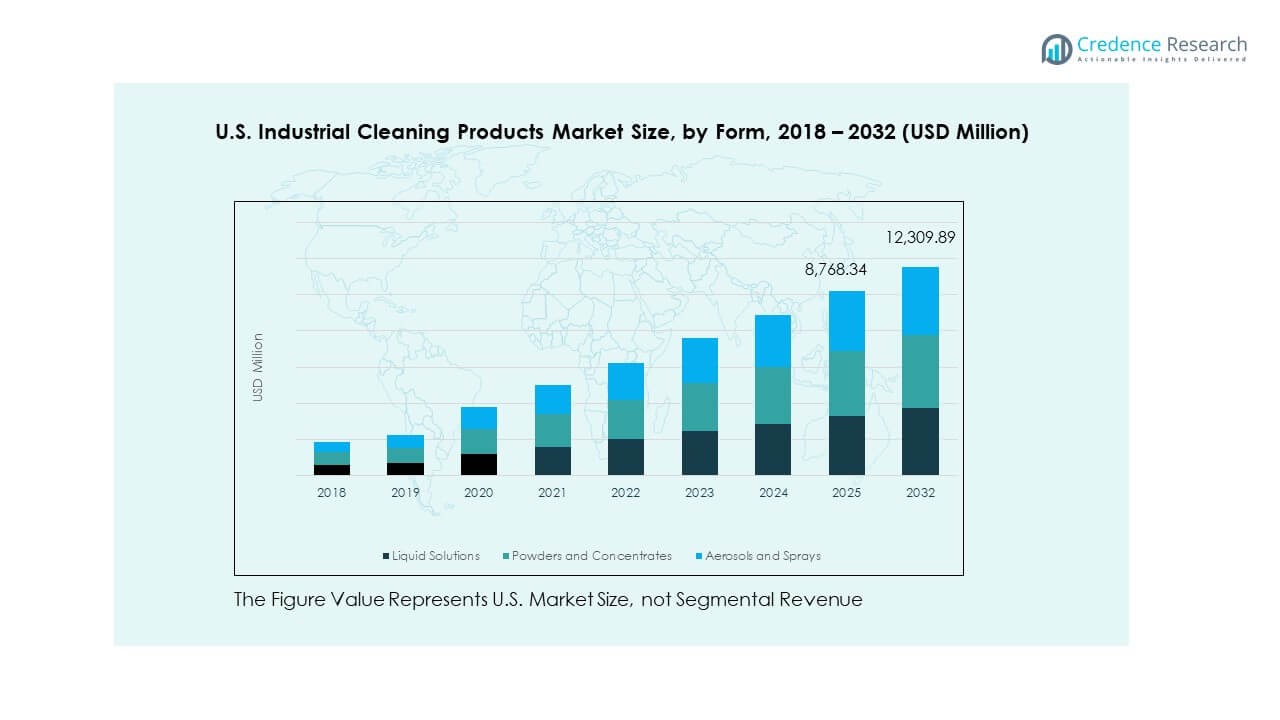

- Liquid solutions dominate the market with 47% share due to their ease of use, dilution flexibility, and compatibility with automated cleaning systems.

- Powders and concentrates hold 32% share, driven by cost efficiency and storage benefits, while aerosols and sprays show steady growth across institutional and commercial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Workplace Hygiene and Safety Standards Across Industries

Stringent hygiene protocols across food processing, healthcare, and manufacturing sectors drive the demand for industrial cleaning products. Companies invest in disinfectants, sanitizers, and degreasers to meet regulatory and health compliance. Increased awareness of workplace safety standards supports frequent cleaning in production areas. Industrial operators adopt advanced surface cleaners that ensure microbial control and safe handling. Growth in automation and production capacity also boosts cleaning frequency. Facility managers prioritize maintaining equipment hygiene to prevent downtime. The U.S. Industrial Cleaning Products Market benefits from consistent institutional and industrial consumption. Continuous innovation in formulations aligns with rising hygiene expectations across sectors.

- For instance, Ecolab’s Validex™ Disinfectant Efficacy Program shows that its cleanroom disinfectants consistently achieve a microbial log reduction validated by global benchmarks, meeting the FDA requirement for effective reduction against typical microbial vegetative flora in manufacturing facilities as per the Aseptic Processing Guidance standards and demonstrating efficacy in published validation studies.

Growing Industrialization and Maintenance of Complex Manufacturing Facilities

Expanding manufacturing operations across automotive, aerospace, and electronics sectors increase the use of cleaning products for equipment maintenance. Modern machinery requires specialized solvents and degreasers that preserve efficiency and minimize wear. Maintenance cycles become shorter due to tighter production schedules and higher operating speeds. Chemical manufacturers supply performance-based cleaning agents tailored to remove industrial residues. Rising awareness among facility managers regarding preventive maintenance sustains product demand. It supports production reliability and safety. The U.S. Industrial Cleaning Products Market gains momentum as industries emphasize operational sustainability and long-term asset protection. Enhanced infrastructure investment strengthens cleaning demand across large-scale plants.

Shift Toward Sustainable and Biodegradable Cleaning Solutions

Sustainability initiatives across U.S. industries accelerate the use of eco-friendly cleaning formulations. Companies prefer biodegradable, non-toxic chemicals to reduce environmental footprints and comply with EPA standards. Cleaning manufacturers adopt green chemistry and enzyme-based technologies for safer applications. Packaging materials now integrate recyclable plastics and refill systems. End users in healthcare and food sectors prioritize low-VOC and fragrance-free products to maintain air quality. It promotes workplace safety while minimizing hazardous waste. The U.S. Industrial Cleaning Products Market continues evolving toward sustainable practices and eco-label certification. Product innovation reflects the transition to greener and performance-driven solutions.

- For instance, Diversey’s Oxivir cleaner and disinfectant range, certified and recognized by the EPA Safer Choice Program, break down into water and oxygen within 28 days according to published EPA biodegradability standards, and can kill enveloped viruses including Coronavirus within 30 seconds, confirmed in recent product performance literature and sustainability reports.

Technological Advancements in Cleaning Equipment and Product Formulations

Automation in cleaning operations supports efficient and consistent sanitation processes. Equipment with smart sensors monitors chemical concentration, reducing product wastage. Formulators integrate nanotechnology for improved cleaning performance and residue control. Distributors expand product lines featuring concentrated solutions for cost efficiency. IoT-enabled cleaning systems allow predictive maintenance scheduling in industrial plants. Technological progress enhances energy efficiency and reduces manual intervention. The U.S. Industrial Cleaning Products Market adapts to automation trends across large facilities. Continuous R&D investment ensures compatibility between cleaning solutions and advanced machinery systems.

Market Trends

Expansion of Contract Cleaning Services Across Industrial and Institutional Sectors

The rise in outsourcing cleaning services drives consistent product demand. Contract cleaners prefer bulk purchasing of disinfectants, floor cleaners, and surface care products. It creates stable revenue streams for manufacturers. Service providers expand across logistics hubs, hospitals, and manufacturing plants. Growth in multi-site contracts increases large-scale procurement opportunities. The U.S. Industrial Cleaning Products Market witnesses higher consumption due to expanded maintenance outsourcing. Chemical suppliers collaborate with cleaning firms to introduce tailored product kits. Sustainability-focused service contracts reinforce long-term market adoption and partnership models.

- For instance, Ecolab’s partnership with Marriott Vacations Worldwide resulted in annual savings of 23.4 million gallons of water, 1,400 metric tons of CO2e emissions, and 46,000 pounds of packaging waste reduced in 2024 through technologies such as 3D TRASAR™ and SMARTPOWER™. Their automated dispensing and closed packaging also delivered 9,100 hours of labor protection every year.

Adoption of Green Certifications and Environmentally Responsible Labeling

Organizations prioritize green-certified cleaning agents to meet sustainability targets and regulatory mandates. Certifications such as Green Seal and EPA Safer Choice guide institutional procurement policies. Manufacturers highlight eco-labels to attract environmentally conscious clients. End users evaluate lifecycle impact and biodegradability before adoption. It influences product development pipelines toward renewable and plant-derived ingredients. Growing customer preference for transparent labeling fosters competitive differentiation. The U.S. Industrial Cleaning Products Market adapts to certified product lines and compliant formulations. Eco-conscious initiatives strengthen credibility and drive industry-wide transformation.

Integration of Automation and Robotics in Industrial Cleaning Processes

Automation in cleaning operations enhances precision and efficiency across factories and warehouses. Robotic floor scrubbers and automated sprayers gain popularity among logistics and food industries. Integration with facility management systems enables scheduling optimization. It reduces human exposure to hazardous substances while improving sanitation consistency. Equipment manufacturers collaborate with chemical suppliers to develop compatible cleaning agents. Smart monitoring tools track consumption levels and chemical concentration. The U.S. Industrial Cleaning Products Market aligns with automation technologies that improve operational safety and productivity. The convergence of robotics and cleaning innovation redefines modern facility maintenance standards.

- For instance, Tennant Company’s T7AMR robotic floor scrubber was deployed in more than 1,200 stores in North America as of 2024, with product specifications confirming a cleaning productivity rate of up to 45,760 square feet per hour and operational sound levels as low as 70 dBA. Tennant has the largest installed population of autonomous floor scrubbers in North America.

Increased Demand for Specialty Cleaners for High-Risk Environments

Industries handling hazardous materials adopt specialty cleaning products to meet strict safety norms. These include solvent-free degreasers and corrosion inhibitors for equipment longevity. Growth in pharmaceuticals and biotechnology facilities expands demand for precision-grade cleaners. It ensures sterility in controlled environments. Manufacturers develop residue-free formulations to protect sensitive instruments. Adoption of such products strengthens compliance with industrial hygiene regulations. The U.S. Industrial Cleaning Products Market sees rising preference for task-specific cleaners across chemical and aerospace facilities. Continuous innovation addresses the complexity of cleaning requirements in advanced industries.

Market Challenges Analysis

Volatility in Raw Material Prices and Dependence on Petrochemical Inputs

Price fluctuations of raw materials such as surfactants, solvents, and packaging compounds affect production stability. Manufacturers face cost pressure when petrochemical inputs rise due to global supply disruptions. It impacts profit margins and pricing strategies in competitive markets. Dependence on petroleum-based derivatives also complicates sustainability transitions. The U.S. Industrial Cleaning Products Market must adapt to sourcing diversification and reformulation efforts. Producers explore bio-based raw materials but face higher initial costs and limited availability. Currency fluctuations and global trade conditions further influence raw material procurement. Maintaining consistent product quality while managing costs remains a critical challenge.

Regulatory Compliance Burden and Environmental Restrictions

Environmental regulations impose strict controls on chemical composition and emissions. Producers must comply with EPA, OSHA, and REACH frameworks governing chemical safety. Frequent regulatory updates demand costly reformulation and testing. It delays product launches and increases compliance expenditures. Manufacturers face penalties for exceeding permissible limits on volatile compounds. The U.S. Industrial Cleaning Products Market operates under close regulatory scrutiny, requiring transparency in labeling and safety documentation. Limited harmonization between state and federal standards complicates market navigation. Companies invest in sustainable R&D and training to align with evolving environmental mandates.

Market Opportunities

Emergence of Smart Cleaning Systems and Data-Driven Facility Management

Integration of IoT and sensor-based technologies enhances cleaning efficiency in industrial facilities. Automated systems track chemical usage and optimize inventory management. It supports cost-effective operations and real-time hygiene monitoring. Facilities integrate analytics to predict cleaning cycles and reduce waste. Manufacturers collaborate with tech companies to develop connected product ecosystems. The U.S. Industrial Cleaning Products Market benefits from digital transformation initiatives across factories and commercial spaces. The trend supports scalability for multi-location enterprises seeking data-backed performance control.

Rising Demand for Green Formulations and Circular Economy Initiatives

Growing environmental awareness encourages companies to launch refill stations and reusable packaging systems. Chemical producers explore closed-loop solutions to minimize waste generation. It promotes customer loyalty and long-term cost efficiency. Demand for biodegradable raw materials creates partnerships with bio-chemical suppliers. The U.S. Industrial Cleaning Products Market gains traction from policies supporting circular business models. Industry collaboration on waste recovery and low-emission production sets new growth avenues. Expansion of eco-certified products reinforces future market competitiveness.

Market Segmentation Analysis

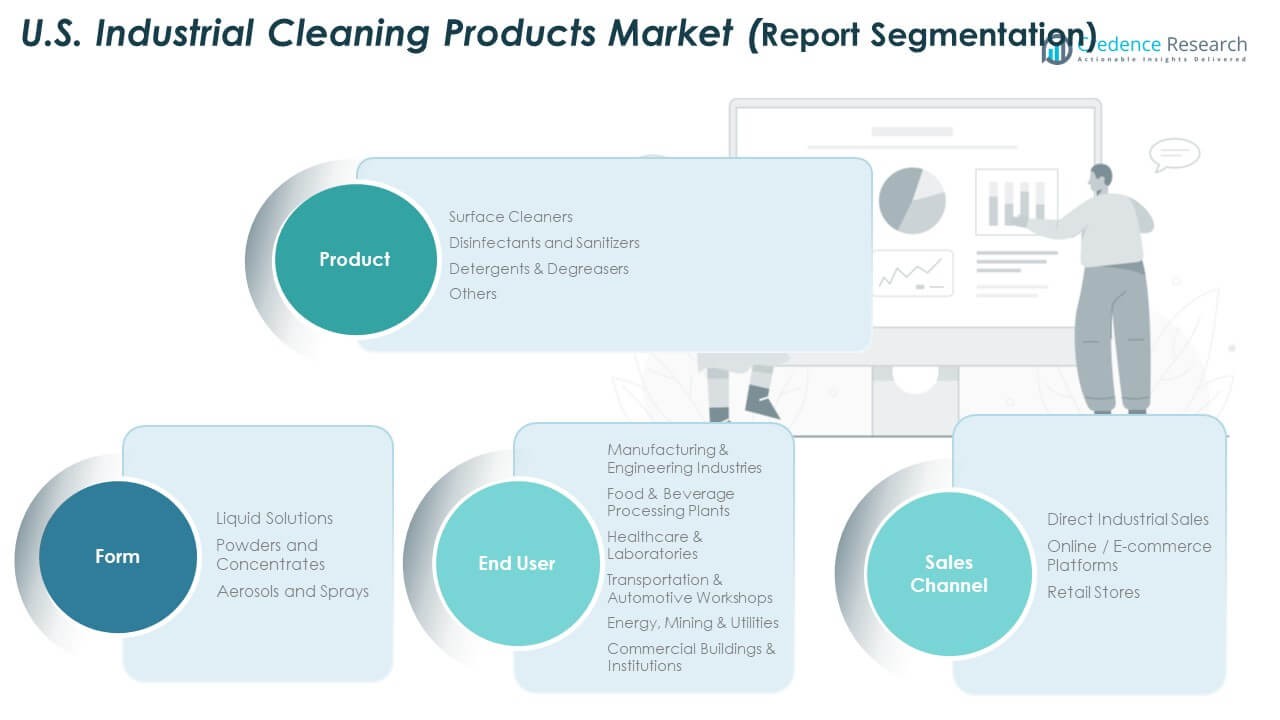

By Product Type

Surface cleaners hold a leading share in the U.S. Industrial Cleaning Products Market due to their extensive use across manufacturing and commercial facilities. Their effectiveness in removing grease, dust, and contaminants ensures compliance with hygiene standards. Disinfectants and sanitizers witness strong demand from healthcare, food processing, and institutional sectors where pathogen control is critical. Detergents and degreasers serve heavy industries and automotive workshops, offering efficient residue removal and machinery protection. The others category includes niche cleaning agents tailored for specialized applications such as laboratory equipment and sensitive instruments.

- For instance, Zep’s Heavy-Duty Citrus Degreaser is designed for industrial and commercial cleaning applications. According to its technical data sheet, the product can be diluted at ratios up to 2 ounces per gallon of water, allowing one gallon of concentrate to produce several dozen gallons of cleaning solution, depending on use requirements.

By Form

Liquid solutions dominate the market for their ease of application, high dilution flexibility, and suitability for automated cleaning systems. They support large-scale industrial use and precise dosing mechanisms. Powders and concentrates attract industrial buyers for their cost efficiency and extended shelf life. It reduces transportation costs and storage space. Aerosols and sprays register steady growth due to rising demand for ready-to-use surface cleaners and disinfectants in commercial spaces. The trend toward portability and convenience strengthens this form’s market presence.

- For instance, Diversey’s Oxivir Tb is available in wipe form, with EPA registration and label claims for 1-minute contact times against a broad spectrum of pathogens. The trend toward portability and convenience strengthens this form’s market presence.

By End User

Manufacturing and engineering industries remain primary consumers due to strict maintenance and safety norms. Food and beverage processing plants rely on advanced cleaners to meet sanitation and FDA compliance standards. Healthcare and laboratories demand sterile cleaning solutions to minimize contamination. Transportation and automotive workshops use degreasers for equipment upkeep. Energy, mining, and utility sectors depend on industrial-grade cleaners for machinery maintenance, while commercial buildings and institutions maintain steady demand for facility hygiene solutions.

By Sales Channel

Direct industrial sales lead the market, driven by long-term contracts with manufacturers and service providers. These channels enable bulk supply and customized chemical formulations. Online and e-commerce platforms grow rapidly through product accessibility and transparent pricing models. Retail stores maintain relevance through small-volume sales targeting local enterprises. The U.S. Industrial Cleaning Products Market benefits from a balanced distribution network that ensures steady product availability across industrial, institutional, and commercial segments.

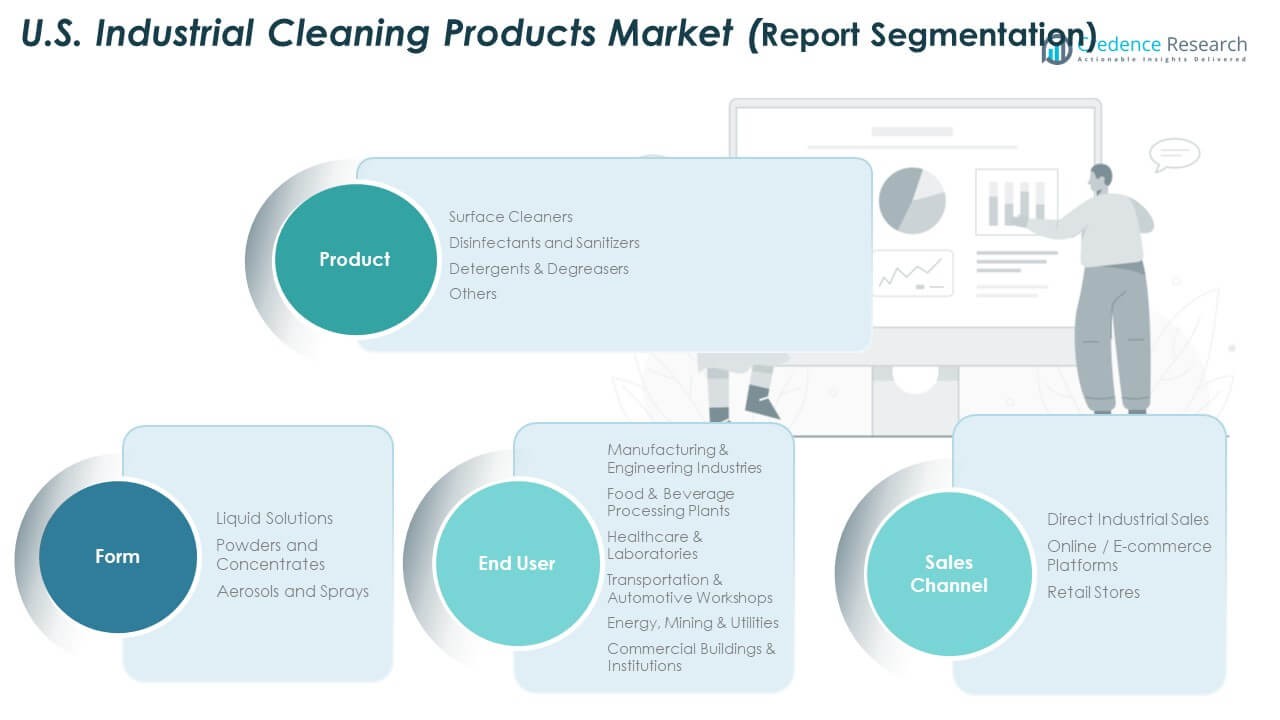

Segmentation

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

Regional Analysis

North and Midwest Regions – Dominant Industrial and Manufacturing Base

The North and Midwest regions hold the leading position in the U.S. Industrial Cleaning Products Market with a 38% market share. These regions account for a high concentration of manufacturing, automotive, and metalworking industries that demand industrial-grade cleaning solutions. The strong presence of major automotive plants and machinery facilities drives continuous consumption of surface cleaners, degreasers, and sanitizers. Industrial users emphasize regular maintenance to ensure compliance with environmental and safety standards. It benefits from advanced infrastructure and strong supply chain networks that support large-scale product distribution. Ongoing expansion in heavy industries and robust institutional cleaning requirements continue to strengthen the region’s leadership position.

Southern Region – Expanding Food, Energy, and Utility Sectors

The Southern region represents 33% of the market share, supported by its growing food processing, petrochemical, and energy industries. Rising demand from food and beverage manufacturing plants fuels adoption of disinfectants and biodegradable cleaning products. Industrial cleaning companies in the South also benefit from the region’s rapid infrastructure development and logistics hubs. It experiences growing investment from chemical manufacturers establishing local production facilities to meet regional demand. The energy and utility sectors generate stable demand for high-performance cleaners used in power plants and oil facilities. Expanding industrial diversity and strong regulatory oversight contribute to sustained growth across southern states.

Western and Northeastern Regions – Institutional and Commercial Growth Drivers

The Western region accounts for 18% of the market, driven by healthcare, hospitality, and technology-based manufacturing activities. Sustainability initiatives across California and neighboring states promote eco-friendly cleaning formulations and water-efficient solutions. The Northeastern region holds a 11% share, supported by a high concentration of institutional facilities, laboratories, and universities. Demand for advanced disinfectants and low-VOC products grows in densely populated metropolitan areas. It benefits from the adoption of green cleaning standards by corporate and public institutions. Combined, both regions contribute to steady nationwide demand and reinforce the country’s transition toward sustainable and technology-integrated industrial cleaning practices.

Key Player Analysis

- The Clorox Company

- Dow Inc

- Clariant AG

- Evonik Industries AG

- Solvay SA

- Stepan Company

- Ecolab Inc.

- 3M

- BASF SE

- Buckeye International, Inc.

- Other Key Players

Competitive Analysis

The U.S. Industrial Cleaning Products Market is highly competitive, characterized by the presence of global chemical companies and regional manufacturers offering specialized formulations. Leading players such as The Clorox Company, Ecolab Inc., Dow Inc., BASF SE, and 3M dominate the market through extensive product portfolios and nationwide distribution networks. These companies focus on innovation in sustainable and high-efficiency cleaning chemicals to meet growing environmental regulations. It also benefits from rising investment in research and development aimed at bio-based and non-toxic formulations. Strong branding, quality assurance, and customer loyalty programs strengthen their market positions across industrial and institutional segments. Mid-tier manufacturers such as Stepan Company, Solvay SA, Evonik Industries AG, Clariant AG, and Buckeye International, Inc. emphasize customized cleaning solutions and private-label production. Their flexibility in catering to industry-specific requirements supports their growth among niche industrial users. The market shows increasing merger and acquisition activity, enabling companies to expand product reach and improve technological expertise. It witnesses growing partnerships between chemical producers and equipment suppliers for integrated cleaning systems. Competitive strategies center around pricing efficiency, sustainability certification, and regulatory compliance.

Recent Developments

- In September 2025, CloroxPro introduced its new Screen+ Sanitizing Wipes, designed to clean and sanitize sensitive electronics in tech-focused workplaces and facilities. The product launch responds to increasing demand for specialized cleaning solutions for touchscreens, laptops, and other shared devices, supporting hygiene efforts in today’s digital environments.

- In May 2025, CloroxPro announced a new partnership agreement with Vizient to supply a broad range of cleaning and disinfecting products, expanding access to Clorox’s professional solutions in healthcare and institutional sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for workplace hygiene and safety standards will continue to drive industrial cleaning product adoption across manufacturing and institutional sectors.

- Increased investment in sustainable and biodegradable cleaning solutions will reshape production methods and packaging formats.

- Technological innovation in automated and sensor-based cleaning systems will enhance operational efficiency and reduce labor dependency.

- Expansion of the healthcare and food processing industries will boost consumption of disinfectants and sanitizers with advanced antimicrobial properties.

- Growing regulatory focus on chemical safety and emission control will encourage manufacturers to develop low-VOC and non-toxic products.

- Strategic collaborations between chemical producers and service contractors will expand the distribution reach and customization of cleaning solutions.

- The rise of e-commerce platforms will improve product accessibility for small and medium enterprises across industrial zones.

- Increasing automation and smart facility management systems will promote the integration of data-driven cleaning operations.

- Regional manufacturers will strengthen competitiveness by offering tailored formulations for heavy industries and commercial users.

- The U.S. Industrial Cleaning Products Market will experience steady transformation toward circular economy practices and energy-efficient production models.

Market Insights

Market Insights