Market Overview

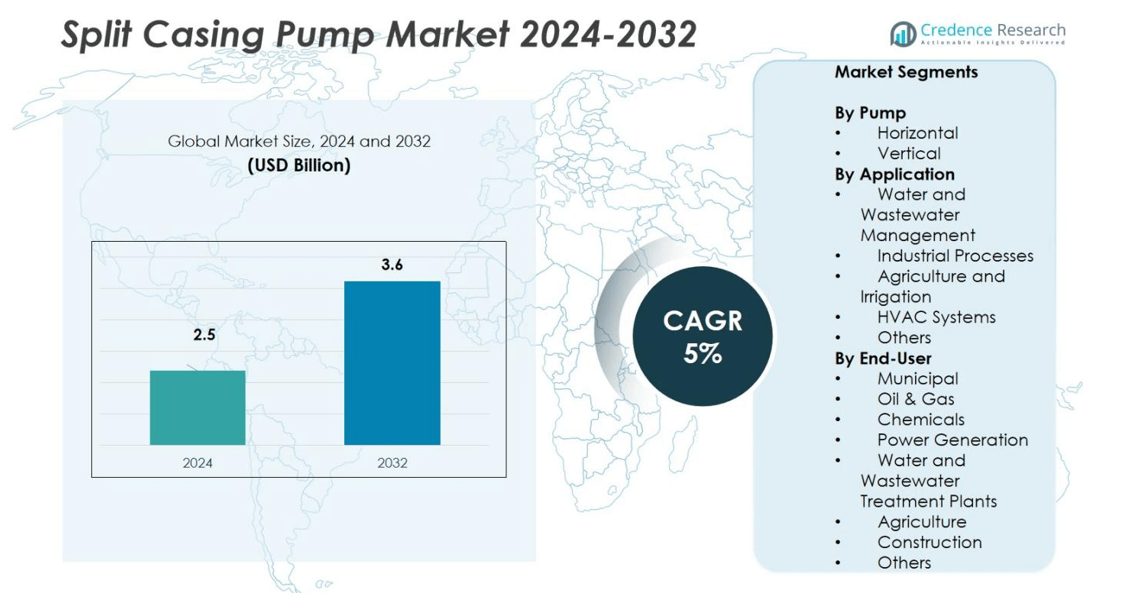

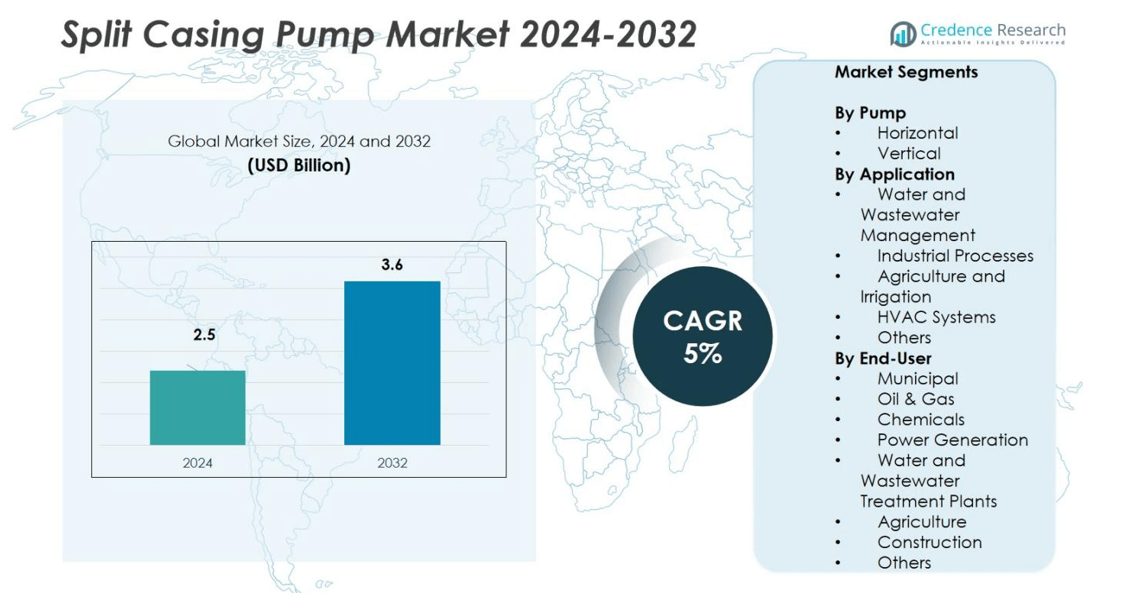

Split Casing Pump Market size was valued at USD 2.5 Billion in 2024 and is anticipated to reach USD 3.69 Billion by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Split Casing Pump Market Size 2024 |

USD 2.5 Billion |

| Split Casing Pump Market, CAGR |

5% |

| Split Casing Pump Market Size 2032 |

USD 3.69 Billion |

The Split Casing Pump Market is led by major players such as Xylem Inc., Ebara Corporation, Grundfos, Sulzer, Flowserve Corporation, KSB Group, Weir Group PLC, Wilo SE, ITT Inc., and Ruhrpumpen Group. These companies dominate through advanced product innovation, energy-efficient technologies, and strategic collaborations with municipal and industrial sectors. Their focus on developing high-performance, low-maintenance, and IoT-integrated pumps strengthens market competitiveness. Asia Pacific emerged as the leading regional market in 2024, holding a 36% share, driven by large-scale water infrastructure projects, rapid industrialization, and rising agricultural irrigation needs across China, India, and Southeast Asia.

Market Insights

- The Split Casing Pump Market was valued at USD 2.5 Billion in 2024 and is projected to reach USD 3.69 Billion by 2032, expanding at a CAGR of 5%.

- Increasing demand for efficient water and wastewater management systems, coupled with rapid industrialization and infrastructure expansion, drives strong adoption across municipal and industrial applications.

- The market is witnessing trends such as integration of IoT-based monitoring systems, energy-efficient pump designs, and sustainability-focused innovations to improve operational efficiency.

- Leading players, including Xylem Inc., Grundfos, Sulzer, and Ebara Corporation, compete through R&D investments, mergers, and digital service advancements to strengthen their global presence.

- Asia Pacific dominated the market with a 36% share in 2024, followed by North America at 27% and Europe at 22%, while the horizontal split casing segment held a commanding 62% share among pump types.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Pump

The horizontal split casing pump segment dominated the market with a 62% share in 2024, driven by its superior efficiency and ease of maintenance. These pumps are widely used for large-scale water transfer and industrial fluid handling due to their double-suction impeller design that minimizes axial thrust and vibration. The vertical split casing pumps, accounting for 38% share, find growing adoption in limited-space environments such as high-rise buildings and offshore platforms. Rising infrastructure projects and municipal water distribution networks continue to strengthen the demand for horizontal configurations globally.

- For instance, Kirloskar Brothers Limited’s DSM series horizontal split case pumps achieve efficiencies exceeding 90% by employing a double-stage design and thru bore manufacturing approach, which also minimizes vibration and improves reliability.

By Application

The water and wastewater management segment led the market with a 41% share in 2024, fueled by expanding urban infrastructure and rising global water treatment needs. Split casing pumps deliver high flow rates and reliability, making them ideal for large-scale municipal and industrial water systems. Industrial processes held a 27% share, supported by chemical, power, and manufacturing industries. Agriculture and irrigation applications captured 15%, driven by the need for efficient water distribution. HVAC systems and other smaller sectors collectively represented 17%, supported by building efficiency initiatives.

- For instance, ANDRITZ split case pumps are widely used in water treatment plants to efficiently handle water supply, desalination, and distribution tasks, ensuring reliable operations in municipal systems.

By End-User

Municipal utilities dominated the market with a 36% share in 2024, driven by government investments in water supply and wastewater treatment infrastructure. These end users rely on split casing pumps for continuous, high-volume operations ensuring low maintenance and long service life. The power generation segment held 18% share, benefiting from the need for cooling water circulation systems. Oil & gas and chemical industries together accounted for 23%, emphasizing reliability under high-pressure operations. Agriculture, construction, and other sectors made up the remaining 23%, supported by increasing irrigation and infrastructure projects.

Key Growth Drivers

Rising Demand for Efficient Water Management Systems

The growing need for efficient water distribution and wastewater management systems significantly drives the Split Casing Pump Market. Governments worldwide are investing in infrastructure projects to ensure reliable water supply and sewage treatment. These pumps provide high flow rates, reduced maintenance, and operational efficiency, making them ideal for municipal applications. Increasing urbanization and industrial expansion continue to raise water consumption levels, reinforcing demand for energy-efficient and durable pumping solutions in both developed and emerging economies.

- For instance, Shakti Pumps received a letter of empanelment to deploy 34,720 solar water pumping systems across Maharashtra, valued at over ₹1,037 crore, supporting sustainable irrigation and reducing dependence on grid electricity and diesel-powered pumps

Expansion of Industrial and Power Generation Sectors

Industrialization and the increasing number of power plants are major contributors to market growth. Split casing pumps are preferred in power generation for cooling water circulation and condensate extraction due to their high efficiency and longevity. The chemical, oil & gas, and manufacturing sectors also rely heavily on these pumps for fluid transfer operations. Growing energy demand and industrial output, particularly in Asia-Pacific and the Middle East, continue to enhance the adoption of split casing pumps across large-scale facilities.

- For instance, ANDRITZ’s ASP series split case pumps achieve efficiencies above 90% and are widely used for circulation water in power stations and district heating networks.

Agricultural Irrigation and Infrastructure Development

The expansion of irrigation systems and rural water supply projects fuels market demand. Split casing pumps deliver high discharge capacity, supporting large-scale agricultural operations and flood control systems. Developing countries are increasingly investing in modern irrigation infrastructure to enhance food production efficiency. Furthermore, the integration of renewable-powered pump systems enhances sustainability. These factors, coupled with public-private partnerships for water and irrigation projects, continue to create strong growth momentum for split casing pumps in agriculture and rural development applications.

Key Trends & Opportunities

Shift Toward Energy-Efficient and Smart Pumping Solutions

Manufacturers are focusing on energy-efficient designs and smart monitoring technologies to improve performance and reduce lifecycle costs. The integration of IoT-enabled sensors and variable frequency drives (VFDs) enables real-time monitoring, predictive maintenance, and optimized energy usage. This trend aligns with global sustainability initiatives aimed at reducing carbon footprints. As end users prioritize operational efficiency and automation, demand for intelligent and eco-friendly split casing pumps continues to grow, particularly in the utilities and industrial segments.

- For instance, Xylem Inc. utilizes advanced digital controls and data analytics in its high-pressure pumps to support real-time system optimization and sustainability goals in municipal and industrial applications.

Rising Investments in Water Infrastructure Modernization

A surge in infrastructure modernization projects presents new growth opportunities. Ageing municipal and industrial water systems in regions such as North America and Europe are being upgraded with advanced pumping equipment. Governments and private entities are allocating substantial budgets for improving pipeline networks, wastewater treatment, and flood control infrastructure. Split casing pumps, with their high reliability and adaptability, are being adopted as a core component in these modernization programs, driving sustained market expansion over the coming years.

- For instance, Kirloskar Brothers Limited offers the i-HT axially split case centrifugal pumps, capable of delivering up to 1300 m³/hr capacity and 250 meters head, widely used for industrial water supply, desalination, and wastewater treatment due to their high efficiency and low downtime design.

Key Challenges

High Initial and Maintenance Costs

Despite operational efficiency, split casing pumps involve high initial investment and maintenance costs. Their complex design and large size require skilled installation and regular servicing, leading to higher operational expenses. Small and medium enterprises often prefer lower-cost alternatives, limiting market penetration in cost-sensitive sectors. Additionally, the replacement of spare parts and periodic alignment checks add to the lifecycle cost. These factors collectively act as barriers for widespread adoption in developing economies where budget constraints are common.

Competition from Alternative Pump Technologies

The growing presence of end-suction, multistage, and vertical turbine pumps poses a significant challenge to market expansion. These alternatives often offer lower installation costs and simpler maintenance procedures, appealing to industrial users with moderate flow requirements. Continuous technological advancements in compact pump designs have improved the performance of competing models. As industries seek flexible and space-saving solutions, split casing pumps must innovate further to maintain their advantage in high-capacity and long-duration operations across sectors.

Regional Analysis

North America

North America held a 27% market share in 2024, driven by strong demand from municipal water utilities and industrial sectors. The United States leads the region, supported by ongoing investments in water infrastructure modernization and wastewater treatment facilities. Increasing energy generation activities and oil & gas operations further enhance adoption. Manufacturers focus on energy-efficient and smart pumping solutions to comply with stringent environmental regulations. Canada’s emphasis on sustainable water management and the replacement of aging equipment also supports market expansion across municipal and agricultural sectors.

Europe

Europe accounted for a 22% market share in 2024, propelled by initiatives toward energy efficiency and infrastructure renewal. Countries such as Germany, the U.K., and France lead adoption due to advanced industrial bases and stringent water management standards. The region’s emphasis on renewable energy integration in pumping systems supports product innovation. Split casing pumps are widely used in municipal, chemical, and power generation applications. The European Union’s focus on reducing carbon emissions and improving water resource sustainability continues to encourage investments in modern, low-maintenance pumping technologies.

Asia Pacific

Asia Pacific dominated the Split Casing Pump Market with a 36% share in 2024, supported by rapid urbanization, industrialization, and agricultural expansion. China and India lead the regional demand due to government-funded projects in water supply, irrigation, and energy generation. Growing construction and manufacturing activities increase the need for high-capacity pumping solutions. The expansion of desalination plants and industrial wastewater treatment facilities also contributes to growth. Technological advancements and local production capabilities are strengthening the competitive landscape across emerging economies in the region.

Latin America

Latin America captured a 9% share in 2024, with market growth supported by expanding municipal water projects and agricultural irrigation systems. Brazil and Mexico represent the key markets, focusing on improving water distribution and wastewater treatment infrastructure. Industrial activities in mining, oil & gas, and construction sectors further stimulate demand for robust split casing pumps. Governments are promoting partnerships with international suppliers to enhance operational efficiency and service quality. The increasing adoption of modern irrigation technologies in rural areas is also contributing to regional market growth.

Middle East & Africa

The Middle East & Africa region held a 6% market share in 2024, primarily driven by the oil & gas and desalination industries. Countries like Saudi Arabia, the UAE, and South Africa are investing heavily in large-scale water treatment and energy projects. The arid climate across the Middle East has led to high demand for efficient water transfer and pumping systems. Africa’s urban development and power generation expansion also provide new growth opportunities. Strategic investments in sustainable infrastructure are expected to strengthen the regional market outlook through 2032.

Market Segmentations:

By Pump

By Application

- Water and Wastewater Management

- Industrial Processes

- Agriculture and Irrigation

- HVAC Systems

- Others

By End-User

- Municipal

- Oil & Gas

- Chemicals

- Power Generation

- Water and Wastewater Treatment Plants

- Agriculture

- Construction

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Split Casing Pump Market features major players such as Xylem Inc., Ebara Corporation, KSB Group, Weir Group PLC, Grundfos, Sulzer, Flowserve Corporation, Wilo SE, ITT Inc., and Ruhrpumpen Group. These companies focus on expanding their global presence through product innovation, strategic mergers, and advanced energy-efficient designs. The market is characterized by intense competition, with leading players investing heavily in research and development to enhance performance, reduce maintenance costs, and improve energy efficiency. Manufacturers are also integrating digital monitoring technologies and IoT-based predictive maintenance systems to optimize operational reliability. Partnerships with municipal bodies and industrial clients strengthen their regional footprint. Additionally, sustainability initiatives and compliance with environmental regulations are key strategic priorities shaping product development and differentiation in this competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Tencarva Machinery Company completed the acquisition of Detroit Pump & Mfg. Co., strengthening its pump distribution and service capabilities across North America.

- In September 2025, Pentair plc acquired Hydra-Stop, enhancing its water infrastructure solutions and supporting growth in the pump and fluid management segment.

- On January 30, 2024, Grundfos introduced its new SP 6-inch hydraulic pump, designed to enhance energy efficiency, hydraulic performance, and remote monitoring capabilities.

- In January 2023, Kirloskar Brothers Limited launched the KW-LC series of pumps aimed at the HVAC segment. This new product series offers efficient performance and reliable operation in HVAC fluid circulation and temperature control.

Report Coverage

The research report offers an in-depth analysis based on Pump, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and smart pumping solutions will continue to grow across industries.

- Municipal water and wastewater projects will remain key revenue drivers globally.

- Asia Pacific will maintain leadership due to rapid urbanization and industrial expansion.

- Integration of IoT and predictive maintenance systems will enhance pump reliability.

- Manufacturers will focus on developing corrosion-resistant and low-maintenance pump materials.

- Increasing investments in power generation and desalination plants will boost market growth.

- Replacement of aging water infrastructure in developed regions will create steady opportunities.

- Adoption of renewable-powered pumping systems will support sustainability goals.

- Strategic collaborations between global and regional players will improve market competitiveness.

- Rising demand from agriculture and construction sectors will strengthen long-term growth prospects.