Market Overview

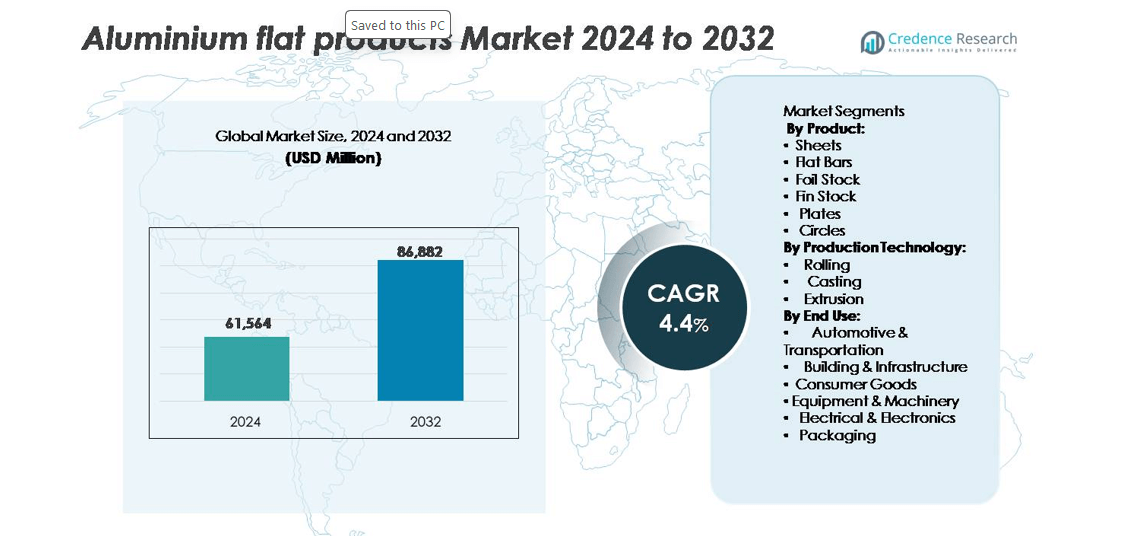

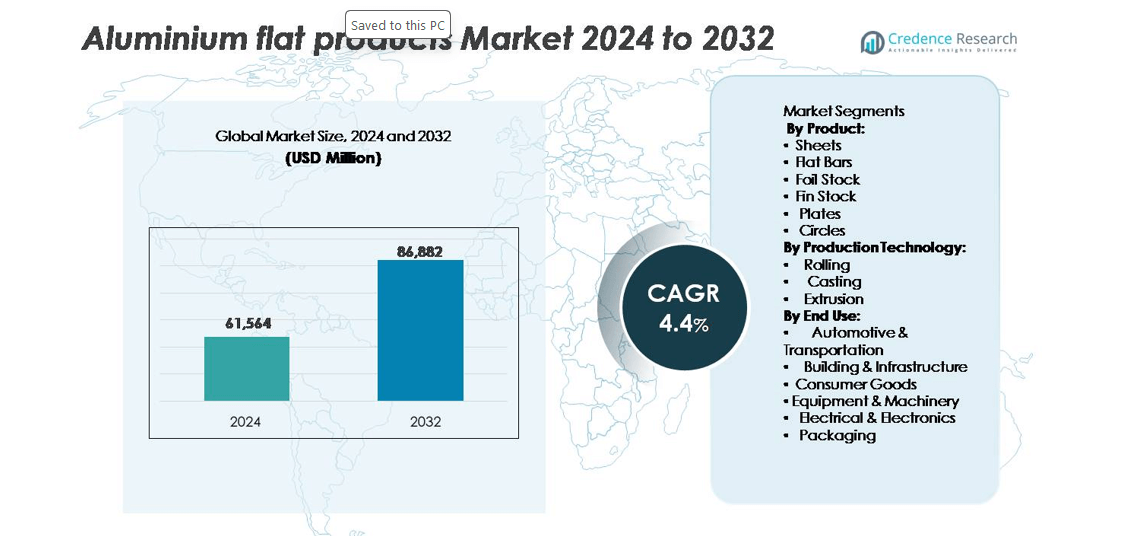

The Aluminium Flat Products Market was valued at USD 61,564 million in 2024 and is projected to reach USD 86,882 million by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminium Flat Products Market Size 2024 |

USD 61,564 million |

| Aluminium Flat Products Market, CAGR |

4.4% |

| Aluminium Flat Products Market Size 2032 |

USD 86,882 million |

In the global aluminium flat products market, key players such as Alcoa Corporation, Novelis, Hindalco Industries Limited, Norsk Hydro and Arconic dominate the landscape through integrated production across sheets, plates and foil‑stock, strong value‑added product offerings and global manufacturing footprints. The Asia‑Pacific region leads the market with around 65 % share, driven by rapid industrialisation and infrastructure demand. Europe and North America each account for roughly 15 % and 14 %, respectively, supported by automotive lightweighting and premium construction use. These firms maintain competitive advantage via scale technology investments and regional reach.

Market Insights

- The global aluminium flat products market registered a value of approximately USD 61,564 million in 2024 and is expected to reach USD 86,882 million by 2032 at a CAGR of 4.4%.

- Lightweighting in automotive and transportation drives demand, as manufacturers increasingly adopt aluminium flat products to achieve fuel efficiency and reduce emissions.

- Material sustainability and recyclability emerge as key trends; manufacturers leverage recycled aluminium and eco‑friendly production to cater to packaging, construction and consumer goods segments.

- Competitive intensity and raw material price volatility restrain growth; major players face margin pressure and emerging manufacturers create regional fragmentation.

- Regionally, Asia‑Pacific commands the largest share (roughly 65 %), supported by infrastructure expansion and industrial production, while Europe and North America contribute about 15 % and 14 % respectively, with demand rooted in automotive and advanced manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

Product Segment Insights

Sheets hold the dominant share in the aluminium flat products market due to their versatility and extensive use in automotive, construction, and packaging applications. Their lightweight, corrosion-resistant, and formable properties drive high adoption rates. Flat bars and plates follow, primarily used in industrial machinery and structural applications. Foil stock and fin stock are increasingly applied in heat exchangers and packaging solutions, benefiting from technological improvements in thin-gauge production. Circles cater to niche applications in aerospace and precision engineering. The growth of sheets and plates is fueled by rising infrastructure projects and demand for lightweight materials in transportation.

- For instance, Novelis’ facility in Pindamonhangaba is designed to produce approximately 680 kilotonnes per year of aluminium sheet, demonstrating high-volume capability.

Production Technology Insights

Rolling is the leading production technology, capturing the largest market share by enabling high-volume manufacturing of sheets, plates, and foil stock with uniform thickness and surface quality. Casting is primarily used for plates and specialized flat products in industrial and machinery sectors, offering dimensional precision and structural strength. Extrusion supports the production of complex profiles and flat bars for construction and automotive applications. The adoption of rolling and extrusion technologies is further boosted by industry efforts to improve energy efficiency, reduce production costs, and meet increasing demand for lightweight, high-strength aluminium products.

- For instance, Novelis Inc. upgraded its Oswego, New York plant to add 124,000 metric tons of hot-mill capacity.

End-Use Segment Insights

Automotive & transportation dominates the end-use segment, driven by the push for fuel efficiency and lightweight vehicle components. Building & infrastructure follows, with demand for durable, corrosion-resistant aluminium in construction projects. Consumer goods and equipment & machinery benefit from aluminium’s strength-to-weight ratio, supporting products like appliances and industrial components. Electrical & electronics applications leverage aluminium for thermal management and conductivity, while packaging increasingly adopts aluminium foil and sheets for sustainable, recyclable solutions. The overall market expansion is reinforced by rising infrastructure development, automotive electrification, and the need for eco-friendly, lightweight materials across industries.

Key Growth Drivers

Rising Demand in Automotive & Transportation

The aluminium flat products market is strongly driven by growing adoption in the automotive and transportation sectors. Manufacturers are increasingly using lightweight aluminium sheets, plates, and bars to improve fuel efficiency, reduce emissions, and meet stricter environmental regulations. For instance, aluminium-intensive vehicles reduce weight by 15–20%, enhancing performance and lowering carbon output. Rising production of electric vehicles further fuels demand for high-strength aluminium components such as battery enclosures and body panels. Expansion of global automotive production, coupled with consumer preference for sustainable vehicles, continues to boost the market. The trend also extends to aerospace and rail transport, where aluminium flat products replace heavier materials, improving energy efficiency and operational performance. Increasing investments in lightweight transportation solutions create long-term growth potential for aluminium flat products globally.

- For instance, Novelis Inc. supplies automotive-grade aluminium sheets to carmakers with a recycled content of up to 85 % for outer skin panels and forming-critical applications.

Growth in Building & Infrastructure Projects

Urbanization and large-scale infrastructure development are significant drivers for aluminium flat products. Aluminium sheets, plates, and extruded bars are widely used in roofing, facades, curtain walls, and structural frameworks due to their corrosion resistance, durability, and aesthetic appeal. Rapid construction in emerging economies, coupled with government initiatives to modernize urban infrastructure, fuels demand. For example, aluminium panels in high-rise buildings enhance fire resistance and reduce maintenance costs. Sustainability trends encourage the use of recyclable aluminium, further boosting adoption in green construction. Continuous investments in public infrastructure, including transportation hubs, commercial complexes, and smart cities, strengthen the market outlook. As aluminium provides a lightweight, strong, and energy-efficient alternative to steel and concrete, its penetration in construction applications is expected to expand steadily.

- For instance, Norsk Hydro’s building systems unit uses approximately 80,000 tonnes of aluminium annually to manufacture façades and windows, demonstrating substantial application in large-scale construction.

Technological Advancements in Production

Technological innovations in rolling, casting, and extrusion processes significantly drive the aluminium flat products market. Modern rolling mills enable the production of ultra-thin, high-strength sheets and foils with improved surface finish and uniformity, while precision casting supports large plates and specialized profiles for industrial machinery. Advanced extrusion techniques allow the creation of complex bars and flat products tailored for automotive and building applications. Automation, digital monitoring, and energy-efficient technologies enhance production speed and reduce scrap rates. For instance, continuous casting combined with hot rolling achieves higher dimensional accuracy and surface quality. These technological developments improve product performance, reduce manufacturing costs, and meet evolving end-user requirements. As industries demand high-quality, lightweight aluminium solutions, ongoing innovation in production technology remains a crucial growth driver.

Key Trends & Opportunities

Sustainability and Recyclability Focus

The aluminium flat products market is increasingly shaped by sustainability and environmental consciousness. Companies are adopting closed-loop recycling processes to produce secondary aluminium with lower energy consumption and carbon emissions. Aluminium’s recyclability offers significant opportunities in automotive, packaging, and construction industries. For instance, recycled aluminium sheets maintain up to 95% of their original properties, making them highly suitable for structural applications. Consumer preference for eco-friendly and lightweight products accelerates adoption across industries. Additionally, government regulations promoting green building materials and circular economy initiatives create new market opportunities. Manufacturers leveraging sustainable aluminium production and marketing eco-friendly products are expected to gain competitive advantage and capture growing demand in environmentally conscious markets.

- For instance, Novelis opened its Ulsan Recycling Center with an annual capacity of 100 000 tonnes of low-carbon sheet ingot, supporting accelerated recycling efforts.

Electrification and Lightweighting in Transportation

Increasing global emphasis on electric vehicles (EVs) and lightweighting provides significant opportunities for aluminium flat products. EV manufacturers require aluminium sheets, plates, and foils for battery casings, chassis, and body panels to reduce overall vehicle weight, improve energy efficiency, and extend driving range. For instance, replacing steel components with aluminium can reduce vehicle weight by up to 25%, enhancing EV performance. Rising EV production in regions like Europe, China, and North America is expected to increase consumption of aluminium flat products. Opportunities also extend to public transportation and railways, where lightweight aluminium components improve fuel efficiency and reduce operational costs. The trend toward sustainable, high-performance mobility ensures continued growth potential in aluminium flat products.

- For instance, Novelis developed a second-generation aluminium sheet battery enclosure for electric vehicles featuring frame mass efficiency of below 1.0 kg/kWh and a mass reduction exceeding 20 kg versus conventional aluminium enclosures.

Integration in Advanced Manufacturing Applications

The adoption of aluminium flat products in advanced manufacturing, including aerospace, electronics, and precision equipment, presents emerging opportunities. High-strength aluminium sheets and extrusions are used in aerospace for fuselage panels, wing structures, and heat-resistant components. In electronics, aluminium foils and sheets facilitate heat dissipation in devices such as smartphones, laptops, and LED lighting. Advanced machinery sectors increasingly prefer aluminium flat bars and plates for lightweight frames, tooling, and structural components. Innovations in surface coatings and alloy compositions enhance performance, corrosion resistance, and thermal management. These trends indicate rising demand for specialized, high-performance aluminium products beyond conventional applications, offering new growth avenues for manufacturers capable of delivering technologically advanced solutions.

Key Challenges

Volatility in Aluminium Prices

Fluctuating global aluminium prices pose a significant challenge to the flat products market. Prices are influenced by raw material availability, energy costs, geopolitical tensions, and trade policies, affecting manufacturing costs and profit margins. For instance, rising bauxite and alumina costs directly increase the production expense for sheets, plates, and bars. Market participants face difficulty in maintaining stable pricing for end-users, especially in cost-sensitive sectors like construction and packaging. Price volatility may also impact investment decisions and long-term contracts, creating uncertainty in supply chains. Manufacturers must adopt cost optimization strategies and supply chain hedging to mitigate the effects of aluminium price fluctuations on market growth.

Intense Competition and Supply Chain Constraints

The aluminium flat products market is highly competitive, with major players striving for technological advancements, product differentiation, and regional expansion. Intense competition limits pricing flexibility and increases the pressure on profit margins. Additionally, supply chain constraints, including transportation bottlenecks, limited raw material availability, and import-export restrictions, affect timely delivery and operational efficiency. For instance, disruptions in bauxite supply or delays in rolling and extrusion facilities can impact production schedules. Manufacturers must invest in strategic sourcing, regional production facilities, and inventory management to address these challenges while maintaining quality standards. Effective supply chain management is crucial to sustain market competitiveness and growth.

Regional Analysis

Asia‑Pacific

The Asia‑Pacific region leads the global aluminium flat products market with an estimated share of about 68.5% in 2024. Rapid industrialisation, expanding automotive and electronics manufacturing, and major infrastructure investment drive demand. China dominates regional output due to abundant raw materials and strong downstream processing capacity. Urbanisation and lightweight material adoption in key end‑use sectors support further growth in this region.

North America

North America holds a significant share and is projected to grow faster than many peers. Its growth is driven by the automotive & transportation sector’s shift to aluminium for lightweight vehicles, as well as aerospace, packaging and electronics applications. Reshoring of manufacturing, regulatory push for fuel efficiency, and advanced production technologies strengthen regional demand for aluminium flat products.

Europe

Europe maintains a mature but steady share of the aluminium flat products market, with growth underpinned by environmental regulations, lightweight vehicle mandates, and high‑end infrastructure projects. The region’s emphasis on sustainability and recycling supports aluminium adoption in construction, automotive, and packaging. Germany and the UK serve as key markets due to strong automotive, aerospace and industrial ecosystems.

Rest of the World (RoW – Middle East, Africa, Latin America)

The Rest of the World region accounts for the remaining market share, driven by infrastructure expansion, resource‐rich countries entering aluminium production, and increasing import of flat products. While individual share data are limited, growth opportunities exist in Latin America and the Middle East due to new rolling mills and government industrialisation efforts. The region remains more volatile than Asia‑Pacific, North America or Europe, with growth tied to commodity prices and local investment.

Market Segmentations:

By Product:

- Sheets

- Flat Bars

- Foil Stock

- Fin Stock

- Plates

- Circles

By Production Technology:

- Rolling

- Casting

- Extrusion

By End Use:

- Automotive & Transportation

- Building & Infrastructure

- Consumer Goods

- Equipment & Machinery

- Electrical & Electronics

- Packaging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the global aluminium flat‑products market, competition centers around a handful of large, integrated aluminium producers that dominate the landscape. For example, Alcoa Corporation, Arconic, Novelis, Constellium and Hindalco Industries Limited hold significant share, thanks to their expansive production capabilities, global footprint and strong R&D investment.

These firms focus heavily on advanced alloys and value‑added flat products—such as high‑strength sheets for automotive and aerospace uses—and they use alliances, acquisitions and capacity expansions to maintain edge. For example, many are expanding rolling mill capacity or introducing lower‑carbon aluminium lines to align with sustainability trends.

Smaller regional players still compete on niche products, cost leadership or service flexibility, but the market’s structure gives advantage to the large integrated players who can scale, absorb raw‑material costs and meet rigorous customer specifications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hindalco Industries Limited

- Arconic

- JW Aluminum

- Norsk Hydro

- Alcoa Corporation

- Maharashtra Metal

- Constellium

- National Aluminum Company Limited (NALCO)

- Aleris Corporation

- Elvalhalcor Hellenic Copper and Aluminum Industry S.A

Recent Developments

- In September 2024, With the combination of new HPDC and balcony assembly line technologies, this plant is a significant addition to the aluminum extrusion industry. As experts in the field, Alumex promises this new facility will demonstrate embroidery of quality, innovative ideas, and environmental concern embroidery over the new age of efficiency and innovation in the transforming industry’s market needs.

- In July 2022, Hydro is extending the subscription period for proposed acquisition of Alumetal S.A.

- In May 2022, Novelis’ First Green Bond Report Highlights $140 Million Allocated to Increase Recycling Capacity, Reduce Usage of Primary Aluminum.

Report Coverage

The research report offers an in-depth analysis based on Product, Production technology, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with rising demand from automotive and construction sectors.

- Manufacturers will focus on developing lightweight and high-strength aluminium alloys.

- Recycling and sustainable production practices will become key strategic priorities.

- Technological advancements in rolling and extrusion will enhance production efficiency.

- Electric vehicle adoption will drive new opportunities for aluminium sheet and plate applications.

- Asia-Pacific will remain the dominant region due to industrial and infrastructure growth.

- North America and Europe will see steady growth supported by green manufacturing initiatives.

- Strategic mergers and capacity expansions will strengthen the position of major producers.

- Price volatility and raw material availability will influence profitability across regions.

- Demand for customized and high-performance flat products will grow across industrial applications.