Market Overview

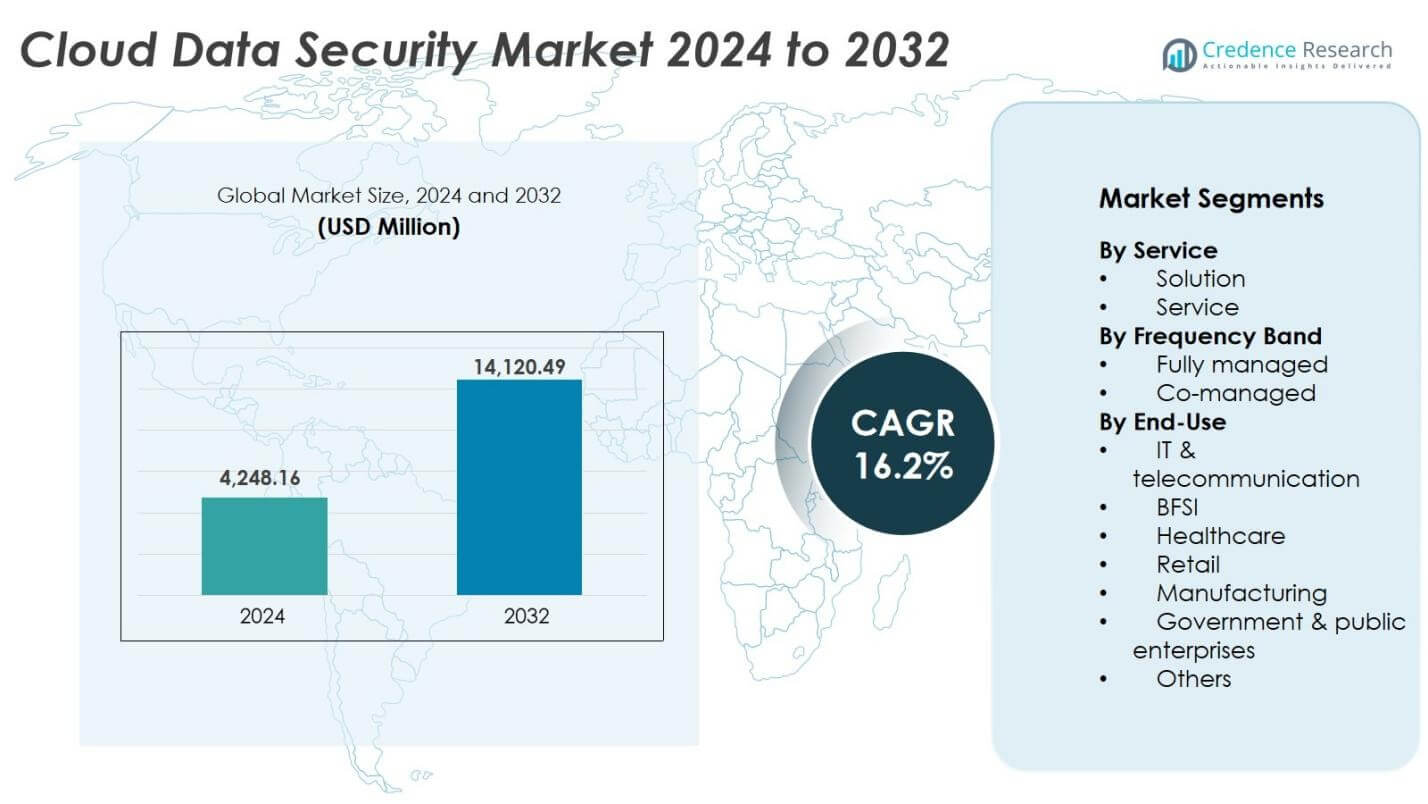

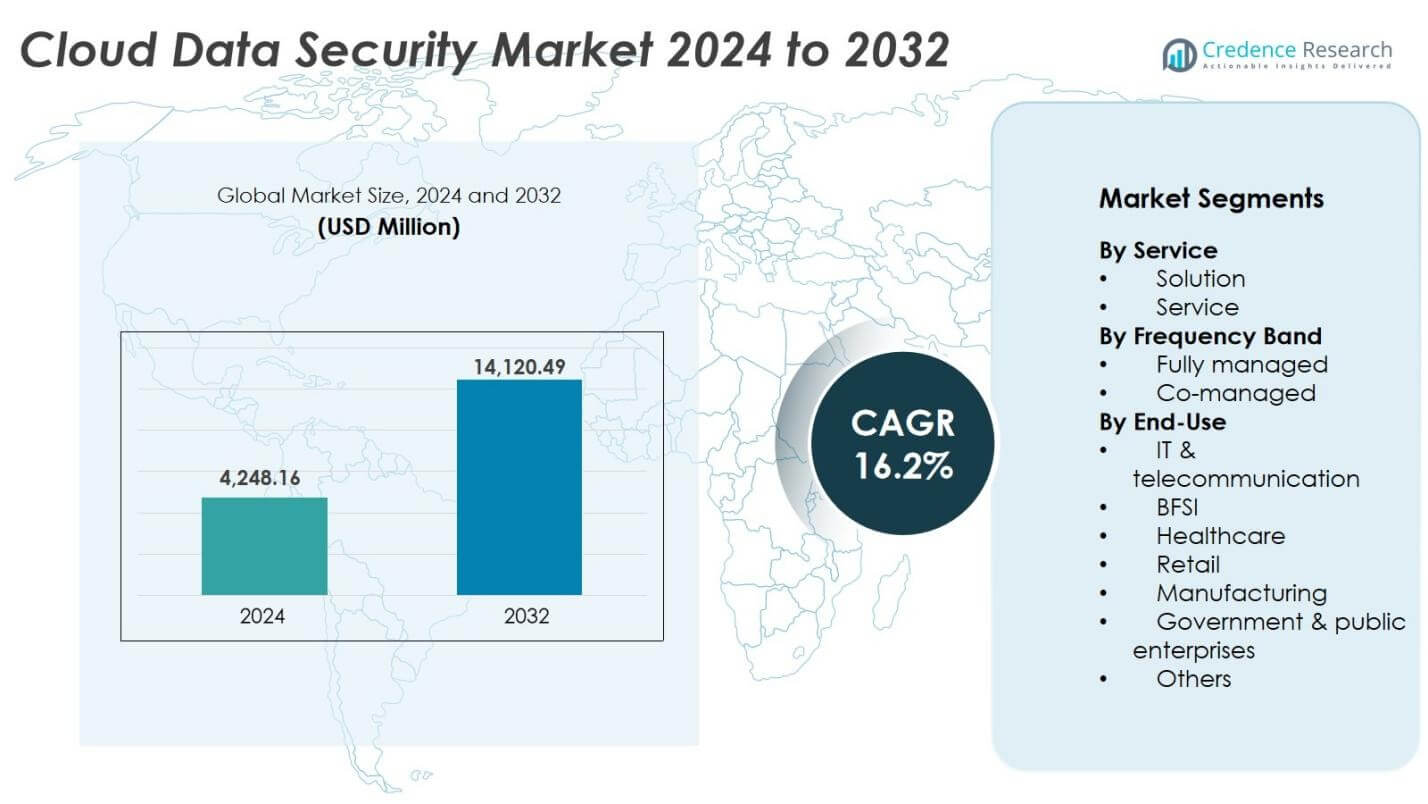

Cloud data security market size was valued USD 4,248.16 million in 2024 and is anticipated to reach USD 14,120.49 million by 2032, at a CAGR of 16.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Data Security Market Size 2024 |

USD 4,248.16 million |

| Cloud Data Security Market, CAGR |

16.2% |

| Cloud Data Security Market Size 2032 |

USD 14,120.49 million |

Top players in the cloud data security market include Microsoft Corporation, Amazon Web Services, Cisco Systems, IBM Corporation, Check Point Software Technologies, Fortinet, Palo Alto Networks, Imperva, Commvault, and Orca Security. These vendors offer encryption, identity management, workload protection, and automated compliance monitoring for multi-cloud environments. North America remains the leading region with a 38% market share in 2024, driven by advanced cloud adoption, high cybersecurity spending, and strict regulatory compliance in BFSI, healthcare, and government sectors. Europe and Asia-Pacific follow, supported by growing digital transformation and increased investment in cloud governance and threat prevention.

Market Insights

- The cloud data security market was valued at USD 4,248.16 million in 2024 and is projected to reach USD 14,120.49 million by 2032, registering a CAGR of 16.2%.

- Demand continues to rise as enterprises migrate to public and hybrid cloud platforms and require encryption, identity access management, and automated compliance to protect sensitive workloads.

- AI-driven threat detection, zero-trust architecture, and cloud security posture management are key trends, with vendors focusing on real-time monitoring, tokenization, agentless scanning, and multi-cloud visibility.

- The market remains competitive, with Microsoft, AWS, Cisco, IBM, Palo Alto Networks, and Fortinet offering integrated security suites, while startups such as Orca Security and Polar Security gain adoption with specialized agentless solutions. High deployment costs and a shortage of cybersecurity talent act as restraints for small enterprises.

- North America leads with a 38% share, followed by Europe at 26% and Asia-Pacific at 23%. On the service side, solutions dominate due to strong demand for encryption, DLP, and compliance automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

Solutions held the largest share of 63% in the Cloud Data Security Market in 2024, driven by rising demand for encryption, data loss prevention, and compliance automation. Organizations are adopting AI-enabled threat detection and zero-trust architectures to counter ransomware, insider breaches, and cloud misconfigurations. Enterprises prefer integrated platforms that support multi-cloud workloads with real-time monitoring. The adoption of data classification and tokenization tools has grown as regulatory frameworks tighten globally. Service offerings such as consulting, deployment, and managed security continue to expand, but solutions remain dominant due to heavy investments in automation and advanced analytics.

- For instance, Microsoft introduced AI-powered encryption and data loss prevention features within its Microsoft Purview platform, enhancing real-time threat detection and regulatory compliance for cloud data workloads.

By Frequency Band

Fully managed services accounted for a 58% share in 2024 as enterprises increasingly outsource complex cloud security operations to external providers. Managed offerings deliver 24/7 threat monitoring, incident response, and compliance management while easing internal resource burdens. The shortage of cybersecurity professionals and the rising sophistication of attacks further encourage outsourcing. Co-managed services gained a 27% share as large firms maintain partial control over policies while using expert assistance. Fully managed services dominate due to faster deployment, reduced overhead costs, and improved compliance across multi-cloud environments.

- For instance, IBM’s co-managed security solutions enable enterprises to share responsibility by combining internal security teams with IBM’s advanced threat management and incident response capabilities, improving security posture while maintaining policy control.

By End-Use

The BFSI sector represented a 34% share in the Cloud Data Security Market in 2024, driven by strict data protection regulations, high transaction volumes, and secure digital banking operations. Financial institutions deploy advanced encryption, identity management, and continuous auditing to safeguard customer data. Healthcare held a 19% share, supported by electronic health record protection and HIPAA compliance efforts. IT & telecom followed with 17%, backed by massive data traffic and cloud-native infrastructure. Retail, manufacturing, and government sectors collectively contributed 30%, focusing on securing consumer information and critical operational systems.

Key Growth Drivers

Growing Cloud Adoption Across Enterprises

Rapid migration from on-premise data centers to cloud environments drives demand for advanced data protection tools. Enterprises adopt public and hybrid cloud platforms for scalability, cost efficiency, and global accessibility, increasing the need for encryption, access control, and automated threat detection. As multi-cloud usage rises, businesses require centralized security that covers diverse workloads, APIs, and storage layers. Regulatory mandates around customer data, especially in finance, healthcare, and e-commerce, push companies to invest in security posture management and data loss prevention. The growth of remote workforces further accelerates the shift, as organizations must safeguard data accessed from multiple endpoints and networks. This convergence of cloud-first IT strategies and expanding digital ecosystems continues to boost the adoption of cloud data security solutions.

- For instance, IBM’s Cloud Data Shield, powered by Fortanix, automatically encrypts data at rest, in transit, and while in use, protecting sensitive financial and healthcare applications in the public cloud.

Rising Cyber Threats and Data Breaches

Complex cyberattacks, including ransomware, insider threats, and phishing, increase the need for cloud-based monitoring and real-time analytics. Organizations store confidential data—financial transactions, customer information, intellectual property—across distributed cloud environments, making security a top priority. Attackers now target misconfigured storage buckets, weak authentication, and unsecured APIs. As threats evolve, security teams implement zero-trust frameworks, identity access management, and AI-based anomaly detection to prevent data exposure. High-profile breaches in banking, healthcare, and government sectors push enterprises to upgrade cloud security architecture. The rising cost of breaches, reputational damage, and legal penalties intensifies the requirement for automated response tools and continuous compliance monitoring.

- For instance, Google’s BeyondCorp zero-trust architecture replaces traditional VPNs, providing secure user and device-based access to cloud resources without relying on network location.

Strict Regulatory Compliance Requirements

Global data protection laws, such as GDPR, HIPAA, PCI-DSS, and national cybersecurity frameworks, require strong cloud data governance. Enterprises must ensure secure data residency, encryption, auditing, and access control to meet compliance standards. Cloud data security tools provide automated reporting, real-time policy enforcement, and continuous risk scoring to avoid fines and policy violations. Sectors like BFSI, government, and telecom adopt advanced classification, tokenization, and key management solutions to protect high-value data. As digital payments, cloud banking, telemedicine, and e-governance expand, regulatory pressures become stricter. This compliance-driven approach remains a major growth factor for cloud data security adoption.

Key Trends & Opportunities

Integration of AI and Zero-Trust Architecture

AI and machine learning enhance cloud data security by enabling behavioral analytics, automated incident response, and predictive threat detection. Enterprises adopt zero-trust models to eliminate reliance on perimeter security and enforce strict identity verification. Cloud Access Security Brokers (CASB) and Secure Access Service Edge (SASE) platforms gain traction, offering unified control across networks and cloud applications. Automation reduces manual workload for security teams dealing with rising alert volumes. Vendors find opportunities in developing AI-driven security posture management, anomaly detection, and automated remediation workflows, especially for large enterprises operating multi-cloud systems.

- For instance, Palo Alto Networks enhanced its Prisma SASE platform with AI-based anomaly detection and adaptive access controls, reducing manual workloads for cybersecurity teams and ensuring stricter identity verification for users accessing cloud applications.

Growth of Data Security in Multi-Cloud and Hybrid Deployments

Large enterprises distribute workloads across AWS, Azure, Google Cloud, and private cloud infrastructures. This trend creates new opportunities for cloud security platforms that provide centralized visibility, unified encryption, and real-time compliance tracking. Organizations seek tools that secure data movement between clouds, prevent unauthorized access, and monitor API interactions. Demand rises for container security, serverless protection, and workload segmentation as DevOps adoption grows. Vendors offering cross-platform security analytics and cloud-native integrations benefit most from this expanding requirement.

- For instance, Cisco’s Multicloud Defense integrates with AWS APIs to provide end-to-end orchestration and autoscaling of security gateways within customer AWS accounts, enabling centralized inspection without forwarding traffic externally and meeting data sovereignty requirements.

Key Challenges

Shortage of Cybersecurity Professionals

Organizations face a global skill gap in cloud security expertise, limiting their ability to manage threats and implement advanced tools. Security teams struggle with configuration, compliance audits, and 24/7 monitoring due to limited resources. As cloud ecosystems grow more complex, handling identity management, encryption keys, and policy enforcement becomes difficult without trained personnel. This challenge drives demand for managed security services, but increases dependency on third-party providers and raises concerns around data control and privacy.

Rising Complexity in Multi-Cloud Environments

Using multiple cloud providers improves scalability and redundancy but complicates data security management. Each platform uses different security controls, access policies, and encryption standards, making unified monitoring difficult. Misconfigured storage, unsecured APIs, and inconsistent identity rules lead to vulnerabilities. Enterprises require centralized dashboards and automated risk assessment tools to handle diverse workloads. Vendors that fail to offer seamless multi-cloud compatibility face adoption barriers, slowing deployment for organizations with diverse digital ecosystems.

Regional Analysis

North America

North America held the largest share of the cloud data security market in 2024, accounting for 38% of global revenue. Strong adoption of public and hybrid cloud platforms, combined with high cybersecurity spending, drives market leadership. Enterprises across BFSI, healthcare, and government sectors invest heavily in encryption, identity management, and zero-trust models. The U.S. leads due to advanced cloud infrastructure and a high volume of data-intensive industries. Strict compliance frameworks, including HIPAA, PCI-DSS, and federal cybersecurity mandates, further accelerate demand for real-time monitoring and automated threat response.

Europe

Europe captured 26% of the market share in 2024, supported by GDPR enforcement and rising investments in cloud modernization. Countries such as Germany, the U.K., and France deploy advanced cloud security platforms to protect financial transactions, healthcare data, and e-commerce operations. Enterprises adopt data localization, encryption, and automated compliance reporting to meet strict regulatory mandates. The region sees rising adoption of identity access solutions and AI-based analytics across banking, manufacturing, and telecom sectors. Growing cloud migration in small and medium enterprises further strengthens market expansion.

Asia-Pacific

Asia-Pacific accounted for 23% of the market share in 2024 and is the fastest-growing region due to rapid digitalization and large-scale cloud adoption. China, India, Japan, and South Korea drive demand for secure cloud platforms across banking, telecom, and e-commerce. Government-led cloud initiatives and increasing cyberattacks push enterprises to adopt encryption, CASB solutions, and threat monitoring tools. The growth of fintech, 5G deployments, and data centers boosts market potential. Expanding adoption among SMEs and cloud-native startups also contributes to strong regional momentum.

Latin America

Latin America held a 7% market share in 2024, driven by growing cloud adoption in banking, retail, and telecom sectors. Countries like Brazil, Mexico, and Colombia invest in data protection tools to counter rising cyberattacks and regulatory initiatives. Cloud security solutions gain traction due to digital banking, online payments, and e-commerce expansion. However, budget constraints and skill shortages limit adoption for smaller enterprises. Vendors offering managed cloud security services see strong opportunities in the region.

Middle East & Africa

The Middle East & Africa region accounted for 6% of the global market share in 2024, supported by cloud transformation in government, oil & gas, and telecom sectors. Countries including the UAE, Saudi Arabia, and South Africa invest in data encryption, identity management, and compliance-driven security platforms. Digital banking growth and smart city projects increase demand for secure multi-cloud deployments. Although adoption is at an early stage, rising cybercrime and data protection laws create strong future prospects for cloud data security vendors.

Market Segmentations:

By Service

By Frequency Band

By End-Use

- IT & telecommunication

- BFSI

- Healthcare

- Retail

- Manufacturing

- Government & public enterprises

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cloud data security market features strong competition among global cybersecurity vendors, cloud service providers, and specialized data protection companies. Major players focus on encryption, identity access management, cloud workload protection, and security posture management to support multi-cloud and hybrid deployments. Leading companies such as Microsoft, Amazon Web Services, IBM, Cisco Systems, Palo Alto Networks, Check Point Software Technologies, and Fortinet strengthen their portfolios with AI-driven analytics, zero-trust frameworks, and automated compliance monitoring. Startups like Orca Security and Polar Security gain traction with agentless scanning and real-time risk prioritization for cloud workloads. Vendors use mergers, product integrations, and managed security services to expand market reach. Strategic partnerships with cloud providers, fintech organizations, and healthcare platforms enhance adoption across high-risk sectors. Pricing flexibility and bundled cloud-security offerings help target small and medium-sized businesses. As demand rises, competition intensifies around automation, unified dashboards, and multi-cloud visibility to reduce operational complexity and improve threat response times.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Palo Alto Networks, Inc

- Orca Security

- Fortinet Inc.

- Microsoft Corporation

- Commvault

- Imperva

- Cisco Systems, Inc.

- Polar Security

- Check Point Software Technologies Ltd.

- IBM Corporation

Recent Developments

- In February 2025, Check Point Software Technologies entered a strategic partnership with Wiz to offer end-to-end cloud security solutions combining CNAPP and network protection under a unified framework.

- In January 2025, Darktrace announced the acquisition of Cado Security, a cloud investigation and response specialist focused on multi-cloud environments to enhance its threat detection capabilities.

- In September 2023, IBMannounced the expansion of its IBM Cloud Security and Compliance Center, an updated solution designed to assist enterprises in reducing risk and safeguarding data across hybrid, multi-cloud environments and workloads.

- In February 2023, Orca Security launched new Data Security Posture Management (DSPM) capabilities as an extension of the Orca Cloud Security Platform. This latest offering builds on Orca’s comprehensive cloud security approach and significantly enhances its existing features.

Report Coverage

The research report offers an in-depth analysis based on Service, Frequency Band, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Enterprises will increase investment in zero-trust frameworks to reduce unauthorized access.

- AI-driven threat analytics will become a core part of cloud security platforms.

- Demand for security posture management will grow as multi-cloud use expands.

- Managed security services will rise due to the shortage of skilled cybersecurity professionals.

- Data classification and tokenization tools will gain adoption in regulated sectors like BFSI and healthcare.

- Agentless cloud scanning will strengthen as organizations seek rapid deployment and low maintenance.

- Hybrid and multi-cloud security solutions will dominate as organizations avoid vendor lock-in.

- Compliance automation will expand to help enterprises meet diverse regional data protection laws.

- SMEs will adopt cost-effective cloud security bundles offered by large cloud providers.

- Integration between cloud security and DevOps pipelines will increase to protect containerized and serverless workloads.