Market Overview

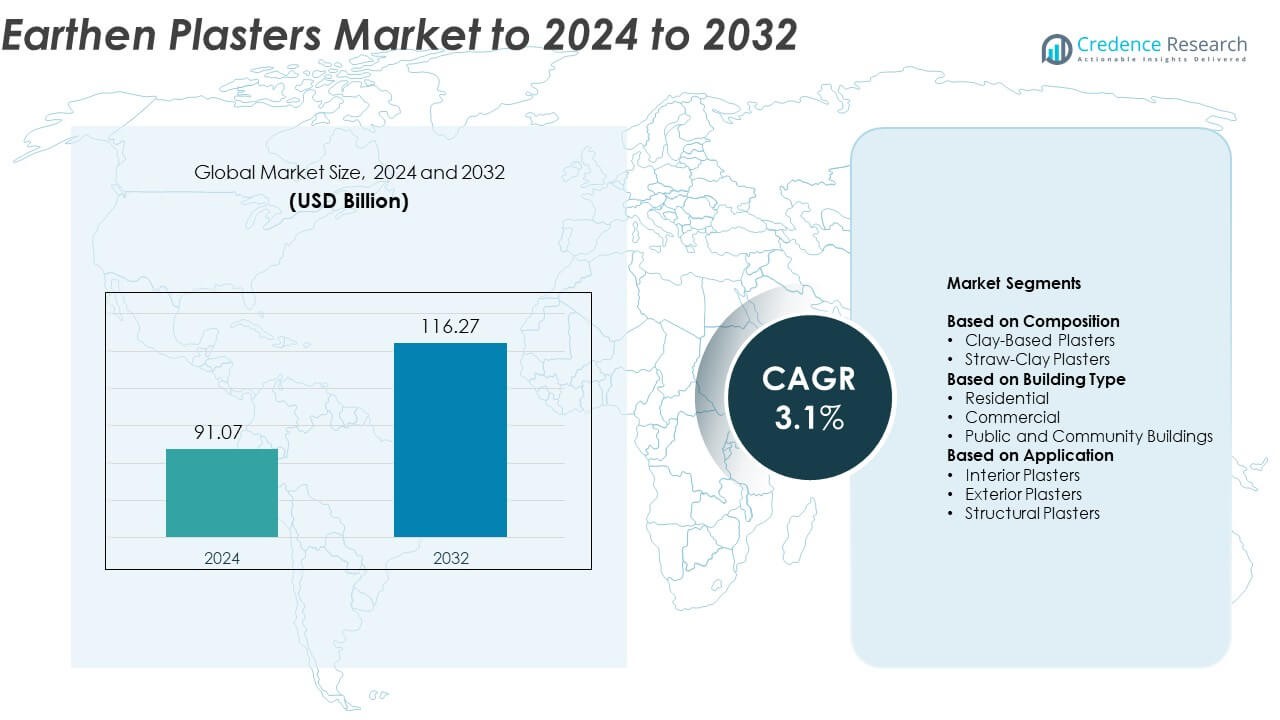

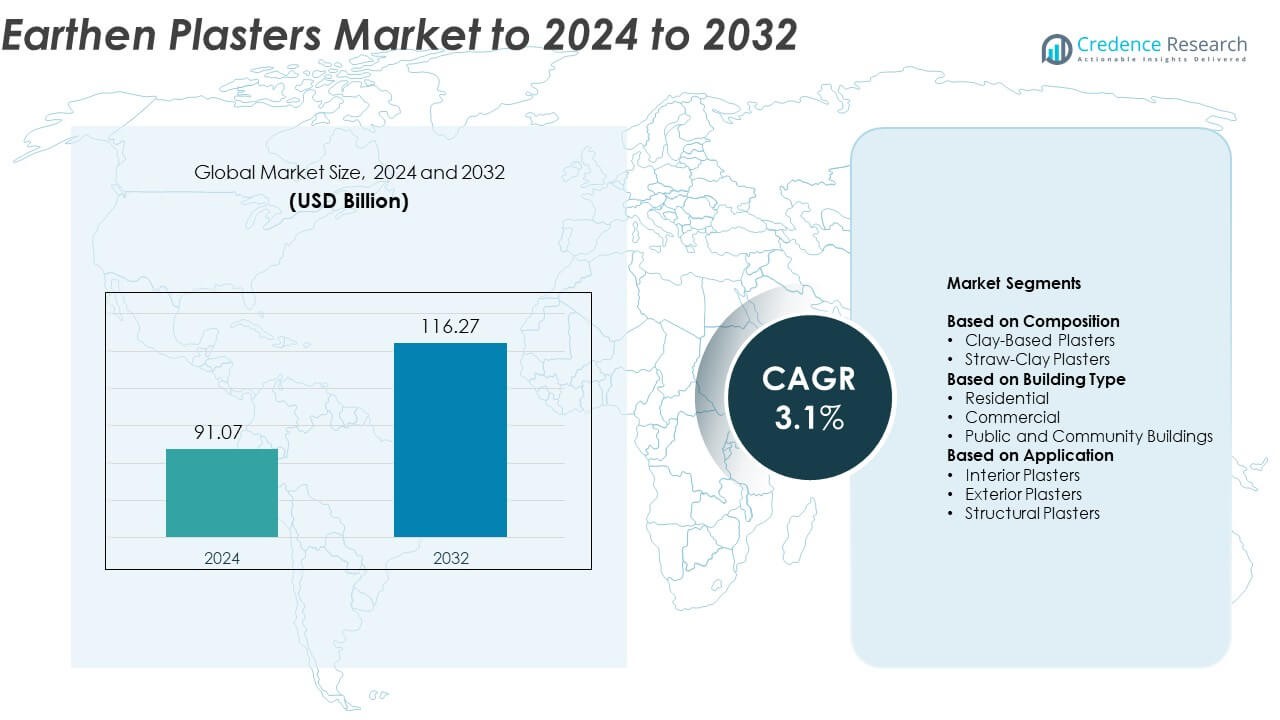

Earthen Plasters Market size was valued at USD 91.07 Billion in 2024 and is anticipated to reach USD 116.27 Billion by 2032, at a CAGR of 3.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Earthen Plasters Market Size 2024 |

USD 91.07 Billion |

| Earthen Plasters Market , CAGR |

3.1% |

| Earthen Plasters Market Size 2032 |

USD 116.27 Billion |

The earthen plasters market is shaped by leading players such as Earthen Shelter, StrawJet, Natural Building Technologies (NBT), Clayworks Ltd, Cobworks, Armourcoat, Straw Bale Gardens, Claylin, Earthbags, and American Clay Enterprises. These companies compete by focusing on sustainable product innovations, advanced formulations, and regional expansion. North America leads the global market with about 34% share in 2024, driven by strong green building adoption and eco-friendly construction initiatives. Europe follows with nearly 29% share, supported by restoration projects and environmental regulations. Asia Pacific shows rising potential with increasing sustainable housing investments across developing economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The earthen plasters market was valued at USD 91.07 Billion in 2024 and is projected to reach USD 116.27 Billion by 2032, registering a CAGR of 3.1%.

- Growing demand for sustainable and low-carbon construction materials is driving market growth across residential and commercial sectors.

- Rising adoption of eco-friendly finishes and natural indoor design trends supports product innovation and market expansion.

- The competitive landscape remains moderately fragmented, with companies investing in product durability, moisture resistance, and regional distribution networks.

- North America leads with 34% share in 2024, followed by Europe with 29%, while the clay-based plaster segment dominates globally with around 61% share due to its superior breathability and environmental benefits.

Market Segmentation Analysis:

By Composition

Clay-based plasters dominate the earthen plasters market with about 61% share in 2024. Their leadership is driven by excellent breathability, thermal mass, and eco-friendly properties, making them suitable for sustainable construction. The increasing adoption of natural and low-carbon building materials further supports their demand. Clay plasters provide aesthetic versatility and compatibility with a variety of substrates, which appeals to architects focused on green certifications. Growing awareness of indoor air quality and the push for renewable construction materials are accelerating the use of clay-based formulations in both new and renovation projects.

- For instance, Clayworks’ EPD reports GWP of 0.068 kg CO₂e/kg (smooth/tonal) and 0.136 kg CO₂e/m² at 1.5 mm thickness

By Building Type

The residential segment leads the earthen plasters market, accounting for nearly 54% share in 2024. Rising consumer preference for natural and toxin-free interiors boosts adoption in homes and apartments. Builders and homeowners increasingly choose earthen finishes for thermal comfort, sound insulation, and sustainability. The commercial and public building sectors are expanding their use in eco-certified designs, but residential construction remains dominant due to widespread renovation and green home initiatives. The popularity of healthy living environments continues to drive demand for earthen finishes in residential spaces.

- For instance, American Clay specifies zero-VOC content and 0% mold growth per ASTM D3273-00 testing.

By Application

Interior plasters hold the dominant share of around 57% in the earthen plasters market in 2024. Their dominance comes from extensive use in wall and ceiling finishes where aesthetics and indoor comfort matter most. Interior earthen plasters regulate humidity, prevent mold, and provide a natural look that appeals to sustainable architecture. The shift toward biophilic design and environmentally friendly interiors further promotes their adoption. Meanwhile, exterior and structural plasters are gaining traction for durability and low maintenance, but interior applications remain the key driver of market growth.

Key Growth Drivers

Rising Demand for Sustainable Construction Materials

The global shift toward sustainable construction practices is a major driver of the earthen plasters market. Builders and architects are increasingly choosing eco-friendly materials that reduce carbon emissions and improve indoor air quality. Earthen plasters meet green building standards while offering thermal insulation and recyclability. Government initiatives promoting low-impact construction and certifications such as LEED and BREEAM further accelerate adoption. This growing focus on sustainability continues to expand the use of natural plasters across both residential and commercial projects worldwide.

- For instance, Diasen’s Diathonite Evolution shows thermal conductivity 0.045 W/m·K and has an EPD for the Diathonite line.

Increasing Preference for Healthy Indoor Environments

Consumers are becoming more aware of the health impacts of synthetic materials used in interiors. Earthen plasters, being non-toxic and vapor-permeable, support better indoor air quality by regulating humidity and reducing mold growth. Their natural composition appeals to homeowners seeking allergen-free spaces. The rise of wellness-focused architecture has increased their use in homes, offices, and community buildings. As demand for natural interior finishes rises, earthen plasters are emerging as a preferred solution for healthier indoor living.

- For instance, Earthborn declares “virtually VOC-free” paints at <0.5 g/L, supporting low-emission interiors.

Growth in Renovation and Restoration Activities

The surge in heritage restoration and building renovation projects has boosted demand for earthen plasters. Their compatibility with traditional materials makes them ideal for restoring historical and cultural structures. Modern renovation efforts also integrate earthen plasters to enhance sustainability and aesthetic appeal. Urban redevelopment initiatives and eco-retrofit programs further drive usage in both developed and emerging economies. This trend aligns with growing investments in energy-efficient and heritage-preserving construction methods.

Key Trends & Opportunities

Integration of Modern Additives and Finishing Techniques

Manufacturers are innovating by incorporating natural fibers, pigments, and binders to enhance durability and visual appeal. These improvements extend the lifespan of earthen plasters and make them suitable for varied climatic conditions. Advanced application methods, such as spray-based finishing and modular plastering systems, improve efficiency and consistency. The combination of traditional materials with modern technology is creating new market opportunities across both developed and emerging construction sectors.

- For instance, Calchèra San Giorgio’s Tadelakt lists μ < 8, a pH of 13, and fire class A1 for durable, breathable finishes. However, the thermal conductivity (\(\lambda \)) for a comparable product is approximately 0.39 W/m·K, not 0.31 W/m·K.

Expansion in Green Building Certifications and Eco-Labeling

The growing emphasis on green certifications is pushing construction projects to adopt natural materials. Earthen plasters contribute positively to sustainability ratings under LEED, WELL, and BREEAM frameworks. Builders are recognizing their value in reducing embodied carbon and improving energy efficiency. This regulatory and market alignment provides strong opportunities for product innovation and brand differentiation. The increasing number of eco-labeled construction projects is likely to sustain market expansion over the coming years.

- For instance, ECOCLAY publishes an Environmental Product Declaration (EPD) for its clay panels, with the official publication date listed as January 15, 2025 (registration number EPD-IES-0012413:002).

Key Challenges

High Labor Intensity and Application Time

Despite their environmental benefits, earthen plasters require skilled labor and longer application times compared to conventional materials. The manual mixing and layering processes often raise installation costs. Limited availability of trained professionals restricts scalability in large projects. These challenges make earthen plasters less appealing for high-speed urban construction. Market growth depends on advancements in mechanized application techniques and better workforce training to address these constraints.

Moisture Sensitivity and Maintenance Concerns

Earthen plasters are prone to degradation in areas with high humidity or water exposure. Without proper sealing, moisture infiltration can cause cracking or mold growth. This restricts their use in exterior applications and damp environments. Frequent maintenance requirements also discourage widespread adoption in cost-sensitive markets. Manufacturers are focusing on improved formulations and protective coatings to enhance moisture resistance and longevity, aiming to overcome this technical limitation.

Regional Analysis

North America

North America holds the largest share of the earthen plasters market, accounting for nearly 34% in 2024. The region’s dominance is driven by strong demand for sustainable construction materials and green building certifications. Rising renovation activities in the United States and Canada, coupled with growing environmental awareness, support market expansion. The integration of eco-friendly design practices in both residential and commercial projects further boosts adoption. Additionally, government incentives for energy-efficient housing and increasing consumer preference for natural interiors contribute to the steady growth of earthen plasters across the region.

Europe

Europe accounts for about 29% share of the earthen plasters market in 2024. The region’s growth is supported by strict environmental regulations, widespread use of eco-labels, and the presence of historic restoration projects. Countries such as Germany, France, and the United Kingdom promote sustainable architecture through policy-driven initiatives. The popularity of traditional building materials in heritage preservation also supports demand. Rising urban redevelopment projects that emphasize low-carbon construction further strengthen the regional market outlook, making Europe one of the leading adopters of natural and breathable wall finishes.

Asia Pacific

Asia Pacific captures nearly 23% share of the earthen plasters market in 2024. Rapid urbanization and infrastructure growth in India, China, and Japan are fueling adoption of eco-friendly building solutions. Increasing awareness of sustainable housing and the availability of cost-effective natural resources support the regional market. The rise of green building programs in urban centers and expansion in the tourism and hospitality sectors contribute to higher usage. Local manufacturers are investing in scalable production and training programs, enhancing accessibility and accelerating adoption across residential and community construction projects.

Latin America

Latin America holds around 8% share of the earthen plasters market in 2024. The region benefits from abundant natural raw materials and growing interest in sustainable housing. Countries like Mexico and Brazil are seeing increasing demand for eco-conscious building materials driven by energy-efficient design trends. Renovation of traditional buildings and community-driven construction initiatives further promote adoption. However, limited industrial production and awareness levels slightly hinder market penetration. Continued investment in sustainable urban development projects is expected to strengthen the presence of earthen plasters in regional construction practices.

Middle East and Africa

The Middle East and Africa region accounts for nearly 6% share of the earthen plasters market in 2024. Growth is supported by rising environmental awareness and the promotion of sustainable construction practices in countries such as the United Arab Emirates and South Africa. Traditional earthen architecture remains relevant in rural and semi-urban settings. Government-led eco-construction initiatives and cultural preservation programs enhance demand. However, arid climates and limited availability of skilled labor present challenges. Increasing focus on energy-efficient building materials is gradually creating opportunities for market expansion across select construction projects.

Market Segmentations:

By Composition

- Clay-Based Plasters

- Straw-Clay Plasters

By Building Type

- Residential

- Commercial

- Public and Community Buildings

By Application

- Interior Plasters

- Exterior Plasters

- Structural Plasters

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The earthen plasters market features key players such as Earthen Shelter, StrawJet, Natural Building Technologies (NBT), Clayworks Ltd, Cobworks, Armourcoat, Straw Bale Gardens, Claylin, Earthbags, and American Clay Enterprises. These companies focus on expanding their product portfolios with innovative and sustainable plaster formulations that enhance durability and application efficiency. The market is witnessing growing investments in research and development aimed at improving moisture resistance and adhesion properties while maintaining eco-friendly characteristics. Manufacturers are increasingly collaborating with green building developers to strengthen their presence in residential, commercial, and restoration projects. Strategic partnerships, regional distribution expansion, and customization options for varying climatic conditions are central to their competitiveness. Companies also emphasize artisan training programs and educational initiatives to promote awareness of natural building materials. The competitive environment remains moderately fragmented, with players differentiating through quality, sustainability credentials, and performance-based product innovations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Earthen Shelter

- StrawJet

- Natural Building Technologies (NBT)

- Clayworks Ltd

- Cobworks

- Armourcoat

- Straw Bale Gardens

- Claylin

- Earthbags

- American Clay Enterprises

Recent Developments

- In 2025, Earthbags promote the use of earthen plasters in their natural building systems involving earthbag construction, which emphasizes thermal regulation and moisture control for sustainable and resilient building solutions, actively supporting traditional, non-toxic materials.

- In 2025, Earthen Shelter Announced in-person “Cob Oven Workshop” for Oct 25–26 in Potter Valley, California, covering cob, adobe, and earthen plaster basics.

- In 2023, Armourcoat, known for sustainable luxury finishes, introduced a new clay lime plaster on the market, offering a green replacement for conventional finishes using natural, uncooked clay and hydraulic lime.

Report Coverage

The research report offers an in-depth analysis based on Composition, Building Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sustainable and low-carbon construction materials will continue to rise globally.

- Technological advancements in formulation and application methods will enhance product durability.

- Growing consumer awareness of healthy indoor environments will drive interior plaster adoption.

- Government initiatives promoting green building standards will support long-term market growth.

- Increased restoration and heritage conservation projects will strengthen market presence in Europe.

- Expansion of eco-friendly residential housing projects will boost demand in emerging economies.

- Manufacturers will invest in modern additives to improve strength and moisture resistance.

- Training programs for skilled artisans will help address labor shortages in application processes.

- Rising adoption of earthen plasters in commercial and public buildings will diversify end-use markets.

- Strategic collaborations between green builders and material suppliers will accelerate global market penetration.