Market Overview

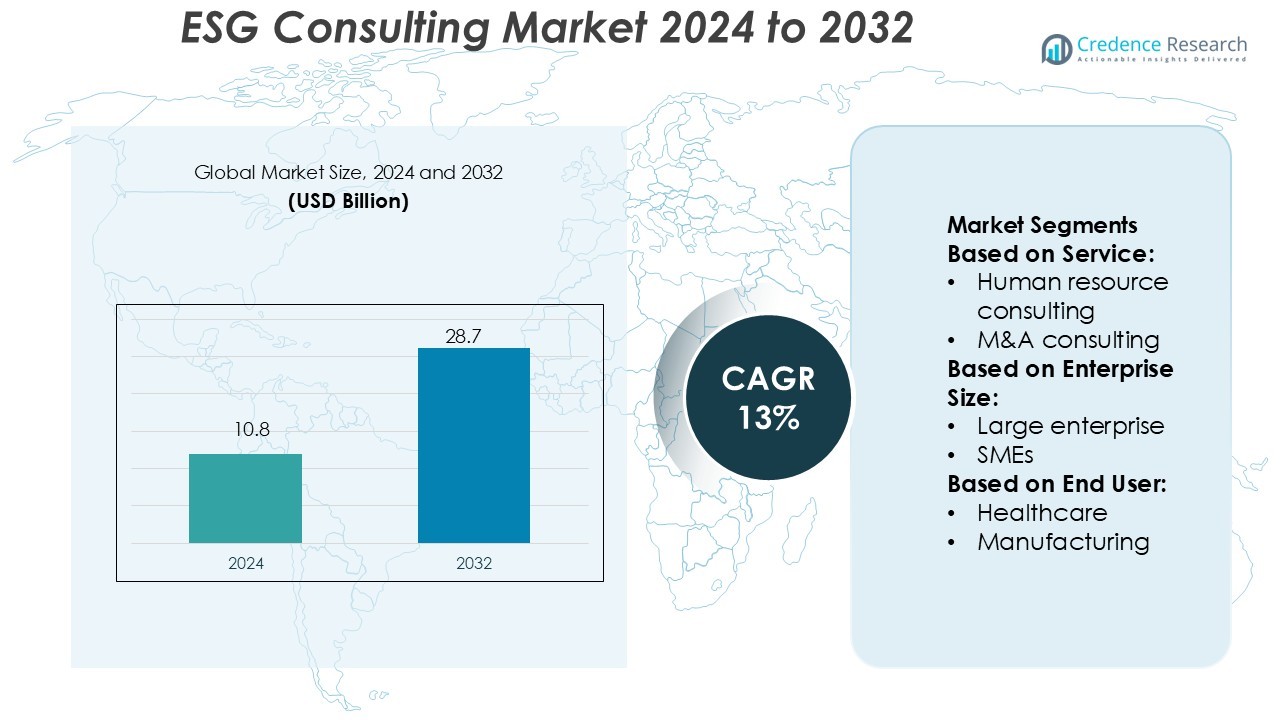

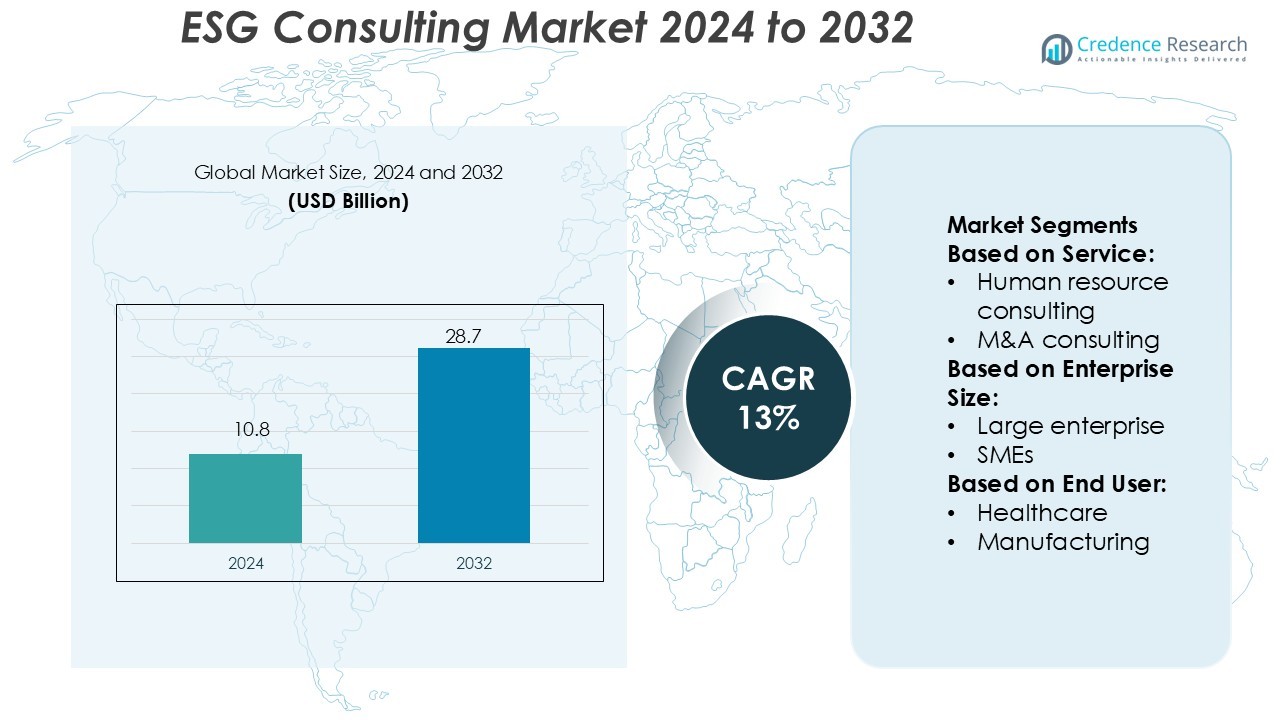

ESG Consulting Market size was valued USD 10.8 billion in 2024 and is anticipated to reach USD 28.7 billion by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ESG Consulting Market Size 2024 |

USD 10.8 Billion |

| ESG Consulting Market, CAGR |

13% |

| ESG Consulting Market Size 2032 |

USD 28.7 Billion |

The ESG Consulting Market Deloitte Touche Tohmatsu Ltd., Cognizant, IBM, Capgemini, Accenture, Oracle, CGI Group, Clearfind, and Atos SE are key players in the ESG consulting market. These companies provide strategy, reporting, and sustainability advisory services using digital platforms and analytics tools. North America leads the market with a 42.15% share, driven by strong regulatory requirements, investor expectations, and corporate adoption of ESG frameworks. Growing demand from industries such as BFSI, manufacturing, healthcare, and IT supports market expansion, while innovation in digital reporting and supply-chain sustainability strengthens the competitive landscape globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The ESG Consulting Market size was valued USD 10.8 billion in 2024 and is anticipated to reach USD 28.7 billion by 2032, at a CAGR of 13% during the forecast period.

- Growth is driven by rising regulatory requirements, investor scrutiny, and corporate commitments to sustainability and net-zero targets.

- Market trends include adoption of digital platforms, predictive analytics, real-time ESG reporting, and supply-chain sustainability integration.

- Competition is strong among Deloitte Touche Tohmatsu Ltd., Cognizant, IBM, Capgemini, Accenture, Oracle, CGI Group, Clearfind, and Atos SE, with firms differentiating through technology-driven advisory and sector-specific ESG frameworks.

- Regionally, North America leads with a 42.15% share, followed by Europe at 30%, Asia-Pacific at 20%, Latin America at 6–8%, and Middle East & Africa at 4–5%, with BFSI and manufacturing segments representing the largest end-user adoption.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Service

Within the ESG consulting market, the strategy consulting sub‑segment dominates with over one‑third share, as firms focus on helping clients define ESG frameworks and governance models. Strategy consulting leads because organizations must align sustainability goals with business strategy and compliance obligations. Driving this sub‑segment are increased regulatory mandates, investor demands and corporate reporting requirements which force firms to engage external advisors for scenario modelling, materiality assessment and integration of ESG into corporate planning. Meanwhile, other services such as operations & supply‑chain consulting and HR consulting follow, but strategy consulting remains the primary entry point for ESG engagements.

- For instance, Accenture PLC reports that its global emissions (Scope 1, 2 and relevant Scope 3 categories) in fiscal 2024 were 654,819 metric tons CO₂e.

By Enterprise Size

Large enterprises represent the dominant client segment, accounting for roughly 60% of ESG consulting revenues, since they possess complex global operations, high regulatory exposure and the resources to invest in comprehensive ESG programs. These organisations increasingly engage consultants for risk assessment, sustainability reporting, stakeholder engagements and governance mechanisms. In contrast, SMEs, while growing in demand, typically adopt lighter‑touch services. The prevalence of large enterprises thus drives the market, as their need for broad ESG transformation supports sustained consulting engagement.

- For instance, Atos announced its “Genesis” plan in May 2025, reporting that it delivered over 250,000 “digital accreditations” to its workforce during the prior three years and intends to grow its newly created Data & AI business line from 2,000 to 10,000 employees by 2028.

By End User

Among end‑user industries, the BFSI sector holds the largest share—around 30%—in the ESG consulting market due to the sector’s exposure to regulatory frameworks, disclosure requirements and investor scrutiny. Financial institutions rely on ESG consulting firms to integrate sustainability into lending, investment and underwriting decisions and to manage transition risk. Manufacturing, healthcare, IT & telecom, retail, government and other industries follow, but the traditional dominance of the BFSI vertical underlines how regulation‑led demand shapes the market’s adoption pattern.

Key Growth Drivers

Regulatory and reporting mandates

Governments and regulators worldwide are imposing stricter ESG disclosure rules, compelling companies to engage external consultants to ensure compliance and credibility. The demand surge arises as firms seek to align with frameworks like the Task Force on Climate‑related Financial Disclosures (TCFD) and mandatory sustainability reports. These mandates drive consulting spend as organisations build frameworks, perform audits and implement governance systems. Such compliance pressure is a significant impetus for growth in the ESG consulting market.

- For instance, CGI states that its data-centres achieved 99.3% renewable electricity consumption in 2024, enabling those sites to report to clients under full Scope 2 renewables.

Investor pressure and capital‑market demands

Asset managers, institutional investors and lenders increasingly embed ESG criteria into their decision‑making, prompting companies to seek consultancy support for materiality assessments, data assurance and sustainable finance strategies. With investors scrutinising ESG performance and disclosure, consulting firms benefit from rising advisory engagements. This push from capital markets effectively strengthens the growth trajectory of ESG advisory services.

- For instance, Deloitte’s 2024 CxO Sustainability Report surveyed 2,103 executives across 27 countries and found that 85% of C-suite leaders say they increased sustainability investments in the past year.

Corporate net‑zero ambitions and supply‑chain transformation

Companies across sectors are committing to carbon‑neutral or net‑zero targets, which require comprehensive supply‑chain re‑engineering, operational emissions tracking and strategic road‑maps. Consulting firms are delivering scenario modelling, transition planning and supply‑chain decarbonisation support. These large‑scale transformation initiatives form the backbone of ESG consulting growth as organisations shift from reactive compliance to proactive sustainability strategies.

Key Trends & Opportunities

Digitalisation of ESG data and real‑time analytics

Consulting firms increasingly offer digital platforms, dashboards, and analytics tools that allow real‑time monitoring of ESG metrics, scenario modelling and predictive insights. With companies integrating ESG data into core business processes, service offerings are evolving from static reports to dynamic, tech‑enabled solutions. This trend presents an opportunity for consultancies to expand into software‑as‑a‑service, analytics and technology‑driven advisory models.

- For instance, BCG announced its tech build & design unit “BCG X”, comprised of nearly 3,000 technologists spanning 80+ cities, to build platforms that accelerate digital transformation including ESG-data solutions.

Expansion into emerging markets and sectoral niches

As regulatory frameworks mature in Europe and North America, consulting firms are turning to emerging markets in Asia Pacific, Latin America and Africa for growth. Additionally, niches such as green hydrogen, circular‑economy transitions and social equity programmes are gaining traction. These areas offer consultants new service lines and geographic reach beyond traditional corporate sustainability strategies.

- For instance, Oracle announced that its cloud training programme in India trained 400,000 students in AI, data science, and cloud technologies during a recent fiscal cycle — illustrating how the company is expanding digital infrastructure expertise into emerging markets.

Key Challenges

Lack of standardised metrics and inconsistent data

Despite rising demand, the ESG consulting market faces hurdles due to fragmented reporting frameworks, disparate metrics and varying regional standards. Many organisations struggle to align ESG disclosures or compare performance across peers, which reduces the effectiveness of advisory services. This lack of standardisation hampers consulting firms in delivering clear, comparable value to clients.

Talent shortage and scalability constraints

With ESG advisory demand growing rapidly, consulting firms face pressure to hire and train specialists in sustainability, climate science, supply‑chain decarbonisation and social innovation. Shortage of qualified talent slows project delivery and limits scalability of service models. Firms that cannot build sufficient teams may struggle to keep up with client expectations and market growth.

Regional Analysis

North America

North America holds the leading position in the ESG consulting market, capturing around 42 % of global share in 2024. This dominance stems from stringent regulatory frameworks and strong investor pressure which push companies to engage consultants for ESG reporting, governance, and risk analysis. U.S.‑based firms routinely contract advisory services to ensure compliance with frameworks such as the Sustainability Accounting Standards Board (SASB) and Task Force on Climate‑related Financial Disclosures (TCFD). Large enterprises in Canada and the U.S. also invest in sustainability strategy, driving consulting engagements. The market is thus buoyed by high demand for ESG consultancy, particularly in the financial and industrial sectors.

Europe

Europe accounts for approximately 30 % of the global ESG consulting market, backed by the EU’s regulatory initiatives such as the Corporate Sustainability Reporting Directive (CSRD) and strong stakeholder ESG expectations. Corporates across the UK, Germany and France hire consultants for regulatory gap‑analysis, sustainability strategy, and carbon‑risk modelling. Some local markets also benefit from subsidies for consultancy services linked to green transition. The presence of mature advisory firms and well‑established ESG service lines allows European companies to adopt more advanced consulting solutions, reinforcing the region’s stable share.

Asia‑Pacific

The Asia‑Pacific region holds roughly 20 % of the global ESG consulting market and is characterised by fast‑rising demand in China, India, Japan and Southeast Asia. Governments and large companies in the region launch net‑zero initiatives and green financing programmes, prompting engagements for supply‑chain decarbonisation, sustainable infrastructure and ESG risk modelling. Although regulatory regimes vary and maturity levels differ across countries, the region’s growth trajectory is strong as consulting firms expand local operations. Emerging markets also offer scope for lower‑cost advisory services adapted to regional conditions.

Latin America

Latin America covers an estimated 6 %–8 % of the global ESG consulting market. Growth is driven by infrastructure investment, renewable energy mandates and industry demand for sustainability disclosures in Brazil, Mexico and Chile. However, slower uptake of comprehensive ESG frameworks limits scale compared with mature regions. Consulting firms often focus on project‑based engagements such as greenhouse‑gas inventories or social‑impact assessments. With increasing multinational presence and rising regulatory interest, Latin America presents incremental growth potential for ESG advisory services.

Middle East & Africa (MEA)

The MEA region holds about 4 %–5 % of the global ESG consulting market. Demand is concentrated in Gulf‐Cooperation Council (GCC) oil and gas nations and North Africa, where sustainability programmes and green infrastructure projects are under development. Corporates engage consultants for energy‑transition roadmaps, social‑impact assessments and governance frameworks tied to sovereign wealth funds. Fragmented markets, legacy infrastructure and limited regulatory maturity slow uptake. Yet, international consulting firms view MEA as a strategic frontier for long‑term expansion as ESG advisory becomes integral to large infrastructure contracts.

Market Segmentations:

By Service:

- Human resource consulting

- M&A consulting

By Enterprise Size:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The ESG consulting market players such as Deloitte Touche Tohmatsu Ltd., Cognizant, International Business Machines Corporation, Capgemini, Accenture PLC, Oracle Corp., CGI Group, Inc., Clearfind and Atos SE. The ESG consulting market is highly competitive, driven by increasing regulatory requirements, investor scrutiny, and corporate sustainability commitments. Firms focus on integrating ESG frameworks into business strategy, governance, and reporting processes to help organizations achieve net‑zero targets and enhance stakeholder trust. Adoption of advanced digital tools, predictive analytics, and real‑time monitoring enables companies to assess risks, optimise supply chains, and track ESG performance efficiently. Rising demand spans industries such as BFSI, manufacturing, healthcare, IT, and government sectors. The market also benefits from growing awareness of social responsibility, climate transition planning, and sustainable finance initiatives, encouraging continuous innovation and expansion of consultancy services globally.

Key Player Analysis

- Deloitte Touche Tohmatsu Ltd.

- Cognizant

- International Business Machines Corporation

- Capgemini

- Accenture PLC

- Oracle Corp.

- CGI Group, Inc.

- Clearfind

- Ernst & Young LLP

- Atos SE

Recent Developments

- In January 2025, BDO USA announced the strategic expansion of its management consulting services through the addition of Blue Beyond Consulting, a San Francisco-based firm specializing in human capital management and organizational effectiveness.

- In October 2024, Accenture completed the acquisition of Camelot Management Consultants, a Germany-based SAP-focused management and technology consulting firm. This acquisition aims to strengthen Accenture’s capabilities in SAP and AI-driven supply chain solutions, addressing the growing demand for intelligent and resilient supply chains.

- In August 2024, Uniqus Consultech launched its tech consulting practice, expanding its offerings beyond financial consulting to include cutting-edge technology solutions. This new initiative aims to address complex business challenges by integrating deep functional expertise in finance, risk, and sustainability with advanced technological capabilities.

- In October 2023, ClearBridge Investments and Franklin Templeton introduced a new value equity fund named the FTGF ClearBridge Global Sustainability Improvers Fund. This innovative fund aims to invest in companies that are actively improving their Environmental, Social, and Governance (ESG) practices rather than focusing solely on those with already robust ESG profiles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service, Enterprise Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising global regulation will drive more companies to engage ESG consulting for compliance and reporting.

- Investor demand for transparent ESG data will lead organisations to hire consultants for materiality assessments and data verification.

- Corporate net‑zero and sustainability goals will push firms to adopt consulting services for decarbonisation road‑maps and supply‑chain strategy.

- Digital tools and analytics in ESG consulting will expand, enabling real‑time monitoring, scenario modelling and automated disclosures.

- Expansion into emerging markets will open new geographies for consulting firms as companies in Asia‑Pacific, Latin America and Africa increase ESG spend.

- Sector‑specific advisory services will grow, as manufacturing, healthcare, retail and IT sectors require tailored ESG frameworks.

- M&A and strategic partnerships in the consulting industry will accelerate, enhancing firms’ capabilities across climate, social and governance domains.

- SMEs will increasingly adopt ESG consulting, increasing service bundling or lighter touch advisory to meet scaled‑down compliance needs.

- Consultants will face increasing pressure to prove ROI, driving adoption of performance‑based contracting and value measurement frameworks.

- Talent shortage and evolving standards will force consulting firms to invest heavily in training, tool‑development and platformisation of ESG services.

Market Segmentation Analysis:

Market Segmentation Analysis: