Market Overview

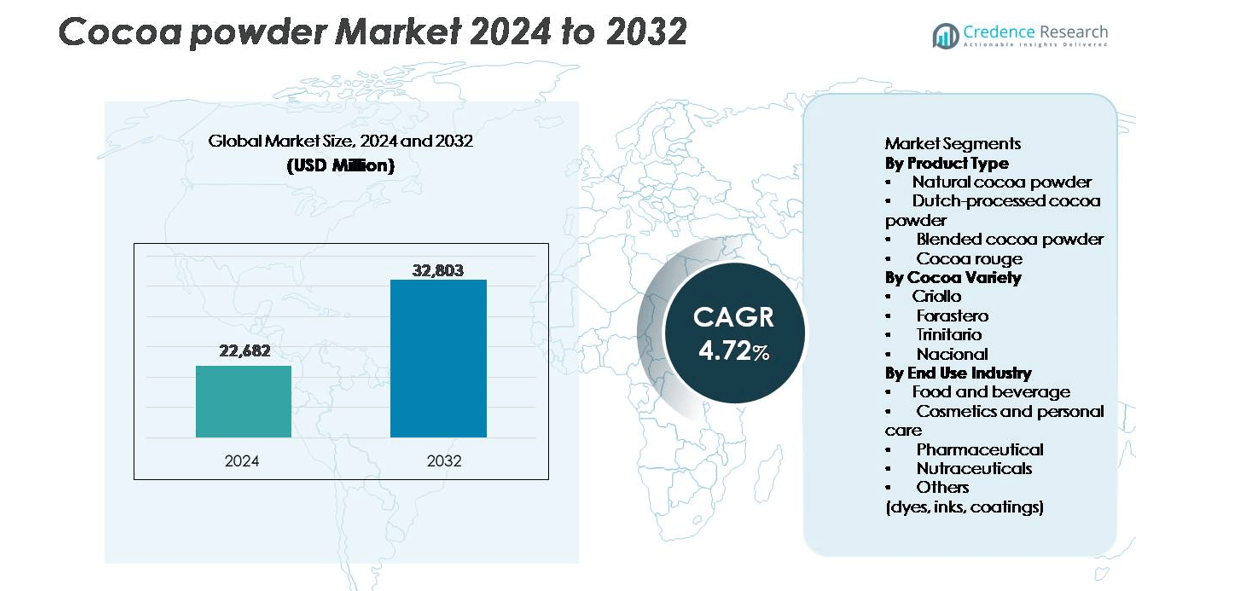

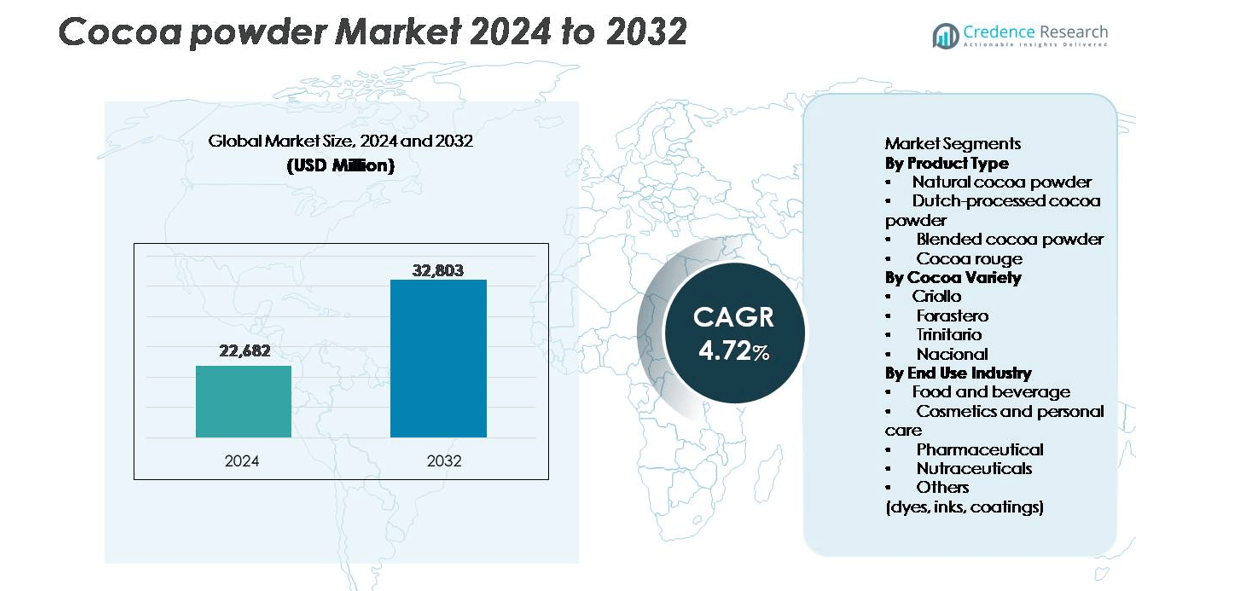

The Cocoa Powder Market size was valued at USD 22,682 million in 2024 and is expected to reach USD 32,803 million by 2032, reflecting a 4.72% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cocoa Powder Market Size 2024 |

USD 22,682 million |

| Cocoa Powder Market, CAGR |

4.72% |

| Cocoa Powder Market Size 2032 |

USD 32,803 million |

Major players in the cocoa powder market include Cargill, Barry Callebaut, Olam International, Hershey, and Nestlé, each competing through large grinding capacity, diversified cocoa portfolios, and sustainable sourcing programs. These companies supply cocoa powder to global bakery, chocolate, beverage, and nutraceutical brands, while investing in certified and traceable cocoa to meet clean-label demand. Europe remains the leading region with 33% market share, supported by a strong chocolate manufacturing base and premium confectionery demand. North America follows with 27%, driven by bakery and dairy products, while Asia-Pacific accounts for 26% as chocolate snacks and café beverages expand across emerging markets.

Market Insights

- The Cocoa Powder Market was valued at USD 22,682 million in 2024 and is projected to reach USD 32,803 million by 2032, at a 4.72% CAGR.

- Growing demand from bakery, confectionery, and beverage industries drives consumption as brands use cocoa powder for flavor, color, and clean-label product claims.

- Trends such as organic cocoa, sugar-free blends, Dutch-processed variants, and premium dark chocolate strengthen market opportunities, while specialty cafés and artisanal bakeries expand usage.

- Key players compete through sustainable sourcing, grinding capacity expansion, and certified product portfolios, while price volatility linked to crop yield and climate remains a major restraint.

- Europe leads with 33% share, followed by North America at 27% and Asia-Pacific at 26%, while natural cocoa powder dominates by product type due to wide food and beverage usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Natural cocoa powder holds the dominant share, driven by its wide use in bakery, confectionery, and beverages. Food manufacturers prefer natural cocoa powder due to its strong flavor profile and clean-label appeal. Dutch-processed cocoa powder also grows steadily, supported by its mild taste and smooth color, which suits premium chocolates and ice-cream. Blended cocoa powder gains adoption among industrial bakeries due to consistent flavor and cost advantages, while cocoa rouge remains a specialty ingredient for gourmet formulations. The shift toward natural ingredients and rising consumer preference for authentic cocoa taste continues to support segment leadership for natural cocoa powder.

- For instance, Barry Callebaut’s extra-dark alkalized cocoa powder delivers a pH of 7.6 and moisture below 5 grams per 100 grams to achieve smoother solubility in cold beverages.

By Cocoa Variety

Forastero remains the leading segment, contributing the highest market share due to large-scale global cultivation and reliable supply. Its strong yield, disease resistance, and lower cost make Forastero the preferred variety for commercial chocolate and beverage production. Criollo attracts premium brands for fine-flavor chocolates but holds a smaller share because of limited availability and higher pricing. Trinitario offers a balance of flavor and productivity, gaining interest in artisanal and specialty cocoa products. Nacional remains a niche variety used in high-end chocolate applications. The need for stable raw material supply and price stability drives Forastero’s demand.

- For instance, Barry Callebaut sources Forastero beans which have an average dried bean weight typically ranging from 0.8 to 1.4 grams and undergo fermentation cycles of generally 5 to 7 days (depending on origin and method) to maintain consistent flavor for industrial chocolate.

By End Use Industry

Food and beverage dominates the market with the largest share, supported by strong demand for chocolates, instant cocoa drinks, baked goods, and flavored dairy products. Major brands add cocoa powder in cookies, cakes, milkshakes, and cereals to enhance taste and color. Cosmetics and personal care also rise as cocoa acts as a natural antioxidant in lotions and face masks. Pharmaceutical and nutraceutical manufacturers use cocoa powder in supplements and functional foods due to flavanols linked to heart health. Additional demand comes from dyes, inks, and coatings. Growth in confectionery and ready-to-eat products keeps food and beverage ahead.

Key Growth Drivers

Rising Demand from Bakery, Confectionery, and Beverage Industries

The expanding bakery, confectionery, and beverage sectors remain primary drivers for cocoa powder consumption. Global chocolate consumption continues to rise, supported by new product launches in cakes, cookies, milk chocolates, flavored dairy, and instant cocoa drinks. Food manufacturers widely prefer cocoa powder due to its ability to improve taste, aroma, texture, and color without synthetic additives. Growth in ready-to-eat snacks, premium chocolates, and flavored bakery items increases demand from commercial bakeries and food processors. International manufacturers also expand into emerging markets in Asia, Africa, and South America, where rising disposable income drives chocolate and dessert consumption. The shift toward flavor-rich and premium snack offerings strengthens the long-term use of cocoa powder across multiple food categories.

- For instance, Mondelez employs alkalized cocoa powders with a pH level of 7.5 in Oreo biscuits to achieve a darker color and smoother taste profile.

Shift Toward Natural, Clean-Label, and Organic Ingredients

Clean-label and ingredient transparency have transformed purchasing behavior, encouraging food brands to replace artificial flavors with natural cocoa ingredients. Consumers prefer minimally processed ingredients free from additives, preservatives, and synthetic colorants, which boosts demand for natural cocoa powder. Organic food launches in confectionery, beverages, and ready-to-eat snacks continue to expand, creating strong opportunities for cocoa suppliers offering certified and sustainably sourced products. Ethical chocolate production, traceable supply chains, and “fair-trade” certifications also influence buying decisions, particularly in developed markets. As sustainability and transparency gain importance, chocolate and dairy manufacturers choose natural cocoa powder to strengthen brand reputation and meet labeling regulations.

Expansion of Functional and Nutraceutical Applications

Cocoa powder contains antioxidants, polyphenols, and flavanols linked to cardiovascular and cognitive health, which increases interest in functional foods and nutraceutical products. Supplement companies use cocoa in protein shakes, energy bars, and vitamin-enriched beverages to improve taste and deliver health benefits. The growing sports nutrition and weight-management sectors drive new cocoa-based protein mixes and meal-replacement formulations. As consumers seek healthier indulgence and low-sugar alternatives, brands develop sugar-free and alkalized cocoa powders for diabetic and fitness-focused buyers. Pharmaceutical applications also rise where cocoa is used in tablets, syrups, and chewables to improve flavor. This shift toward health-centric product innovation improves long-term market penetration.

Key Trends & Opportunities

Premiumization and Growth of Specialty Cocoa Products

Premium cocoa powders, including Dutch-processed, organic, Criollo-based, and cocoa rouge varieties, are gaining traction as consumers seek richer flavor and gourmet quality. Artisanal chocolate makers, luxury dessert brands, and specialty bakeries increasingly adopt high-grade cocoa with enhanced flavor precision, smooth texture, and darker color. The rise of café culture and premium confectionery chains also boosts demand for specialty hot chocolates and dark chocolate desserts. Innovations such as alkalized cocoa for enhanced solubility or reduced bitterness create strong opportunities for manufacturers to target premium markets. As consumers associate dark cocoa with health and luxury, brands leverage high-cocoa and fine-flavor products to maximize margins and brand loyalty.

- For instance, Valrhona produces premium, Dutch-processed cocoa powders with a fat content of 21-22% (or 21-22 grams per 100 grams). This high fat content, combined with a very finely ground texture (typically with an average particle size of 10 to 20 microns), creates a smoother mouthfeel and intense flavor in pastry applications.

Growth of Sustainable and Fair-Trade Cocoa Sourcing

Sustainability has become a major trend shaping cocoa powder production and marketing strategies. Large chocolate manufacturers adopt fair-trade, Rainforest Alliance, and UTZ-certified cocoa to ensure ethical sourcing, farmer welfare, and reduced environmental impact. Buyers increasingly evaluate carbon footprint, deforestation risk, and traceability before choosing suppliers. Companies invest in farmer training, blockchain-based supply tracking, and zero-deforestation commitments to strengthen their responsible sourcing narrative. Premium consumers favor brands promoting sustainable cocoa usage in chocolates, beverages, and skincare. These commitments open new opportunities for suppliers that provide certified, transparent, and ethically sourced cocoa powder with added brand value.

- · For instance, Lindt & Sprüngli supports farmer training programs covering over 118,000 cocoa farmers (as of 2024) and supplies high-yielding and disease-resistant cocoa seedlings to improve plantation sustainability.

Key Challenges

Volatile Cocoa Bean Prices and Supply Instability

Cocoa production depends heavily on climatic conditions, crop diseases, and political stability in major producing regions such as Côte d’Ivoire and Ghana. Unpredictable rainfall, drought, soil degradation, and aging plantations directly affect bean yield and supply consistency. These fluctuations lead to rapid price volatility, impacting profit margins for chocolate producers, bakeries, and beverage companies. Rising labor costs, logistics disruptions, and fluctuating currency inflation further intensify supply-chain pressure. Companies hedge risk through long-term contracts and diversified sourcing, but small manufacturers face strong pricing challenges that limit competitiveness and innovation efforts.

Regulatory Requirements and Quality Certifications

Cocoa powder used in food, pharmaceuticals, and cosmetics must adhere to strict quality and safety standards, creating cost and compliance challenges. Regulations cover pesticide residue, microbial safety, heavy metals, allergen labeling, and permissible flavor additives. Companies must invest in testing, quality audits, and certification systems such as organic or fair-trade compliance. Differences in regulations across Europe, North America, and Asia increase complexity for exporters. Smaller suppliers face high certification and processing costs, making market entry difficult. Compliance remains essential for brand credibility, but ongoing regulatory tightening continues to challenge operational efficiency and pricing stability.

Regional Analysis

North America

North America holds a strong share of the cocoa powder market, contributing around 27% of global revenue. The region benefits from high chocolate consumption, expanding bakery chains, and steady demand for flavored dairy, cereals, and confectionery snacks. U.S. manufacturers launch sugar-free and organic cocoa products to match clean-label preferences, while café chains increase purchases of specialty cocoa for beverages and desserts. Growing demand for functional foods also supports nutraceutical applications. Strong retail presence, premium chocolate brands, and investments in ethical sourcing keep North America a key revenue-generating region with consistent long-term demand.

Europe

Europe leads the global market with nearly 33% share, supported by its well-established chocolate manufacturing base and presence of premium confectionery brands. Countries such as Germany, Belgium, Switzerland, and the U.K. drive large production volumes for bakery, cakes, biscuits, and ready-to-drink cocoa beverages. Consumers show strong interest in organic, fair-trade, and sustainably sourced cocoa ingredients, encouraging suppliers to maintain certified and traceable supply chains. Demand for artisanal chocolate, gourmet bakery products, and dark cocoa beverages strengthens growth. Europe’s advanced processing technology and long-standing chocolate culture keep the region at the forefront of cocoa powder consumption.

Asia-Pacific

Asia-Pacific is one of the fastest-growing regions, holding about 26% market share with strong expansion in China, India, Japan, and Southeast Asia. Rising disposable income and shifting tastes increase demand for chocolates, instant cocoa drinks, baked goods, and flavored dairy products. International manufacturers expand local production and introduce cocoa-based snacks tailored to regional preferences. Growing café culture and rapid growth of industrial bakeries fuel commercial usage, while specialty dark chocolate gains popularity among young consumers. Urbanization, retail expansion, and increased adoption of premium bakery and confectionery products position Asia-Pacific as a key future growth destination.

Latin America

Latin America accounts for close to 9% of market share, supported by strong cocoa cultivation and chocolate processing activities in Brazil, Mexico, and Ecuador. Local manufacturers produce cocoa powder for confectionery, beverages, and bakery segments, while exports supply global chocolate brands. Premium and organic cocoa varieties gain attention due to high-quality regional bean production. Rising café chains, flavored sweet beverages, and chocolate-based snacks boost domestic demand. However, price volatility and supply fluctuations remain challenges. Despite this, increasing investment in value-added cocoa processing supports long-term growth across regional markets.

Middle East & Africa

The Middle East & Africa generate around 5% share, but the region remains a strategic raw material hub, especially in West Africa, which supplies most of the world’s cocoa beans. Processing capacity is gradually expanding as governments encourage local cocoa grinding and manufacturing. Rising chocolate consumption in Gulf countries, growing bakery demand, and premium import brands support market growth. Product launches in flavored dairy beverages and desserts also increase cocoa use. While infrastructure limitations and price fluctuations affect production costs, increased investment in domestic chocolate manufacturing strengthens regional market potential.Top of Form

Market Segmentations:

By Product Type

- Natural cocoa powder

- Dutch-processed cocoa powder

- Blended cocoa powder

- Cocoa rouge

By Cocoa Variety

- Criollo

- Forastero

- Trinitario

- Nacional

By End Use Industry

- Food and beverage

- Cosmetics and personal care

- Pharmaceutical

- Nutraceuticals

- Others (dyes, inks, coatings)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cocoa Powder Market is characterized by strong competition among multinational chocolate manufacturers, ingredient suppliers, and regional cocoa processors. Established players focus on product quality, sustainable sourcing, and advanced processing technologies to secure long-term supply agreements with confectionery and bakery companies. Leading cocoa processors expand grinding capacity and invest in flavor refinement, alkalization, and low-fat cocoa formulations to meet diverse food and beverage requirements. Companies also strengthen ethical sourcing programs through fair-trade certifications, farmer training initiatives, and traceable supply chains to attract premium buyers. Strategic activities include capacity expansions in Asia and Africa, partnerships with chocolate brands, and new product launches featuring organic or specialty cocoa variants. Regional suppliers compete on pricing and customized blends, offering consistent flavor profiles for industrial bakeries, beverages, and confectionery applications. Continuous innovation, sustainability commitments, and global distribution networks remain key factors shaping competitive positioning in the cocoa powder industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JB Foods

- Cargill

- Cocoacraft

- Plot Enterprise

- Olam Cocoa

- Belcolade

- Cocoa Processing Company

- Blommer

- Newtown Foods USA

- Indcresa

- Barry Callebaut

Recent Developments

- In October 2024, Cargill launched new cocoa production line in Indonesia to meet growing Asian consumers’ demand for indulgent foods. Cargill’s cocoa processing plant in Gresik, the new line brings innovation capabilities and competitiveness to customers in the bakery, ice cream and chocolate confectionery categories, as well as for the café-style beverages in foodservice.

- In November 2022, Barry Callebaut announced the groundbreaking of its third manufacturing facility in India. The new chocolate and compound factory will be in the Ghiloth industrial area, in the city of Neemrana, about 120 km southwest of Delhi.

Report Coverage

The research report offers an in-depth analysis based on Product type, Cocoa variety, End-Use industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Makers will expand clean-label cocoa powders for health-focused snacks and drinks.

- Brands will launch sugar-free and vegan cocoa products for fitness buyers.

- Food service chains will use premium cocoa powders in bakery and desserts.

- Ready-to-drink cocoa beverages will gain space in retail and vending.

- Producers will adopt sustainable farming and traceable sourcing programs.

- Equipment upgrades will improve flavor, color, and aroma consistency.

- Cocoa powders with higher protein and fiber will support sports nutrition.

- Premium dark cocoa powders will grow in cafes, hotels, and ice-cream shops.

- E-commerce platforms will boost direct sales to small bakeries and home chefs.

- Brands will invest in recyclable packs and lower-energy processing lines.