Market Overview

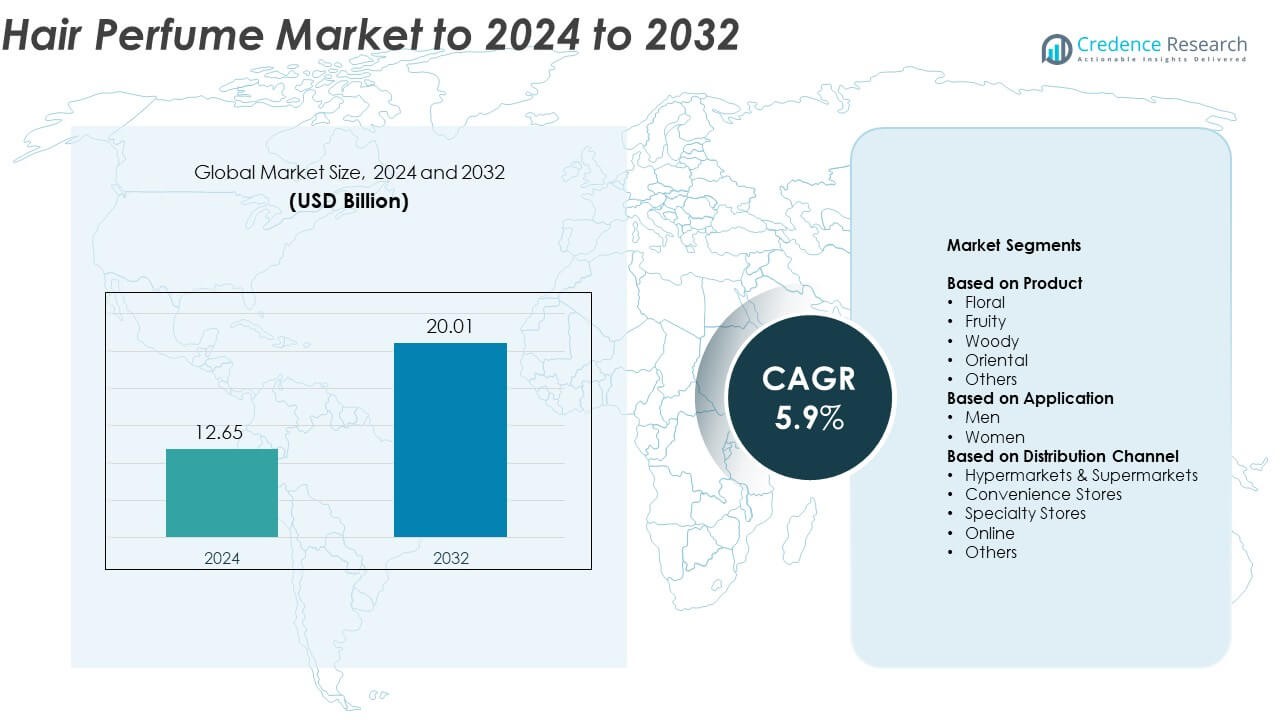

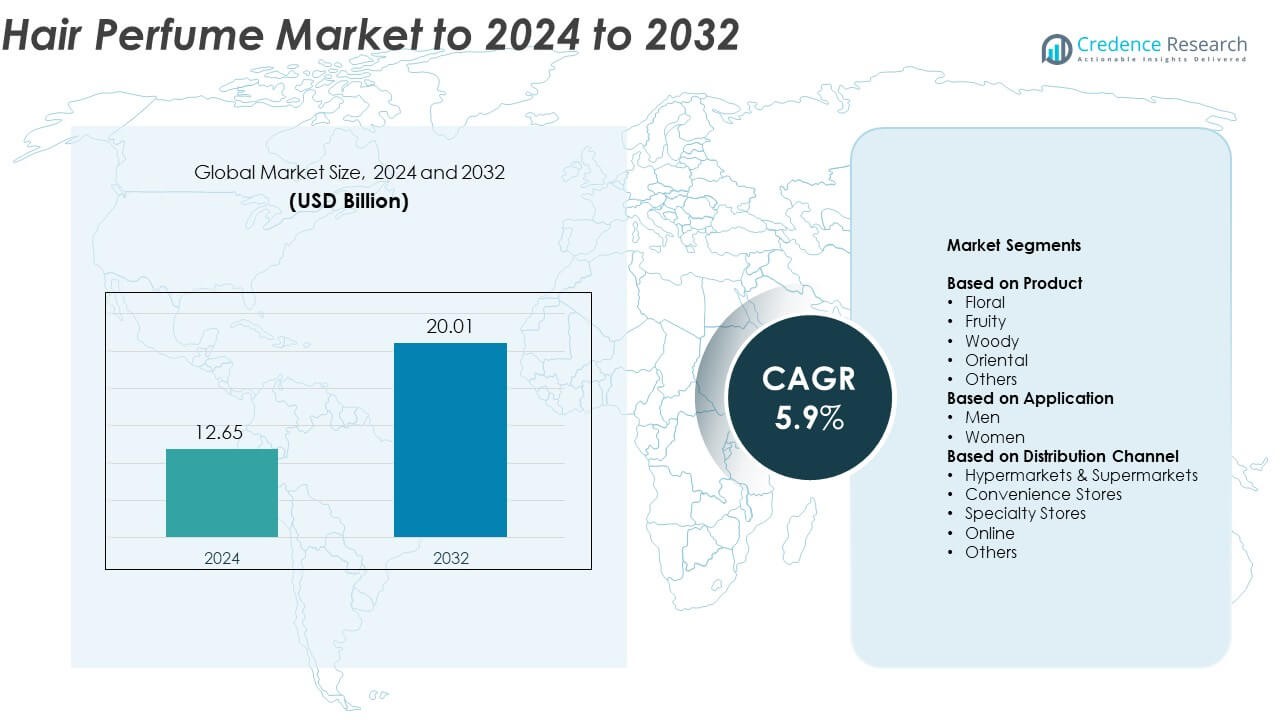

The Hair Perfume Market size was valued at USD 12.65 Billion in 2024 and is anticipated to reach USD 20.01 Billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hair Perfume Market Size 2024 |

USD 12.65 Billion |

| Hair Perfume Market, CAGR |

5.9% |

| Hair Perfume Market Size 2032 |

USD 20.01 Billion |

The hair perfume market is led by established brands such as Viktor&Rolf, Chanel, Gucci, Aerin, Dior, Unilever, Byredo, Oribe, Estée Lauder Companies, Maison Francis Kurkdjian, Shiseido, Yves Saint Laurent, Balmain, Diptyque, and Kao. These companies dominate through strong brand portfolios, continuous innovation, and premium positioning across global markets. North America holds the largest share at around 34.6% in 2024, driven by high consumer spending on luxury and personal grooming products. Europe follows with 28.3% share, supported by a strong presence of heritage fragrance houses and sustainable product trends. Asia Pacific, accounting for 24.9%, remains the fastest-growing region due to rising disposable income and growing demand for premium beauty products among younger consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hair perfume market was valued at USD 12.65 Billion in 2024 and is projected to reach USD 20.01 Billion by 2032, growing at a CAGR of 5.9%.

- Rising demand for premium grooming products and alcohol-free formulations is driving steady market expansion worldwide.

- Growing trends toward sustainable, vegan, and gender-neutral fragrances are reshaping consumer preferences across beauty segments.

- The market is moderately consolidated, with global luxury brands competing through innovation, online retail expansion, and customized product offerings.

- North America leads with 34.6% share, followed by Europe at 28.3%, while Asia Pacific, holding 24.9%, remains the fastest-growing region. The floral product segment accounts for about 38.2% share, reflecting consumer preference for fresh and long-lasting scents.

Market Segmentation Analysis:

By Product

The floral segment dominates the hair perfume market, holding nearly 38.2% share in 2024. Its leadership is driven by widespread consumer preference for light, natural, and refreshing fragrances that evoke a sense of cleanliness and freshness. Floral scents, such as rose, jasmine, and lavender, are commonly used by leading beauty brands to appeal to diverse age groups and climatic conditions. The segment’s growth is further supported by product launches that blend floral notes with modern fragrance technologies, enhancing scent retention and long-lasting freshness across hair types.

- For instance, Jo Malone London sells three Hair Mists, each in 30 ml size (English Pear & Freesia, Wild Bluebell, Wood Sage & Sea Salt), aligning with floral demand.

By Application

The women segment leads the market with around 71.5% share in 2024. This dominance is due to the strong consumer demand for personal grooming and premium haircare products among women globally. Increasing use of styling tools and exposure to pollution has driven interest in hair perfumes that combine fragrance with nourishing ingredients. Major cosmetic manufacturers continue to introduce women-specific formulations featuring lightweight, non-alcoholic bases that protect hair from dryness while offering elegant scents, reinforcing this segment’s sustained growth.

- For instance, Gisou offers a Hair Perfume line with 3 products and 2 sizes, supported by 178 product reviews on one SKU, reflecting strong female adoption.

By Distribution Channel

The online segment holds the largest share, accounting for about 42.7% in 2024. The surge in e-commerce platforms and digital marketing campaigns has significantly influenced purchasing behavior. Consumers prefer online retail for its convenience, broader product range, and access to exclusive brand collections. The rise of social media promotions, influencer collaborations, and direct-to-consumer strategies by major beauty brands has further boosted online sales. Additionally, subscription-based fragrance delivery models and virtual scent trials have strengthened online penetration within the hair perfume category.

Key Growth Drivers

Rising Focus on Personal Grooming and Premiumization

Increasing consumer spending on personal care and grooming products is driving hair perfume adoption. Growing awareness of hair hygiene and the desire for pleasant fragrance throughout the day have expanded the demand for high-quality, long-lasting formulations. Premiumization trends, particularly in urban markets, are encouraging consumers to choose niche and luxury hair perfumes featuring natural or alcohol-free ingredients, contributing to the segment’s sustained growth.

- For instance, L’Oréal’s World Refill Day campaign unified 12 brands (including Kérastase and Maison Margiela) to promote premium, sustainable formats, reinforcing grooming-led trade-up.

Expansion of E-Commerce and Direct-to-Consumer Channels

Rapid digitalization and e-commerce growth have transformed the distribution landscape of hair perfumes. Online platforms provide broader accessibility, personalized recommendations, and competitive pricing, boosting consumer engagement. Direct-to-consumer strategies by fragrance brands allow greater brand visibility and customer loyalty. The availability of exclusive online collections and subscription models is fueling steady market expansion.

- For instance, Sephora.com had approximately 49.5 million total visits in October 2025. During the same period, the competitor website ulta.com recorded approximately 40.7 million visits, which highlights the significant scale and reach of top beauty e-commerce platforms.

Innovation in Formulation and Sustainable Ingredients

Manufacturers are focusing on innovative formulations that combine fragrance with hair care benefits, such as UV protection and hydration. Rising preference for natural, vegan, and cruelty-free ingredients has spurred research into sustainable alternatives to synthetic fixatives. Eco-friendly packaging and low-VOC compositions are enhancing brand appeal among environmentally conscious consumers, promoting long-term market growth.

Key Trends & Opportunities

Growing Popularity of Gender-Neutral and Custom Scents

The trend toward inclusivity and personalized grooming has increased interest in gender-neutral and custom-blended hair perfumes. Brands are offering fragrances that appeal to all consumers, regardless of gender, using balanced notes such as musk and amber. Customization through online scent profiles is also enhancing consumer satisfaction, fostering new opportunities for niche fragrance houses.

- For instance, Maison Margiela positions fragrances as all-gender, with the site listing 18 results in its main perfume range, mirroring demand for gender-neutral scents.

Integration of Multifunctional Benefits

Hair perfumes are evolving beyond fragrance, offering added benefits such as conditioning, frizz control, and pollution protection. This multifunctional approach attracts consumers seeking convenience and holistic hair care. Advances in microencapsulation technology enable controlled scent release, ensuring longer fragrance retention while maintaining hair texture and shine.

- For instance, Moroccanoil cites its Treatment boosting hair shine by up to 118%, supporting the shift to multifunctional scented care.

Key Challenges

High Product Pricing and Limited Consumer Awareness

Premium hair perfumes often command higher prices due to specialized ingredients and advanced formulations, limiting affordability among mass consumers. In emerging markets, limited awareness about hair-specific fragrances compared to traditional perfumes hampers adoption. Expanding educational marketing and affordable product lines remain essential to broaden consumer reach.

Stringent Regulations on Fragrance Ingredients

Regulatory restrictions on certain synthetic compounds used in perfumes pose challenges for product formulation. Compliance with global standards such as REACH and IFRA increases production costs and limits formulation flexibility. Brands must continuously invest in research to develop compliant, safe, and appealing fragrance blends, impacting overall profitability and innovation pace.

Regional Analysis

North America

North America dominates the hair perfume market with around 34.6% share in 2024. The region’s leadership is attributed to strong consumer awareness of premium personal care products and high spending on grooming essentials. Major beauty brands focus on innovative fragrance launches tailored to local preferences, such as clean and floral notes. The rising demand for alcohol-free and nourishing formulations supports continued market expansion. Increasing adoption of online retail and influencer-driven marketing campaigns further enhances sales across the United States and Canada, reinforcing North America’s strong market position.

Europe

Europe holds approximately 28.3% share in 2024, driven by a mature cosmetics industry and the presence of leading fragrance manufacturers. Consumers across France, Germany, and the United Kingdom show strong preference for sustainable and cruelty-free formulations. The region’s emphasis on artisanal and natural scents has encouraged local brands to develop eco-friendly hair perfume lines. Growing popularity of unisex fragrances and niche luxury collections continues to strengthen market demand. Retailers are also expanding e-commerce penetration and cross-border trade, contributing to Europe’s steady growth trajectory within the global market.

Asia Pacific

Asia Pacific accounts for nearly 24.9% share in 2024 and is the fastest-growing regional market. Rapid urbanization, increasing disposable income, and evolving grooming habits among millennials are fueling product adoption. Consumers in China, Japan, and South Korea show growing interest in long-lasting and lightweight hair fragrances suitable for humid climates. Expanding beauty retail chains and strong social media influence are enhancing product awareness. International and regional brands are investing in localized scent profiles and affordable premium ranges, supporting continued expansion of the hair perfume market across Asia Pacific.

Latin America

Latin America captures about 7.4% share in 2024, supported by rising consumer inclination toward fragrance-based hair care routines. Brazil and Mexico are the leading markets due to strong beauty culture and increasing demand for multipurpose grooming products. The shift toward natural and floral-based hair perfumes aligns with regional climate preferences. Growing e-commerce channels and promotional campaigns from global fragrance brands are improving market accessibility. Despite moderate purchasing power, the region presents opportunities through mid-range and locally produced hair perfume offerings targeting younger demographics.

Middle East & Africa

The Middle East & Africa region holds nearly 4.8% share in 2024, characterized by growing demand for luxury and oriental-inspired hair fragrances. High per-capita spending on personal grooming in Gulf Cooperation Council countries drives premium product sales. The preference for alcohol-free and long-lasting scents aligns with cultural and climatic conditions. Expanding retail presence and increasing tourism influence fragrance trends in the region. Local perfume houses are collaborating with global brands to introduce hybrid formulations, blending traditional attar elements with modern fragrance technologies, fostering gradual market development.

Market Segmentations:

By Product

- Floral

- Fruity

- Woody

- Oriental

- Others

By Application

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hair perfume market features prominent players such as Viktor&Rolf, Chanel, Gucci, Aerin, Dior, Unilever, Byredo, Oribe, Estée Lauder Companies, Maison Francis Kurkdjian, Shiseido, Yves Saint Laurent, Balmain, Diptyque, and Kao. The market is characterized by strong brand differentiation, innovation in fragrance formulation, and emphasis on product aesthetics. Companies focus on blending signature scents with nourishing ingredients to create lightweight, long-lasting, and alcohol-free products suitable for diverse hair types. Strategic marketing through celebrity endorsements, influencer collaborations, and exclusive online collections strengthens brand visibility. Premium packaging, sustainability initiatives, and customization options further enhance consumer engagement. Moreover, expanding product portfolios across gender-neutral and travel-friendly formats has enabled global players to attract wider demographics. Continuous R&D investments and the integration of natural extracts with advanced fragrance technologies define the competitive edge in this market, supporting long-term brand loyalty and sustained global growth.

Key Player Analysis

- Viktor&Rolf

- Chanel

- Gucci

- Aerin

- Dior

- Unilever

- Byredo

- Oribe

- Estée Lauder Companies

- Maison Francis Kurkdjian

- Shiseido

- Yves Saint Laurent

- Balmain

- Diptyque

- Kao

Recent Developments

- In 2024, Balmain launched a new “Heritage 1974” collection, featuring unisex hair perfumes inspired by vintage fragrances and emphasizing a modern, sophisticated scent profile.

- In 2024, Kao introduced “The Answer,” a premium hair care brand with advanced repair and hydration treatments, emphasizing high-quality ingredients backed by 100 years of research.

- In 2024, Unilever announced a €100 million investment to build its own fragrance house using digital and AI technologies, recruiting expert perfumers and integrating advanced scent design.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with rising consumer focus on personal grooming and hygiene.

- Premium and niche fragrance brands will gain stronger traction among urban consumers.

- Demand for sustainable, vegan, and cruelty-free formulations will grow across key regions.

- Online retail and direct-to-consumer models will dominate future distribution channels.

- Gender-neutral and customized fragrances will emerge as major growth themes.

- Brands will invest in multifunctional hair perfumes offering care and protection benefits.

- Asia Pacific will remain the fastest-growing region driven by youth-centric beauty trends.

- Product innovation using natural essential oils will enhance brand competitiveness.

- Luxury and travel-size product variants will see higher adoption in global markets.

- Strategic partnerships between global and local fragrance brands will boost regional diversification.