Market Overview

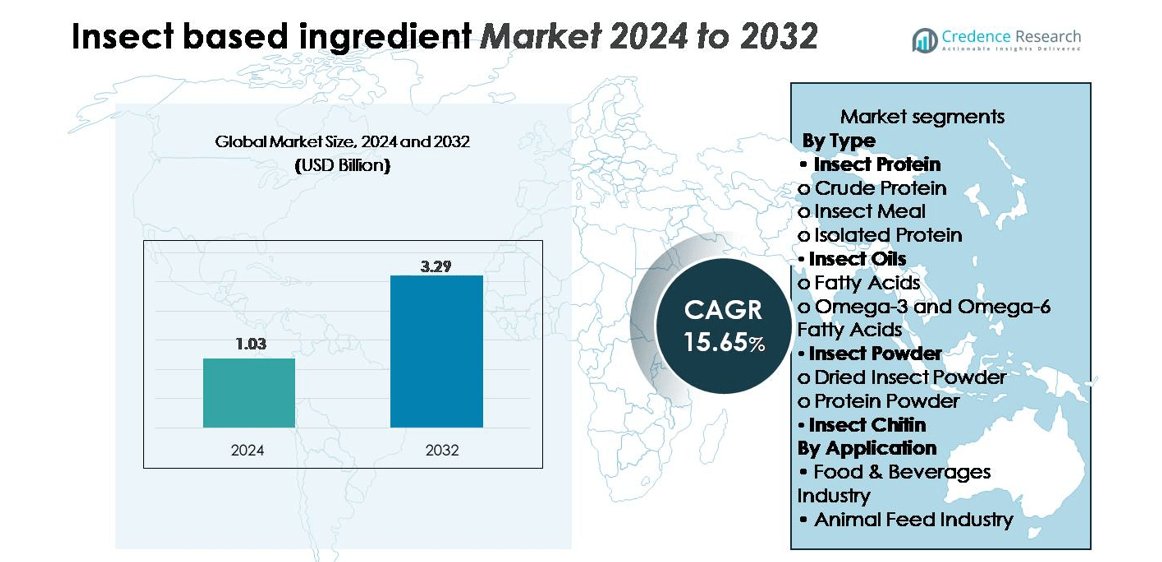

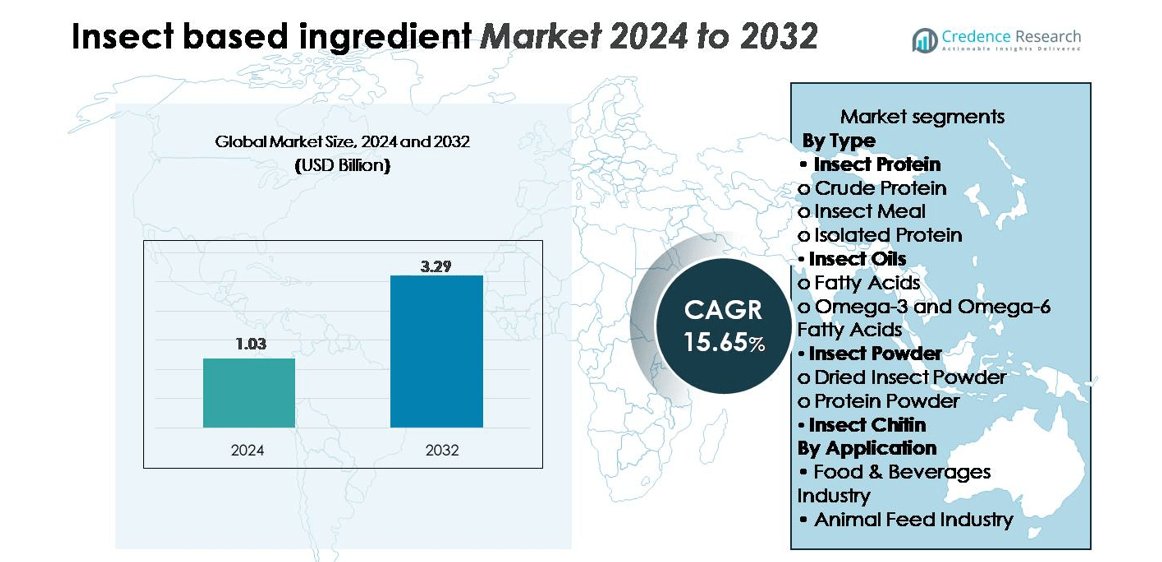

The Insect-Based Ingredient Market was valued at USD 1.03 billion in 2024 and is projected to reach USD 3.29 billion by 2032, expanding at a CAGR of 15.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Insect Based Ingredient Market Size 2024 |

USD 1.03 billion |

| Insect Based Ingredient Market, CAGR |

15.65% |

| Insect Based Ingredient Market Size 2032 |

USD 3.29 billion |

The insect-based ingredient market features leading players such as Ÿnsect, Protix, InnovaFeed, Entomo Farms, Aspire Food Group, Beta Hatch, and Entobel, each driving innovation through large-scale insect farming and advanced protein extraction technologies. These companies focus on sustainable production, automation, and circular economy models to meet the rising demand for eco-friendly protein sources. North America leads the global market with a 36% share, supported by strong regulatory backing and consumer acceptance, followed by Europe with 31%, driven by favorable policies and established production facilities. Asia-Pacific, holding a 25% share, is emerging rapidly due to high insect consumption and cost-efficient manufacturing.

Market insights

- The Insect-Based Ingredient Market was valued at USD 1.03 billion in 2024 and is projected to reach USD 3.29 billion by 2032, growing at a CAGR of 15.65% during the forecast period.

- Growing demand for sustainable and high-protein food sources is a major driver, with insect protein leading the segment due to its high amino acid content and eco-friendly production advantages.

- Key trends include the integration of insect ingredients into functional foods, nutraceuticals, and pet nutrition, supported by regulatory approvals and technological innovations in insect farming.

- High production costs, limited large-scale infrastructure, and consumer acceptance barriers in Western regions remain key restraints affecting market expansion and profitability.

- North America holds a 36% share, followed by Europe with 31% and Asia-Pacific with 25%; the insect protein segment dominates globally, accounting for the largest share due to its wide use in food and animal feed industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Insect protein leads the market with the largest share, primarily driven by its growing adoption in food and animal feed applications. Among its subtypes, insect meal dominates due to its balanced amino acid composition, high digestibility, and suitability for large-scale feed production. Crude and isolated proteins are also gaining traction in sports nutrition and dietary supplements. The increasing demand for sustainable and high-quality protein alternatives continues to fuel the expansion of this segment, supported by favorable regulations and investment in insect farming technologies.Insect oils and powders are emerging as fast-growing segments, favored for their nutritional and functional benefits. Insect oils, rich in essential fatty acids such as omega-3 and omega-6, are increasingly used in food fortification, cosmetics, and pet nutrition. Insect powders, including protein and dried forms, are valued for long shelf life, ease of processing, and incorporation in bakery, snack, and health supplement products. The trend toward clean-label and nutrient-dense ingredients significantly drives market growth for these categories, while insect chitin gains attention for its application in bioplastics, pharmaceuticals, and cosmetics.

- For instance, Ÿnsect operates its Amiens farm in France, which was designed with the projected capacity to produce around 100,000 tons of insect products (including 20,000 tons of protein meal and 80,000 tons of fertilizer) annually once fully operational.

By Application

The food and beverages industry holds the largest share in the insect-based ingredient market, propelled by rising consumer acceptance of insect-derived protein in snacks, bakery, and functional foods. Growing awareness of the nutritional profile of insect ingredients—rich in protein, fiber, and micronutrients—supports this dominance. The animal feed industry follows closely, driven by the sustainability advantages of insect-based feed formulations in aquaculture, poultry, and pet food production. Additionally, the cosmetics and pharmaceutical industries are adopting insect ingredients for their bioactive and antimicrobial properties, while agricultural applications such as fertilizers and bioplastics continue to expand, promoting circular economy practices.

- For instance, Ÿnsect’s facility in Amiens, France, produces up to 100,000 tons of mealworm-based protein annually, supplying food manufacturers such as Agronutris and Cargill with premium-grade insect ingredients containing 72 g of protein per 100 g and complete amino acid profiles verified by EU Novel Food regulations.

Key Growth Drivers

Rising Demand for Sustainable Protein Sources

Growing concerns over environmental sustainability and food security are driving demand for insect-based ingredients. Insects require significantly less land, water, and feed compared to livestock, making them a viable protein alternative. The high nutritional value of insect protein—rich in amino acids, vitamins, and minerals—further strengthens its adoption in food and feed industries. Major food producers and startups are investing in insect farming technologies to meet global protein needs sustainably. This eco-efficient production model aligns with climate goals and consumer preference for environmentally responsible nutrition solutions.

- For instance, Protix’s facility in Bergen op Zoom (its headquarters are in Dongen), the Netherlands, utilizes black soldier fly larvae to convert up to 100,000 metric tons of vegetable residual flows into high-quality sustainable protein annually. The facility itself is 14,000 square meters in size and produces over 10,000 metric tons of live larvae (LLE – Live Larvae Equivalent) annually which is processed into ingredients like protein meal and lipids.

Expanding Use in Animal Feed and Pet Nutrition

The animal feed sector is one of the primary growth engines of the insect-based ingredient market. Insect meal offers superior digestibility and nutritional balance for poultry, aquaculture, and pet food. Feed manufacturers are replacing conventional fishmeal and soy protein with insect-based proteins to enhance growth performance and sustainability. Regulatory approvals in regions such as the EU and North America are accelerating commercialization. Partnerships between feed producers and insect farms are increasing, promoting long-term feed security and reducing dependence on traditional protein sources.

- For instance, InnovaFeed’s Decatur plant in Illinois, co-located with ADM’s corn facility, produces 60,000 tons of insect protein and 20,000 tons of oil annually, enabling a verified 12% improvement in feed conversion ratios for farmed tilapia and trout.

Advancements in Processing and Extraction Technologies

Innovations in processing techniques such as enzymatic hydrolysis and lipid extraction are enhancing the quality and scalability of insect-based ingredients. These technologies improve protein yield, oil purity, and chitin extraction efficiency, allowing manufacturers to tailor products for diverse applications. Automation in insect rearing and precision feeding systems are optimizing production costs. The development of standardized processing methods ensures food safety and consistency, encouraging broader industrial acceptance. Technological advancements are thus making insect ingredients more competitive with traditional sources in both cost and performance.

Key Trends & Opportunities

Integration into Functional Foods and Nutraceuticals

The growing interest in functional foods and high-protein snacks is opening new avenues for insect-based ingredients. Insect protein powders are being formulated into sports nutrition products, energy bars, and meal replacements due to their nutrient density. Companies are leveraging the clean-label trend by highlighting natural, allergen-free, and sustainable sourcing benefits. Expanding retail presence and product innovation—especially in protein-rich snacks—are driving market visibility. This trend provides opportunities for ingredient manufacturers to diversify applications and tap into the growing health-conscious consumer base.

- For instance, Jimini’s, a France-based company, incorporates mealworm protein powder containing 72 g of protein and 5.3 g of branched-chain amino acids (BCAAs) per 100 g into protein bars distributed across 2,000 retail outlets in Europe.

Circular Economy and Waste Valorization Opportunities

Insect farming supports circular economy models by converting organic waste into high-value products such as protein, oil, and chitin. The ability of insects to upcycle agricultural and food waste reduces environmental burden while creating economic value. Governments and sustainability-focused organizations are promoting insect farming for waste management and resource recovery. Chitin and chitosan derived from insect exoskeletons are being explored for bioplastics, fertilizers, and biomedical applications. This alignment with circular economy principles presents long-term opportunities for sustainable industrial integration.

- For instance, Protix’s Dongen facility in the Netherlands processes 70,000 tons of organic byproducts annually, yielding 14,000 tons of insect-based protein and oil, while achieving a verified 90% waste-to-product conversion efficiency.

Expanding Regulatory Support and Consumer Acceptance

Evolving regulatory frameworks across Europe, North America, and Asia-Pacific are legitimizing the use of insect-based ingredients in food and feed. As safety assessments confirm their nutritional benefits, more countries are approving insect protein for human consumption. Educational campaigns and marketing efforts are improving consumer perception and overcoming cultural barriers. The growing inclusion of insect-based foods in retail and e-commerce channels signals a positive shift in acceptance. These developments are expected to accelerate industry expansion and attract greater investment.

Key Challenges

High Production Costs and Limited Scale

Despite strong demand, large-scale insect ingredient production faces cost challenges due to energy-intensive rearing, controlled environments, and feed requirements. The absence of established infrastructure limits economies of scale. Automation and advanced breeding techniques are improving efficiency but require significant investment. Inconsistent supply chains also hinder market stability. Reducing production costs through technological innovation and efficient waste-to-feed conversion remains essential for achieving competitiveness with conventional protein sources.

Consumer Perception and Cultural Barriers

Widespread adoption of insect-based products is still constrained by cultural resistance and limited awareness in several regions. Many consumers associate insect consumption with hygiene concerns or negative perceptions, particularly in Western markets. Despite their nutritional advantages, the psychological barrier to acceptance persists. Brands are addressing this through education, rebranding strategies, and product innovation that disguises insect ingredients within familiar food formats. Overcoming perception challenges is crucial to unlocking mass-market potential for insect-based ingredients.

Regional Analysis

North America

North America holds the largest share of the insect-based ingredient market, accounting for 36% of the global revenue. The region benefits from strong regulatory support, growing consumer acceptance of sustainable proteins, and the presence of major players investing in edible insect startups. The U.S. leads due to advancements in insect farming technology and incorporation of insect protein in food and feed sectors. Expanding applications in pet food and aquaculture, along with rising environmental awareness, continue to drive regional demand. Government initiatives supporting alternative protein sources further strengthen market growth across the region.

Europe

Europe represents 31% of the global market share, driven by progressive regulations and high adoption of insect-derived products in food and feed industries. Countries such as France, the Netherlands, and Denmark are leading producers, supported by established insect-rearing facilities and R&D collaborations. The European Food Safety Authority’s approval of various insect species for human consumption has accelerated commercialization. Rising preference for sustainable diets and circular economy initiatives has boosted product penetration across food processing and animal nutrition sectors, positioning Europe as a leading innovation hub for insect-based ingredients.

Asia-Pacific

Asia-Pacific accounts for 25% of the market share and is experiencing rapid growth due to traditional acceptance of insect consumption and expanding feed applications. China, Thailand, and Vietnam lead the market, supported by abundant raw material availability and low production costs. Increasing demand for protein-rich feed in aquaculture and poultry industries fuels regional expansion. Government initiatives encouraging sustainable farming and food security are also driving investments. The region’s dynamic food industry and expanding urban population continue to create opportunities for innovative insect-based ingredient formulations.

Latin America

Latin America captures a 5% share of the insect-based ingredient market, driven by growing awareness of sustainable protein alternatives and expanding agricultural integration. Brazil and Mexico lead with emerging insect farming operations supported by local startups and academic research. The region shows strong potential in animal feed and fertilizer applications due to favorable climatic conditions and waste management initiatives. As demand for high-value animal nutrition increases, investment in insect protein production is expected to rise, enhancing the region’s contribution to the global sustainable protein ecosystem.

Middle East & Africa

The Middle East & Africa region holds a 3% market share, supported by increasing interest in sustainable food and feed sources amid limited agricultural resources. South Africa and the United Arab Emirates are emerging as early adopters of insect-based technologies, focusing on waste-to-protein conversion and animal feed solutions. The scarcity of conventional protein sources and growing aquaculture industries are driving adoption. Regional collaborations and pilot projects for insect farming are expanding, positioning the region to gradually strengthen its presence in the global insect-based ingredient value chain.

Market Segmentations

By Type

- Insect Protein

- Crude protein

- Insect meal

- Isolated protein

- Insect Oils

- Fatty acids

- Omega-3 and Omega-6 fatty acids

- Insect Powder

- Dried insect powder

- Protein powder

- Insect Chitin

By Application

- Food & beverages industry

- Animal feed industry

- Cosmetics Industry

- Pharmaceutical Industry

- Agriculture (bioplastics, fertilizers, etc.)

- Others (textile, biochemical)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The insect-based ingredient market is highly competitive, featuring both established players and emerging startups focused on sustainable protein innovation. Key companies include Ÿnsect, Protix, InnovaFeed, Entomo Farms, Beta Hatch, Aspire Food Group, and Entobel, among others. These firms emphasize vertical integration, automation, and large-scale insect rearing to enhance production efficiency. Strategic partnerships, product innovation, and global expansion are central to their growth strategies. For instance, Ÿnsect operates one of the world’s largest vertical farms in France, producing premium insect protein for feed and food applications. Similarly, Protix in the Netherlands focuses on circular production models using organic waste as feedstock. Companies are also investing in advanced processing technologies for extracting insect oils, chitin, and protein isolates to diversify product portfolios. Regulatory approvals across North America, Europe, and Asia-Pacific have further intensified competition, encouraging new entrants and accelerating innovation toward scalable, high-quality insect-based ingredient solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Protifarm

- Exo Inc

- Thailand Unique

- Entomo Farms

- Ÿnsect

- AgriProtein

- Protix

- Enterra Feed Corporation

- ENTOTRUS

- EnviroFlight

Recent Development

- In October 2023, Tyson Foods, Inc., one of the world’s largest food companies, reached an agreement for a two-fold investment with Protix, the leading global insect ingredients company. The strategic investment will help in supporting the growth of the emerging insect ingredient industry and expand the use of insect ingredient solutions to create more efficient sustainable proteins and lipids for use in the global food system. The agreement combines Tyson Foods’ global scale, experience and network with Protix’s technology and market leadership to meet current market demand and scale production of insect ingredients.

- In 2023, Singapore-based multi-Billion-dollar company Entobel inaugurated its largest insect protein production facility in Vietnam for black soldier fly larvae to “produce functional insect-based ingredients” for animal feed and health

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rapid growth as sustainable protein alternatives gain mainstream adoption across industries.

- Expansion in insect farming technology will improve scalability and reduce production costs.

- Growing use of insect-based proteins in sports nutrition and functional foods will strengthen consumer acceptance.

- Regulatory approvals across more countries will accelerate commercialization and international trade.

- Collaboration between food manufacturers and insect farms will boost product innovation and application diversity.

- Animal feed and aquaculture sectors will remain major growth contributors due to high protein demand.

- Advancements in extraction and processing methods will enhance ingredient quality and shelf stability.

- Rising investments in circular economy projects will promote insect-based bioplastics and fertilizers.

- Branding and awareness campaigns will reduce consumer hesitation toward insect-derived foods.

- Asia-Pacific and North America will continue leading global expansion supported by strong industrial and regulatory frameworks.