Market Overview

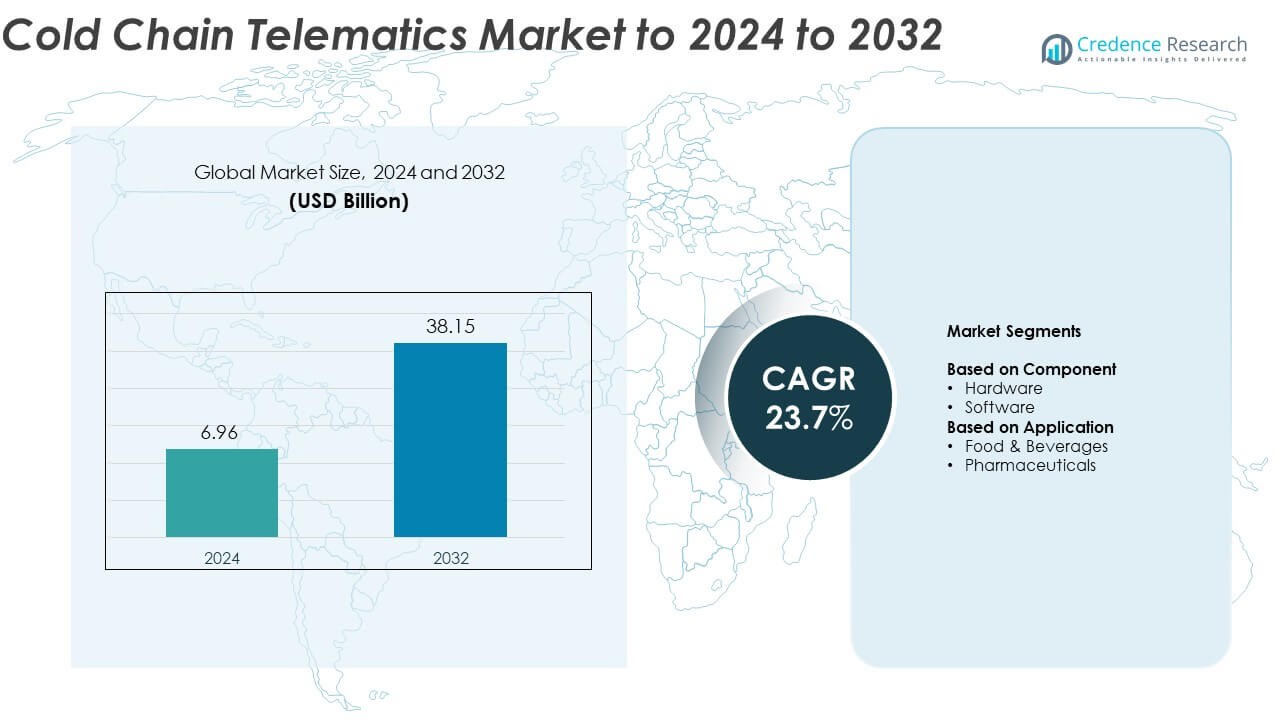

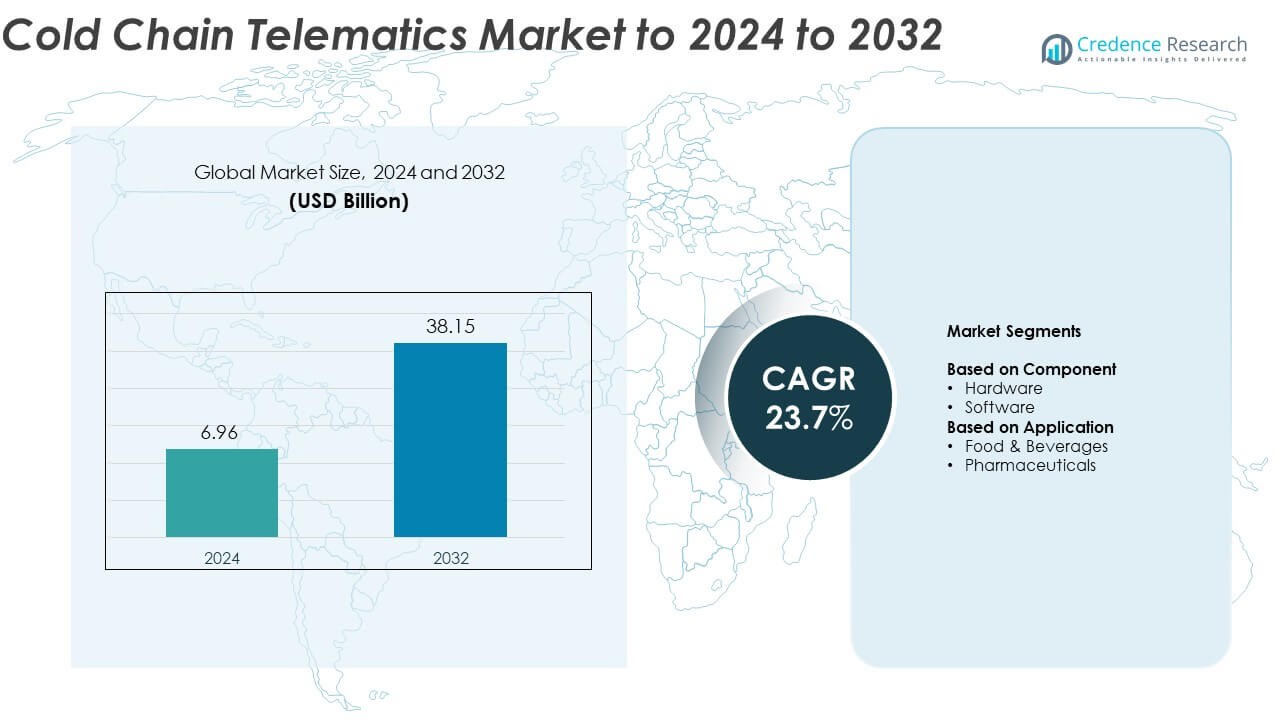

The Cold Chain Telematics Market size was valued at USD 6.96 billion in 2024 and is anticipated to reach USD 38.15 billion by 2032, at a CAGR of 23.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cold Chain Telematics Market Size 2024 |

USD 6.96 Billion |

| Cold Chain Telematics Market, CAGR |

23.7% |

| Cold Chain Telematics Market Size 2032 |

USD 38.15 Billion |

The cold chain telematics market is led by key players including Zebra Technologies Corp., ORBCOMM, Controlant, Savi Technology, Monnit Corporation, Verizon, Sensitech (Carrier), ELPRO-BUCHS AG, Astrata, and Roambee Corporation. These companies focus on advanced IoT, AI, and cloud-integrated telematics systems to ensure temperature control, regulatory compliance, and real-time visibility across global supply chains. North America dominates the market with a 37.6% share in 2024, driven by strong infrastructure, early technology adoption, and strict food and pharmaceutical safety regulations. Europe follows with 29.4%, supported by sustainability goals and advanced logistics modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cold chain telematics market was valued at USD 6.96 billion in 2024 and is projected to reach USD 38.15 billion by 2032, growing at a CAGR of 23.7% during the forecast period.

- Rising demand for temperature-sensitive goods, including pharmaceuticals and perishable foods, is a major driver supporting the adoption of real-time monitoring and tracking systems.

- Key trends include the integration of IoT, AI, and cloud-based analytics for enhanced fleet visibility, predictive maintenance, and route optimization.

- The market is moderately consolidated, with players investing in advanced telematics hardware and partnerships to expand global presence and ensure regulatory compliance.

- North America leads with 37.6% share, followed by Europe at 29.4%, while the hardware segment dominates with 61.4% share; the food and beverage segment remains the top application, capturing 53.8% of total revenue due to rising cold chain logistics in global food distribution.

Market Segmentation Analysis:

By Component

The hardware segment dominates the cold chain telematics market, accounting for around 61.4% share in 2024. This leadership is driven by the widespread use of GPS sensors, RFID tags, and temperature-monitoring devices in refrigerated transport and storage systems. The rising need for accurate real-time tracking and compliance with food safety regulations accelerates hardware adoption. Technological advancements, including IoT-enabled devices and cloud connectivity, enhance monitoring efficiency. Integration of predictive maintenance tools within telematics hardware further strengthens its role in ensuring uninterrupted cold chain operations across logistics networks.

- For instance, ORBCOMM reports tracking and monitoring 600,000 reefer containers, and in 2024 it shipped over 1,000,000 dry-container devices.

By Application

The food and beverages segment leads the cold chain telematics market with nearly 53.8% share in 2024. Its dominance stems from increasing global demand for perishable food products and the need to reduce spoilage during transit. Telematics systems provide real-time monitoring of temperature, humidity, and location, ensuring product safety and quality. Expansion of international food trade and adoption of strict cold chain standards by retailers and distributors fuel segment growth. Rising implementation of IoT and cloud-based analytics in refrigerated fleets further boosts efficiency and reliability.

- For instance, Maersk has 380,000+ reefer containers RCM-enabled across 400+ vessels, covering 99% of its reefer fleet.

Key Growth Drivers

Rising Demand for Temperature-Sensitive Goods

The increasing global trade of perishable food, beverages, and pharmaceuticals drives strong adoption of cold chain telematics. Companies are investing in real-time monitoring systems to ensure temperature stability and reduce spoilage risks during transit. The surge in vaccine distribution and biopharmaceuticals requiring precise thermal control further strengthens market growth. Enhanced visibility and compliance with international safety regulations support widespread implementation across logistics networks.

- For instance, UPS Healthcare operates over 220 facilities with 10,000+ healthcare logistics experts and more than 19 million square feet of cold-chain and healthcare-compliant space.

Expansion of IoT and AI-Driven Monitoring Solutions

Integration of IoT sensors, AI algorithms, and cloud analytics is transforming cold chain efficiency. Real-time tracking, predictive maintenance, and automated alerts help operators minimize equipment downtime and improve asset utilization. The use of AI-powered analytics enables proactive temperature management and route optimization. Growing preference for connected logistics platforms in refrigerated transport systems continues to drive the adoption of advanced telematics solutions.

- For instance, Samsara’s platform processed over 9 trillion data points and 75 billion API calls in FY24.

Stringent Regulatory and Quality Compliance Standards

Governments and regulatory agencies across regions are enforcing stricter cold chain quality standards. Compliance requirements from organizations such as the FDA and WHO are accelerating the deployment of telematics for continuous monitoring and reporting. The demand for audit-ready systems that ensure transparency and data traceability supports market growth. Increasing focus on maintaining product integrity and safety across long-distance transportation further boosts adoption.

Key Trends and Opportunities

Adoption of Cloud-Based Cold Chain Platforms

Cloud-based telematics systems are gaining traction due to their scalability, cost efficiency, and real-time analytics capabilities. These platforms enable centralized data management, multi-location visibility, and remote configuration of refrigerated fleets. Businesses benefit from enhanced decision-making supported by AI-driven insights and predictive analytics. The trend aligns with digital transformation in logistics, promoting sustainable and connected cold chain ecosystems.

- For instance, Tive reached 2,000,000 real-time visibility trackers sold by December 2024.

Emergence of 5G and Edge Computing Technologies

The introduction of 5G and edge computing is enhancing communication speed and reliability across telematics networks. These technologies enable faster data transmission between vehicles, sensors, and control centers, improving real-time responsiveness. Edge processing reduces latency in monitoring temperature deviations and mechanical issues. This evolution supports smarter logistics operations and boosts the reliability of perishable goods transportation across long distances.

- For instance, Geotab reported over 4.7 million connected vehicles in some earlier 2024 reports and, as of a September 2025 press release, has surpassed the milestone of 5 million connected vehicle subscriptions worldwide, processing 100 billion data points daily for approximately 100,000 global customers.

Growing Focus on Sustainability and Energy Efficiency

Companies are increasingly adopting eco-friendly telematics systems to reduce energy consumption and emissions. Smart routing, optimized refrigeration cycles, and solar-powered telematics devices are key developments. This shift toward sustainable cold chain operations supports corporate ESG goals and regulatory compliance. The trend is fostering innovation in low-power devices and renewable integration within refrigerated transport systems.

Key Challenges

High Implementation and Maintenance Costs

The cost of installing and maintaining advanced telematics hardware, sensors, and connectivity solutions remains high. Small and medium enterprises face budget constraints that limit large-scale deployment. Continuous data transmission and software upgrades add to operational expenses. Despite long-term benefits, high upfront costs can delay adoption, particularly in developing regions with limited cold chain infrastructure.

Data Security and Connectivity Concerns

As telematics systems become more connected, data security risks and cyber vulnerabilities increase. Breaches or network disruptions can compromise real-time monitoring and lead to product losses. Ensuring data integrity, encryption, and secure cloud storage remains a major challenge for logistics operators. Dependence on stable internet connectivity in remote transport routes further complicates reliable data transmission and system resilience.

Regional Analysis

North America

North America dominates the cold chain telematics market with nearly 37.6% share in 2024. The region’s leadership stems from advanced logistics infrastructure, strong adoption of IoT-based fleet management, and stringent food and drug safety regulations. The United States drives growth through extensive deployment of GPS-enabled tracking systems and cloud-integrated monitoring solutions. Rising demand for pharmaceutical cold storage and the expansion of e-commerce grocery delivery services further boost adoption. Major logistics providers are investing in real-time visibility platforms to improve operational efficiency and ensure regulatory compliance across the supply chain.

Europe

Europe accounts for around 29.4% share of the cold chain telematics market in 2024. Growth is supported by strict regulatory frameworks such as GDP and HACCP standards for food and pharmaceutical transport. Countries like Germany, France, and the U.K. are investing heavily in connected fleet solutions and energy-efficient refrigeration systems. The presence of strong logistics networks and sustainability-focused initiatives enhances adoption. Increasing export of temperature-sensitive goods and the expansion of cross-border trade within the EU continue to drive demand for telematics-enabled cold chain monitoring solutions across the region.

Asia Pacific

Asia Pacific holds approximately 24.8% share of the cold chain telematics market in 2024 and is the fastest-growing regional segment. Rapid industrialization, rising consumption of packaged food, and increasing pharmaceutical exports are fueling adoption. China, Japan, and India are leading markets due to large-scale investments in smart logistics and IoT integration. Expanding retail and food delivery sectors also contribute to market acceleration. Government initiatives supporting cold chain modernization and rising demand for end-to-end temperature monitoring solutions are propelling growth across developing economies in the region.

Latin America

Latin America captures nearly 5.1% share of the cold chain telematics market in 2024. Countries such as Brazil, Mexico, and Chile are witnessing growing adoption of refrigerated transport systems to support agricultural and food exports. Increasing focus on reducing post-harvest losses and improving food quality during transit strengthens telematics deployment. Infrastructure modernization projects and strategic partnerships between logistics firms and technology providers are enhancing real-time visibility. However, challenges related to cost and connectivity continue to affect large-scale adoption, though government investments in smart logistics are gradually improving market conditions.

Middle East & Africa

The Middle East & Africa region holds about 3.1% share in the cold chain telematics market in 2024. Growth is primarily driven by increasing demand for temperature-controlled logistics in pharmaceuticals, dairy, and fresh produce sectors. The United Arab Emirates and Saudi Arabia lead regional investments in digital logistics and fleet connectivity. Rising import of perishable goods and expansion of retail distribution networks encourage adoption of monitoring technologies. Despite infrastructure challenges, growing trade volumes and smart city logistics initiatives are expected to enhance market penetration in the coming years.

Market Segmentations:

By Component

By Application

- Food & Beverages

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cold chain telematics market features major participants such as Zebra Technologies Corp., ORBCOMM, Controlant, Savi Technology, Monnit Corporation, Verizon, Sensitech (Carrier), ELPRO-BUCHS AG, Astrata, and Roambee Corporation. The market is characterized by high innovation intensity, with companies focusing on developing integrated telematics platforms that combine real-time temperature monitoring, GPS tracking, and data analytics. Vendors are investing in cloud-based solutions and AI-driven systems to enhance asset visibility, ensure regulatory compliance, and optimize operational efficiency. Strategic partnerships between logistics providers and technology developers are expanding global service networks. Continuous advancements in IoT sensors, connectivity modules, and edge computing are driving performance improvements in fleet management. Companies are also prioritizing sustainability by introducing energy-efficient devices and eco-friendly monitoring systems to align with green logistics standards. The growing emphasis on automation, predictive analytics, and interoperability defines the next phase of competition in this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Sensitech announced a strategic collaboration with Qualcomm Technologies to advance real-time monitoring solutions for the cold chain industry, focusing on enhanced connectivity, precision visibility, and device energy optimization for global cold chain shipments.

- In 2024, Controlant launched its Right First Time (RFT) dashboard, providing pharma companies and logistics providers with actionable data insights to improve cold chain operational efficiency and compliance through real-time monitoring.

- In 2023, ORBCOMM launched the RT 8000 telematics system tailored for European refrigerated transport fleets, featuring real-time temperature monitoring, fuel tracking, automated compliance, and preventive maintenance.

Report Coverage

The research report offers an in-depth analysis based on Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing integration of AI and IoT will enhance predictive maintenance and route optimization.

- Expansion of connected logistics platforms will improve real-time monitoring across global supply chains.

- Rising demand for pharmaceutical cold storage will drive adoption of advanced telematics systems.

- Cloud-based analytics will become central to improving visibility and compliance management.

- Adoption of 5G technology will boost communication speed and reduce data latency in fleet operations.

- Sustainability goals will encourage development of energy-efficient and low-emission telematics devices.

- Increasing cross-border food trade will accelerate the need for reliable cold chain tracking solutions.

- Collaboration between logistics firms and technology providers will foster innovative monitoring ecosystems.

- Regulatory compliance and quality assurance standards will continue to shape market investments.

- Emerging economies will witness rapid deployment of smart cold chain infrastructure and digital platforms.