Market Overview

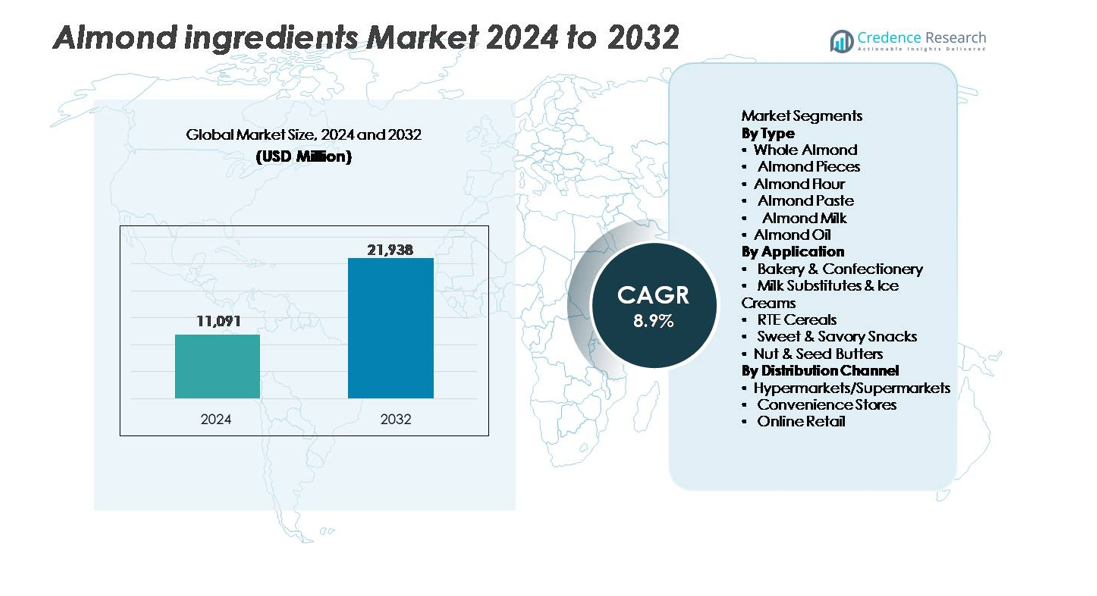

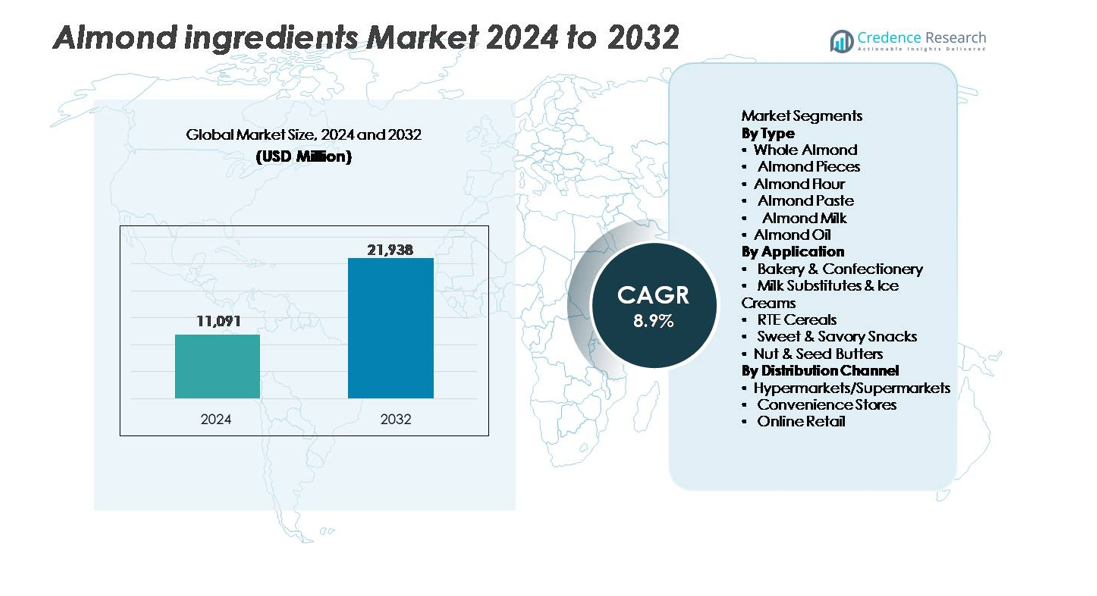

The global Almond Ingredients Market was valued at USD 11,091 million in 2024 and is projected to reach USD 21,938 million by 2032, expanding at a CAGR of 8.9% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Almond Ingredients Market Size 2024 |

USD 11,091 million |

| Almond Ingredients Market, CAGR |

8.9% |

| Almond Ingredients Market Size 2032 |

USD 21,938 million |

The almond ingredients market is led by prominent players such as Blue Diamond Growers, Olam Food Ingredients, Archer Daniels Midland Company (ADM), Barry Callebaut Group, Döhler GmbH, and John B. Sanfilippo & Son, Inc. These companies dominate through advanced processing technologies, sustainable sourcing, and diversified product portfolios spanning almond milk, flour, oil, and paste. North America remains the leading region with a 38% market share in 2024, driven by strong production in California and high consumer adoption of plant-based and functional foods. Ongoing innovations in clean-label and fortified formulations continue to strengthen the competitive landscape across global markets.

Market Insights

- The Almond Ingredients Market was valued at USD 11,091 million in 2024 and is projected to reach USD 21,938 million by 2032, growing at a CAGR of 8.9% during the forecast period.

- Rising demand for plant-based, gluten-free, and clean-label products is driving the market, supported by growing use of almond milk, flour, and oil in health-focused foods.

- Product innovations, such as fortified almond beverages and bakery ingredients, are shaping key market trends, with strong investment in sustainable and traceable sourcing.

- Leading companies including Blue Diamond Growers, ADM, Olam Food Ingredients, and Barry Callebaut focus on technological advancements, eco-efficient processing, and product diversification to maintain competitiveness.

- North America led with a 38% share, followed by Europe at 29% and Asia-Pacific at 22%, while the whole almond segment dominated with a 32% share, supported by its widespread use in snacks and confectionery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Whole almonds held the dominant share in the almond ingredients market, accounting for 32% in 2024. Their popularity stems from their wide use in snacks, confectionery, and dairy alternatives due to high nutritional value and clean-label appeal. Demand for almond flour and almond milk is also increasing as consumers shift toward gluten-free and plant-based diets. Product innovation and improved processing technologies continue to drive this segment’s growth across global food industries.

- For instance, Blue Diamond Growers operates processing facilities with a combined capacity exceeding 1 billion pounds of almonds annually, utilizing precision optical sorting and steam pasteurization systems to ensure consistent quality and maintain nutrient integrity across product categories.

By Application

Bakery and confectionery dominated the almond ingredients market with a 35% share in 2024. The segment benefits from rising demand for premium baked goods and natural ingredients that enhance taste and texture. Almond flour, paste, and oil are widely used for their flavor, stability, and nutritional benefits. Increasing use in clean-label and vegan bakery products further supports market expansion, especially in Europe and North America.

- For instance, Barry Callebaut operates numerous chocolate, cocoa, and nut ingredient production facilities globally, utilizing a range of advanced processing technologies. These technologies are designed to ensure consistent product quality, superior texture, and optimal shelf stability for use in bakery and confectionery applications.

By Distribution Channel

Hypermarkets and supermarkets led the market with a 48% share in 2024, driven by broad product availability and consumer trust in retail brands. The segment benefits from organized shelf placement and promotional campaigns by major food processors. Online retail is growing rapidly due to the rising popularity of e-commerce platforms and direct-to-consumer models. The shift toward digital shopping, combined with premium packaging innovations, is reshaping product accessibility for global consumers.

Key Growth Drivers

Rising Demand for Plant-Based and Healthy Ingredients

The growing preference for plant-based and natural foods is a major driver of the almond ingredients market. Consumers are replacing animal-based proteins and dairy with almond-derived products like almond milk, flour, and butter due to their high nutritional profile and cholesterol-free composition. The global rise in veganism and lactose intolerance awareness has strengthened market adoption across regions. Food manufacturers are reformulating products to include almonds as a primary ingredient, aligning with clean-label and sustainable nutrition trends. For instance, Blue Diamond Growers expanded its almond milk portfolio with reduced-sugar variants and fortified options to cater to health-conscious consumers.

- For instance, Blue Diamond Growers, which has major processing facilities in locations including Sacramento, Salida, and Turlock, processes about 1 billion pounds of almonds annually across its entire operation.

Expanding Use in Functional and Fortified Foods

Almond ingredients are gaining traction in functional foods and beverages for their high vitamin E, magnesium, and antioxidant content. These nutrients support heart health, immunity, and energy balance, making almonds a preferred choice in health-focused formulations. Manufacturers are incorporating almond proteins and flours into energy bars, ready-to-drink beverages, and cereals. The trend toward fortified foods, particularly in urban markets, drives innovation in almond-based formulations. For example, Archer Daniels Midland (ADM) launched functional almond protein blends aimed at improving nutritional density and taste in plant-based snacks.

- For instance, Archer Daniels Midland (ADM) offers a variety of plant protein concentrates, such as their Profam® pea protein powder or Arcon® T textured pea proteins, which typically have a protein content exceeding 50 grams per 100 grams.

Technological Advancements in Processing and Extraction

Advancements in almond processing technologies are improving product quality, yield, and shelf life. Modern techniques such as cold-press extraction, dry roasting, and microfiltration enhance flavor retention and nutrient stability in almond oils and flours. Automation and precision roasting systems enable consistent quality for large-scale production. Companies are also investing in sustainable processing methods to minimize water use and waste. For instance, Olam Food Ingredients implemented water-saving roasting systems that reduced water consumption by over 25%, enhancing both efficiency and environmental performance.

Key Trends & Opportunities

Growth of Dairy Alternatives and Clean-Label Beverages

The surge in plant-based beverages has positioned almond milk as a top-selling dairy alternative globally. Consumers seek lactose-free, low-calorie, and protein-rich options that support ethical and sustainable living. Manufacturers are investing in fortified almond drinks enriched with calcium and vitamin D to match dairy nutrition. The clean-label movement has further encouraged the use of almonds due to their natural processing and transparent sourcing. Companies like Califia Farms and Danone have introduced barista-friendly almond milk formulations to meet growing café and home-use demand.

- For instance, Califia Farms publishes that its Unsweetened Almondmilk product contains “0 g sugar” and “35 calories” per serving, and is labeled an “excellent source of calcium.”

Product Diversification and Innovation in Food Applications

The market is witnessing innovation across diverse categories, from bakery fillings and savory sauces to confectionery coatings. Almond-based inclusions and toppings are increasingly used in cereals, chocolates, and ready-to-eat meals for added crunch and flavor. Companies are launching new almond ingredient formats such as flour blends, emulsions, and paste variants to enhance product versatility. For instance, Barry Callebaut introduced almond praline fillings designed for artisanal and industrial confectionery applications, broadening usage in premium and functional foods.

- For instance, Barry Callebaut Group offers an “Almond & Hazelnut Praliné 50%” product containing 25 % almonds and 25 % hazelnuts, with a shelf-life of 12 months and processing applications such as moulding, depositing, and one-shot operations (US–EU product SKUs).

Sustainable and Ethical Sourcing Initiatives

Sustainability has become a critical factor influencing purchase decisions in the almond industry. Producers are adopting water-efficient irrigation, renewable energy, and traceable sourcing practices to meet environmental goals. These initiatives appeal to conscious consumers and attract partnerships with global food brands emphasizing ESG compliance. For instance, Almond Board of California’s sustainability program achieved a 33% reduction in water use per pound of almonds produced through precision farming techniques. Such efforts enhance brand credibility and strengthen long-term supply stability.

Key Challenges

Fluctuating Almond Prices and Supply Chain Volatility

The almond ingredients market faces challenges due to price instability caused by climatic variations and production constraints. California, which accounts for a large share of global almond production, often experiences droughts and water scarcity that disrupt supply. Rising input costs, labor shortages, and logistics delays further strain market consistency. These fluctuations impact profit margins for food manufacturers dependent on steady almond supplies. For instance, prolonged drought conditions in California led to a nearly 15% reduction in yield, increasing pressure on processors and downstream industries.

Allergic Reactions and Regulatory Constraints

Allergen concerns associated with nuts remain a major challenge for product adoption in certain demographics. Manufacturers must comply with strict food safety regulations and labeling requirements to prevent cross-contamination. This increases production costs and limits almond ingredient use in mass-market food products. Moreover, some countries impose import restrictions and high tariffs on nut-based goods, affecting trade flexibility. To address this, companies are investing in allergen-free processing facilities and transparent labeling systems, as seen in Oetker Group’s allergen-controlled production plants for bakery ingredients.

Regional Analysis

North America

North America dominated the almond ingredients market with a 38% share in 2024, supported by strong demand for plant-based foods and dairy alternatives. The U.S. leads regional growth due to extensive almond production in California and rising health-conscious consumption. Major food manufacturers use almond flour, milk, and butter across bakery and snack segments. Investments in sustainable farming and product innovation by companies such as Blue Diamond Growers and Olam Food Ingredients continue to enhance market competitiveness. Growing adoption of fortified beverages and gluten-free products further strengthens regional market expansion.

Europe

Europe accounted for a 29% share in 2024, driven by high consumer preference for natural, organic, and clean-label food ingredients. Countries like Germany, France, and the U.K. lead demand for almond-based bakery, confectionery, and dairy alternatives. The region benefits from strict quality standards and a growing vegan population. Food processors are increasingly sourcing traceable and sustainably produced almonds to meet EU regulatory norms. Companies such as Barry Callebaut and Döhler are innovating with almond-based inclusions and beverages, enhancing the region’s position as a hub for premium and functional food ingredients.

Asia-Pacific

Asia-Pacific captured a 22% share in 2024, emerging as one of the fastest-growing regions due to rising disposable incomes and increasing awareness of healthy diets. India, China, and Japan are key markets for almond milk, snacks, and confectionery applications. Rapid urbanization and expanding retail distribution networks are boosting demand for convenient and nutritious almond-based products. The growing popularity of Western-style bakery items also contributes to consumption growth. Investments in local processing and partnerships between regional food companies and international almond suppliers are improving supply reliability and affordability.

Latin America

Latin America held a 7% share in 2024, with demand driven by increasing adoption of plant-based and fortified food products. Brazil and Mexico lead regional consumption, supported by growing urban populations and rising interest in dairy alternatives. Manufacturers are introducing almond flours and oils for health-focused bakery and snack products. Regional players are also expanding online retail channels to increase accessibility. Although production remains limited, rising imports from North America and Europe ensure consistent supply to meet consumer needs for nutritious and sustainable ingredients.

Middle East & Africa

The Middle East & Africa accounted for a 4% share in 2024, reflecting growing demand for premium health foods and clean-label products. The UAE and Saudi Arabia are key markets, supported by a strong retail sector and rising disposable incomes. Almond-based beverages, confectionery, and bakery products are gaining traction among affluent consumers. Import dependency remains high, but expanding logistics and distribution capabilities are improving market reach. Strategic collaborations between regional distributors and international almond processors are helping bridge supply gaps and meet increasing consumer preferences for plant-based nutrition.

Market Segmentations:

By Type

- Whole Almond

- Almond Pieces

- Almond Flour

- Almond Paste

- Almond Milk

- Almond Oil

By Application

- Bakery & Confectionery

- Milk Substitutes & Ice Creams

- RTE Cereals

- Sweet & Savory Snacks

- Nut & Seed Butters

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The almond ingredients market is highly competitive, featuring both global and regional players focused on product innovation, sustainability, and value-added offerings. Key companies include Blue Diamond Growers, Olam Food Ingredients, Archer Daniels Midland Company (ADM), Barry Callebaut Group, Döhler GmbH, and John B. Sanfilippo & Son, Inc. These firms emphasize technological advancements in processing to improve texture, flavor, and nutritional quality while reducing environmental impact. Strategic partnerships and mergers strengthen their market presence and supply chain resilience. For instance, Blue Diamond expanded its California processing facilities to enhance almond flour and milk output, while ADM invested in sustainable sourcing programs to ensure traceability and water-efficient cultivation. Companies are also prioritizing R&D for clean-label and allergen-controlled products to cater to evolving consumer preferences. The competition centers on diversifying almond formats—such as pastes, oils, and powders—across bakery, beverage, and dairy substitute applications, driving steady innovation in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Barry Callebaut Group

- Blue Diamond Growers

- The Wonderful Company LLC

- Olam International

- Kanegrade Ltd.

- Borges Agricultural & Industrial Nuts

- John B. Sanfilippo & Son, Inc.

- Treehouse California Almonds

- Harris Woolf California Almonds

- Archer Daniels Midland Company

Recent Developments

- In September 2024, Blue Diamond Growers partnered with Kagome Co., Ltd. for all production and distribution of Almond Breeze in Japan. The new partnership is focused on accelerating market growth and driving new demand for Almond Breeze. The new partnership was asserted to harness the qualities of Almond Breeze while leveraging the in-market expertise of Kagome to drive additional consumption within Japan.

- In February 2024, SunnyGem, a key California almond supplier, released SunnyGem Almond Oil, its first direct-to-consumer, premium food-grade almond oil, offering a high-quality ingredient for culinary, food processing, and flavor applications.

- In January 2023, Califia Farms, a renowned and high-quality brand in the plant-based beverage sector, broadened its acclaimed range of dairy-free offerings by introducing USDA-certified Organic Oatmilk and Almondmilk

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for almond-based products will continue to rise with growing preference for plant-based diets.

- Innovation in almond milk, flour, and protein formulations will expand product diversity.

- Sustainable and traceable sourcing practices will become essential for global competitiveness.

- Technological advancements in processing will enhance yield, flavor retention, and shelf life.

- Expansion in functional foods and beverages will drive new application areas.

- Asia-Pacific markets will experience strong growth due to rising disposable incomes and urbanization.

- Manufacturers will invest in allergen-free and clean-label product developments.

- Strategic mergers and partnerships will strengthen supply chains and product portfolios.

- E-commerce and direct-to-consumer channels will boost accessibility of premium almond products.

- Rising demand for organic and non-GMO variants will influence future product innovation and market direction.