Market Overview

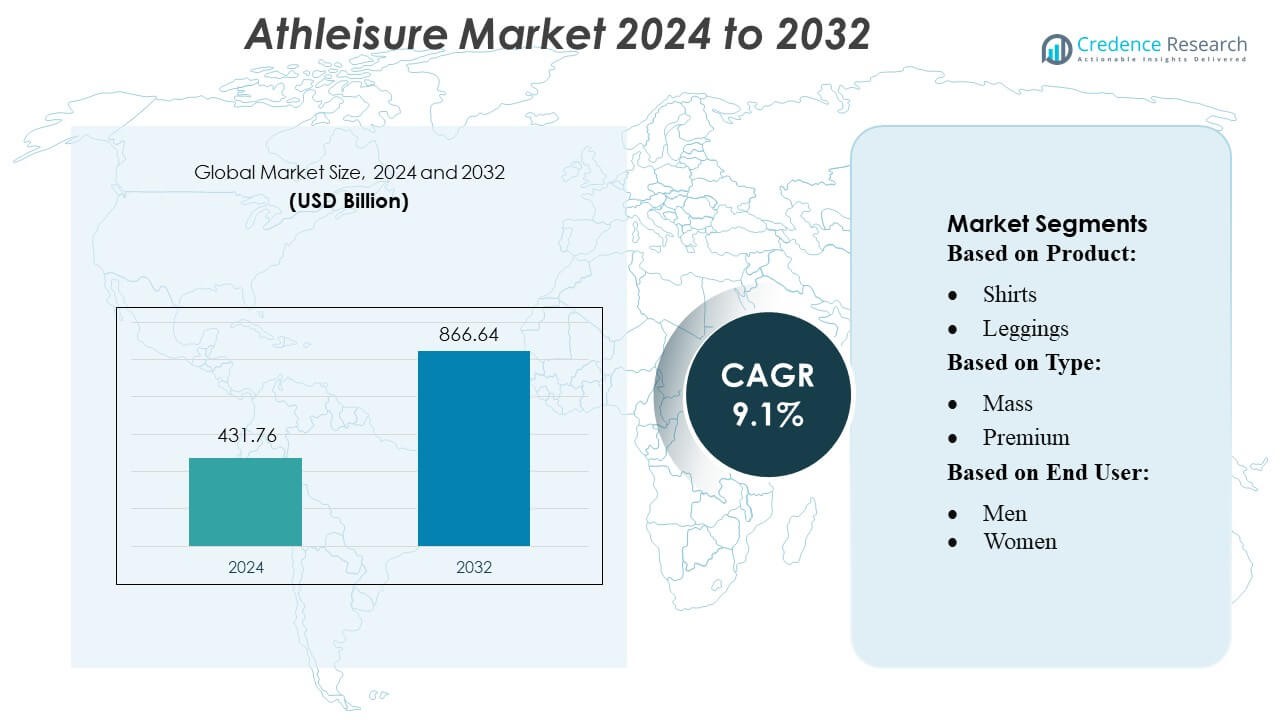

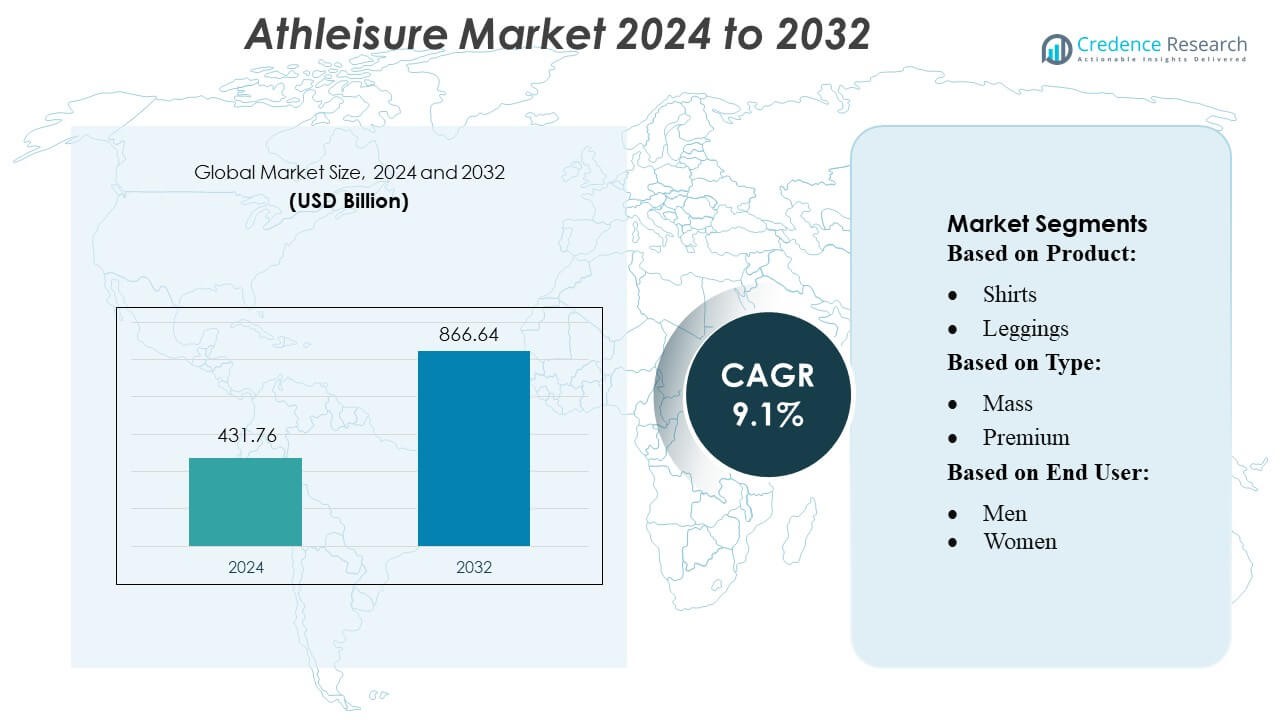

Athleisure Market size was valued USD 431.76 billion in 2024 and is anticipated to reach USD 866.64 billion by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Athleisure Market Size 2024 |

USD 431.76 Billion |

| Athleisure Market, CAGR |

9.1% |

| Athleisure Market Size 2032 |

USD 866.64 Billion |

The athleisure market is dominated by leading companies such as Lululemon Athletica Inc., Adidas AG, Under Armour, and emerging sustainable brands like PANGAIA and Outerknown. These players compete fiercely through innovation, performance fabrics, and eco-friendly production methods, shaping product strategy across segments. Lululemon leverages its design-first positioning and strong retail ecosystem, while Adidas and Under Armour emphasize technical performance and global distribution. PANGAIA and Outerknown differentiate through sustainability and recycled materials. Regionally, North America leads the market, capturing approximately 35 % of global athleisure revenues, driven by high fitness engagement, disposable income, and widespread digital retail penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Athleisure Market was valued at USD 431.76 billion in 2024 and is expected to reach USD 866.64 billion by 2032, registering a CAGR of 9.1% during the forecast period.

- Strong market drivers include rising health awareness, growing adoption of comfort-based fashion, and increased use of performance fabrics that enhance durability, flexibility, and everyday wear appeal.

- Key trends involve rapid expansion of sustainable athleisure, with brands integrating recycled fibers, low-impact dyes, and circular design, while the apparel segment maintains the largest share due to high demand for leggings, tops, and versatile sportswear.

- Competitive activity intensifies as major players strengthen innovation pipelines, expand omnichannel strategies, and differentiate through eco-friendly materials, though high production costs and raw-material fluctuation remain key restraints.

- Regionally, North America leads with a 35% share, supported by strong fitness culture and digital retail growth, while Asia Pacific grows fastest as lifestyle shifts and urbanization accelerate athleisure adoption.

Market Segmentation Analysis:

By Product

Yoga apparels represent the dominant product segment, holding the largest market share due to their versatility, ergonomic design, and adoption in both fitness and casual wear. Their growth is driven by rising participation in yoga and Pilates, increasing demand for flexible and breathable fabrics, and strong brand investments in gender-neutral collections. Tops and leggings also witness strong traction as consumers seek multipurpose garments suitable for both workouts and daily activities. Innovation in moisture-wicking textiles and seamless construction continues to accelerate the segment’s expansion within the overall athleisure category.

- For instance, Under Armour integrates its proprietary Iso-Chill yarn—a ribbon-shaped nylon fiber treated with titanium dioxide—to pull heat away from the skin, enabling a cooling effect that helped athletes push their VO2 max ~7–12 minutes longer in testing.

By Type

The mass segment leads the athleisure market, capturing the largest share because of its affordability, wide retail penetration, and high consumer adoption across emerging and developed economies. Its growth is propelled by fast-fashion brands offering trend-aligned athletic basics, expanding e-commerce availability, and frequent product refresh cycles. Premium athleisure, while growing rapidly, remains secondary due to higher price points but benefits from demand for luxury performance wear and advanced fabric technologies. The dominance of mass athleisure continues as consumers prioritize value, comfort, and everyday functionality in sports-inspired apparel.

- For instance, Vuori developed its signature DreamKnit™ fabric, which in their Ponto Performance styles comprises 89% recycled polyester and 11% elastane, delivering four-way stretch and moisture-wicking performance.

By End-User

Women constitute the dominant end-user segment, accounting for the largest proportion of athleisure demand due to strong adoption of leggings, yoga wear, and versatile lifestyle-fitness hybrids. This segment is driven by rising fitness engagement, increased preference for comfortable apparel in hybrid work environments, and targeted product innovation such as sculpting fabrics and inclusive sizing. Men follow with growing demand for performance shorts, tees, and joggers, while the children’s category expands steadily as parents prioritize durable and movement-friendly clothing. The women’s segment remains central, supported by higher product variety and faster trend cycles.

Key Growth Drivers

1. Rising Health and Wellness Consciousness

Growing global awareness around fitness, active living, and preventive healthcare significantly drives athleisure demand. Consumers increasingly participate in yoga, home workouts, and outdoor sports, boosting purchases of versatile athletic apparel. This shift is further strengthened by the proliferation of fitness influencers, mobile health apps, and social media communities promoting active lifestyles. As consumers prioritize comfort and performance in their daily wardrobe, athleisure products gain relevance beyond exercise, supporting continuous market expansion across diverse demographic and income groups.

- For instance, Activewear 3.0 collection uses 99.99% plant-based EVO® Nylon from Fulgar combined with 30% bio-based creora® elastane sourced from corn, making it the first activewear range using this stretch fiber.

2. Expansion of Hybrid Workwear and Casual Fashion

The rise of remote and hybrid work arrangements has accelerated the adoption of comfortable yet presentable apparel, positioning athleisure as a preferred choice for everyday wear. Consumers value stretchable fabrics, minimalistic designs, and performance features that support long hours of sitting or movement. Brands respond with elevated aesthetics, softer textures, and multifunctional silhouettes that bridge home, office, and leisure activities. This dressing shift toward “comfort-first” fashion has become structural rather than temporary, enabling sustained athleisure sales and broader penetration into lifestyle wardrobes.

- For instance, PANGAIA 365 Seamless Activewear line is engineered entirely from EVO® Nylon, made from castor beans and industrial corn, and regen™ BIO Max elastane, which contains 98% renewable feedstock.

3. Material Innovation and Performance Fabric Technologies

Advancements in textile engineering—such as seamless knitting, moisture-wicking fibers, four-way stretch materials, and enhanced breathability—significantly strengthen the athleisure value proposition. Brands invest in eco-friendly fabrics like recycled polyester, organic cotton blends, and bio-based elastane to meet growing sustainability expectations. These innovations improve durability, comfort, and fit, encouraging consumers to replace traditional casual wear with performance-oriented alternatives. Continuous R&D in lightweight compression, odor control, and thermal regulation further diversifies product functionality, driving higher adoption across fitness routines, everyday activities, and transitional outfits.

Key Trends & Opportunities

1. Sustainability and Circular Fashion Models

Sustainable manufacturing, recycled materials, and transparent supply chains are becoming defining trends within athleisure. Consumers increasingly prefer brands offering low-impact dyes, waste-reducing production methods, and ethically sourced fabrics. This shift creates opportunities for circular initiatives such as repair services, take-back programs, and resale platforms, which help companies strengthen brand loyalty while reducing environmental footprint. As sustainability becomes a differentiator, brands leveraging eco-certified materials and lifecycle-focused design gain competitive advantage and capture environmentally conscious consumers across both mass and premium segments.

- For instance, Hanes has reduced single-use plastics by 50% (vs 2019) and is cutting packaging weight by 16%. It also uses EcoSmart® polyester, which accelerates fiber breakdown once discarded, helping minimize microplastic pollution.

2. Digital Commerce Expansion and D2C Acceleration

Strong growth in e-commerce and direct-to-consumer (D2C) channels provides significant opportunities for athleisure brands to scale efficiently. Digital-first players leverage data analytics, influencer marketing, and personalized recommendations to convert online traffic into repeat customers. Virtual try-ons, size prediction tools, and AI-driven product customization enhance the online shopping experience, particularly for performance wear. The continued rise of mobile commerce and social commerce enables brands to reach younger demographics more effectively, strengthening sales and enabling rapid testing of new product lines and designs.

- For instance, Renew resale platform has processed over 1.5 million returned garments using Trove’s white-label resale technology, generating more than 40.6% repeat customers.

3. Growing Demand in Emerging Markets

Urbanization, rising disposable incomes, and expanding middle-class populations in emerging markets present strong growth opportunities. Consumers in Asia-Pacific, Latin America, and the Middle East increasingly embrace active lifestyles and aspirational fashion trends, fueling demand for affordable athleisure staples. International brands continue to expand retail footprints while collaborating with local influencers to tailor styles to regional preferences. Increased access to global e-commerce platforms further accelerates adoption. As fitness and wellness culture spreads, these markets become high-potential zones for both mass and premium athleisure offerings.

Key Challenges

1. Intense Competitive Pressure and Price Sensitivity

The athleisure market faces heavy competition from global sportswear giants, fast-fashion retailers, and emerging D2C brands, pressuring pricing strategies and margins. Consumers often compare products across categories—comfort wear, sportswear, and casual apparel—heightening the need for differentiation. Price-sensitive customers in many regions prioritize affordability over advanced material technologies, limiting premium product adoption. Brands must balance cost efficiency with innovation while maintaining consistent quality and brand identity. This competitive intensity challenges newcomers and existing players seeking sustainable, long-term market positioning.

2. Supply Chain Disruptions and Volatile Raw Material Costs

Fluctuations in global supply chains, including delays in fabric sourcing, rising transportation costs, and dependency on specialized textile suppliers, create operational vulnerabilities. Athleisure relies heavily on performance materials such as elastane, polyester blends, and technical yarns, which are subject to price volatility. Sustainability demands further complicate procurement as brands seek certified suppliers with stable capacity. Any disruption impacts production timelines and inventory planning, leading to stockouts or excess inventory. Managing supply chain resilience becomes critical for brands aiming to sustain product availability and cost competitiveness.

Regional Analysis

North America

North America leads the global athleisure market with an estimated 35% market share. The region benefits from strong consumer interest in fitness, high disposable income, and widespread adoption of casual clothing in workplaces and daily life. Major brands such as Nike, Lululemon, and Under Armour maintain high visibility and drive continuous product innovation. Well-developed retail networks and rapid e-commerce expansion also support market growth. The trend toward health-focused lifestyles and increased participation in outdoor and gym-based activities continues to boost demand for versatile and comfortable athleisure apparel.

Europe

Europe accounts for roughly 22–25% of the global athleisure market, supported by a shift toward comfort-driven fashion and growing interest in sustainable apparel. Consumers in countries such as Germany, France, and the UK increasingly choose casual, functional clothing for everyday wear. Strong brand presence from Adidas, Puma, and various premium labels accelerates product adoption. The expansion of digital retail channels and rising gym memberships further support market growth. Sustainability regulations and consumer preference for eco-friendly fabrics continue to influence product development and purchasing decisions across the region.

Asia Pacific

Asia Pacific holds about 25–28% market share and remains the fastest-growing region in the athleisure market. Rapid urbanization, rising incomes, and expanding interest in fitness activities among younger populations drive strong demand. China, India, and Southeast Asian countries show increasing adoption of activewear for both exercise and casual use. Local brands such as Anta and Li-Ning compete actively with global companies, boosting product availability. The region’s strong manufacturing base, along with the rapid expansion of online retail, further accelerates market penetration and supports long-term growth.

Latin America

Latin America represents approximately 8–10% of the global athleisure market. Growth is supported by a rising middle class, broader access to online retail, and increasing interest in health and wellness. Countries such as Brazil, Argentina, and Mexico see growing demand for stylish yet affordable activewear. Local and international brands are expanding their presence through both physical stores and digital platforms. Despite economic fluctuations, consumer preference for comfortable, multipurpose clothing continues to rise, supported by sports culture and youth population trends across the region.

Middle East & Africa (MEA)

The Middle East & Africa region holds an estimated 6–7% market share and is experiencing steady growth in athleisure adoption. Rising health awareness, expanding gym culture, and increasing participation in sports activities contribute to demand. Countries such as the UAE, Saudi Arabia, and South Africa lead regional consumption. Hot climates support strong interest in lightweight, breathable performance fabrics, while modest-activewear options are gaining popularity. Expanding retail infrastructure and government initiatives promoting sports and fitness further support long-term market expansion across MEA.

Market Segmentations:

By Product:

By Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Athleisure Market features a diverse mix of established and emerging players, including Wear Pact, LLC, Under Armour, Inc., Vuori, Lululemon Athletica Inc., PANGAIA, Hanesbrands Inc., EILEEN FISHER, Adidas AG, and Outerknown. The Athleisure Market remains highly dynamic, driven by rapid shifts in consumer preferences toward comfort-driven, performance-oriented, and sustainably produced apparel. Companies increasingly prioritize innovation in fabric engineering, incorporating moisture-wicking materials, stretchable blends, and temperature-regulating textiles to enhance functionality. Sustainability has emerged as a central differentiator, with many brands investing in recycled fibers, low-impact dyes, and circular production models to align with rising environmental expectations. Digital commerce continues to transform competition, as brands leverage data-driven personalization, influencer marketing, and omnichannel strategies to strengthen customer engagement. Product diversification, limited-edition drops, and fitness-lifestyle collaborations further intensify market activity.

Key Player Analysis

- Wear Pact, LLC

- Under Armour, Inc.

- Vuori

- Lululemon Athletica Inc.

- PANGAIA

- Hanesbrands Inc.

- EILEEN FISHER

- Adidas AG

- Outerknown

Recent Developments

- In October 2025, Under Armour has introduced UA ECHO, marking its entry into the growing sportswear and street culture category. The UA ECHO targets younger consumers, particularly Generation Z, who value both performance and personal expression in athletic footwear.

- In May 2025, Nike has re-released the Hypervenom football boot line with the Hypervenom RGN. This updated version combines the original Hypervenom design with new technology, incorporating an enhanced upper, a redesigned plate, and the established mesh and Gripskin technology.

- In January 2025, Reflo introduced its proprietary Reloop technology into its athletic uniforms to enable a circular economy for sportswear. This innovation is a real-world development, not a hypothetical scenario.

- In February 2024, lululemon launched a new footwear collection, expanding from its core athletic apparel business to offer a complete head-to-toe uniform for athletes. This launch included the debut casual sneaker, the Cityverse, and new running models like the Beyondfeel and Beyondfeel Trail.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand as consumers increasingly prioritize comfort-focused and performance-driven apparel for everyday use.

- Sustainability will become a core competitive factor, pushing brands to adopt recycled materials and circular production practices.

- Digital retail will grow further, supported by personalization tools, virtual try-ons, and data-driven consumer insights.

- Hybrid clothing designs will gain popularity as work–leisure boundaries continue to blur globally.

- Demand for eco-friendly fabrics and low-impact dyeing processes will rise as environmental awareness strengthens.

- Premium athleisure segments will grow as consumers seek high-quality, durable, and versatile apparel.

- Direct-to-consumer brands will expand their presence through strong online engagement and influencer-based marketing.

- Regional brands will increasingly compete with global players by offering localized designs and value-driven collections.

- Smart textiles and functional apparel innovations will accelerate, improving comfort, fit, and performance capabilities.

- Fitness culture, wellness trends, and outdoor lifestyle activities will continue to fuel long-term market growth.