Market Overview

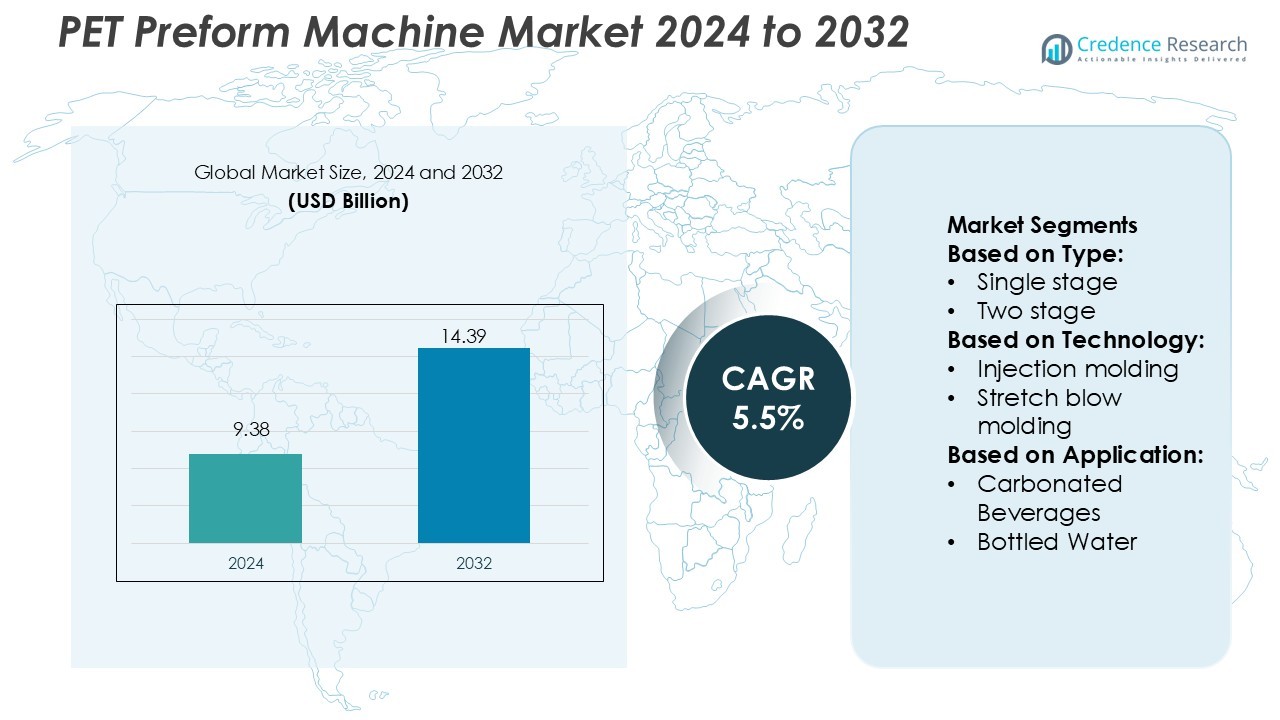

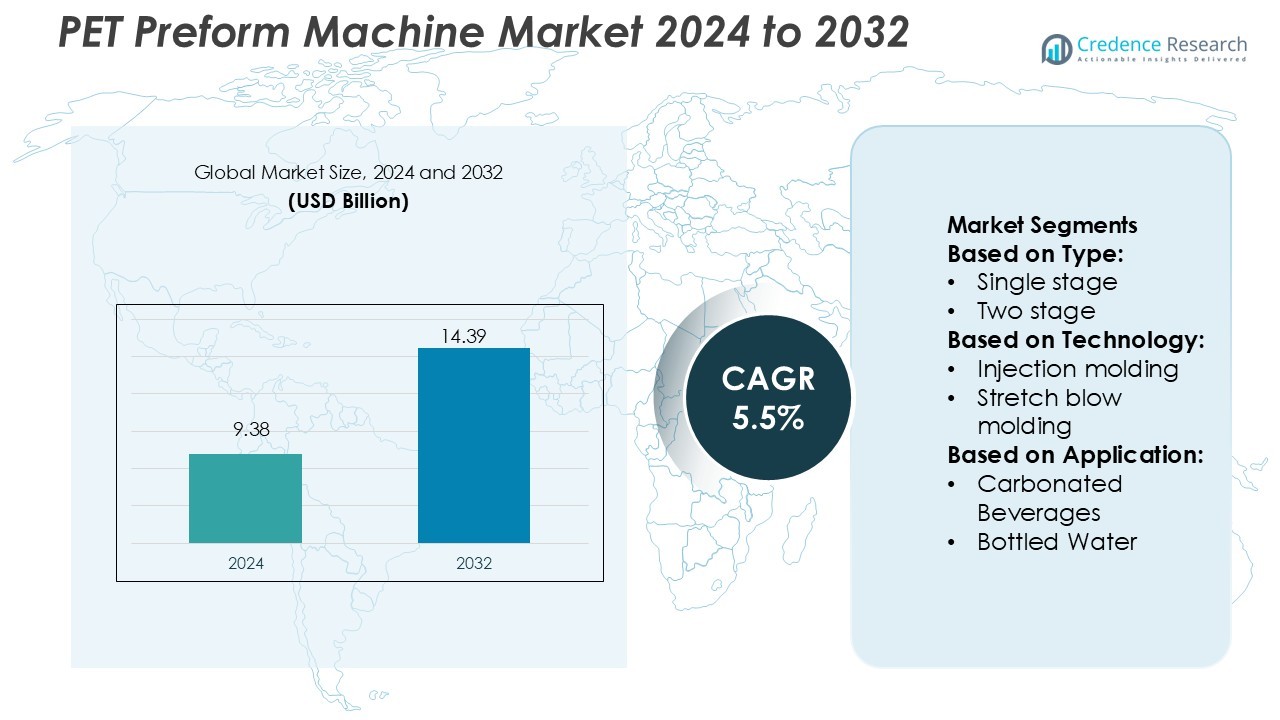

PET Preform Machine Market size was valued USD 9.38 billion in 2024 and is anticipated to reach USD 14.39 billion by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PET Preform Machine Market Size 2024 |

USD 9.38 Billion |

| PET Preform Machine Market, CAGR |

5.5% |

| PET Preform Machine Market Size 2032 |

USD 14.39 Billion |

The PET preform machine market features strong participation from major players such as Sidel Group, Idaho Milk Products, Preform Technologies Inc., Urola S.Coop., Nissei ASB Machine Co., Ltd., Krauss Maffei Group GmbH, SIPA S.p.A., Powerjet Plastic Machinery Co., Ltd., Husky Injection Molding Systems Ltd., and Sumitomo (SHI) Demag Plastics Machinery GmbH. These firms differentiate through advanced automation, high‑cavity mold technology, and global service networks. Regionally, the Asia‑Pacific region leads the market, capturing approximately 36 % of market share, thanks to rapid growth in beverage packaging demand and strong manufacturing bases in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The PET preform machine market was valued at USD 9.38 billion in 2024 and is anticipated to reach USD 14.39 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

- The market is driven by the rising demand for bottled beverages and packaging solutions that require high‑speed, high‑precision PET preform machines.

- Key trends include the growing adoption of automation and smart manufacturing technologies, leading to faster cycle times and more efficient production.

- The competitive landscape is shaped by major players like Sidel Group, Husky Injection Molding Systems, and KraussMaffei, which focus on advanced mold designs and high‑output capabilities.

- The Asia‑Pacific region leads the market with approximately 36% of the global market share, driven by strong manufacturing bases in China and India and increasing demand for packaged beverages.

Market Segmentation Analysis:

By Type

In the PET preform machine market, the single‑stage segment holds the largest market share, driven by its ability to integrate both injection and blow‑moulding in one machine. This results in reduced space requirements and faster production times, making it ideal for manufacturers looking to optimize efficiency. Single‑stage machines are particularly popular in the beverage industry for producing small to medium‑sized bottles, where quick changeovers and compact designs are essential for high‑volume production.

- For instance, Revlon established a 62,000-square-foot innovation center in Kenilworth, New Jersey, relocating its research and development operations to the Northeast Science and Technology (NEST) Center.

By Technology

Injection molding dominates the technology segment of the PET preform machine market. This is due to its high precision, reliability, and fast cycle times, which are ideal for large‑scale production of preforms. Injection molding machines can produce a high volume of lightweight preforms with consistent quality, which is critical for industries like beverages and personal care. The ability to maintain high speeds and accuracy has made injection molding the preferred choice in this market.

- For instance, Johnson & Johnson’s consumer health division revealed 16 new skincare research studies at the 2021 American Academy of Dermatology Virtual Meeting. The presentations, which included 3 oral publications and 13 poster presentations, highlighted targeted innovation in various aspects of skin health, including for women, cancer patients, and multicultural populations.

By Application

The carbonated beverage segment leads the PET preform machine market, as PET bottles are widely used for soda and sparkling drinks. The demand for lightweight, durable, and high‑quality bottles for these beverages has driven the growth of this segment. PET preform machines used for carbonated beverages are capable of high production rates, with some machines producing over 200,000 preforms per hour. This high output is essential for meeting the large-scale demands of the carbonated beverage industry.

Key Growth Drivers

Rising Beverage Packaging Demand

The global growth in beverage consumption, especially bottled water and carbonated drinks, is driving the demand for PET preform machines. High‑output machines are needed to keep up with the growing production needs, with some systems able to produce over 200,000 preforms per hour. This demand for faster and more efficient production capabilities is one of the major factors driving growth in the PET preform machine market.

- For instance, FOREO LUNA 4 cleansing device integrates 16 T-Sonic pulsation intensities and ultra-hygienic silicone touchpoints. It offers up to 600 uses per full charge, improving both cleansing precision and user longevity.

Adoption of Lightweight and Recyclable PET Packaging

As consumers and manufacturers focus on sustainability, lightweight and recyclable PET packaging is gaining popularity. PET preform machines are being optimized to produce thinner bottles using less material, which helps reduce costs and environmental impact. This trend is boosting demand for machines that can handle lower weight preforms while still maintaining strength and durability.

- For instance, L’Oréal’s new North America Research & Innovation Center spans 250,000 sq ft and houses a 26,000 sq ft modular lab, on-site mini factory, and capacity for daily user testing with up to 400 consumers.

Automation & Smart Manufacturing

With the rise of Industry 4.0, more PET preform machines are integrating automation and smart manufacturing technologies. Machines with features like predictive maintenance, real‑time analytics, and robotic automation are improving efficiency and reducing downtime, driving the demand for these advanced systems in the PET preform market.

Key Trends & Opportunities

Lightweight Preform Technology

There is increasing demand for PET bottles that use less material, and preform machines are evolving to support this. Machines that can create lightweight preforms without compromising strength are becoming more popular. This trend offers opportunities for manufacturers to innovate and produce more cost‑effective and environmentally friendly solutions.

- For instance, Krones has deployed remote service over more than 20,000 machines worldwide via the CENTERSIGHT / Device Insight platform, enabling remote diagnostics and legally compliant access logging.

Sustainability‑Focused Machines

Sustainability is becoming a key focus in the PET preform machine market. Many new machines are designed to use less energy and are compatible with recycled PET materials. These features appeal to manufacturers looking to reduce their carbon footprint and meet environmental goals, presenting a strong opportunity for growth in the market.

- For instance, PackSys Global builds modular machines and configurable lines, notably in tube production mini 300 Line achieves up to 300 tubes per minute, combining FlexSeamer, Mini 300 Header-Capper, and FlexMaster modules into one scalable system

Expansion in Emerging Markets

As the middle class grows in regions like Asia‑Pacific and Latin America, the demand for packaged beverages is rising. This presents a huge opportunity for PET preform machine manufacturers to expand into these emerging markets. Manufacturers can capture a larger market share by tailoring their machines to meet the specific needs of these growing regions.

Key Challenges

High Capital Investment and Machine Cost

The high cost of PET preform machines can be a barrier, especially for smaller manufacturers. The initial investment required for these advanced machines may limit adoption in price‑sensitive markets. To overcome this challenge, manufacturers may need to offer more affordable or flexible financing options.

Raw Material Price Volatility and Supply Chain Issues

The fluctuating prices of PET resin and metal parts can disrupt production costs for PET preform machines. Additionally, supply chain issues can delay deliveries and increase costs. Manufacturers in the market need to find ways to manage these challenges and minimize their impact on production and pricing.

Regional Analysis

North America

The North American region commands an estimated 28% of the global PET preform machine market. Manufacturers benefit from mature bottled‑beverage demand, well‑established packaging infrastructure and rapid adoption of automation technologies. The prevalence of high‑output, multi‑cavity machines in the United States drives the region’s share, as converters upgrade equipment to meet stringent sustainability and performance standards. North America’s strong service‑support network and ready access to precision machine suppliers also reinforce its leading position.

Europe

Europe holds approximately 22% of the PET preform machine market. The region’s share is supported by stringent regulatory emphasis on recyclability and lightweighting, compelling machine buyers to invest in next‑generation equipment. Key markets—such as Germany, France and Italy—feature robust beverage and bottled‑water production, encouraging adoption of high‑speed, high‑cavity machines. Further, Europe’s strong research ecosystem promotes advanced machine designs that cater to complex bottle formats, sustaining the region’s significant market presence.

Asia‑Pacific

The Asia‑Pacific region leads globally with around 36% share of the PET preform machine market. Rapid urbanisation, rising consumption of bottled beverages in China and India, and a strong manufacturing base drive this dominance. Machine suppliers target local markets with high‑output models, multi‑station machines and lightweight preform capabilities. Industrial expansion and growing packaging conversions to PET in Southeast Asia further support the region’s leadership in both volume and growth trajectory.

Latin America

Latin America accounts for about 9% of the global PET preform machine market. Growth in this region is driven by increasing bottled‑beverage consumption, infrastructure expansion, and rising interest in lightweight packaging solutions. Brazil and Mexico serve as key markets, where machine uptake—though moderate—reflects investments in regional production capacity. Price sensitivity and local logistics challenges moderate the rate of machine upgrades, but emerging demand underscores the region’s potential.

Middle East & Africa (MEA)

The Middle East & Africa region holds roughly 5% of the PET preform machine market. Growth stems from increasing bottled‑water demand in Gulf countries and industrial investments in North Africa. However, the region’s share remains relatively small due to limited machine‑supplier presence and logistical constraints. As cold‑chain infrastructure and packaging manufacturing mature across MEA, machine‑buyers are gradually adopting higher‑output PET machines, suggesting future potential for expansion.

Market Segmentations:

By Type:

By Technology:

- Injection molding

- Stretch blow molding

By Application:

- Carbonated Beverages

- Bottled Water

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PET preform machine market is highly competitive, with key players such as Sidel Group, Idaho Milk Products, Preform Technologies Inc., Urola S.Coop., Nissei ASB Machine Co., Ltd., KraussMaffei Group GmbH, SIPA S.p.A., Powerjet Plastic Machinery Co., Ltd., Husky Injection Molding Systems Ltd., and Sumitomo (SHI) Demag Plastics Machinery GmbH. The PET preform machine market is characterized by intense competition, with manufacturers continuously innovating to enhance machine efficiency, speed, and energy consumption. Companies in the market are focusing on the development of advanced technologies, such as high‑precision molds and automated production systems, to reduce cycle times and improve production output. Additionally, there is a growing emphasis on sustainability, with many manufacturers incorporating energy‑efficient solutions and environmentally friendly practices into their production processes. The demand for customizable solutions across various industries, including beverages, food, and personal care, is pushing companies to offer more versatile machines capable of producing a wide range of preform sizes and designs. Strategic collaborations, investments in research and development, and geographical expansion are common strategies to maintain market leadership and cater to the increasing need for high‑quality, cost‑effective PET preform machines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sidel Group

- Idaho Milk Products

- Preform Technologies Inc.

- Urola S.Coop.

- Nissei ASB Machine Co., Ltd.

- KraussMaffei Group GmbH

- SIPA S.p.A.

- Powerjet Plastic Machinery Co., Ltd.

- Husky Injection Molding Systems Ltd.

- Sumitomo (SHI) Demag Plastics Machinery GmbH

Recent Developments

- In August 2024, Kay Beauty, an India-based beauty brand, launched its new range of lipsticks, Kay Beauty Hydra Crème Lipstick. According to the company, the new 16 shades are made using hyaluronic acid and lychee extracts.

- In July 2024, Eliter Packaging Machinery launched the Multi-Wrap C-80S, a new automatic sleeving machine designed for applying cardboard sleeves to multipacks. The machine can operate at a maximum speed of 80 wraps per minute and is suitable for a variety of products like cans, bottles, and cups from industries such as food, dairy, and beverages.

- In February 2024, IMA Group did unveil two specific artificial intelligence solutions aimed at improving the efficiency and effectiveness of their customer services.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The PET preform machine market will grow steadily as global beverage consumption expands and packaging infrastructure ramps up.

- Manufacturers will increasingly adopt machines that support higher cavity counts and faster cycle times to meet the demand for lightweight bottles.

- Equipment suppliers will integrate smart manufacturing features—such as predictive‑maintenance sensors and IIoT connectivity—to enhance operational efficiency.

- Rising sustainability requirements will drive demand for machines that handle higher recycled PET (rPET) content and lower energy consumption per preform.

- Emerging markets in Asia‑Pacific and Latin America will present significant growth opportunities as bottled beverage consumption and retail packaging infrastructure deepen.

- Compact single‑stage systems that combine injection and blow‑moulding will gain traction in small and mid‑scale production settings.

- Suppliers will develop modular and upgrade‑friendly machines to help converters manage capital investment while keeping production current.

- Industry‑specific customization—such as special neck finishes for carbonated beverages and high‑viscosity containers—will be a key differentiator for machine OEMs.

- Raw material volatility and costs of advanced components will pressure machine pricing and may encourage leasing or rental models.

- Supply‑chain disruptions and compression of lead‑times will force machine vendors to expand regional service networks and local spare‑parts inventories.