Market Overview:

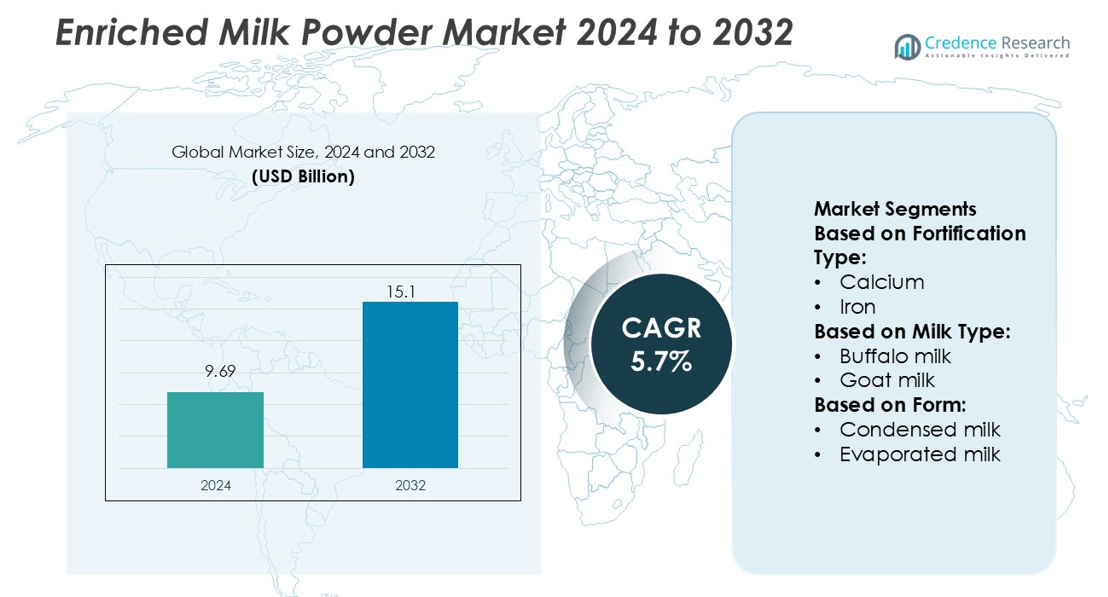

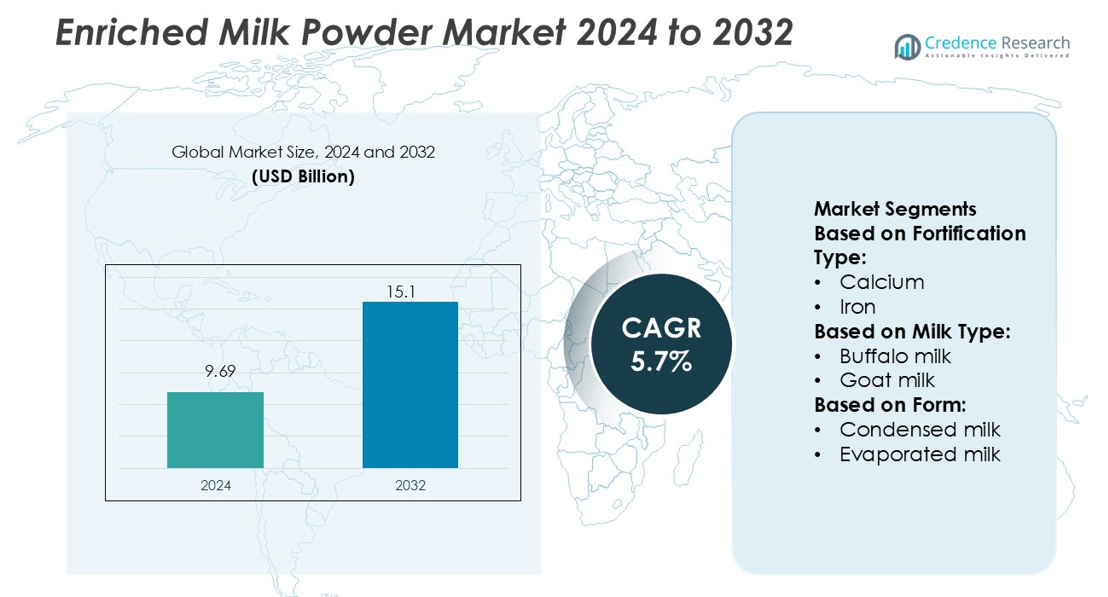

Enriched Milk Powder Market size was valued USD 9.69 billion in 2024 and is anticipated to reach USD 15.1 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enriched Milk Powder Market Size 2024 |

USD 9.69 billion |

| Enriched Milk Powder Market, CAGR |

5.7% |

| Enriched Milk Powder Market Size 2032 |

USD 15.1 billion |

The enriched milk powder market features strong participation from major manufacturers such as Arla Foods Ingredients, Actus Nutrition, Glanbia Plc., AMCO Proteins, Vitalis Nutrition, Saputo Inc., Kerry Group plc, Idaho Milk Products, Agropur, and Carbery Group. These companies drive growth through innovation in fortified formulations, strategic acquisitions, and expanded global distribution. Regionally, the Asia‑Pacific region leads the market with a share of approximately 33 %, supported by rising disposable incomes, enhanced nutrition awareness, and wide dairy consumption across China and India.

Market Insights

- The enriched milk powder market was valued at USD 9.69 billion in 2024 and is anticipated to reach USD 15.1 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

- Key drivers include increasing consumer awareness about health and nutrition, particularly the need for fortified foods in daily diets.

- Growing demand for clean-label products with natural ingredients is a significant trend, leading to innovations in fortified milk powders with added vitamins, proteins, and minerals.

- The market is highly competitive, with major players such as Arla Foods Ingredients, Glanbia, Plc., and Kerry Group focusing on innovation, acquisitions, and global distribution to maintain their market leadership.

- The Asia-Pacific region holds the largest market share, approximately 33%, driven by rising incomes and greater awareness of nutrition, especially in China and India, where fortified milk powders are increasingly popular.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fortification Type

In the enriched milk powder market, vitamin‑fortified milk holds the largest share, particularly in regions with high demand for nutritional products. Among the various types, vitamin D‑fortified milk is the dominant sub‑segment, driven by growing awareness of vitamin D’s role in bone health and immune support. The increasing incidence of deficiencies, particularly in developing regions, is boosting demand for fortified milk powders. Additionally, multi‑nutrient fortified milk is gaining traction due to the convenience of combining several essential vitamins and minerals in a single product, contributing to market growth.

- For instance, Actus Nutrition acquired a 99,000‑square‑foot whey‑protein processing facility in Sparta, Wisconsin, and added it to their manufacturing network of twelve U.S. facilities.

By Milk Type

Cow milk dominates the enriched milk powder market, particularly whole milk and skimmed milk variants, which account for the majority of the market share. This is primarily due to the widespread availability of cow milk and consumer familiarity with its nutritional benefits. Goat and A2 milk, however, are gaining popularity due to perceived health benefits, such as better digestibility. The shift towards A2 milk, which is believed to be gentler on the stomach, is contributing to the growth of this segment, particularly among health-conscious consumers.

- For instance, Glanbia plc’s Michigan whey‑and‑cheese processing facility recovers around 800,000 gallons of clean water daily, demonstrating advanced dairy‑ingredient processing that supports large‑scale cow‑milk‑based production lines.

By Form

Powdered milk is the leading form in the enriched milk powder market, with whole milk powder and skimmed milk powder capturing the highest market share. Powdered milk’s longer shelf life, convenience, and ease of storage make it the preferred option for both households and commercial applications. UHT and flavored milk powders are also growing due to rising demand for convenient, ready-to-use dairy products with added flavors and nutritional benefits. The ability to fortify powdered milk with multiple nutrients further drives its dominance in the market.

Key Growth Drivers

Health Consciousness

The rise in global health awareness, especially after the COVID-19 pandemic, has significantly boosted the demand for enriched milk powders. Consumers are becoming more focused on their overall health and nutrition, which has led to an increased preference for fortified foods. Enriched milk powders, with added vitamins and minerals, offer an easy and convenient way for people to enhance their daily nutrition. For example, milk powders fortified with vitamin D, calcium, and protein help support bone health, immune function, and overall wellness. This growing awareness of the importance of nutrition is expected to drive continued demand for enriched milk powders, particularly in health-conscious segments.

- For instance, AMCO Proteins lists a“CMP‑9000 Milk Protein Isolate 90%” product—offering 90 % protein content—that is designed for high‑nutrition formulations and ensures improved nutrient absorption and functionality in fortified powders.

Convenience and Shelf-Life

The convenience and long shelf life of enriched milk powders are major factors contributing to their popularity. Powdered milk offers consumers a ready-to-use solution that is easy to store, transport, and use, making it an ideal choice for those with busy lifestyles. Unlike fresh milk, which requires refrigeration and has a limited shelf life, powdered milk can be stored at room temperature for extended periods. This makes it particularly attractive in regions with limited access to refrigeration or for consumers looking for a shelf-stable alternative to fresh dairy products. The ease of use and the ability to store powdered milk for long periods without compromising on quality are key drivers in the market’s growth.

- For instance, Kerry’s 2024 Annual Report confirms the company employs an R&D team of over 1,200 food scientists globally. The report also mentions that Kerry operates over 70 technology and innovation centers worldwide.

Emerging Market Growth

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the enriched milk powder market. As disposable incomes rise and awareness of nutrition increases, consumers in these regions are demanding more nutritious food options. Fortified milk powder offers an affordable and convenient solution to address nutritional deficiencies commonly found in these markets, such as calcium, vitamin D, and protein deficiencies. The growing urbanization, changing lifestyles, and rising middle-class population in these regions further contribute to the increased demand for enriched milk powders. Manufacturers are capitalizing on these opportunities by tailoring their products to suit local dietary needs and preferences, thereby expanding their reach into these fast-growing markets.

Key Trends & Opportunities

Clean-Label and Functional Products

Consumers are increasingly demanding clean-label products, which are free from artificial additives, preservatives, and other chemicals. In the enriched milk powder market, this trend is leading to a shift towards more natural and transparent ingredients. Consumers are also looking for products with added health benefits, such as omega-3, probiotics, or plant-based nutrients. As a result, manufacturers are responding by developing fortified milk powders that cater to these demands, offering a variety of functional ingredients that support digestive health, cognitive function, and overall wellness. Companies that can innovate and provide these clean-label, functional products are well-positioned to capitalize on the growing consumer demand for healthy and natural food options.

- For instance, Arla uses advanced filtration processes to produce high-protein streams from milk. These methods often involve microfiltration to separate components, with pasteurization (typically at around 72°C for 15 seconds) conducted as a separate step.

Growth in E-Commerce

The growth of e-commerce has created significant opportunities for the enriched milk powder market. With the increasing number of consumers shopping for groceries online, especially in the wake of the pandemic, manufacturers have the chance to reach a wider audience. E-commerce platforms offer convenience and the ability to compare various brands and products, which can help consumers make more informed choices. This trend is especially beneficial in regions where retail infrastructure is still developing, as it provides an easy way for consumers to access a range of enriched milk powder products. As online grocery shopping continues to grow, manufacturers and retailers can tap into new customer segments by focusing on digital channels and expanding their online presence.

- For instance, Danone’s R&D documentation confirms American Dairy Products Institute (ADPI) and in various academic documents, mandate a minimum protein content of 34.0 grams per 100 grams (or 34.0% protein on a solids-not-fat basis).

Key Challenges

High Production Costs

One of the primary challenges facing the enriched milk powder market is the high cost of production. Fortifying milk powder with essential nutrients such as vitamins, minerals, and proteins requires specialized equipment, processes, and raw materials, which can increase production costs. Additionally, the need for quality control and testing to ensure that the fortification levels meet regulatory standards adds to the expense. These higher production costs can make it difficult for manufacturers to offer competitive prices, especially in price-sensitive markets where consumers are looking for affordable alternatives. To overcome this challenge, companies are exploring cost-effective production techniques and alternative sources of nutrients to maintain competitive pricing while ensuring product quality.

Regulatory and Supply Chain Issues

Enriched milk powder products are subject to strict regulatory standards, which vary by region. These regulations can pose challenges for manufacturers looking to expand their market reach, as they must ensure that their products comply with local fortification requirements, labeling laws, and safety standards. In addition, maintaining the quality of enriched milk powder during transportation and storage can be difficult, especially in regions without reliable cold-chain infrastructure. Without proper storage conditions, the quality of the nutrients in the milk powder may degrade, leading to reduced product efficacy and consumer trust. Overcoming these regulatory hurdles and supply chain complexities is essential for manufacturers to maintain product quality, ensure compliance, and expand their market presence.

Regional Analysis

North America

The North American enriched milk powder market held roughly 26.8 % of global revenues in 2023, making it one of the largest regional shares. This strength reflects high consumer awareness of nutritional needs and strong institutional demand for fortified dairy products. Premium formulations with added vitamins, proteins, and minerals dominate shelves, backed by robust distribution frameworks. Growing recognition of preventive health care and widespread retail‑ecommerce integration further bolster the region’s lead. The developed cold‑chain infrastructure and established dairy industry also enable faster roll‑out of novel enriched powder variants.

Europe

Europe captured approximately 23.3 % of the global enriched milk powder market in 2023, positioning it as another major region. The share stems from strong consumer focus on health and wellness, clean‑label formulations, and government nutritional initiatives. European manufacturers emphasise high‑quality enrichment—such as calcium‑fortified and probiotic powders tailored for aging populations and children. A mature retail environment and increasing penetration of value‑added dairy support the region’s performance. Premium branding and regulation‑driven reformulation also help maintain Europe’s substantial footprint in the market.

Asia‑Pacific

The Asia‑Pacific region recorded about 33 % of the global enriched milk powder market share in 2023, reflecting its leadership position in volume terms. Rapid urbanisation, rising middle‑class incomes, and growing nutritional awareness drive demand for fortified milk powders across countries such as China and India. Manufacturers increasingly localise formulations, targeting regional micronutrient deficiencies with iron, vitamin D and multinutrient‑fortified variants. The expanding ecommerce networks and broad retail reach further facilitate uptake, positioning Asia‑Pacific as a key growth engine for the market.

Latin America

Latin America accounted for roughly 8 % of the global enriched milk powder market in 2023, reflecting its emerging status. Growth is propelled by rising urbanisation, increased disposable income, and greater adoption of fortified dairy brands in countries like Brazil and Mexico. However, distribution challenges and price sensitivity constrain expansion. Local manufacturers and multinationals are partnering to tailor affordable enriched variants for regional nutrition programmes. The expanding middle class and improved retail networks present opportunities for sustained growth in this region.

Middle East & Africa (MEA)

The MEA region contributed about 7 % of the global enriched milk powder market in 2023, reflecting modest but rising demand. Growth is supported by growing public‑health awareness, government initiatives to address micronutrient deficiencies, and expanding retail access in urban centres. Challenges include variable cold‑chain logistics and lower per‑capita dairy consumption. Nevertheless, manufacturers are introducing fortified milk powder products with iron, calcium or multinutrient profiles tailored for regional dietary gaps. The MEA region offers long‑term potential as infrastructure improves and nutritional programmes gain traction.

Market Segmentations:

By Fortification Type:

By Milk Type:

By Form:

- Condensed milk

- Evaporated milk

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The enriched milk powder market features strong participation from key players such as Arla Foods Ingredients, Actus Nutrition, Glanbia, Plc., AMCO Proteins, Vitalis Nutrition, Saputo, Inc., Kerry Group plc, Idaho Milk Products, Agropur, and Carbery Group. The enriched milk powder market is highly competitive, with numerous companies focusing on product innovation, geographic expansion, and strategic partnerships to strengthen their positions. Companies are increasingly investing in research and development to create new formulations with added nutrients, such as proteins, vitamins, and minerals, to meet the growing consumer demand for functional dairy products. There is also a strong emphasis on sustainability, with manufacturers developing eco-friendly packaging and cleaner production methods. As consumer preferences shift towards health-conscious, nutrient-dense options, companies are adapting their offerings to cater to these trends, positioning themselves for long-term growth in both developed and emerging markets.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Oerlikon Metco, headquartered in Winterthur, Switzerland, has launched its new MetcoMed brand with metal powders the release of two materials tailored for the Additive Manufacturing of medical components and implants.

- In March 2024, SSAB is launching the world’s first emission-free steel powder for commercial deliveries, made of recycled SSAB Zero[®] steel. The product will create opportunities for customers to 3D-print their unique designs in steel produced without fossil carbon dioxide emissions.

- In November 2023, 6K Additive acquired Global Metal Powders (GMP) to expand its production of refractory metal powders and develop more sustainable products. This acquisition adds GMP’s proprietary manufacturing and recycling capabilities to 6K Additive’s business

Report Coverage

The research report offers an in-depth analysis based on Fortification Type, Milk Type, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The enriched milk powder market is poised for sustained expansion, driven by increasing awareness of fortified nutrition among consumers.

- Manufacturers will intensify development of products enriched with specific vitamins, minerals, proteins, and probiotics to meet diversified nutritional needs.

- Online and direct‑to‑consumer distribution models will gain momentum, enabling targeted delivery of enriched milk powders in both urban and remote regions.

- Emerging markets in Asia‑Pacific and Latin America will present significant opportunities as disposable incomes rise and dietary preferences evolve.

- Clean‑label and natural‑ingredient variants of enriched milk powder will attract health‑conscious consumers seeking minimal‑additive formulations.

- Protein‑ and nutrient‑rich formulations (such as high‑protein or multinutrient powders) will gain traction as part of functional food trends.

- Collaboration between dairy companies and technology providers will lead to enhanced processing and fortification techniques for improved nutrient bioavailability.

- Sustainable sourcing of dairy and environmentally friendly packaging will become key differentiators in enriched milk powder offerings.

- Brands will tailor enriched milk powder products to specific demographic segments, such as children, seniors, athletes, and pregnant women.

- Supply‑chain optimization and improved cold‑chain or shelf‑stable technologies will broaden access to enriched milk powder in underserved or remote markets.