Market Overview

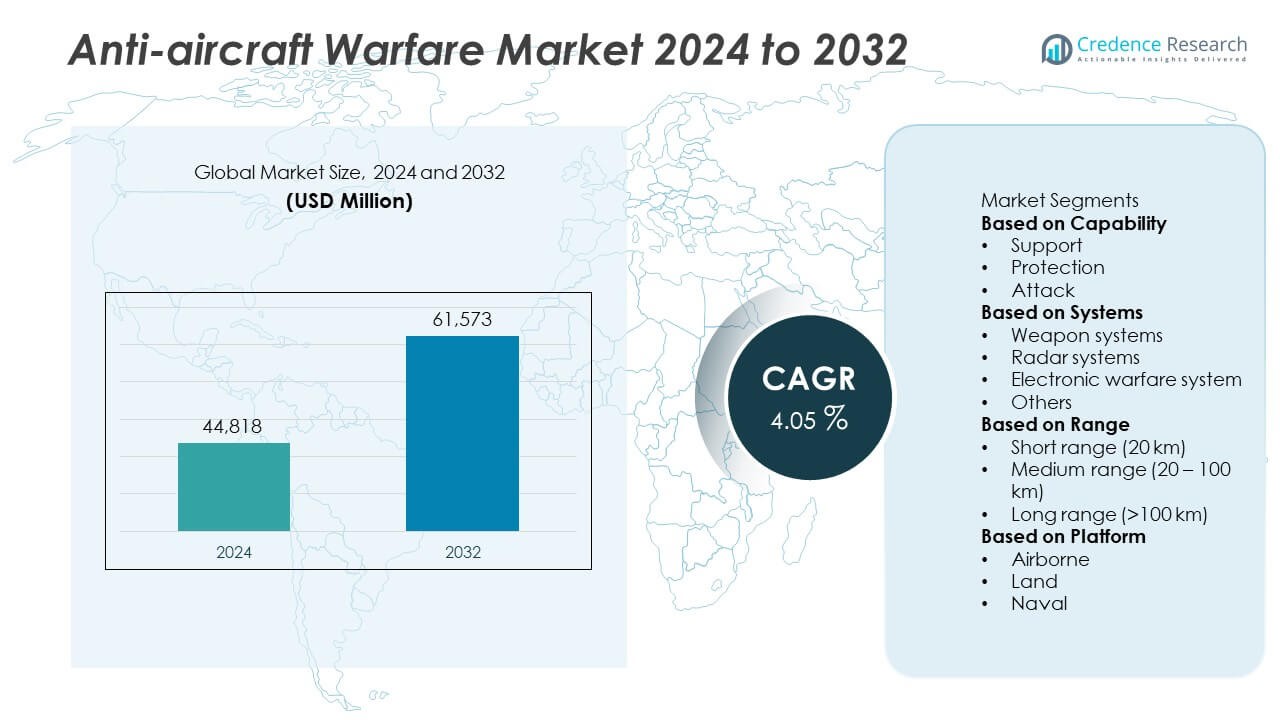

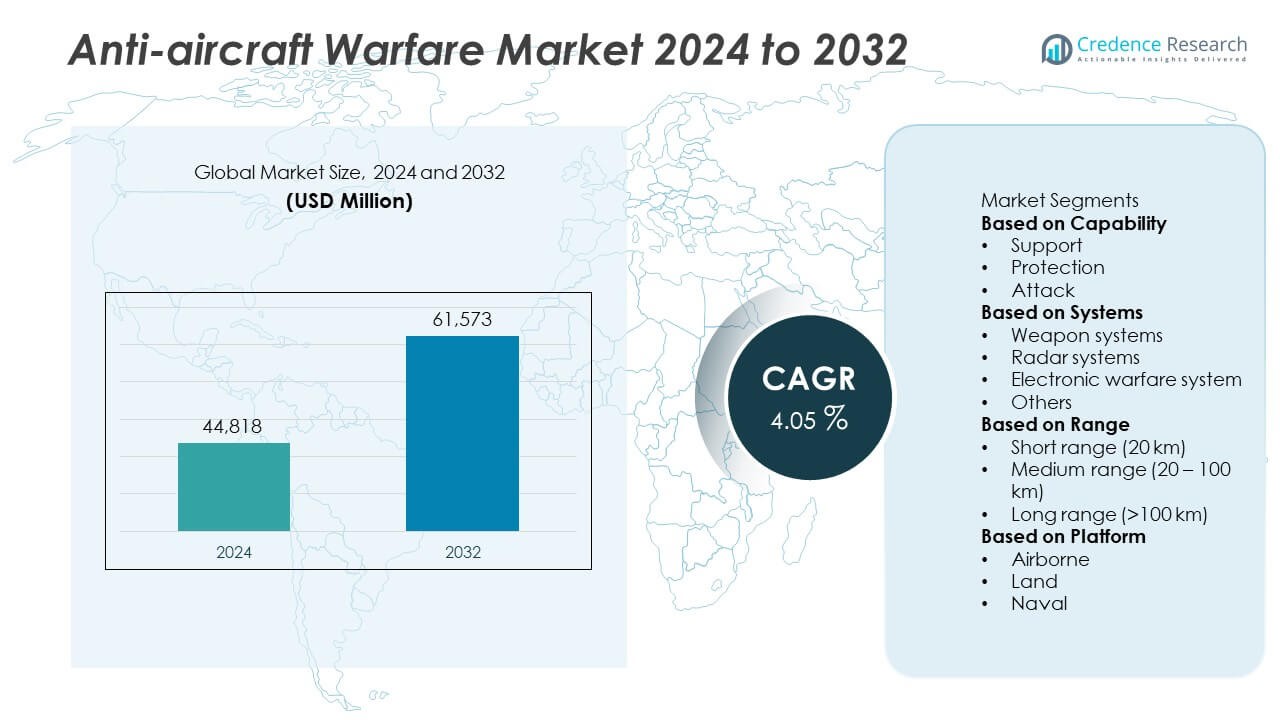

The Anti-Aircraft Warfare Market was valued at USD 44,818 million in 2024 and is projected to reach USD 61,573 million by 2032, growing at a CAGR of 4.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Aircraft Warfare Market Size 2024 |

USD 44,818 Million |

| Anti-Aircraft Warfare Market, CAGR |

4.05% |

| Anti-Aircraft Warfare Market Size 2032 |

USD 61,573 Million |

The anti-aircraft warfare market is led by prominent companies including Hanwha Defense, Elbit Systems, Leonardo S.p.A., Aselsan A.S., Kongsberg Gruppen ASA, Diehl Stiftung & Co. KG, BAE Systems PLC, Israel Aerospace Industries, L3Harris Technologies, Inc., and General Dynamics Corporation. These players dominate through innovation in missile defense, radar systems, and electronic warfare technologies. Strategic partnerships and modernization contracts with defense ministries strengthen their global presence. North America remained the leading region with a 41.5% share in 2024, supported by extensive defense budgets and continuous technological upgrades. Europe followed with a 27.8% share, driven by NATO-led modernization initiatives and the expansion of multi-layered air defense systems.

Market Insights

- The anti-aircraft warfare market was valued at USD 44,818 million in 2024 and is projected to reach USD 61,573 million by 2032, expanding at a CAGR of 4.05% during the forecast period.

- Rising geopolitical tensions, increased cross-border threats, and growing investments in air and missile defense modernization are driving global demand.

- The market trend is shifting toward AI-integrated radar, directed-energy weapons, and network-centric warfare systems, with the protection segment holding 48.2% share as the dominant capability.

- Leading players such as BAE Systems, Leonardo, Elbit Systems, and Israel Aerospace Industries dominate through innovation in integrated defense platforms and radar-based targeting systems.

- North America leads the market with a 41.5% share, followed by Europe at 27.8% and Asia-Pacific at 22.9%, while Latin America and the Middle East & Africa continue to strengthen regional defense infrastructure through modernization and strategic alliances.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capability

The protection segment dominated the anti-aircraft warfare market in 2024, accounting for a 48.2% share. This dominance is attributed to the rising need for air defense systems that safeguard military bases, strategic assets, and urban areas from modern aerial threats such as drones and missiles. Nations are investing heavily in layered defense architectures that integrate radar surveillance, interceptor missiles, and command systems. The growing emphasis on homeland security and critical infrastructure defense has further driven the deployment of protection-oriented systems across both developed and emerging economies.

- For instance, Hanwha Aerospace developed the L-SAM long-range interceptor capable of engaging targets up to 150 kilometers away, featuring dual-pulse rocket motors and advanced radar tracking. The system is part of South Korea’s multi-layered defense network, with over 24 launchers planned for deployment under national defense upgrades.

By Systems

The weapon systems segment held the largest market share of 44.7% in 2024, driven by the increasing adoption of surface-to-air missile (SAM) systems and anti-aircraft artillery. These systems remain essential for neutralizing enemy aircraft, drones, and cruise missiles at varying altitudes. Ongoing modernization programs by defense forces are introducing next-generation missile platforms equipped with precision guidance and networked targeting. Meanwhile, radar and electronic warfare systems are witnessing strong growth as they enhance early threat detection, target tracking, and battlefield situational awareness for integrated defense operations.

- For instance, Diehl Defence’s IRIS-T SLM system demonstrated interception capability against aerial targets at ranges exceeding 40 kilometers and altitudes up to 20 kilometers during field evaluations. The system integrates active radar seekers and data-link connectivity, enabling precise multi-target engagements in real-time command networks.

By Range

The medium-range segment led the market in 2024 with a 39.6% share, supported by its versatility in countering both short- and long-range aerial threats. Medium-range systems offer a balanced combination of mobility, accuracy, and coverage, making them ideal for both field operations and fixed installations. Countries such as the U.S., Russia, and India are enhancing their defense capabilities through the deployment of systems like Patriot PAC-3 and S-350E. Rising demand for networked missile defense solutions capable of intercepting multi-layered threats continues to fuel investment in medium-range anti-aircraft systems.

Key Growth Drivers

Rising Geopolitical Tensions and Defense Modernization Programs

Escalating regional conflicts and evolving aerial threats are compelling nations to strengthen their air defense capabilities. Governments are heavily investing in upgrading existing anti-aircraft systems and developing integrated air defense networks. Countries such as the U.S., China, and India are modernizing their military arsenals with advanced missile systems, interceptors, and radar units. This surge in defense spending, coupled with growing concerns over drone and hypersonic missile attacks, continues to drive sustained market demand for modern anti-aircraft warfare technologies.

- For instance, Israel Aerospace Industries and DRDO fielded Barak-8 MR-SAM with a 70 km land-based range and a naval LR-SAM reaching 100 km. The missile carries a 60 kg warhead and uses a dual-pulse rocket motor for end-game maneuvers. Indian services operate land and sea variants through BDL-made launchers and command systems.

Technological Advancements in Missile and Radar Systems

Continuous innovation in missile guidance, radar tracking, and command systems is accelerating the market’s growth. Next-generation systems now feature improved target acquisition, enhanced range, and automated response capabilities. The integration of AI and sensor fusion technologies enables real-time threat detection and interception. These advancements improve accuracy, reduce human error, and enhance overall battlefield effectiveness. Defense manufacturers are focusing on modular, network-enabled platforms to strengthen multi-domain interoperability and improve system resilience against complex threats.

- For instance, Thales’ Ground Master 400α lists a detection range up to 515 km and an update rate of 6 s. The radar fits in a 20-ft ISO container and can deploy in about one hour. Fielded GM400/400α units exceed 90 across users, supporting long-range air-picture generation.

Increasing Focus on Unmanned Aerial Threats and Drone Defense

The proliferation of military drones and loitering munitions has intensified the need for specialized anti-aircraft systems. Modern defense forces are prioritizing counter-drone technologies that integrate electronic warfare, radar, and directed-energy weapons. These solutions effectively neutralize unmanned threats at both tactical and strategic levels. The growing use of small, low-flying drones for surveillance and attack missions is driving investment in compact, mobile defense systems designed for rapid deployment and layered protection.

Key Trends & Opportunities

Adoption of AI and Network-Centric Defense Systems

AI-driven command and control systems are transforming the anti-aircraft warfare landscape. These technologies enhance situational awareness, predictive analytics, and rapid response against complex aerial threats. Network-centric warfare allows seamless data sharing between radar, missile, and electronic warfare systems, improving coordination and accuracy. This digital integration provides a major opportunity for defense contractors to develop interoperable solutions aligned with modern military doctrines emphasizing agility and precision.

- For instance, Northrop Grumman’s IBCS logged 32 of 32 successful flight tests. A recent Army event used IBCS to defeat two maneuvering cruise missiles with first-shot kills. A PAC-3 MSE achieved a 360-degree intercept using LTAMDS secondary-sector data. These trials confirm sensor-to-shooter networking across modern radar and missile nodes.

Emergence of Directed-Energy and Laser-Based Weapons

Directed-energy weapons (DEWs) are emerging as a cost-effective alternative to conventional interceptors. Countries such as the U.S., Israel, and China are developing laser-based air defense systems that can disable enemy drones and missiles instantly. These weapons offer rapid target engagement and lower per-shot costs compared to missile-based systems. The increasing interest in scalable, power-efficient DEW platforms presents significant opportunities for technological advancement and defense modernization in the coming decade.

- For instance, the U.S. Army deployed four Stryker-mounted 50 kW DE M-SHORAD prototypes for operational testing. An Army exercise at Fort Sill evaluated DE systems against Group 1–3 drone swarms. Israel’s Iron Beam completed final trials and is slated for fielding in 2025. Test campaigns validated interceptions of rockets, mortars, aircraft, and UAVs.

Key Challenges

High Development and Procurement Costs

The complex design, manufacturing, and integration processes of advanced anti-aircraft systems make them highly expensive. High procurement and maintenance costs limit adoption in developing economies with constrained defense budgets. Even for major nations, balancing spending between offensive and defensive systems remains a challenge. The increasing reliance on advanced materials, radar sensors, and AI-based components further escalates overall project costs, hindering widespread deployment of next-generation air defense systems.

Integration and Interoperability Issues Across Platforms

Modern military forces operate diverse defense systems sourced from multiple manufacturers, often leading to interoperability challenges. Integrating radar, missile, and electronic warfare systems across various platforms can create data-sharing gaps and operational inefficiencies. These issues hinder unified threat response and delay decision-making during high-intensity conflicts. To overcome this, defense forces and manufacturers are focusing on standardization, software-based integration, and advanced communication networks to ensure seamless coordination across all air defense layers.

Regional Analysis

North America

North America dominated the anti-aircraft warfare market in 2024 with a 41.5% share, driven by high defense budgets and ongoing modernization initiatives. The United States leads the region, with heavy investments in missile defense programs such as THAAD, Aegis, and Patriot systems. Continuous upgrades in radar, command, and control technologies enhance air defense capabilities. Canada’s focus on joint defense collaborations under NATO also contributes to regional growth. Strong partnerships between defense contractors and governments, along with innovation in electronic warfare and AI-based threat detection, further strengthen North America’s leadership in this market.

Europe

Europe held a 27.8% share of the global anti-aircraft warfare market in 2024, propelled by rising defense spending and the need for regional security reinforcement. The Russia-Ukraine conflict has intensified investment in air and missile defense systems across NATO countries. Nations like Germany, France, and the U.K. are modernizing their short- and medium-range missile systems to counter growing aerial threats. Collaborative programs such as the European Sky Shield Initiative and joint R&D projects between defense companies are enhancing technological capabilities. Growing reliance on advanced radar and integrated command systems continues to support Europe’s defense preparedness.

Asia-Pacific

Asia-Pacific accounted for a 22.9% share in 2024, emerging as a key growth hub for anti-aircraft warfare systems. Countries including China, India, Japan, and South Korea are rapidly expanding their air defense infrastructure amid rising geopolitical tensions and territorial disputes. Governments are investing in indigenous missile development and multi-layered defense networks. China’s advancements in hypersonic and long-range interceptor systems are influencing regional arms competition. Meanwhile, India’s collaborations with Russia and domestic defense initiatives like Akash and QR-SAM are strengthening its strategic capabilities. The region’s rapid military modernization and technology adoption continue to fuel market expansion.

Latin America

Latin America represented a 4.3% share of the anti-aircraft warfare market in 2024, supported by gradual improvements in defense spending and border security measures. Brazil, Mexico, and Colombia are focusing on upgrading radar systems and air surveillance networks to combat aerial threats and drug trafficking operations. However, limited defense budgets and reliance on imported technologies hinder large-scale procurement. Regional collaborations and U.S. support programs are aiding modernization efforts. Growing investment in electronic warfare and radar detection capabilities is expected to enhance Latin America’s defensive readiness in the coming years.

Middle East & Africa

The Middle East & Africa accounted for a 3.5% share of the global anti-aircraft warfare market in 2024, driven by persistent regional conflicts and the need for air defense modernization. Countries such as Saudi Arabia, Israel, and the UAE continue to invest in advanced missile interception systems to counter drone and ballistic missile threats. Israel’s Iron Dome and the UAE’s THAAD deployments set benchmarks for regional air defense. In Africa, nations like Egypt and South Africa are gradually upgrading legacy systems. Strategic alliances and foreign defense partnerships are expected to strengthen regional capabilities further.

Market Segmentations:

By Capability

- Support

- Protection

- Attack

By Systems

- Weapon systems

- Radar systems

- Electronic warfare system

- Others

By Range

- Short range (20 km)

- Medium range (20 – 100 km)

- Long range (>100 km)

By Platform

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the anti-aircraft warfare market is characterized by strong participation from major defense contractors such as Hanwha Defense, Elbit Systems, Leonardo S.p.A., Aselsan A.S., Kongsberg Gruppen ASA, Diehl Stiftung & Co. KG, BAE Systems PLC, Israel Aerospace Industries, L3Harris Technologies, Inc., and General Dynamics Corporation. These companies compete through innovation in radar systems, missile guidance, and integrated air defense solutions. BAE Systems and Leonardo lead in developing advanced radar and electronic warfare systems, while Israel Aerospace Industries and Elbit Systems focus on missile intercept technologies. Hanwha Defense and Aselsan are expanding their regional footprint through cost-effective and modular air defense systems. Strategic alliances, government contracts, and modernization programs play key roles in maintaining competitive advantage. The market is witnessing increased focus on AI-driven command systems, directed-energy weapons, and interoperability across platforms, enhancing operational readiness and multi-domain defense integration.

Key Player Analysis

- Hanwha Defense

- Elbit Systems

- Leonardo S.p.A.

- Aselsan A.S.

- Kongsberg Gruppen ASA

- Diehl Stiftung & Co. KG

- BAE Systems PLC

- Israel Aerospace Industries

- L3Harris Technologies, Inc.

- General Dynamics Corporation

Recent Developments

- In October 2025, Diehl Defence demonstrated its navalised IRIS-T SLM system aboard a German frigate during the Maritime Firing Exercise 2025.

- In September 2025, ASELSAN A.Ş. announced a US $1.9 billion contract with Turkey’s SSB to equip the Turkish Armed Forces with layered air-defence systems (including ground-based high/medium/low altitude systems) for delivery from 2027 to 2031.

- In June 2025, Hanwha Aerospace was awarded a contract via Agency for Defense Development (ADD) in South Korea to integrate and prototype launcher systems for the L-SAM II long-range surface-to-air missile programme.

- In January 2025, Diehl Defence (part of Diehl Stiftung & Co. KG) entered into a contract with Germany’s BAAINBw and partner nations to develop the IRIS-T Block II air-defence missile variant.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Capability, Systems, Range, Platform and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for integrated air and missile defense systems will continue to increase globally.

- AI and machine learning will enhance threat detection, tracking, and response accuracy.

- Development of directed-energy and laser-based defense systems will gain strong momentum.

- Nations will focus on upgrading radar and electronic warfare capabilities for multi-layered defense.

- Collaboration between defense contractors and governments will drive large-scale modernization programs.

- Rising drone and hypersonic missile threats will accelerate investment in next-generation interceptors.

- Modular and mobile air defense systems will become a key priority for rapid deployment.

- Asia-Pacific will experience the fastest growth due to regional security concerns and defense expansion.

- Cybersecurity integration in defense networks will be crucial for protecting command systems.

- Increased defense spending and strategic partnerships will shape global market competitiveness.