Market Overview:

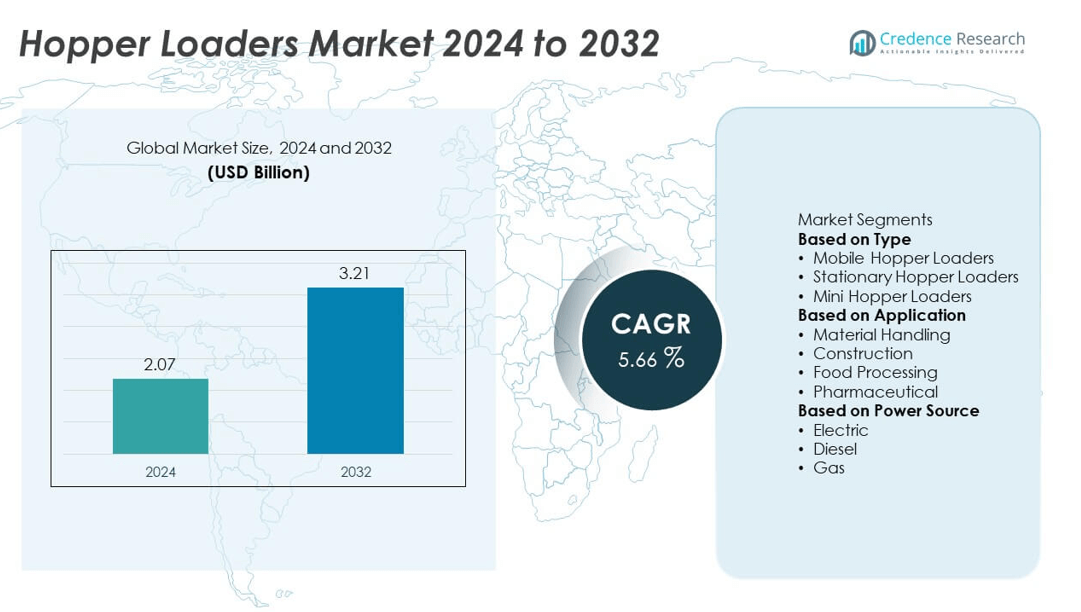

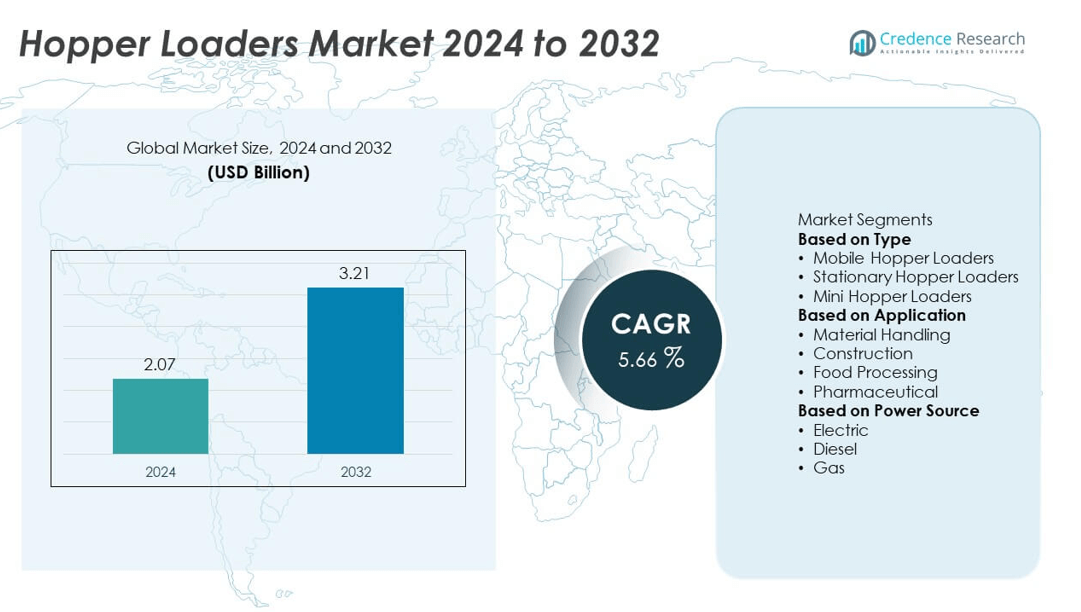

The Hopper Loaders Market was valued at USD 2.07 billion in 2024 and is projected to reach USD 3.21 billion by 2032, growing at a CAGR of 5.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hopper Loaders Market Size 2024 |

USD 2.07 billion |

| Hopper Loaders Market, CAGR |

5.66% |

| Hopper Loaders Market Size 2032 |

USD 3.21 billion |

The Hopper Loaders market is led by prominent companies such as Piovan S.p.A., Conair Group, Movacolor B.V., Shini Plastics Technologies, Inc., Koch Technik GmbH, Novatec, Inc., Summit Systems Ltd., Matsui America, Inc., Witte Pumps & Technology GmbH, and Moretto S.p.A. These players focus on automation, digital monitoring, and energy-efficient designs to enhance operational performance. Strategic partnerships and product innovations are strengthening their global presence across plastics, food, and construction industries. Asia-Pacific dominated the market with a 33.8% share in 2024, followed by Europe with 31.2% and North America with 28.6%, driven by rapid industrial automation, manufacturing expansion, and strong demand for efficient material handling systems.

Market Insights

- The Hopper Loaders market was valued at USD 2.07 billion in 2024 and is projected to reach USD 3.21 billion by 2032, growing at a CAGR of 5.66% during the forecast period.

- Rising automation in manufacturing, plastics, and food processing industries is driving market growth, as hopper loaders improve efficiency, reduce manual labor, and ensure precise material handling.

- Key trends include growing adoption of electric-powered and IoT-integrated hopper loaders that enable energy efficiency, real-time monitoring, and predictive maintenance.

- The market is competitive, with major players such as Piovan, Conair, Shini Plastics, Moretto, and Novatec focusing on smart system development, product innovation, and regional expansion to strengthen global presence.

- Asia-Pacific held 33.8%, followed by Europe with 31.2% and North America with 28.6%, while the mobile hopper loaders segment led with 43.8% share, reflecting rising demand for flexible, energy-efficient material handling solutions worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The mobile hopper loaders segment dominated the Hopper Loaders market in 2024 with a 43.8% share. Its dominance is attributed to higher flexibility, ease of installation, and efficient movement of bulk materials across production lines. Mobile units are widely used in plastics and packaging industries for quick material transfer between machines. Their compact design and energy efficiency enhance productivity in automated environments. Stationary hopper loaders follow, driven by their suitability for high-volume operations, while mini hopper loaders gain traction in small-scale and precision manufacturing applications requiring controlled feeding systems.

- For instance, Conair Group offers the FLX-128 central conveying control system, a flexible control solution designed to manage material handling for a wide range of processing needs. The system is scalable and can support up to 128 receivers and 40 vacuum pumps of various capacities, allowing for customized system configurations rather than having a single, fixed conveying rate and pump specification.

By Application

The material handling segment held the largest 48.5% share of the Hopper Loaders market in 2024. This growth is supported by the rising demand for automated conveying solutions in plastic processing, manufacturing, and recycling sectors. Hopper loaders improve operational efficiency by reducing manual handling and contamination risks. The construction sector follows, driven by growing adoption of loaders for cement and aggregate transfer. Meanwhile, food processing and pharmaceutical industries are witnessing steady growth due to stringent hygiene standards and the need for precise material dosing and contamination-free transport.

- For instance, Piovan S.p.A. offers centralized material handling systems and hopper loaders for use in plastics manufacturing and other industries, which are designed for efficient granule transport and can integrate with plant management software.

By Power Source

The electric segment accounted for the highest 57.2% share in 2024, fueled by its energy efficiency, low noise, and compatibility with automation systems. Electric hopper loaders are preferred in manufacturing and packaging due to lower maintenance costs and improved operational safety. The diesel-powered segment remains important for outdoor and heavy-duty applications, particularly in construction and mining. Gas-powered variants are seeing moderate adoption in regions with stable gas infrastructure. The global transition toward energy-efficient and low-emission equipment continues to strengthen demand for electric-powered hopper loaders across industries.

Key Growth Drivers

Rising Automation in Industrial Operations

The growing adoption of automation in manufacturing and processing industries is a key driver for the Hopper Loaders market. Automated hopper loaders improve operational efficiency, reduce manual labor, and enhance material transfer accuracy. Industries such as plastics, food processing, and pharmaceuticals increasingly rely on automated feeding systems to maintain consistent production. The demand for automated solutions that ensure high productivity and energy efficiency is accelerating the replacement of conventional material handling systems with advanced, sensor-enabled hopper loaders across industrial facilities.

- For instance, Shini Plastics Technologies, Inc. produces SAL-UG series separate-vacuum hopper loaders that feature microcomputer-based automation and material-level sensors, with certain models like the SAL-5HP-UG capable of conveying up to 1,000 kg/h under specified test conditions.

Increasing Demand from Plastic and Packaging Industries

Expanding plastic and packaging sectors are driving significant growth in the Hopper Loaders market. These industries require reliable and contamination-free handling of raw materials such as granules, powders, and resins. Hopper loaders ensure steady material flow, preventing clogs and product waste. The rise in global packaging demand, fueled by e-commerce and consumer goods, is creating strong demand for efficient material conveying systems. Manufacturers are adopting advanced hopper loaders to optimize production lines and meet high-speed, high-volume packaging requirements.

- For instance, Moretto S.p.A. produces a range of hopper loaders and centralized conveying systems, some of which feature stainless-steel construction and multi-stage filtering systems that can achieve filtration down to 2 µm.

Focus on Energy Efficiency and Sustainability

The global shift toward energy-efficient industrial equipment is positively influencing the market. Electric hopper loaders are gaining traction as industries aim to reduce emissions, operational costs, and noise pollution. These systems consume less energy while delivering high performance in continuous operations. Growing environmental regulations and corporate sustainability goals are encouraging industries to replace diesel- and gas-powered equipment with cleaner alternatives. The trend toward green manufacturing practices supports the adoption of electric hopper loaders in modern, energy-conscious facilities.

Key Trends & Opportunities

Integration of Smart Control and Monitoring Systems

Technological advancements are transforming hopper loader operations through the integration of IoT and smart control systems. Modern hopper loaders now feature automated fill-level sensors, real-time monitoring, and remote diagnostics. These capabilities enable predictive maintenance and minimize downtime in production environments. Smart monitoring also improves process transparency and material traceability, supporting data-driven decisions. As Industry 4.0 adoption grows, demand for intelligent hopper loading solutions that integrate seamlessly with centralized control systems will continue to expand.

- For instance, Novatec, Inc. produces various PLC-based touch screen control systems, such as the FlexXpand FX3 conveying control, which is equipped with an IoT-enabled interface capable of monitoring up to 160 receivers within a central system.

Expansion of the Food and Pharmaceutical Sectors

Growing demand for high-purity material handling in food and pharmaceutical production is opening new opportunities for hopper loader manufacturers. These industries require contamination-free, hygienic systems made from stainless steel or FDA-compliant materials. Hopper loaders designed for cleanroom and controlled environments are witnessing rapid adoption. The emphasis on precision dosing, hygiene, and safety regulations is boosting sales of automated and compact loaders suited for sensitive production processes, particularly in developed markets across North America and Europe.

- For instance, Piab, a real industrial technology company, offers hygienic-grade stainless-steel vacuum conveyors (hopper loaders) for pharmaceutical applications that meet stringent industry requirements like FDA and ATEX certifications, and are available with electropolished surfaces and tri-clamp style fittings for easy cleaning and sterilization.

Key Challenges

High Initial Investment and Maintenance Costs

The advanced design and automation features of hopper loaders increase their upfront costs, posing challenges for small and medium-scale enterprises. The need for specialized installation, regular servicing, and skilled operators adds to operational expenses. Many industries in developing regions still rely on manual or semi-automatic material handling systems due to budget constraints. Manufacturers must focus on cost-effective production and modular designs to make hopper loaders more accessible and appealing to a wider range of users globally.

Technical Limitations in Handling Diverse Materials

Despite their versatility, hopper loaders face challenges when handling materials with varying densities, moisture content, or particle sizes. Inconsistent material flow can cause clogging, bridging, or reduced conveying efficiency. These technical limitations affect performance in sectors dealing with complex or sticky materials such as food powders or resins. Continuous R&D is required to enhance design adaptability and suction performance, ensuring reliable operation across diverse material types and industrial applications.

Regional Analysis

North America

North America held a 28.6% share of the Hopper Loaders market in 2024. The region’s growth is supported by strong industrial automation adoption and advanced manufacturing infrastructure in the United States and Canada. Expanding plastic, packaging, and food processing industries are driving steady demand for efficient material handling systems. Electric and mobile hopper loaders are increasingly preferred due to energy efficiency and low maintenance. Government initiatives promoting smart manufacturing and sustainable production also contribute to market expansion, while key manufacturers focus on integrating IoT-based control systems to enhance operational performance and productivity.

Europe

Europe accounted for a 31.2% share of the global Hopper Loaders market in 2024, driven by stringent energy regulations and widespread automation across industrial sectors. Germany, Italy, and France lead in adopting high-performance hopper loaders for plastics and pharmaceutical production. The region’s focus on reducing carbon emissions and optimizing material handling efficiency supports the transition toward electric-powered systems. Demand for compact and hygienic designs suitable for food and pharmaceutical processing continues to grow. Continuous technological upgrades and sustainability-driven manufacturing practices are strengthening Europe’s position in the global hopper loaders market.

Asia-Pacific

Asia-Pacific dominated the Hopper Loaders market with a 33.8% share in 2024. Rapid industrialization, infrastructure growth, and expanding manufacturing sectors in China, India, and Japan are key growth drivers. The rise in automation within plastics, packaging, and construction industries supports strong adoption of hopper loaders. Local manufacturers are offering cost-effective and energy-efficient systems, catering to regional demand. Government initiatives promoting smart factory development and energy efficiency are accelerating market penetration. Increasing investment in advanced material handling and growing awareness of process automation further reinforce Asia-Pacific’s leadership in global market expansion.

Latin America

Latin America captured a 3.5% share of the Hopper Loaders market in 2024. The region’s industrial growth, particularly in Brazil and Mexico, is creating demand for efficient and automated material handling equipment. Hopper loaders are gaining popularity in food processing and construction sectors due to their ability to improve productivity and minimize manual labor. Expansion of the plastics industry and adoption of lightweight materials are further supporting market growth. Ongoing government efforts to modernize manufacturing processes and promote automation technologies are expected to strengthen regional demand in the coming years.

Middle East & Africa

The Middle East & Africa region held a 2.9% share of the global Hopper Loaders market in 2024. Market growth is driven by increasing industrialization, infrastructure development, and expansion of food and packaging industries in countries such as the UAE, Saudi Arabia, and South Africa. The shift toward automated systems to improve operational efficiency and safety is gaining momentum. Electric and mobile hopper loaders are increasingly used for material handling in manufacturing plants. Rising investments in industrial automation and growing adoption of sustainable technologies are expected to enhance the region’s market potential.

Market Segmentations:

By Type

- Mobile Hopper Loaders

- Stationary Hopper Loaders

- Mini Hopper Loaders

By Application

- Material Handling

- Construction

- Food Processing

- Pharmaceutical

By Power Source

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Hopper Loaders market includes key players such as Piovan S.p.A., Conair Group, Movacolor B.V., Shini Plastics Technologies, Inc., Koch Technik GmbH, Novatec, Inc., Summit Systems Ltd., Matsui America, Inc., Witte Pumps & Technology GmbH, and Moretto S.p.A. These companies focus on developing advanced hopper loading systems with improved automation, energy efficiency, and real-time monitoring capabilities. Leading manufacturers are investing in research and development to integrate IoT and smart control features that enhance process efficiency and reduce downtime. Strategic collaborations with plastic processors, food manufacturers, and construction equipment suppliers are strengthening market reach. Additionally, companies are expanding their product portfolios through modular, lightweight, and electric-powered hopper loaders to meet sustainability goals. Increasing emphasis on precision material handling, reduced contamination, and energy-efficient design continues to shape competition in the global hopper loaders market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Piovan S.p.A.

- Conair Group

- Movacolor B.V.

- Shini Plastics Technologies, Inc.

- Koch Technik GmbH

- Novatec, Inc.

- Summit Systems Ltd.

- Matsui America, Inc.

- Witte Pumps & Technology GmbH

- Moretto S.p.A.

Recent Developments

- In April 2025, Piovan S.p.A. introduced its Ryng production-monitoring hopper loader system capable of handling 40 kg/h to 300 kg/h of granules, equipped with a high-precision load cell achieving 1 % material-weight accuracy under vibration conditions.

- In February 2025, during Plastimagen 2025, PIOVAN S.p.A. unveiled its S and SBL Series single-phase hopper loaders, equipped with advanced automation, self-monitoring features, and brushless motor options designed to enhance reliability and simplify maintenance.

- In February 2024, Piab AB introduced a new range of vacuum hopper loaders designed to optimize material handling in the food and pharmaceutical sectors. These advanced systems feature improved filtration technology, ensuring cleaner, more efficient operations and higher product quality across sensitive manufacturing environments

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hopper loaders will grow with increased automation in manufacturing and processing industries.

- Electric-powered hopper loaders will gain dominance due to energy efficiency and lower emissions.

- Integration of IoT and smart monitoring systems will enhance equipment reliability and productivity.

- Asia-Pacific will remain the leading region driven by rapid industrial growth and automation investments.

- Manufacturers will focus on developing compact, modular, and maintenance-free hopper loading systems.

- Food and pharmaceutical sectors will adopt hygienic designs to meet strict safety standards.

- Product innovation will center on noise reduction and improved suction performance.

- Strategic partnerships between equipment manufacturers and end users will expand market reach.

- Sustainability goals will encourage the transition from diesel and gas to electric-powered systems.

- Continuous R&D will improve operational precision, energy management, and digital connectivity in hopper loader designs.