Market Overview:

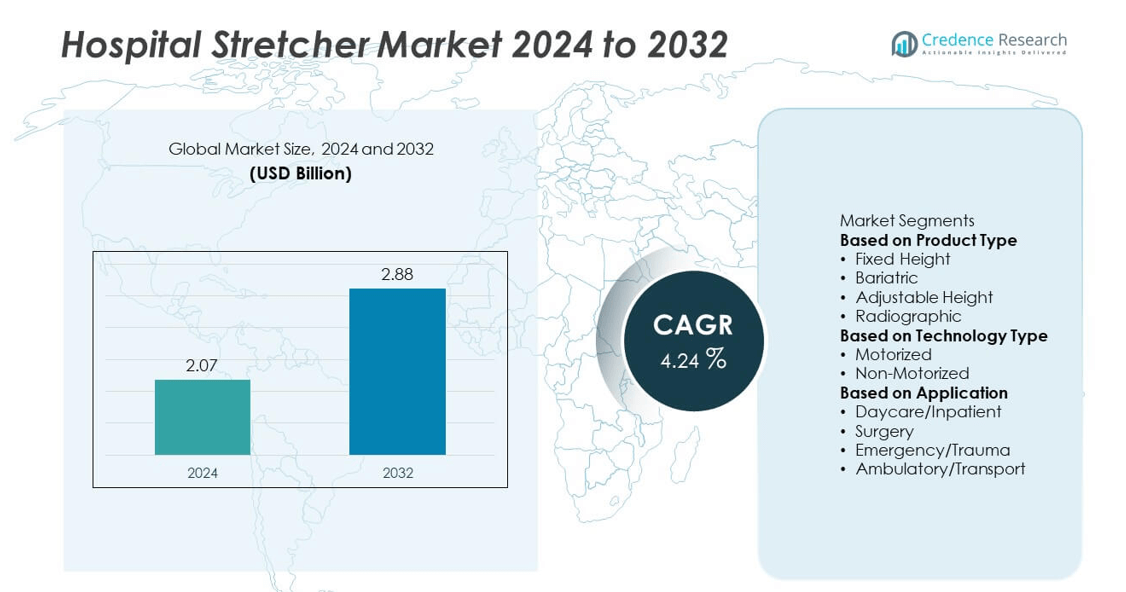

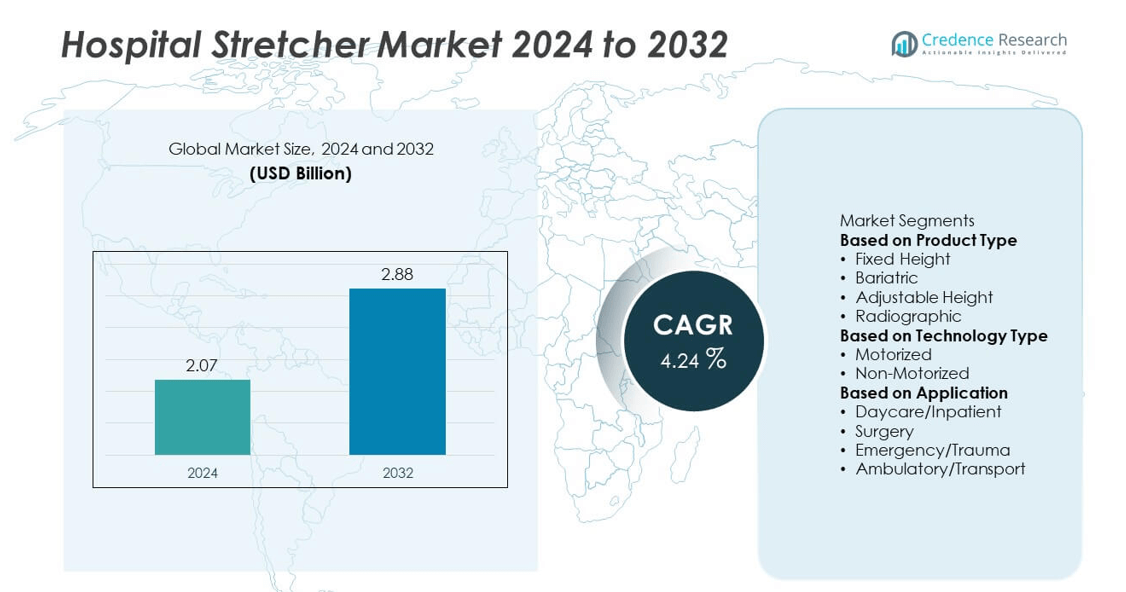

The Hospital Stretcher Market was valued at USD 2.07 billion in 2024 and is projected to reach USD 2.88 billion by 2032, growing at a CAGR of 4.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hospital Stretcher Market Size 2024 |

USD 2.07 billion |

| Hospital Stretcher Market, CAGR |

4.24% |

| Hospital Stretcher Market Size 2032 |

UUSD 2.88 billion |

The Hospital Stretcher Market is led by prominent players including Stryker, Hill-Rom Holdings, Inc., FU SHUN HSING TECHNOLOGY CO., LTD, MAC Medical, Inc., Narang Medical Limited, Royax, Pedigo Products, Ferno-Washington, Inc., Wy’East Medical, and TAYLOR HEALTHCARE PRODUCTS, INC. These companies dominate through advanced product portfolios, global distribution networks, and continuous innovation in patient transport systems. North America led the market in 2024 with a 37.8% share, driven by high healthcare spending and adoption of smart stretchers. Europe followed with 29.6%, supported by strong hospital infrastructure, while Asia-Pacific, holding 23.4%, remains the fastest-growing region due to rapid healthcare expansion.

Market Insights

- The Hospital Stretcher Market was valued at USD 2.07 billion in 2024 and is projected to reach USD 2.88 billion by 2032, growing at a CAGR of 4.24%.

- Increasing hospital admissions, surgical procedures, and focus on patient comfort are driving demand for advanced adjustable and motorized stretchers.

- Trends include rising adoption of smart, sensor-enabled stretchers and expanding production of lightweight, ergonomic designs for improved handling.

- The market is moderately competitive, with major players such as Stryker, Hill-Rom Holdings, and FU SHUN HSING TECHNOLOGY CO., LTD emphasizing innovation and regional expansion.

- North America led with 37.8% share, followed by Europe (29.6%) and Asia-Pacific (23.4%), while the adjustable height segment dominated with a 42.6% share, driven by its enhanced safety and flexibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The adjustable height stretcher segment dominated the Hospital Stretcher Market in 2024 with a 42.6% share. These stretchers offer improved ergonomics, enhancing patient comfort and reducing caregiver strain during transfer or examination. Hospitals prefer adjustable models due to their flexibility in accommodating different medical needs and surgical setups. Rising demand for advanced patient handling systems and increased investments in hospital modernization support this dominance. The bariatric stretcher segment is also gaining traction, driven by the growing prevalence of obesity and the need for higher load-bearing capacity equipment.

- For instance, Stryker Corporation launched its Prime Series adjustable stretcher featuring a hydraulic lift system with a height range from 51 cm to 91 cm and a Safe Working Load of 318 kg. The system integrates an automatic backrest assist mechanism that reduces caregiver exertion by 25%, ensuring both patient safety and ergonomic handling during transfers.

By Technology Type

The non-motorized stretcher segment held the largest market share of 67.4% in 2024, owing to its affordability, easy maintenance, and suitability across small to medium healthcare facilities. These stretchers remain widely used in emergency and transport settings where manual operation is preferred. However, the motorized stretcher segment is witnessing faster growth due to automation in hospital infrastructure and improved maneuverability. The rising adoption of electric mobility systems and powered patient transport solutions is driving demand in technologically advanced healthcare facilities globally.

- For instance, Hill-Rom Holdings, Inc. introduced the Procedural Motorized Stretcher (P8000 series) equipped with an electric drive system (IntelliDrive® Transport System) that assists caregivers with moving patients.

By Application

The emergency/trauma segment led the market in 2024 with a 38.9% share, attributed to high demand in accident and critical care units. Rapid emergency response needs and the expansion of trauma centers fuel this dominance. These stretchers are designed for quick mobility, stability, and compatibility with life-support systems. The surgery segment follows closely, driven by increasing surgical procedures and the need for patient positioning flexibility. Additionally, the rise in outpatient and daycare facilities further supports stretcher demand for short-duration patient transfers.

Key Growth Drivers

Rising Hospital Admissions and Surgical Procedures

Growing hospitalization rates and increasing surgical volumes are key drivers of the hospital stretcher market. Demand for patient transport and mobility solutions has surged due to higher incidences of chronic illnesses and trauma cases. Hospitals are investing in advanced stretchers that improve patient safety, comfort, and ease of handling. The expansion of surgical facilities, particularly in emerging economies, continues to create strong growth opportunities for stretcher manufacturers focusing on ergonomics and multi-functionality.

- For instance, Pedigo Products launched the 7500-W Trauma Stretcher designed with a hydraulic height adjustment range of 58 cm to 83 cm and a 340 kg load capacity. The model features a four-wheel brake and steer system, allowing caregivers to maneuver through narrow corridors with a 1.8-meter turning radius, optimizing patient transfer in busy surgical departments.

Advancements in Medical Equipment Technology

Technological innovations such as motorized stretchers, integrated monitoring systems, and height-adjustable designs are propelling market growth. These advancements enhance patient transfer efficiency and reduce manual effort for healthcare workers. Increasing adoption of electric-powered stretchers in large hospitals reflects the shift toward automation and safety. Furthermore, integration of digital sensors and lightweight materials improves durability and maneuverability, supporting operational efficiency across emergency and inpatient departments.

- For instance, FU SHUN HSING TECHNOLOGY CO., LTD is a manufacturer of electric actuators used in various applications including medical devices like stretchers and medical beds. Their products, such as certain linear actuators, are noted for features like high dynamic and static loads, waterproof ratings, and durable design for medical environments

Increasing Focus on Patient Safety and Comfort

Healthcare facilities are emphasizing patient-centric care, driving demand for stretchers with advanced comfort and safety features. The introduction of stretchers with pressure-relief mattresses, adjustable backrests, and restraint systems minimizes risks during transport. Hospitals and clinics are prioritizing ergonomically designed stretchers to enhance the patient experience and prevent strain injuries for caregivers. This growing emphasis on patient well-being and care quality continues to strengthen product demand globally.

Key Trends & Opportunities

Growing Adoption of Motorized and Smart Stretchers

Motorized and sensor-enabled stretchers are gaining popularity due to their superior mobility and monitoring features. Hospitals are adopting smart stretchers equipped with power drives, automated braking, and patient vital tracking. These solutions reduce manual labor, prevent accidents, and improve workflow efficiency. Manufacturers are leveraging IoT integration and smart control systems to offer advanced hospital mobility solutions, particularly in developed healthcare systems.

- For instance, Stryker Corporation developed its Prime TC Transport Stretcher, which can be equipped with a fifth-wheel electric motor system to provide a powerful, motorized assist to caregivers, helping to reduce the physical strain of pushing heavy loads

Expansion of Healthcare Infrastructure in Emerging Economies

Rapid hospital infrastructure development in Asia-Pacific, Latin America, and the Middle East presents strong opportunities. Governments and private investors are expanding healthcare facilities and emergency care networks, increasing stretcher procurement. Demand for cost-effective, durable, and transport-efficient models is rising in both public and private sectors. Local manufacturing and partnerships with global brands are further supporting market penetration in these developing regions.

- For instance, Narang Medical Limited is a manufacturer and supplier of hospital furniture and medical equipment, including various stretchers, from its facilities in India. The company offers a folding aluminum stretcher model which weighs approximately 6 kg and has a load-bearing capacity of 159 kg, designed for portability and rapid deployment in emergency situations.

Key Challenges

High Maintenance and Procurement Costs

The initial cost of advanced stretchers, especially motorized and radiographic types, remains a barrier for small hospitals. Regular maintenance, battery replacement, and equipment calibration add to operational expenses. Budget constraints in public healthcare systems limit adoption of premium models, pushing buyers toward low-cost alternatives. This pricing pressure challenges manufacturers to balance quality with affordability.

Limited Standardization and Compatibility Issues

Variations in stretcher design, size, and compatibility with other hospital equipment pose operational challenges. Integration with imaging systems, operating tables, and transport vehicles often requires customization, raising procurement complexity. The lack of universal standards in stretcher design impacts efficiency and interoperability in multi-departmental use. Addressing these inconsistencies remains vital for improving workflow and equipment utilization in hospitals.

Regional Analysis

North America

North America held the largest share of 37.8% in the Hospital Stretcher Market in 2024. The dominance is driven by advanced healthcare infrastructure, high surgical procedure volumes, and increased demand for emergency transport equipment. The U.S. leads the region due to strong hospital investments in motorized and specialized stretchers. Rising emphasis on patient safety and ergonomic product designs further supports market expansion. Additionally, the presence of key manufacturers and continuous technology upgrades in hospital equipment strengthen North America’s position as a key contributor to global revenue.

Europe

Europe accounted for 29.6% of the Hospital Stretcher Market share in 2024. Growth is supported by well-established public healthcare systems and strict safety regulations promoting advanced medical equipment use. Countries such as Germany, France, and the U.K. lead due to increasing hospital modernization projects and a focus on reducing caregiver strain. Demand for bariatric and adjustable height stretchers continues to rise, especially in aging populations. The strong presence of medical equipment manufacturers and growing adoption of smart, motorized systems also contribute to Europe’s steady market performance.

Asia-Pacific

Asia-Pacific captured a 23.4% share of the Hospital Stretcher Market in 2024, driven by rapid healthcare infrastructure expansion and increasing hospital admissions. China, India, and Japan are the key growth engines, supported by rising investments in healthcare modernization and emergency response systems. Growing awareness about patient safety and rising surgical procedure rates further strengthen regional demand. Local manufacturing and government funding initiatives enhance affordability and accessibility, making Asia-Pacific one of the fastest-growing regions for both motorized and non-motorized stretcher products.

Latin America

Latin America held a 5.6% share of the Hospital Stretcher Market in 2024. Growth is primarily fueled by expanding hospital networks, especially in Brazil and Mexico. The region is witnessing gradual adoption of advanced patient mobility systems to improve emergency and surgical care. Government investments in healthcare infrastructure and an increasing number of private hospitals support product demand. However, high costs of premium models and limited technical expertise restrict widespread motorized stretcher adoption. Local distributors and collaborations with global brands are helping bridge product availability gaps.

Middle East & Africa

The Middle East & Africa accounted for a 3.6% share of the Hospital Stretcher Market in 2024. Market growth is supported by expanding healthcare facilities and rising demand for advanced patient handling equipment in Gulf nations. The United Arab Emirates and Saudi Arabia are leading markets, driven by investments in hospital modernization and medical tourism. African countries are increasingly adopting cost-efficient, non-motorized stretchers to enhance emergency and trauma care systems. Continued healthcare funding and infrastructure development programs are expected to improve regional market penetration over the forecast period.

Market Segmentations:

By Product Type

- Fixed Height

- Bariatric

- Adjustable Height

- Radiographic

By Technology Type

By Application

- Daycare/Inpatient

- Surgery

- Emergency/Trauma

- Ambulatory/Transport

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hospital Stretcher Market is highly competitive, featuring key players such as Stryker, Hill-Rom Holdings, Inc., FU SHUN HSING TECHNOLOGY CO., LTD, MAC Medical, Inc., Narang Medical Limited, Royax, Pedigo Products, Ferno-Washington, Inc., Wy’East Medical, and TAYLOR HEALTHCARE PRODUCTS, INC. These companies focus on product innovation, ergonomic design, and advanced mobility solutions to enhance patient safety and comfort. Leading manufacturers are investing in electric and height-adjustable stretchers to meet growing hospital automation needs. Partnerships, product launches, and regional expansions are core strategies driving competition. Moreover, firms are emphasizing durable materials, lightweight construction, and integrated monitoring systems to align with global healthcare standards. The market’s competitive intensity is further shaped by pricing strategies, after-sales service quality, and the growing presence of regional manufacturers offering cost-effective solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FU SHUN HSING TECHNOLOGY CO., LTD

- TAYLOR HEALTHCARE PRODUCTS, INC.

- Stryker

- Royax

- Pedigo Products

- Wy’East Medical

- Hill-Rom Holdings, Inc.

- Narang Medical Limited

- MAC Medical, Inc.

- Ferno-Washington, Inc.

Recent Developments

- In 2024, Stryker expanded its Prime Series stretchers offering a Safe Working Load capacity of 318 kg (700 lb) as standard.

- In October 2023, Stryker Corporation launched the “Prime Connect” stretcher featuring integrated sensors for real-time patient monitoring and workflow optimisation in hospital settings.

- In September 2023, at the Emergency Nursing 2023 event in San Diego, California, Stryker unveiled Prime Connect, a new smart and connected hospital stretcher designed to enhance fall prevention protocols across facilities

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for adjustable and motorized stretchers will continue to rise with hospital modernization.

- Increasing surgical procedures will drive the need for advanced patient transport solutions.

- Adoption of smart and sensor-integrated stretchers will expand in developed healthcare systems.

- Manufacturers will focus on ergonomic and lightweight designs to improve caregiver efficiency.

- Growth in emergency and trauma care centers will strengthen stretcher demand globally.

- Asia-Pacific will emerge as the fastest-growing market due to rapid healthcare infrastructure expansion.

- Partnerships between global and regional manufacturers will enhance product accessibility.

- Eco-friendly materials and sustainable production practices will gain higher preference.

- Integration of digital monitoring systems will improve safety and operational efficiency.

- Continuous innovation and customization will remain key strategies for maintaining competitiveness.