Market Overview

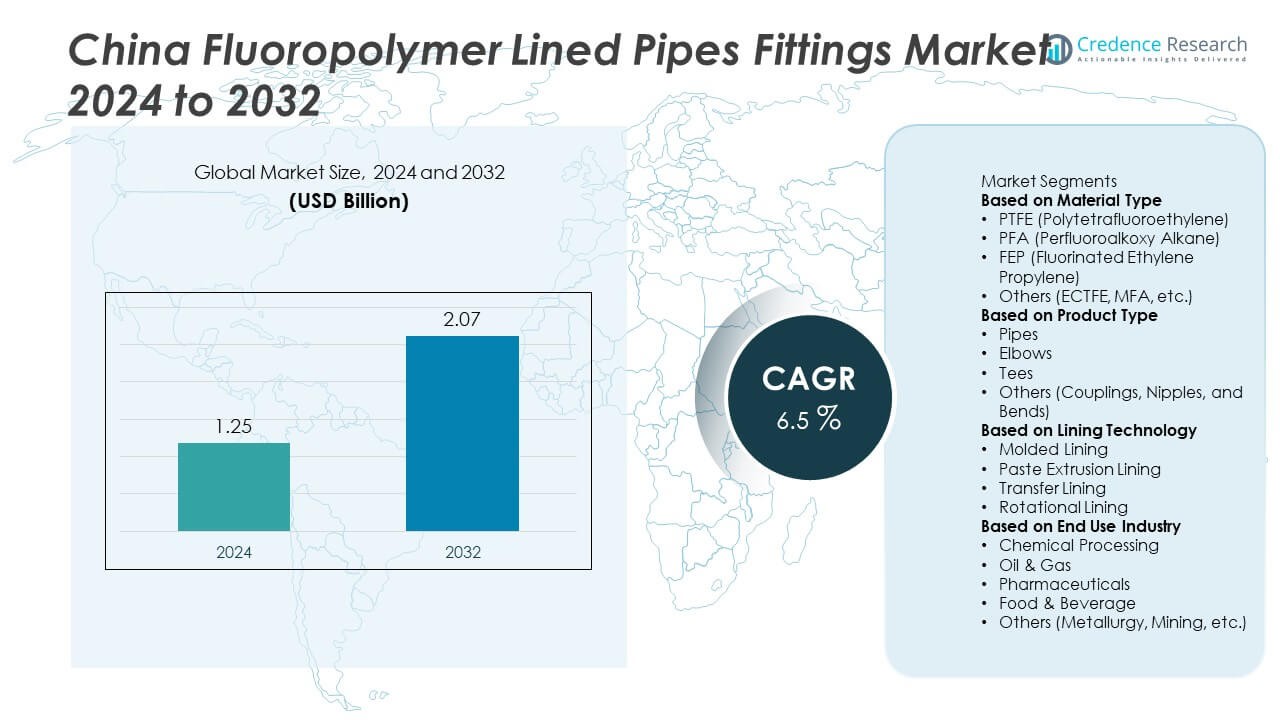

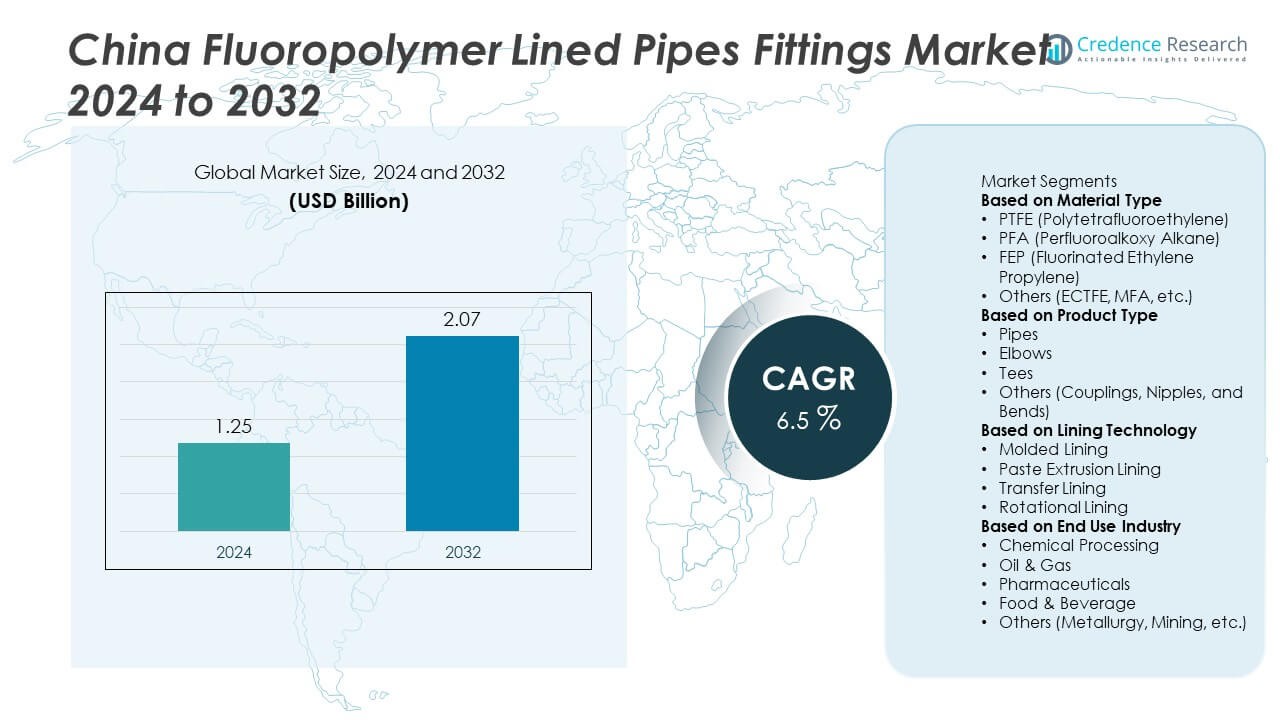

The China fluoropolymer lined pipes and fittings market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.07 billion by 2032, expanding at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Fluoropolymer Lined Pipes And Fittings Market Size 2024 |

USD 1.25 Billion |

| China Fluoropolymer Lined Pipes And Fittings Market, CAGR |

6.5% |

| China Fluoropolymer Lined Pipes And Fittings Market Size 2032 |

USD 2.07 Billion |

The China fluoropolymer lined pipes and fittings market is led by major players including Jiangsu Sunmon New Materials Co., Ltd., Zhejiang Juhua Co., Ltd., Shandong Dongyue Polymer Material Co., Ltd., 3P Performance Plastics Products Co., Ltd., Ningbo Kaxite Sealing Materials Co., Ltd., Parker Hannifin Corporation, CRP Group, Chengdu Huayi Chemical New Material Co., Ltd., Fluorocarbon Company Ltd., and Sinfluoro Industrial Co., Ltd. These companies emphasize technological advancements, strong distribution networks, and expansion of fluoropolymer processing capabilities. East China emerged as the dominant regional market with a 38.6% share in 2024, driven by its concentration of chemical, pharmaceutical, and semiconductor manufacturing hubs in Jiangsu, Zhejiang, and Shanghai, supported by strong infrastructure and continuous industrial modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The China fluoropolymer lined pipes and fittings market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.07 billion by 2032, growing at a CAGR of 6.5%.

- Strong demand from chemical, petrochemical, and semiconductor industries drives market expansion, supported by corrosion resistance and high-performance requirements in harsh processing environments.

- PTFE materials held the largest 46.3% share in 2024, while pipes accounted for 54.7%, driven by use in fluid transport and industrial safety upgrades.

- The market is moderately consolidated, with key players such as Jiangsu Sunmon, Juhua, Dongyue, Parker Hannifin, and CRP Group focusing on R&D and domestic production to strengthen competitiveness.

- East China led with a 38.6% share, followed by North China (19.4%) and South China (15.9%), driven by infrastructure growth, environmental regulations, and investments in high-purity and chemical manufacturing facilities.

Market Segmentation Analysis:

By Material Type

PTFE dominated the China fluoropolymer lined pipes and fittings market in 2024 with a 46.3% share. Its superior chemical resistance, non-reactivity, and high-temperature stability make it the preferred choice for corrosive chemical and pharmaceutical applications. PFA and FEP are gaining ground due to their smoother surface finish and enhanced mechanical performance in semiconductor and food-grade systems. The growing shift toward high-purity process environments continues to favor PTFE-based systems, supported by local production capacity expansion and increasing demand for cost-effective corrosion control solutions in chemical processing facilities.

- For instance, SGL Group’s POLYFLURON® PTFE lined steel piping system provides nominal diameters up to DN 600 and is rated for operating temperatures up to +260 °C in China.

By Product Type

Pipes accounted for the largest share of 54.7% in 2024, driven by their extensive application in transporting aggressive fluids across petrochemical and water treatment industries. Their high mechanical strength, leak-free performance, and ease of installation make them ideal for long-run operations. Elbows and tees followed as essential complementary components in complex pipeline layouts. Continuous investments in large-scale chemical and power generation plants across coastal provinces have further accelerated demand for PTFE-lined pipes, reinforcing their dominance in overall product consumption.

- For instance, a China-based manufacturer lists PTFE-lined steel pipe sizes from DN 10 mm to DN 300 mm with lengths between 2,000 mm and 6,000 mm and rated for positive pressure of 1.6 MPa and negative pressure up to 0.07 MPa.

By Lining Technology

Molded lining held a 41.2% share in 2024, emerging as the leading technology in the market. Its superior bond strength, uniform thickness, and resistance to permeation make it suitable for critical chemical and high-pressure service environments. Paste extrusion and transfer lining technologies are expanding adoption due to their cost-effectiveness and compatibility with various pipe diameters. Meanwhile, rotational lining is gaining traction for custom fittings and low-volume production. Growing focus on extending service life and reducing maintenance downtime continues to drive preference for molded lining solutions in industrial applications.

Key Growth Drivers

Rising Demand from Chemical and Petrochemical Industries

China’s expanding chemical and petrochemical sectors remain the strongest growth driver for fluoropolymer lined pipes and fittings. These components ensure safe handling of corrosive chemicals such as acids, alkalis, and solvents in harsh industrial environments. The government’s focus on upgrading chemical infrastructure and increasing specialty chemical output further stimulates adoption. Companies are investing in advanced PTFE- and PFA-lined piping systems to minimize leaks, extend service life, and reduce maintenance costs, strengthening market growth across major industrial provinces like Jiangsu, Zhejiang, and Shandong.

- For instance, PTFE-lined spools from various manufacturers are available in internal diameter DN 300 mm and lengths up to 4 000 mm, and such products can typically withstand a positive pressure of 1.6 MPa (PN16) and operate at temperatures up to +230 °C for use in demanding chemical applications like acid-alkali recycling units.

Expansion of Semiconductor and Pharmaceutical Manufacturing

Rapid growth in China’s semiconductor and pharmaceutical sectors is fueling demand for ultra-pure and corrosion-resistant piping systems. Fluoropolymer-lined products provide excellent chemical inertness and prevent contamination in cleanroom and process transfer operations. Increasing investments in chip fabrication facilities and biopharmaceutical plants across East and South China are driving procurement of high-grade PFA and FEP-lined components. Their ability to maintain process integrity under extreme temperatures and chemicals positions these materials as critical to high-precision manufacturing environments.

- For instance, Zhejiang Youfumi Valve Co., Ltd. produces PTFE/PFA-lined valves and fittings in a class-100,000 workshop that serve ultra-pure water loops in semiconductor fabs, supporting wafer-cleaning systems consuming over 5,500 m³/day of ultra-pure water.

Focus on Infrastructure Modernization and Environmental Compliance

The ongoing modernization of China’s industrial infrastructure supports higher adoption of advanced lining systems. Government-driven initiatives to improve environmental standards and reduce pipeline failures promote the use of fluoropolymer-lined pipes in wastewater treatment and chemical processing. Their durability and low maintenance needs align with sustainability objectives. Additionally, growing replacement demand for aging steel pipelines with lined alternatives is propelling market expansion, as industries seek long-term corrosion protection and compliance with evolving safety and emission regulations.

Key Trends & Opportunities

Technological Advancements in Lining Techniques

Innovations in lining technologies such as rotational and transfer lining are expanding the design flexibility and performance of fluoropolymer-lined systems. Manufacturers are introducing improved bonding methods to ensure seamless adhesion and minimize permeability. The integration of advanced inspection and quality control systems enables consistent production standards. These technological improvements enhance lifespan and cost-efficiency, allowing domestic producers to compete globally and cater to specialized industries like electronics, where ultra-clean processing requirements are critical.

- For instance, AGRU Kunststofftechnik developed its SureGrip liner technology, integrating thermoplastic fluoropolymers with a mechanical anchoring system featuring over 2,200 locking studs per square meter. This ensures zero delamination and extends service life in chemical and semiconductor applications, supported by automated ultrasonic inspection for quality validation.

Rising Adoption in Water Treatment and Power Generation

Growing industrial water recycling and wastewater treatment initiatives create major opportunities for fluoropolymer-lined piping systems. Their strong resistance to chemical degradation and biofouling makes them ideal for corrosive process environments. Power generation plants, particularly those using flue gas desulfurization systems, increasingly use PTFE-lined pipes to ensure operational safety and efficiency. The government’s push for greener energy and stricter discharge standards is expected to further increase demand for reliable and environmentally sustainable piping solutions.

- For instance, Saint-Gobain Performance Plastics manufactures Chemfluor PTFE (polytetrafluoroethylene) products, which are widely used in industrial applications, including the chemical processing industry, due to their exceptional chemical resistance and high-temperature capabilities.

Key Challenges

High Production and Material Costs

The manufacturing of fluoropolymer-lined pipes and fittings involves high material and processing costs, limiting their widespread use in cost-sensitive industries. Raw materials such as PTFE and PFA are expensive, and the production process requires advanced equipment and strict quality control. Domestic manufacturers face pricing pressure from low-cost alternatives like rubber or metal-lined systems. Balancing cost optimization while maintaining product performance remains a key challenge, particularly for smaller players trying to compete with established multinational brands.

Limited Standardization and Technical Expertise

A lack of standardized specifications and limited technical expertise in lining processes hinder market consistency in China. Variations in design, thickness, and bonding quality across manufacturers affect reliability and performance, reducing user confidence. Additionally, insufficient skilled labor for precision lining and testing leads to uneven quality outcomes. Strengthening certification systems and training programs is essential to ensure consistent production standards and to support the market’s long-term industrial adoption across critical process applications.

Regional Analysis

East China

East China dominated the China fluoropolymer lined pipes and fittings market in 2024 with a 38.6% share. The region’s strong base in chemical processing, pharmaceuticals, and semiconductor manufacturing drives extensive demand for corrosion-resistant piping systems. Jiangsu, Zhejiang, and Shanghai host major production and consumption hubs supported by well-established industrial infrastructure. Ongoing investments in high-purity chemical plants and cleanroom facilities enhance the need for PTFE and PFA-lined systems. Government-led environmental and safety regulations further encourage industries to upgrade existing pipelines with durable fluoropolymer-lined alternatives for improved operational reliability.

North China

North China accounted for a 19.4% share in 2024, driven by its expanding petrochemical and metallurgy sectors. Provinces such as Beijing, Tianjin, and Shandong are key consumers of fluoropolymer-lined fittings due to their strong industrial and energy output. The growing adoption of these systems in chemical and wastewater treatment facilities supports regional growth. Increasing investment in industrial modernization and emission control has accelerated demand for advanced corrosion protection materials. The region’s proximity to key raw material suppliers and transportation networks also enhances manufacturing efficiency and product distribution.

South China

South China held a 15.9% share in 2024, supported by significant demand from electronics, power generation, and food processing industries. Guangdong and Fujian provinces are emerging as important manufacturing centers for lined components due to their robust industrial clusters and export orientation. The expansion of semiconductor fabrication facilities and chemical export zones continues to strengthen market penetration. Growing awareness of environmental compliance and the need for high-performance piping solutions further contribute to market expansion in the region, particularly among multinational and domestic process equipment manufacturers.

Central China

Central China captured a 10.3% share in 2024, benefiting from rising infrastructure and industrial investment across Henan, Hunan, and Hubei provinces. The growth of manufacturing zones and industrial parks has increased demand for reliable, corrosion-resistant pipeline systems. Fluoropolymer-lined products are widely adopted in new chemical, pharmaceutical, and water treatment facilities. Government-backed initiatives promoting regional industrialization and wastewater management have supported steady consumption. The increasing shift toward modern pipeline replacement in industrial utilities also contributes to sustained market growth across key provinces in this central corridor.

Southwest China

Southwest China accounted for a 9.1% share in 2024, driven by industrial expansion in Sichuan, Chongqing, and Yunnan. These provinces are witnessing rapid growth in chemical and power generation projects, creating demand for high-performance lined piping systems. The rising focus on environmental sustainability and industrial safety is pushing adoption across process industries. Local manufacturers are expanding capacity to meet regional supply needs and reduce dependence on imports. Infrastructure development and increased investment in new energy and metallurgical sectors are expected to sustain market growth over the forecast period.

Northwest China

Northwest China represented a 6.7% share in 2024, driven primarily by oil and gas, mining, and metallurgy operations in Shaanxi, Gansu, and Xinjiang. The region’s focus on energy infrastructure and resource-based industries supports steady demand for fluoropolymer-lined systems resistant to corrosive fluids. Government investments in industrial pipeline safety and environmental protection are promoting adoption across refineries and processing units. Although the region remains less industrialized compared to eastern provinces, continuous development of petrochemical complexes and wastewater treatment projects is expected to strengthen long-term market prospects.

Market Segmentations:

By Material Type

- PTFE (Polytetrafluoroethylene)

- PFA (Perfluoroalkoxy Alkane)

- FEP (Fluorinated Ethylene Propylene)

- Others (ECTFE, MFA, etc.)

By Product Type

- Pipes

- Elbows

- Tees

- Others (Couplings, Nipples, and Bends)

By Lining Technology

- Molded Lining

- Paste Extrusion Lining

- Transfer Lining

- Rotational Lining

By End Use Industry

- Chemical Processing

- Oil & Gas

- Pharmaceuticals

- Food & Beverage

- Others (Metallurgy, Mining, etc.)

By Geography

- East China

- North China

- South China

- Central China

- Southwest China

- Northwest China

Competitive Landscape

The competitive landscape of the China fluoropolymer lined pipes and fittings market features key players such as Jiangsu Sunmon New Materials Co., Ltd., Zhejiang Juhua Co., Ltd., Shandong Dongyue Polymer Material Co., Ltd., 3P Performance Plastics Products Co., Ltd., Ningbo Kaxite Sealing Materials Co., Ltd., Parker Hannifin Corporation, CRP Group, Chengdu Huayi Chemical New Material Co., Ltd., Fluorocarbon Company Ltd., and Sinfluoro Industrial Co., Ltd. These companies focus on product innovation, enhanced material performance, and cost-efficient manufacturing processes. Local players dominate with strong regional networks and customized product offerings, while international brands maintain an edge through advanced technology and strict quality standards. Strategic collaborations with chemical and semiconductor industries are increasing, supporting specialized applications. Ongoing investments in R&D, capacity expansion, and eco-friendly production further intensify competition, positioning China as a growing hub for high-performance fluoropolymer piping solutions across multiple industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Zhejiang Juhua Co., Ltd. continued its innovation focus on manufacturing fluoropolymers including PTFE, PVDF, and FKM, enhancing product quality and expanding applications into electronics, semiconductors, and chemical industries, supported by multiple R&D platforms and certifications for export and domestic markets.

- In October 2025, Shandong Dongyue Polymer Material Co., Ltd. reported the successful development of high-end PTFE products needed in 5G high-frequency, chip manufacturing, and other advanced sectors through its globally distributed research and innovation system, further driving adoption of fluoropolymer lined solutions in industrial applications.

- In October 2025, Parker Hannifin Corporation showcased new fluoropolymer and hydraulic fitting designs at the 138th Canton Fair in China, introducing features such as increased wear resistance, simplified installation, and improved sustainability to align with energy-efficient industry trends.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, Lining Technology, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with continued industrial expansion in chemical and semiconductor sectors.

- Technological advancements will enhance lining durability and reduce maintenance costs.

- Domestic manufacturers will increase capacity to reduce import dependence.

- Environmental regulations will drive replacement of metal pipes with fluoropolymer-lined alternatives.

- PTFE and PFA materials will maintain dominance due to superior chemical resistance.

- Growth in wastewater treatment and power generation projects will support adoption.

- Increasing investment in smart manufacturing will boost automated lining production.

- Strategic partnerships with petrochemical firms will enhance product customization.

- Export opportunities will expand as Chinese products gain international certifications.

- Sustainable production practices and recycling of fluoropolymers will become key industry priorities.