Market Overview:

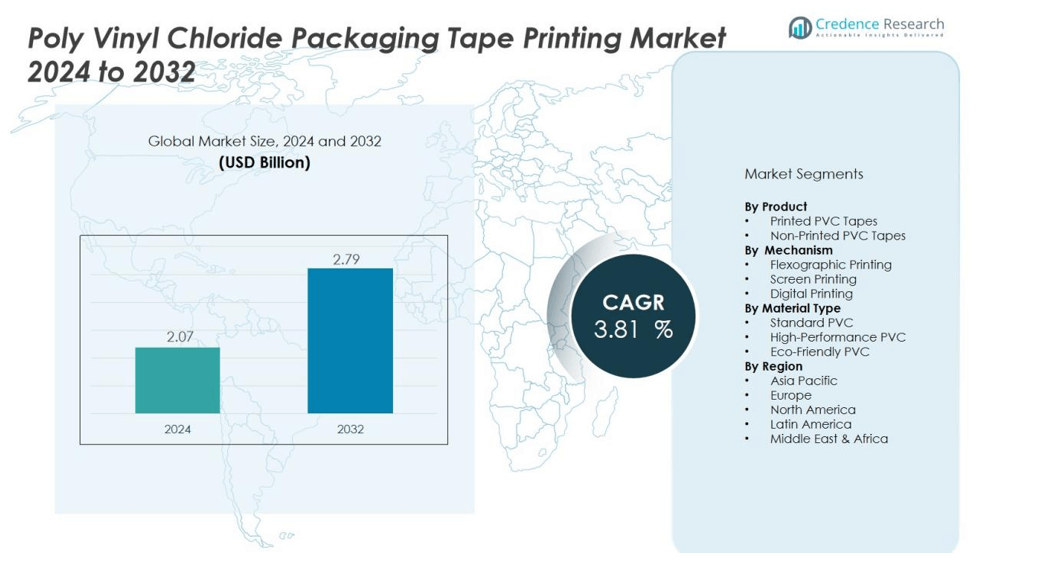

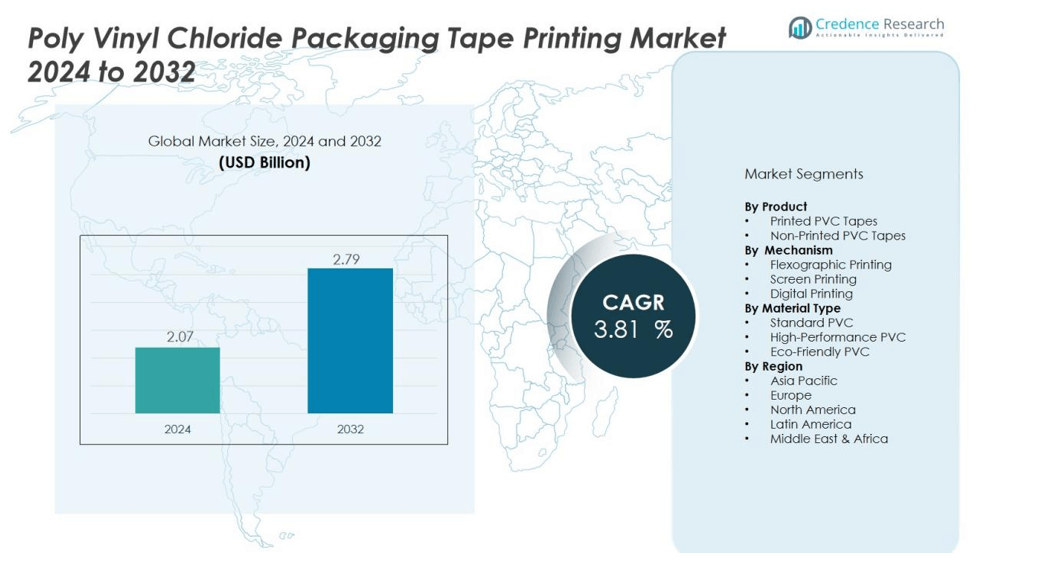

The Poly Vinyl Chloride Packaging Tape Printing Market size was valued at USD 2.07 billion in 2024 and is anticipated to reach USD 2.79 billion by 2032, at a CAGR of 3.81 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Poly Vinyl Chloride Packaging Tape Printing Market Size 2024 |

USD 2.07 billion |

| Poly Vinyl Chloride Packaging Tape Printing Market, CAGR |

3.81% |

| Poly Vinyl Chloride Packaging Tape Printing Market Size 2032 |

USD 2.79 billion |

The PVC packaging tape printing market is primarily driven by the growing demand for branded and customized packaging solutions. Companies are increasingly seeking packaging that not only serves as a protective measure but also enhances the aesthetic appeal and functionality of the product. The rising need for better stock handling, shipment identification, and differentiation in competitive markets supports the growth of printed PVC tapes. Technological advancements in printing inks, such as UV-curable and water-based systems, also contribute to the wider adoption of PVC tapes, offering eco-friendly and efficient solutions.

The Asia-Pacific region leads the global PVC packaging tape printing market due to its strong manufacturing base and extensive distribution networks for printing materials and equipment. North America is expected to register the highest growth rate, fueled by the demand for aesthetically appealing packaging solutions and innovative printing techniques. Emerging markets in regions like Latin America and the Middle East are also showing potential for growth, driven by expanding e-commerce and logistics sectors.

Market Insights:

- The Poly Vinyl Chloride Packaging Tape Printing Market was valued at USD 2.07 billion in 2024 and is projected to reach USD 2.79 billion by 2032, growing at a CAGR of 3.81% during the forecast period.

- North America holds 30% of the global market share, driven by strong demand for high-quality, customizable packaging solutions across industries like retail and e-commerce, with a focus on sustainability and innovation.

- Europe accounts for 25% of the market share, with growth fueled by stringent environmental regulations and high demand for eco-friendly PVC tapes in industries such as food and beverage.

- Asia-Pacific leads with 35% market share and is the fastest-growing region, driven by rapid industrialization, expanding e-commerce, and increased interest in cost-effective and sustainable packaging solutions.

- The product segment dominates the market, with printed PVC tapes holding the largest share due to increasing demand for branded and customized packaging solutions, while the material segment is led by standard PVC tapes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Customization and Branding

The Poly Vinyl Chloride (PVC) Packaging Tape Printing Market benefits from the growing demand for branded and customized packaging solutions. Companies are increasingly focused on creating unique packaging that helps differentiate their products in the competitive marketplace. Printed PVC tapes provide an opportunity for businesses to showcase their brand identity, offering a cost-effective method for increasing brand visibility on products and shipments. This trend is especially prevalent in industries like retail, e-commerce, and consumer goods, where packaging plays a crucial role in consumer decision-making.

- For instance, Shurtape Technologies introduced its AP 251 Custom-Printed Acrylic Packaging Tape, engineered for manual and automated carton sealing with a tensile strength of 24 lbs/in width, UV-resistant properties, and high visual clarity that enables logos and branded messaging to remain readable throughout the supply chain.

Advancements in Printing Technologies

Technological innovations in printing techniques are significantly driving the growth of the PVC packaging tape printing market. The shift towards more advanced printing systems, such as UV-curable inks and water-based coatings, has enhanced the quality, durability, and eco-friendliness of printed PVC tapes. These improvements allow for better resolution and longer-lasting prints, which are essential for industries requiring high-quality labels and packaging. The adoption of these technologies enables faster production times and cost savings, which adds to the market’s appeal.

- For Instance, 3M offers various Scotch® packaging tapes utilizing high-performance acrylic adhesives, with some varieties resistant to UV light and aging for durability in typical warehouse and shipping environments.

Growing E-commerce and Logistics Demand

The rise of e-commerce and the growing demand for efficient logistics are major contributors to the increasing use of printed PVC packaging tapes. The need for secure, identifiable packaging that ensures the safe delivery of goods has heightened the importance of quality packaging materials. PVC tapes are widely used for sealing boxes, cartons, and packages, offering both security and visibility for shipments. As e-commerce continues to expand globally, demand for reliable and branded packaging solutions, including printed PVC tapes, is expected to increase.

Environmental Considerations and Sustainability

Sustainability concerns are driving the demand for eco-friendly packaging solutions, and PVC tape manufacturers are responding by improving the environmental profile of their products. With growing emphasis on reducing plastic waste and adopting sustainable practices, manufacturers are focusing on producing recyclable and environmentally responsible PVC tapes. As industries shift toward more sustainable packaging options, the Poly Vinyl Chloride Packaging Tape Printing Market is seeing increased demand for tapes that align with corporate social responsibility goals and environmental regulations.

Market Trends:

Shift Towards Eco-friendly and Sustainable Packaging Solutions

A significant trend in the Poly Vinyl Chloride (PVC) Packaging Tape Printing Market is the growing shift towards eco-friendly and sustainable packaging solutions. As businesses and consumers alike become more environmentally conscious, there is a rising demand for packaging materials that minimize environmental impact. Manufacturers are responding by developing recyclable and biodegradable PVC tapes that align with sustainability goals. Companies are also adopting water-based inks and eco-friendly adhesives in their PVC packaging tapes to reduce harmful emissions and minimize waste. This trend is particularly evident in sectors such as food and beverage, cosmetics, and retail, where sustainability is becoming a key competitive factor. PVC tape suppliers are now prioritizing eco-conscious solutions to meet the increasing pressure for greener packaging alternatives.

- For Instance, Tesa SE has launched various sustainable packaging tapes, such as the tesapack® Bio & Strong which uses up to 98% bio-based material, and the tesa® 60400, an alternative to fossil-based tapes with lower CO2 emissions. The company has a broader goal and, in 2023, exceeded its climate target by achieving a 38% reduction in Scope 1 and Scope 2 CO2 emissions compared to 2018 levels.

Integration of Smart Packaging and Technological Advancements

Another notable trend is the integration of smart packaging solutions in the PVC packaging tape printing market. Advances in technology are leading to the incorporation of QR codes, RFID tags, and augmented reality features in printed PVC tapes, providing an interactive and informative experience for consumers. This allows brands to engage with customers, track shipments, and provide product-related information easily. The growth of e-commerce and the need for better supply chain tracking are major drivers of this trend. As a result, PVC packaging tape manufacturers are investing in research and development to enhance the functionality of their products beyond just sealing and labeling. These innovations are expected to improve the user experience while adding value to packaging applications across various industries.

- For instance, Avery Dennison Smartrac opened its largest RFID manufacturing facility in Querétaro, Mexico with an investment exceeding $100 million, creating 600 technology jobs and establishing capacity to produce over 10 billion RFID units annually across its seven global manufacturing facilities, supporting brands requiring track-and-trace capabilities for food, pharmaceutical, and logistics applications.

Market Challenges Analysis:

Raw Material Cost Volatility

One of the primary challenges faced by the Poly Vinyl Chloride (PVC) Packaging Tape Printing Market is the volatility in raw material costs. PVC resin, a key component in manufacturing PVC tapes, is subject to price fluctuations driven by supply chain disruptions, geopolitical tensions, and changes in demand from various industries. These cost fluctuations impact manufacturers’ profitability and pricing strategies. As prices for raw materials increase, it becomes difficult for companies to maintain competitive pricing while ensuring quality and performance. Managing these cost changes requires strategic sourcing, efficient production processes, and innovation to minimize the impact on profit margins.

Environmental and Regulatory Pressure

The growing environmental concerns surrounding plastic packaging present significant challenges for the PVC packaging tape market. Increased scrutiny from regulators and consumers regarding plastic waste and sustainability is pushing manufacturers to explore alternatives or make their products more environmentally friendly. Many regions have introduced stricter regulations on plastic use, requiring companies to invest in sustainable materials and processes. This shift demands substantial investment in research and development, which may strain resources for smaller players. Balancing environmental responsibility with cost-efficiency remains a key challenge for the market, particularly as demand for eco-friendly solutions rises.

Market Opportunities:

Rising Demand for Sustainable Packaging Solutions

The Poly Vinyl Chloride (PVC) Packaging Tape Printing Market presents significant opportunities driven by the increasing demand for sustainable packaging solutions. Consumers and businesses are becoming more environmentally conscious, and there is a growing preference for recyclable and eco-friendly packaging materials. Manufacturers are focusing on producing PVC tapes that meet sustainability standards, offering an opportunity to cater to this market shift. The adoption of water-based inks, recyclable PVC films, and eco-friendly adhesives is gaining momentum. Companies that can innovate in these areas are well-positioned to capitalize on the expanding market for sustainable packaging solutions, particularly in sectors like food, cosmetics, and retail.

Expansion in Emerging Markets

The Poly Vinyl Chloride Packaging Tape Printing Market also has strong growth prospects in emerging markets, where industrialization, e-commerce, and infrastructure development are rapidly increasing. Regions such as Asia-Pacific, Latin America, and Africa are experiencing significant growth in manufacturing and logistics, creating a higher demand for quality packaging materials. As these regions expand their retail and consumer goods sectors, there will be an increasing need for customized and branded packaging solutions. This trend provides opportunities for manufacturers to tap into new markets and establish a strong presence in regions with high growth potential.

Market Segmentation Analysis:

By Product

In the Poly Vinyl Chloride (PVC) Packaging Tape Printing Market, the product segment is primarily divided into printed PVC tapes and non-printed PVC tapes. Printed PVC tapes are gaining traction due to their branding and customization potential. These tapes are widely used in retail, e-commerce, and packaging industries, where visual appeal and brand identity are essential. Non-printed PVC tapes remain essential for general sealing and shipping purposes, offering basic functionality without additional customization. The growing demand for branded and customized packaging is driving the expansion of the printed PVC tape segment.

- For example, Scapa’s 2702 PVC Premium Electrical Adhesive Tape, with a thickness of 0.13 mm and aggressive rubber-based adhesive, is designed for robust electrical insulation and harnessing applications and is approved to international standards, demonstrating high performance in electrical and industrial contexts.

By Mechanism

The mechanism segment in the PVC packaging tape printing market includes flexographic, screen printing, and digital printing. Flexographic printing dominates the market due to its ability to handle high-volume orders with cost-effective production. It is widely used for large-scale printing on PVC tapes, making it a preferred choice for manufacturers. Screen printing, while more expensive, is utilized for high-quality, detailed prints that require more precision. Digital printing is emerging in the market, offering flexibility and quick turnaround times for customized, low-volume orders. The increasing trend for personalized packaging is likely to boost the demand for digital printing in the coming years.

- For example, Scapa’s 2702 PVC Premium Electrical Adhesive Tape, with a thickness of 0.13 mm and aggressive rubber-based adhesive, is designed for robust electrical insulation and harnessing applications and is approved to international standards, demonstrating high performance in electrical and industrial contexts.

By Material

The material segment of the Poly Vinyl Chloride Packaging Tape Printing Market is mainly classified into standard PVC, high-performance PVC, and eco-friendly PVC. Standard PVC remains the most widely used due to its cost-effectiveness and broad applicability. High-performance PVC is gaining ground, especially in industries requiring durable and resistant packaging materials. Eco-friendly PVC, produced using recyclable materials, is increasingly being adopted in response to growing environmental concerns and sustainability demands.

Segmentations:

By Product

- Printed PVC Tapes

- Non-Printed PVC Tapes

By Mechanism

- Flexographic Printing

- Screen Printing

- Digital Printing

By Material

- Standard PVC

- High-Performance PVC

- Eco-Friendly PVC

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America’s Leading Role in the Market

North America holds a significant share in the Poly Vinyl Chloride (PVC) Packaging Tape Printing Market, contributing 30% of the global market revenue. The region’s growth is driven by a strong demand for high-quality, customizable packaging solutions across industries such as retail, e-commerce, and food packaging. As consumers increasingly prefer branded and eco-friendly packaging, manufacturers are adopting advanced printing technologies. The market in the U.S. is particularly robust, bolstered by a highly developed packaging industry and a focus on innovation. Canada also sees steady demand, especially for sustainable and high-performance PVC tapes. The region’s strong infrastructure and emphasis on sustainability further contribute to market expansion.

Europe’s Expanding Market Demand

Europe accounts for 25% of the global market share in PVC packaging tape printing. The region’s market growth is fueled by stringent environmental regulations that encourage the use of sustainable packaging materials. Countries like Germany, France, and the U.K. are at the forefront of adopting eco-friendly PVC tapes, driven by both regulatory pressure and consumer demand for environmentally responsible solutions. Europe also sees high demand for customized packaging, particularly in the food and beverage industry, where brand differentiation is crucial. The growing emphasis on recycling and circular economy principles supports the shift towards recyclable PVC tapes, further promoting market growth.

Asia-Pacific’s Rapid Growth Potential

Asia-Pacific is the fastest-growing region in the Poly Vinyl Chloride Packaging Tape Printing Market, holding a 35% market share. This growth is attributed to rapid industrialization, an expanding e-commerce sector, and increased demand for cost-effective and reliable packaging solutions. Countries like China and India are seeing a rise in manufacturing activities, which drives the demand for durable and customized PVC tapes. The region is also witnessing increased interest in eco-friendly packaging due to rising environmental awareness. As these economies continue to grow, the market for PVC packaging tapes is expected to expand significantly, driven by both local and export demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- The 3M Company

- Windmill Tapes

- Bron Tapes, Inc.

- Le Mark Group Ltd

- Easitape

- Shurtape Technologies, LLC

- The BoxMaker

- Packit Packaging Solutions

- Uline

- FLEXcon Company, Inc.

- Cenveo Corporation

Competitive Analysis:

The competitive landscape of the Poly Vinyl Chloride Packaging Tape Printing Market features strong global and regional players that drive innovation and market reach. The key companies include The 3M Company, Windmill Tapes, Bron Tapes, Inc., Le Mark Group Ltd, Easitape, and Shurtape Technologies, LLC. 3M leads the market with strong brand equity and extensive distribution, especially in printed PVC tapes and custom branding solutions. Windmill Tapes and Bron Tapes focus primarily on regional markets, offering flexible manufacturing and quick turnaround times for printed tape orders. Le Mark Group and Easitape concentrate on niche sectors including premium and specialty printed tapes, carving out distinct segments within the broader market. Shurtape Technologies offers durable and high‑performance printed PVC tapes, targeting industries requiring robust sealing and visibility under challenging conditions. It remains imperative for companies to invest in new printing technologies, expand into emerging markets, and adopt sustainable materials to retain competitive advantage. Firms that develop cost‑effective, eco‑friendly printed PVC tapes can capture rising demand from e‑commerce, logistics, and retail sectors. Strategic partnerships and broader geographical presence will further strengthen their positions in this growing market.

Recent Developments:

- In October 2024, Windmill launched the Windmill Air Purifier, featuring advanced purification technology and three color options, while also announcing the closing of a $5 million Series A funding round to support the expansion of its smart product portfolio.

- In May 2025, 3M introduced the ScotchBlue ProSharp Painter’s Tape, cited as a key innovation that contributed to its strong performance in the third quarter of 2025.

Report Coverage:

The research report offers an in-depth analysis based on Product, Mechanism, Material and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The demand for sustainable and eco-friendly PVC tapes is expected to rise as businesses focus more on environmental responsibility.

- Technological advancements in printing techniques, such as digital and UV printing, will lead to enhanced customization and faster production times.

- The growing e-commerce sector will continue to drive demand for reliable, branded, and secure packaging solutions.

- Innovations in adhesive formulations and eco-friendly materials will open up new market opportunities for manufacturers.

- The increasing importance of branding and consumer engagement through packaging will boost the adoption of printed PVC tapes.

- The market will see a shift towards more durable and high-performance PVC tapes, catering to industries requiring enhanced security and visibility.

- Global expansion, particularly in emerging markets such as Asia-Pacific and Latin America, will offer significant growth opportunities.

- Stricter environmental regulations will prompt manufacturers to invest in recyclable and biodegradable PVC packaging solutions.

- Companies will focus on product differentiation by offering custom-designed PVC tapes with unique visual appeal for various industries.

- Strategic collaborations and partnerships between manufacturers and packaging companies will strengthen market presence and drive innovation in the coming years.