Market Overview

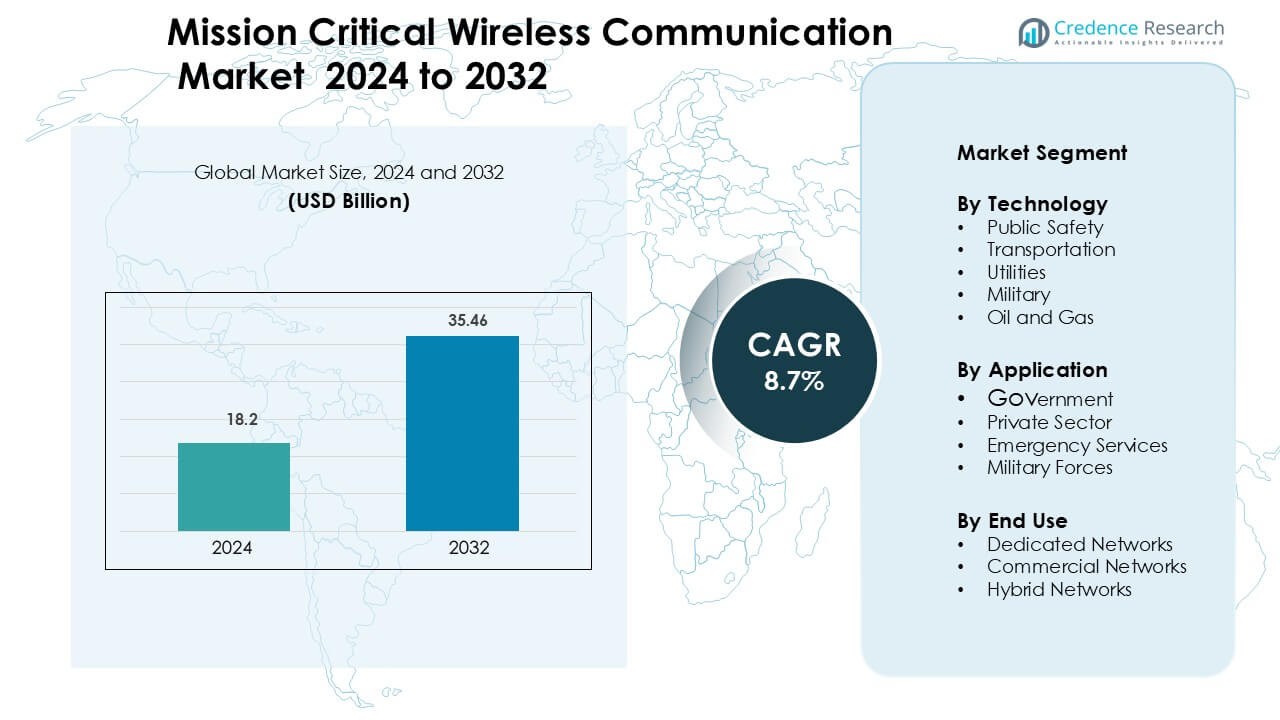

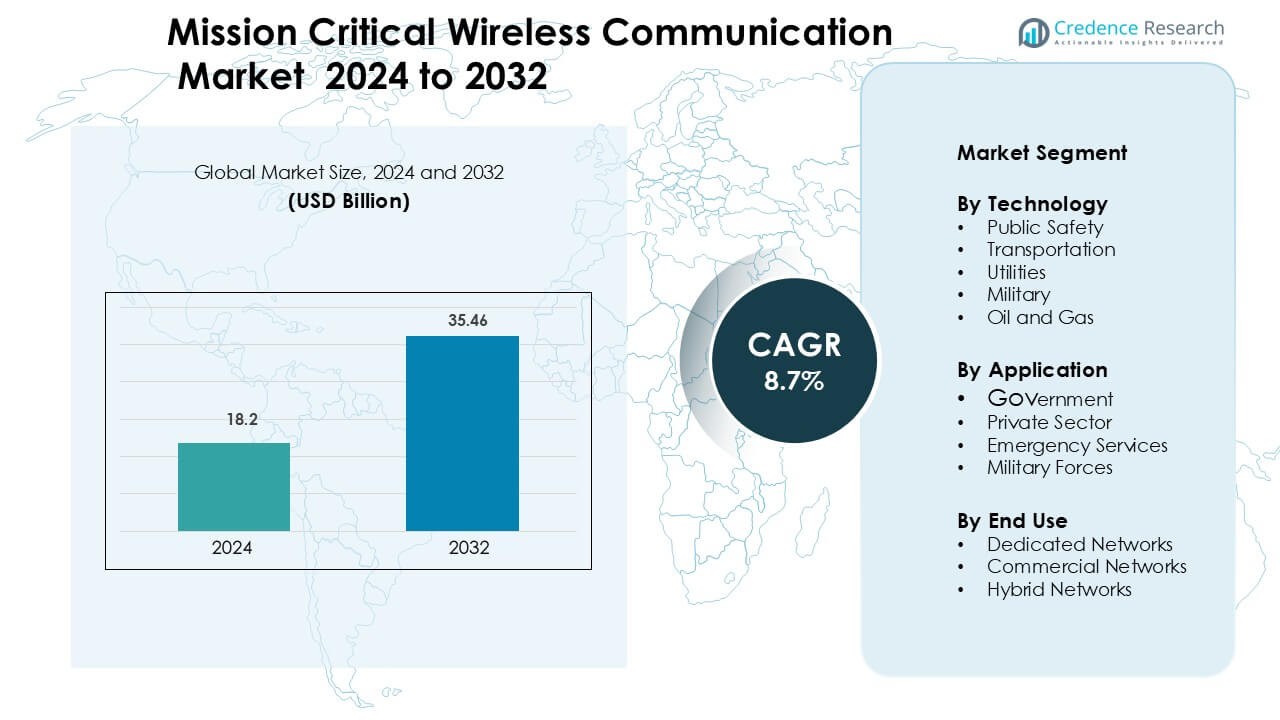

Mission Critical Wireless Communication Market was valued at USD 18.2 billion in 2024 and is anticipated to reach USD 35.46 billion by 2032, growing at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mission Critical Wireless Communication Market Size 2024 |

USD 18.2 Billion |

| Mission Critical Wireless Communication Market, CAGR |

8.7% |

| Mission Critical Wireless Communication Market Size 2032 |

USD 35.46 Billion |

The mission critical wireless communication market is shaped by major players such as Motorola Solutions, Nokia, Ericsson, Huawei, Hytera, Samsung Electronics, Airbus, Sepura, AT&T, and Verizon. These companies compete by offering secure broadband networks, TETRA and P25 radio systems, mission-critical push-to-talk services, and integrated command platforms for public safety, utilities, and transportation. North America remains the leading region with 34% market share, supported by strong public safety investments, nationwide LTE programs, and advanced 5G rollouts. Partnerships between equipment vendors and telecom carriers continue to strengthen multi-agency communication, improve response capabilities, and expand long-term network modernization across government and industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 18.2 billion in 2024 and is projected to grow at a CAGR of 8.7% through 2032, supported by rising public safety and industrial communication demand.

- Growing modernization of emergency networks, digital command platforms, and secure broadband systems drives adoption across police, firefighting, disaster response, utilities, and transportation agencies worldwide.

- Key trends include migration from narrowband to LTE and 5G, integration of IoT sensors, AI analytics, and hybrid networks combining dedicated infrastructure with commercial carriers for wider coverage.

- Competition involves Motorola Solutions, Nokia, Ericsson, Huawei, Hytera, AT&T, and Verizon, offering encrypted devices, push-to-talk platforms, and rugged infrastructure; pricing pressure and high deployment cost remain restraints.

- Regionally, North America leads with 34% share, followed by Europe at 28% and Asia Pacific at 29%; by technology, public safety holds 37% share, driven by nationwide broadband and secure communication upgrades.

Market Segmentation Analysis:

By Technology

Public safety systems form the dominant technology segment, holding 37% of the market share due to rising investments in secure broadband, push-to-talk systems, and LTE-based mission-critical solutions. Police, fire, and disaster management agencies depend on low-latency links and encrypted voice and data to support field coordination. Transportation and utilities follow, driven by connected railways, smart grid automation, and pipeline monitoring. Oil and gas and military users also expand adoption to secure remote operations. Growing digital command centers and nationwide emergency networks continue to push demand for high-reliability public safety communication.

- For instance, Ericsson developed a deployable temporary cellular network weighing 150 grams mounted on a drone to provide mission-critical voice and video connectivity in areas with minimal network coverage.

By Application

Government applications lead the market with a 40% share, supported by large public safety modernization programs and secure communication mandates across national and regional agencies. The segment benefits from critical infrastructure monitoring, disaster response, and real-time situational awareness platforms. Emergency services remain the fastest-growing adopter as ambulance, police, and fire units shift from analog to broadband-enabled devices. Private sector deployments in industrial automation, airports, mining, and energy facilities also strengthen adoption. Military forces maintain consistent demand for encrypted radio and battlefield coordination technologies.

- For instance, Thales’ network-encryptor solutions were selected by a U.S county sheriff’s office to protect voice, video, and data streams from over 500 IoT and edge-devices in their facility and infrastructure-monitoring operations.

By End Use

Dedicated networks dominate with a 45% market share, supported by guaranteed bandwidth, advanced encryption, and uninterrupted coverage required in life-saving and defense-grade operations. Governments and utility providers rely on purpose-built LTE, TETRA, and P25 systems to manage emergency response, grid stability, and national security. Hybrid networks are rising as agencies combine commercial 4G/5G with private infrastructure to reduce deployment time and cost. Commercial networks remain smaller but gain traction in enterprise fleets, logistics, and private industrial clusters seeking reliable communication without full dedicated system investment.

Key Growth Drivers

Public Safety Modernization and Digital Command Systems

Modernization of public safety networks is a major driver for mission-critical wireless communication. Governments are upgrading legacy analog radio systems to secure broadband standards that support real-time voice, video, and data transmission. Disaster management units, law enforcement, and firefighting teams need reliable coverage in dense urban zones and remote terrains. Digital command systems also require encrypted channels, geolocation tracking, facial recognition feeds, and drone-based surveillance. These functions depend on low-latency and high-availability connectivity, which traditional systems cannot deliver. As national safety programs expand, procurement of LTE, 5G, and TETRA infrastructure accelerates, boosting long-term market growth.

- For instance, Airbus Critical Communications highlights TETRA’s continued role for many governments, offering scalable, hardened trunked radio systems used by long-standing national networks and professional mobile radio operators, and positioning TETRA as an interoperable complement to broadband public-safety rollouts.

Industrial Automation and Critical Infrastructure Expansion

Utilities, oil and gas, and transportation sectors increasingly adopt mission-critical communication to secure field operations and asset monitoring. Smart grids use wireless systems for outage management, substation control, and real-time load balancing. Oil and gas operators rely on rugged connectivity for pipeline surveillance, refinery communication, and worker safety in hazardous sites. Railways and airports deploy mission-critical solutions to manage signaling, traffic control, and emergency response. Digital twins and IoT sensors further drive wireless demand by sending telemetry data from assets directly into control centers. As countries invest in energy transition, smart grids, and transport upgrades, industrial adoption continues to climb.

- For instance, Hitachi Energy’s XMC20 multiservice communication system supports data link recovery times under 50 milliseconds and is certified for 25 C to 60 C operation in railway environments.

Integration of Broadband, IoT, and AI Analytics

The shift from narrowband voice-only radios to broadband multi-service systems is accelerating adoption. LTE and 5G networks enable video streaming, biometric authentication, predictive maintenance, and AI-driven decision systems for mission-critical users. IoT sensors feed live data to command centers, supporting faster threat detection and automated alerts for infrastructure failures. AI analytics improve operational planning and reduce response times during emergencies. Connected ambulances, augmented reality tools for firefighters, drone monitoring, and smart body-worn devices all rely on mission-critical wireless platforms. As digital transformation deepens across public safety and industry, demand for intelligent communication systems grows sharply.

Key Trends & Opportunities

Hybrid Networks and Shared Infrastructure Deployment

Agencies and enterprises are increasingly shifting toward hybrid communication networks that combine dedicated private systems with commercial LTE or 5G. This model reduces deployment time and capital cost while maintaining high reliability. Shared infrastructure allows public safety teams to operate broadband services alongside commercial carriers without losing coverage or security. Governments also encourage network sharing to optimize spectrum and accelerate nationwide rollouts. As 5G coverage expands and private spectrum availability improves, hybrid deployments are expected to reshape mission-critical communication strategies across regions.

- For instance, the Indian firm PEL India offers hybrid private LTE with commercial network connectivity supporting up to 10,000 users in both static and mobile field conditions.

AI-Enabled Situational Awareness and Smart Devices

Mission-critical communication is evolving to include AI-driven analytics and sensor-rich devices that enhance decision-making in real time. Smart helmets, wearable cameras, biometric monitors, and drone feeds provide instant field intelligence to command centers. AI platforms analyze data to detect threats, manage traffic, and coordinate multi-agency emergency response. These advancements create new revenue streams for device manufacturers and software vendors. The rise of smart cities and autonomous infrastructure further strengthens the opportunity, as municipalities require integrated communication to manage safety, mobility, and disaster resilience.

- For instance, the device 4G smart helmets with AR glasses exist and are used in industrial inspections for remote guidance and real-time streaming (often 1080p resolution).

Key Challenges

Interoperability and Legacy System Constraints

Many agencies still operate aging radio networks that are incompatible with next-generation broadband technologies. Lack of interoperability between TETRA, P25, LTE, and vendor-specific systems restricts seamless communication during joint operations. Upgrading nationwide systems requires high investment, time-consuming integration, and policy alignment across multiple jurisdictions. Without unified standards and training, responders face communication gaps during emergencies, impacting operational effectiveness. Vendor lock-in and fragmented procurement also slow modernization efforts.

High Deployment Cost and Spectrum Regulations

Mission-critical networks require dedicated infrastructure, rugged equipment, and secure spectrum allocations, all of which drive cost. Developing regions struggle with funding large-scale upgrades, leading to slower adoption outside major cities. Spectrum licensing adds regulatory complexity, especially where commercial operators already dominate allocation. Private networks demand additional investment in cybersecurity and redundancy to ensure zero downtime. These financial and regulatory barriers limit market penetration, particularly for smaller agencies and private industrial users.

Regional Analysis

North America

North America holds 34% of the market share, driven by strong public safety investments, rapid 5G rollout, and early adoption of LTE-based mission-critical systems. The United States leads deployments across law enforcement, firefighting, and EMS agencies, supported by federal funding and nationwide interoperability programs. Utilities and oil and gas companies rely on secure networks for pipeline and grid monitoring. Canada follows with upgrades to emergency response and transportation communication. Strong vendor presence and high cybersecurity standards continue to support expansion across both government and industrial sectors.

Europe

Europe accounts for 28% of total share, supported by smart city initiatives, cross-border emergency coordination, and modernization of TETRA systems. Countries such as Germany, France, and the U.K. are transitioning to broadband-enabled platforms for public safety and transportation management. Rail and aviation operators use mission-critical networks for signaling, traffic control, and predictive maintenance. Strict security regulations and spectrum policies support system reliability and data protection. Increasing adoption in utilities, manufacturing plants, and defense applications sustains market momentum across the region.

Asia Pacific

Asia Pacific leads growth velocity and holds 29% of the market share, supported by large-scale infrastructure expansion, rapid urbanization, and government-funded emergency communication projects. China, Japan, India, and South Korea invest heavily in 4G and 5G mission-critical systems for smart grids, railways, airports, and industrial zones. Public safety reforms drive demand for encrypted broadband devices and command centers. The expanding oil, gas, and mining industries also rely on rugged wireless networks for worker safety and asset monitoring. Growing population density increases need for reliable disaster response and real-time communication.

Latin America

Latin America captures 5% of the market, but adoption continues to rise as governments strengthen national security and disaster response frameworks. Brazil, Mexico, and Chile are upgrading public safety radio systems and adopting broadband connectivity for police, border control, and emergency teams. Mining and energy sectors also fuel demand for reliable mission-critical communication in remote terrains. Budget constraints and uneven rural connectivity limit rapid deployment, yet public-private partnerships are improving infrastructure availability. Growing smart city projects and transportation upgrades create new development pathways.

Middle East & Africa

The Middle East & Africa region holds 4% of the market share, driven by investments in national security, oil and gas operations, and critical infrastructure protection. Gulf countries deploy advanced LTE-based networks for border security, smart airports, and industrial monitoring. In Africa, adoption is increasing through electrification programs, utility modernization, and emergency communication upgrades. Limited funding and spectrum challenges remain barriers in several countries, but international partnerships and modernization mandates are gradually expanding regional deployment of mission-critical wireless systems.

Market Segmentations:

By Technology

- Public Safety

- Transportation

- Utilities

- Military

- Oil and Gas

By Application

- Government

- Private Sector

- Emergency Services

- Military Forces

By End Use

- Dedicated Networks

- Commercial Networks

- Hybrid Networks

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the mission critical wireless communication market features global telecom vendors, specialized radio manufacturers, and network service providers competing on reliability, security, and interoperability. Companies such as Motorola Solutions, Nokia, Ericsson, Huawei, and Hytera offer end-to-end portfolios that include mission-critical push-to-talk, encrypted broadband devices, TETRA and P25 radios, and LTE/5G infrastructure. Network operators like Verizon and AT&T support nationwide public safety upgrades with dedicated priority and pre-emption services. Defense-focused suppliers such as Airbus and Sepura cater to high-security environments with rugged terminals and secure command systems. Competition centers on low-latency performance, multi-agency interoperability, cybersecurity, and integration with AI and IoT. Vendors pursue contracts with public safety agencies, utilities, transport networks, and energy operators, while partnerships with governments and carriers strengthen long-term deployment. Frequent product upgrades, software integration, and public-private collaborations continue to shape competitive positioning in this market

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Motorola Solutions completed the $4.4B acquisition of Silvus Technologies. Adds MANET mesh networking for contested environments. Strengthens mission-critical broadband and unmanned systems.

- In June 2025, Huawei showcased 5G-A advances at MWC Shanghai. Focused on scenario-based services with AI agents. Relevant to mission-critical broadband evolution.

- In February 2025, Sepura participated in ETSI’s 9th MCX Plugtests. Interoperability testing covered MCPTT/MCData/MCVideo. Event ran 24–28 February at Texas A&M.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Public safety agencies will continue shifting from legacy radio to broadband-based mission-critical platforms.

- 5G adoption will expand low-latency communication for real-time video, drone feeds, and data analytics.

- Hybrid networks using both dedicated and commercial infrastructure will gain wider acceptance.

- IoT sensors and AI will enhance predictive alerts, situational awareness, and automated emergency response.

- Smart city projects will drive demand for interconnected security, traffic control, and disaster management.

- Utilities and energy operators will adopt mission-critical wireless systems for smart grid monitoring and automation.

- Transportation networks will use secure wireless communication for rail signaling, air traffic control, and fleet coordination.

- Rugged wearable devices and smart equipment will support frontline workers with live data and location tracking.

- Cloud-based command platforms will enhance multi-agency coordination and data interoperability.

- Vendors will increase collaboration with governments and telecom carriers to expand nationwide emergency communication networks.