Market Overview

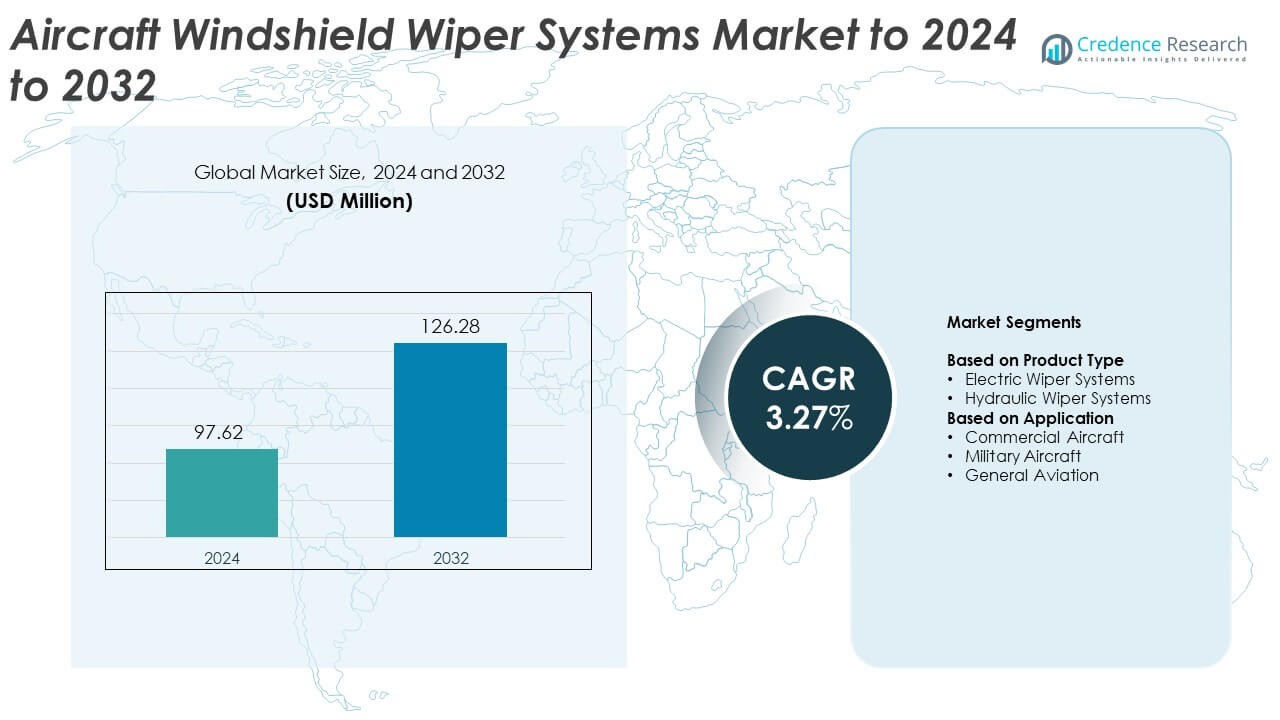

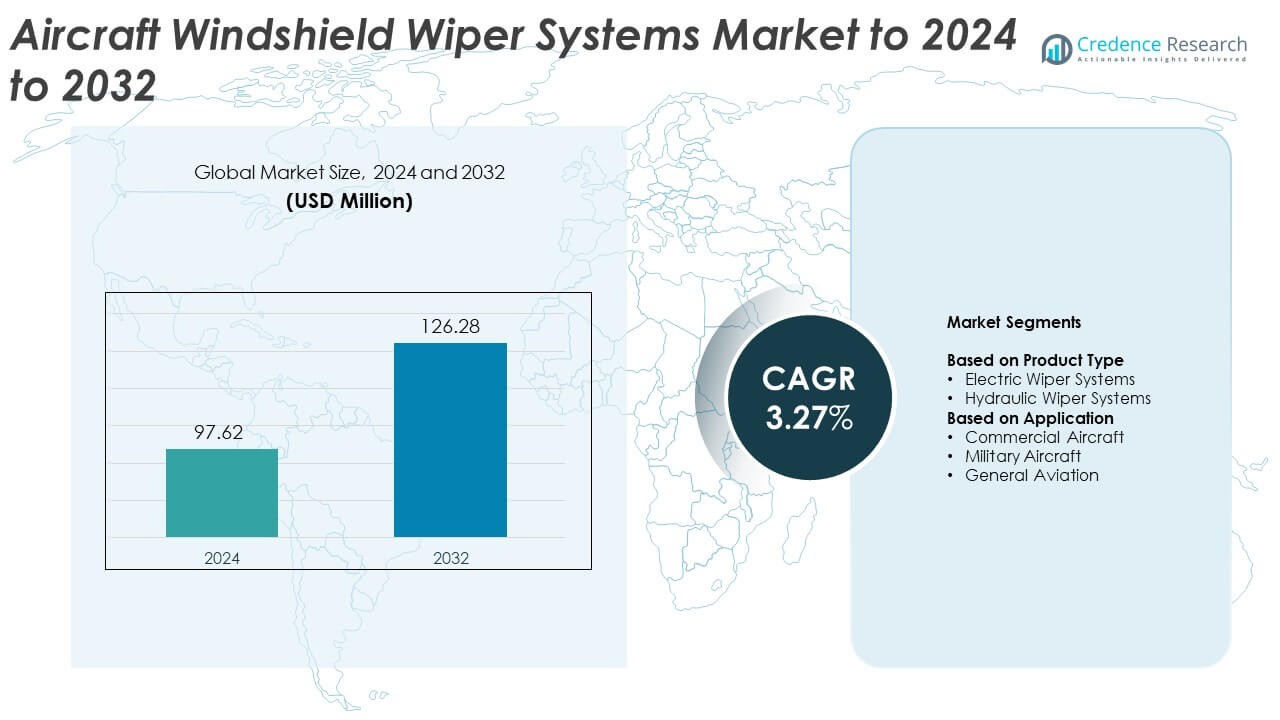

Aircraft Windshield Wiper Systems Market size was valued at USD 97.62 Million in 2024 and is anticipated to reach USD 126.28 Million by 2032, at a CAGR of 3.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aircraft Windshield Wiper Systems Market Size 2024 |

USD 97.62 Million |

| Aircraft Windshield Wiper Systems Market , CAGR |

3.27% |

| Aircraft Windshield Wiper Systems Market Size 2032 |

USD 126.28 Million |

The Aircraft Windshield Wiper Systems Market is shaped by several major aerospace system suppliers that compete through advanced cockpit-safety technologies and long-term OEM partnerships. These companies focus on electric wiper designs, lightweight materials, and improved weather-resistant components to meet global fleet modernization needs. North America leads the market with about 38% share in 2024, supported by strong commercial aviation activity, large military procurement programs, and a well-established MRO ecosystem. Europe follows with nearly 27% share, driven by robust aircraft manufacturing and rising upgrades across regional fleets. Asia-Pacific remains a fast-growing region with about 24% share due to rapid expansion in commercial and general aviation fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Aircraft Windshield Wiper Systems Market was valued at USD 97.62 Million in 2024 and is projected to reach USD 126.28 Million by 2032, growing at a CAGR of 3.27%.

- Rising demand for commercial aircraft boosts adoption of electric wiper systems, which hold about 63% segment share due to lower maintenance needs and better reliability.

- Lightweight designs and smart-control features shape market trends as manufacturers focus on efficiency, automated activation, and improved cockpit integration.

- Competition grows as companies strengthen OEM contracts, expand aftermarket services, and develop durable systems that reduce operational downtime across aviation fleets.

- North America leads with 38% share, followed by Europe at 27% and Asia-Pacific at 24%, while commercial aircraft dominate applications with about 58% share in 2024.

Market Segmentation Analysis:

By Product Type

Electric wiper systems lead this segment with about 63% share in 2024 due to strong use in commercial and regional aircraft fleets. Airlines prefer electric designs because they offer smoother motion control, lower maintenance needs, and better reliability in harsh weather. The shift toward lightweight, power-efficient components also supports wider adoption as manufacturers modernize cockpit systems. Hydraulic wiper systems maintain steady use in older or heavy-duty aircraft platforms, but growth remains slower as operators continue transitioning to electric alternatives for improved long-term performance.

- For instance, the European Patent Register shows that a patent with the application number EP2683580 was filed by Falgayras SAS for a ‘motor-driven windshield wiper device

By Application

Commercial aircraft dominate this segment with nearly 58% share in 2024, driven by large fleet sizes, higher flight frequency, and strict visibility-safety requirements. Aircraft wiper systems play a key role in maintaining clear windshields during rain, snow, and ground operations, making them essential for global airline operations. Military aircraft show steady demand due to mission-critical reliability needs, while general aviation records moderate growth as private operators upgrade cockpit systems in newer light aircraft models.

- For instance, Collins Aerospace provides windshield wiper/wash systems for many commercial aircraft including the Boeing 737 and various Embraer and helicopter models.

Key Growth Drivers

Rising Commercial Aircraft Deliveries

Growing deliveries of commercial aircraft act as a major driver for the Aircraft Windshield Wiper Systems Market as airlines expand fleets to meet higher passenger demand. New narrow-body and wide-body platforms require advanced wiper systems that support visibility under rain, snow, and high-altitude moisture conditions. Manufacturers integrate lightweight and energy-efficient designs, which increases replacement and OEM demand. Fleet modernization programs further strengthen market growth as carriers retire aging aircraft and adopt next-generation models with improved cockpit safety components.

- For instance, Airbus reported deliveries of 766 commercial aircraft in 2024, and this production volume directly drives demand for cockpit hardware such as windshield wiper systems on each new narrow-body and wide-body jet it hands over to airlines.

Expansion of Military Aviation Programs

Military fleet upgrades support strong demand for windshield wiper systems as defense authorities prioritize platform readiness in harsh weather. Modern combat and surveillance aircraft require durable systems that maintain clear visibility during complex missions, low-altitude operations, and adverse climate exposure. Ongoing procurement of multirole fighters, transport aircraft, and training jets further expands installation needs. The market benefits from sustainability of long-term military contracts and mid-life upgrades that include cockpit component modernization.

- For instance, Laversab’s windshield wiper and wash system developed for LCH, LUH and ALH helicopters offers two wiping speeds, a nominal wiper angle of 35 degrees and safe operation at airspeeds up to 285 kilometres per hour, matching the harsh-weather mission needs of modern military rotorcraft.

Growth in General Aviation and Business Jets

The rise of general aviation and business jet operations fuels demand for high-performance wiper systems designed for smaller aircraft. Increasing flight activity from charter operators, fractional ownership programs, and private travel boosts the need for reliable cockpit visibility solutions. Manufacturers provide compact, low-maintenance electric wipers tailored to lightweight platforms. Growing adoption of premium avionics packages accelerates system replacement cycles, strengthening aftermarket revenue and ensuring sustained demand across global general aviation fleets.

Key Trends & Opportunities

Shift Toward Lightweight and Energy-Efficient Systems

Lightweight wiper system designs create a major market opportunity as aircraft manufacturers seek components that reduce power consumption and improve fuel efficiency. Advances in motor technology, composite arms, and optimized aerodynamic structures support lower drag and smoother operation. This trend aligns with broader aviation goals for sustainable performance, enabling suppliers to deliver upgraded systems that meet strict efficiency requirements. Increased focus on cabin and cockpit modernization further encourages adoption of these optimized components.

- For instance, Safran Helicopter Engines announced in June 2023 a program to develop a 600 kilowatt electric turbogenerator for a nine-passenger hybrid-electric short-take-off aircraft prototype, highlighting how major equipment suppliers are redesigning power and accessory systems to cut fuel use and enable lighter, more efficient onboard equipment.

Integration of Smart Control and Automated Features

The growing integration of automated sensing and smart-control capabilities represents a key market trend. Modern wiper systems feature variable-speed operation, automatic activation during precipitation, and improved synchronization with cockpit electronics. These advancements increase pilot visibility and reduce manual workload, supporting safer flight operations. Rising demand for digitally integrated components in both commercial and defense platforms enables suppliers to expand product offerings with enhanced diagnostics and predictive maintenance options.

- For instance, European patent application EP 3 900 987 A1 was published on October 27, 2021, for a “SMART WIPER SYSTEM”.

Emergence of All-Electric Aircraft Platforms

The shift toward all-electric and hybrid-electric aircraft creates new opportunities for electric-driven wiper systems that match low-emission aviation goals. As urban air mobility vehicles and light electric aircraft advance toward commercial use, manufacturers seek compact wipers compatible with simplified electrical architectures. This emerging segment encourages design innovation and long-term product development, supporting future growth across next-generation aviation technologies.

Key Challenges

Stringent Certification and Regulatory Compliance

Strict aviation certification requirements remain a major challenge for windshield wiper system manufacturers. Every component must meet rigorous performance standards for safety, vibration tolerance, and extreme-weather reliability. Long approval cycles increase development costs and slow product launches, particularly for new electric or automation-enabled designs. Small suppliers face added pressure due to high testing expenses and documentation demands, limiting entry into large commercial aviation programs.

High Installation and Maintenance Costs

High installation and lifecycle maintenance costs challenge broader adoption, especially among smaller operators and aging aircraft fleets. Wiper systems must endure heavy operational loads, frequent exposure to rain and debris, and mechanical stress during flight and taxi operations. These factors drive the need for periodic replacement and component overhauls, raising operational expenditure. Limited availability of standardized parts also increases procurement complexity, impacting overall cost-efficiency for operators.

Regional Analysis

North America

North America holds about 38% share in 2024, driven by a large commercial aircraft fleet, high replacement cycles, and strong presence of OEMs and Tier-1 suppliers. The region benefits from steady demand from major airlines upgrading cockpit components to improve operational safety. Growth is also supported by rising procurement of military aircraft with advanced visibility systems designed for all-weather missions. Strong regulatory standards, well-developed MRO networks, and continuous fleet modernization help maintain North America’s lead in the global market.

Europe

Europe accounts for nearly 27% share in 2024, supported by major aircraft manufacturers and robust aviation infrastructure. The region’s demand is strengthened by high adoption of electric wiper systems in commercial and regional aircraft fleets. Rising focus on improving cockpit safety and integrating lightweight components also drives procurement across countries with mature aerospace industries. Ongoing defense modernization and an active aftermarket ecosystem contribute to steady demand, while strict certification requirements influence product development cycles in the market.

Asia-Pacific

Asia-Pacific holds around 24% share in 2024, influenced by rising commercial air traffic and expanding airline fleets across China, India, Japan, and Southeast Asia. Rapid aircraft deliveries and increasing investments in regional aviation boost demand for advanced wiper systems. Growing interest in general aviation and rapid expansion of MRO capabilities strengthen market activity. The region’s shift toward fleet modernization and new aircraft procurement supports ongoing adoption of energy-efficient and reliable cockpit visibility solutions across multiple aviation segments.

Latin America

Latin America represents about 6% share in 2024, driven by ongoing recovery in regional airline operations and gradual expansion of commercial fleets. Replacement demand rises as operators upgrade older aircraft to meet improved safety and reliability requirements. Economic constraints slow large-scale procurement, but steady growth in domestic travel supports continued use of windshield wiper systems. Emerging general aviation activity and modest military modernization contribute additional demand across select markets in the region.

Middle East & Africa

Middle East & Africa account for nearly 5% share in 2024, supported by strong investment in commercial fleets by Gulf carriers and increasing procurement of military aircraft. High exposure to sand, dust, and harsh weather drives demand for durable and high-performance wiper systems. Expanding airport infrastructure and growing long-haul operations encourage consistent maintenance and replacement cycles. Limited local manufacturing and reliance on imported components pose challenges, but steady growth in airline activity sustains system demand across the region.

Market Segmentations:

By Product Type

- Electric Wiper Systems

- Hydraulic Wiper Systems

By Application

- Commercial Aircraft

- Military Aircraft

- General Aviation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Aircraft Windshield Wiper Systems Market features leading companies such as Safran S.A., Magellan Aerospace Corporation, Crane Aerospace & Electronics, GKN Aerospace, Triumph Group, Inc., Rockwell Collins, Inc., JAMCO Corporation, Parker Hannifin Corporation, L3Harris, and UTC Aerospace Systems. The competitive landscape is shaped by strong OEM partnerships, long-term supply agreements, and continuous innovation in electric and lightweight wiper technologies. Manufacturers focus on enhancing reliability, reducing power consumption, and improving system durability to meet strict aviation safety standards. Collaboration with aircraft producers helps secure consistent demand across commercial, military, and general aviation platforms. Companies invest in advanced motor designs, automated control features, and materials that support harsh-weather performance. Growing emphasis on cockpit modernization and fleet upgrades strengthens aftermarket revenue, while expanding MRO networks ensure sustained replacement cycles. Overall, competition remains defined by technological capabilities, global service reach, and compliance with rigorous certification requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, L3Harris completed the sale of its own Commercial Aviation Solutions (CAS) business to an affiliate of the private equity firm TJC L.P.

- In June 2025, Triumph Group’s Cable Control Systems Division in Germany was awarded a contract to design, manufacture, and support the Gust Lock system for Deutsche Aircraft’s D328eco regional turboprop, highlighting their expanding role in advanced aircraft systems.

- In January 2022, Safran was contracted to supply various flight control systems including windshield wiper systems for the Airbus H160M helicopter project for the French armed forces.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as global commercial fleets expand over the forecast period.

- Electric wiper systems will gain wider adoption due to lower maintenance needs.

- Airlines will replace older hydraulic systems with lighter and more efficient designs.

- Military aviation upgrades will boost demand for durable, weather-resistant wiper systems.

- General aviation growth will support increased installation of compact electric wipers.

- Smart-control features will become more common to enhance cockpit automation.

- Digital diagnostics will help operators reduce downtime and improve maintenance planning.

- Suppliers will focus on lightweight materials to support fuel-efficiency goals.

- Rising aircraft deliveries in Asia-Pacific will create strong future opportunities.

- Aftermarket demand will remain stable as fleets age and visibility-safety standards tighten.