Market Overview

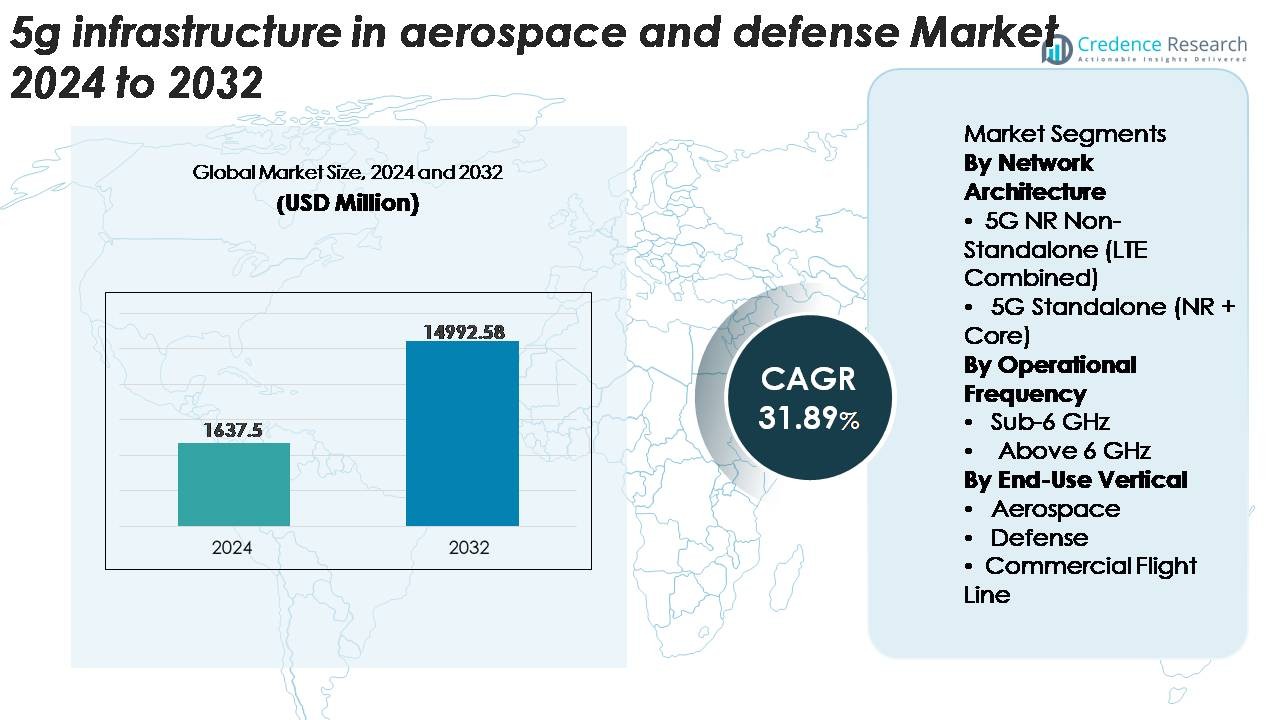

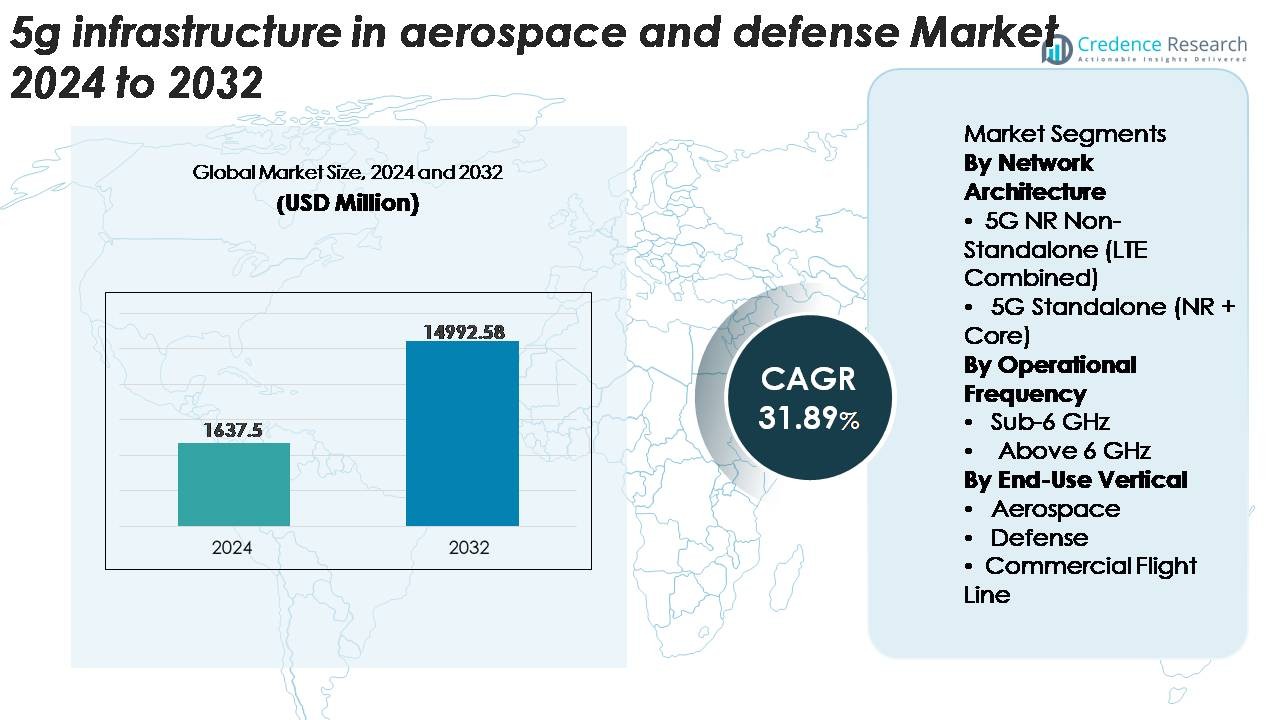

The 5G Infrastructure In Aerospace And Defense Market was valued at USD 1,637.5 million in 2024 and is anticipated to reach USD 14,992.58 million by 2032, expanding at a CAGR of 31.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 5G Infrastructure In Aerospace And Defense Market Size 2024 |

USD 1,637.5 Million |

| 5G Infrastructure In Aerospace And Defense Market, CAGR |

31.89% |

| 5G Infrastructure In Aerospace And Defense Market Size 2032 |

USD 14,992.58 Million |

The 5G infrastructure market in aerospace and defense is shaped by a competitive mix of telecom leaders, network specialists, and infrastructure providers, including Ericsson, Cisco Systems, AT&T, China Mobile, Airspan Networks, Affirmed Networks Inc, CommScope Inc, Comba Telecom, American Tower, and Ciena Corporation. These companies focus on secure, low-latency, and high-bandwidth solutions tailored for mission-critical aviation and defense environments, ranging from private 5G deployments to edge computing and advanced RAN technologies. North America leads the global market with approximately 38% share, supported by robust defense modernization programs and early adoption by aerospace OEMs, strengthening its position as the core hub for advanced 5G-enabled aerospace and defense infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The 5G infrastructure in aerospace and defense market was valued at USD 1,637.5 million in 2024 and is projected to reach USD 14,992.58 million by 2032, growing at a 31.89% CAGR.

- Strong demand for secure, low-latency mission-critical communication systems drives adoption, with increasing deployment of private 5G networks across defense bases, aerospace manufacturing hubs, and digital flight-line environments.

- Trends include rapid integration of edge computing, Massive MIMO, and network slicing, along with rising investments in autonomous systems, UAV connectivity, predictive maintenance, and high-capacity data offloading for connected aircraft.

- The market remains competitive, with key players such as Ericsson, Cisco, AT&T, China Mobile, and Airspan focusing on hardened 5G RAN, core network virtualization, and advanced cybersecurity; however, high deployment cost and complex infrastructure integration restrain growth.

- North America leads with ~38% share, followed by Europe at ~27% and Asia-Pacific at ~23%, while 5G NR Non-Standalone dominates network architecture and Sub-6 GHz holds the larger operational frequency share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Network Architecture

The 5G NR Non-Standalone (LTE Combined) segment currently holds the dominant market share, supported by its seamless integration with existing LTE infrastructure and lower deployment complexity. Aerospace and defense operators prioritize NSA architectures to accelerate early 5G rollout for secure communications, ground operations, and real-time telemetry without requiring full core replacement. Its ability to deliver enhanced mobile broadband and low-latency performance using established networks reduces capital expenditure while enabling mission-critical functions. Meanwhile, 5G Standalone (NR + Core) adoption is rising as organizations transition toward ultra-reliable, cloud-native architectures to support advanced autonomous and AI-enabled defense systems.

· For example, Nokia deployed a 5G SA private wireless network at the U.S. Marine Corps Logistics Base Albany as part of the DoD’s 5G smart-warehouse initiative. The system uses Nokia’s AirScale 5G SA Core to support automated vehicles, robotics, and real-time warehouse operations. The deployment demonstrates secure, high-bandwidth connectivity for advanced logistics automation.

By Operational Frequency

The Sub-6 GHz band accounts for the largest share of deployments due to its balanced coverage, penetration capability, and reliability across airfields, hangars, and defense bases. Its robustness in challenging environments makes it suitable for long-range communication, secure tactical operations, and uninterrupted connectivity for unmanned systems. Defense agencies favor Sub-6 GHz for encrypted command links and wide-area situational awareness. The Above 6 GHz (mmWave) segment is expanding as aerospace programs adopt high-capacity, low-latency connectivity for high-density data exchange, advanced cockpit systems, and real-time aircraft-to-infrastructure interfaces during critical flight line operations.

· For example, Lockheed Martin and Verizon have demonstrated 5G-enabled ISR data transfer for unmanned aircraft systems as part of joint defense connectivity trials. The tests used Verizon’s 5G mmWave spectrum, including the 28 GHz band, to support high-throughput data links. These demonstrations highlight the potential of 5G networks for rapid mission data exchange in defense applications.

By End-Use Vertical

The Defense segment leads the market with the highest share, driven by modernization programs emphasizing battlefield connectivity, secure mesh networks, and high-bandwidth communication for unmanned platforms. Militaries increasingly deploy 5G to enhance ISR workflows, edge analytics, and command-and-control operations across distributed environments. The Aerospace segment is also advancing as manufacturers integrate 5G for smart hangars, predictive maintenance, and real-time aircraft diagnostics. Commercial Flight Line operations adopt 5G for rapid data offloading, turnaround optimization, and digitalized ground workflows, accelerating operational efficiency and aircraft readiness.

Key Growth Drivers

Rising Demand for High-Bandwidth, Low-Latency Mission-Critical Communications

Aerospace and defense organizations increasingly require ultra-reliable, high-bandwidth, and low-latency communication systems to support next-generation operations. Activities such as real-time ISR data transfer, multi-domain situational awareness, drone swarming, and advanced early-warning systems depend on sub-10 ms latency and enhanced throughput capabilities that legacy communication networks cannot deliver. 5G infrastructure enables secure, rapid movement of high-volume sensor datasets between aircraft, satellites, and ground stations, improving decision cycles and operational precision. Defense modernization initiatives across the U.S., Europe, and Asia-Pacific further accelerate the shift toward 5G-enabled digital command structures, while aerospace manufacturers adopt 5G for predictive maintenance, automated workflows, and advanced avionics testing. This rising operational dependency on resilient connectivity continues to be a major growth catalyst.

- For instance, Airbus deployed an Nokia private 5G SA wireless network at its Hamburg manufacturing plant to support applications including automated guided vehicles (AGVs) and real-time quality control.

Expansion of Autonomous and Unmanned Platform Deployment

The surge in adoption of unmanned aerial vehicles (UAVs), unmanned combat platforms, autonomous ground systems, and robotics across defense and aerospace ecosystems is a significant driver of 5G infrastructure demand. Autonomous and semi-autonomous assets require continuous data exchange, real-time navigation updates, edge-processed intelligence, and secure command-and-control links that 4G or satellite communication architectures cannot fully support. 5G’s network slicing and ultra-reliable low-latency communication (URLLC) enable simultaneous, secure operation of numerous autonomous systems across contested environments. In aerospace manufacturing and flight-line operations, 5G also supports autonomous tugs, robotic inspection systems, and automated logistics movements. As militaries expand investment in autonomous force structures and aerospace OEMs accelerate smart factory transformations, the need for robust 5G backbone networks becomes fundamental to achieving full operational capability.

- For instance, Honda and Verizon are collaborating on research using 5G and mobile edge computing (MEC) to enhance safety for connected road vehicles.

Increasing Cybersecurity Requirements and Shift Toward Software-Defined Infrastructure

Escalating cyber threats targeting defense communication networks, aircraft systems, and flight-line digital ecosystems drive accelerated adoption of 5G infrastructure with embedded security features. 5G introduces enhanced encryption standards, multi-factor authentication, and AI-driven threat detection embedded at both network and edge layers. Defense agencies prioritize 5G systems that combine advanced cybersecurity with centralized orchestration through software-defined networking (SDN) and network function virtualization (NFV), ensuring flexible and dynamically reconfigurable architectures. This modernization reduces vulnerabilities associated with legacy hardware-bound systems and supports secure interlinking of command posts, aircraft systems, and logistics networks. As aerospace operations digitalize from digital twins to cloud-connected avionics stronger, adaptive, and software-defined 5G environments are increasingly regarded as strategic assets, driving substantial demand across global programs.

Key Trends & Opportunities

Growing Adoption of 5G-Enabled Edge Computing in Defense Operations

A leading market trend involves integrating mobile edge computing (MEC) with 5G networks to bring high-speed data processing closer to mission sites. By processing intelligence, surveillance, reconnaissance, and threat-detection data at the edge, defense agencies reduce latency and enhance real-time tactical decision-making. MEC-enabled 5G nodes can support forward-operating bases, naval vessels, and mobile command centers, enabling resilient operations even in bandwidth-constrained environments. This trend opens major opportunities for vendors offering ruggedized edge servers, AI-enabled processing units, and battlefield-grade 5G base stations. Aerospace applications also benefit through smart hangars, on-wing diagnostics, and augmented-reality maintenance systems powered directly from edge nodes, positioning MEC as a high-value growth area.

· For example, Boeing has tested 5G-enabled manufacturing and digital-twin workflows as part of its broader Industry 4.0 program, including AR-assisted inspection and connected factory systems. AT&T has publicly deployed 5G + MEC solutions in aerospace and industrial environments

Acceleration of Digital Flight-Line and Connected Aircraft Ecosystems

Aerospace organizations rapidly adopt 5G to transform flight-line operations, aircraft turnaround processes, and maintenance ecosystems. The trend toward fully connected aircraft where avionics, sensors, and health-monitoring systems automatically offload gigabytes of data upon landing creates strong opportunities for high-speed 5G networks at airports and MRO hubs. Real-time data transfer supports immediate diagnostics, predictive maintenance scheduling, and quicker readiness assessments. Airlines and defense operators also explore 5G-enabled AR/VR for training, digital twins for aircraft monitoring, and connected ground equipment for streamlined workflows. This shift toward digital flight-line ecosystems drives demand for small-cell deployments, private 5G networks, and high-throughput antenna architectures tailored to aviation environments.

- For example, Lufthansa Technik and Vodafone deployed a 5G campus network at the company’s Hamburg facility to support digital aircraft maintenance workflows. The network accelerates the wireless transfer of operational and sensor data during MRO processes, reducing the time needed to upload aircraft diagnostic files compared to older Wi-Fi systems. This setup forms part of Lufthansa Technik’s push toward fully digitalized hangar operations.

Key Challenges

High Deployment Costs and Complex Infrastructure Requirements

Implementing 5G in aerospace and defense environments remains capital-intensive due to the need for rugged infrastructure, spectrum licensing, specialized small cells, hardened base stations, and secure core network upgrades. Defense sites, airbases, and manufacturing facilities require extensive fiber backhaul and redundant nodes to achieve reliable coverage. Additionally, retrofitting existing communication systems with 5G capabilities demands specialized integration, compliance alignment, and testing against aerospace-grade safety standards. These complexities slow adoption, particularly for developing regions and smaller aerospace operators. High initial investment and long deployment cycles therefore represent a substantial barrier to widespread 5G rollout.

Security, Spectrum Management, and Operational Vulnerability Concerns

Despite offering enhanced security features, 5G introduces new vulnerabilities tied to virtualization layers, distributed architectures, and increased entry points across edge nodes and small-cell deployments. Defense agencies face challenges ensuring end-to-end encryption, zero-trust frameworks, and protection against cyber intrusions targeting network slicing, SDN controllers, or UAV command links. Additionally, securing dedicated spectrum bands for military and aerospace operations remains complex due to regulatory constraints and civilian–defense frequency overlaps. Ensuring uninterrupted operation in contested or hostile environments where jamming, spoofing, or EMP attacks may occur poses another significant challenge affecting mission-critical adoption.

Regional Analysis

North America

North America holds the largest market share of around 38%, driven by extensive defense modernization programs, strong private 5G deployments, and early adoption by aerospace OEMs. The U.S. Department of Defense actively invests in 5G testbeds, secure base communications, UAV mission networks, and advanced radar integration, strengthening regional infrastructure leadership. Major aerospace hubs in states such as Washington, Texas, and California use 5G to expand digital MRO operations and connected flight-line ecosystems. Canada’s investments in unmanned systems and airspace digitization further support growth, reinforcing North America’s dominance in advanced communication-enabled military and aerospace applications.

Europe

Europe accounts for approximately 27% of the global market, supported by strong adoption across defense agencies, airbases, and commercial aerospace manufacturing centers. Countries such as the U.K., Germany, and France deploy private 5G networks for secure mission systems, smart hangars, and flight-line automation. NATO-led initiatives focused on multi-domain communication interoperability also fuel investment. Additionally, major aerospace OEMs in France, Germany, and Spain integrate 5G into production automation and real-time aircraft health monitoring. Regulatory alignment around secure spectrum usage and increasing reliance on unmanned platforms strengthen Europe’s position as a leading adopter of 5G-enabled aerospace and defense infrastructure.

Asia-Pacific

Asia-Pacific captures around 23% of the market, driven by expanding military modernization programs, rapidly growing aerospace manufacturing capacity, and proactive 5G infrastructure deployment. China, Japan, South Korea, and India invest heavily in 5G-enabled command networks, tactical communication platforms, and unmanned aerial systems. Commercial aircraft production in China and rising MRO hubs in Southeast Asia integrate 5G to enhance predictive maintenance and turnaround operations. Regional airports accelerate digital transformation with small-cell deployments and high-capacity data offloading. Defense-driven demand for secure, resilient communication systems positions Asia-Pacific among the fastest-growing adopters of 5G in operational aviation environments.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% of global share, supported by increasing investment in aviation modernization, smart airport infrastructure, and strategic defense communication upgrades. Gulf countries including the UAE, Saudi Arabia, and Qatar lead adoption with private 5G networks deployed across major airbases and international airports to enhance surveillance, maintenance, and air-traffic data management. Defense programs focusing on UAV integration and border command networks further drive demand. Africa’s adoption remains gradual but improving, especially as nations invest in digital airspace management and defense communication resilience, increasing long-term opportunities for 5G-enabled aerospace systems.

Latin America

Latin America represents roughly 5% of the market, with growth driven by gradual upgrades across air traffic systems, commercial aviation operations, and selective military modernization projects. Brazil and Mexico lead regional adoption, deploying 5G technologies to improve airport operations, data-driven maintenance workflows, and secure communication systems for defense forces. Emerging UAV regulations and rising commercial air travel drive interest in 5G-enabled ground connectivity. However, budget constraints, slower infrastructure rollout, and limited defense digitization slow broader penetration. Despite these challenges, long-term demand for connected flight-line operations and modernized tactical networks positions Latin America as an emerging growth market.

Market Segmentations:

By Network Architecture

- 5G NR Non-Standalone (LTE Combined)

- 5G Standalone (NR + Core)

By Operational Frequency

By End-Use Vertical

- Aerospace

- Defense

- Commercial Flight Line

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the 5G infrastructure market in aerospace and defense is characterized by a concentrated group of global telecom vendors, defense contractors, and specialized technology integrators competing to deliver secure, high-performance networks. Leading companies focus on developing hardened 5G solutions with advanced encryption, network slicing, and low-latency capabilities tailored for mission-critical aviation and defense environments. Major players collaborate with defense agencies, aerospace OEMs, and airport operators to deploy private 5G networks, edge computing architectures, and high-bandwidth communication systems supporting UAV operations, predictive maintenance, and digital flight-line workflows. Strategic partnerships between telecom giants and defense system integrators accelerate innovation, while investments in spectrum optimization, ruggedized base stations, and interoperable core networks strengthen competitive positioning. Vendors also differentiate through AI-enabled cybersecurity, cloud-native 5G cores, and solutions designed for contested or high-interference environments. As nations expand modernization programs, competition intensifies around secure communication, autonomy enablement, and real-time data mobility across aerospace and defense ecosystems.

Key Player Analysis

Recent Developments

- In October 2025, Ericsson showcased 5G and AI-powered innovations at the India Mobile Congress, including secure, resilient connectivity use-cases and reinforcing infrastructure for next-gen defense and aerospace ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Network Architecture, Operational Frequency, End use vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Private 5G networks will expand across defense bases, airfields, and MRO hubs to support mission-critical and high-density data environments.

- Autonomous and unmanned platforms will increasingly rely on 5G-enabled low-latency command, navigation, and sensor data exchange.

- Integration of edge computing with 5G will accelerate real-time analytics, predictive maintenance, and digital flight-line operations.

- Aerospace manufacturing will adopt 5G for smart factory automation, robotic inspection, and advanced quality-control systems.

- Militaries will deploy 5G mesh networks to enhance battlefield connectivity and multi-domain operational coordination.

- High-capacity 5G networks will support next-generation connected aircraft ecosystems, enabling instant data offloading on landing.

- Cybersecurity innovations embedded in virtualized 5G cores will strengthen protection of tactical and aerospace communication systems.

- Adoption of mmWave technologies will rise to support high-throughput mission systems and advanced avionics testing environments.

- Collaborative partnerships between telecom vendors and defense contractors will drive specialized 5G solutions.

- Global defense modernization and airspace digitization programs will consistently elevate long-term 5G infrastructure demand.

Market Segmentation Analysis:

Market Segmentation Analysis: