Market Overview

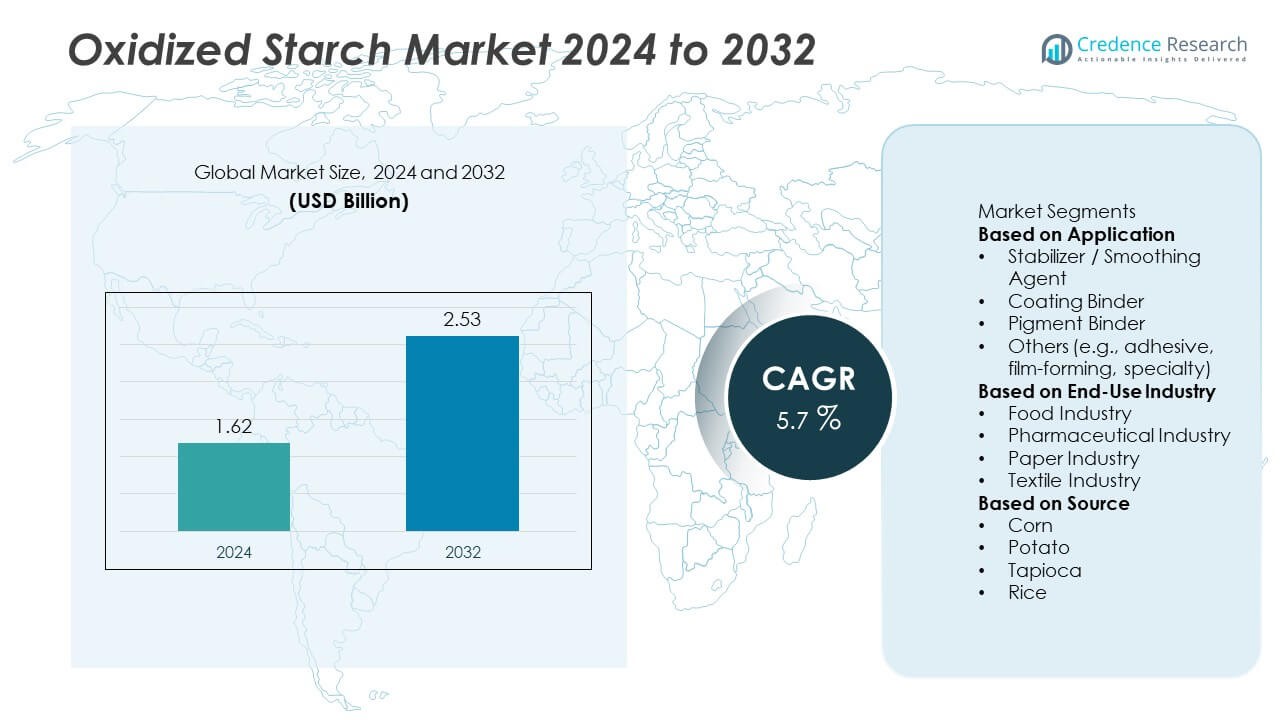

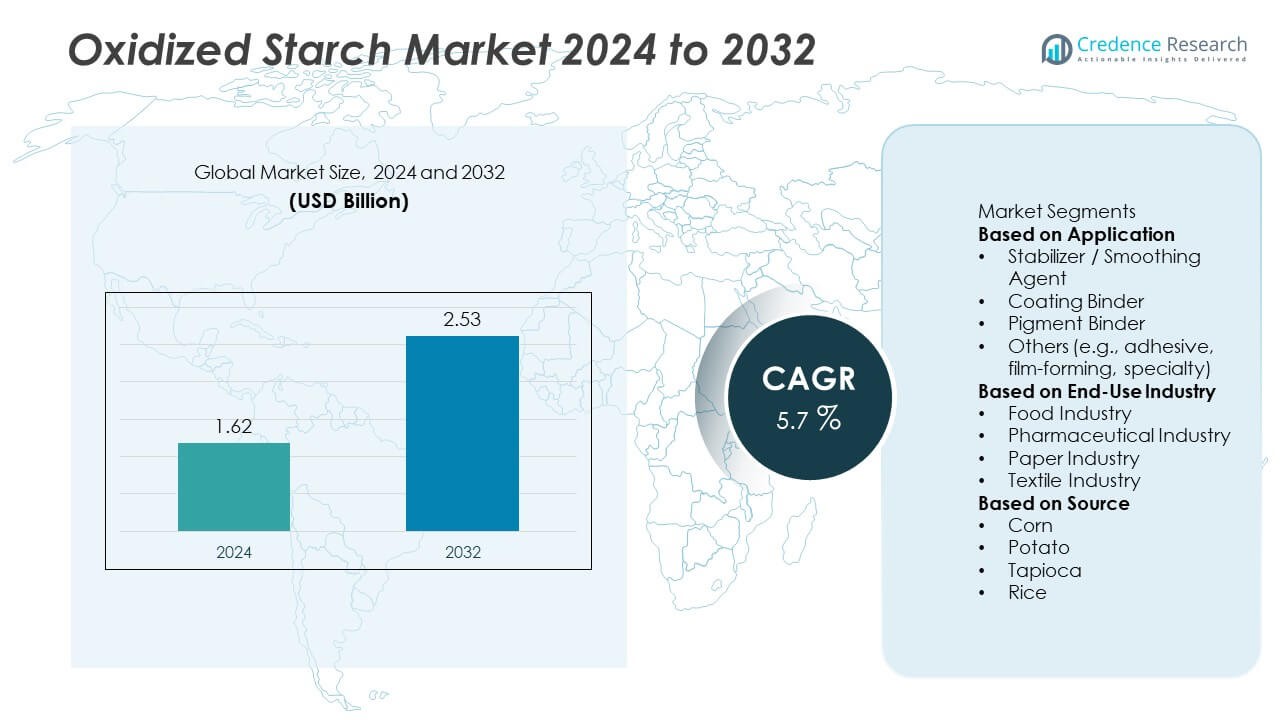

The Oxidized Starch Market was valued at USD 1.62 billion in 2024 and is expected to reach USD 2.53 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oxidized Starch Market Size 2024 |

USD 1.62 Billion |

| Oxidized Starch Market, CAGR |

5.7% |

| Oxidized Starch Market Size 2032 |

USD 2.53 Billion |

The Oxidized Starch market is led by key players such as Cargill, Ingredion, Tate & Lyle, Roquette Frères, and Avebe, who dominate the global market through robust supply chains, strategic acquisitions, and extensive R&D investments. These companies focus on producing specialized oxidized starch grades tailored to industries such as food, pharmaceuticals, paper, and textiles. The Asia-Pacific region holds the largest market share at 40%, driven by strong agricultural production and rising demand in processed food and pharmaceuticals. North America follows with a 25% market share, benefiting from a well-established food processing sector and regulatory standards. Europe, with a 20% market share, emphasizes eco-friendly ingredients, while Latin America and the Middle East & Africa hold smaller shares of 8% and 7%, respectively.

Market Insights

Market Insights

- The global oxidized starch market is valued at USD 1.62 billion in 2024 and is projected to reach USD 2.53 billion by 2032, growing at a CAGR of 5.7%.

- The rising demand for clean-label ingredients and the expanding use of oxidized starch in pharmaceuticals as a tablet binder drive market growth.

- A major trend involves the use of sustainable and biodegradable oxidized starch in packaging, coatings, and eco-friendly food formulations. Segments like stabilizer/smoothing agents (40% share) and coating binders (25% share) are growing.

- Key restraints include price volatility of raw materials (particularly corn and potato starch) and increasing regulatory and quality control challenges in the food and pharmaceutical industries.

- Regionally, Asia-Pacific leads with a 40% share due to strong agriculture and processed-food growth, followed by North America with 25%, Europe with 20%, Latin America with 8%, and the Middle East & Africa with 7%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The stabilizer/smoothing agent segment holds the largest share in the Oxidized Starch market, contributing approximately 40% of the total market share. This segment is favored for its ability to enhance texture and stability in food products, particularly in processed foods, dairy, and sauces. Coating binders follow closely with around 25% market share, driven by their use in food coatings, pharmaceuticals, and paper industries. Pigment binders and other applications, such as adhesives and film-forming, collectively account for the remaining 35%. The stabilizer/smoothing agent segment continues to dominate, supported by the growing demand for clean-label and natural ingredients.

- For instance, Cargill, in a joint venture with HELM, built a new bio-industrial facility in Eddyville, Iowa, capable of producing approximately 65,000 to 66,000 metric tons of the bio-intermediate QIRA per year, an alternative to petroleum-based materials.

By End-Use Industry

The food industry leads the Oxidized Starch market with a market share of approximately 45%. This growth is driven by the increasing demand for natural and functional ingredients in processed food, beverages, and bakery products. The pharmaceutical industry holds the second-largest share at around 25%, as oxidized starch is widely used in tablet production as a binder. The paper industry and textile industry contribute smaller shares of 15% and 10%, respectively. The food industry remains the dominant force, driven by consumer preferences for clean-label products and the increasing trend of natural food additives.

- For instance, Roquette made a major capital investment to upgrade its Lestrem facility to support the production of injectable carbohydrates (dextrose monohydrate), a project completed around 2011, and has since invested €25 million (between 2022 and 2024) to strengthen its position as a global leader in polyols at the site, which is the world’s largest polyol plant.

By Source

Corn is the leading source of oxidized starch, commanding around 50% of the market share. Its widespread availability and cost-effectiveness make it the preferred choice for production. Potato follows with a share of 20%, mainly used in food and pharmaceutical applications, while tapioca holds around 15% of the market share, primarily for its use in clean-label products. Rice, while a smaller contributor, holds an 8% share, gaining traction in gluten-free and specialty food segments. Corn remains the dominant raw material due to its agricultural abundance and versatility in various applications.

Key Growth Drivers

Rising Demand for Clean-Label Ingredients

The growing consumer preference for natural and clean-label ingredients is a key driver for the Oxidized Starch market. As consumers increasingly demand products with fewer artificial additives, oxidized starch serves as an effective alternative due to its natural origin and versatility. The food industry, in particular, benefits from this trend, as manufacturers seek natural stabilizers and emulsifiers to meet evolving consumer expectations for healthier, transparent ingredients in packaged foods, dairy, and beverages.

- For instance, Ingredion invested over $100 million in its Indianapolis plant to improve efficiency and expand its capacity for texture solutions and specialty starch-based texturizers, including clean-label options.

Expanding Applications in Pharmaceuticals

The pharmaceutical industry’s expanding use of oxidized starch as a binder in tablet formulations is driving market growth. With an increasing demand for biopharmaceuticals and oral solid dosage forms, the need for high-quality excipients like oxidized starch is rising. The material’s ability to improve the stability and shelf life of pharmaceutical products, while also offering compatibility with various drug formulations, contributes to its growing adoption in the healthcare sector, further propelling market growth.

- For instance, Colorcon provides data on the performance of its starch-based excipient, Starch 1500, in various applications, and studies have shown that it exhibits good compressibility as a direct compression excipient and binder, though specific tensile strength values will vary depending on the particular tablet formulation.

Technological Advancements in Production Processes

Advancements in starch modification technologies are boosting the production of oxidized starch, making it more efficient and cost-effective. The development of new oxidation methods and improved production facilities enhances the quality and consistency of oxidized starch. These innovations reduce manufacturing costs, expand application possibilities, and meet the evolving needs of industries such as food, pharmaceuticals, and paper, fueling the growth of the oxidized starch market.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-friendly Products

Sustainability is a growing trend, and industries are increasingly focusing on eco-friendly, biodegradable materials. Oxidized starch, being a natural and biodegradable product, is gaining traction as a green alternative in various industries, including packaging, food, and pharmaceuticals. Companies are investing in sustainable sourcing and environmentally friendly manufacturing processes to meet regulatory standards and consumer demands for eco-conscious solutions, presenting a significant opportunity for the market.

- For instance, Agrana upgraded its Gmünd starch plant with a biomass boiler delivering 55 MW thermal output, lowering reliance on fossil fuels. The facility also installed filtration units that cut wastewater load by 480 cubic meters per day.

Growth of Gluten-Free and Clean Label Foods

The increasing demand for gluten-free and clean-label foods presents a significant opportunity for the Oxidized Starch market. As more consumers turn to gluten-free diets and seek products with fewer artificial ingredients, oxidized starch serves as a key ingredient in gluten-free formulations. This trend is expected to drive demand across various food categories, including snacks, baked goods, and ready-to-eat meals, presenting a substantial growth opportunity for the market.

- For instance, Banpong Tapioca Flour Industrial utilizes advanced manufacturing technology and starch innovation to create modified starch solutions that enhance texture and functionality, facilitating their use as a wheat flour replacement in gluten-free bakery products.

Key Challenges

Price Volatility of Raw Materials

The Oxidized Starch market faces challenges related to the price volatility of raw materials, particularly corn and potato. Factors such as climate change, crop diseases, and fluctuations in supply chains can impact the availability and cost of raw materials. This volatility creates uncertainty for manufacturers, potentially affecting the pricing and profitability of oxidized starch products, and could slow down market growth if not effectively managed.

Regulatory Compliance and Quality Control

As the demand for oxidized starch grows, manufacturers must adhere to increasingly stringent regulatory requirements and quality control standards, especially in the food and pharmaceutical industries. Compliance with food safety regulations, labeling laws, and quality standards presents a significant challenge. Failure to meet these requirements could result in product recalls, fines, and damage to brand reputation, posing a barrier to market expansion and growth.

Regional Analysis

North America

The North American region holds a market share of 25% in the oxidized starch market. The region benefits from a strong food processing sector and high consumption of modified starches in pharmaceuticals and paper. The United States and Canada lead in demand for carbon-based starch derivatives used in coatings and bakery products. Innovation in R&D and strict regulatory standards for food ingredients also support growth. Expansion of convenience foods and growth in tablet formulations further drives the regional market.

Europe

Europe records a market share of 20% in the oxidized starch market. Leading economies such as Germany, the United Kingdom, and France drive demand via food, paper, and textile end-users. The region emphasizes eco-friendly and clean-label ingredients, which increases adoption of oxidized starch. Regulatory frameworks ensure high-grade quality materials, thereby increasing market value. Growth in confectionery, bakery, and specialty paper applications further supports expansion in this region.

Asia-Pacific

The Asia-Pacific region commands a market share of 40% in the oxidized starch market and is the fastest-growing region. Demand in China, India, Japan, and Southeast Asia stems from rapid urbanization, rising disposable incomes, and expansion of processed foods and pharmaceuticals. A large agricultural base offers ample raw materials such as corn, tapioca, and potato starch. Investment in manufacturing capacity and the entry of global ingredient suppliers boost market growth.

Latin America

Latin America contributes a market share of 8% in the oxidized starch market. Growth is supported by rising consumption of processed food and beverages in Brazil, Argentina, and other countries. Raw material availability and increasing industrial applications in paper and adhesives add momentum. However, slower industrialization and economic constraints moderate growth relative to other regions.

Middle East & Africa

The Middle East and Africa region accounts for a market share of 7% in the oxidized starch market. Growth is driven by increasing construction activities and rising demand in food processing in Gulf Cooperation Council (GCC) countries. Limited raw material base and infrastructural challenges constrain growth compared to more developed markets. Nonetheless, emerging opportunities in sustainable packaging and pharmaceuticals create potential for expansion.

Market Segmentations:

By Application

- Stabilizer / Smoothing Agent

- Coating Binder

- Pigment Binder

- Others (e.g., adhesive, film-forming, specialty)

By End-Use Industry

- Food Industry

- Pharmaceutical Industry

- Paper Industry

- Textile Industry

By Source

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of The global oxidized starch market features major players such as Cargill, Ingredion, Tate & Lyle, Avebe, and Agrana, who lead through strong supply-chain control and broad geographic footprints. These firms invest substantially in R&D to develop specialty oxidized starch grades tailored for food, pharmaceutical, paper, and textile markets, thereby securing premium positioning. They also pursue strategic acquisitions and partnerships to expand production capacity and accelerate entry into emerging regions. Competitive pressure from regional players remains, especially in lower-cost raw-material territories, forcing leaders to focus on differentiation through performance, sustainability credentials, and regulatory compliance. As demand grows for clean-label, biodegradable, and high-functionality starches, players intensify marketing, cost-efficiency, and innovation efforts to maintain market share and profitability.

Key Player Analysis

Recent Developments

- In October 2025, Roquette Frères launched AMYSTA™ L 123 thermally soluble pea starch, marking expansion of its modified and bio-based starch capacity.

- In 2025, AGRANA Research & Innovation Center (ARIC) announced a series of research and development activities, including an improved process for producing potato protein for food on May 14, and the digitalization of its sensory analysis panel on April 3.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, End-Use Industry, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for oxidized starch will continue to grow due to increasing consumer preference for natural, clean-label ingredients.

- The pharmaceutical industry’s adoption of oxidized starch as a binder in tablet formulations will drive further market expansion.

- Innovations in starch modification technologies will improve production efficiency and lower costs, making oxidized starch more accessible.

- The growing trend toward sustainable and eco-friendly packaging solutions will increase the use of oxidized starch in the packaging industry.

- The food industry will remain the largest end-use sector, fueled by the rising demand for natural ingredients in processed foods and beverages.

- The increasing use of oxidized starch in gluten-free and clean-label foods will open new growth opportunities, particularly in the snack and bakery sectors.

- Manufacturers will focus on diversifying raw material sources, such as tapioca and rice, to reduce dependency on corn and mitigate supply chain risks.

- Strategic partnerships and mergers will be crucial for companies aiming to expand their production capacity and enter emerging markets.

- Regulatory pressures around food safety and quality control will drive further innovations in product formulations and manufacturing processes.

- The Asia-Pacific region will continue to dominate the market, with increasing urbanization and rising disposable incomes fueling demand for processed foods.

Market Insights

Market Insights