Market Overview

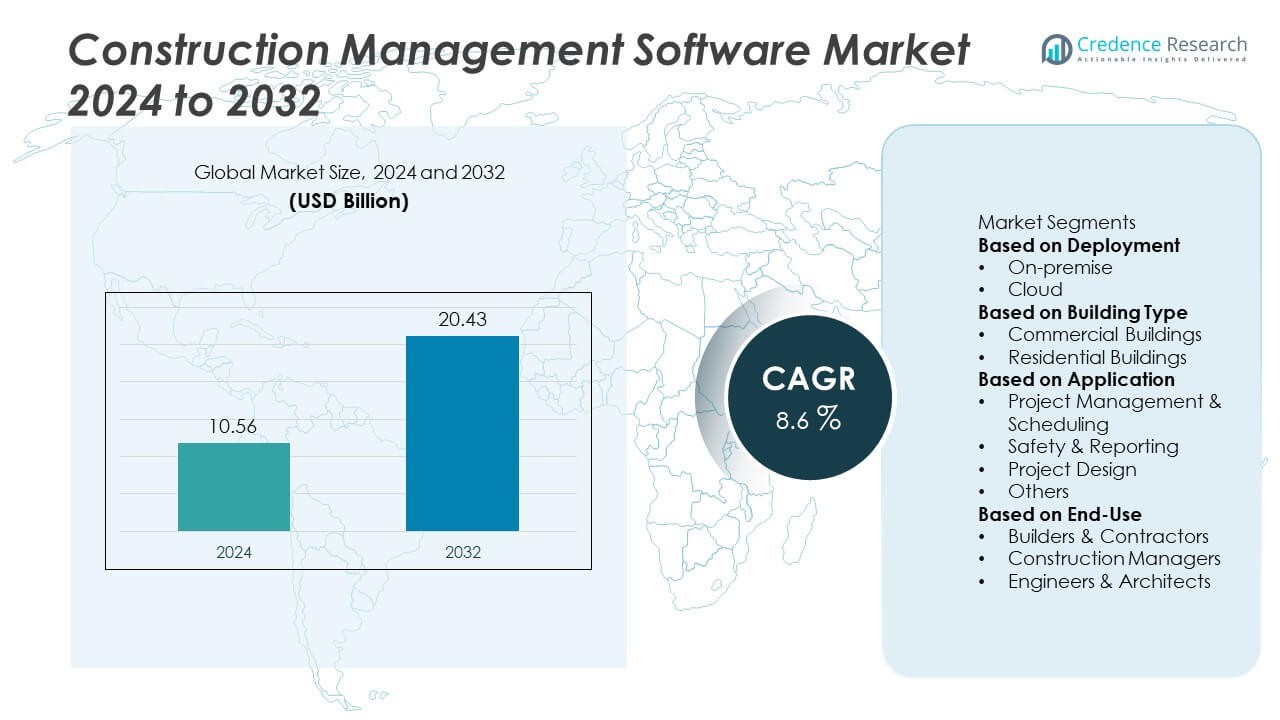

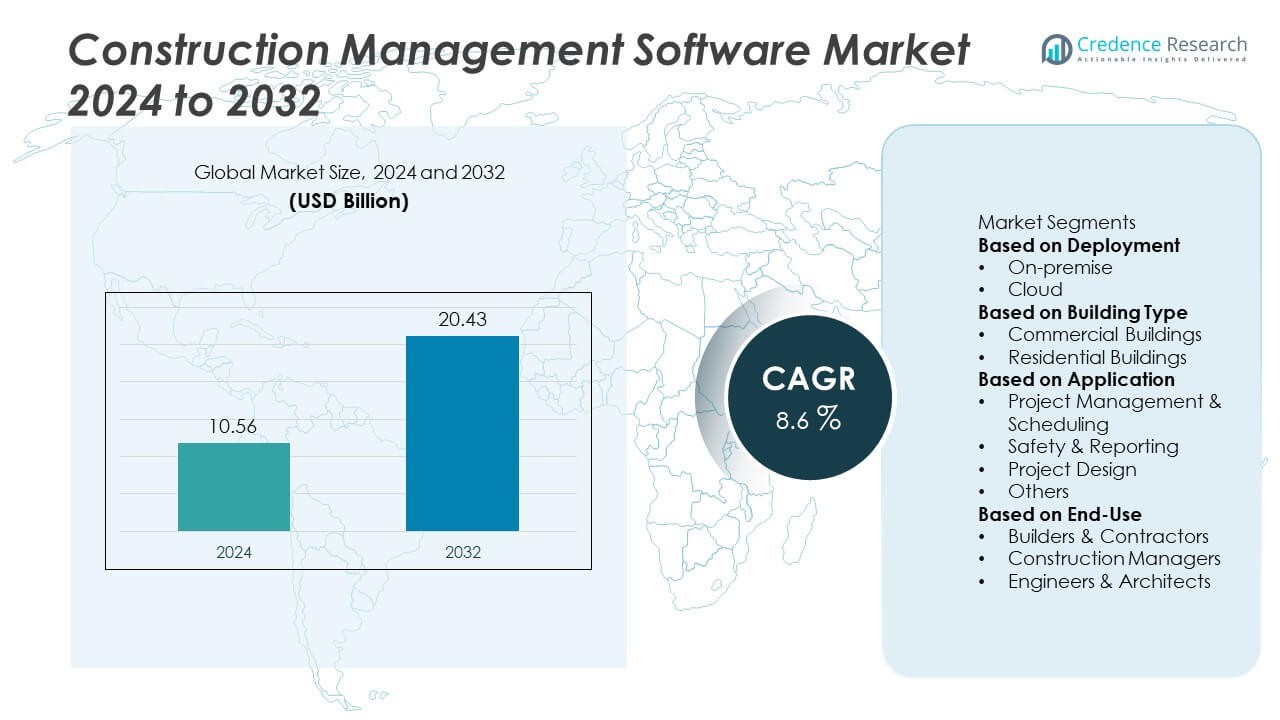

The Construction Management Software market reached USD 10.56 billion in 2024 and is projected to grow to USD 20.43 billion by 2032, supported by an 8.6% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Management Software Market Size 2024 |

USD 10.56 Billion |

| Construction Management Software Market, CAGR |

8.6% |

| Construction Management Software Market Size 2032 |

USD 20.43 Billion |

The Construction Management Software market is driven by leading players such as Autodesk Inc., Procore Technologies Inc., Trimble Inc., Oracle Corporation, Bentley Systems Inc., Sage Group plc, Buildertrend, CMiC, PlanGrid, and Viewpoint. These companies expand their presence by delivering cloud-based platforms, BIM-integrated solutions, mobile tools, and AI-enabled analytics that improve scheduling, cost control, and on-site coordination. Their focus on automation, real-time reporting, and data-driven decision-making strengthens adoption across commercial and residential construction projects. North America leads the market with a 39% share, supported by strong digitalization and advanced construction ecosystems, while Europe follows with a 28% share, driven by BIM mandates and increasing demand for efficient project delivery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Management Software market reached USD 10.56 billion in 2024 and will grow to USD 20.43 billion by 2032 at an 8.6% CAGR, supported by rising digital adoption in construction workflows.

- Strong growth is driven by high demand for cloud deployment, which leads the segment with a 67% share, and expanding use of project management and scheduling tools holding a 49% share across commercial and residential projects.

- Key trends include wider adoption of BIM-integrated platforms, mobile-based field reporting, and AI-enabled analytics that improve forecasting, automate documentation, and enhance productivity across job sites.

- Competition increases as major vendors invest in cloud ecosystems, mobile apps, and real-time collaboration tools, while high implementation costs and integration challenges continue to restrain adoption among small contractors.

- Regionally, North America leads with a 39% share, followed by Europe at 28% and Asia Pacific at 26%, supported by strong infrastructure spending, digital transformation initiatives, and the shift toward connected construction platforms.

Market Segmentation Analysis:

By Deployment

Cloud deployment leads the segment with a 67% share, driven by strong demand for scalable, accessible, and cost-efficient construction management tools. Contractors and developers prefer cloud platforms because they support real-time collaboration, remote project monitoring, and seamless data sharing across teams and job sites. Cloud solutions also reduce IT infrastructure costs and simplify software updates, making them ideal for fast-growing construction firms. On-premise deployment continues to serve large enterprises that require full data ownership and enhanced customization. Rising digitalization and mobile integration further strengthen cloud adoption across global construction operations.

- For instance, Procore expanded its cloud ecosystem by continuing to process a large, unstated number of drawings through its platform in 2023, supported by its existing automated version tracking and the release of new features like more precise measurement markups.

By Building Type

Commercial buildings dominate the segment with a 58% share, supported by large-scale infrastructure projects, corporate developments, and complex construction workflows that require advanced management tools. Contractors rely on software for budget tracking, scheduling, document control, and compliance management in commercial portfolios. Demand increases as enterprises invest in smart buildings, industrial facilities, and retail expansions. Residential buildings show steady growth as small and mid-sized developers adopt digital platforms for project planning, cost control, and customer coordination. Rising urbanization and automated design workflows also boost platform adoption in both multi-family and single-family housing projects.

- For instance, Bentley Systems supported commercial megaprojects by enabling over 45,000 documents (equating to 750 GB of design files) across a connected data environment, allowing over 1,500 users to collaborate on the Klang Valley Mass Rapid Transit project.

By Application

Project management and scheduling hold a leading 49% share due to high usage across planning, resource allocation, budgeting, and timeline control. Construction teams depend on these tools to monitor progress, track deliverables, and reduce delays across diverse project environments. Safety and reporting solutions gain momentum as firms face stricter compliance requirements and seek better oversight of on-site risks. Project design applications grow with increased use of digital models and pre-construction planning tools. Broader digital transformation in the construction sector supports rising adoption across all application areas, strengthening workflow efficiency and decision-making accuracy.

Key Growth Drivers

Rising Demand for Real-Time Project Monitoring

Construction firms adopt digital platforms to improve oversight, reduce delays, and streamline workflows. Real-time dashboards help track labor, materials, timelines, and cost deviations across multiple job sites. Cloud-based tools offer instant access to project data, enabling faster decisions and better coordination among contractors, engineers, and suppliers. Growing pressure to reduce rework and improve productivity drives wider software adoption. As projects become more complex, real-time monitoring supports improved accuracy, lower risk, and stronger operational efficiency across large and mid-sized construction companies.

- For instance, Autodesk Construction Cloud enabled teams to manage more than 1.5 billion daily data exchanges, supporting faster decision-making.

Growing Adoption of Cloud and Mobile Technologies

Cloud-based construction management solutions gain strong traction due to low upfront cost, easy deployment, and scalable storage options. Mobile integration enables field teams to upload reports, update progress, and manage tasks directly from job sites. This improves communication and reduces manual documentation errors. Companies benefit from automated backups, software updates, and seamless access across devices. The shift to flexible digital tools supports collaboration among distributed teams and enhances project transparency. Expanding use of IoT and remote monitoring further strengthens cloud adoption across global construction operations.

- For instance, Oracle Aconex manages information for large-scale construction projects with over 6 million users and US$1 trillion of project value, improving collaboration in distributed teams by providing a common data environment and an unalterable audit trail.

Increasing Focus on Cost Control and Productivity Improvement

Rising construction expenses and tighter project margins push firms to adopt digital tools that enhance budgeting accuracy and resource planning. Software platforms support detailed cost estimation, expense tracking, and automated procurement workflows. Real-time visibility helps reduce wastage, avoid delays, and optimize equipment usage. Companies rely on analytics-driven insights to improve productivity and reduce operational inefficiencies. The need for lower project risks and faster delivery timelines reinforces the use of advanced management software across both commercial and residential construction projects.

Key Trends & Opportunities

Expansion of BIM-Integrated Construction Platforms

The integration of Building Information Modeling (BIM) with construction management software offers opportunities for improved design accuracy and coordinated execution. BIM-enabled tools support 3D visualization, clash detection, and digital twins, helping teams avoid design errors early. Contractors adopt BIM workflows to strengthen collaboration across architects, engineers, and project managers. The growing shift toward smart buildings and sustainability-focused construction further boosts BIM adoption. Software providers offering seamless BIM integration gain competitive advantage as developers demand more precise planning and execution capabilities.

- For instance, Bentley Systems enables clash detection and resolution through its BIM-enabled iTwin platform, helping teams identify issues before construction begins. The platform supports the automated process of detecting geometric conflicts between design elements and allows for interactive review and follow-up.

Rising Adoption of Automation and AI-Based Tools

Automation and AI reshape construction workflows by improving demand forecasting, risk assessment, and scheduling accuracy. AI-powered platforms analyze historical data to predict delays, optimize staffing levels, and minimize material shortages. Automated reporting reduces paperwork and improves compliance accuracy on job sites. The use of drones, sensors, and IoT devices enhances site visibility and safety tracking. These technological advancements create strong opportunities for software vendors that integrate predictive analytics and intelligent automation into their solutions, supporting smarter and more efficient project execution.

- For instance, Buildots used AI vision systems to scan over 200,000 square meters of construction progress each month, improving schedule accuracy.

Key Challenges

High Implementation Costs and Integration Complexity

Small and mid-sized contractors face challenges adopting construction management software due to high subscription costs, training expenses, and system setup requirements. Integrating new platforms with existing tools, accounting software, or project databases can be complex and time-consuming. Limited digital literacy among field workers also slows adoption. These barriers lead some firms to rely on manual or legacy systems, reducing technology penetration. Vendors must focus on simplified onboarding, modular pricing, and user-friendly platforms to overcome this challenge.

Data Security and Privacy Concerns in Cloud Platforms

As construction firms increasingly rely on cloud-based systems, concerns arise about data breaches, unauthorized access, and loss of sensitive project information. Large-scale infrastructure and commercial projects involve confidential designs, financial data, and supply-chain information that require strict protection. Companies hesitate to fully shift to digital platforms without assured cybersecurity measures. Compliance with data protection regulations adds further complexity. Ensuring strong encryption, secure access control, and reliable backup systems remains essential to build trust and wider market adoption.

Regional Analysis

North America

North America leads the Construction Management Software market with a 39% share, supported by strong digital adoption across large construction firms and infrastructure developers. Companies in the U.S. and Canada rely on cloud-based platforms, mobile applications, and AI-driven tools to improve project coordination and minimize delays. Government investment in transportation, commercial buildings, and smart cities further accelerates software usage. The region benefits from mature technology ecosystems and strong demand for solutions that enhance cost control and compliance. Growing emphasis on real-time analytics and BIM integration continues to strengthen market expansion across commercial and residential construction segments.

Europe

Europe holds a 28% share, driven by rising adoption of digital construction standards and strong focus on reducing project delays and cost overruns. Countries such as Germany, the UK, and France invest heavily in cloud-based platforms and BIM-integrated tools to streamline design, scheduling, and safety compliance. Regulatory frameworks promoting digital documentation and sustainability enhance software penetration across infrastructure and commercial projects. Construction firms increasingly adopt mobile solutions to improve collaboration between onsite teams and office planners. Growing demand for automation, real-time reporting, and project analytics supports further market growth across the region.

Asia Pacific

Asia Pacific accounts for a 26% share, driven by rapid urbanization, large-scale infrastructure development, and expanding construction activity in China, India, Japan, and Southeast Asia. Rising investment in smart cities and industrial projects boosts demand for cloud-based construction management solutions that streamline scheduling, material tracking, and cost planning. Local contractors adopt digital platforms to enhance productivity and manage high project volumes. Government initiatives supporting digital transformation in construction further strengthen adoption. Increasing use of mobile applications and BIM tools also contributes to steady market growth across diverse building segments.

Latin America

Latin America holds a 4% share, influenced by growing modernization in construction practices and rising adoption of digital project management tools. Brazil and Mexico lead regional demand as developers seek solutions that improve scheduling accuracy, cost tracking, and onsite coordination. Infrastructure development and public–private partnerships support increased software usage. Limited digital literacy and budget constraints slow adoption in smaller firms, but cloud-based and mobile-friendly platforms help overcome some barriers. As construction companies shift from manual methods to digital systems, the region shows steady progress in software integration.

Middle East & Africa

The Middle East & Africa represent a 3% share, driven by expanding construction activities across the Gulf region, including commercial complexes, smart cities, and large infrastructure projects. Countries such as UAE and Saudi Arabia adopt advanced construction management solutions to support mega-projects and ensure adherence to timelines and budgets. Software usage rises as firms prioritize real-time monitoring, safety compliance, and digital documentation. In Africa, adoption grows gradually due to infrastructure expansion and increasing awareness of digital tools. Cloud-based platforms gain traction due to lower upfront costs and easier implementation across emerging markets.

Market Segmentations:

By Deployment

By Building Type

- Commercial Buildings

- Residential Buildings

By Application

- Project Management & Scheduling

- Safety & Reporting

- Project Design

- Others

By End-Use

- Builders & Contractors

- Construction Managers

- Engineers & Architects

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Construction Management Software market features major players such as Autodesk Inc., Procore Technologies Inc., Trimble Inc., Oracle Corporation, Bentley Systems Inc., Buildertrend, Sage Group plc, CMiC, PlanGrid, and Viewpoint. These companies strengthen their positions by offering integrated platforms that support project scheduling, cost control, safety management, and real-time collaboration across construction teams. Leading vendors invest in cloud-based architectures, mobile applications, and AI-driven analytics to improve forecasting accuracy and workflow efficiency. Strategic partnerships with contractors, engineering firms, and government agencies expand their market reach. Many players enhance competitiveness through BIM integration, IoT connectivity, and automated documentation tools that reduce delays and improve compliance. Continuous upgrades, flexible pricing models, and user-friendly interfaces help attract both large enterprises and mid-sized contractors. As digital transformation accelerates across global construction industries, these companies focus on innovation and scalability to capture emerging growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Autodesk Inc.

- Procore Technologies Inc.

- Trimble Inc.

- Oracle Corporation

- Bentley Systems Inc.

- Buildertrend

- Sage Group plc

- CMiC

- PlanGrid (an Autodesk company)

- Viewpoint (a Trimble company)

Recent Developments

- In November 2025, Autodesk Inc. released over 40 updates within its Autodesk Construction Cloud platform, including enhanced civil coordination functionality, simplified file-sharing mechanisms, mobile-first improvements and the introduction of Autodesk Estimate.

- In August 2025, Procore Technologies Inc. entered into a strategic collaboration with Amazon Web Services, Inc. (AWS) aimed at accelerating AI-powered product innovation and improving project outcomes in construction.

- In March 2025, Oracle Corporation reported that its Construction & Engineering division enabled customers to reduce payment-application times by 50 % through its Textura Payment Management solution.

Report Coverage

The research report offers an in-depth analysis based on Deployment, Building Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-based construction platforms will see wider adoption as firms shift toward scalable digital solutions.

- BIM-integrated workflows will become standard practice across commercial and infrastructure projects.

- AI and predictive analytics will play a larger role in forecasting delays and optimizing schedules.

- Mobile-based field management tools will expand, improving real-time data sharing and on-site reporting.

- Automation of documentation and compliance processes will reduce errors and improve project transparency.

- IoT-connected equipment and sensors will enhance job-site safety and operational efficiency.

- Small and mid-sized contractors will adopt cost-effective subscription models to replace manual processes.

- Digital twins will gain traction for project simulation, asset monitoring, and lifecycle management.

- Cybersecurity investment will increase as firms prioritize protection of project data and digital infrastructure.

- Global construction firms will prioritize integrated platforms that unify scheduling, budgeting, design, and reporting functions.