Market Overview

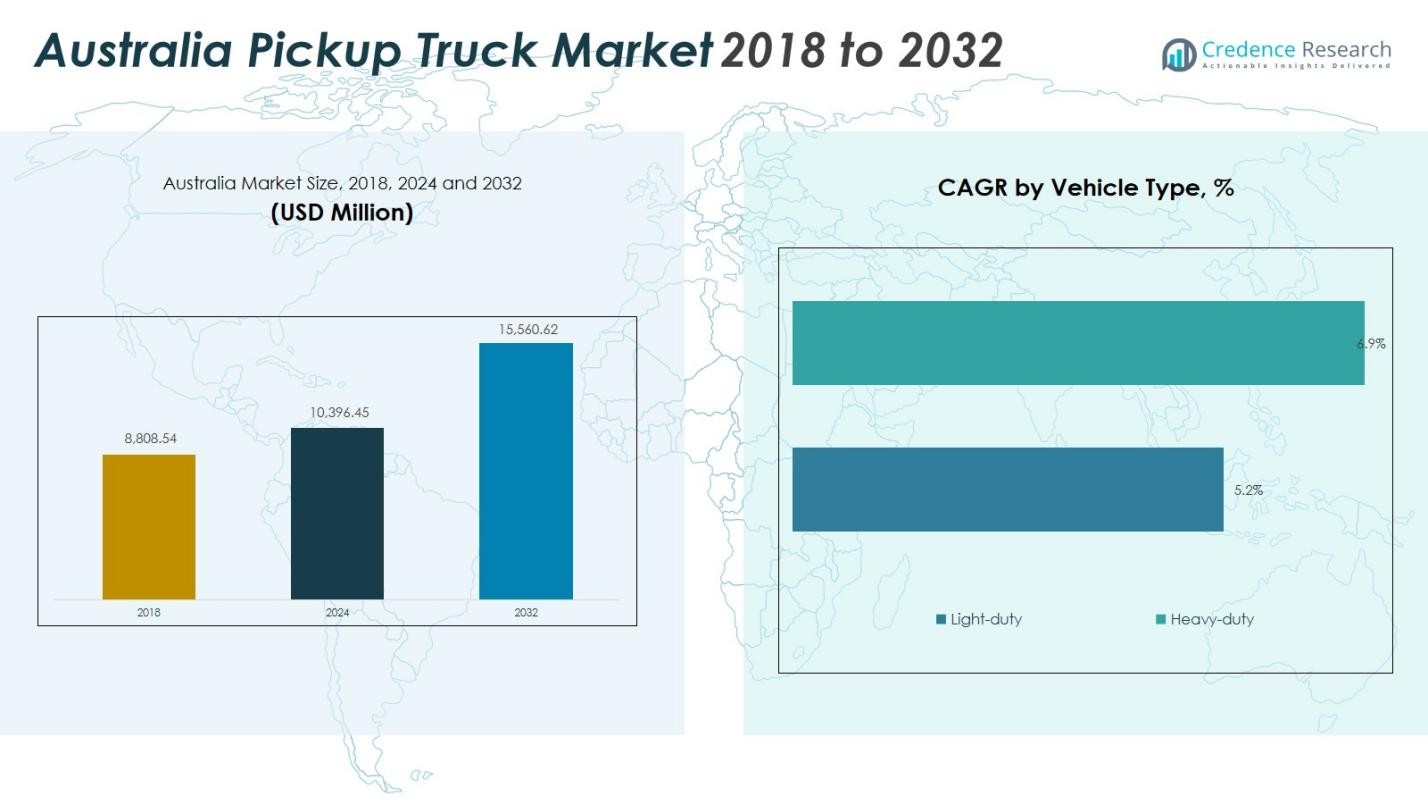

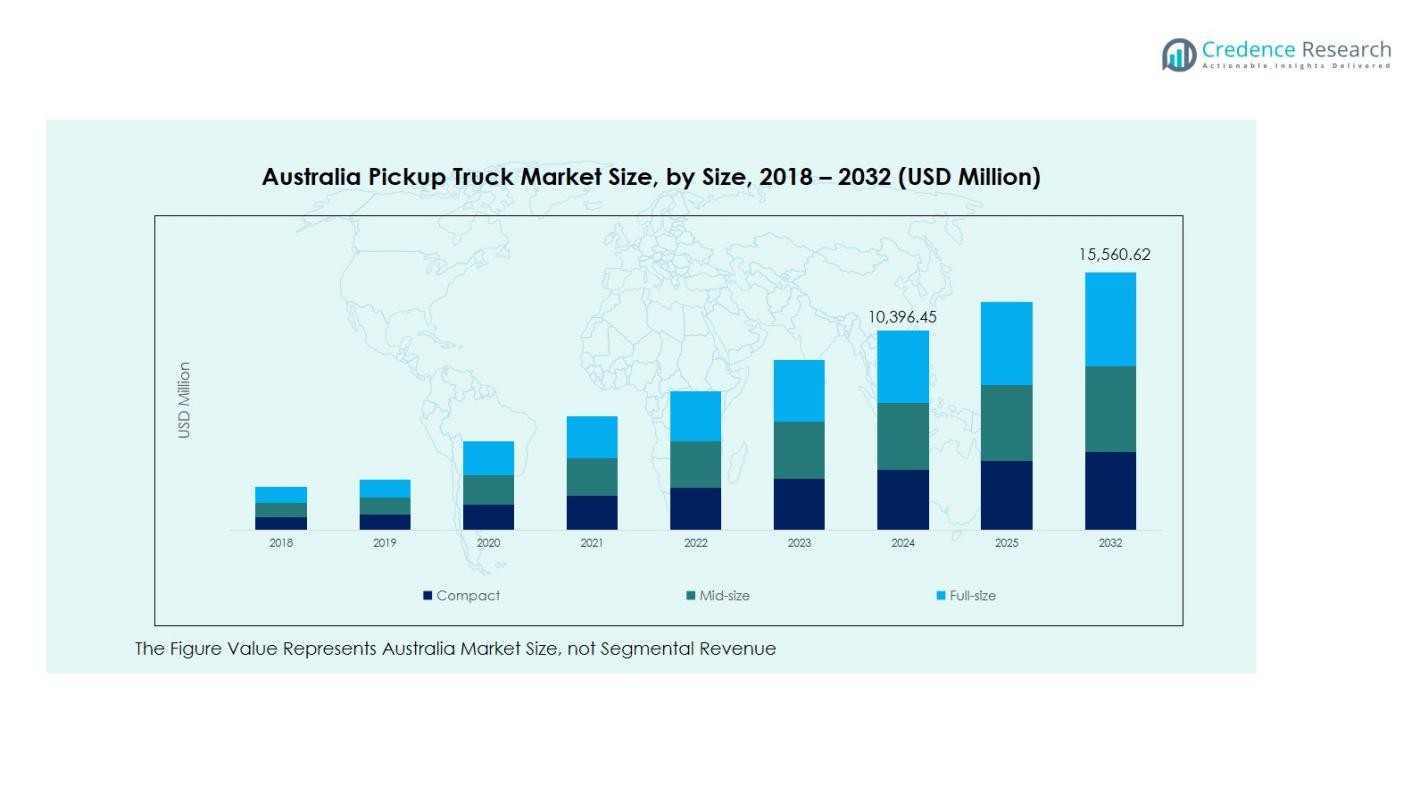

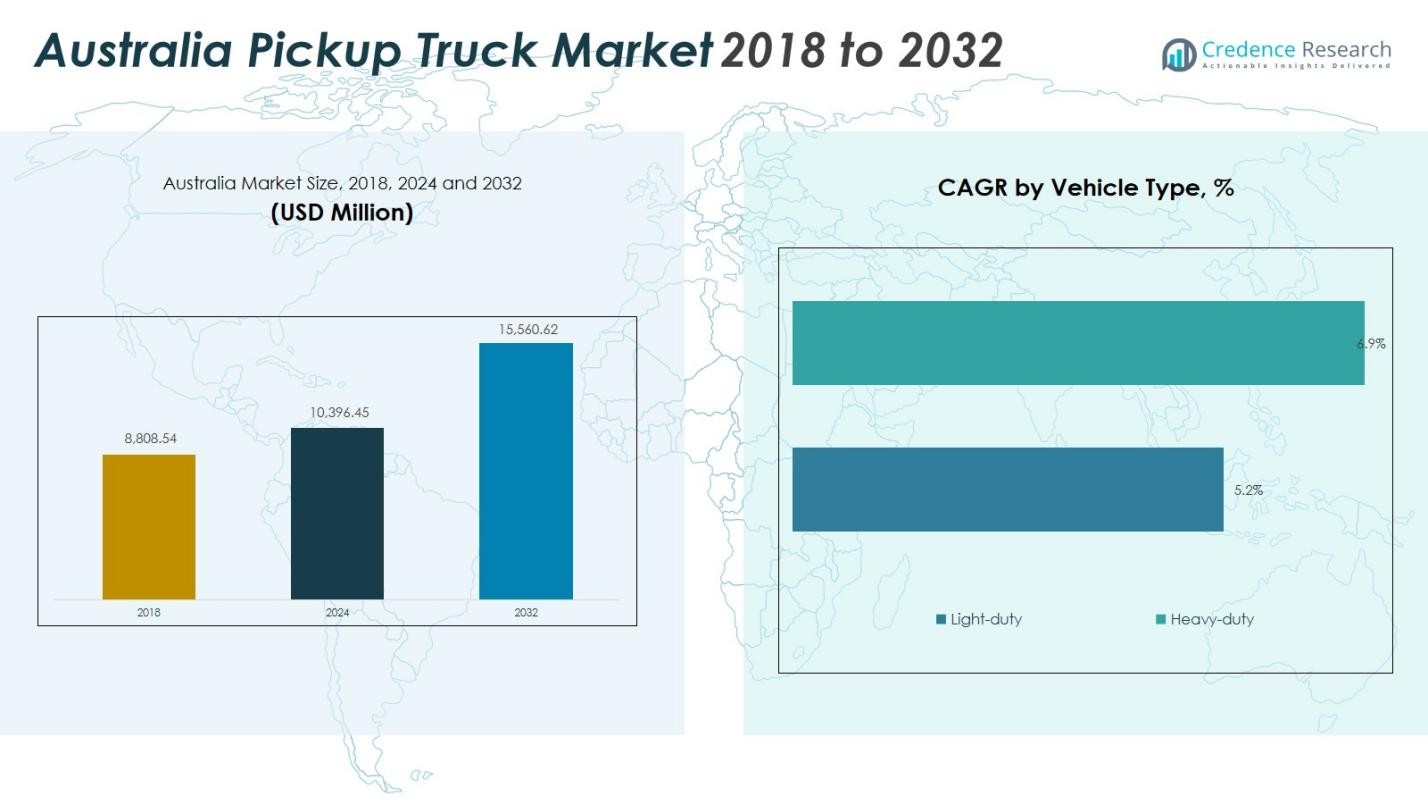

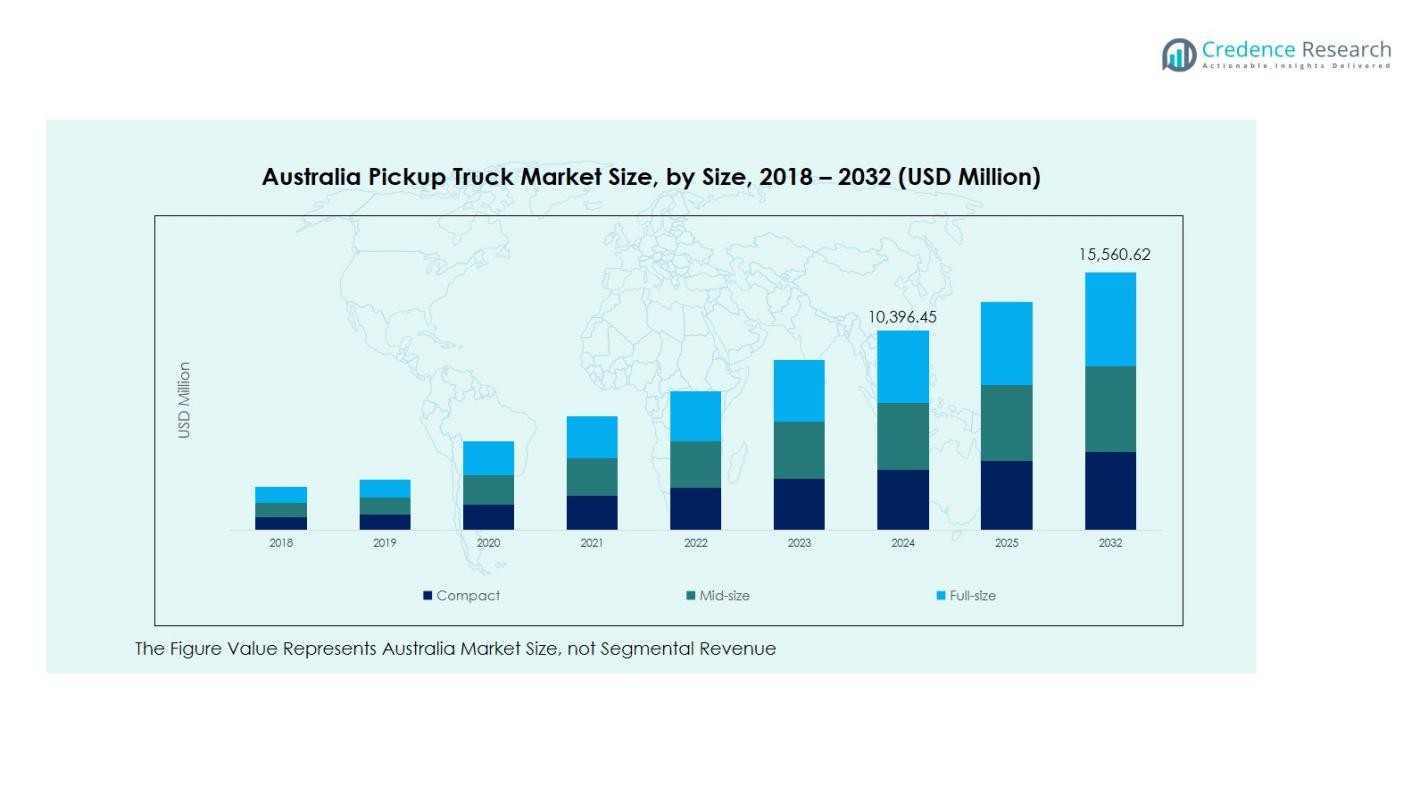

The Australia Pickup Truck Market size was valued at USD 8,808.54 Million in 2018, reaching USD 10,396.45 Million in 2024, and is projected to attain USD 15,560.62 Million by 2032, at a CAGR of 5.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Pickup Truck Market Size 2024 |

USD 10,396.45 Million |

| Australia Pickup Truck Market, CAGR |

5.17% |

| Australia Pickup Truck Market Size 2032 |

USD 15,560.62 Million |

The Australia Pickup Truck Market is led by major players such as Ford Motor Company, Toyota Motor Corporation, Mitsubishi Motors Corporation, Isuzu Motors Ltd., and Nissan Motor Co., Ltd. These companies maintain a strong presence with their popular models, including Ford’s Ranger, Toyota’s Hilux, Mitsubishi’s Triton, and Nissan’s Navara. These manufacturers focus on enhancing vehicle performance, fuel efficiency, and safety features to cater to both personal and commercial segments. Among the regions, New South Wales (NSW) dominates the market, holding a 30% share. This is driven by the state’s robust commercial and industrial sectors, including agriculture, construction, and logistics, which fuel demand for both light-duty and heavy-duty pickup trucks. Urban centers like Sydney also contribute to the growth in light-duty pickups, thanks to their versatility, fuel efficiency, and suitability for urban lifestyles.

Market Insights

- The Australia Pickup Truck Market reached USD 10,396.45 Million in 2024 and is projected to grow at a CAGR of 5.17 % to USD 15,560.62 Million by 2032.

- The rising preference for light‑duty pickup trucks (65 % share) and diesel‑fuel variants (70 % share) is pushing the market, as businesses and individuals seek versatility and fuel efficiency.

- A growing trend toward electric pickup trucks (roughly 10 % share) and increased customization options are creating new opportunities for manufacturers in both personal and commercial segments.

- Intense rivalry among top manufacturers is reinforcing innovation, yet high purchase prices and sparse charging infrastructure are limiting broader electric‑pickup adoption.

- Regionally, New South Wales leads the market with a 30 % share, driven by its strong commercial‑industrial base and robust demand across urban and rural applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type:

The Australia Pickup Truck Market is primarily segmented into light-duty and heavy-duty pickup trucks. Light-duty pickup trucks dominate this segment, capturing a significant market share due to their versatility, affordability, and suitability for both urban and rural applications. This sub-segment is increasingly favored for personal and commercial use, holding a share of 65%. The growing demand for efficient, fuel-conscious vehicles, particularly for small business and urban usage, is driving this segment’s growth. On the other hand, heavy-duty pickup trucks are gaining traction in industries requiring robust performance, such as construction and logistics, and account for the remaining 35%.

- For instance, the Ford Ranger, another popular light-duty model, offers a 3.0-litre V6 turbo-diesel engine with 184kW power and 600Nm torque, making it efficient for small businesses and city driving.

By Application:

The application segment of the Australian Pickup Truck Market is categorized into commercial, industrial, personal, and others. The commercial pickup truck segment is the dominant player, holding 50% of the market share. This is driven by the increasing need for reliable transportation in sectors like agriculture, retail, and logistics. Industrial pickup trucks follow closely, supported by the expansion in mining, construction, and heavy-duty operations, while personal and recreational pickup trucks make up smaller portions of the market. The demand for multi-functional vehicles, combining utility and personal use, is fueling the growth in the personal segment.

- For instance, autonomous and tele-remote mining trucks, including those used by BHP with Komatsu’s FrontRunner system, have become vital for heavy-duty operations.

By Fuel Type:

In terms of fuel type, diesel-powered pickup trucks hold the largest share in the Australian Pickup Truck Market, accounting for 70% of the market. This dominance is largely due to their higher fuel efficiency and better performance in heavy-duty tasks, which makes them a preferred choice for commercial and industrial applications. Petrol pickup trucks are also popular, particularly in light-duty models, making up around 20% of the market, as they offer lower upfront costs and smoother driving experiences. Electric pickup trucks, though in the early stages of adoption, are steadily increasing in popularity due to environmental concerns and government incentives, capturing about 10% of the market.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Versatile and Fuel-Efficient Vehicles

The increasing demand for versatile and fuel-efficient vehicles is a major growth driver for the Australian Pickup Truck Market. Consumers and businesses alike are looking for vehicles that can offer both utility and cost savings. Light-duty pickups are particularly popular in urban areas, where their fuel efficiency and lower operating costs appeal to small businesses and individuals. Diesel-powered trucks also remain a preferred choice for heavy-duty tasks, offering superior fuel economy and durability. This demand for practical, cost-effective vehicles is accelerating market growth.

- For instance, Toyota Australia’s 2025 HiLux models are engineered for fuel efficiency, consuming between 7.2 and 7.6L/100km depending on the variant, with advanced energy regeneration technology reducing fuel consumption in urban and mixed-use driving.

Boom in Commercial and Industrial Sectors

The growth of the commercial and industrial sectors in Australia is significantly boosting the demand for pickup trucks. Industries such as construction, mining, and agriculture require reliable and durable vehicles for transporting goods and equipment. As these sectors expand, particularly in rural areas, the need for pickups with robust capabilities increases. The commercial sub-segment dominates the market, driven by businesses seeking trucks that combine utility, performance, and affordability. These factors contribute to the continued expansion of the Australian pickup truck market.

- For instance, Isuzu UTE’s D-Max models are also widely utilized across agricultural and industrial sectors for their strong towing capabilities and fuel-efficient diesel engines, reinforcing the demand for pickups that blend utility, durability, and cost-effectiveness.

Technological Advancements in Pickup Trucks

Technological advancements are playing a crucial role in the growth of the Australian Pickup Truck Market. Manufacturers are focusing on incorporating innovative technologies to improve vehicle performance, fuel efficiency, and safety. Features such as advanced driver-assistance systems (ADAS), improved towing capabilities, and fuel-efficient powertrains are making pickup trucks more attractive to consumers. Additionally, the emergence of electric pickup trucks is reshaping the market, offering consumers an eco-friendly alternative to traditional fuel-powered vehicles. These technological innovations are driving growth by attracting both personal and commercial buyers.

Key Trends & Opportunities

Shift Towards Electric Pickup Trucks

The growing shift towards electric pickup trucks presents a significant opportunity for market growth. With rising environmental concerns and government incentives promoting electric vehicles, many consumers and businesses are considering electric alternatives to traditional diesel or petrol-powered trucks. This trend is particularly noticeable in urban areas where stricter emissions regulations are encouraging the adoption of eco-friendly vehicles. As electric pickup trucks continue to improve in terms of range, performance, and affordability, they are expected to capture a larger share of the Australian market in the coming years.

- For instance, Mercedes-Benz and Fuso have introduced electric trucks like the eActros and eCanter, focusing on urban and refuse collection applications with ranges up to 300 km, underscoring the increasing adoption of zero-emissions trucks in Australia.

Increased Focus on Customization and Personalization

There is a growing trend towards customization and personalization in the Australian Pickup Truck Market. Consumers are increasingly seeking vehicles that reflect their personal preferences and needs. This trend is particularly evident in the personal and recreational segments, where buyers look for tailored features such as upgraded interiors, specialized towing options, and aesthetic modifications. As pickup truck manufacturers respond to these demands with more customizable options, this trend presents an opportunity to drive sales and expand customer satisfaction in both the commercial and personal vehicle segments.

- For instance, Ford Australia provides nearly 600 factory-backed accessories for the Ranger, ranging from work-related additions to urban and adventure-focused gear, all covered under their warranty for peace of mind.

Key Challenges

Key Challenges

High Initial Cost of Electric Pickup Trucks

One of the key challenges facing the Australian Pickup Truck Market is the high initial cost of electric pickup trucks. While electric vehicles (EVs) offer long-term savings in fuel and maintenance costs, the upfront cost remains a significant barrier for many potential buyers. Although government incentives and rebates are available, the premium price of electric pickup trucks compared to traditional fuel-powered vehicles limits their adoption, especially in the commercial sector where cost efficiency is a critical factor. Overcoming this price gap is essential for the widespread adoption of electric pickups.

Limited Charging Infrastructure for Electric Pickup Trucks

The limited availability of charging infrastructure is another challenge hindering the growth of electric pickup trucks in Australia. While the market for electric vehicles is expanding, the lack of widespread charging stations, particularly in rural and remote areas, presents a significant obstacle. This issue is especially critical for businesses that rely on pickups for long-distance travel and heavy-duty applications. To fully realize the potential of electric pickups, investment in charging infrastructure and the development of faster, more accessible charging networks will be crucial for encouraging wider adoption.

Regional Analysis

New South Wales (NSW)

New South Wales (NSW) holds the largest market share in the Australian Pickup Truck Market, accounting for 30% of the total market. The state’s strong commercial and industrial sectors, including construction, agriculture, and logistics, are key drivers of demand for pickup trucks. Additionally, urban centers like Sydney contribute to the increasing popularity of light-duty pickups due to their fuel efficiency and versatility. The demand for commercial vehicles, coupled with the state’s substantial rural areas, makes NSW a dominant region in the pickup truck market, supporting both personal and commercial applications.

Victoria (VIC)

Victoria ranks second in the Australian Pickup Truck Market with a market share of 25%. The state’s diverse economy, including manufacturing, agriculture, and retail, contributes to the strong demand for pickup trucks. Melbourne, being a major urban hub, sees significant demand for light-duty and electric pickups, driven by eco-conscious consumers and government incentives. Additionally, rural regions of Victoria continue to see strong demand for heavy-duty trucks due to agricultural and industrial requirements. The combination of urban and rural demands ensures consistent growth for pickup truck sales in Victoria.

Queensland (QLD)

Queensland accounts for 20% of the Australian Pickup Truck Market, driven by its vast agricultural industry and large mining sector. The demand for robust, heavy-duty pickup trucks is high in the rural and remote areas of the state, where these vehicles are essential for daily operations. Urban areas like Brisbane also contribute to the demand, particularly for light-duty models due to their fuel efficiency. The growth in recreational use of pickup trucks, coupled with increasing interest in electric vehicles, offers substantial opportunities for expansion in the Queensland market.

Western Australia (WA)

Western Australia holds a market share of 15% in the Australian Pickup Truck Market. The state’s mining and resource sectors are key contributors to the demand for heavy-duty pickup trucks, used for transportation and logistics in remote and rugged terrains. Urban areas like Perth also contribute to the demand for light-duty trucks, particularly for commercial use. With increasing awareness of environmental issues, there is a gradual shift toward electric and hybrid pickups, although the growth is still in its early stages. Western Australia’s vast geographical size further drives demand for reliable and durable pickup trucks.

South Australia (SA)

South Australia accounts for 5% of the Australian Pickup Truck Market. While the state is smaller in terms of market share compared to others, the agricultural and defense sectors remain key drivers for pickup truck sales. In particular, rural and regional areas of South Australia have high demand for heavy-duty trucks due to agricultural and mining activities. Additionally, Adelaide’s urban population contributes to the demand for light-duty trucks, especially for personal use. The state’s focus on sustainability also opens up opportunities for electric pickup trucks in the coming years.

Tasmania (TAS)

Tasmania represents 3% of the Australian Pickup Truck Market. Despite its smaller market share, Tasmania’s strong agricultural industry drives the demand for both light-duty and heavy-duty pickup trucks. These vehicles are essential for the state’s farming and forestry sectors, where durability and off-road capabilities are crucial. In urban areas like Hobart, there is a growing interest in more eco-friendly vehicle options, leading to a slow yet steady increase in the adoption of electric pickup trucks. The relatively small size of the market, however, limits the rapid growth seen in larger states.

Australian Capital Territory (ACT)

The Australian Capital Territory (ACT) holds a modest market share of 2% in the Australian Pickup Truck Market. With a predominantly urban landscape, the demand for pickup trucks in Canberra is driven by personal use, including recreational and lifestyle choices. While the ACT lacks significant rural areas that drive heavy-duty truck demand, the rise in government fleet purchases and the increasing adoption of electric vehicles offer growth potential. The region is expected to see steady growth in the light-duty and electric pickup segments, driven by government incentives and environmental consciousness.

Market Segmentations:

By Vehicle Type

- Light-duty Pickup Trucks

- Heavy-duty Pickup Truck

By Application:

- Commercial Pickup Trucks

- Industrial Pickup Trucks

- Personal Pickup Trucks

- Others (including recreational and other niche applications)

By Fuel Type:

- Diesel Pickup Trucks

- Petrol Pickup Trucks

- Electric Pickup Trucks

By Size:

- Compact Pickup Trucks

- Mid-size Pickup Trucks

- Full-size Pickup Trucks

By Towing Capability:

- Light Towing Pickup Trucks (Up to 7,500 lbs)

- Medium Towing Pickup Trucks (7,501-12,000 lbs)

- Heavy Towing Pickup Trucks (12,001+ lbs)

By Region

- New South Wales (NSW)

- Victoria (VIC)

- Queensland (QLD)

- Western Australia (WA)

- South Australia (SA)

- Tasmania (TAS)

- Australian Capital Territory (ACT)

Competitive Landscape

Competitive Landscape

The Australia Pickup Truck Market is highly competitive, with several key players dominating the landscape, including Ford Motor Company, Toyota Motor Corporation, Mitsubishi Motors Corporation, Isuzu Motors Ltd., and Nissan Motor Co., Ltd. These companies lead the market through their diverse product offerings, robust dealer networks, and strong brand recognition. Ford’s Ranger and Toyota’s Hilux continue to be the top contenders, catering to both the personal and commercial segments with advanced features, performance, and reliability. Mitsubishi, Isuzu, and Nissan also maintain substantial market shares with their popular models, such as the Triton, D-Max, and Navara. These manufacturers are increasingly focusing on incorporating advanced technologies, such as enhanced towing capabilities, fuel-efficient powertrains, and electric or hybrid options, to meet the growing consumer demand for eco-friendly and performance-driven trucks. With new entrants like Volkswagen and Mazda also expanding their footprint, competition in the Australian pickup truck market is expected to intensify in the coming years.

Key Player Analysis

- Ford Motor Company (Ranger)

- Toyota Motor Corporation (Hilux)

- Mitsubishi Motors Corporation (Triton / L200)

- Isuzu Motors Ltd. (D-Max)

- Nissan Motor Co., Ltd. (Navara)

- Volkswagen AG (Amarok)

- Mazda Motor Corporation (BT-50)

- Great Wall Motors (P Series / Cannon)

- LDV (Maxus T60)

- Haval (Pickup variants)

Recent Developments

- In September 2024, Toyota Australia announced that the full‑size pickup Toyota Tundra would go on sale in Australia from November 2024.

- In September 2025, MG Motor Australia revealed the upcoming mid‑size pickup MG U9 (dual‑cab ute) for the Australian market, with pre‑orders open and deliveries expected later in 2025.

- In March 2024, JAC launched its T9 pickup in Australia the first high‑end right‑hand‑drive pickup from JAC aimed at the Australian market.

- In November 2024, BYD announced its hybrid pickup the “Shark” targeting Australia’s pickup segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type. Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for light-duty pickup trucks is expected to continue growing, driven by urbanization and the need for versatile, fuel-efficient vehicles.

- Heavy-duty pickups will see sustained demand due to the growth of commercial and industrial sectors, particularly in agriculture and construction.

- Electric pickup trucks will experience increased adoption as government incentives, environmental awareness, and infrastructure improve.

- The market will witness a steady shift toward hybrid and electric vehicles as manufacturers develop more affordable and accessible options.

- Consumers will increasingly prioritize advanced technologies, including driver-assistance systems, infotainment, and safety features, in their purchasing decisions.

- Pickup trucks in the commercial sector will dominate the market, with a strong preference for vehicles offering reliability and durability.

- The rise of e-commerce and logistics will further drive the need for robust pickup trucks to support last-mile delivery and transportation needs.

- Competitive dynamics will intensify as new entrants, like Mazda and Volkswagen, push for greater market share with innovative models.

- The growth of recreational and lifestyle segments will fuel demand for personalized and customizable pickups for personal use.

- Regional demand will continue to vary, with rural areas driving the need for heavy-duty models and urban areas focusing on light-duty, electric, and hybrid vehicles.

Key Growth Drivers

Key Growth Drivers Key Challenges

Key Challenges Competitive Landscape

Competitive Landscape