Market Overview

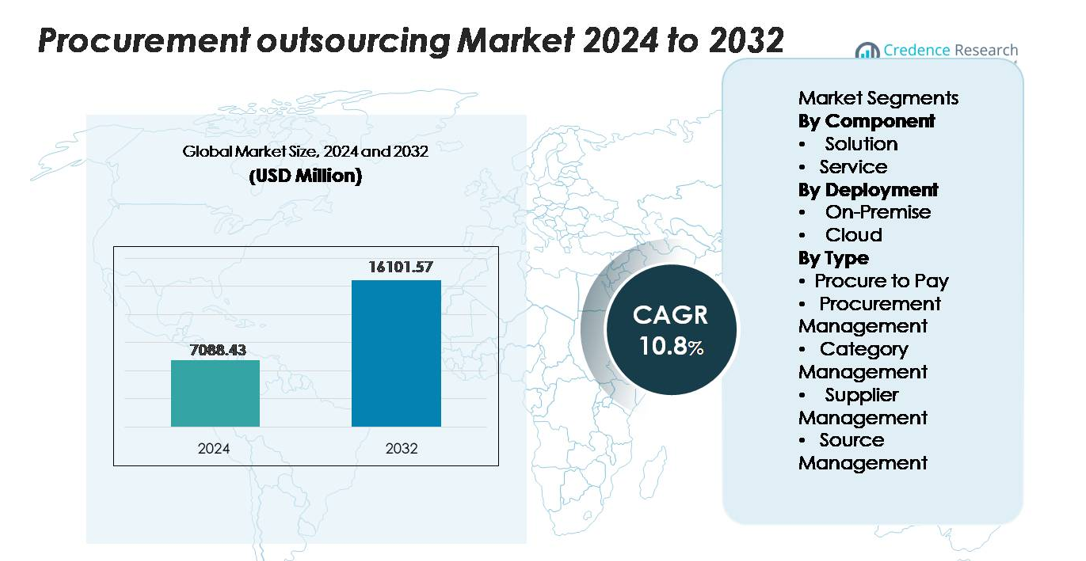

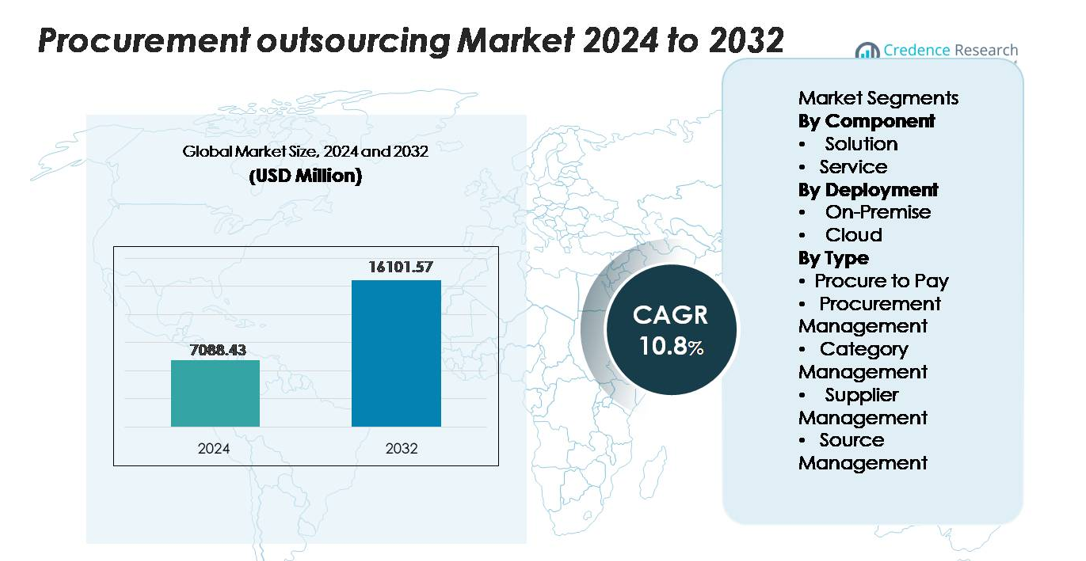

The global procurement outsourcing market was valued at USD 7,088.43 million in 2024 and is anticipated to reach USD 16,101.57 million by 2032, expanding at a CAGR of 10.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Procurement outsourcing market Size 2024 |

USD 7,088.43 million |

| Procurement outsourcing market, CAGR |

10.8% |

| Procurement outsourcing market Size 2032 |

USD 16,101.57 million |

The procurement outsourcing market is shaped by leading players such as Accenture, IBM, Genpact, Infosys BPM, Wipro, GEP, Capgemini, TCS, HCLTech, and WNS, each offering advanced sourcing, category management, and procure-to-pay automation services. These companies leverage digital procurement platforms, analytics-driven decisioning, and global delivery centers to support enterprise-wide transformation. North America leads the market with approximately 34% share, supported by mature digital adoption and strong outsourcing penetration, while Europe follows with around 28%, driven by regulatory complexity and demand for compliance-focused procurement models. Asia-Pacific, holding about 25%, emerges as the fastest-growing region due to expanding supply bases and rapid digitalization.

Market Insights

- The global procurement outsourcing market was valued at USD 7,088.43 million in 2024 and is projected to reach USD 16,101.57 million by 2032, expanding at a CAGR of 10.8% during the forecast period.

- Market growth is driven by increasing demand for cost optimization, digital procurement automation, supplier risk management, and the shift toward centralized procurement models across large enterprises and SMEs.

- Key trends include the adoption of AI-enabled sourcing, intelligent automation, ESG-integrated procurement frameworks, and outcome-based outsourcing models that align provider performance with savings and compliance outcomes.

- Competition intensifies as leading players such as Accenture, IBM, Genpact, GEP, Wipro, Infosys BPM, and Capgemini expand analytics-driven category management and P2P automation; Solution dominates the component segment with ~58% share, while Cloud deployment leads with ~64%.

- Regionally, North America holds 34% share, followed by Europe at 28% and Asia-Pacific at 25%, reflecting strong digital procurement adoption and rising spend-management initiatives across global supply chains.Top of FormBottom of Form

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

In the procurement outsourcing market, Solution remains the dominant component, accounting for around 58% of the total share. Its lead is driven by the rapid adoption of integrated procurement platforms that streamline spend analytics, contract lifecycle management, and supplier risk assessment in a single architecture. Organizations prioritize scalable digital solutions that reduce manual workload and enhance process transparency. Meanwhile, Service offerings—such as strategic sourcing, category management, and supplier onboarding—continue to gain traction as enterprises seek specialized expertise, but Solution maintains leadership due to its strong role in automation, compliance control, and real-time visibility across procurement cycles.

- For instance, GEP SMART™ processes more than 500 million procurement transactions annually across its global client base and manages hundreds of thousands of active supplier contracts, demonstrating the significant scale, automation depth, and enterprise-grade orchestration capabilities organizations increasingly rely on.

By Deployment

Cloud deployment dominates the market with approximately 64% share, propelled by its lower upfront cost, easy scalability, faster implementation, and ability to support global procurement teams through centralized dashboards. Cloud-based outsourcing platforms integrate advanced capabilities such as AI-driven sourcing, automated invoice reconciliation, and supplier performance analytics, enabling higher efficiency than traditional systems. On-premise solutions retain relevance in highly regulated sectors that require strict data residency and internal control, but the ongoing shift toward digital transformation and remote-enabled procurement operations firmly positions Cloud as the preferred deployment model across enterprises.

- For instance, the SAP Business Network (formerly the SAP Ariba Network) supports more than 5 million connected businesses transacting nearly $6 trillion in annual commerce, demonstrating the volume and global interoperability achievable only on cloud-native procurement infrastructure.

By Type

Procure-to-Pay (P2P) leads the segment with close to 40% market share, supported by the demand for end-to-end automation that encompasses requisitioning, approval workflows, invoice matching, and payment processing. Enterprises outsource P2P processes to reduce transaction costs, eliminate manual errors, and improve compliance through standardized digital frameworks. Procurement Management and Supplier Management also expand steadily as companies prioritize supplier risk mitigation and strategic sourcing efficiency. Category Management and Source Management attract organizations seeking expertise for complex categories, but P2P maintains dominance due to its high transaction volume and direct impact on operational efficiency.

Key Growth Drivers

Rising Need for Cost Optimization and Process Efficiency

Organizations increasingly adopt procurement outsourcing to achieve measurable cost reductions, operational transparency, and streamlined purchasing workflows. As global supply chains expand and procurement categories become more complex, enterprises struggle to manage spend effectively using traditional in-house teams. Outsourcing allows companies to leverage specialized service providers with expertise in strategic sourcing, contract negotiation, and category intelligence—leading to substantial savings across direct and indirect spend. The shift toward centralized procurement models also supports improved compliance and reduced maverick spend. Providers enhance efficiency through automated requisitioning, digital invoice processing, and data-driven supplier evaluation, which eliminate repetitive tasks and shorten sourcing cycles. As companies seek resilient and scalable procurement operations amid inflationary pressures and supply disruptions, cost optimization remains a primary driver encouraging enterprises to outsource both transactional and strategic procurement activities.

- For instance, GEP SMART™—a unified cloud procurement platform—processes more than 500 million procurement transactions annually and executes over 18 million sourcing events each year, according to GEP’s published operational data.

Expansion of Digital Procurement and Advanced Analytics

Rapid digital transformation significantly accelerates adoption of procurement outsourcing, as enterprises prioritize automation, predictive analytics, and real-time visibility across the procurement lifecycle. Outsourcing partners deploy advanced tools such as AI-driven supplier scoring, robotic process automation (RPA) for invoice matching, and machine-learning models to forecast pricing or supply risks. These technologies enhance decision-making and reduce the reliance on manual processes that often cause delays and errors. Advanced analytics platforms also improve spend categorization, compliance monitoring, and contract lifecycle management, enabling strategic procurement functions to operate with higher precision. As organizations move toward data-centric procurement ecosystems, outsourcing providers with strong analytics capabilities gain competitive advantage. The ability to integrate procurement data across ERP systems, supplier portals, and payment networks further strengthens efficiency, making digital transformation a core driver of procurement outsourcing growth.

- For instance, The SAP Business Network—formerly the SAP Ariba Network—is the world’s largest B2B trading platform, connecting millions of trading partners and facilitating nearly USD 6 trillion in annual commerce, including more than 746 million business-commerce transactions each year.

Increased Focus on Supplier Risk Management and Global Compliance

Global supply chain disruptions and regulatory complexity have elevated supplier risk management as a critical driver of procurement outsourcing. Businesses increasingly depend on outsourcing partners to monitor supplier performance, assess financial stability, and ensure compliance with industry standards and regional trade regulations. Outsourcing providers implement structured supplier risk frameworks that integrate third-party audits, ESG assessments, and continuous risk scoring to protect organizations from disruptions, non-compliance penalties, or reputational damage. Their ability to conduct multi-region supplier evaluations supports companies operating in diverse markets where regulations vary widely. Enterprises also benefit from providers’ expertise in ethical sourcing, anti-bribery compliance, and labor-standard monitoring. As global procurement networks become more fragmented and volatile, the need for structured and proactive supplier governance fuels widespread adoption of outsourced procurement functions.

Key Trends & Opportunities

Growing Adoption of AI-Enabled Procurement and Intelligent Automation

One of the most significant trends shaping procurement outsourcing is the accelerating adoption of AI-driven platforms and intelligent automation. Outsourcing partners increasingly integrate natural language processing (NLP) for contract analysis, AI bots for auto-sourcing events, and predictive engines for demand forecasting. These capabilities reduce manual intervention, compress sourcing cycles, and boost accuracy in supplier assessments. The rise of conversational procurement interfaces, cognitive analytics, and autonomous buying systems creates vast opportunities for outsourcing providers to deliver more strategic value. Companies pursuing agile procurement structures now favor partners capable of orchestrating automated workflows across sourcing, ordering, and invoicing. This trend also opens opportunities for providers to offer advanced analytical dashboards that support CFO-level decision-making and spend governance. As enterprises move toward future-ready procurement models, the market for AI-enabled outsourcing continues to expand rapidly.

- For instance, Coupa’s AI models are trained on more than USD 4 trillion in cumulative business spend and process billions of transactional data points annually, enabling precise anomaly detection and automated supplier-risk scoring across thousands of procurement categories.

Shift Toward Outcome-Based Procurement Outsourcing Models

Procurement outsourcing is evolving toward outcome-based models where service providers are evaluated on measurable results rather than fixed service-level agreements. This shift creates opportunities for providers to deliver higher-value solutions tied to performance metrics such as realized savings, supplier consolidation, risk reduction, and compliance improvement. Companies prefer flexible commercial models where providers are incentivized to enhance sourcing outcomes rather than simply deliver transactional services. This trend aligns with growing interest in strategic categories like logistics, IT procurement, facilities management, and professional services, where outcome-based models drive better efficiency. Providers offering co-sourcing and hybrid engagement structures also benefit from enterprises seeking deeper collaboration without fully relinquishing control. As organizations aim for measurable ROI from outsourcing, outcome-based models strengthen trust, transparency, and long-term provider partnerships.

- For instance, GEP’s AI-enabled procurement platform and managed services business process more than 10 million purchasing and invoice transactions annually. This capacity, along with their management of thousands of sourcing events and over $525 billion in annual client spend, allows providers to commit to significant transaction-cycle reductions and sourcing-event efficiencies backed by real system capacity.

Expansion of ESG-Integrated and Sustainable Procurement Practices

Sustainability initiatives generate strong opportunities for procurement outsourcing companies as enterprises increasingly incorporate ESG criteria into sourcing decisions. Providers now help evaluate supplier emissions, ethical sourcing standards, energy efficiency practices, and labor compliance as part of procurement strategies. Outsourcing partners support the development of supplier sustainability scorecards, carbon-impact assessments, and circular procurement frameworks that improve environmental performance. ESG-aligned procurement is particularly relevant for industries facing regulatory pressure, such as manufacturing, FMCG, energy, and technology. Companies also rely on outsourcing partners to diversify supply sources, promote local supplier development, and improve traceability across supply chains. As sustainability becomes a core corporate priority, demand for ESG-integrated procurement outsourcing creates substantial long-term growth opportunities.

Key Challenges

Data Security, Compliance, and Intellectual Property Concerns

Despite strong market growth, data security and compliance remain major challenges in procurement outsourcing. Transferring sensitive procurement data—including supplier contracts, pricing benchmarks, and financial records—to third-party providers exposes companies to risks such as data breaches, unauthorized access, or IP leakage. Industries with strict regulatory frameworks, including healthcare, defense, and BFSI, face heightened concerns when outsourcing procurement operations. Ensuring adherence to GDPR, regional data residency rules, and industry-specific compliance standards adds complexity to outsourcing agreements. Providers must deploy advanced cybersecurity tools, encryption protocols, and audit mechanisms to gain client trust. Yet many organizations remain hesitant, particularly when outsourcing strategic procurement categories that involve confidential negotiations or proprietary sourcing methodologies.

Integration Complexity and Resistance to Organizational Change

Integrating outsourced procurement systems with existing ERPs, supplier portals, and financial workflows poses significant challenges. Enterprises often operate fragmented legacy infrastructure that is difficult to synchronize with outsourced platforms, leading to delays, inaccurate data flow, or operational inconsistencies. Additionally, internal teams may resist outsourcing due to concerns over job displacement, loss of control, or reduced visibility into procurement decisions. Successful adoption requires strong change management, cross-functional collaboration, and standardized workflows—elements that many organizations struggle to implement. Operational misalignment, poorly defined KPIs, and inadequate onboarding processes can further hinder outsourcing performance. The complexity of transitioning from in-house procurement to shared or hybrid models remains a significant barrier for many enterprises.

Regional Analysis

North America

North America leads the procurement outsourcing market with approximately 34% share, supported by strong adoption of digital procurement platforms, advanced analytics, and enterprise-wide automation strategies. Large organizations in the U.S. and Canada increasingly outsource indirect and strategic procurement categories to optimize cost structures and improve compliance. Mature supply chain ecosystems and the presence of global outsourcing providers drive steady demand. High emphasis on supplier risk management, cybersecurity-compliant purchasing frameworks, and ESG-aligned sourcing further accelerates outsourcing penetration. As businesses shift toward cloud-native procurement models, North America continues to maintain its dominant position.

Europe

Europe accounts for nearly 28% of the procurement outsourcing market, driven by strict regulatory frameworks, cross-border trade complexities, and strong demand for supplier compliance management. Countries such as the UK, Germany, France, and the Netherlands lead adoption as enterprises increasingly outsource category management, contract standardization, and supplier audits. The region’s expanding digital procurement initiatives and emphasis on sustainable sourcing also attract outsourcing partnerships. Additionally, rising energy costs and inflation encourage companies to optimize spend and improve supplier diversification. With a strong push toward ethical procurement and ESG reporting, Europe remains a critical growth hub for outsourcing services.

Asia-Pacific

Asia-Pacific holds about 25% market share and represents the fastest-growing region due to rapid industrial expansion, rising procurement complexity, and strong digital transformation initiatives across manufacturing, retail, and technology sectors. Companies in China, India, Japan, and Southeast Asia increasingly adopt outsourced procurement to manage large supplier bases and reduce operational overhead. The region benefits from abundant outsourcing talent, cost-effective service delivery, and the presence of global BPO hubs. Growing investments in cloud-based procurement platforms and analytics-driven sourcing strengthen demand, positioning Asia-Pacific as a strategic base for both domestic and global procurement operations.

Latin America

Latin America captures roughly 7% of the procurement outsourcing market, supported by growing adoption among industries such as energy, mining, manufacturing, and consumer goods. Countries including Brazil, Mexico, and Colombia increasingly outsource procurement functions to improve operational efficiency, reduce compliance risk, and manage volatile supply conditions. The region’s economic fluctuations drive demand for spend optimization, while rising digital procurement initiatives open new opportunities for outsourcing providers. Limited internal procurement capabilities and the need for supplier standardization also contribute to expansion, although adoption remains gradual compared with more mature regions.

Middle East & Africa

The Middle East & Africa region holds close to 6% of the procurement outsourcing market, with growth driven by large-scale infrastructure investments, diversification of national economies, and expanding corporate governance standards. Organizations in the UAE, Saudi Arabia, and South Africa increasingly adopt outsourced procurement to enhance transparency, manage supplier risks, and streamline complex sourcing processes. The region’s shift toward digital procurement tools, coupled with rising interest in sustainable and compliant sourcing, further strengthens adoption. While market penetration is still emerging, MEA shows strong long-term potential as enterprises modernize procurement practices.

Market Segmentations:

By Component

By Deployment

By Type

- Procure to Pay

- Procurement Management

- Category Management

- Supplier Management

- Source Management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the procurement outsourcing market is defined by a mix of global consulting firms, specialized procurement service providers, and technology-led BPO companies competing to deliver high-value sourcing and spend-management solutions. Key players such as Accenture, IBM, Genpact, GEP, Wipro, Capgemini, Infosys BPM, TCS, and HCLTech leverage strong global delivery networks and advanced digital procurement platforms to expand their presence across strategic sourcing, category management, procure-to-pay automation, and supplier risk assessment. These providers invest heavily in AI-driven analytics, contract intelligence tools, and cloud-based procurement suites to enhance efficiency and ensure real-time visibility for clients. Strategic partnerships, multi-region delivery hubs, and domain expertise in indirect and complex categories strengthen competitive differentiation. As enterprises increasingly adopt hybrid and outcome-based outsourcing models, competition intensifies around innovation, pricing flexibility, and domain specialization. The market continues to consolidate through alliances and capability expansions to address rising demand for digital, resilient, and ESG-aligned procurement operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Capgemini

- GEP

- IBM Corporation

- Wipro

- Infosys BPM

- Genpact

- Tata Consultancy Services (TCS)

- HCL Technologies

- Accenture

- IRIS Software Group

Recent Developments

- In November 2025, IBM was named a Leader in the Everest Group 2025 Procurement Outsourcing Services PEAK Matrix, recognizing its AI-powered Source-to-Pay solutions across the procurement lifecycle.

- In September 2025, GEP Software was selected by India’s Bangalore International Airport Limited (BIAL) to transform procurement operations, strengthen supplier collaboration and unlock new value through its procurement outsourcing services.

- In July 2025, Capgemini announced the acquisition of WNS Global Services for USD 3.3 billion (cash) to bolster its AI-powered intelligent operations and expand its procurement outsourcing and BPO capabilities

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for procurement outsourcing will rise as enterprises prioritize cost efficiency and streamlined sourcing operations.

- Adoption of AI-driven procurement tools will accelerate automation across sourcing, contracting, and supplier evaluation.

- Supplier risk management services will expand as companies seek stronger resilience against global disruptions.

- Cloud-based procurement platforms will become the preferred deployment model for scalability and integration.

- Outcome-based outsourcing models will gain traction as clients seek measurable savings and compliance improvements.

- ESG-focused procurement services will grow as sustainability criteria shape supplier selection.

- Hybrid outsourcing models will increase as organizations blend internal expertise with external category specialists.

- Analytics-driven category management will become a core differentiator among leading service providers.

- Outsourcing adoption will deepen in emerging markets as digital procurement maturity improves.

- Consolidation among procurement service providers will intensify as firms expand capabilities through acquisitions and partnerships.