Market Overview

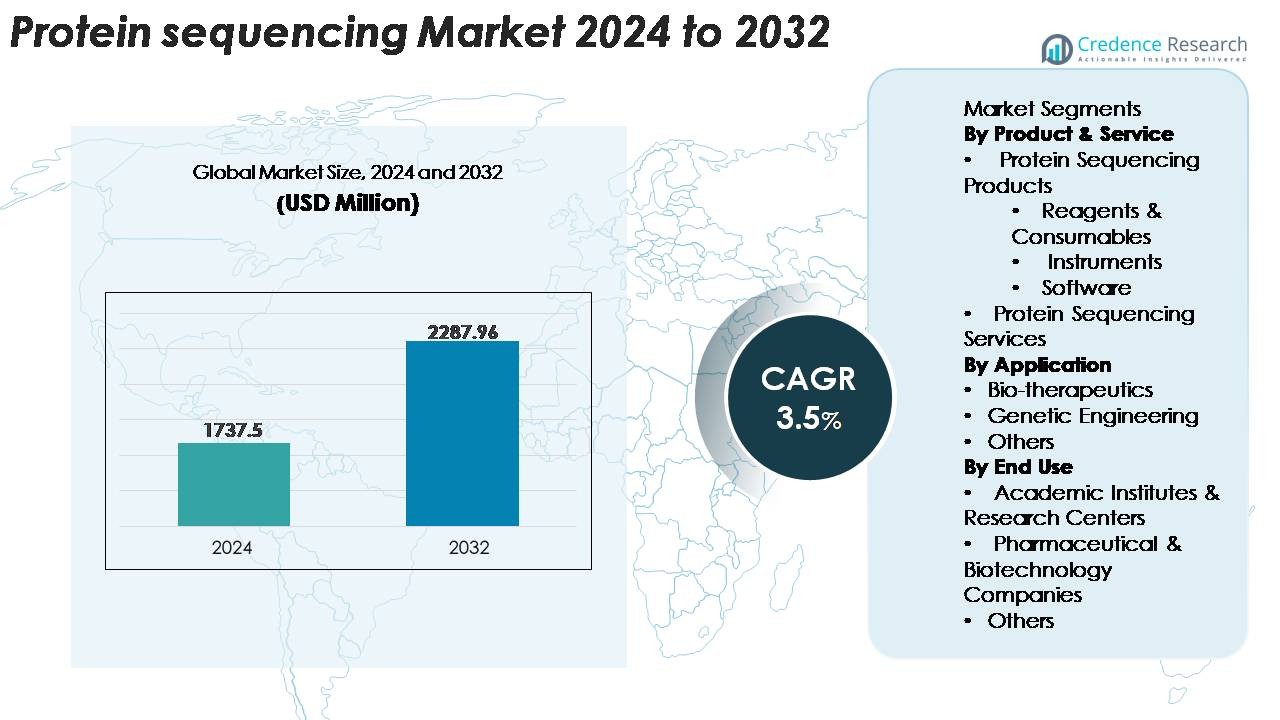

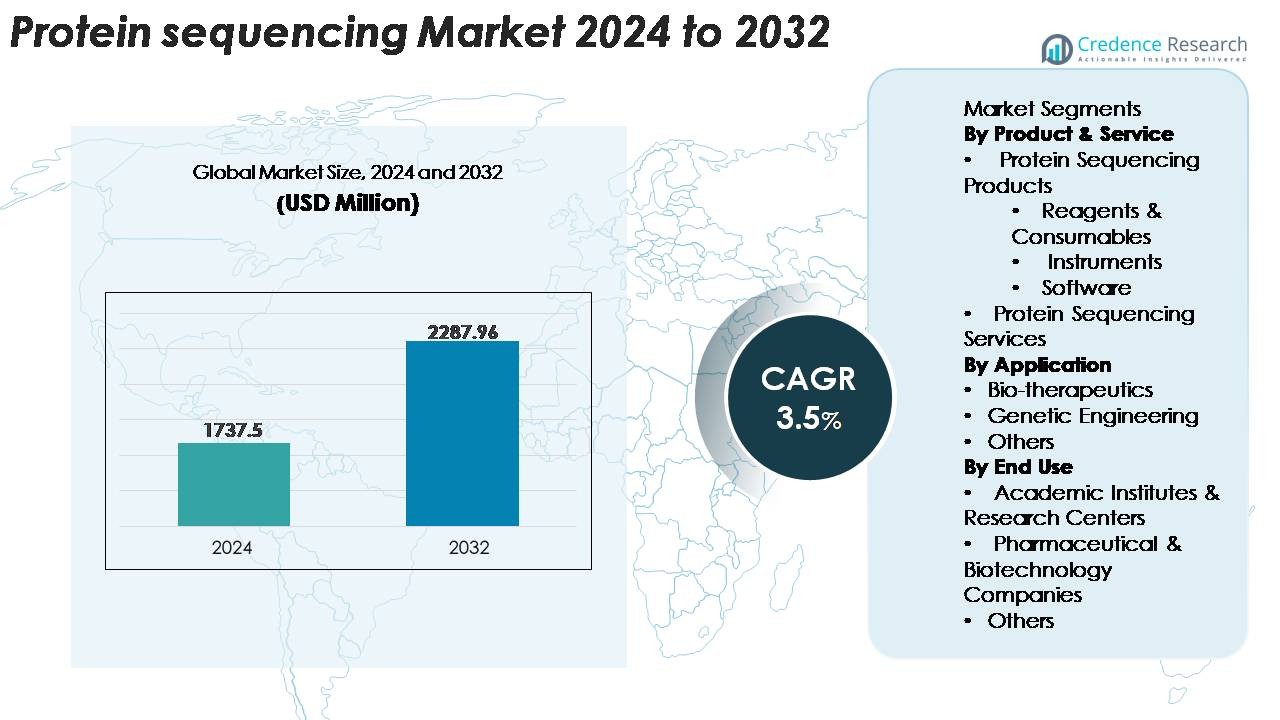

The Protein Sequencing Market was valued at USD 1,737.5 million in 2024 and is projected to reach USD 2,287.96 million by 2032, registering a CAGR of 3.5% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Protein Sequencing Market Size 2024 |

USD 1,737.5 Million |

| Protein Sequencing Market, CAGR |

3.5% |

| Protein Sequencing Market Size 2032 |

USD 2,287.96 Million |

The protein sequencing market is shaped by leading technology developers and specialized service providers, including Creative Proteomics, Agilent Technologies, Rapid Novor, Thermo Fisher Scientific, Selvita, Proteome Factory AG, Alphalyse, Bioinformatics Solutions Inc., Charles River Laboratories, and Shimadzu Corporation. These companies compete through advancements in high-resolution mass spectrometry, de novo sequencing accuracy, and PTM-profiling capabilities, while service providers differentiate through customized analytical workflows and regulatory-ready reporting. North America remains the dominant region with approximately 38–40% market share, driven by strong biopharmaceutical R&D activity, advanced proteomics infrastructure, and widespread adoption of next-generation sequencing instruments and bioinformatics platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The protein sequencing market reached USD 1,737.5 million in 2024 and is projected to hit USD 2,287.96 million by 2032, advancing at a CAGR of 3.5%.

- Market growth is driven by expanding biologics pipelines, rising demand for detailed structural analysis of therapeutic proteins, and increasing adoption of high-resolution mass spectrometry and AI-enabled proteomics platforms.

- Key trends include rapid uptake of de novo sequencing for engineered proteins, growing outsourcing of sequencing services, and the integration of advanced bioinformatics tools for PTM mapping and large-scale proteome interpretation.

- Competitive intensity rises as leading players such as Thermo Fisher Scientific, Agilent Technologies, Rapid Novor, and Creative Proteomics enhance instrumentation, reagents, and analytical service capabilities; however, high operational costs and data-analysis complexity remain major restraints.

- Regionally, North America leads with 38–40% share, followed by Europe at 29–31% and Asia-Pacific at 20–22%, while reagents & consumables remain the dominant product segment due to recurring usage in sequencing workflows.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product & Service

Protein sequencing products dominate the market, with reagents and consumables holding the largest share due to their recurring use in Edman degradation, mass spectrometry workflows, and sample preparation protocols. High assay frequency in proteomics research and biopharmaceutical characterization drives continuous demand for purification kits, digestion enzymes, labeling reagents, and sequencing-grade chemicals. Instruments such as advanced LC-MS/MS platforms gain traction as labs expand high-throughput capabilities, while software adoption accelerates with the need for automated de novo sequencing and post-translational modification analysis. Protein sequencing services continue to grow as organizations outsource complex, data-intensive analyses.

- For instance, Agilent Technologies’ Bravo Automated Sample Prep platform processes 96 samples in under 60 minutes, ensuring consistent peptide digestion and cleanup.

By Application

Bio-therapeutics represent the largest application segment, driven by the rising need for detailed structural analysis of monoclonal antibodies, fusion proteins, and recombinant biologics. Protein sequencing supports critical workflows including identity confirmation, batch consistency analysis, and impurity profiling across drug development pipelines. Genetic engineering applications expand as researchers integrate sequencing tools for protein variant validation, enzyme optimization, and synthetic biology constructs. The “others” segment includes food proteomics, forensic analysis, and environmental studies, all benefiting from improved accuracy and sensitivity of next-generation sequencing-compatible proteomic methods.

- For instance, Rapid Novor’s RAb-Seq platform delivers complete antibody heavy- and light-chain sequences with 100% amino-acid coverage, ensuring accurate lot-to-lot comparability.

By End Use

Pharmaceutical and biotechnology companies hold the dominant market share, supported by intensive R&D activities, regulatory mandates for protein characterization, and continuous biologics pipeline expansion. These organizations rely on sequencing for structural validation, biosimilar development, and quality assurance. Academic institutes and research centers remain significant users as proteomics research expands toward precision medicine, structural biology, and functional protein studies. The “others” category comprising CROs, government labs, and specialized diagnostic developers benefits from the growing need for outsourced high-resolution proteomic analysis and advanced characterization capabilities.

Key Growth Drivers

Expanding Biologics and Biotherapeutics Pipeline

The accelerating development of monoclonal antibodies, antibody–drug conjugates, recombinant proteins, and cell- and gene-therapy products serves as a major driver for protein sequencing demand. Modern biologics pipelines require precise primary structure confirmation, impurity profiling, glycosylation mapping, and post-translational modification analysis to meet stringent regulatory expectations. As biopharmaceutical manufacturers scale clinical candidates into commercial products, sequencing becomes essential for verifying molecular consistency across batches, optimizing upstream expression systems, and de-risking quality deviations. The rise of biosimilars further intensifies the need for deep structural characterization to demonstrate therapeutic equivalence. Increasing investments in targeted biologics, next-generation antibodies, and engineered enzymes reinforce the uptake of advanced de novo sequencing platforms and services. Collectively, these trends establish protein sequencing as a core analytical tool supporting innovation and compliance across the global biologics landscape.

· For example, Thermo Scientific’s Orbitrap Astral mass spectrometer reaches MS/MS speeds up to 200 Hz, which supports deep proteomic and sequencing workflows. The Orbitrap module can achieve sub-1 ppm mass accuracy with internal calibration, enabling precise characterization of complex proteins and therapeutic antibodies.

Advancements in Mass Spectrometry and Bioinformatics

Rapid progress in mass spectrometry sensitivity, resolution, and throughput significantly strengthens the market’s growth trajectory. Modern instruments enable accurate sequencing of complex proteins, highly glycosylated structures, and low-abundance targets that were previously challenging to analyze. Improvements in ion mobility spectrometry, fragmentation techniques, and hybrid MS platforms elevate de novo sequencing accuracy while shorteninganalysis time. Parallel growth in bioinformatics enhances data interpretation through AI-driven algorithms, improved PTM mapping, and automated peptide assembly workflows. These advancements reduce manual data processing, increase confidence scores, and support large-scale proteomic studies across research, clinical, and industrial settings. The integration of cloud-based analytical suites and machine-learning tools further accelerates adoption by enabling seamless storage, processing, and collaboration. The combined technological evolution creates a compelling driver for both hardware and software investments in protein sequencing workflows.

· For instance, Agilent’s 6546 LC/Q-TOF system delivers > 60,000 resolving power (FWHM) at high m/z and achieves sub-1 ppm mass accuracy in many applications. That level of precision supports detection of subtle post-translational modifications across complex proteomes.

Rising Adoption of Precision Medicine and Proteomics Research

Precision medicine initiatives across oncology, immunology, and rare disease research are increasing reliance on protein sequencing to uncover functional biomarkers and therapeutic targets. Researchers use sequencing to investigate mutation effects, characterize protein isoforms, and identify clinically relevant PTMs that influence disease progression and treatment response. Growing use of proteomics in early-stage drug discovery strengthens the need for high-resolution structural analysis to validate protein interactions and assess pathway modulation. Healthcare systems are also integrating large-scale proteomic datasets with genomic information to enable multi-omics-driven personalized treatment strategies. Investments in national and international precision-medicine consortia, clinical proteomics centers, and translational research facilities amplify demand for reliable sequencing tools and services. This shift toward patient-specific insights positions protein sequencing as a strategic enabler of next-generation diagnostics and targeted therapeutic development.

Key Trends & Opportunities

Expansion of De Novo Sequencing for Novel and Engineered Proteins

De novo sequencing is rapidly emerging as a significant trend, driven by the development of novel biologics, engineered enzymes, synthetic proteins, and therapeutic variants. Many of these molecules lack reference databases, making traditional sequencing approaches inadequate. Enhanced MS/MS fragmentation methods and deep-learning–based peptide assembly tools are increasing de novo accuracy, opening opportunities for analyzing complex or highly diverse protein structures. This trend also benefits companies developing next-generation antibodies, where variable regions and rare PTMs demand precise structural insights. As more research shifts toward engineered and non-standard proteins, providers offering advanced de novo sequencing solutions are positioned to capture substantial market opportunities.

- For instance, Rapid Novor’s REmAb® de novo sequencing platform determines full-length antibodies by employing a multi-step workflow involving multi-enzyme digestions and liquid chromatography-tandem mass spectrometry (LC-MS/MS), followed by analysis with advanced bioinformatics.

Outsourcing of Protein Sequencing Services

Biopharmaceutical firms and research institutions increasingly outsource sequencing workflows to specialized service providers to reduce operational burden, improve turnaround time, and access advanced instrumentation. This creates strong opportunities for CROs and analytical service companies equipped with high-resolution MS systems and dedicated bioinformatics platforms. Outsourcing is particularly attractive for organizations managing multiple biologics programs or requiring deep analytical validation for regulatory submissions. Additionally, service providers benefit from growing demand for custom sequencing, PTM profiling, and complex proteomic analysis that exceed internal lab capabilities. As outsourcing becomes a strategic cost-efficient model, specialized sequencing services will continue expanding.

- For instance, Creative Proteomics’ N-terminal Edman sequencing service can resolve up to the first 30–50 amino acids of a protein with picomole-level sensitivity. For full-length protein sequencing, the company applies multi-enzyme digestion combined with LC-MS/MS and specialized bioinformatics to assemble complete sequences with high confidence.

Integration of AI-Driven Analytical Platforms

AI and machine learning are reshaping protein sequencing workflows by enhancing automation, accelerating peptide assembly, and improving prediction accuracy for PTMs and structural variants. Advanced algorithms can process large datasets faster than manual methods, reducing bottlenecks and enabling high-throughput characterization. Opportunities arise for software developers and instrument companies that integrate AI-enabled analytical suites into existing sequencing pipelines. AI-driven platforms also support real-time data validation, error reduction, and customizable reporting tailored to regulatory requirements. The convergence of AI and proteomics is becoming a transformative opportunity for the entire protein sequencing ecosystem.

Key Challenges

Technical Complexity and Data Interpretation Limitations

Despite technological advances, protein sequencing remains technically demanding, particularly for proteins with extensive PTMs, disulfide bonds, or low-abundance peptide regions. De novo sequencing accuracy can decline for long or highly modified peptides, while data reconstruction requires advanced algorithms and expert interpretation. Fragmentation inefficiencies, ion suppression, and incomplete peptide coverage continue to hinder full-sequence recovery in certain protein classes. Additionally, the surge in multi-omics workflows generates large data volumes that necessitate sophisticated bioinformatics infrastructure and skilled personnel. The complexity of data interpretation becomes a barrier for smaller labs and organizations lacking specialized analytical resources.

High Instrumentation and Operational Costs

Acquiring, operating, and maintaining high-resolution mass spectrometry systems remains a significant challenge, especially for academic laboratories and small biotechnology firms. Advanced instruments require substantial capital investment, frequent calibration, and specialized environmental control systems. Operational costs increase further with the need for high-grade reagents, consumables, and trained technical staff. The financial burden limits market penetration in emerging regions and reduces the feasibility of in-house protein sequencing capabilities. Consequently, organizations must rely heavily on outsourcing, which introduces challenges related to turnaround time, data confidentiality, and limited customization. High costs remain one of the most persistent constraints to broader adoption.

Regional Analysis

North America

North America holds the largest share of the protein sequencing market, supported by strong biopharmaceutical R&D investments, advanced proteomics infrastructure, and widespread adoption of high-resolution mass spectrometry platforms. The U.S. dominates regional demand due to its expanding biologics pipeline, increasing focus on precision medicine, and extensive presence of sequencing service providers and academic proteomics centers. Regulatory emphasison detailed structural characterization also drives adoption among drug developers. Government-funded proteomics initiatives and growing partnerships between universities, CROs, and biotech companies further strengthen North America’s leadership position in protein sequencing technologies.

Europe

Europe represents the second-largest region, driven by strong proteomics research programs, well-established pharmaceutical hubs, and active investments in structural biology and biomarker discovery. Countries such as Germany, the U.K., Switzerland, and the Netherlands contribute significantly through advanced research centers and collaborations focused on protein engineering and antibody development. Regulatory requirements for deep analytical characterization in biosimilar development further boost protein sequencing adoption. The region’s emphasis on personalized medicine, coupled with widespread integration of high-resolution LC-MS technologies in research institutes and CRO networks, sustains Europe’s high market penetration and steady growth trajectory.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by expanding biotechnology industries, increasing investment in proteomics research, and rising demand for biologics manufacturing capabilities. China, Japan, South Korea, and India are rapidly adopting advanced sequencing instrumentation to support therapeutic protein development, quality control, and academic proteomics projects. Growing government funding for precision medicine, the rise of local biopharma companies, and the establishment of national proteomics centers support market expansion. The region’s strong outsourcing ecosystem, particularly in China and India, further accelerates demand for highly specialized sequencing services.

Latin America

Latin America’s protein sequencing market is developing steadily, supported by growing academic research activity and increasing interest in proteomics-based disease studies. Brazil and Mexico lead the region with expanding biotechnology clusters, improving laboratory infrastructure, and rising adoption of mass spectrometry systems in universities and research hospitals. While budget limitations and limited access to high-end sequencing platforms constrain rapid expansion, partnerships with global service providers and capacity-building initiatives are improving adoption levels. Growing biopharmaceutical manufacturing capabilities in select countries also contribute to the region’s incremental market growth.

Middle East & Africa

The Middle East & Africa region remains in an early growth stage, with demand primarily concentrated in research universities, government-funded health institutes, and emerging biotechnology labs. Countries such as the UAE, Saudi Arabia, and South Africa are gradually adopting proteomic tools to support public health research, oncology studies, and academic protein analysis. Limited availability of advanced MS instrumentation and high operational costs pose barriers; however, rising investments in healthcare modernization and collaborations with global research organizations are enabling greater access to sequencing services. Adoption is expected to strengthen as regional life-science capabilities expand.

Market Segmentations:

By Product & Service

- Protein Sequencing Products

- Reagents & Consumables

- Instruments

- Software

- Protein Sequencing Services

By Application

- Bio-therapeutics

- Genetic Engineering

- Others

By End Use

- Academic Institutes & Research Centers

- Pharmaceutical & Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the protein sequencing market is characterized by a mix of established analytical instrumentation companies, specialized sequencing service providers, and emerging bioinformatics innovators. Industry leaders focus on expanding their portfolios of high-resolution mass spectrometry platforms, sequencing-grade reagents, and advanced data interpretation software to strengthen their market presence. Strategic priorities include improving de novo sequencing accuracy, enhancing PTM analysis, and accelerating turnaround times for structural characterization workflows. Companies increasingly invest in AI-enabled analytical suites and cloud-based proteomics solutions to differentiate their offerings. Partnerships between instrument manufacturers, CROs, and biotechnology firms are becoming more common as organizations seek integrated hardware–software–service ecosystems. Meanwhile, service providers compete on expertise, customization capabilities, and regulatory-aligned reporting, especially for biopharmaceutical clients performing comparability studies, identity confirmation, and impurity profiling. Continuous innovation in MS hardware, automation, and computational proteomics reinforces competition and drives market evolution.

Key Player Analysis

- Creative Proteomics

- Agilent Technologies, Inc.

- Rapid Novor, Inc.

- Thermo Fisher Scientific, Inc.

- Proteome Factory AG

- Alphalyse

- Bioinformatics Solutions Inc.

- Shimadzu Corporation

Recent Developments

- In June 2025, Thermo Fisher Scientific, Inc. introduced two next-generation mass-spectrometry instruments delivering enhanced analytical performance and speed for complex proteome and protein-structure analysis.

- In March 2025, Creative Proteomics launched a cut-ting-edge N-terminal Edman Degradation service enabling verification of N-terminal sequences in therapeutic and engineered proteins.

- In January 2025, Rapid Novor, Inc. announced a grant program for in-kind access to its protein sequencing and epitope-mapping service advancing non-DNA-based antibody sequencing workflows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product & Service, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for protein sequencing will rise as biologics, biosimilars, and engineered therapeutic proteins become central to drug development pipelines.

- Advancements in high-resolution mass spectrometry will enable faster, more accurate full-length protein sequencing and PTM analysis.

- AI-driven bioinformatics platforms will significantly improve de novo sequencing accuracy and automate complex data interpretation.

- Outsourcing of sequencing services will expand as biopharma companies seek specialized expertise and faster turnaround times.

- Multi-omics integration will strengthen the role of protein sequencing in precision medicine, biomarker discovery, and disease-pathway mapping.

- Increasing adoption of cloud-based analytical workflows will support large-scale proteomics projects and global collaboration.

- Miniaturized and automated sequencing systems will enhance accessibility for academic and mid-sized research labs.

- Regulatory requirements for deeper structural characterization will drive greater use of sequencing in quality control and comparability studies.

- Emerging markets in Asia-Pacific will accelerate adoption due to expanding biopharma infrastructure and proteomics initiatives.

- Continuous innovation in sample preparation, fragmentation techniques, and ion-mobility technologies will broaden sequencing applications across industries.

Market Segmentation Analysis:

Market Segmentation Analysis: