Market Overview:

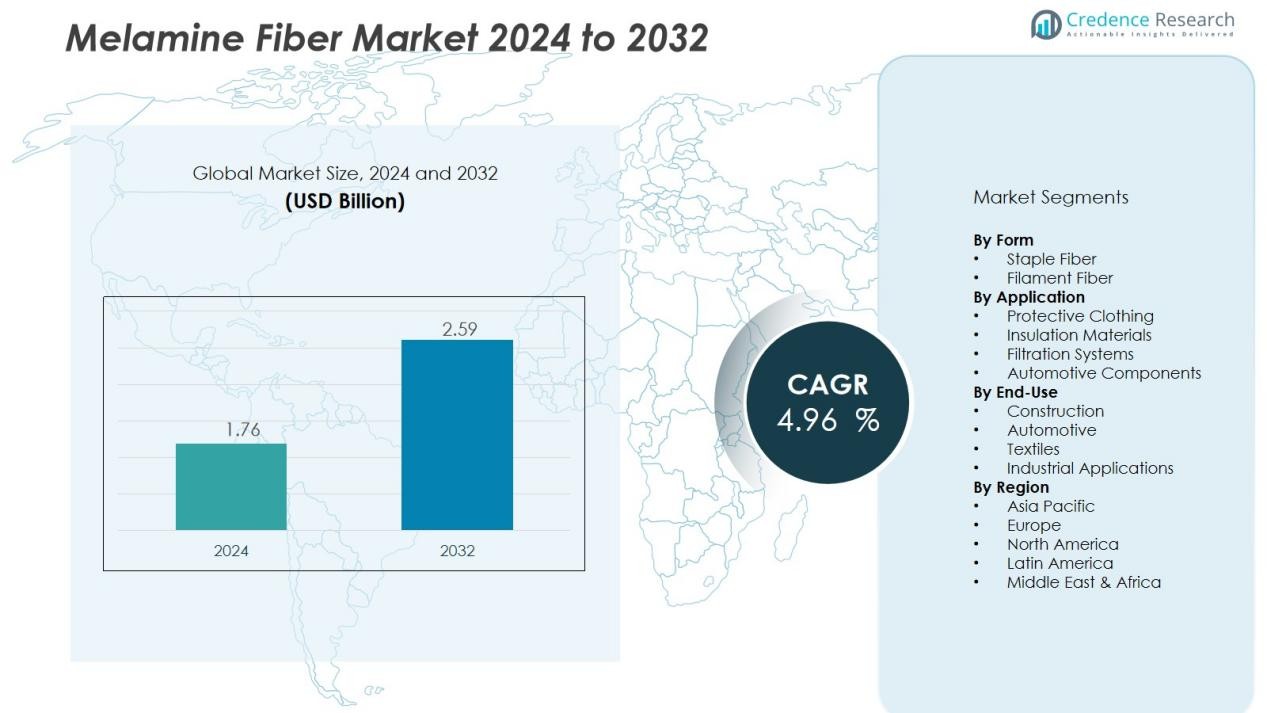

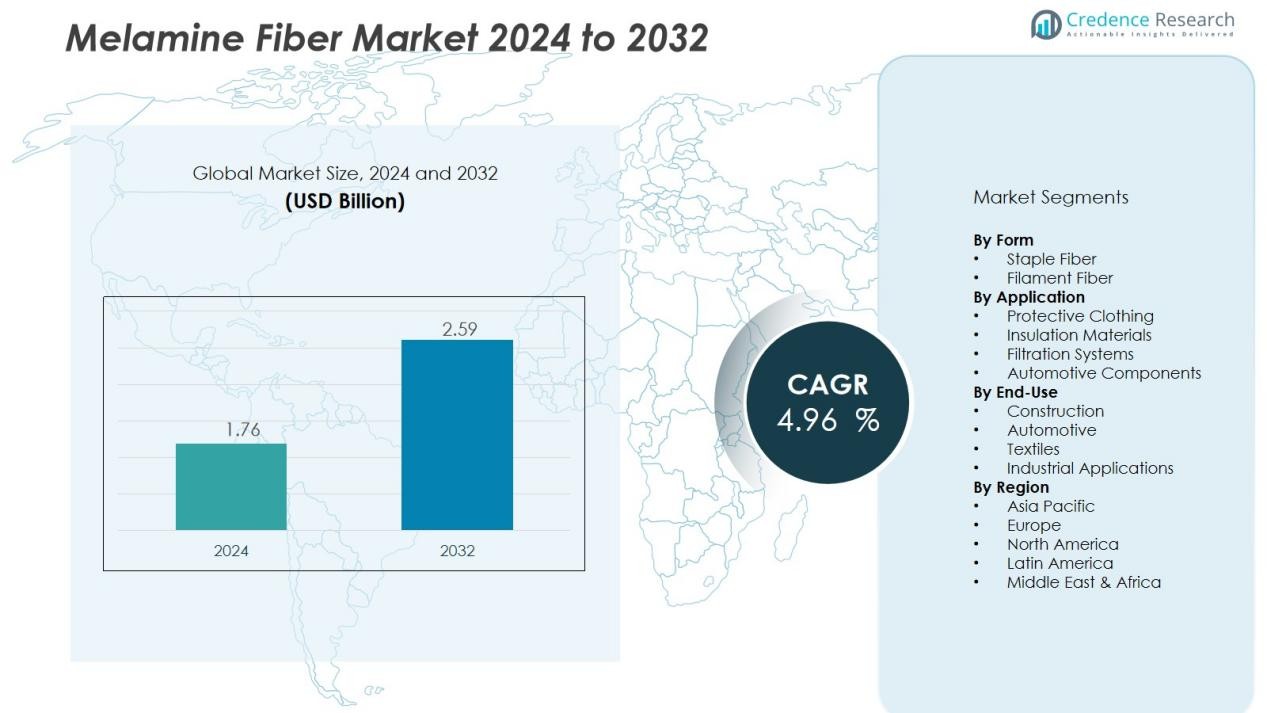

The Melamine Fiber Market size was valued at USD 1.76 billion in 2024 and is anticipated to reach USD 2.59 billion by 2032, at a CAGR of 4.96 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Cyclotron Market Size 2024 |

USD 1.76 Billion |

| Medical Cyclotron Market, CAGR |

4.96 % |

| Medical Cyclotron Market Size 2032 |

USD 2.59 Billion |

Market growth is primarily driven by the growing need for fire-retardant materials in industrial and commercial sectors. Stricter fire-safety regulations, coupled with the rising use of insulation materials in construction and energy applications, are significantly boosting product adoption. Additionally, increasing demand for durable and lightweight protective clothing in manufacturing, firefighting, and military operations continues to support market expansion. Technological advancements and the development of eco-efficient fiber variants further enhance growth opportunities.

Regionally, Asia-Pacific leads the market due to rapid industrialization, large-scale infrastructure projects, and the expanding automotive sector. Europe remains a key consumer, supported by strong regulatory frameworks for safety and sustainability. North America shows steady growth driven by the adoption of high-performance materials in construction and protective gear. Emerging regions such as Latin America and the Middle East are also witnessing gradual uptake as awareness of fire-resistant materials increases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Melamine Fiber Market was valued at USD 1.76 billion in 2024 and is expected to reach USD 2.59 billion by 2032, growing at a CAGR of 4.96% during the forecast period.

- Asia-Pacific leads the market, holding the largest share due to rapid industrialization, large-scale infrastructure projects, and a growing automotive sector. Europe follows closely, driven by strong regulatory frameworks and a focus on safety and sustainability, while North America maintains steady growth with a focus on high-performance materials for construction and protective gear.

- The fastest-growing region is Latin America, which is witnessing gradual uptake due to increasing awareness of fire-resistant materials and industrial growth.

- In terms of market segmentation, the staple fiber segment holds the largest share, accounting for 55%, while the filament fiber segment captures 45% of the market.

- The protective clothing segment leads in application share, holding 40%, followed by insulation materials at 35%, and automotive components at 25%.

Market Drivers:

Market Drivers:

Rising Demand for Fire-Resistant Materials

The increasing emphasis on safety in industries such as construction, automotive, and textiles is one of the primary drivers of the Melamine Fiber Market. Melamine fibers are recognized for their exceptional fire-retardant properties, making them a preferred choice in applications where fire resistance is critical. Regulatory frameworks across regions are becoming more stringent, encouraging businesses to adopt materials that enhance fire safety. The growing need for fire-resistant materials is further amplified by expanding construction and infrastructure projects globally.

- For instance, Saint-Gobain offers various insulation and construction panels, such as certain gypsum boards and mineral wool products, that achieve the highest possible non-combustibility ratings (e.g., Euroclass A1 or A2-s1, d0) when tested to relevant standards like EN 13501.

Growth in Automotive and Industrial Applications

The automotive sector’s shift toward lightweight and durable materials boosts the demand for melamine fibers. These fibers offer excellent heat resistance and durability, making them suitable for automotive components, including interior fabrics and insulation materials. The expanding use of melamine fibers in industrial applications, such as filtration and insulation, drives market growth. Companies in these sectors are increasingly seeking cost-effective yet high-performance materials to meet efficiency and safety standards.

- For instance, Altair’s 2024 Enlighten Award highlighted CompositeEdge’s EcoFiber AFP approach, which automates fiber placement using natural fiber composites to reduce weight while maintaining strength.

Technological Advancements in Fiber Manufacturing

Innovations in fiber production techniques have enhanced the capabilities of melamine fibers, making them more versatile and cost-effective. Advancements in manufacturing processes allow for the development of fibers with superior strength, stability, and environmental resistance. These improvements enable melamine fibers to meet the growing demand for high-performance materials in sectors such as protective clothing, military applications, and energy-efficient buildings, further expanding the Melamine Fiber Market.

Increasing Focus on Sustainable and Eco-Friendly Materials

Sustainability concerns are prompting industries to adopt eco-friendly materials, including melamine fibers. Manufacturers are increasingly focusing on the environmental impact of their products, pushing for the development of more sustainable melamine fiber options. These fibers are often produced using more energy-efficient processes, and their durability contributes to a longer product lifecycle, appealing to businesses aiming to reduce their environmental footprint. This growing focus on sustainability is expected to continue driving the market’s expansion.

Market Trends:

Increased Adoption of Melamine Fiber in Protective Textiles

One significant trend in the Melamine Fiber Market is the growing adoption of melamine fibers in protective textiles, driven by rising safety concerns across industries. Melamine fibers offer exceptional heat and fire resistance, making them ideal for use in personal protective equipment (PPE) such as firefighting suits, industrial uniforms, and military gear. The demand for these textiles is increasing as industries face stricter regulations regarding worker safety and fire hazards. As a result, manufacturers are innovating to develop high-performance fibers with improved comfort and functionality, meeting both safety and usability standards. This trend is particularly prominent in regions with strong industrial sectors, including North America and Europe.

- For Instance, Research indicates ongoing development in intelligent thermoregulation systems and the use of advanced fibers in protective clothing, as well as the use of melamine fiber blends in fire-resistant fabrics, with major companies like DuPont and 3M active in the overall PPE market.”

Sustainability and Eco-Friendly Product Development

Sustainability is becoming a major trend in the melamine fiber industry, as manufacturers are increasingly focusing on producing eco-friendly products. The demand for sustainable materials is rising as businesses aim to reduce their environmental footprint, both in production and product life cycles. Melamine fibers are often considered more environmentally friendly than synthetic alternatives due to their durability and ability to contribute to longer product lifespans. Manufacturers are adopting green technologies in fiber production, including energy-efficient methods and the use of recycled materials, to cater to the growing preference for eco-conscious products. This shift towards sustainability is expected to drive innovation within the Melamine Fiber Market, aligning with global trends toward reducing environmental impact.

- For instance, leading panel manufacturers commonly introduce low-emission or formaldehyde-free resin lines that significantly reduce formaldehyde emissions, with some products able to meet stringent standards such as the European EN 717-1 chamber method for very low E1 or ‘E0’ class panels.

Market Challenges Analysis:

High Production Costs and Price Volatility

One of the key challenges facing the Melamine Fiber Market is the high production cost associated with manufacturing melamine fibers. The complex production process, including raw material sourcing and specialized processing techniques, contributes to the overall expense. This high cost can limit the widespread adoption of melamine fibers, particularly in price-sensitive markets where cheaper alternatives are more attractive. Furthermore, fluctuations in raw material prices and energy costs can lead to price volatility, making it difficult for manufacturers to maintain consistent profit margins. This challenge may hinder market growth in the short term, especially for small and medium-sized enterprises.

Limited Awareness and Adoption in Emerging Markets

Another challenge is the limited awareness and adoption of melamine fibers in emerging markets. While the demand for fire-resistant materials is growing, many industries in developing regions remain unaware of the benefits melamine fibers offer over traditional materials. Lack of technical expertise and infrastructure further complicates the market penetration in these areas. Overcoming these barriers requires significant educational efforts and investment in market development, which can slow down the market’s expansion in regions like Latin America and parts of Asia.

Market Opportunities:

Expansion in Emerging Markets

The Melamine Fiber Market presents significant growth opportunities in emerging markets, where industrialization and infrastructure development are accelerating. As industries in regions like Asia-Pacific, Latin America, and the Middle East expand, there is an increasing demand for fire-resistant and durable materials. Melamine fibers, with their superior heat stability and resistance, are well-positioned to meet these needs. The rise in construction, automotive, and manufacturing industries in these regions offers a lucrative opportunity for market players to introduce their products. Investment in awareness campaigns and local production could further fuel growth in these underpenetrated markets.

Innovation in Eco-Friendly and High-Performance Applications

There is a growing opportunity in the development of eco-friendly and high-performance melamine fibers. With sustainability becoming a key priority globally, the demand for environmentally responsible materials is on the rise. Melamine fibers, known for their durability and recyclability, can meet this demand. By focusing on innovations such as recyclable fibers or products made with renewable resources, manufacturers can tap into the environmentally-conscious consumer base. Additionally, applications in advanced protective clothing, insulation, and high-temperature industrial settings continue to expand, creating new avenues for innovation and growth in the melamine fiber sector.

Market Segmentation Analysis:

By Form

The Melamine Fiber Market is segmented based on form into staple fiber and filament fiber. Staple fibers dominate the market due to their wide range of applications in textiles and non-woven products. These fibers are primarily used in the production of fire-resistant clothing, insulation, and other protective materials. Filament fibers are also gaining traction, particularly in high-performance applications that require superior strength and durability, such as in industrial fabrics and automotive components. The increasing demand for flame-retardant materials drives the growth of both segments, with staple fiber taking a significant share of the market.

- For Instance, In textile manufacturing, process optimization techniques such as advanced carding systems are used to improve efficiency and fiber consistency. Achieving consistent staple fiber lengths, which can range broadly (e.g., from less than 1 inch to over 5 inches, depending on the fiber type and end product specifications), is a critical factor in producing high-quality yarn or non-woven fabrics.

By Application

In terms of application, the melamine fiber market is primarily driven by the demand for fire-resistant materials. Key applications include protective clothing, insulation, filtration, and automotive components. The growth of the construction and automotive industries, where heat-resistant materials are crucial, supports the increasing adoption of melamine fibers. The rise in demand for flame-retardant textiles in military, industrial, and firefighting gear also contributes to the growth of this segment. Its versatile use across various industries makes melamine fiber an essential material in safety-critical applications.

- For Instance, High-performance materials are used in filtration media for industrial air cleaners to achieve enhanced filtration efficiency, particularly at elevated temperatures.

By End-Use

The melamine fiber market is divided into several end-use industries, with the major ones being construction, automotive, and textiles. In construction, the demand for melamine fibers in insulation and fireproof materials is strong. In automotive, melamine fibers are used for interior fabrics and heat-resistant components. The textile sector uses these fibers in protective clothing and safety gear. The growing focus on safety and fire prevention, coupled with the rise in industrial activity, ensures continued demand across these sectors.

Segmentations:

By Form

- Staple Fiber

- Filament Fiber

By Application

- Protective Clothing

- Insulation Materials

- Filtration Systems

- Automotive Components

By End-Use

- Construction

- Automotive

- Textiles

- Industrial Applications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Market Analysis

North America holds a substantial share of the Melamine Fiber Market, driven by the high demand for fire-resistant materials in various industries. The region is particularly strong in the construction, automotive, and protective textiles sectors, where safety standards are stringent. The presence of major manufacturers and technological advancements in fiber production contribute to market growth. The demand for melamine fibers in protective clothing and industrial applications continues to rise due to increasing awareness of fire hazards and the need for safety. In the automotive sector, melamine fibers are utilized for heat-resistant components, further boosting market penetration. The United States remains the dominant country, with Canada also showing growth due to its expanding industrial base.

Europe Market Analysis

Europe accounts for a significant share of the global market, driven by robust regulatory frameworks and increasing industrial demand for fire-resistant materials. The region’s market growth is fueled by the automotive, construction, and textiles industries, which prioritize safety and durability. Melamine fibers are in high demand for use in protective clothing, insulation, and automotive components. European countries, particularly Germany, France, and the UK, are at the forefront of adopting advanced materials for both industrial and consumer applications. Strong environmental regulations and a growing emphasis on sustainability have also led to an increased interest in eco-friendly melamine fiber solutions.

Asia-Pacific Market Analysis

Asia-Pacific dominates the Melamine Fiber Market in terms of volume, with countries like China, India, and Japan showing significant growth in demand. The rapid industrialization and infrastructural development in this region are key drivers. As industries such as automotive, construction, and textiles expand, the need for heat-resistant and fire-retardant materials increases. China, being the largest manufacturing hub in the region, contributes significantly to melamine fiber production and consumption. India is witnessing growing demand in sectors such as automotive and construction, while Japan remains a leader in advanced manufacturing and technology adoption. The region’s large-scale industrialization ensures continued growth in the melamine fiber market.

Key Player Analysis:

- BASF SE

- Engineered Fibers Technology, LLC

- Basofil Fibers, LLC

- Borealis AG

- smartMELAMINE d.o.o.

Competitive Analysis:

Competitive dynamics within the Melamine Fiber Market exhibit moderate concentration, with several major players driving innovation and production. In the second line, key companies include BASF SE, Engineered Fibers Technology, LLC, Basofil Fibers, LLC, Borealis AG and smartMELAMINE d.o.o.. It stresses high entry barriers due to specialized production processes and significant capital investments, which limit new competitors. These incumbent firms maintain competitive advantage through proprietary technologies, broad product portfolios, and global customer networks.

BASF SE leads the market with its Basofil® fibers and Basotect® melamine foam, leveraging decades of expertise and extensive R&D capability. Engineered Fibers Technology, LLC and Basofil Fibers, LLC focus on high‑performance melamine fibers for extreme environments. Borealis AG offers integrated chemical solutions and supports broad end‑use sectors, while smartMELAMINE d.o.o. specializes in melt‑blown melamine nonwovens for insulation and filtration. Competitive pressure centers around product innovation, cost efficiency, and sustainability credentials, and companies that enhance value through these dimensions increase their market share and reinforce their positioning.

Recent Developments:

- In October 2025, BASF SE reached a binding agreement with the Carlyle Group to carve out its Coatings business, forming a standalone coatings company in which BASF will retain a 40% equity stake.

- In November 2025, it was reported that Borealis (together with Borouge) and Nova Chemicals would be merged under a new agreement with OMV and ADNOC, creating one of the world’s largest polyolefins producers.

Report Coverage:

The research report offers an in-depth analysis based on Form, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Future Outlook:

- The Melamine Fiber Market is expected to see continued growth as demand for fire-resistant materials increases across various industries.

- Technological advancements in fiber manufacturing will improve product performance and efficiency, driving further adoption.

- The shift towards sustainable materials will encourage the development of eco-friendly melamine fibers, appealing to environmentally conscious consumers.

- The growing automotive industry will continue to create demand for heat-resistant melamine fibers in components like interior fabrics and insulation.

- The construction sector will remain a key contributor, with a strong demand for fireproofing materials and insulation solutions.

- The expanding protective clothing market, especially for firefighting and industrial safety gear, will provide significant opportunities.

- Asia-Pacific will maintain its dominant position in the market, driven by industrialization and infrastructure growth in key countries like China and India.

- Increased regulations around fire safety and environmental sustainability will further boost melamine fiber adoption in developed regions.

- New applications in filtration and textiles will diversify the market, leading to further growth.

- With rising awareness and demand for safety standards, the melamine fiber market is poised to expand in both established and emerging markets, creating diverse opportunities.

Market Drivers:

Market Drivers: