Market Overview

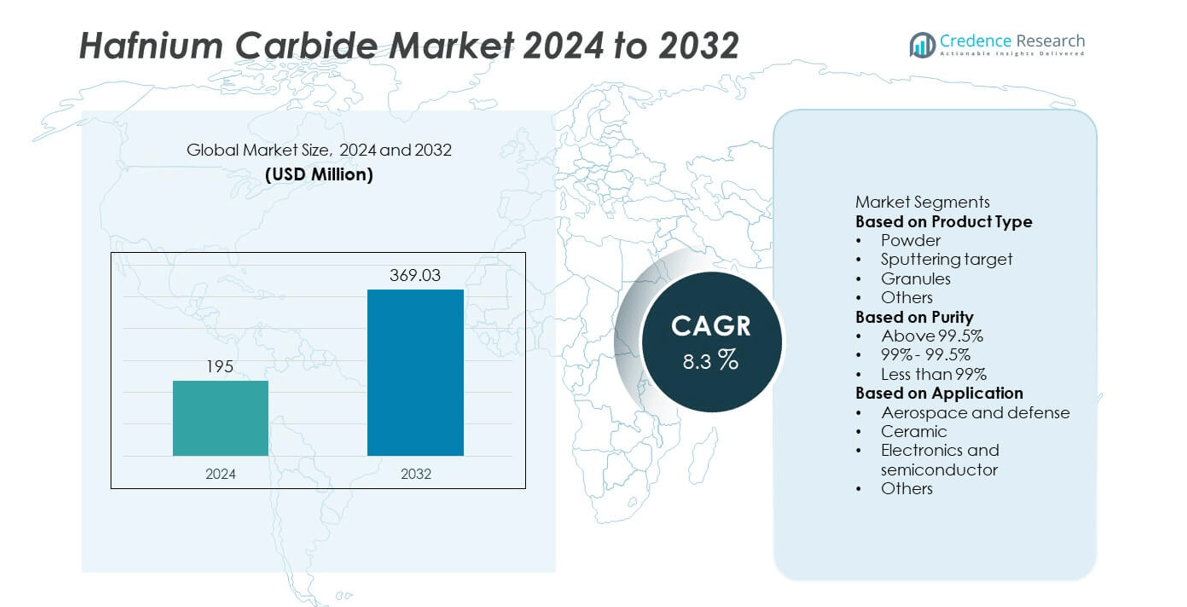

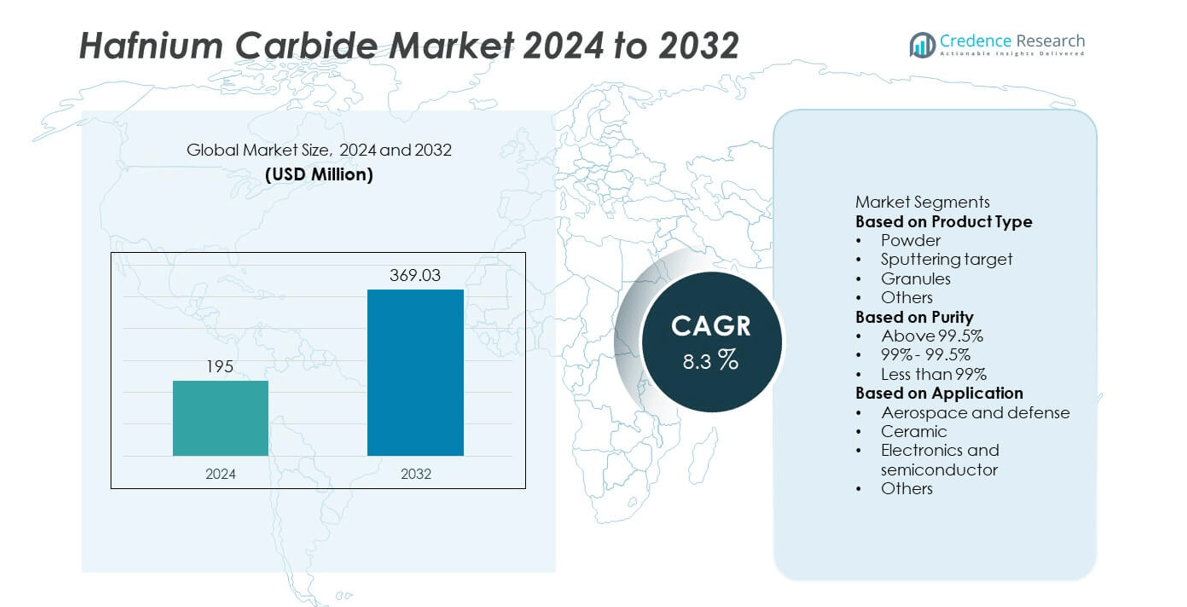

The Hafnium Carbide Market was valued at USD 195 million in 2024 and is projected to reach USD 369.03 million by 2032, registering a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hafnium Carbide Market Size 2024 |

USD 195 million |

| Hafnium Carbide Market, CAGR |

8.3% |

| Hafnium Carbide Market Size 2032 |

USD 369.03 million |

The Hafnium Carbide market is driven by leading players such as Hunan Huawei Advanced Materials Co., Ltd., Treibacher Industrie AG, American Elements, Materion Corporation, China Rare Metal Material Co., Ltd., Zirconium Research Corp., Pacific Industrial Development Corporation (PIDC), Advanced Ceramics Manufacturing, LLC, Stanford Advanced Materials, and Alfa Aesar (Thermo Fisher Scientific). These companies focus on high-purity carbide powders, sputtering targets, and ultra-high temperature ceramic materials for aerospace, defense, and semiconductor applications. Asia-Pacific leads the market with a 30% share, supported by strong aerospace and electronics manufacturing growth. North America follows with 32%, driven by hypersonic research and defense programs, while Europe holds 28%, supported by ceramic engineering and propulsion system development.

Market Insights

- The Hafnium Carbide market reached USD 195 million in 2024 and is projected to reach USD 369.03 million by 2032, registering a CAGR of 8.3% during the forecast period.

- Demand continues to grow as aerospace and defense programs adopt ultra-high temperature ceramics for hypersonic systems and re-entry platforms. Powder form holds a 58% share due to its suitability for thermal protection structures, while aerospace and defense lead applications with 46% driven by propulsion and shielding needs.

- Key trends include advancements in additive manufacturing feedstock, nano-engineered carbide powder, and UHTC composite development. Increasing semiconductor usage for sputtering targets and high-temperature electronics strengthens future material innovation.

- Competitive landscape includes Hunan Huawei Advanced Materials Co., Ltd., Treibacher Industrie AG, American Elements, Materion Corporation, China Rare Metal Material Co., Ltd., and others focusing on purity optimization, oxidation resistance, and specialized coating technology for spacecraft and turbine components.

- Asia-Pacific holds 30%, supported by expanding aerospace and semiconductor manufacturing, North America accounts for 32% driven by hypersonic research and private space programs, while Europe maintains 28% due to advanced ceramic engineering. Latin America and Middle East & Africa represent the remaining regional presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Powder form leads the market with a market share of 58%, driven by its wide adoption in ultra-high temperature ceramics, aerospace thermal protection components, cutting tools, and additive manufacturing feedstock. Manufacturers prefer hafnium carbide powder for its ease of processing, strong sintering performance, and ability to form dense, heat-resistant structures. Sputtering targets and granules follow, used in thin-film coatings and specialized composite production. Demand for powdered hafnium carbide increases as defense and space programs invest in hypersonic vehicle development and high-temperature propulsion systems. The segment benefits from advancements in powder metallurgy and nanostructured material engineering.

- For instance, American Elements provides HfC sputtering targets at 99.9% purity for refractory coating systems used in aerospace testing chambers operating above 2,000°C. The segment benefits from advancements in powder metallurgy and nanostructured material engineering.

By Purity

The above 99.5% purity segment dominates with a market share of 51%, driven by demand from aerospace, semiconductor, and research applications that require extreme thermal stability and minimal impurity tolerance. High-purity hafnium carbide supports superior oxidation resistance and electrical conductivity, making it valuable for next-generation propulsion systems, ultra-high temperature coatings, and precision electronic components. The 99%–99.5% category remains important for industrial ceramics and durable tooling, while lower purity grades are used in cost-sensitive refractory applications. Growth in high-purity demand is supported by investments in space programs and semiconductor manufacturing requiring advanced material performance.

- For instance, Stanford Advanced Materials offers 99.2% purity HfC for ceramic dies and induction furnace parts rated for 1,800–2,200°C thermal cycles. Growth in high-purity demand is supported by investments in space programs and semiconductor manufacturing requiring advanced material performance.

By Application

The aerospace and defense sector holds the dominant market share of 46%, driven by increased development of hypersonic aircraft, reusable launch systems, and high-temperature propulsion technologies. Hafnium carbide is used in thermal protection systems, rocket nozzles, leading edges, and control surfaces due to its exceptional melting point and oxidation resistance. Electronics and semiconductors also contribute significant demand for sputtering targets and high-temperature conductive components. Ceramic manufacturers use hafnium carbide to enhance wear resistance and thermal shock stability. Market growth is strengthened by global defense modernization, expanding satellite launches, and rising use of ultra-high-temperature materials in advanced manufacturing.

Key Growth Drivers

Rising Adoption in Hypersonic and Aerospace Applications

Hafnium carbide demand grows as aerospace and defense programs develop hypersonic aircraft, reusable launch systems, and ultra-high temperature propulsion technologies. Its extremely high melting point and strong oxidation resistance make it suitable for leading edges, thermal protection systems, and rocket nozzle components. Space agencies and defense contractors invest in advanced materials to withstand extreme aerodynamic heating and mission-critical stress. The driver strengthens as global security initiatives prioritize rapid-response flight platforms and long-range strike capabilities. Collaboration between material research institutes and aerospace manufacturers accelerates innovation in hafnium carbide composites and coating technologies.

- For instance, Arceon B.V. develops HfC-reinforced ultra-high temperature ceramic matrix composites (UHTCMCs) for aerospace applications such as rocket nozzle parts, where materials must withstand extreme heat and thermal flux during propulsion system trials.

Expansion of Electronics and Semiconductor Manufacturing

The semiconductor sector increases hafnium carbide usage in sputtering targets, thin films, and high-temperature electronic components. Its high hardness, conductivity, and thermal stability support manufacturing of microelectronics, memory devices, and wear-resistant coatings for chip fabrication tools. Growing demand for faster processing speeds, power-efficient chips, and durable circuit materials drives investment in advanced refractory carbides. Rapid expansion of data centers, AI computing, and electric mobility electronics furthers market opportunities. Material suppliers and semiconductor foundries focus on improving purity levels and deposition performance to meet next-generation device requirements.

- For instance, leading ceramics suppliers offer Hafnium Carbide (HfC) and Zirconium Carbide (ZrC) coating materials used in extreme aerospace environments, such as rocket nozzles and leading edges of hypersonic vehicles, where they maintain structural integrity and resist oxidation at operating temperatures approaching 4,000°C due to their ultra-high melting points and thermal stability.

Growth in Advanced Technical Ceramics and Additive Manufacturing

Technical ceramic producers integrate hafnium carbide into ultra-high temperature composites used in cutting tools, wear plates, and industrial furnace components. Powder-based hafnium carbide also supports metal additive manufacturing and 3D-printed aerospace structures requiring extreme heat resistance. Growing interest in lightweight, durable, and corrosion-resistant ceramic components enhances demand. Investments in powder metallurgy, nano-structured ceramic materials, and binder jetting processes accelerate adoption. Industrial automation, energy generation, and chemical processing sectors further support market expansion.

Key Trends & Opportunities

Development of Ultra-High Temperature Ceramic Composites

Manufacturers explore hafnium carbide reinforced composites paired with carbon-carbon and silicon carbide matrices to achieve superior thermal and mechanical performance. These materials support hypersonic flight, plasma-facing fusion reactor components, and next-generation turbine systems. Research opportunities arise in improving oxidation behavior, thermal shock resistance, and manufacturing scalability. Collaboration between universities, aerospace contractors, and defense agencies accelerates commercialization of UHTC components. Long-term opportunities emerge in space exploration, sustainable aviation, and nuclear energy applications.

- For instance, certain hafnium carbide–silicon carbide (HfC-SiC) ultra-high temperature ceramic (UHTC) coatings have been tested at heat fluxes up to 0.6 MW/m² (equivalent to approximately 525 Btu/ft²·sec), demonstrating survivability and protection to temperatures over 2,000°C for shorter periods in hot-gas environments.

Increasing Use in Thin-Film Coatings and Semiconductor Tooling

Growing use of hafnium carbide sputtering targets supports high-performance coatings for semiconductors, hard protective films, and optical components. Coating technologies improve wear resistance, reduce microfractures, and prolong equipment life in precision manufacturing. Opportunities expand as integrated circuit producers adopt refractory carbide layers for thermal management and advanced transistor designs. Thin-film applications extend into automotive electronics, sensors, and high-frequency communication systems.

- For instance, companies such as Stanford Advanced Materials (SAM), the Kurt J. Lesker Company, and MSE Supplies LLC manufacture Hafnium Carbide (HfC) sputtering targets with purity levels up to 99.5% or higher, enabling uniform thin-film deposition for advanced applications, including potential use in next-generation power semiconductor switches utilized in electric mobility platforms.

Key Challenges

High Production Costs and Raw Material Constraints

Hafnium carbide production requires high-purity hafnium feedstock, complex synthesis processes, and energy-intensive temperature management. These factors increase cost and limit large-scale industrial adoption. Dependence on limited global hafnium supply, tied to zirconium refining, creates additional price volatility. Industries with cost-sensitive applications face procurement challenges, encouraging research into alternative UHTC materials and recycling systems.

Manufacturing Complexity and Scaling Limitations

Processing hafnium carbide into dense, defect-free structures requires advanced sintering, hot pressing, or chemical vapor deposition methods, increasing manufacturing difficulty. Achieving consistent microstructure, purity, and thermal performance across large components remains a technical barrier. Limited technical expertise and specialized equipment restrict widespread commercial scaling. Addressing this challenge demands improvements in powder engineering, additive manufacturing compatibility, and streamlined fabrication processes.

Regional Analysis

North America

North America holds a market share of 32%, driven by strong demand from aerospace, defense, and advanced material research programs. The United States leads the region due to ongoing hypersonic aircraft development, space exploration projects, and investments in ultra-high temperature ceramic components. Hafnium carbide is used in thermal protection systems, rocket nozzles, and high-temperature coatings, supporting its adoption across NASA, defense contractors, and private space companies. Research universities and government laboratories advance material innovation, while powder metallurgy and additive manufacturing capabilities strengthen the supply ecosystem. Growth continues as national security initiatives and commercial space launches increase material utilization.

Europe

Europe accounts for a market share of 28%, supported by robust aerospace manufacturing, defense modernization, and ceramic material engineering. Germany, France, and the United Kingdom are key contributors due to ongoing investments in hypersonic aviation, reusable launch systems, and advanced propulsion research. Hafnium carbide is used in turbine coatings, thermal barrier systems, and semiconductor tooling, benefiting industrial manufacturing. Collaborative research between aerospace agencies, academic institutions, and material suppliers drives innovation in hafnium-based composites. The region’s focus on reducing high-temperature component degradation and expanding strategic defense capabilities strengthens long-term market opportunities.

Asia-Pacific

Asia-Pacific holds a market share of 30%, fueled by expanding aerospace programs, semiconductor manufacturing, and defense technology investments. China, Japan, South Korea, and India increase the use of hafnium carbide in ultra-high temperature ceramics, avionics protection surfaces, and electronic component coatings. Rapid growth in space missions, satellite production, and hypersonic platform development boosts material requirements. Semiconductor fabrication facilities use hafnium carbide sputtering targets and precision coatings for high-performance chip production. Government support for advanced materials research and expanding industrial manufacturing capability strengthens the regional supply chain and accelerates adoption across aerospace and electronics sectors.

Latin America

Latin America maintains a market share of 5%, driven by limited but rising demand from aerospace component manufacturing, mining equipment, and industrial refractory applications. Brazil leads the region due to its space launch initiatives and material research collaborations. Hafnium carbide adoption remains moderate, supported by ceramic tooling and furnace component production requiring high thermal resistance. Investment in higher-efficiency industrial systems and technology partnerships with global material suppliers gradually increases product utilization. Growth is supported by academic research programs exploring next-generation ceramic composites, though supply chain and cost factors constrain wider commercial deployment.

Middle East & Africa

The Middle East & Africa region holds a market share of 5%, supported by growing interest in high-temperature materials for aerospace, energy, and defense applications. The United Arab Emirates and Saudi Arabia invest in space programs, missile systems, and advanced propulsion research, increasing hafnium carbide usage. Industrial manufacturing and oil refinery operations adopt the material in extreme-heat equipment and protective ceramic components. Africa shows early-stage market development, primarily in mining and furnace technologies requiring durable refractory solutions. Market growth is influenced by strategic collaborations with research institutions and international material suppliers, enhancing access to advanced ceramic technologies.

Market Segmentations:

By Product Type

- Powder

- Sputtering target

- Granules

- Others

By Purity

- Above 99.5%

- 99% – 99.5%

- Less than 99%

By Application

- Aerospace and defense

- Ceramic

- Electronics and semiconductor

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the Hafnium Carbide market features key players including Hunan Huawei Advanced Materials Co., Ltd., Treibacher Industrie AG, American Elements, Materion Corporation, China Rare Metal Material Co., Ltd., Zirconium Research Corp., Pacific Industrial Development Corporation (PIDC), Advanced Ceramics Manufacturing, LLC, Stanford Advanced Materials, and Alfa Aesar (Thermo Fisher Scientific). Companies compete based on purity levels, powder particle size control, thermal performance, and supply reliability for aerospace, defense, electronics, and ceramic applications. Major manufacturers focus on improving ultra-high temperature stability, oxidation resistance, and sintering characteristics to serve hypersonic propulsion and thermal protection system demand. Strategic partnerships with aerospace contractors, research organizations, and semiconductor firms support material validation and product qualification. Continuous investments in powder metallurgy, nano-structured carbide production, and additive manufacturing compatibility enhance competitive positioning. Companies also expand global distribution networks and strengthen sourcing of hafnium feedstock to mitigate supply chain risks and meet increasing demand for high-performance refractory materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hunan Huawei Advanced Materials Co., Ltd.

- Treibacher Industrie AG

- American Elements

- Materion Corporation

- China Rare Metal Material Co., Ltd.

- Zirconium Research Corp.

- Pacific Industrial Development Corporation (PIDC)

- Advanced Ceramics Manufacturing, LLC

- Stanford Advanced Materials

- Alfa Aesar (Thermo Fisher Scientific)

Recent Developments

- In 2025, Hunan Huawei Advanced Materials Co., Ltd. has been recognized as a key player focusing on scaled manufacturing and export strategies for hafnium carbide products, especially serving aerospace and defense sectors with products exhibiting exceptional heat resistance and structural integrity under extreme conditions.

- In January 2023, American Elements announced an expansion of its production facilities for rare earth and less common metals organometallic compounds, including hafnium compounds, to meet growing demand from thin film deposition and catalyst manufacturers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Purity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as hypersonic flight and reusable launch systems increase material demand.

- Aerospace and defense contractors will adopt hafnium carbide composites for ultra-high temperature protection.

- Semiconductor manufacturers will increase use of hafnium carbide sputtering targets for advanced chip fabrication.

- Additive manufacturing will boost consumption of high-purity hafnium carbide powders and feedstock materials.

- Research initiatives will focus on improving oxidation resistance and thermal shock performance.

- Partnerships between material producers and aerospace research agencies will accelerate product qualification.

- Industrial furnace and high-temperature tooling applications will support broader commercial adoption.

- Supply chain optimization and recycling technologies will help mitigate raw material constraints.

- Manufacturers will enhance nano-structured and sinter-ready carbide formulations for improved performance.

- Expansion of space exploration, satellite deployment, and defense modernization will strengthen long-term market growth.