Market Overview

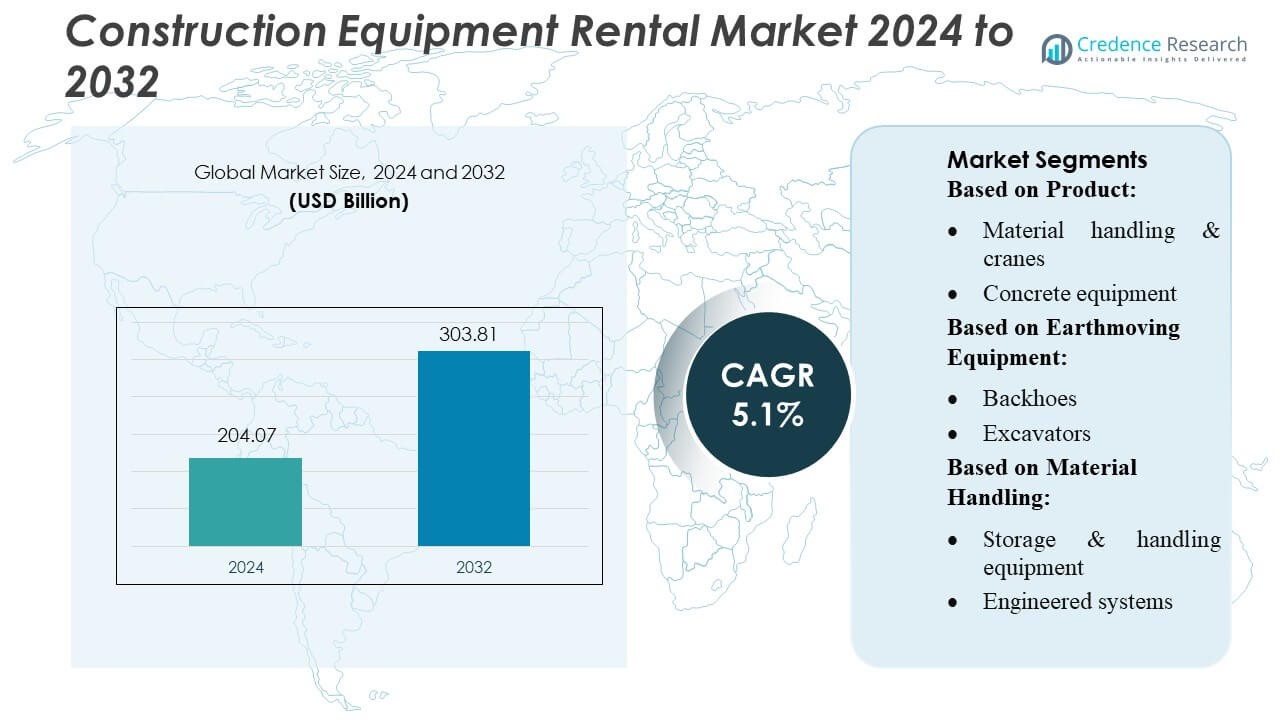

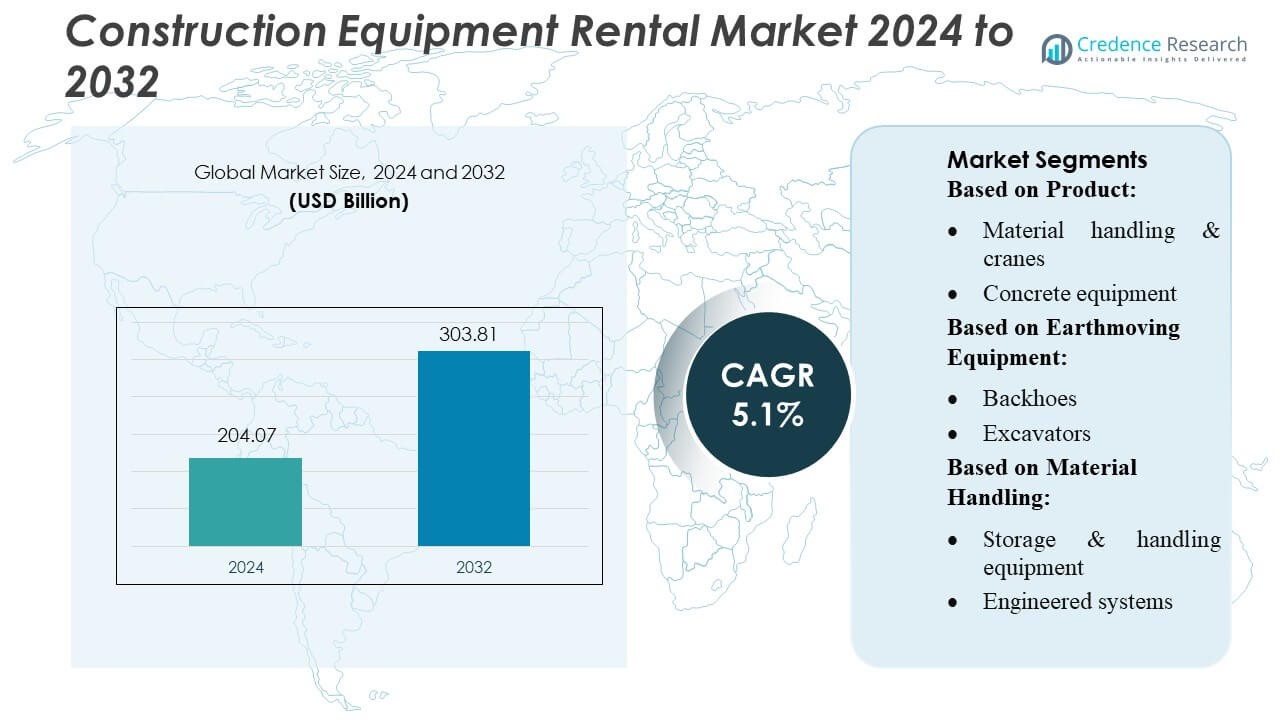

Construction Equipment Rental Market size was valued USD 204.07 billion in 2024 and is anticipated to reach USD 303.81 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Rental Market Size 2024 |

USD 204.07 Billion |

| Construction Equipment Rental Market, CAGR |

5.1% |

| Construction Equipment Rental Market Size 2032 |

USD 303.81 Billion |

The construction equipment rental market is anchored by major firms such as United Rentals, Inc., Caterpillar Inc., Liebherr-International AG, Ahern Rentals Inc., Cramo Plc, Byrne Equipment Rental, Finning International Inc., Kanamoto Co., Ltd., AKTIO Corporation, and Maxim Crane Works, L.P., which together drive innovation and service excellence across regions. These players invest heavily in fleet modernization, telematics-enabled machinery, and comprehensive maintenance programs to enhance utilization and customer retention. They also pursue strategic alliances and acquisitions to expand their geographical footprints. The market is dominated by the Asia-Pacific region, which accounts for 49.7 % of global rental demand, propelled by large-scale infrastructure investments, urbanization, and the growing preference for rented machinery.

Market Insights

- The construction equipment rental market reached USD 204.07 billion in 2024 and is projected to hit USD 303.81 billion by 2032, advancing at a 5.1% CAGR during the forecast period.

- Growing demand for cost-efficient, flexible equipment access and rising infrastructure development continue to drive rental adoption across small and large contractors.

- The market experiences strong trends in telematics integration, digital rental platforms, and the rapid expansion of electric and low-emission fleet categories to meet sustainability demands.

- Competitive pressure intensifies as leading players expand fleets, pursue acquisitions, and enhance maintenance services, while high equipment costs and uncertain construction cycles act as restraints.

- Asia-Pacific leads with 49.7% regional share, supported by mega-projects and urbanization, while earthmoving equipment dominates the segment landscape with the largest share due to widespread use in roadbuilding and structural construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The construction equipment rental market reports strong demand across earthmoving & road-building equipment, material handling & cranes, and concrete equipment, with earthmoving & road-building equipment dominating nearly 48–50% of total rental share. This leadership stems from its essential role in excavation, grading, and large-scale infrastructure expansion. Rising investment in road construction, urban redevelopment, and government-led public works projects accelerates rental preference, as contractors seek cost-effective access to high-capacity machinery without long-term ownership burdens. Additionally, improved fleet availability and flexible renting models further reinforce the segment’s dominance.

- For instance, Cramo, a prominent European equipment rental company now part of the Boels Group, operates approximately 200 depots across Europe and has a full fleet exceeding 200,000 equipment units, enabling the rapid deployment of a wide range of machinery for large-scale construction and infrastructure projects.

By Earthmoving Equipment

Within earthmoving equipment, key categories include backhoes, excavators, loaders, compaction equipment, and others, with excavators accounting for the dominant market share at approximately 40–42%. Their versatile application in digging, demolition, landscaping, and foundation work drives widespread rental adoption. Contractors increasingly opt for excavator rentals due to rising project variability, the need for multiple machine sizes, and high upfront purchase costs. Technological upgrades such as fuel-efficient hydraulic systems, telematics-based fleet monitoring, and reduced maintenance downtime further enhance rental appeal, supporting sustained demand growth across infrastructure and commercial construction projects.

- For instance, AKTIO Corporation placed a record order for 13 Volvo EW145B Prime wheeled excavators, each weighing 14 tonnes, shifting from heavier 20-ton crawler models to achieve lower fuel consumption and higher mobility.

By Material Handling

The material handling segment encompasses storage & handling equipment, engineered systems, industrial trucks, and bulk material handling equipment, where industrial trucks—particularly forklifts—dominate with nearly 45% market share. Their leadership is driven by expanding warehouse construction, logistics activity, and on-site material movement across industrial and commercial projects. Rental penetration continues to grow as businesses prioritize operational flexibility, short-term fleet scaling, and reduced capital expenditure. Increasing adoption of electric and hybrid forklifts, improved lifting capacities, and enhanced safety features further strengthen rental preference, making industrial trucks the most influential sub-segment within material handling rentals.

Key Growth Drivers

- Rising Infrastructure Investments and Urban Development

Rapid infrastructure expansion across transportation, energy, and residential sectors continues to drive demand for rental equipment. Governments are accelerating capital expenditure on highways, metro rail, and smart city projects, prompting contractors to rent machinery to avoid large upfront costs. Increasing urbanization, particularly in Asia and the Middle East, also supports demand for cranes, loaders, and excavators. Rental models help firms manage fluctuating project volumes, reduce maintenance expenses, and ensure access to modern fleets, making rentals a preferred solution in both developed and emerging markets.

- For instance, Kanamoto Co., Ltd. maintains a fleet of approximately 810,000 rental items across around 1,100 different models, enabling rapid deployment for infrastructure projects.

- Shift Toward Cost-Efficient and Asset-Light Operating Models

Contractors increasingly adopt asset-light strategies to manage financial risk and maintain operational flexibility. Renting equipment helps companies avoid high capital expenditure, depreciation losses, and long-term storage costs. The availability of short-term rental contracts, pay-per-use models, and fleet-on-demand services strengthens the appeal of rental solutions. Additionally, competitive pricing from rental providers encourages small and mid-sized construction firms to optimize budgets while accessing the latest equipment. This shift significantly boosts rental penetration across mining, road construction, commercial building, and utility maintenance activities.

- For instance, Ahern’s National Accounts program gives access to over 67,000 units via its floating fleet, helping customers scale without owning or maintaining their own assets.

- Growing Adoption of Advanced, Fuel-Efficient, and Smart Machinery

Rising emphasis on productivity, safety, and sustainability increases demand for technologically advanced rental fleets. Contractors prefer renting modern machines equipped with telematics, fuel-efficiency enhancements, automated controls, and emissions-compliant engines to meet regulatory standards without investing in new equipment. Rental companies continuously upgrade fleets to offer GPS-enabled monitoring, predictive maintenance features, and real-time performance analytics. As environmental regulations tighten and digitalization accelerates project execution, access to smart equipment becomes a critical growth catalyst for the rental market.

Key Trends & Opportunities

1. Expansion of Digital Rental Platforms and On-Demand Fleet Management

Digital transformation enables equipment rental companies to streamline operations through online marketplaces, mobile apps, and automated booking systems. These platforms offer real-time availability, transparent pricing, and remote fleet management, improving customer convenience and utilization rates. Integration of telematics and IoT enhances equipment tracking, predictive maintenance, and contract management. As users demand faster procurement and data-driven decision-making, digital rental ecosystems create significant opportunities for service differentiation and operational efficiency, especially in large-scale infrastructure and industrial projects.

- For instance, Manitowoc’s EnCORE team to remanufacture 14 of its existing Manitowoc 2250 crawler cranes, a process estimated to extend the life of each crane by 12–15 years and allow them to serve the 300-ton capacity market cost-effectively.

2. Increasing Demand for Electric and Low-Emission Construction Equipment

Sustainability goals and emissions regulations are accelerating the adoption of electric and hybrid rental equipment. Contractors increasingly prefer electric mini-excavators, loaders, and access platforms to comply with urban emission limits and noise restrictions. Rental providers can capitalize on this by diversifying fleets with low-emission machinery and partnering with OEMs offering green technologies. The transition toward cleaner equipment also aligns with corporate ESG mandates, creating long-term opportunities for rental firms offering environmentally compliant and energy-efficient solutions.

- For instance, Liebherr-International AG recently announced a landmark deal with Fortescue to deploy 475 zero-emission machines, including 55 R 9400 E electric excavators and 60 battery-powered PR 776 dozers, powered by Fortescue Zero’s battery system.

3. Growth in Short-Term, Project-Specific, and Specialized Equipment Rentals

As construction projects become more specialized, demand grows for niche equipment such as aerial work platforms, compact earthmovers, and advanced lifting solutions. Companies prefer renting specialized machinery for short-term or irregular tasks to avoid high ownership costs. Industries including renewable energy, industrial maintenance, and logistics increasingly rely on such rentals. Providers offering tailored rental packages, operator training, and value-added services stand to benefit from this shift, creating new revenue streams and improving customer retention.

Key Challenges

1. High Maintenance Costs and Fleet Depreciation Pressure on Rental Providers

Maintaining large, diverse rental fleets requires substantial investment in servicing, skilled technicians, spare parts, and compliance inspections. Frequent wear-and-tear, misuse by renters, and rising repair costs strain profitability. Additionally, equipment depreciates rapidly due to technological upgrades and emissions regulations, forcing rental firms to accelerate fleet renewal. This increases capital burden, particularly for smaller companies. Balancing maintenance optimization while keeping rental prices competitive remains a key operational challenge for market participants.

2. Supply Chain Disruptions and Equipment Availability Constraints

Fluctuations in global supply chains continue to affect the availability of new construction equipment and spare parts. Lead times for engines, hydraulic components, and electronic systems remain volatile, limiting fleet expansion and slowing replacement cycles. Rental companies may struggle to meet peak-season demand due to delayed equipment deliveries. Additionally, sourcing specialized machinery becomes difficult during global manufacturing slowdowns. These constraints can reduce rental availability, impact customer satisfaction, and increase operational unpredictability across regional markets.

Regional Analysis

North America:

North America commands a strong position in the construction equipment rental market, holding approximately 34 % of global share. This dominance is underpinned by a mature rental ecosystem, high fleet utilization, and widespread adoption of telematics-enabled machinery. The United States is the regional leader, driven by steady infrastructure renewal, commercial developments, and government-backed construction initiatives. Rental companies benefit from established logistics networks and sophisticated after-sales service, enabling efficient operations and high customer retention. Overall, North America’s market continues to grow at a moderate but stable pace.

Europe:

In Europe, the construction equipment rental market accounts for roughly 21–27 % of the global total, depending on the source. Growth is largely fueled by renovation of aging infrastructure, green retrofits, and stricter emissions regulations, which encourage contractors to rent low-emission machinery rather than invest in ownership. Western European markets, especially Germany, the U.K., and France, lead in fleet modernization and digital rental platforms. Rental firms increasingly focus on service bundles and flexible contracts to cater to demand from urban redevelopment and sustainability-driven construction.

Asia-Pacific:

Asia-Pacific is the leading region in the global construction equipment rental market, with a share ranging between 40–50 %. Rapid urbanization, expansive infrastructure programs, and mega-projects in China, India, Southeast Asia, and Australia drive this dominance. Governments in several countries are promoting rental over ownership to minimize capital expenditure for contractors, especially SMEs. Additionally, rising demand for earthmoving and road-building equipment, coupled with flexible rental terms, supports sustained growth. The region’s competitive landscape is further shaped by investments in digital platforms and modern fleet expansion.

Latin America:

Latin America contributes a more modest portion to the global construction equipment rental market, estimated at around 8 % of overall share in some reports. Expansion in the region is primarily supported by urban infrastructure development, public works, and housing initiatives in countries such as Brazil and Mexico. Rental providers in this region focus on building localized networks, offering tailored contracts, and innovating to mitigate logistical challenges. While capital constraints and lower equipment utilization rates remain hurdles, rising construction investment offers steady rental demand, particularly in emerging metropolitan zones.

Middle East & Africa:

The Middle East & Africa (MEA) region accounts for approximately 5–13 % of the global construction equipment rental market, variable by report. Growth drivers include mega-infrastructure projects in Gulf Cooperation Council (GCC) states, urban development in Africa, and tourism-led construction. In the Gulf, cities such as Dubai and Riyadh fuel demand for earthmoving and crane equipment, while African markets rely on mining and transport infrastructure projects. Although rental penetration is still nascent and much equipment is imported, increasing economic diversification and urbanization are creating long-term opportunities for rental firms.

Market Segmentations:

By Product:

- Material handling & cranes

- Concrete equipment

By Earthmoving Equipment:

By Material Handling:

- Storage & handling equipment

- Engineered systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the construction equipment rental market features a diverse mix of global and regional leaders, including Cramo Plc, AKTIO Corporation, Kanamoto Co., Ltd., Ahern Rentals Inc., Maxim Crane Works, L.P., Liebherr-International AG, United Rentals, Inc., Byrne Equipment Rental, Finning International Inc., and Caterpillar Inc. The construction equipment rental market remains highly dynamic, shaped by continuous fleet expansion, digital transformation, and rising customer demand for flexible rental solutions. Companies in the sector prioritize investments in telematics, IoT-enabled equipment tracking, and predictive maintenance systems to improve operational efficiency and reduce downtime. The market also benefits from growing preferences for short-term rentals, bundled service contracts, and on-site maintenance support. Firms increasingly diversify their fleets with low-emission, hybrid, and energy-efficient machinery to meet stringent environmental regulations and appeal to sustainability-focused contractors. Competitive differentiation further strengthens through strategic acquisitions, regional network expansion, and rental platforms that streamline reservations, payments, and fleet availability. As construction activity intensifies globally, providers continue to emphasize service quality, rapid delivery, and cost-effective rental models to secure greater customer loyalty and enhance market positioning.

Key Player Analysis

- Cramo Plc

- AKTIO Corporation

- Kanamoto Co., Ltd.

- Ahern Rentals Inc.

- Maxim Crane Works, L.P.

- Liebherr-International AG

- United Rentals, Inc.

- Byrne Equipment Rental

- Finning International Inc.

- Caterpillar Inc.

Recent Developments

- In May 2025, Vandalia Rental announced the launch of its brand-new Specialized Onsite Services (SOS) focused on Trench Shoring equipment. This significant expansion underscores the company’s commitment to meeting the evolving needs of the construction industry while prioritizing safety and efficiency on job sites.

- In April 2025, CASE Construction Equipment launched new products and technology upgrades specifically for the rental market, emphasizing simplicity, reliability, and versatility. The new lineup includes the following key machines.

- In December 2024, United Rentals launched its new Excavation Safety Training for Competent Persons Program to improve trench and excavation safety through interactive, engaging learning. This program helped workers and supervisors understand and apply OSHA’s excavation safety standards, including soil evaluation and protective systems.

- In June 2024, Herc Rentals acquired Durante Rentals, a move that expands Herc’s footprint in the Northeast U.S. with the addition of Durante’s 12 locations across New York, New Jersey, and Connecticut. This acquisition is intended to strengthen Herc’s position in the region, particularly in serving construction and industrial clients.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Earthmoving Equipment, Material Handling and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand as contractors increasingly prefer rentals over ownership to reduce upfront capital costs.

- Digital platforms and automated rental management systems will enhance fleet visibility, booking efficiency, and customer experience.

- Telematics adoption will grow, enabling better equipment monitoring, predictive maintenance, and higher utilization rates.

- Demand for eco-friendly, low-emission, and electric construction equipment will rise due to stricter sustainability regulations.

- Rental companies will invest in expanding diversified fleets to support complex infrastructure and urban development projects.

- Strategic partnerships and acquisitions will strengthen regional presence and broaden service offerings.

- Short-term and project-based rental contracts will gain traction as construction cycles become more flexible.

- Advanced safety technologies integrated into rental equipment will become a key differentiator for providers.

- Emerging markets will experience rapid rental penetration driven by infrastructure investments and SME adoption.

- Data-driven decision-making will guide fleet expansion, pricing optimization, and customer engagement strategies.