Market Overview

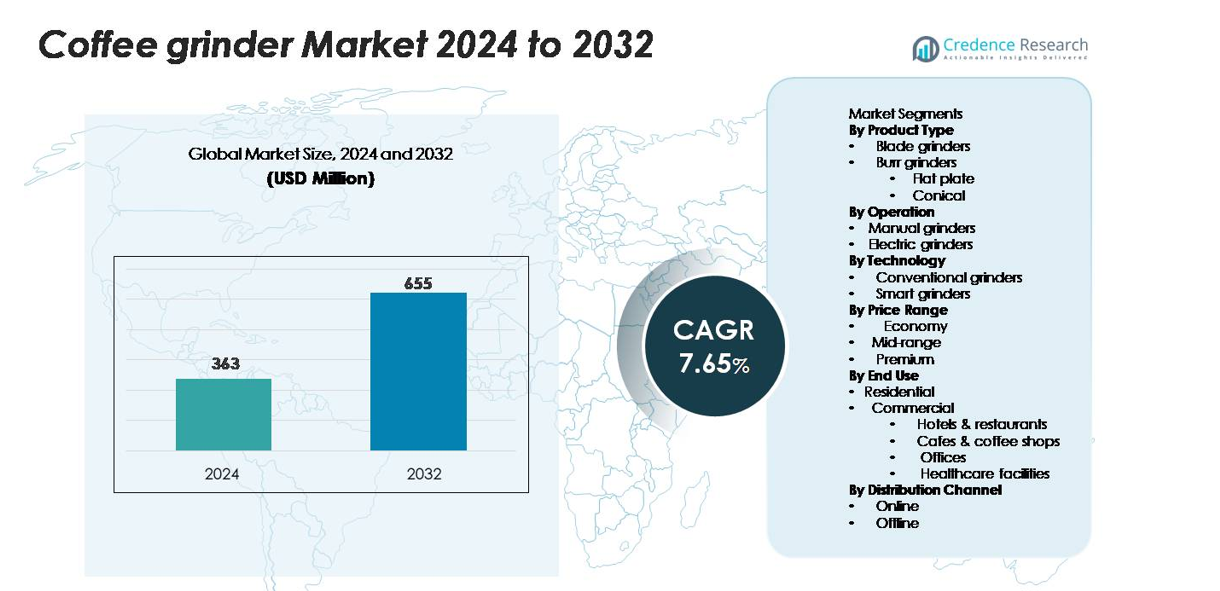

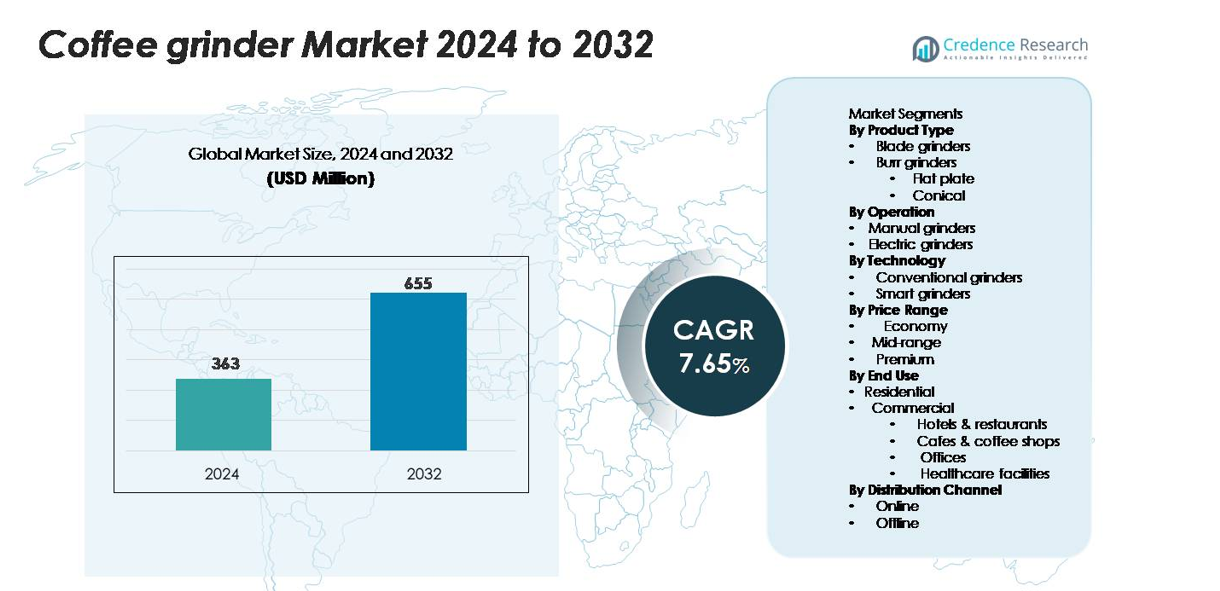

The global coffee grinder market was valued at USD 363 million in 2024 and is expected to reach USD 655 million by 2032, growing at a CAGR of 7.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coffee Grinder Market Size 2024 |

USD 363 million |

| Coffee Grinder Market, CAGR |

7.65% |

| Coffee Grinder Market Size 2032 |

USD 655 million |

The coffee grinder market includes strong competition from global and regional manufacturers offering premium, mid-range, and entry-level models. Leading players focus on stainless-steel burr mechanisms, noise-optimized motors, and smart dosing systems to support consistent grinding for cafés and home brewing. Brands with digital control features and durable conical burr designs hold a strategic advantage in premium residential and commercial segments. North America remains the leading region with 32% market share, supported by strong specialty café growth and high adoption of electric and smart kitchen appliances. Europe follows with 28% share driven by espresso culture, boutique roasters, and strong commercial demand.

Market Insights

- The coffee grinder market was valued at USD 363 million in 2024 and is projected to reach USD 655 million by 2032, at a CAGR of 7.65% during the forecast period.

- Rising demand for specialty coffee and home brewing boosts adoption of electric and burr grinders, with conical burr grinders holding the dominant share due to consistent particle size and aroma retention.

- Smart grinders with auto-dosing, grind memory, and app connectivity gain popularity in urban regions, while compact manual models attract budget-focused users and travelers.

- High pricing of premium grinders and maintenance needs remain key restraints, particularly in price-sensitive markets where blade grinders still hold share.

- North America leads with 32% share, followed by Europe with 28% and Asia Pacific with 24%, while residential users account for the largest end-use demand and offline retail channels remain dominant in most regions despite rapid e-commerce growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

Burr grinders hold the dominant share in the coffee grinder market due to their precision grinding, uniform particle size, and ability to preserve aroma. Within this category, conical burr grinders lead the segment with a major share, supported by low heat generation, quieter operation, and consistent performance for both home and commercial brewing. Flat plate burr grinders show steady demand among cafés needing faster grinding and higher throughput. Blade grinders remain popular in the entry-level segment due to lower prices and compact design, but limited grind control keeps growth moderate compared to burr models.

- For instance, Breville’s Smart Grinder Pro uses hardened stainless-steel conical burrs driven at 450 RPM and delivers a grind range from 200 to approximately 820 microns across 60 grind settings.

By Operation

Electric grinders command the largest share of the market, driven by convenience, speed, and advanced grind settings suitable for espresso machines, French press, and drip systems. Digital controls, adjustable burr mechanisms, and noise reduction features support higher adoption in homes and commercial outlets. Manual grinders continue to attract budget-conscious and travel users who prefer portability and low-maintenance designs. Their use is common among specialty brewing enthusiasts, but slower grinding and limited capacity restrict wider uptake compared to electric models.

- For instance, Baratza’s Sette 270Wi uses a digital Acaia weight-based dosing system with accuracy down to 0.1 grams and a motor running at 19:1 gear reduction to deliver rapid grinding for espresso.

By Technology

Smart grinders lead the technology segment with a strong market share, supported by programmable grind settings, Bluetooth or Wi-Fi connectivity, and automatic dose control for precision brewing. These features appeal to premium residential users, cafés, and specialty coffee chains aiming for consistent grind quality. Conventional grinders retain steady demand in price-sensitive markets due to mechanical simplicity and lower cost of ownership. However, rising consumer focus on brewing consistency and specialty coffee culture continues to push the shift toward smart grinder adoption.

Key Growth Drivers

Rising Demand for Specialty Coffee and Home Brewing

Growing interest in specialty coffee strongly drives the coffee grinder market. More consumers now brew espresso, cold brew, and pour-over at home, which requires precise grinding for flavor consistency. Burr and smart grinders attract buyers who care about grind uniformity and aroma retention. Premium cafés influence this trend by promoting single-origin beans and fresh grinding at the counter. Social media and barista tutorials also increase brewing awareness among younger consumers. E-commerce platforms add strong support by offering wide product ranges and reviews that simplify selection. Demand rises further in North America, Europe, and Asia-Pacific where coffee culture continues to expand in urban areas. As households invest in high-end coffee machines, grinder sales increase as a complementary product, pushing long-term growth.

- For instance, Blue Bottle Coffee operates more than 100 cafés that grind fresh beans for every order, based on company data. Social media and barista tutorials raise brewing awareness among younger buyers.

Growth of Cafés, Roasters, and Boutique Coffee Chains

Expansion of coffee chains fuels large commercial demand for burr and conical grinders. Global brands add new outlets every year, and many regional chains follow similar growth strategies. Each store requires multiple grinders for espresso, filter coffee, and decaf service. Small independent cafés and micro-roasters also adopt advanced grinders to improve flavor standards and attract repeat customers. High-capacity grinders support fast service during peak hours, which improves workflow and customer satisfaction. Many commercial buyers upgrade to smart models with automatic dose control to reduce waste and maintain consistent extraction. This trend directly pushes high-value grinder sales and strengthens premium product adoption.

- For instance, Mahlkönig’s EK43, widely used in cafés and roasteries, uses a 98 mm flat burr set and a 1,750 RPM motor that delivers high grinding throughput reaching up to 22 grams per second for espresso and filter coffee production

Increasing Preference for Smart Kitchen Appliances

Smart kitchen devices support steady expansion in automated coffee grinders. Wi-Fi and Bluetooth-based controls allow users to adjust grind size, schedule grinding, and store preferences. These features attract tech-savvy homeowners who want café-style brewing with minimal effort. Automatic grinding and dosing reduce guesswork, helping beginners make better coffee at home. Integration with smart coffee makers and mobile apps improves convenience and increases product value. Manufacturers also introduce noise-control motors, heat-resistant burrs, and long-life materials that strengthen adoption. As connected appliances become mainstream across major urban centers, smart grinders show strong future potential.

Key Trends & Opportunities

Premiumization and Product Innovations

Premiumization is a major trend shaping the coffee grinder market. Consumers now look for quiet operation, stainless-steel burrs, grind-size memory, and dosing accuracy. Many brands launch compact countertop grinders with adjustable settings to suit espresso, drip, and French press. High-end commercial models use faster motors and digital screens to improve workflow in busy cafés. Manufacturers also offer eco-friendly materials and grinding chambers that reduce heat and preserve aroma. Product innovation opens opportunities for both established and emerging brands to target niche coffee communities that value quality more than price.

- For instance, Fellow’s Ode Gen 2 grinder uses a 64 mm stainless-steel burr set with an anti-static grinding chamber and a redesigned motor calibrated to 1,400 RPM, engineered to reduce retention and preserve flavor compounds during grinding.

Growth of Online Sales and Subscription Models

Online platforms create new growth opportunities by offering easy product comparison, fast delivery, and customer reviews. Digital marketplaces expand brand visibility for small manufacturers that cannot reach offline retail chains. Many companies now pair grinders with subscription coffee bean deliveries, keeping customers engaged and driving repeat sales. Influencer marketing, unboxing videos, and home brewing tutorials raise awareness about grind quality and product features. Strong online engagement boosts premium product sales and encourages frequent upgrades among home users.

- For instance, Breville’s Beanz subscription service ships roasted coffee directly to customers and lists more than 850 coffees from over 100 roasters, with standard deliveries in 250-gram bags, encouraging regular purchasing through online grinder bundles.

Key Challenges

High Price of Premium and Smart Grinders

High prices remain a major challenge for smart and commercial-grade grinders. Advanced models use metal burrs, digital sensors, and durable motors, which increase production cost. Many consumers still choose budget blade grinders due to lower upfront spending. This limits fast adoption in price-sensitive regions. Even cafés and restaurants delay upgrades when operating margins tighten. Lack of awareness about grind quality further slows demand for premium units. Manufacturers must balance pricing, performance, and marketing to expand reach across middle-income buyers.

Noise, Maintenance, and Durability Concerns

Noise and maintenance issues also challenge market expansion. High-speed grinders can be loud in homes, offices, and cafés, creating discomfort in small spaces. Burr units require regular cleaning to prevent clogs and flavor mixing, which many casual users ignore. Low-quality grinders wear out quickly or lose consistency over time, leading to negative reviews and brand switching. Manufacturers must improve motor efficiency, material quality, and easy-clean designs to maintain customer trust and protect repeat sales.

Regional Analysis

North America

North America holds the largest share of the coffee grinder market at 32%, driven by high household coffee machine penetration and a strong specialty café culture. Consumers show growing interest in premium espresso machines, which increases demand for burr and smart grinders. Commercial establishments, including cafés and roasteries, prefer conical burr grinders for consistency and aroma retention. E-commerce platforms offer wide product choices and frequent promotional discounts, supporting steady retail growth. The U.S. remains the dominant country, while Canada shows rising adoption of electric and compact kitchen appliances for urban households.

Europe

Europe accounts for 28% of global market share, supported by a long-established coffee culture and high demand for fresh grinding in homes and commercial venues. Italy, Germany, France, and the U.K. lead premium grinder adoption, particularly for espresso preparation. Cafés and boutique roasters increasingly prefer smart grinders with automatic dosing to maintain consistency during peak hours. Eco-friendly models with durable metal burrs and low noise motors gain popularity among home users. Strong distribution networks across supermarkets, specialty stores, and online channels help sustain steady sales across Western and Central Europe.

Asia Pacific

Asia Pacific holds 24% market share and represents the fastest-growing region due to rising café chains, urban lifestyle changes, and premium home brewing trends. Countries such as China, Japan, South Korea, and Australia show strong demand for electric and smart grinders as consumer spending increases. Expansion of specialty cafés and roasteries drives commercial purchases, while compact and portable grinders attract younger users. Online marketplaces play a major role in product visibility and price comparison. Growing coffee consumption, especially among urban professionals, continues to strengthen long-term market prospects in the region.

Latin America

Latin America captures 9% of the coffee grinder market, supported by a strong coffee-producing ecosystem and increasing specialty café activity. Brazil, Colombia, and Mexico lead regional demand as local roasters focus on fresh grinding to upgrade flavor quality and branding. Commercial outlets prefer burr grinders for consistent extraction, while residential buyers continue shifting from manual to electric units. Growth remains moderate due to price sensitivity in certain countries, but rising tourism and café expansion create new business opportunities. Local brands also introduce cost-effective grinders to improve adoption among first-time home brewers.

Middle East & Africa

The Middle East & Africa region holds 7% share, with demand concentrated in GCC countries and South Africa. Café expansion, premium hotels, and rising Western dining influence drive adoption of commercial grinders. The United Arab Emirates and Saudi Arabia show strong growth as specialty roasteries promote fresh grinding for artisanal beverages. Residential demand grows steadily with the rise of capsule machines paired with compact grinders. However, limited awareness and higher pricing slow adoption in cost-sensitive markets. Tourism growth and premium coffee chains continue to create new opportunities for both international and regional brands.

Market Segmentations

By Product Type

- Blade grinders

- Burr grinders

By Operation

- Manual grinders

- Electric grinders

By Technology

- Conventional grinders

- Smart grinders

By Price Range

- Economy

- Mid-range

- Premium

By End Use

- Residential

- Commercial

- Hotels & restaurants

- Cafes & coffee shops

- Offices

- Healthcare facilities

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The coffee grinder market features strong competition among global appliance manufacturers, specialty coffee equipment brands, and emerging smart kitchen innovators. Leading companies focus on durable burr designs, noise-control motors, and precise grind settings to target both household and commercial buyers. Premium brands introduce conical burr grinders with digital dosing, auto-calibration, and heat-resistant burrs to maintain flavor consistency in cafés and roasteries. Mid-range players compete through stainless-steel builds and multi-grind adjustment at affordable price points. Compact electric grinders and travel-friendly manual models attract younger home users seeking convenience and portability. Smart grinders with Wi-Fi connectivity, mobile app controls, and programmable profiles gain traction in urban markets. E-commerce growth allows regional manufacturers to expand visibility and offer competitive pricing. Product innovation, design upgrades, and warranty support remain key differentiators, while partnerships with cafés and roasters strengthen brand credibility and drive premium demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, During the SCA Expo in Houston, Baratza (Breville Group) introduced a new model Encore ESP Pro, supporting such advanced features as the stepless grind adjustment and static control.

- In April 2025, During the SCA show in Houston, Mazzer presented a new grinder (Mini G), compact size based on weight and a built-in load cell, an asynchronous motor and vibration compensation.

- In July 2024, Swiss coffee grinder maker Pinecone launched the Siberian, a relatively compact production grinder for commercial settings. The grinder’s breakthrough features include a brushless DC motor designed to maintain cool operation while also being compatible with single-phase 110-volt power, as well as adjustable burr speed.

Report Coverage

The research report offers an in-depth analysis based on Product type, Operation, Technology, Price range, End-Use, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for burr and conical grinders will continue to rise as specialty brewing becomes mainstream.

- Smart grinders with auto-dosing and app connectivity will gain stronger adoption in homes and cafés.

- Manufacturers will introduce quieter motors and heat-resistant burrs to improve flavor consistency.

- Compact electric grinders will see higher sales among small apartments and urban buyers.

- More cafés and roasteries will upgrade to high-capacity commercial grinders for faster service.

- Sustainable materials and recyclable components will become a key product focus.

- Online channels will expand sales through reviews, comparison tools, and subscription bundles.

- Manual travel grinders will remain popular among camping and outdoor users.

- Price-competitive brands will enter emerging markets to capture cost-sensitive buyers.

- Replacement demand will increase as households upgrade from blade to burr and smart models.