Market Overview

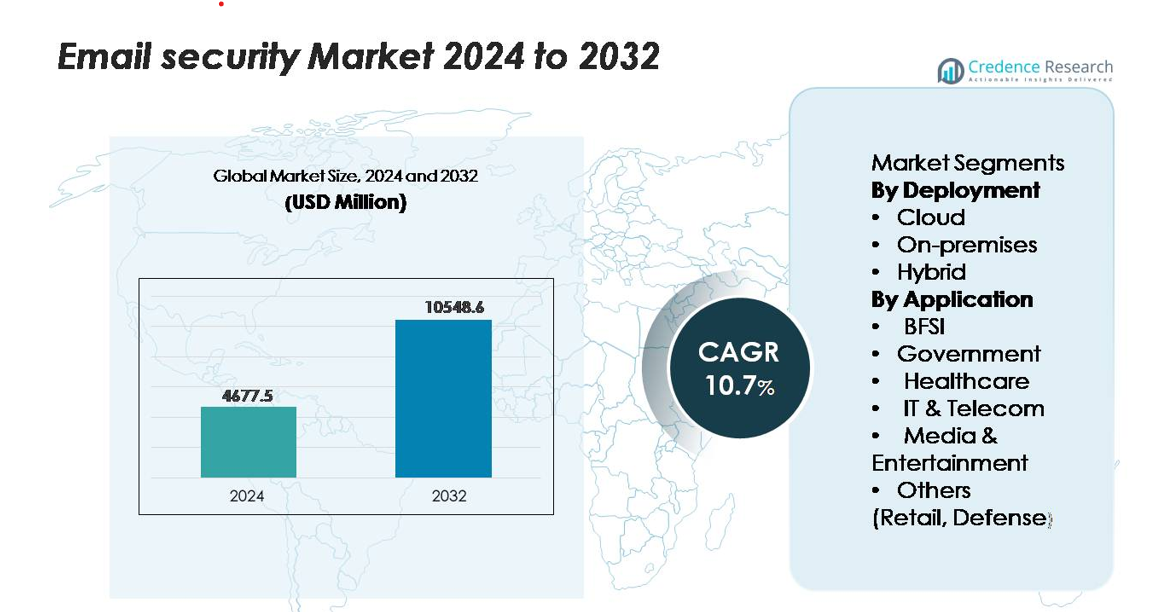

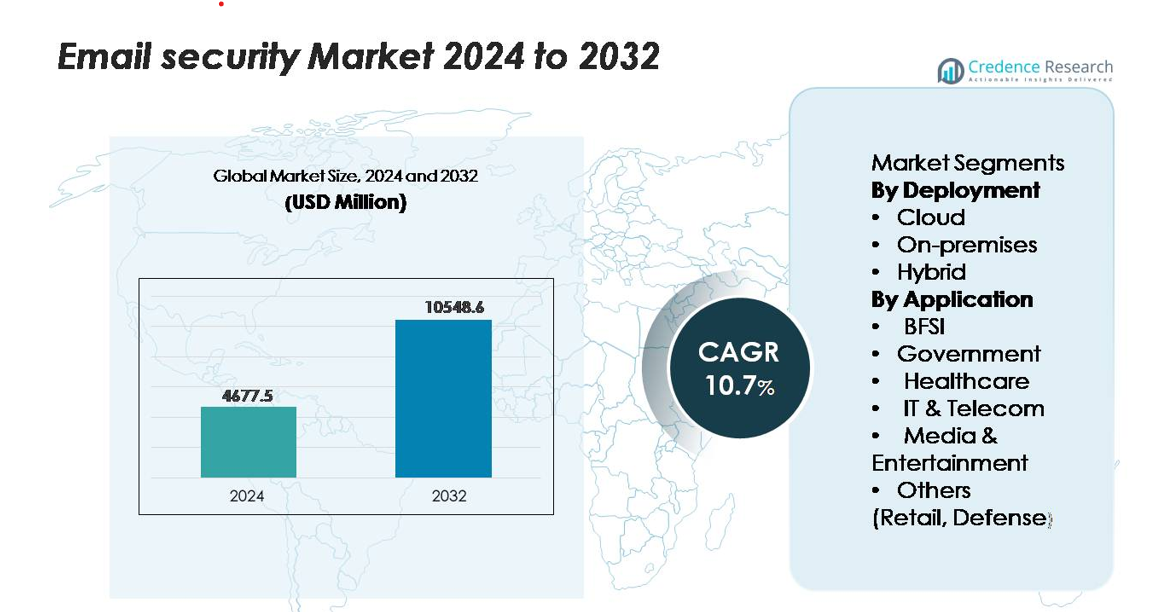

The global Email Security market was valued at USD 4,677.5 million in 2024 and is anticipated to reach USD 10,548.6 million by 2032, expanding at a CAGR of 10.7% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Email Security Market Size 2024 |

USD 4,677.5 million |

| Email Security Market, CAGR |

10.7% |

| Email Security Market Size 2032 |

USD 10,548.6 million |

The email security market is shaped by leading vendors such as Trend Micro Inc., Proofpoint Inc., Cisco Systems Inc., Fortinet Inc., Barracuda Networks Inc., Broadcom Inc., Open Text Corporation, Sophos Ltd., Intermedia.net Inc., and DataFlowX, all of which compete through advanced threat detection, AI-driven analytics, and cloud-integrated protection platforms. These companies strengthen their portfolios with real-time phishing defense, identity authentication, and zero-trust email architectures tailored for hybrid work environments. North America leads the global market with approximately 39% share, driven by high cyberattack frequency, mature cloud adoption, and strong enterprise investment in advanced email security solutions.

Market Insights

- The global email security market was valued at USD 4,677.5 million in 2024 and is projected to reach USD 10,548.6 million by 2032, expanding at a CAGR of 10.7% during the forecast period.

- Strong market growth is driven by rising phishing, ransomware, and business email compromise attacks, prompting enterprises to adopt AI-enhanced filtering, identity authentication, and cloud-integrated security frameworks.

- Key trends include rapid migration to cloud email, dominance of the cloud deployment segment, and increased adoption of zero-trust architectures; the BFSI sector remains the leading application segment due to stringent compliance needs.

- Competition intensifies as major vendors such as Trend Micro, Cisco, Proofpoint, Fortinet, and Broadcom expand threat intelligence capabilities, API-integrated protection, and real-time anomaly detection, while smaller players innovate in identity and data loss prevention.

- North America leads with ~39% share, followed by Europe (~27%) and Asia-Pacific (~21%), with Latin America and MEA accounting for the remainder; cloud-based solutions maintain the highest segment-level share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

The cloud segment dominates the email security market, driven by its ease of deployment, lower maintenance requirements, and ability to deliver real-time threat intelligence at scale. Enterprises increasingly adopt cloud-based solutions to counter advanced phishing, spoofing, and ransomware attacks, benefitting from continuous updates and AI-powered threat detection. Cloud platforms also support remote and hybrid workforces, making them the preferred choice for organizations seeking flexible, cost-efficient security architectures. On-premises deployments retain importance in sectors with strict data-sovereignty mandates, while hybrid models gain momentum among enterprises transitioning from legacy infrastructure to modern cloud environments.

- For instance, Trend Micro Cloud App Security supports advanced email threat detection by using sandbox analysis for suspicious attachments and URLs. The platform integrates with Microsoft 365 and Gmail to block phishing attempts and ransomware delivery. Trend Micro verifies these functions through its public product documentation and ongoing security updates.

By Application

The BFSI segment holds the largest market share owing to high-value financial data, strict compliance obligations, and increased targeting by credential-harvesting and business email compromise attacks. Government agencies follow closely, investing in encrypted communication frameworks and multi-layered gateways to protect sensitive public data. Healthcare providers rely on robust email security to mitigate ransomware risks and safeguard patient information. IT & telecom firms adopt advanced filtering and authentication tools to protect large-scale communication networks, while media and entertainment companies prioritize content protection against impersonation threats. Retail and defense entities, grouped under “Others,” focus on fraud prevention, secure communication routing, and identity verification to strengthen operational resilience.

- For instance, Proofpoint’s Adaptive Threat Protection uses behavioral-AI and machine-learning models to detect phishing, credential theft, and impersonation attempts across Microsoft 365 and Google Workspace. The platform analyzes large volumes of email-borne threats each day and applies post-delivery remediation to remove risky messages.

Key Growth Drivers

Rising Sophistication of Email-Borne Cyber Threats

The increasing sophistication of phishing, ransomware, spoofing, and business email compromise (BEC) attacks remains a major driver for the email security market. Attackers now employ AI-generated phishing content, deepfake-enabled impersonation, and multi-stage malware delivery techniques that bypass traditional email filters. These evolving threats compel organizations to adopt advanced email security architectures incorporating machine learning, behavioral analytics, and threat intelligence feeds capable of identifying zero-day patterns. Enterprises across sectors especially BFSI, healthcare, government, and IT prioritize solutions that offer automated detection, URL sandboxing, payload inspection, and identity-based authentication. The shift toward remote and hybrid work further exposes distributed networks to email-centric risks, reinforcing the need for cloud-native protection tools. As attackers increasingly target employees rather than infrastructure, businesses invest in comprehensive email security platforms to protect high-value communication workflows and sensitive data, driving continuous market expansion.

- For instance, Microsoft Defender for Office 365 processes over 65 trillion signals each day across its ecosystem and uses these telemetry streams to detect ransomware payloads, BEC attempts, and malicious URL patterns with continuous machine-learning updates verified through Microsoft’s published security documentation.

Accelerating Digital Transformation and Cloud Email Adoption

The rapid adoption of cloud email platforms such as Microsoft 365 and Google Workspace significantly fuels demand for modern email security solutions. Organizations transitioning to cloud environments seek scalable, always-updated security layers capable of protecting large volumes of email traffic in distributed environments. Cloud-driven digital transformation initiatives push enterprises to integrate API-based security tools, AI-enabled detection engines, and automated policy frameworks that align with remote work and mobile-first usage patterns. Cloud email services generate extensive data streams that can be analyzed in real time, enabling faster anomaly detection and more accurate classification of suspicious messages. As businesses prioritize cost efficiency, scalability, and operational agility, cloud-native email security becomes a foundational requirement. The need to secure cloud collaboration tools, file-sharing systems, and integrated communication channels further boosts adoption, positioning cloud email protection as a dominant market driver across industries.

- For instance, Google Workspace Security integrates VirusTotal’s corpus of more than 2 billion analyzed malware samples to classify suspicious attachments and URLs, enabling real-time detection pipelines that run across Google’s global cloud infrastructure with verified transparency reports.

Expanding Regulatory Compliance Mandates and Data Protection Requirements

Increasing regulatory pressure across global markets drives organizations to invest heavily in advanced email security solutions. Data protection and privacy regulations such as GDPR, HIPAA, CCPA, PCI-DSS, and financial sector compliance frameworks mandate strong controls over email-based communication, data retention, encryption, and access governance. Non-compliance risks include severe financial penalties, reputational damage, and operational disruptions, prompting organizations to prioritize compliance-centric email protection. Enterprises now adopt secure email gateways, end-to-end encryption, multi-factor authentication, data loss prevention (DLP), and audit-ready reporting systems to satisfy regulatory auditors. Industries with high sensitivity BFSI, healthcare, defense, and public sector accelerate adoption due to stricter oversight. As cross-border data flows expand and privacy legislation advances globally, compliance-driven demand for email security platforms continues to strengthen.

Key Trends & Opportunities

Growth of AI-Driven Email Security and Autonomous Threat Detection

AI, machine learning, and natural language processing (NLP) are transforming email security by enabling intelligent, autonomous threat detection capabilities. Behavioral analytics systems now profile normal communication patterns and detect subtle anomalies such as unusual writing tone, login patterns, or metadata deviations indicative of account takeover attempts. AI-enhanced engines can analyze millions of email attributes in milliseconds, providing predictive filtering and adaptive defense against zero-day threats. Vendors increasingly integrate automated remediation workflows that quarantine suspicious emails, block compromised accounts, and alert security teams with minimal human intervention. As cyberattacks evolve in complexity and speed, AI-driven email security offers an essential opportunity for organizations to strengthen risk mitigation, reduce incident response times, and minimize reliance on manual analysis. This shift positions AI-native platforms as key differentiators in the market.

Rising Adoption of Zero-Trust Email Security Architectures and Identity Protection

Zero-trust frameworks are becoming a central trend in email security, as organizations shift from perimeter-based models to identity-centric protection. Zero-trust email systems continuously validate user identities, device states, and communication intent before granting access to email channels. Features such as DMARC enforcement, identity authentication, adaptive access controls, and secure email gateways support a multi-layered approach that mitigates account takeover and impersonation attacks. Growing use of digital signatures, certificate-based encryption, and identity analytics provides strong opportunities for vendors to offer integrated identity protection solutions. As organizations adopt zero-trust architectures across IT infrastructure, email becomes a primary implementation area due to its high attack frequency. This trend supports demand for solutions that unify identity governance with email security.

- For instance, Google Workspace enforces DMARC, DKIM, and SPF by default and validates cryptographic signatures on every inbound and outbound message, with Gmail blocking more than 99.9% of spam, phishing, and malware using AI models trained on billions of daily messages according to Google’s documented security disclosures.

Expansion of API-Integrated and Cloud-Native Email Security Ecosystems

A rapid shift toward API-based email security solutions designed for cloud platforms is creating new market opportunities. API-driven tools offer seamless integration with Microsoft 365, Google Workspace, Slack, and collaboration suites, enabling deep inspection of content, attachments, and links without disrupting productivity. These systems allow continuous threat monitoring across inboxes, shared drives, and communication apps, supporting modern workflows where data moves beyond traditional gateways. Cloud-native architectures make it easier for organizations to deploy security policies across global teams, ensuring consistent protection regardless of device or location. The rise of integration-friendly ecosystems presents opportunities for vendors to differentiate through interoperability, automation, and cross-platform intelligence sharing.

- For instance, Mimecast’s API ecosystem processes over 100 million emails daily and integrates with Microsoft 365, Slack, ServiceNow, and SIEM tools to deliver continuous monitoring of messages, attachments, and URLs, as confirmed by Mimecast’s documented platform telemetry and API integration guides.

Key Challenges

Rising Complexity of Evolving Threat Landscapes and Detection Limitations

Despite rapid technological advancements, organizations face significant challenges in keeping pace with the evolving threat landscape. Attackers employ increasingly sophisticated methods, including polymorphic malware, AI-generated phishing emails, and advanced impersonation techniques that bypass traditional detection systems. The high volume of daily email traffic complicates threat analysis, making it difficult for security teams to distinguish between legitimate messages and well-crafted malicious content. Legacy security tools often fail to identify zero-day threats or complex social engineering attacks. This gap increases the likelihood of account takeover, data breaches, and operational disruptions. Organizations must continually update detection engines, integrate multi-layered security controls, and invest in skilled cybersecurity talent—yet resource shortages remain widespread.

Integration Challenges, Skill Gaps, and High Operational Costs

Deploying comprehensive email security systems presents integration challenges, particularly for organizations with hybrid or legacy infrastructures. Many enterprises struggle to align new cloud-native tools with older email gateways, authentication frameworks, or identity management systems, leading to operational inefficiencies. Additionally, maintaining advanced solutions requires specialized cybersecurity expertise, which remains in short supply globally. The cost of subscription services, continuous updates, and security orchestration tools can strain budgets, especially for small and mid-sized enterprises. Misconfigurations during integration also increase the risk of false positives, email delivery disruptions, and reduced productivity. These combined factors pose substantial barriers to effective email security implementation, limiting the ability of organizations to achieve optimal protection.

Regional Analysis

North America

North America holds the largest share of the global email security market at approximately 39%, supported by high cyberattack frequency, rapid adoption of cloud email platforms, and strong regulatory requirements across BFSI, healthcare, and government institutions. Enterprises in the United States lead investments in AI-powered threat detection, zero-trust email frameworks, and advanced identity authentication to counter sophisticated phishing and BEC attacks. The region benefits from a mature cybersecurity ecosystem and the presence of major security vendors, driving continuous upgrades to cloud-native email protection. Increasing hybrid work models and expanding collaboration tool usage further strengthen North America’s dominance.

Europe

Europe accounts for around 27% of the global email security market, driven by strict data protection regulations such as GDPR, NIS2, and ePrivacy directives. The region experiences growing email-borne threats targeting financial services, manufacturing, and public-sector networks, prompting organizations to adopt encrypted gateways, DMARC enforcement, and advanced anomaly-detection solutions. The U.K., Germany, and France lead regional demand, supported by strong corporate compliance cultures and investments in secure cloud communication systems. European enterprises prioritize privacy-centric email security architectures with audit-ready reporting and data residency controls, ensuring steady market growth across both enterprise and mid-sized sectors.

Asia-Pacific (APAC)

Asia-Pacific represents approximately 21% of the global market and is the fastest-growing region, driven by expanding digital ecosystems, high cyberattack exposure, and accelerated adoption of cloud email services. Organizations in China, India, Japan, and Southeast Asia increasingly deploy AI-enhanced filtering, identity verification tools, and multi-layered email authentication to counter advanced phishing and credential theft. Government-led cybersecurity policies and rapid IT modernization initiatives strengthen regional adoption. As digital banking, e-commerce, and remote work continue to scale across APAC, enterprises invest more heavily in cloud-native email security, positioning the region as a rapidly expanding growth hub.

Latin America

Latin America captures around 7% of the global email security market, supported by growing digital transformation initiatives and rising email-centric cybercrime. Countries such as Brazil, Mexico, and Colombia experience increasing ransomware and spear-phishing activity, prompting organizations to invest in secure email gateways, DLP systems, and authentication tools. Although budget constraints affect smaller enterprises, the region is witnessing steady adoption of cloud-based email security as businesses migrate to Microsoft 365 and Google Workspace. Government cybersecurity programs and corporate modernization efforts continue to elevate demand, gradually strengthening Latin America’s overall market presence.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for approximately 6% of the global market, with growing demand fueled by rising cyber threats targeting government agencies, critical infrastructure, BFSI, and energy sectors. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption of advanced email protection systems, including encrypted communication frameworks and identity-based authentication. Increasing cloud migration, expanding digital services, and heightened geopolitical cyber risks accelerate investments in multi-layered email security. While adoption levels vary across the region, MEA continues to strengthen its market position as awareness and regulatory initiatives advance

Market Segmentations:

By Deployment

By Application

- BFSI

- Government

- Healthcare

- IT & Telecom

- Media & Entertainment

- Others (Retail, Defense)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the email security market is characterized by a diverse mix of global cybersecurity vendors, cloud platform providers, and emerging AI-driven security innovators. Leading players focus on strengthening protection against advanced phishing, business email compromise, ransomware delivery, and identity-based attacks. Major companies invest heavily in AI- and ML-powered threat detection, adaptive anomaly analysis, API-integrated cloud email protection, and zero-trust authentication frameworks to secure remote and hybrid work environments. Vendors also expand capabilities through strategic partnerships, real-time threat intelligence networks, and integrated security ecosystems that support Microsoft 365, Google Workspace, and multi-cloud environments. As organizations shift rapidly to cloud communication tools, competition intensifies around API-based email security, DMARC enforcement, and identity protection solutions. Continuous innovation, compliance-focused capabilities, and scalability remain key differentiators shaping market leadership in the global email security landscape.Top of FormBottom of Form

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Trend Micro updated its Email Security platform by introducing enhanced domain-report management and adding two new tokens %CI_RULE_NAME% and %CI_RULE_DESC% to the administrator console, enabling more detailed policy-alert notifications and improved rule-based reporting.

- In February 2025, Intermedia expanded its Intermedia Archiving platform to include support for archiving Microsoft Teams chats and meetings, along with voice, SMS, unified communications, and contact-centre interactions, strengthening compliance coverage across multi-channel communication workflows.

- In December 2024, Trend Micro released an Email Security update that added BIMI support. The update enabled verified brand-logo display and strengthened DMARC and BIMI enforcement in customer mail flows

Report Coverage

The research report offers an in-depth analysis based on Deployment, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt AI-driven detection engines that identify phishing and impersonation attacks with higher accuracy.

- Cloud-native email security platforms will continue to dominate as enterprises expand hybrid and remote work environments.

- Zero-trust email architectures will gain widespread implementation across enterprises seeking identity-centric protection.

- API-based security models will integrate more deeply with Microsoft 365, Google Workspace, and collaboration tools.

- Advanced DMARC, DKIM, and SPF authentication will become standard across high-risk sectors.

- Behavioral analytics will play a larger role in detecting account takeover and anomalous communication patterns.

- Secure email gateways will evolve to support cross-platform threat intelligence and automated remediation workflows.

- Industry-specific compliance requirements will drive increased adoption in BFSI, healthcare, and government sectors.

- Small and mid-sized enterprises will accelerate migration to managed email security services for cost efficiency.

- Vendors will expand regional data centers to support data residency, privacy mandates, and localized threat visibility.