Market Overview

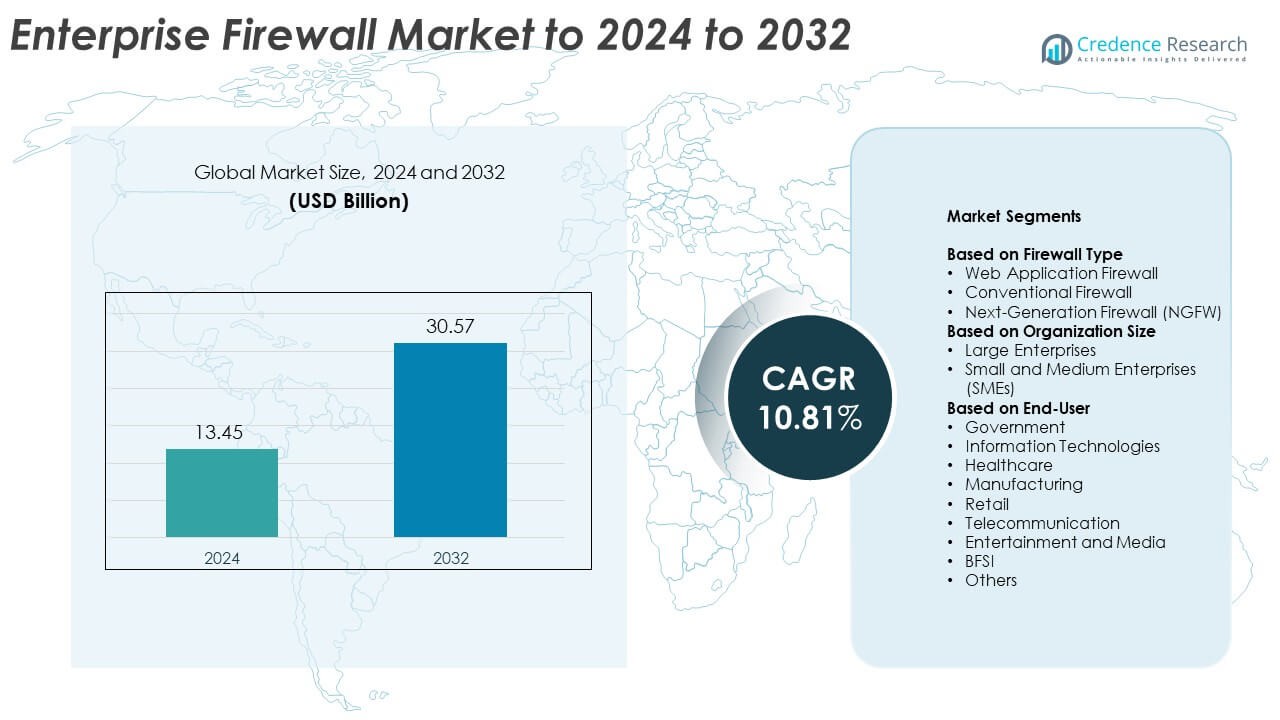

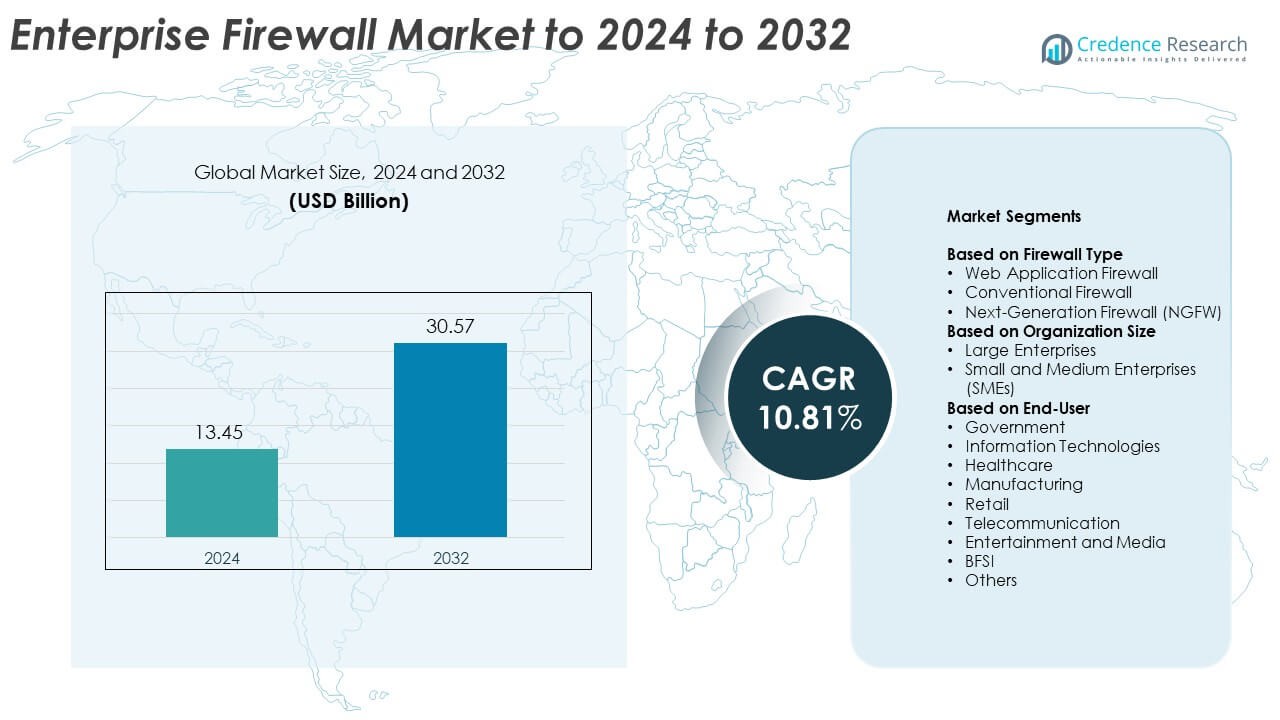

Enterprise Firewall Market size was valued at USD 13.45 Billion in 2024 and is anticipated to reach USD 30.57 Billion by 2032, at a CAGR of 10.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise Firewall Market Size 2024 |

USD 13.45 Billion |

| Enterprise Firewall Market, CAGR |

10.81% |

| Enterprise Firewall Market Size 2032 |

USD 30.57 Billion |

The Enterprise Firewall Market features major players such as Palo Alto Networks, McAfee, Cisco Systems, Barracuda Networks Inc., Microsoft, Fortinet Inc., Sophos Group Plc., Checkpoint Technologies, Dell Inc., and Juniper Networks. These companies lead the industry through advanced threat prevention tools, AI-enabled inspection, and strong cloud-security integration. North America remains the leading region with about 38% share in 2024 due to high cybersecurity spending, strict compliance standards, and rapid adoption of next-generation firewalls. Europe follows with nearly 27% share, supported by strong data-protection regulations, while Asia Pacific holds about 24% share driven by fast digitalization and increasing cyberattack exposure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Enterprise Firewall Market size reached USD 13.45 Billion in 2024 and is projected to hit USD 30.57 Billion by 2032, growing at a CAGR of 10.81%.

- Strong demand for next-generation firewall solutions drives growth as enterprises secure hybrid networks, encrypted traffic, and cloud workloads. The NGFW segment leads with about 61% share due to advanced threat detection and deep packet inspection.

- AI-enabled monitoring, cloud-delivered firewall services, and zero-trust adoption shape major market trends as companies modernize security frameworks.

- Competition intensifies as leading vendors enhance unified security platforms, expand automation, and strengthen integration with identity management and cloud infrastructure tools.

- North America leads with around 38% share, followed by Europe with nearly 27% and Asia Pacific with about 24%. Large enterprises hold roughly 67% share due to complex architectures, while BFSI remains the top end-user segment with about 29% share.

Market Segmentation Analysis:

By Firewall Type

Next-Generation Firewall leads this segment with about 61% share in 2024 due to strong demand for advanced threat inspection, deep packet analysis, and integrated intrusion prevention. Enterprises choose NGFW because the system blocks modern malware and encrypted attacks more effectively than conventional models. Web application firewalls grow steadily as companies secure cloud apps and APIs, while conventional firewalls keep a smaller share as many firms upgrade to layered security frameworks.

- For instance, Palo Alto Networks reports blocking an average of 11.3 billion online threats per day across its platforms, according to disclosures on its Precision AI-driven security capabilities in 2024.

By Organization Size

Large enterprises hold nearly 67% share in 2024 because these companies manage complex networks, higher data volumes, and strict compliance needs. Large firms deploy advanced firewall suites to secure multi-site operations and hybrid cloud setups. SMEs expand adoption as cyberattacks rise on smaller businesses and cost-efficient NGFW solutions become accessible through subscription-based and cloud-delivered models.

- For instance, IBM’s X-Force Threat Intelligence Index is based on monitoring more than 150 billion security events per day across over 130 countries, reflecting the scale of large enterprise networks.

By End-User

BFSI dominates this segment with around 29% share in 2024 due to strict regulatory rules, sensitive financial data, and high attack exposure. Banks and insurers deploy NGFW systems to secure real-time transactions and reduce fraud risks. Government, IT, and telecom sectors maintain strong usage, while healthcare and manufacturing accelerate adoption to safeguard patient records and industrial control systems. Retail and media sectors also grow due to rising digital payment use and content distribution security needs.

Key Growth Drivers

Rising Frequency of Cyberattacks

Growing volumes of ransomware, phishing, and zero-day threats push organizations to invest in advanced firewall systems. Enterprises across sectors strengthen security layers to protect expanding digital workloads and distributed teams. The rise of encrypted traffic also increases the need for deep packet inspection to prevent stealth breaches. This driver remains dominant because companies prioritize network resilience and real-time threat visibility.

- For instance, Cloudflare’s 2024 DDoS Threat Report shows its autonomous defense systems blocked about 21.3 million distributed denial-of-service attacks in 2024, averaging roughly 4,870 attacks mitigated every hour.

Expansion of Cloud and Hybrid Infrastructure

More businesses migrate workloads to multi-cloud and hybrid environments, increasing demand for scalable and cloud-delivered firewall solutions. Enterprises rely on firewalls to secure virtual networks, control traffic flows, and protect cloud-native applications. The shift toward SaaS adoption also drives firewall integration with identity management and zero-trust frameworks. This driver grows stronger as firms modernize architectures to improve agility.

- For instance, the Zscaler Zero Trust Exchange processes and protects over 500 billion transactions per day across more than 160 global data centers.

Stringent Compliance and Data Protection Regulations

Tighter security laws in finance, healthcare, and government require stronger network protection and audit-ready controls. Enterprises deploy advanced firewalls to meet privacy standards and maintain secure data exchange across global regions. Rising regulatory pressure ensures consistent investment in secure perimeter and internal segmentation. This driver gains priority as businesses avoid fines and operational disruptions tied to non-compliance.

Key Trends & Opportunities

Adoption of AI-Driven Threat Detection

Enterprises shift toward AI-powered firewall systems that enhance anomaly detection, automate threat response, and reduce analyst workload. Machine learning models improve pattern recognition across encrypted and high-volume traffic. Vendors expand AI features to support predictive defenses, offering strong opportunities for innovation. This trend grows as companies pursue faster, smarter, and more autonomous security operations.

- For instance, Fortinet’s FortiGuard Labs analyzes billions of threat events each day through its global sensor network and feeds this telemetry into AI-powered models that continuously update security controls across the Fortinet Security Fabric.

Growth of Firewall-as-a-Service

Cloud-based firewall delivery gains traction as firms adopt remote work and distributed branch operations. Firewall-as-a-Service offers simplified deployment, centralized visibility, and lower operating costs compared to hardware-based systems. Organizations benefit from elastic scaling and zero-touch updates, creating strong opportunities for service providers. This trend accelerates as enterprises integrate network security with cloud access strategies.

- For instance, iboss states that its cloud security platform processes over 150 billion transactions daily and blocks around 4 billion threats per day for more than 4,000 global enterprises, illustrating the scale of cloud-delivered firewall services.

Rising Demand for Zero-Trust Network Security

More companies adopt zero-trust principles that require strict identity verification and segmented access at every layer. Firewalls evolve as core components of zero-trust frameworks, enabling micro-segmentation and real-time access control. This shift creates new opportunities for vendors offering identity-aware and context-driven firewall platforms. The trend strengthens as businesses replace perimeter-only security models.

Key Challenges

High Deployment and Maintenance Costs

Advanced firewalls require skilled personnel, continuous updates, and significant operational budgets. Many SMEs face budget constraints that limit adoption of high-performance systems. Growing network complexity also raises the cost of integration across cloud, on-premise, and remote environments. This challenge persists as companies balance strong security needs with financial pressures.

Complexity of Managing Encrypted Traffic

A large share of enterprise traffic is encrypted, making threat detection harder without deep inspection tools. Decrypting and re-encrypting data strains network performance and increases hardware demands. Organizations struggle to maintain speed, user experience, and security simultaneously. This challenge intensifies as encryption standards evolve and data volumes rise.

Regional Analysis

North America

North America holds about 38% share in 2024 due to strong adoption of next-generation firewalls across BFSI, government, healthcare, and IT enterprises. The region benefits from advanced cybersecurity maturity, high spending on threat prevention, and rapid transition toward cloud-integrated firewall systems. U.S. organizations lead deployment as they secure hybrid networks and manage rising ransomware risks. Canada supports steady growth as firms invest in identity-aware and AI-driven protection tools. Broad regulatory frameworks and a well-established vendor presence reinforce North America’s leadership in the market.

Europe

Europe accounts for nearly 27% share in 2024 supported by strict data protection rules and increasing digital transformation across enterprises. The region adopts modern firewalls to protect cloud workloads, secure operational technology, and comply with GDPR-aligned security mandates. Western Europe leads demand as financial and industrial sectors upgrade to unified threat platforms. Eastern Europe shows growth due to rising cyber threats targeting critical infrastructure. Growing investments in zero-trust models and secure cross-border data exchange further enhance Europe’s market position.

Asia Pacific

Asia Pacific holds around 24% share in 2024 driven by rapid cloud adoption, digital payments expansion, and rising cyberattacks across large enterprises and SMEs. China, India, Japan, and South Korea lead deployments as organizations strengthen security around e-commerce, telecom networks, and manufacturing ecosystems. Expanding data center infrastructure and growing regulatory focus push companies toward advanced firewall technologies. Increased demand for scalable and cost-efficient firewall solutions among fast-growing businesses supports strong regional momentum.

Latin America

Latin America captures about 6% share in 2024 supported by rising digitalization in finance, retail, and telecom. Countries such as Brazil and Mexico invest in advanced firewall systems as cyber threats escalate and regulatory frameworks tighten. Many enterprises adopt cloud-based firewalls to manage distributed operations and reduce hardware costs. Growth is steady as organizations modernize networks and improve visibility across multi-location environments. Broader cybersecurity awareness programs also support regional adoption.

Middle East and Africa

Middle East and Africa hold nearly 5% share in 2024 with growth driven by increased cybercrime activity, digital government initiatives, and expanding cloud ecosystems. Gulf countries lead deployment as financial institutions and energy companies secure critical assets with next-generation firewall platforms. African markets show gradual adoption supported by rising internet penetration and investments in secure digital infrastructure. Strong interest in zero-trust and identity-centric models supports long-term growth across the region.

Market Segmentations:

By Firewall Type

- Web Application Firewall

- Conventional Firewall

- Next-Generation Firewall (NGFW)

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-User

- Government

- Information Technologies

- Healthcare

- Manufacturing

- Retail

- Telecommunication

- Entertainment and Media

- BFSI

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Enterprise Firewall Market features leading companies such as Palo Alto Networks, McAfee, Cisco Systems, Barracuda Networks Inc., Microsoft, Fortinet Inc., Sophos Group Plc., Checkpoint Technologies, Dell Inc., and Juniper Networks. Vendors compete by enhancing threat detection accuracy, improving encrypted traffic inspection, and integrating AI-driven automation into firewall platforms. Many providers focus on unified security architectures that combine network, cloud, and endpoint protection within a single management interface. The market shows rising emphasis on cloud-delivered firewalls as organizations shift toward hybrid environments and remote workforce models. Companies also invest in zero-trust security features, advanced intrusion prevention, and scalable subscription-based offerings. Strategic partnerships with cloud service providers, managed security firms, and telecom operators strengthen distribution channels and expand global reach. Continuous innovation, regulatory compliance alignment, and faster response capabilities remain central competitive factors shaping long-term positioning in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Palo Alto Networks

- McAfee

- Cisco Systems

- Barracuda Networks Inc.

- Microsoft

- Fortinet Inc.

- Sophos Group Plc.

- Checkpoint Technologies

- Dell Inc.

- Juniper Networks

Recent Developments

- In 2025, Palo Alto Networks continues to lead with next-generation firewalls that incorporate machine learning and advanced threat prevention, including deep packet inspection, intrusion prevention, sandboxing, and machine learning-powered threat analysis.

- In 2025, Cisco announced enhancements to its Secure Firewall portfolio with the introduction of two new models—the 200 Series for branch offices and the 6100 Series for data centers

- In 2022, Juniper introduced Juniper Secure Edge, a cloud-delivered Firewall-as-a-Service (FWaaS) providing unified policy management with dynamic zero-trust segmentation to secure distributed workforces.

Report Coverage

The research report offers an in-depth analysis based on Firewall Type, Organization Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as enterprises strengthen defenses against advanced cyber threats.

- Demand for AI-driven and automated firewall functions will rise across industries.

- Cloud-delivered firewall services will gain strong traction in hybrid and multi-cloud setups.

- Zero-trust network adoption will push companies toward identity-aware firewall systems.

- Encrypted traffic inspection capabilities will become a standard requirement for buyers.

- SMEs will adopt cost-efficient firewall subscriptions as cyber risks increase.

- Integration of firewalls with SOC platforms will improve real-time threat response.

- Vendors will focus on unified platforms combining network, cloud, and endpoint defense.

- Sectors such as BFSI, healthcare, and telecom will drive steady long-term demand.

- Regulatory pressure will encourage enterprises to modernize legacy firewall infrastructures.