Market Overview:

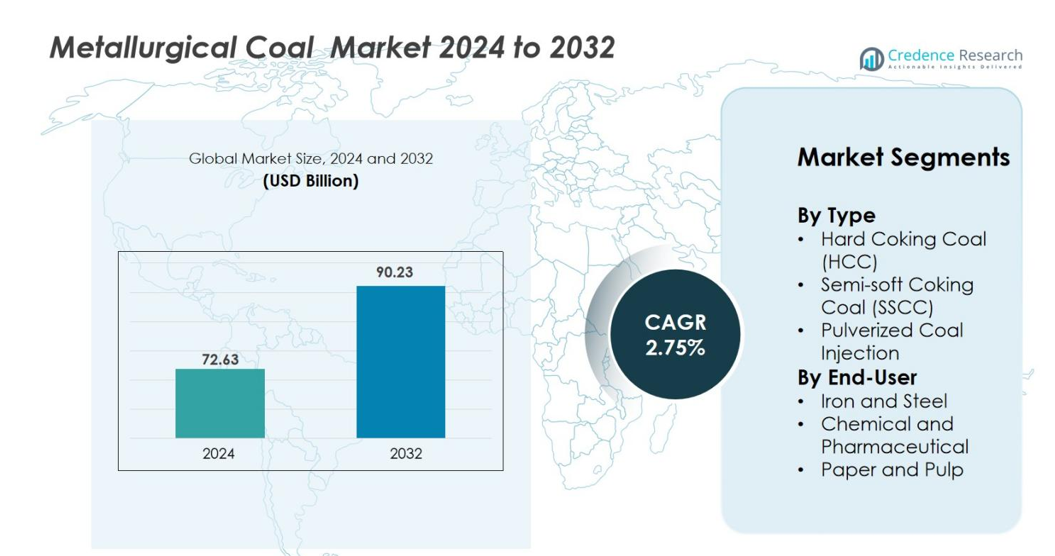

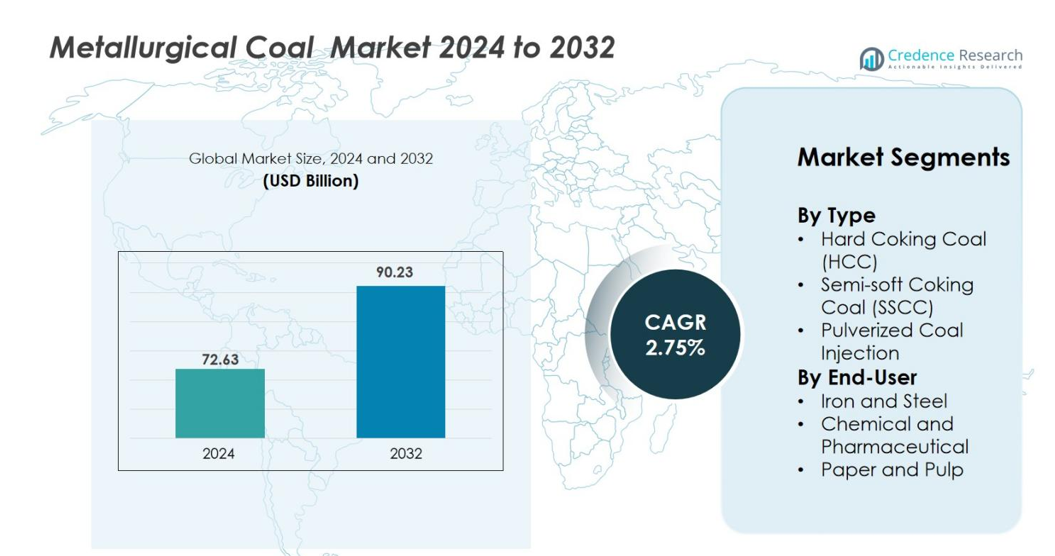

The Metallurgical Coal Market size was valued at USD 72.63 Billion in 2024 and is anticipated to reach USD 90.23 Billion by 2032, at a CAGR of 2.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Metallurgical Coal Market Size 2024 |

USD 72.63 Billion |

| Metallurgical Coal Market, CAGR |

2.75% |

| Metallurgical Coal Market Size 2032 |

USD 90.23 Billion |

The Metallurgical Coal Market is led by prominent players such as Coal India Limited, China Shenhua Energy Company, Peabody Energy, Arch Coal, Inc., Anglo American, BHP Billiton and Alpha Natural Resources. These companies command leading coal‑mining assets, extensive global supply chains and long‑term relationships with steel manufacturers. Regionally, the market is dominated by Asia‑Pacific with a share of 60 %, supported by large steelmaking hubs in China and India. North America contributes 15 % of the market, while Europe holds 12 %, reflecting mature production and consumption bases.

Market Insights

- The Metallurgical Coal Market was valued at USD 72.63 Billion in 2024 and is projected to reach USD 90.23 Billion by 2032, growing at a CAGR of 2.75% during the forecast period.

- The primary driver for market growth is the rising demand from the steel industry, particularly in emerging economies like China and India, which are expanding their infrastructure and manufacturing sectors.

- Key trends include the shift toward sustainable steel production and technological advancements in coal mining, with increasing investments in carbon capture and cleaner mining techniques.

- The market is highly competitive with top players like Coal India, China Shenhua Energy, and Peabody Energy dominating, leveraging strong reserves and global distribution networks.

- Asia-Pacific holds the largest market share at over 60%, with North America and Europe following at 15% and 12%, respectively, driven by strong demand in steel production and industrialization efforts in these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Metallurgical Coal Market is categorized into Hard Coking Coal (HCC), Semi-soft Coking Coal (SSCC), and Pulverized Coal Injection (PCI). Among these, Hard Coking Coal (HCC) holds the dominant position, accounting for over 55% of the market share. HCC is highly sought after due to its superior carbon content and high coke quality, making it essential for blast furnaces in steel production. The demand for HCC is driven by the continued growth in the steel industry, particularly in regions like Asia-Pacific, where infrastructure and construction activities are booming.

- For instance, BHP’s steel‑making coal segment (via its BMA partnership) recorded 22.3 million tonnes of metallurgical coal production in the year ended 30 June 2024.

By End-User

The key end-users in the Metallurgical Coal Market include Iron and Steel, Chemical and Pharmaceutical, and Paper and Pulp industries. The Iron and Steel industry is the dominant end-user, representing nearly 70% of the market share. This is largely attributed to the critical role of metallurgical coal in steel production, where it is used in blast furnaces to produce coke. The growth in infrastructure and manufacturing activities, particularly in emerging markets, drives the demand for metallurgical coal within the iron and steel sector.

- For instance, China Baowu Group consumed approximately 68 million tonnes of coking coal in 2023 for its blast‑furnace steel operations.

Key Growth Drivers

Rising Demand from the Steel Industry

The primary driver for growth in the metallurgical coal market is the increasing demand from the steel industry. Metallurgical coal is a critical raw material used in the production of coke, which is a vital component in the production of steel through blast furnaces. The expansion of the construction, automotive, and manufacturing sectors in emerging economies, particularly in Asia-Pacific, has led to a surge in steel demand. China, India, and other developing nations are witnessing rapid urbanization and infrastructure development, directly contributing to higher steel production. As a result, the need for high-quality coking coal, particularly hard coking coal (HCC), is set to remain robust, driving the overall growth of the metallurgical coal market. Additionally, the ongoing industrialization of African and Latin American regions further supports this growth trajectory, ensuring sustained demand for metallurgical coal in the coming years.

- For instance, global steel production in 2022 used approximately 755 million tonnes of coking coal.

Increasing Steel Production in Emerging Economies

The industrialization of emerging economies is another significant growth driver for the metallurgical coal market. As countries like India, China, and other Southeast Asian nations continue their industrial transformation, steel production remains one of the key pillars of their economic growth. The demand for steel in these regions is driven by infrastructure development, urbanization, and the manufacturing of consumer goods. Consequently, the need for metallurgical coal, particularly for use in steel production, is expected to rise exponentially. China, which accounts for a major portion of the global steel production, continues to be the largest consumer of metallurgical coal. Furthermore, nations like India, Vietnam, and Indonesia are ramping up their steel production capacities, which will significantly contribute to the overall demand for metallurgical coal, pushing market growth over the forecast period.

- For instance, China Baowu Group produced over 130 million tonnes of crude steel in 2023, reinforcing its position as the world’s largest steelmaker and a major consumer of hard coking coal for its blast furnace operations.

Technological Advancements in Coal Mining and Processing

Technological advancements in mining and coal processing have significantly improved the efficiency of metallurgical coal extraction and utilization, further contributing to the market’s growth. The development of advanced mining technologies, such as automation and remote-controlled operations, has enhanced the productivity and safety of coal mining operations. Additionally, improvements in coal beneficiation processes have allowed for the production of higher-quality metallurgical coal, which is essential for steel production. These advancements not only increase the yield of metallurgical coal but also reduce operational costs, making coal mining more economically viable. As a result, these technological innovations are expected to support an increase in supply, helping meet the growing demand for high-quality coal from the steel industry, thus propelling the overall growth of the metallurgical coal market.

Key Trends & Opportunities

Growing Focus on Sustainable Steel Production

A key trend in the metallurgical coal market is the increasing focus on sustainable steel production. As environmental regulations become more stringent, there is growing pressure on the steel industry to reduce its carbon footprint. This has led to the exploration of alternative technologies, such as hydrogen-based steelmaking, which may reduce reliance on traditional coal-powered blast furnaces. However, while the transition to cleaner technologies presents long-term opportunities, the current lack of widespread adoption means that metallurgical coal remains essential for the steel production process in the near term. Companies that can innovate and provide cleaner or more efficient coal technologies are poised to capitalize on this trend. Moreover, some coal producers are exploring carbon capture and storage (CCS) technologies, presenting a significant opportunity for companies to align with global sustainability goals while maintaining a competitive edge in the market.

- For instance, ArcelorMittal in partnership with Mitsubishi Heavy Industries Engineering (MHIENG) and BHP launched a pilot carbon‑capture unit at its Gent blast furnace site in Belgium in May 2024, aiming to test the feasibility of capturing a “significant portion” of CO₂ emissions over the next 1‑2 years.

Expansion of Steel Production Capacity in Emerging Markets

The expansion of steel production capacity in emerging markets presents a significant opportunity for the metallurgical coal market. As industrialization accelerates in regions such as India, Southeast Asia, and Africa, these regions are ramping up their steel production capacities to meet the demands of infrastructure development, urbanization, and industrial manufacturing. This growth in steel production is expected to drive the demand for metallurgical coal, particularly for use in blast furnaces. The availability of affordable coal, along with the increasing number of steel production plants in these regions, offers a lucrative opportunity for both coal producers and suppliers to capture a larger market share. As these economies continue to develop, the metallurgical coal market is poised to experience strong growth in both supply and demand.

- For instance, JSW Steel is expanding its steel production capacity from 27 million tonnes in 2023 to 37 million tonnes by FY 2025, which will increase its metallurgical coal demand

Key Challenges

Environmental Concerns and Regulatory Pressures

Environmental concerns and regulatory pressures represent significant challenges for the metallurgical coal market. As the global community becomes more focused on reducing greenhouse gas emissions and combating climate change, the coal industry faces increasing scrutiny. Metallurgical coal, used in coke production for steelmaking, is a major contributor to carbon emissions. Governments and regulatory bodies are implementing stricter environmental regulations, pushing for reductions in carbon footprints across industries, including steel production. This shift towards greener alternatives poses a challenge for coal producers, who may face higher operational costs due to compliance with environmental standards. The growing demand for cleaner production technologies, such as hydrogen-based steelmaking, further intensifies this challenge, as it could eventually reduce the market’s reliance on metallurgical coal.

Volatility in Coal Prices and Supply Chain Disruptions

Volatility in coal prices and potential supply chain disruptions pose a significant challenge to the stability of the metallurgical coal market. The prices of coal are influenced by factors such as geopolitical tensions, transportation issues, and fluctuations in demand from key markets like China and India. Recent events, such as the global COVID-19 pandemic, highlighted the vulnerability of global supply chains, with disruptions in mining operations, transportation, and trade. Furthermore, environmental disasters or policy changes in key coal-producing regions can impact coal availability and drive up costs. This volatility in prices creates uncertainty for coal producers and steel manufacturers, making long-term planning and investment decisions more difficult. The unpredictability of the coal market poses a challenge for both suppliers and end-users, affecting profitability and market dynamics.

Regional Analysis

Asia-Pacific

Asia-Pacific holds the dominant share of the metallurgical coal market, accounting for 60% of the global market in 2024. The region’s growth is primarily driven by the steel production needs of countries like China and India, which are the largest consumers of metallurgical coal. China’s rapidly expanding infrastructure and steel production capacities, along with India’s ongoing industrialization, are significant contributors to demand. Additionally, Southeast Asian nations, such as Vietnam and Indonesia, are increasing their steel production, further fueling the demand for high-quality coking coal. This regional dominance is expected to continue as industrialization intensifies.

North America

North America holds a substantial share of the metallurgical coal market, estimated at 15% in 2024. The United States is the key driver in this region, with metallurgical coal being a crucial input for its steel industry. The country is one of the largest producers and exporters of metallurgical coal, with significant mining operations in states like West Virginia and Pennsylvania. Canada’s demand for metallurgical coal is also increasing, primarily for steel production and industrial applications. Growth in both the U.S. and Canadian markets is supported by advanced mining technologies and strong regional industrial activities.

Europe

Europe is another important region in the metallurgical coal market, holding a market share of 12% in 2024. The demand for metallurgical coal in Europe is largely driven by the steel industry in countries like Germany, Italy, and Poland. As part of its efforts to transition toward more sustainable manufacturing, Europe is exploring alternative technologies like hydrogen-based steelmaking. However, metallurgical coal still plays a vital role in steel production. In addition, several European countries import metallurgical coal from countries like Russia and the U.S. to meet their industrial demands, although regional challenges related to emissions standards remain a concern.

Latin America

Latin America accounts for 5% of the global metallurgical coal market. Brazil is the key player in this region, with a large steel industry that requires significant amounts of metallurgical coal. The country’s industrial sector, particularly in infrastructure and construction, drives steady demand. Additionally, emerging economies in the region, such as Mexico and Argentina, are also increasing their steel production capacities, further boosting the demand for coal. The region’s future growth potential lies in expanding industrial activities, supported by increased demand for steel in the automotive and construction sectors.

Middle East & Africa

The Middle East and Africa region holds a smaller share of 3% of the global metallurgical coal market. However, the region is experiencing growth, primarily driven by the steel industries in countries like Turkey, South Africa, and Egypt. These nations are expanding their steel production capabilities to support infrastructural projects and industrial development. While the region’s demand for metallurgical coal is currently lower compared to other regions, it is expected to grow steadily as countries like South Africa increase steel production and new projects emerge, supported by investments in local infrastructure.

Market Segmentations

By Type

- Hard Coking Coal (HCC)

- Semi-soft Coking Coal (SSCC)

- Pulverized Coal Injection

By End-User

- Iron and Steel

- Chemical and Pharmaceutical

- Paper and Pulp

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global metallurgical coal market is characterized by a concentration of major mining companies that combine substantial production capacity with advanced logistical capabilities. Firms such as Coal India Limited, China Shenhua Energy Company, Peabody Energy, Anglo American plc, BHP Billiton and Alpha Natural Resources dominate the market through integrated mining‑to‑supply operations. These companies are leveraging strategic acquisitions, long‑term supply contracts with steel manufacturers, and regional diversification to strengthen their positions. The top players have secured key high‑quality coking coal reserves, optimized cost structures, and established global trade networks, enabling them to respond swiftly to changing demand dynamics in the steel and alloy industries. At the same time, smaller producers and niche players focus on specialized coal grades or regional markets to carve out their share. As the market evolves, partnerships, joint ventures, digitalisation of mining operations, and sustainability investments are emerging as differentiators among competitors, underlining the importance of operational agility and supply‑chain resilience in maintaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Anglo American

- Alpha Natural Resources

- China Shenhua Energy Company

- RWE AG

- BHP Billiton

- Peabody Energy

- Arch Coal, Inc.

- China National Coal Group Co., Ltd

- Coal India Limited

- Beijing Jingmei Group Co. Ltd

Recent Developments

- In September 2025, JSW Steel Limited announced that through its subsidiary it will increase its economic interest in M Res NSW to 83.33 %, thereby raising its effective stake in Illawarra Metallurgical Coal (Australia) from 20 % to 30 %.

- In August 2024, Arch Resources, Inc. and CONSOL Energy Inc. entered into a definitive all‑stock merger of equals to create Core Natural Resources, combining their high‑quality metallurgical coal portfolios.

- In August 2024, Whitehaven Coal Limited announced binding agreements to sell a combined 30% interest in its Blackwater Mine to Nippon Steel Corporation (20%) and JFE Steel Corporation (10%) for US $1.08 billion, with associated long‑term offtake contracts for the mine’s metallurgical coal.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high‑quality hard coking coal will continue to underpin the market’s growth as steel producers seek reliable supply.

- Emerging economies will expand blast furnace capacity, increasing reliance on metallurgical coal for the foreseeable future.

- Advances in mining automation and beneficiation technologies will improve yield and reduce cost, enhancing the competitiveness of coal supply.

- Suppliers that integrate carbon capture, utilization and storage (CCUS) will gain strategic advantage amid tightening climate regulations.

- The transition toward hydrogen and electric steelmaking will create niche demand for metallurgical coal in hybrid pathways, delaying full substitution.

- Trade flows will shift as Africa and Latin America ramp up production and export infrastructure, altering global supply‑chain dynamics.

- Steel producers will adopt longer‑term supply contracts for coal to mitigate price volatility and ensure feedstock security.

- Environmental policy reforms in key importing nations will prompt coal producers to enhance transparency and ESG compliance.

- The market share of semi‑soft coking coal and pulverised coal injection will gradually increase as steelmakers optimize fuel mixes.

- Investment in downstream value‑chains, such as integrated steel‑coal complexes, will grow as companies seek to control feedstock cost and quality.